Canada is renowned for its stunning landscapes, multicultural cities, and high standard of living. It’s no wonder that many Canadian immigrants wish to reunite with their families and share in these opportunities. The Canadian government acknowledges the importance of family unity and offers various visa options, one of which is the Super Visa. In this blog post, we will get to know the Super Visa income requirement in Canada, what it entails, and how it can be a pathway to bringing your loved ones to join you in Canada.

What is a Super Visa Income Requirement?

By Canadian LIC, June 20, 2025, 8 Minutes

- What is a Super Visa Income Requirement?

- What is a Super Visa?

- The Super Visa Income Requirement

- What is the Minimum Income Requirement?

- LICO Table For 2025

- What is the Responsibility of Buyer Before Buying a Super Visa Insurance?

- How to Prove Your Income?

- Calculating the Minimum Necessary Income (MNI)

- Meeting the Income Requirement: Tips and Strategies

- To Sum Up

SUMMARY

The content explains the Super Visa income requirement in Canada, including how to meet the minimum necessary income using the 2025 LICO table. It outlines key sponsor responsibilities, acceptable proof of income documents, and common mistakes to avoid. Readers also get tips to strengthen their application and understand how Canadian LIC’s expert guidance can help reunite families through Super Visa eligibility.

Canada is known for beautiful landscapes and a high quality of life in diverse cities. Is it any wonder that so many Canadian newcomers are eager to bring their loved ones over to benefit from these opportunities? The Canada government has taken into account the value of the family and thus allows various types of visas including the Super Visa. In this post, we will explain the Super Visa income requirement in Canada, what it means, and how it can be a way for you to bring your family to Canada to be with you.

What is a Super Visa?

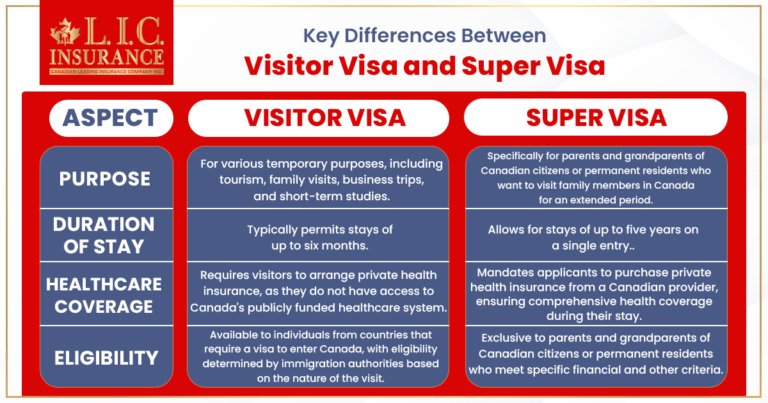

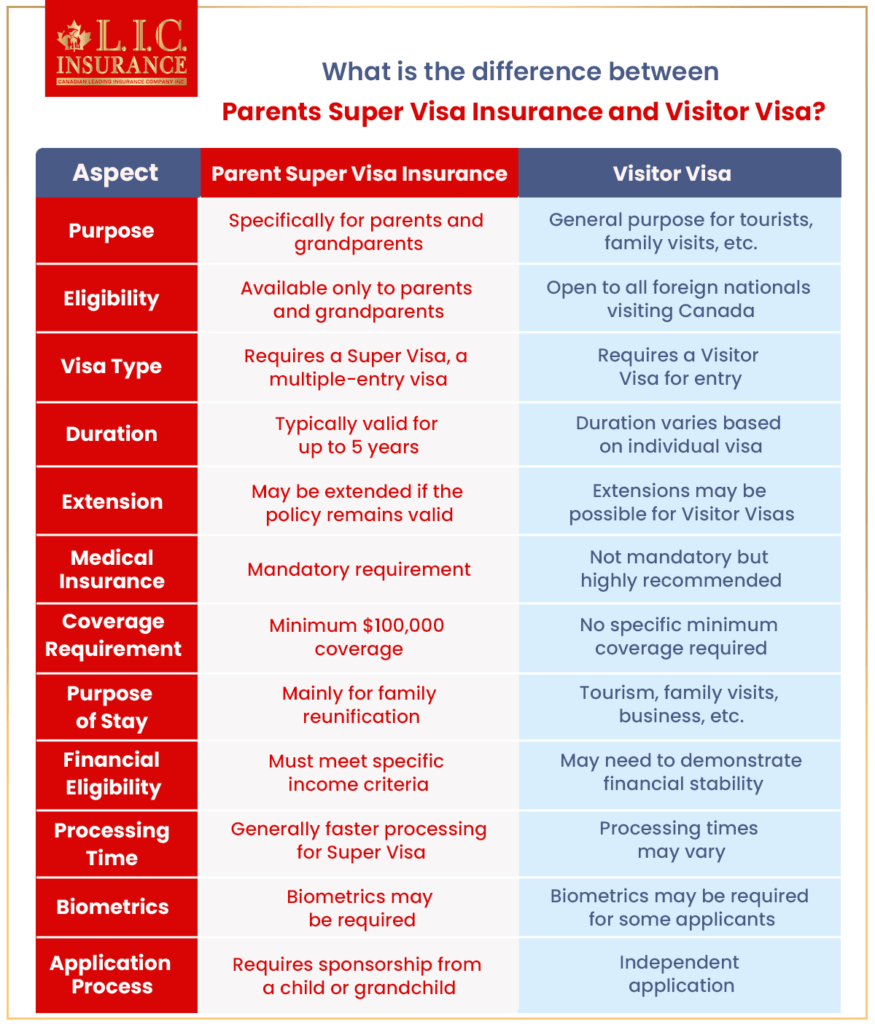

The Super Visa is a kind of visa to help reunite families in Canada. It is intended mainly for the parents and grandparents of Canadian citizens and permanent residents. Unlike a regular visitor visa that lets you stay in Canada for up to six months at a time, the Super Visa offers parent and grandparents exclusive access.

Super Visa allows eligible family members of Canadian citizens and permanent residents to stay in Canada long-term (even up to 5 years) without having to renew their status. This translates to longer uninterrupted visits for parents and grandparents who will be visiting Canada.

Read More – About Super Visa

The Super Visa Income Requirement

The Super Visa entails particular eligibility requirements and one of the most important is the income requirement. To sponsor a Super Visa, the Canadian sponsor (the child or grandchild inviting his or her parent or grandparent) must have a certain income level. This amount is a showing of the sponsors ability or strength financially, to take care of their parents or grandparents when they are in Canada.

What is the Minimum Income Requirement?

What is the minimum income requirement for the Super Visa? The requirement is determined by the size of the sponsor’s family and the number of people from that family the sponsor will be supporting, including the parents/grandparents being invited. This income floor is measured using the Low Income Cut-Off (LICO) statistics released annually by Statistics Canada. It’s important to remember that these LICO numbers fluctuate from year to year, so be sure to check the latest LICO figures at the time of application.

Income Some form of income is typically required. There are generally three types of income requirements:

If you’re applying alone: If you are sponsoring only a parent or grandparent, and you do not have any family members, the minimum necessary income should be calculated based on the LICO for your remaining family members.

For sponsors who have a spouse or common-law partner: The minimum income requirement for those who sponsor their parents or grandparents is generally higher if you have a spouse or common-law partner, who will be part of your application to sponsor your parents or grandparents, because it takes into account his or her income.

For sponsors with dependents: If you do have dependents (children or other family members that depend on you for financial support), the income requirement will increase proportionally.

LICO Table For 2025

The Low-income Cut-off (LICO) table gives information regarding the poverty line in urban Canada. LICO is inflation adjusted annually. If the settlement funds are less than, or are equal to, the amounts on this table according to your family size, you will be considered an LICO.

Did you know that you need something to show that you are meeting the Low Income Cut off Minimum (LICO) if you are applying for a Super Visa for your parents or grandparents?

