- How To Find The Most Affordable Super Visa Insurance Plan?

- How To Find The Most Affordable Super Visa Insurance Plan?

- Assessing Your Needs And Circumstances

- How To Get Canadian Super Visa Health Insurance Online?

- Comparing Insurance Providers: What To Look For

- Leverage Discounts And Special Offers

- Conclusion: Securing Your Future Visits With Confidence

Are you planning a long stay in Canada to visit family, but the thought of getting Super Visa Insurance is making you stressed? Have you been confused by the high premiums and confusing coverage options? You are not the only one. Many hopeful visitors face these challenges, feeling lost in a sea of information that seems both complex and costly. This blog’s purpose is to help people find the cheapest Super Visa Insurance Plan in Canada so that the process is simple, straightforward, and easy. By the end of it, you will have known just how to get Canadian Super Visa Health Insurance online effectively and thus will be able to manage to get the best Super Visa Insurance Policy that suits your needs effectively.

Understanding Super Visa Insurance Requirements

Before we really get into the hunt for an affordable insurance policy, let’s unpack what exactly the Canadian government requires from a Super Visa Insurance Policy. Here are the requirements of the medical insurance that you need to obtain from a Canadian insurance company in order for your application to be successful according to the law:

- It provides coverage for a period of not less than one year from the date of entry.

- It offers a minimum coverage of $100,000 for health care, hospitalization, and repatriation.

Understanding these requirements sets the stage for what one should look for while shopping for insurance to make sure they have a safe stay in Canada, which is also compliant with immigration laws.

Assessing Your Needs and Circumstances

The search for the appropriate cover starts with a self-assessment. Individuals’ health needs are different. Some have conditions that chronically cause diseases, in which health needs to be sought from a medical provider, while some might be very healthy and only seek health coverage on a “just in case” basis. Take into consideration your medical history and how age might affect your insurance premiums. This is a reminder that the right one for you balances affordability with comprehensive coverage.

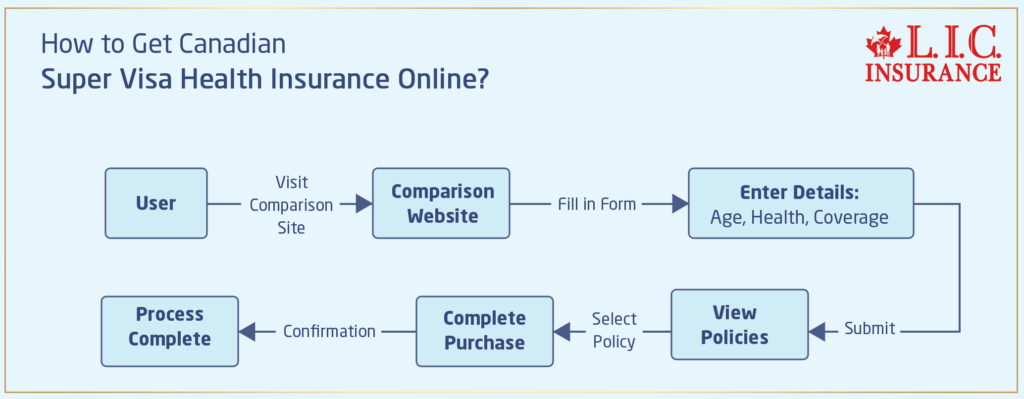

How to Get Canadian Super Visa Health Insurance Online?

Now, with the internet, this is the easiest place in the world to look for insurance. First of all, visit those sites dedicated to making comparisons between Super Visa Insurance policies. The websites give you a form to fill in with the details: your age, your health condition, the coverage you would like to take, and so on. It can be done without necessarily moving out of the house, therefore saving time and probably money.

Comparing Insurance Providers: What to Look For

Now, with a list of potential suppliers at your fingertips, what can make a difference in choosing the best one? In order to reach the right decision, the factors given below should be kept in mind:

Premium Costs: Obviously, you’ll want to look at how much the premiums will cost you. Don’t just go for the cheapest option; check what is included.

Plan Coverage Details: Check if all that the Super Visa program requires is being fulfilled, and look into what more benefits each plan extends.

Amounts Deductible: Lowering this deductible might jack up your premium, but it could also mean less when paying out of pocket if you ever have to use the insurance.

Customer Service: Ensure that the customer service of the company you are about to choose is at par, for they will be able to offer support at the time of need.

