Imagine you are in for your usual check-up; everything is the same as always. Your doctor suggests further testing because there’s an unusual growth. You get more anxious with every passing moment. And finally, the verdict is passed: it’s cancer. But that’s not just any kind of cancer—it’s the one specifically excluded from your Critical Illness Insurance. Suddenly, you’re facing not only an illness for your life but also some of its financial consequences—perhaps treatment costs that your insurance won’t cover.

It is more common than many would be led to believe. This, therefore, is another pointer as to why there are such evident gaps in Critical Illness Insurance. Many people make the mistake of assuming ‘cancer’ means all kinds under a Critical Illness Insurance Policy – but the reality is more complex.”. These policies will only cover some types and amounts of cancer. They don’t protect the insured person when they need it the most, when they are the most vulnerable.

This blog is somewhat an attempt to cover the critical illness landscape in Canada, with a focus on types of cancers that are often excluded in the coverage. Knowing the diseases that may be covered by Critical Illness Insurance and those that are normally excluded can, in fact, guide Canadians in making the right decisions on the type of insurance they may need and how best to protect themselves and their families.

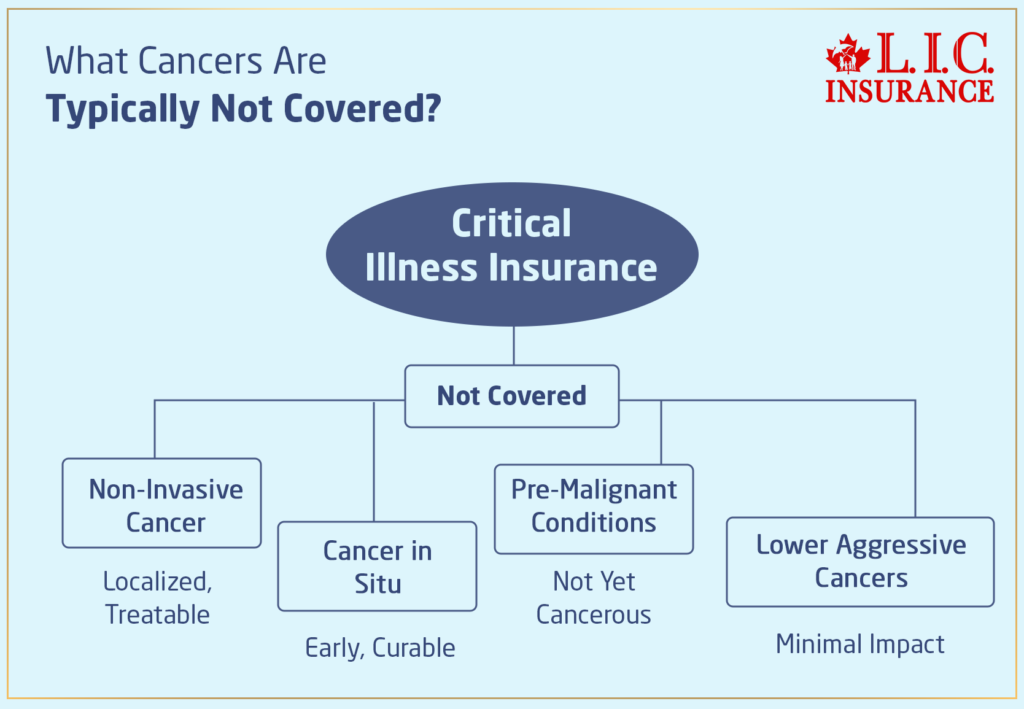

What Cancers Are Typically Not Covered?

The territory of diseases covered by Critical Illness Insurance policies may be a minefield of definitions and terms. Most of them are meant to be paid for when you are diagnosed with a disease that will change your life, but not all types of cancer fit this exact description. These are the most usual exceptions:

Non-Invasive Cancers: These are cancers that lie at a definite site in the body and have not spread to the surrounding tissues. This includes certain skin cancers that, on investigation or by means of localized procedures, have not spread beyond the epidermis and can almost invariably be successfully treated. They do not provide entitlement to a claim under Critical Illness Insurance.

Cancer in Situ: In this case, cancer stays at the same place where it started, and it has not spread. Though this may sound serious, many Critical Illness Insurance policies do not cover such cases since they are considered early stages and are amenable to potential complete cures by way of treatment, such as surgery alone.

Pre-Malignant Conditions: These conditions are precursors to cancer but are not cancerous themselves. Policies generally exclude these because they do not constitute a critical illness.

Lower Aggressive Cancers: This may fail to include cancers judged by medical professionals as having low potential for being malignant or cancers that are likely not to become invasive ever. This would include some forms of prostate and thyroid cancer that, in their early stages, may have a limited impact on quality of life.