Let’s have a look at LICO Table for 2025

| SIZE OF FAMILY UNIT | One person |

|---|---|

| One person | $29,380 |

| Two persons | $36,576 |

| Three persons | $44,966 |

| Four persons | $54,594 |

| Five persons | $61,920 |

| Six persons | $69,834 |

| Seven persons | $77,750 |

| If more than seven persons, for each additional person, add | $7,916 |

Disclaimer: The LICO values presented here are projections and not official figures; it’s advisable to seek information from multiple sources, especially when applying for immigration programs. Additionally, these figures will be updated once the IRCC releases the official data.

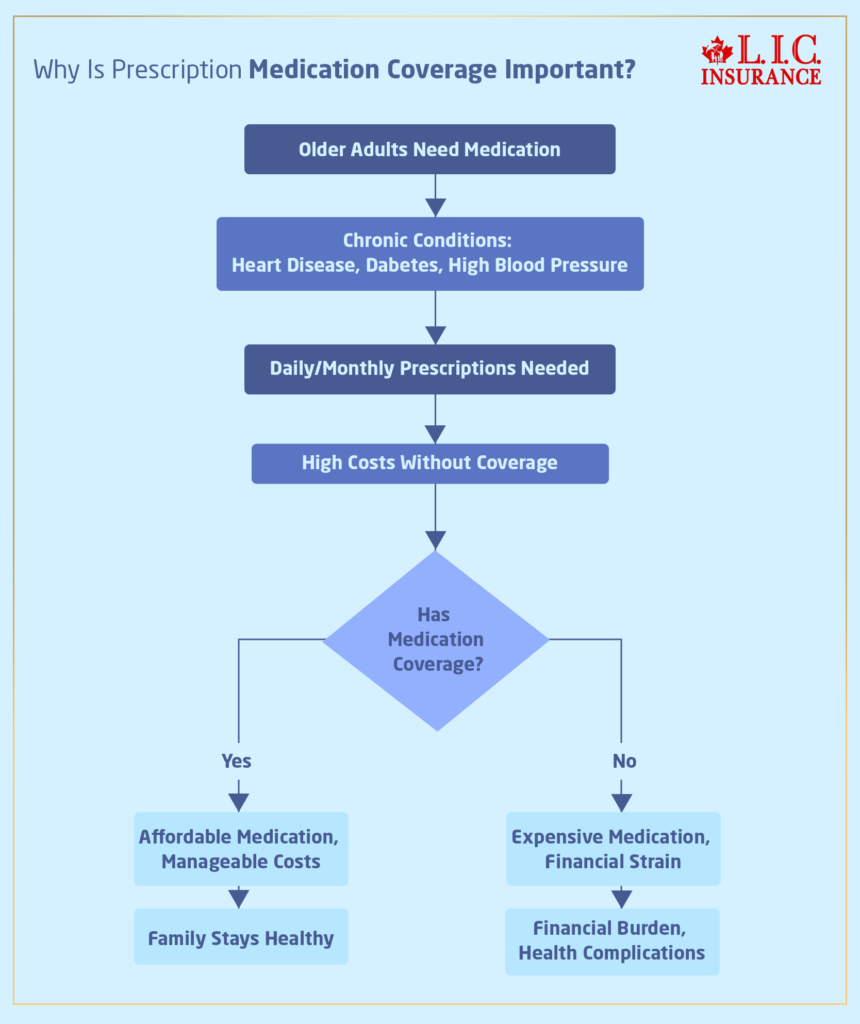

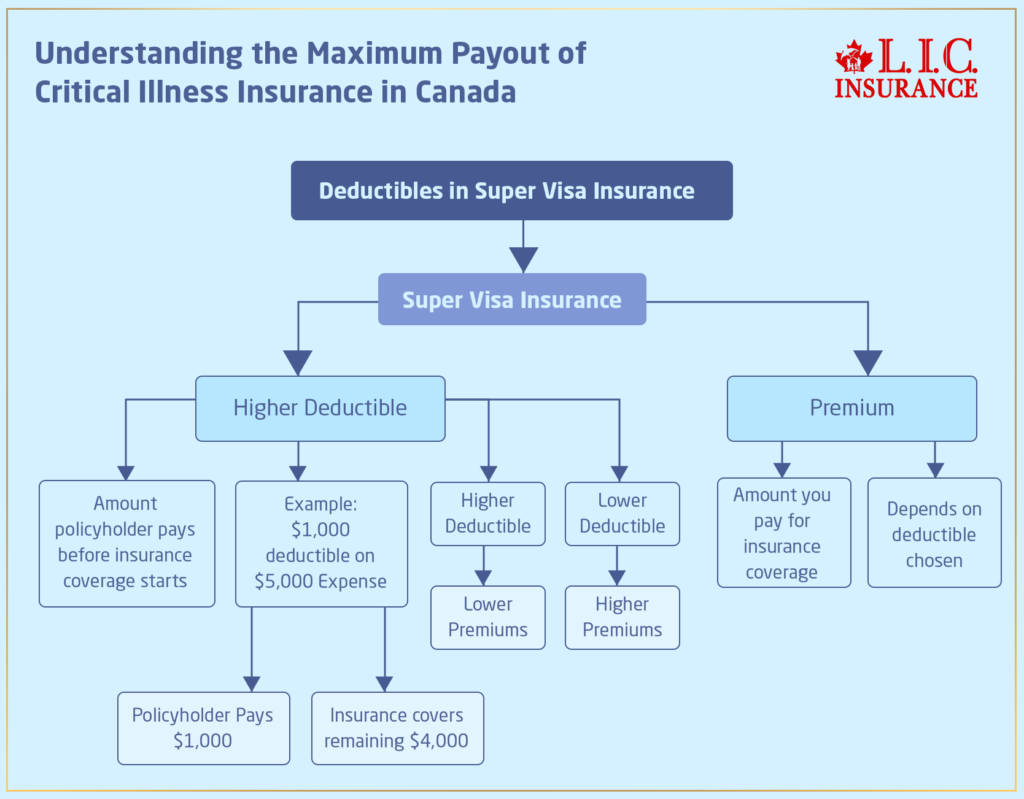

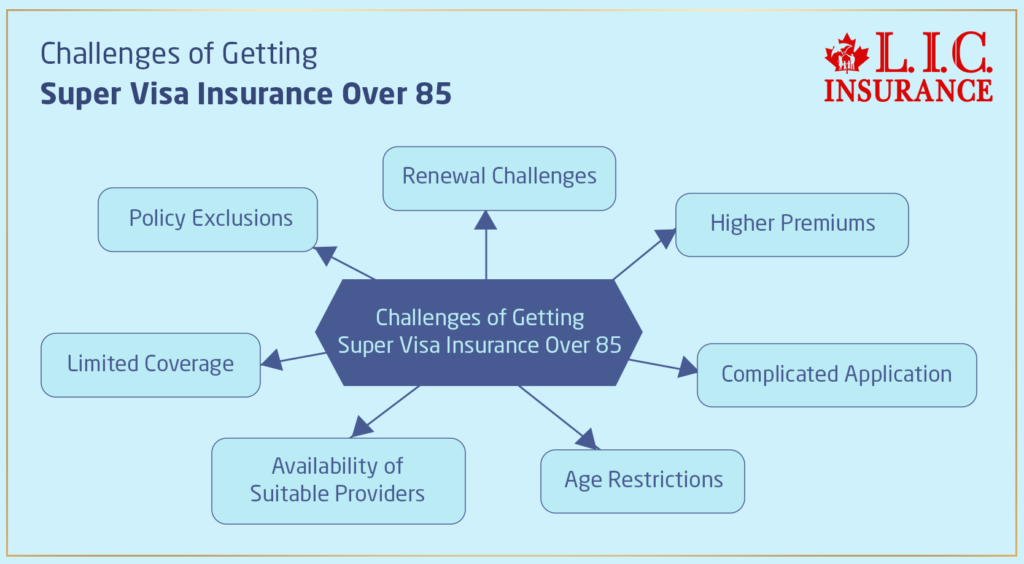

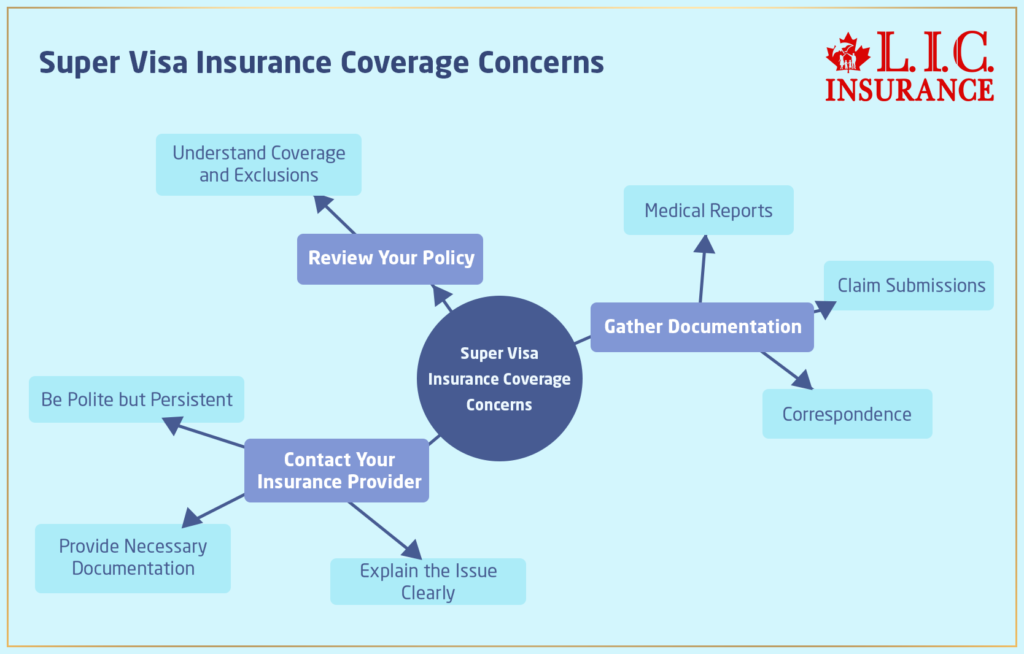

What is the Responsibility of Buyer Before Buying a Super Visa Insurance?