Claim Process: Make sure that the Canadian insurance company you choose has a clear and easy-to-understand claim process so that when you get sick, you don’t have to run from one place to another.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Learning from Others

It is always good to learn from the experiences of others. A good number of forums and social media groups allow the sharing of Super Visa Insurance experiences. Take, for example, the case of Maya. She had first joined a very cheap insurance scheme but later, at the time of admission for treatment, realized that the scheme was not availing certain crucial medical services. Hers is a story that drove home the point of how important it is to know exactly what your policy covers and does not.

Leverage Discounts and Special Offers

In the modern-day world, some insurance companies will give you discounts based on factors like purchasing your policy online, early purchasing, or if you have no prior medical conditions. Look out for such offers as they will reduce your Super Visa Insurance cost by a great margin.

Conclusion: Securing Your Future Visits with Confidence

This should really make the process of finding and selecting the best Super Visa Insurance Policy a whole lot easier. Always remember, in choosing the right insurance, it shouldn’t be about meeting government regulation. That choice should, rather, bring peace to you as you get to enjoy precious time with family in Canada.

Don’t wait; explore your options and get your Canadian Super Visa Health Insurance through Canadian LIC today. Working as one of the leading brokerages in insurance, we provide a solution tailored to fit your needs, making sure your sole concern remains engrossed in what really is of concern: building lasting memories with your near and dear. Secure your insurance today and step into your Canadian journey with confidence!

This guide offers you the insight to go through the intricacies of Super Visa Insurance, allowing you to make wise choices in relation to your finances and health. You will have peace of mind and not have to worry about “what-ifs” if you get the right insurance. Your journey begins right here, with the best coverage for a hassle-free visit to Canada.

Find Out: Where can you buy Super Visa Insurance in Canada?

Find Out: Can we cancel Super Visa Insurance?

FAQs on Finding the Most Affordable Super Visa Insurance Plan in Canada

You can get Canadian Super Visa Health Insurance online. The first step will be to visit a credible Canadian insurance comparison website. Here, filling in of personal details is done concerning age, state of health, and the amount of coverage one is willing to take. Websites like Canadian LIC are simple to navigate and take you through the process. Take a case like John’s, who tried to find insurance offline and ended up with mindless paperwork. He recently switched his application method from paper to online and completed it with just a few clicks in no time, proving just how convenient and fast the process can be online.

A well-rounded, reasonably priced Super Visa Insurance Policy offers the following: comprehensive coverage and reliability; at the very least, it should include the minimum essentials of health insurance, hospitalization, and repatriation, if not a less than $100,000 required by Super Visa regulations. For example, Lisa came across one that was affordable but did not have coverage for some of the services. She compared the policies of a few websites and finally found the one with slightly better coverage at a slightly higher premium. She then knew there wouldn’t be any surprise bills while in Canada.

For the best way to know how reliable the insurer might be, check the reviews and ratings of customers on third-party websites. You should also pay attention to how long they have been in business and the reputation carried with time in the market. A good practice would be to see how responsive they are to inquiries. For instance, the times Mark attempted to get clarification on the details of his cover, he reached out to the customer service of two different providers and subscribed to the one, which responded clearly and on time, thus indicating good customer service.

Yes, many provide a discount if the Canada insurance policy is bought online or if bought earlier, and some do provide discounts on the sum assured when buying coverage for a few years at one time. All such discounts make your insurance cheaper. Sunita had applied for her Super Visa Insurance three months before and had got a 10% discount, which she was entitled to as an early bird.

If your claim is denied, first review the reasons for the denial carefully. It is essential for you to know if the documentation was sufficient or if there was a case of misunderstanding of Super Visa Medical Insurance Coverage. Reach out to the insurance provider with the necessary clarification and even appeal this decision when need be. Remember the story of Alex, whose first claim was shot down on the grounds of an error in document submission. He appealed by submitting duly this time, and the decision was successfully appealed in his favour, whereby he got his medical expenses covered.

To ensure your Super Visa Medical Insurance covers everything you need, list all your specific health needs and compare them against the policy details before purchasing. Look out for exclusions and coverage limitations. Consulting with licensed insurance brokers can also help as they walk with you and help you set up the policy to meet your needs. For example, in the case of Naomi, she needed coverage for specific medications. With the help of an expert, she was able to find a policy that included all of their medications and, therefore, saved them from high out-of-pocket costs farther down the line.

Contact your Canada travel insurance company immediately if your parents become ill during the visit. Most companies have hotlines open 24 hours a day, seven days a week. Take the insurance information with your parents so that he or she will be able to present it at the health facilities if needed. This will streamline the treatment from their own initiative, just the way it would have helped in Alex’s case when his mother needed urgent care after falling.