Understanding the Exceptions

Understanding the limits of a Critical Illness Insurance Policy can feel like attempting to find your way through a confusing maze. Insurance companies create specific guidelines about what illnesses are covered by Critical Illness Insurance to manage risk and ensure the stability of the insurance fund for all policyholders. It’s somewhat of a balancing act and often poses huge challenges to those with conditions not covered.

Reason for Exclusion

This, of course, being frank to speak. But, of course, there are exclusions to keep the insurance viable for all. In short, by not covering conditions that are less severe or more treatable, large sums can be afforded to be paid out by the insurance companies for cases that are more critical and meet policy terms. And that is a fairly important point to understand—that it should not be about the arbitrary denial of critical illness benefit but to ensure, in fact, that the fund is always able to cover those most in need. However, this doesn’t diminish the hardship faced by individuals like Maria, whose stories bring to light the tangible impacts of these exclusions.

Understanding Coverage Gaps Through Policy Wording: A Deep Dive Often Overlooked

When analyzing what cancers are not covered by Critical Illness Insurance, most people focus solely on the list of included or excluded illnesses. But few truly examine how policy wording—especially definitions and qualifiers—plays a key role in whether a claim is approved or denied. This is where many applicants unintentionally fall short. It’s not just what is covered, but how it’s defined by the insurance provider.

For instance, is breast cancer considered a critical illness? The answer is yes—but with a caveat. Most Critical Illness Insurance policies only offer coverage for breast cancer if it’s classified as invasive and life-threatening. Early-stage diagnoses such as ductal carcinoma in situ (DCIS), which is a non-invasive form, often fall outside the coverage unless additional riders or enhancements are added. That makes it critical to review not just the illness names, but also the staging and severity criteria.

A valuable but underused tactic is requesting sample policy documents before buying any plan. Comparing how different insurance companies define terms like “malignant,” “invasive,” or “stage 1” allows you to gain a much clearer understanding of what cancers are covered by Critical Illness Insurance and those that are commonly left out. This helps you go beyond assumptions and select a plan that truly meets your health and financial protection needs.

There’s also a common misconception that Critical Illness Insurance covers cancer in all forms. However, many policies explicitly exclude cancers that don’t meet certain thresholds of severity or progression. For example, if a policy defines eligible cancers based on TNM staging (Tumor, Nodes, Metastasis), you may find that your condition doesn’t qualify for a payout—despite being medically serious. In these cases, Critical Illness may not cover cancer unless it’s in a more advanced stage.

So, does Critical Illness Insurance cover cancer comprehensively? Only if you’ve taken the time to carefully examine the fine print and work with an advisor to find a policy that aligns with your health risks and family history. Understanding the specifics now could prevent a devastating surprise later—just like Maria’s case showed. When it comes to Critical Illness Insurance, clarity is just as crucial as coverage.

Maria’s Story

Maria, the creative spirit in Toronto’s dynamic graphic design scene, awoke to the diagnosis of her world being turned upside down. Ductal carcinoma in situ (DCIS) is marked as a stage 0 breast cancer. It was hardly an advanced, serious health hazard for which her CI insurance policy would not pay out. This is a pure example that differentiates between medical severity and insurance coverage. Despite having a policy she believed would protect her financially, Maria was left to navigate her treatment’s high costs alone. Surgical procedures and radiation therapy started showing up on her bills as soon as they were needed to save her life. Because she had to pay for these services out of her own pocket, her funds were being wiped out, revealing a critical vulnerability in her financial planning.

Why Maria’s Experience Matters

After what Maria went through, we can all learn this lesson. Have you checked your own Critical Illness Policy? Do you know which illnesses are included in it and, more importantly, which illnesses are not? It’s not just a small print issue; it’s about knowing if your policy really fills your needs and expectations. For any of us out there who are not yet feeling the cold burn of a surprise diagnosis, Maria really puts a powerful human face to how this vigilance is needed. Talking with your insurance company to clarify—or perhaps make amendments to—your coverage might just avert such a fate.

Engage and Act

Now, it’s time to put that realization into action. Review your current Critical Illness Insurance Policy, then talk to your insurance advisor about all the illnesses you’re covered for – more importantly, though, ask about the ones you’re not. Think about how you might augment your current coverage if it feels insufficient. This could mean changing your policy or looking for a new one. Insurance is not just another bill—it is a lifesaving safety net, as Maria’s story vividly points out. What is very valuable to learn from her experience with her Critical Illness Insurance is the lesson on preparedness and exactly knowing what exactly your insurance policy covers. Taking the time to review and possibly even update your insurance plan can save you from falling into those pitfalls of uncovered conditions and make sure you really are protected when the time comes. Don’t wait for a crisis to tell you where you stand. Take control now and be certain your insurance is working for you.