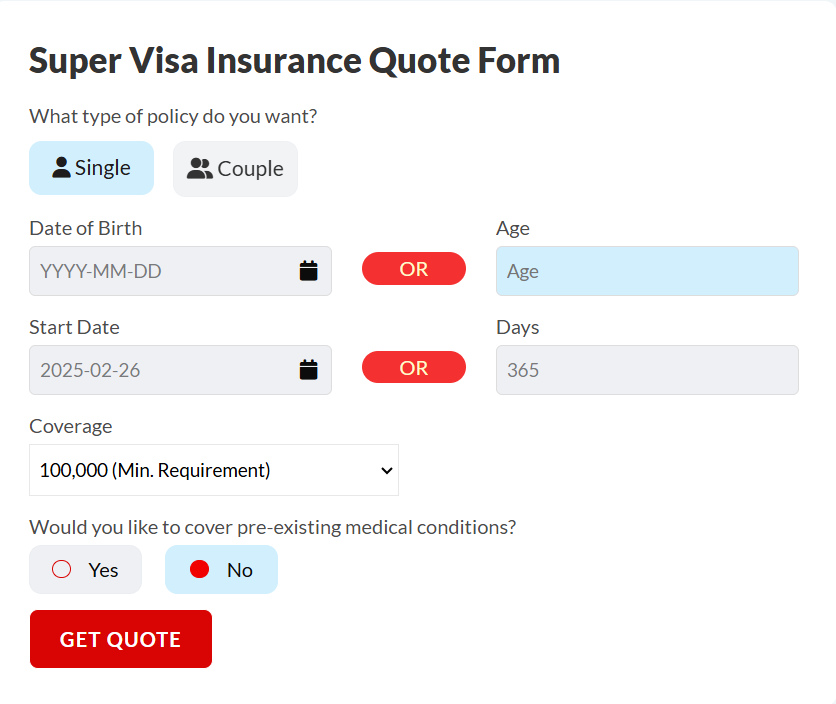

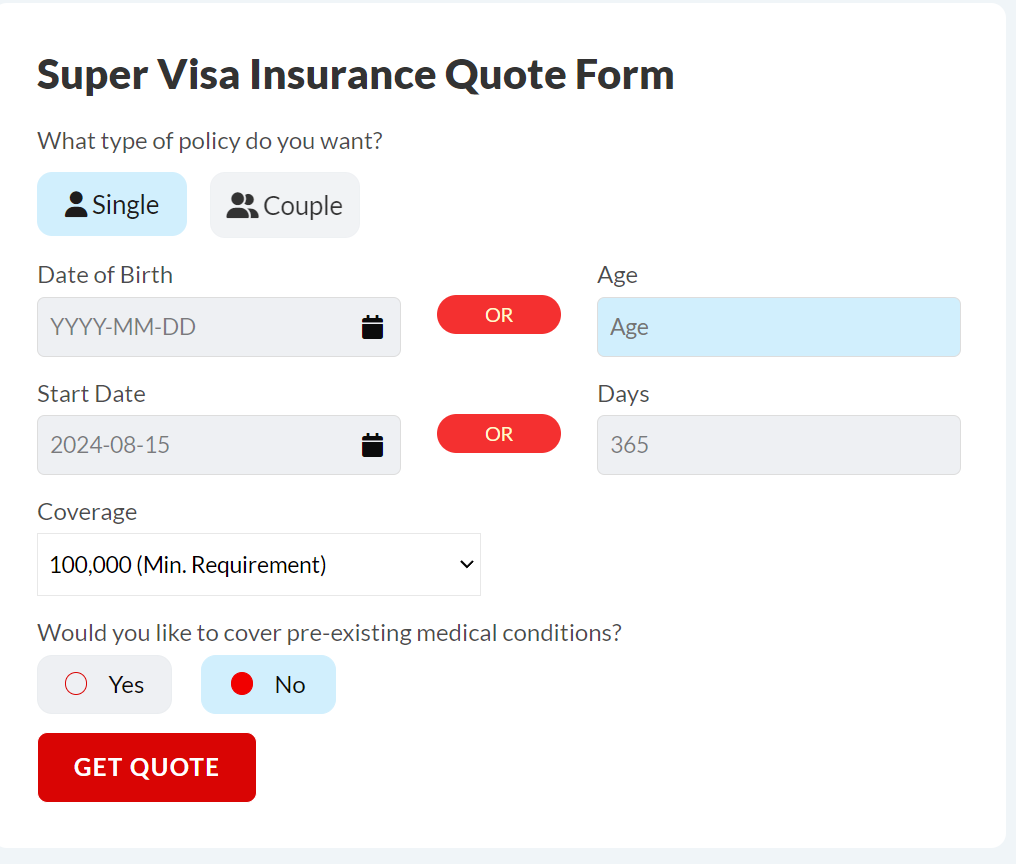

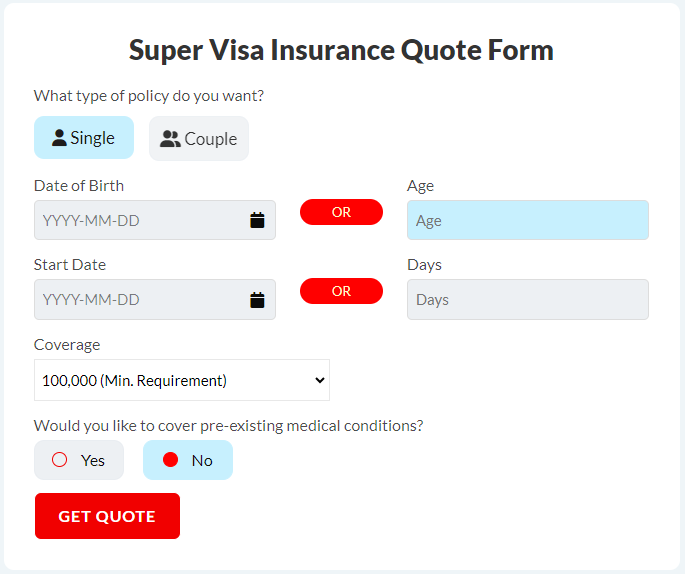

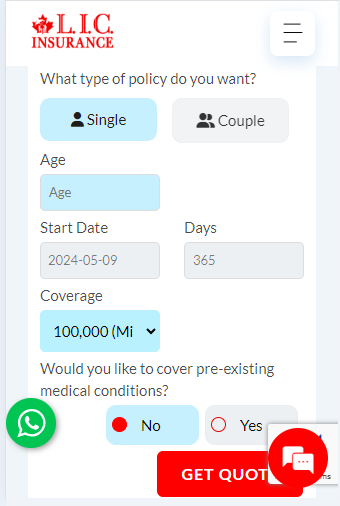

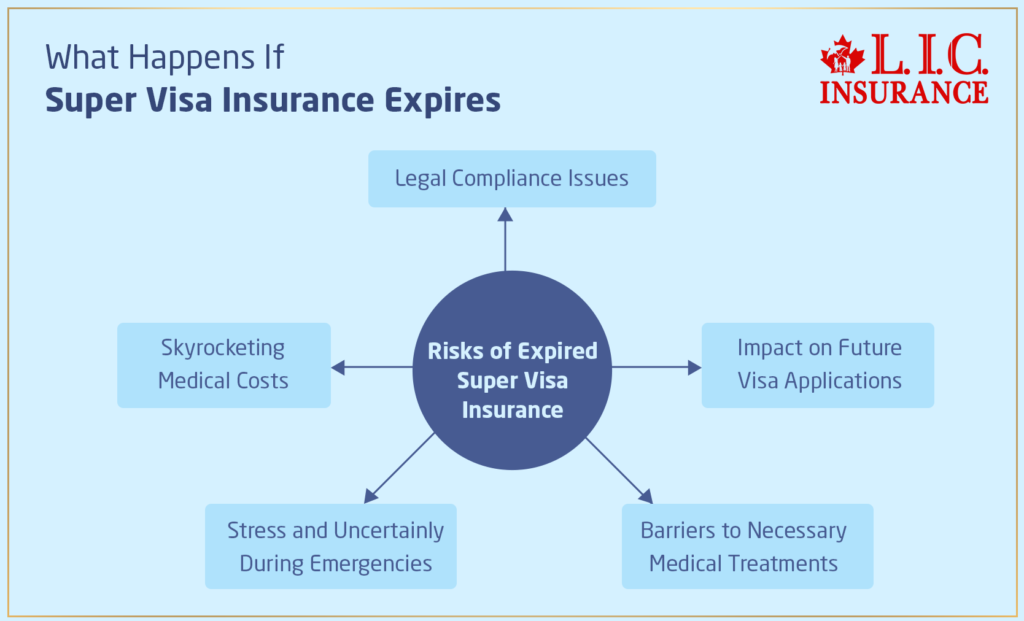

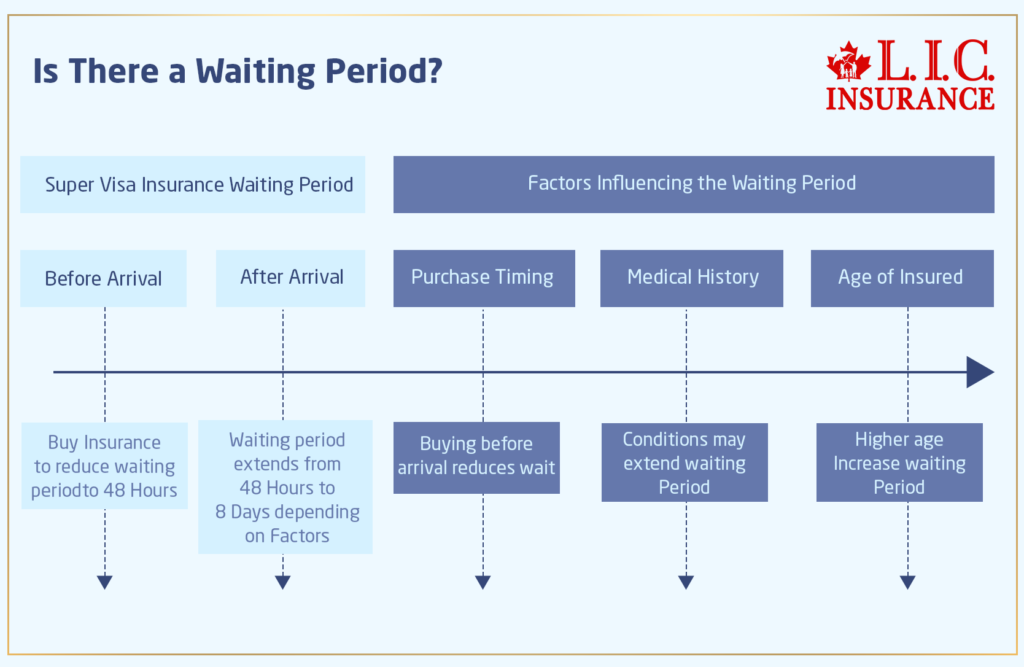