When looking for visitor Canada insurance for parents, specifically when they have pre-existing medical conditions, one has to go through the policy details very carefully. Many insurance companies claim they cover pre-existing conditions, but there might just be a certain waiting time that has to pass after such a condition. For instance, your father has hypertension, and while in Canada, he suddenly needs serious medical attention. For this kind of case, take out a policy that covers the condition to avoid instances when you are paying huge medical bills out of your pocket because this was excluded from the standard policy.

Absolutely! Purchasing online Super Visa Private Medical Insurance Coverage is designed in such a way that it is user-friendly, even for a person who is not very comfortable with technology. Websites usually take you through each and every step. For example, consider Paula, who had never bought anything online before. She was able to get the insurance by following simple instructions provided on the insurance provider’s website, and she could always call customer service to come to her aid if she was stuck.

A common mistake is focusing only on the premium cost and ignoring the details of coverage. A clear understanding should be developed about what will be covered and what won’t be in relation to pre-existing conditions. Another big mistake is the failure to check the reputation of the insurer for paying claims. Tom learned this the hard way when he went for the cheapest option and ended up with a provider that was slow to handle claims, causing unnecessary stress.

In the experts’ opinion, it’s rather a smart idea to arrange your Super Visa Insurance just at the time you plan your travel to Canada. This should protect you not only on the very first day that you come but also from any unexpected issues at the day of your visa approval. Norah planned her insurance three months earlier, so she had enough time to compare the propositions from different insurance companies and choose the best policy without being in a hurry.

Making sure that the insurance policy meets Super Visa requirements would entail checking whether the policy includes, at the minimum, $100,000 in coverage for medical and hospitalization, including repatriation coverage. Also, ensure that the policy is valid for a period of one year, at least from the date of entry into Canada. You can always confirm these details with the insurance provider. While most fell through the cracks, Raj did this and could confidently present his insurance documents to the immigration office, knowing very well that they met all the necessary requirements.

If you need to extend your insurance for the Super Visa period while in Canada, contact your insurance provider as soon as possible to discuss the options for an extension. They are more likely to be flexible about extending the insurance if done before the expiry of the current policy. Emily’s stay was extended for some reason, and she extended her insurance by reaching out to her provider two weeks before the expiration of her policy.

Yeah, sure. The family members living in Canada could help buy Super Visa Medical Insurance for the Canadian Super Visa online. They could help in knowing about the policy, comparing with others, and understanding terms and conditions. Joseph’s daughter had to help him go through the insurance website. They found a policy that would cover most of what needed to be covered at a fair price.

These FAQs will help you locate and buy the right Super Visa Insurance by answering some popular questions with practical advice and real-life examples. Choosing the right Super Visa Insurance Cover goes beyond meeting the legal requirements; it’s about ensuring peace of mind when the time comes to enjoy precious family time in Canada.

Sources and Further Reading

Immigration, Refugees and Citizenship Canada (IRCC) – Official government pages provide the most accurate and detailed information on Super Visa requirements and the insurance needed to support applications. Visit their website at Canada.ca.

Comparing Insurance Providers – Websites like Kanetix.ca and Ratehub.ca allow you to compare different Super Visa Insurance policies based on price, coverage, and other essential factors.

These sources offer valuable information that can help you understand the ins and outs of purchasing and utilizing Super Visa Insurance in Canada. They provide a solid foundation for making informed decisions regarding your insurance needs while staying in Canada.

Key Takeaways

- Know that Super Visa Insurance must offer at least $100,000 in coverage and be valid for at least one year.

- Assess your health needs to choose a policy that provides sufficient coverage for any pre-existing conditions.

- Use online platforms to compare different policies and find the best Super Visa Insurance Policy.

- Choose an insurance provider with a good reputation for customer service and claims handling.

- Engage with reviews and community feedback to learn from the experiences of others.

- Look for discounts or promotional offers that can make your insurance more affordable.

- Choose a policy that offers comprehensive coverage to avoid high out-of-pocket costs for unexpected medical issues.

- Consult with insurance brokers or customer service if you have questions or need assistance choosing a policy.

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand the challenges Canadians face when searching for affordable Super Visa Insurance. Your feedback is invaluable and will help improve the services we offer.

Thank you for participating in this survey. Your insights are crucial to helping us better serve the community and ensure that Canadians can find the best Super Visa Insurance options available.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]