How to Secure the Right Coverage

- Read the Fine Print: You might look into taking out a policy and even consider buying more insurance just to cover some of the less likely cancers.

- Discuss with a Specialist: Insurance brokers and financial advisors will throw light on the best suitable features of the policy under your circumstances. They can help to go through all the Critical Illness Insurance plans and recommend the best available policies.

- Compare Policies: Sites like Canadian LIC allow you to compare various Critical Illness Insurance policies. Find a provider that offers the most coverage, such as for less common cancers.

Wrapping It Up

This journey through understanding Critical Illness Insurance can be a complex one, but it’s paramount to get armed with the right information so that you can choose the best policy for you and your family. The very purpose of Critical Illness Insurance is not only to give its holder peace of mind but also some solid financial support in case of very big health challenges. This is one thing that Canadian LIC offers through a range of policies that are sure to be tailored in a way that fits your needs when it truly counts. Do not fall into any surprises of fine print. Act today and get the policy from the best insurance brokerage in Canada—Canadian LIC- for your family’s future security.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Critical Illness Insurance

A Critical Illness Insurance covers some of the major illnesses, such as life- threatening cancer, heart attack, and stroke. But in this case, what has been included is likely to vary very much based upon the policy and provider; please refer to your policy details for exact coverage.

This would, therefore, mean that not all forms of cancer are covered by Critical Illness Insurance. Some of the early-stage cancers, for example, that are not covered by Critical Illness Insurance include pre-cancer and cancer in situ since they are never potentially life-threatening or severe. Always consult the list of conditions and be aware of what is covered in your policy document to keep away from surprises.

This means that insurance companies often exclude milder types of cancers so that premiums can be kept within means for a wider policyholder base. This is to manage the risk and ensure that their insurance fund remains viable to take care of more severe cases, requiring a significant financial outlay.

The best way to find out if your particular condition is covered is by reading the document of your Critical Illness Insurance Policy with great care. Alternatively, ask your insurance company for information pertaining to the various illnesses that may be listed under their coverage. This will make you understand your coverage limits and prepare much better for any eventualities that may occur in your health.

Most insurance providers do have the option of modifying their policy to include more critical illnesses but, of course, with higher premiums. Discussing this with your insurance advisor to tailor your coverage to your and your family’s personal health history is prudent.

When one receives a diagnosis of a disease, condition, or health problem that is outside the coverage of health insurance, he will be forced to find a means to finance his health care through personal savings, health benefits from employers, or assistance programs from the government. It may also be quite helpful to consult a financial advisor to make sure that sudden and huge medical expenses are managed in the best way.

In the event of cancer, if diagnosed by the doctor after taking the policy and that also is a new type of cancer which is nowhere in the list of the policy, then he or she might not get the claim for this cancer. ‘Unspecified conditions’ clauses do, however, impose certain severity criteria. Always check your Critical Illness Insurance Policy or speak to your insurer to see how it deals with new illnesses. Contacting your insurance provider directly will provide you with the most accurate information in order to make any necessary adjustments to your coverage.

Ideally, review your Critical Illness Insurance at least once a year and then again whenever something major has occurred in your life, such as marriage, the birth of a child, or a marked change in your health. Regular reviews of the policy will help ensure that the coverage is current and includes any recent illnesses most relevant to Critical Illness Insurance. This practice can help avoid unpleasant surprises when times are crucial.

Yes, one can purchase Critical Illness Insurance even in the face of a family history of non-covered cancers. While coverage for these specific cancers may not be valid, coverage for other illnesses can also give a person enough room to make significant financial differences and peace of mind. It also helps to share the family history with your insurer because they can provide a policy that is befitting of your own risk profile.

They are best compared by the insurance broker or even compared online. Specifically, the range of illnesses included, the exclusion clauses, the premium costs, and the credibility of the insurer need to be focused upon. Real-life stories shared by others who have navigated the complexities of these policies can also provide insights into how different insurers handle claims and customer service.

In general, these exclusions would bear upon the overall value of the Critical Illness Insurance Policy in the sense that they would have limited the conditions or circumstances under which you would be protected and would successfully make a claim. One may end up financially unprotected from such conditions that would be considered within the insurance coverage, like in Maria’s case with DCIS, which was less severe or in the early stages and hence not covered. Knowing these exclusions help one realize the reality of how vulnerable the policy really is for them and then plan accordingly for other safety nets.

Most insurers provide the policyholders with a copy of the policy document containing details of illnesses covered under Critical Illness Insurance in print or with online resources. They could also talk to insurance advisors or customer service teams who would help in clarification of any ambiguities. At the same time, they may seek the help of independent health insurance review sites or financial advisors for guided comparison toward making the right decision.