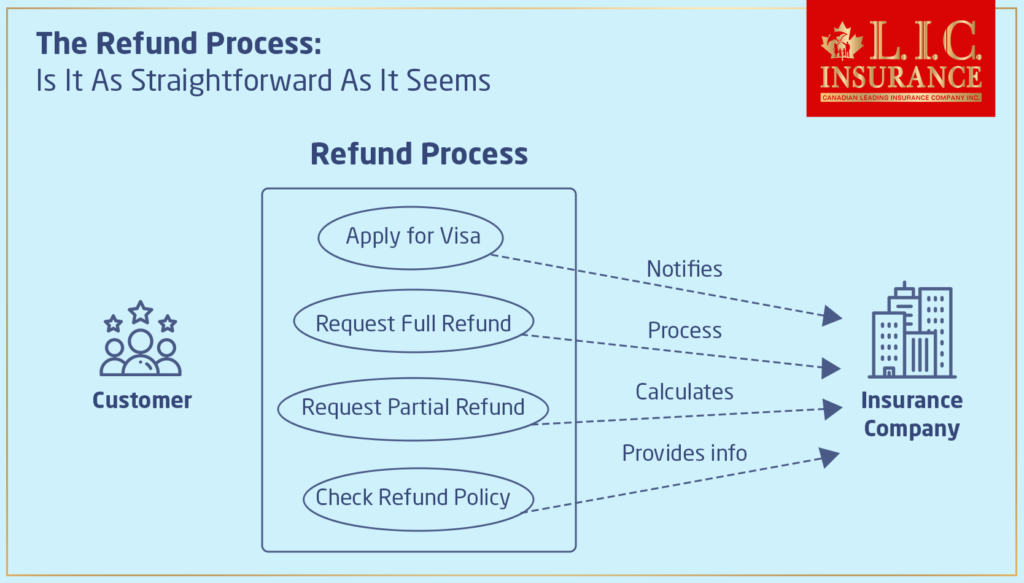

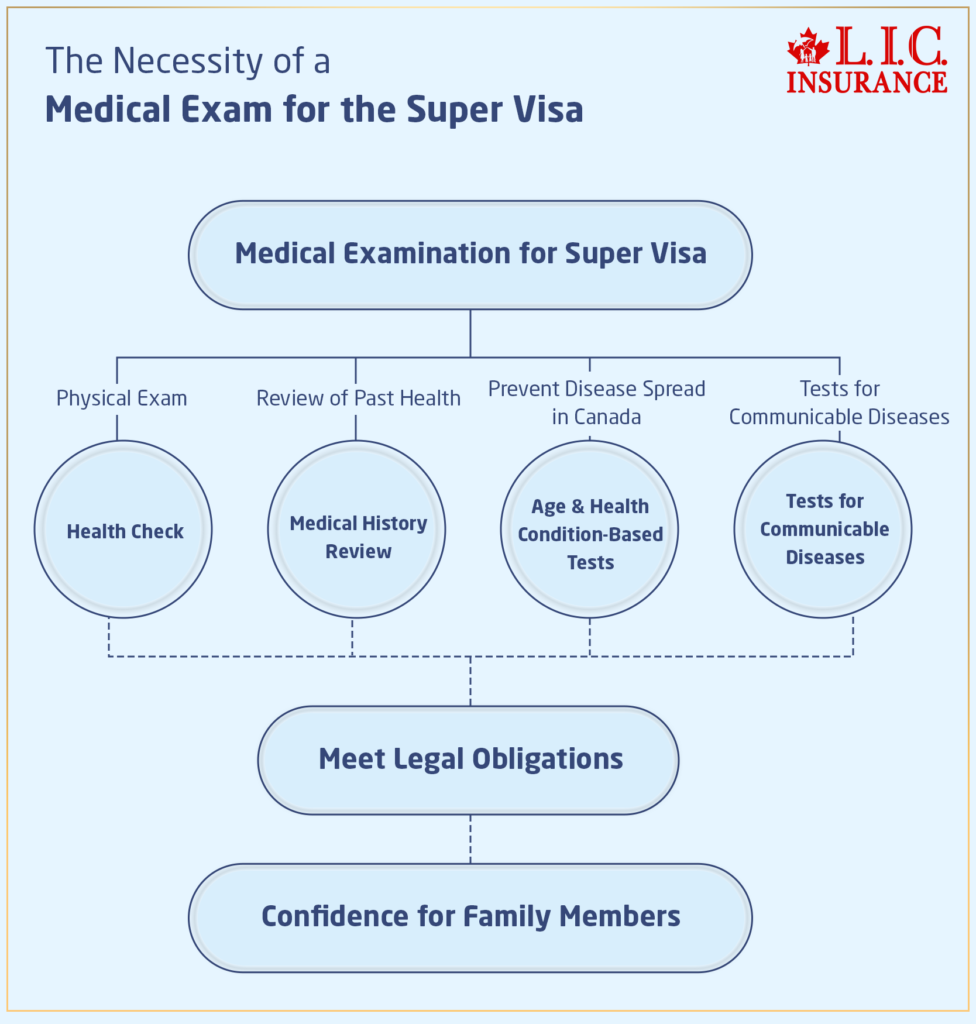

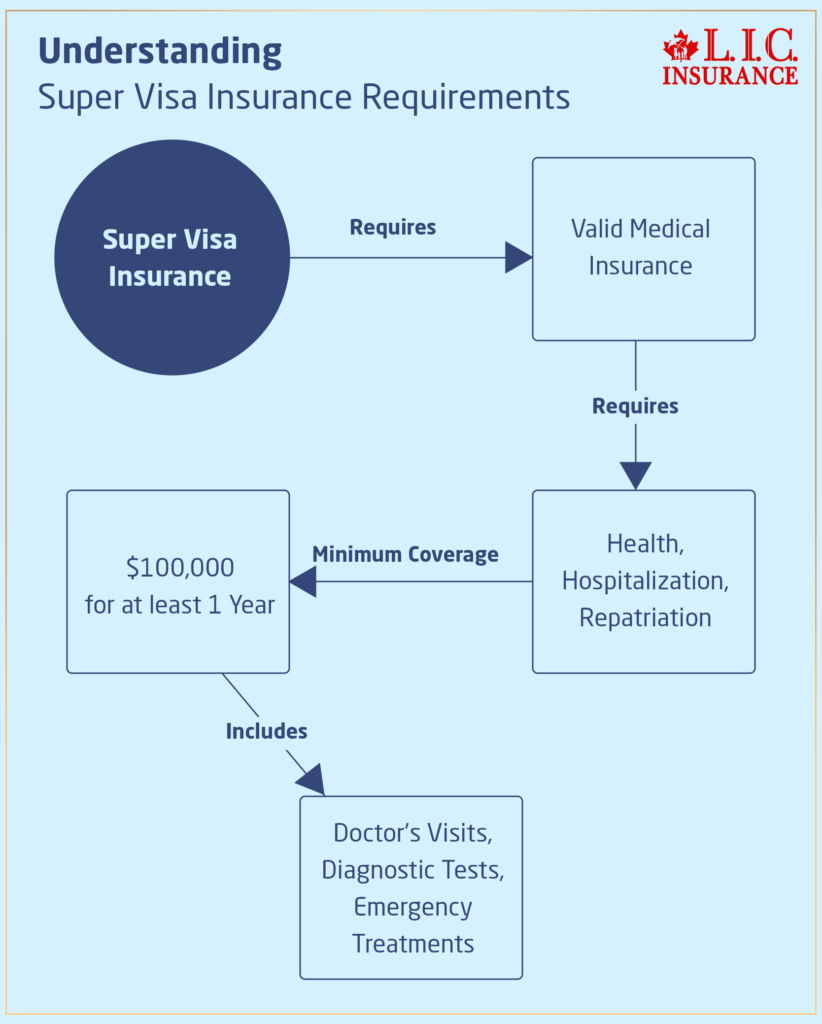

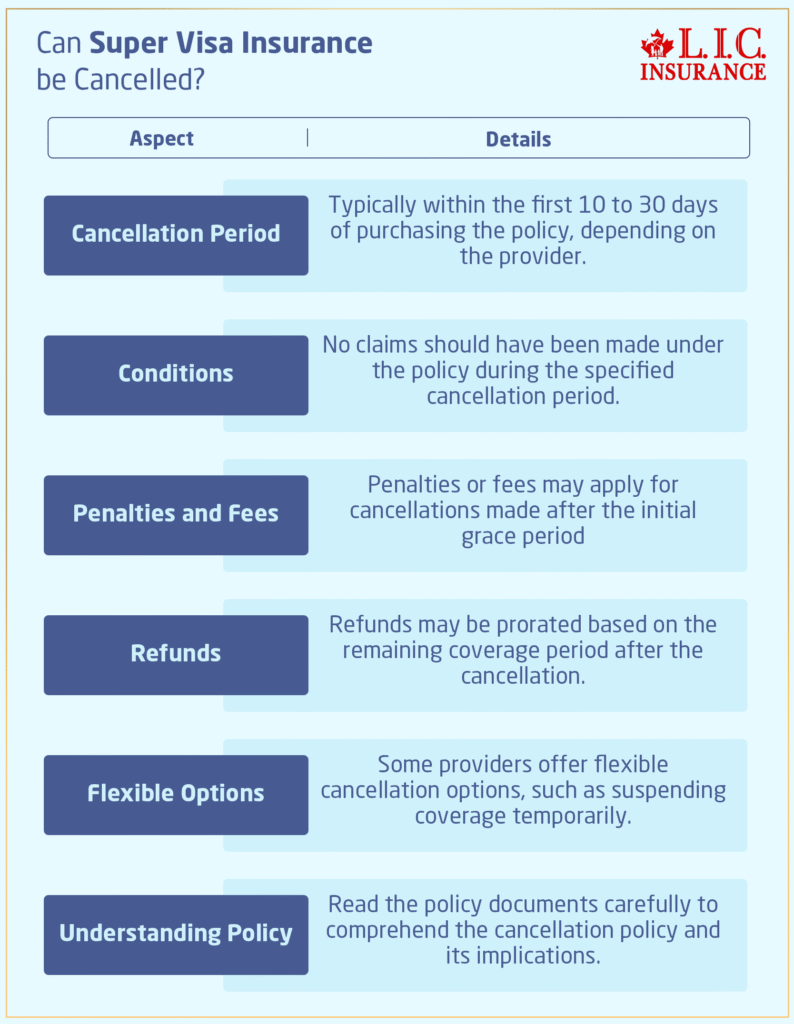

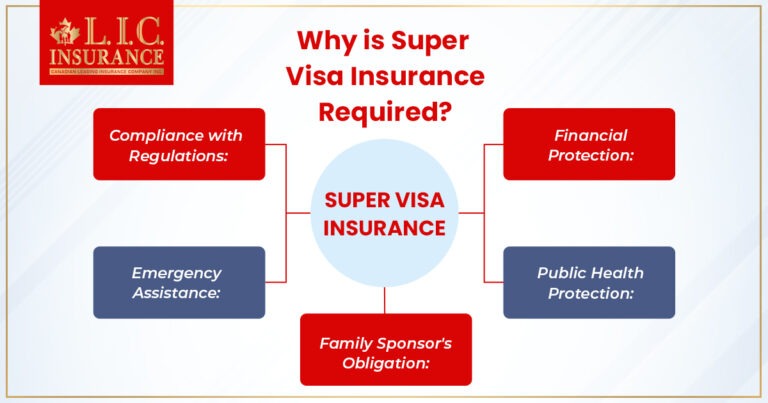

Also note that it is the responsibility of the buyer of the insurance to get the tentative effective date changed to ensure they have insurance in effect at the desired date (day when your parents arrive in Canada). If you are disapproved for any reason, the premium paid on this insurance will be refunded.

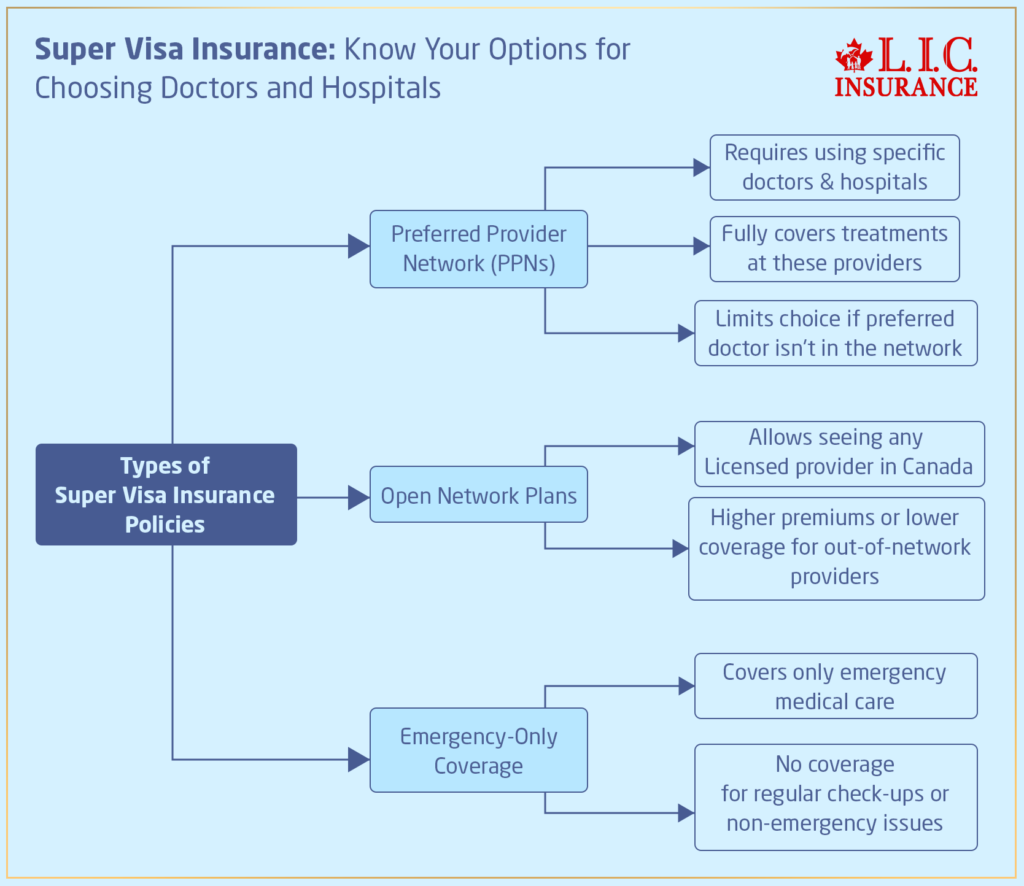

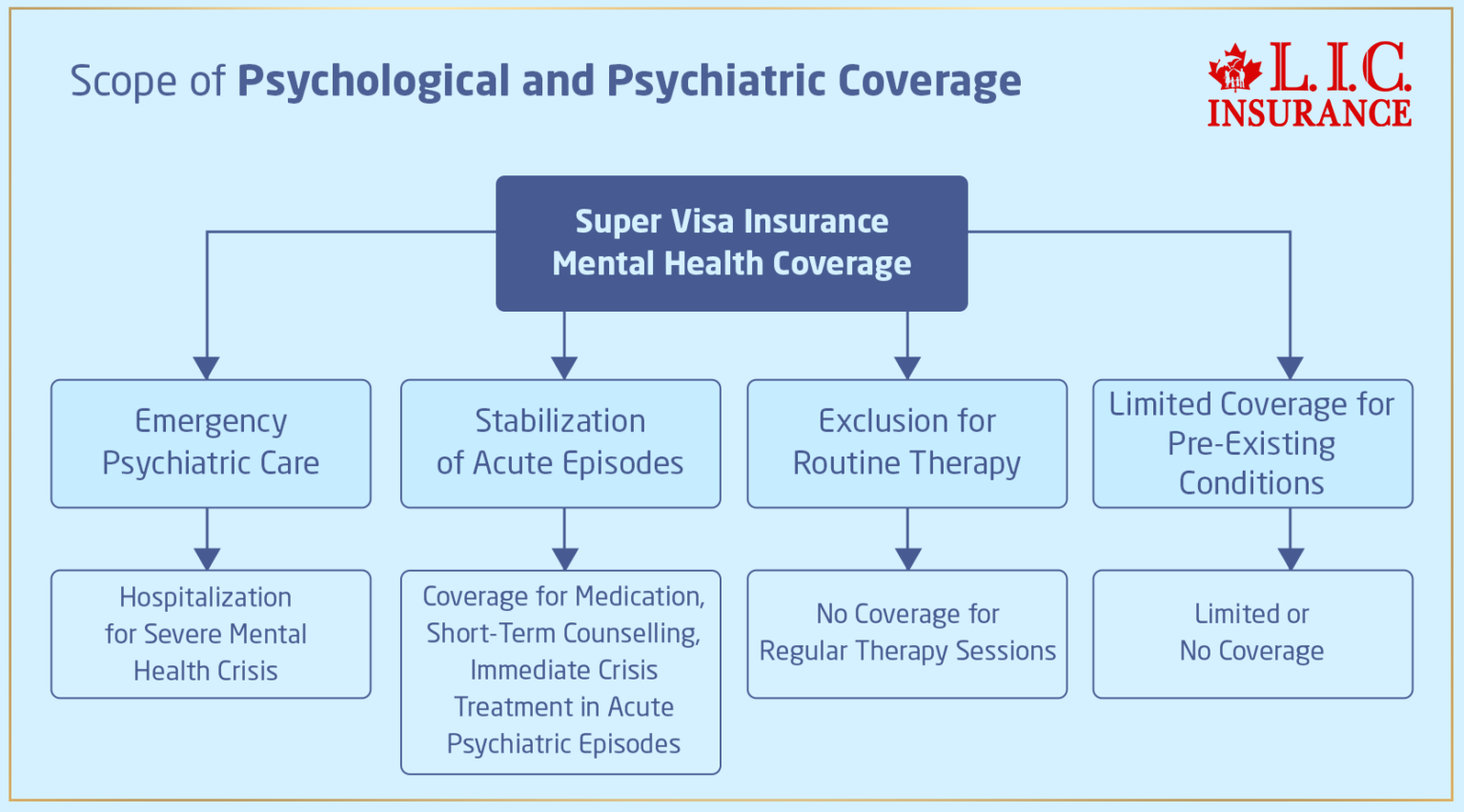

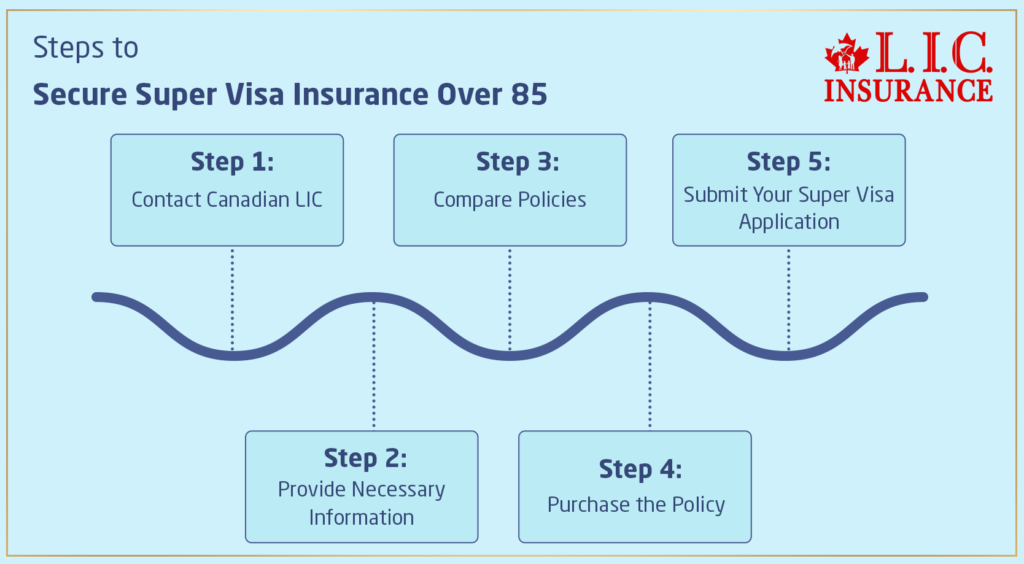

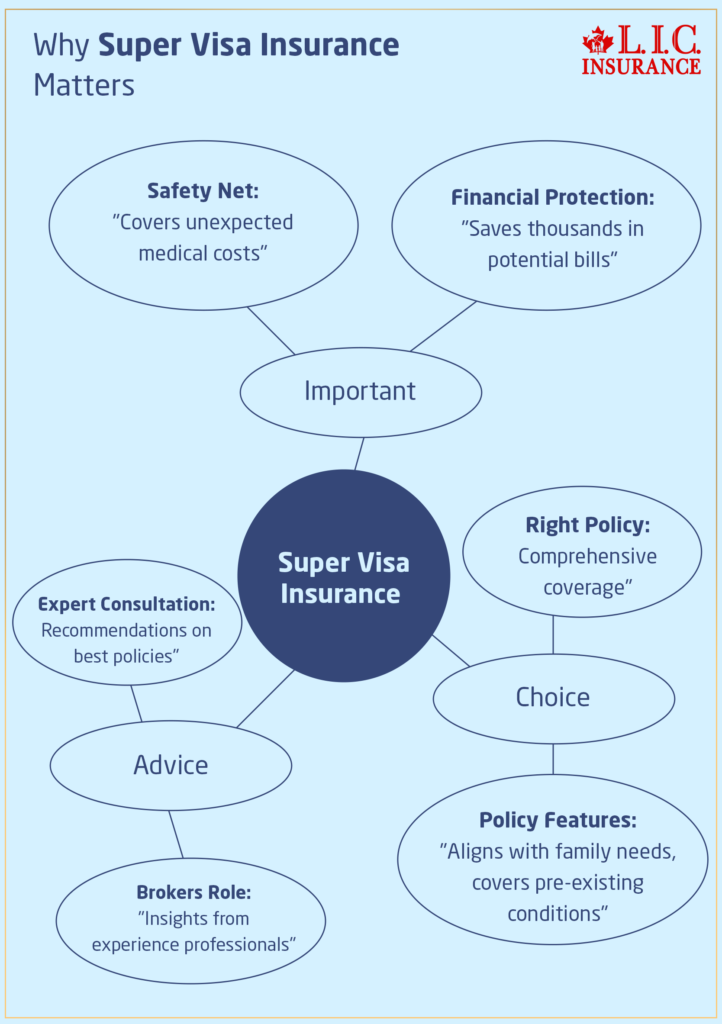

There are different kinds of super visa insurance, make sure you compare the coverage and get one that will provide you with adequate coverage. When you are choosing super visa insurance, then there are certain things that you should consider, the super should be then issued to you by the licensed Canadian company, it must provide the $100, 000 health/medical insurance and the validity of the insurance should be for 1 year. This is just a high-level overview of super visa insurance. For more information, contact our experts today.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

How to Prove Your Income?

This is an important step in the application process for the Super Visa. You’re going to need documentation and proof to show that you meet the minimum income requirement. Here are some of the major documents you might be asked to file:

- Notice of Assessment (NOA): A document from the Canada Revenue Agency (CRA) summarizing your income, deductions, and any credits for a particular tax year. Your NOA is key evidence that demonstrates your income.

- Letter of Employment: Having a letter from your employer that confirms your annual salary, as well as your job title and the number of years employed, is good for showcasing your income.