For example, direct consideration from the policy document or direct inquiry to your insurance provider can establish whether your Critical Illness Insurance Policy covers a particular type of cancer. These documents are under the Critical Illness Insurance Policy, and there is no specification. If you’re unsure about the terminology or need clarification, don’t hesitate to ask your insurer for a detailed explanation—it’s better to know the specifics before you need to rely on the coverage.

In case an insured is diagnosed with cancer that is not covered under the policy, he may look for the existing financial avenue for the treatment. This could be your savings, other insurance policies that you may have, or even governmental and charitable programs meant to help people in your kind of situation. For instance, James realized that his skin cancer was not covered. This is the point where he applied for help from the government, and he was able to use local charity programs that adequately helped him deal with his costs of treatment.

Yes, a large number of insurers provide the facility of Critical Illness Insurance but with customization features to their customers. This way, you can even opt for much broader coverage or exclude some specified diseases, say the less common forms of cancer, taking into consideration the health history of yourself and your family. Adapting your policy to your needs may result in higher premiums, but it offers priceless peace of mind for many customers, such as Sarah from Vancouver, who added coverage for genetic illnesses prevalent in her family.

In general, premiums on Critical Illness Coverage are calculated based on some factors, including age, health, length of the policy, and the range of diseases. Exclusions serve as a way of decreasing the risk for the insurer, which in turn may impact the premium cost. For example, leaving highly treatable cancers or leaving those less likely to cause long-term disability makes your policy more affordable yet gives substantial cover in case of far more serious conditions.

Most Critical Illness Insurance policies include a waiting period, also known as a qualification period, which must pass before a claim can be made. Usually, this is a period of 90 days from the start of the policy, though this may vary from one insurer to another. This particular period is one that needs to be understood very well, as Anita would have had to claim for her illness too early. Then, he or she would have to sort out the extra financial planning to cover her needs first.

One common mistake is not thoroughly understanding what illnesses are covered and what exclusions exist within their Critical Illness Insurance Policy. People mostly give in to the idea that other critical illnesses are taken care of and don’t really pay attention to the details; therefore, they mostly put themselves under unnecessary stress during a health crisis. Always read the fine print, ask questions, and, if necessary, get an opinion from an insurance expert to ensure the policy protects you for all your needs.

Sources and Further Reading

Insurance Provider Documents

Provider Websites: Visit the websites of major Canadian insurance providers, such as Manulife, Sun Life, and Canada Life. They often provide detailed policy documents and brochures that list covered conditions and exclusions.

Policy Comparison Tools: Websites like InsuranceHotline.com and Ratehub.ca allow you to compare different Critical Illness Insurance policies, highlighting differences in coverage, exclusions, and premiums.

Medical Resources

Canadian Cancer Society: Offers comprehensive information on different types of cancers, including those not typically covered by insurance policies.

Health Canada: Provides resources on health and medical conditions, treatments available in Canada, and assistance programs, which can be useful for understanding the broader context of health care needs and insurance coverage.

Legal and Financial Advice

Canadian Bar Association: Provides resources on understanding your rights when it comes to insurance and how to handle disputes.

Financial Consumer Agency of Canada (FCAC): Offers advice on financial products, including Critical Illness Insurance, and how to wisely choose and manage these products.

Personal Finance and Insurance Blogs

MapleMoney: Features articles and advice on a variety of insurance products, including Critical Illness Coverage, and how to integrate these into your financial planning.

MoneySense: A Canadian personal finance website that offers tips and insights on insurance products, financial planning, and how to get the most out of your insurance coverage.

By consulting these resources, you can gain a deeper understanding of Critical Illness Insurance, the specifics of what is and isn’t generally covered, and how to best protect yourself and your family financially in case of a serious health diagnosis. This knowledge will empower you to choose the right policy and ensure that you are adequately prepared for the future.

Key Takeaways

- Know the exclusions in your Critical Illness Insurance Policy to prepare for potential out-of-pocket expenses.

- Ensure the illnesses covered by your Critical Illness Insurance align with your health risks and family history.

- Regularly review your Critical Illness Insurance Policy to ensure it meets your changing needs.

- Consult with insurance brokers or financial advisors to navigate complex policy terms effectively.

- Use online tools to compare different Critical Illness Insurance policies and identify the best coverage.

- Learn from real-life stories to understand the importance of being prepared for unexpected health issues.

- Proactively review and enhance your Critical Illness Insurance coverage to secure financial security and peace of mind.

Your Feedback Is Very Important To Us

This questionnaire aims to gather insights on the real-world impact of Critical Illness Insurance exclusions, particularly for cancer, to better understand the challenges policyholders face and identify potential areas for improvement in policy transparency and support services.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]