- Payslips: Recent payslips add another piece of evidence of your income. They reflect your income on an ongoing basis, and you can use them to bolster your application.

- Bank Statements: Bank statements can show that you have been in good financial standing and confirm that you can afford the keep of your parents / grandparents when they will be in Canada.

- Affidavit of Support: In the event that your individual income does not satisfy the income requirement, you may submit an Affidavit of Support from another relative who does meet the income threshold.

- HOA Documentation: If you own real estate and have equity, you may be able to include the market value of your home to meet the income requirement.

You should read the requirements from the Immigration, Refugees and Citizenship Canada (IRCC) so that you can know exactly what documents to submit.

Calculating the Minimum Necessary Income (MNI)

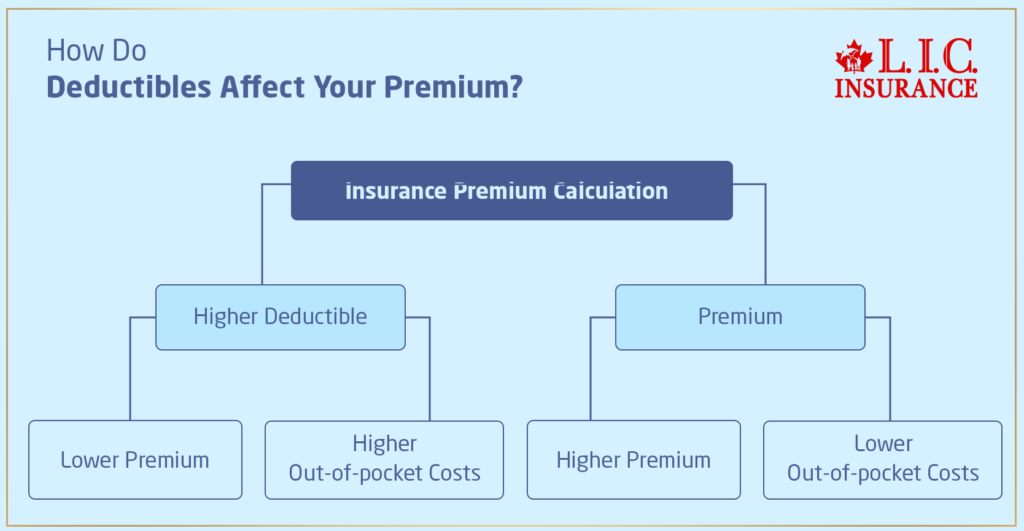

What is the Minimum Necessary Income (MNI) for the Super Visa? you intend to support (such as your parents or grandparents), taking into account the applicable LICO numbers. Here’s a simple calculation to estimate the MNI:

LICO-based MNI for your family size plus 30%

The “30%” factor is included to leave sponsors with a little extra financial padding. It is also wise to plan for any unforeseen costs while your parents or grandparents are in Canada.

Real Mistakes Sponsors Make When Proving Income — And How to Avoid Them

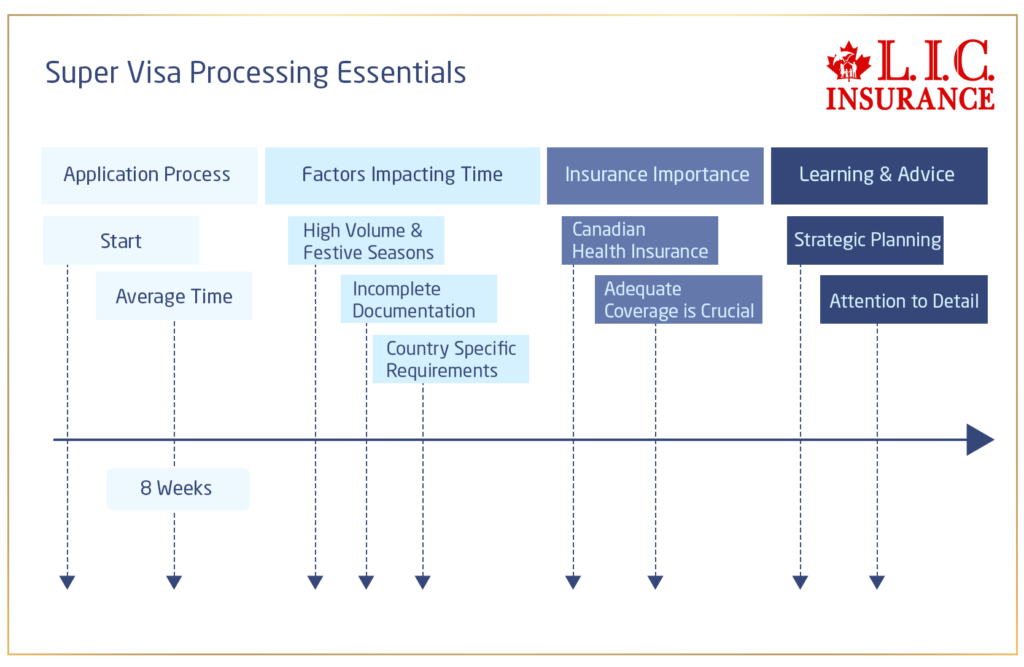

At Canadian LIC, we’ve reviewed hundreds of Super Visa files — and we’ve seen some common income-related mistakes that cause unnecessary delays or rejections. One of the biggest issues is using outdated Notice of Assessment (NOA) documents. Many applicants mistakenly submit NOAs from two or three years ago, unaware that IRCC typically requires the most recent tax year’s information.

Another common error? Miscalculating family size. For Super Visa purposes, family size includes not just dependents in your household, but also the parent or grandparent being invited. If even one person is missed in that calculation, it can cause you to fall below the LICO requirement — even if you technically earn enough.

We’ve also seen sponsors combine incomes without documentation to support it—for example, listing a spouse’s income but failing to include their employment letter or pay stubs.

When you work with Canadian LIC’s licensed consultants, we guide you step-by-step through income proof and documentation, ensuring every figure, form, and file aligns perfectly with IRCC standards. Don’t risk rejection over technicalities. Let our experience work for your family’s reunion.

Meeting the Income Requirement: Tips and Strategies

Reaching the income requirement for the Super Visa will help make this journey of family reunification a memorable one. Here are some strategies and tips for making it over the income threshold:

Take a Look at the Updated LICO Numbers

Keep an eye on the latest LICO numbers released by Statistics Canada. These numbers may fluctuate from year to year, so be sure to have the latest info on hand when determining the income requirement.

Plan Ahead

If you plan to sponsor your parents or grandparents in the future, plan ahead. So make sure you know the income requirement ahead of time so that you can prepare.

Combine Incomes

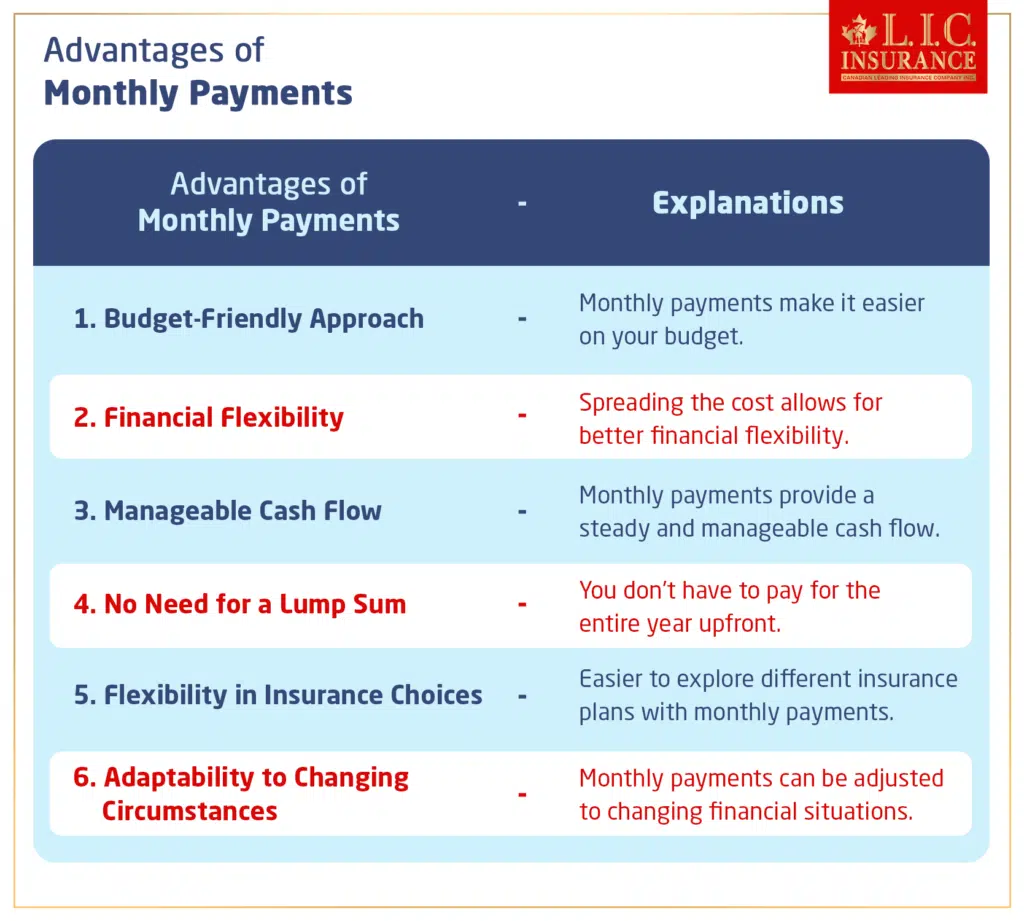

If you have spouse or common-law partner, you may pool your income together to satisfy the income requirement. This is particularly useful if one party is earning more.

Increase Your Earnings

Look for options to enhance or add to your income (take on extra jobs, seek out promotions if possible, invest with a zest and wisdom.)

Seek Financial Advice

Visit with a financial adviser to assist in developing a plan to satisfy the income requirement. They can be a lot of help when it comes to effective financial planning.

Use Assets

You might want to use your investments or savings when applying to show how you’re financially stable.

Gather Strong Supporting Documents

Collect all the necessary documents to prove your income, including Notice of Assessment (NOA), employment letters, pay stubs, and bank statements. Ensure that these documents are accurate and up-to-date.

Think About an Affidavit of Support

If you cannot satisfy the financial requirement you may opts for having a family member supply an Affidavit of Support.

To Sum Up

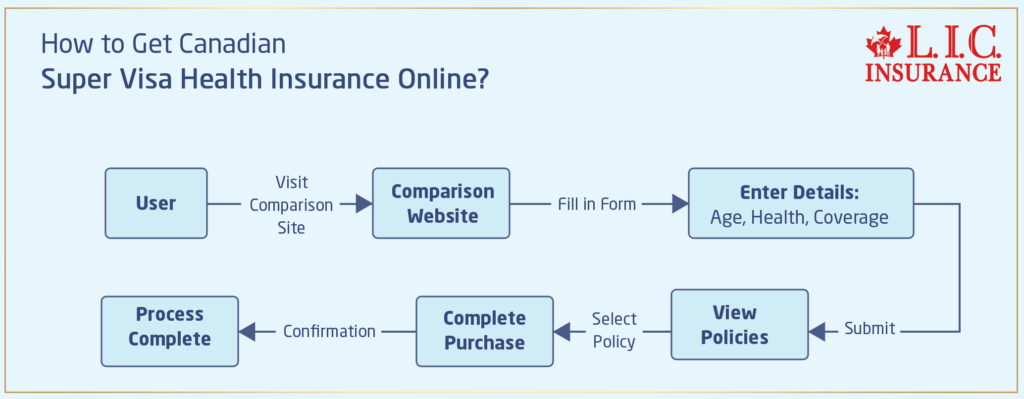

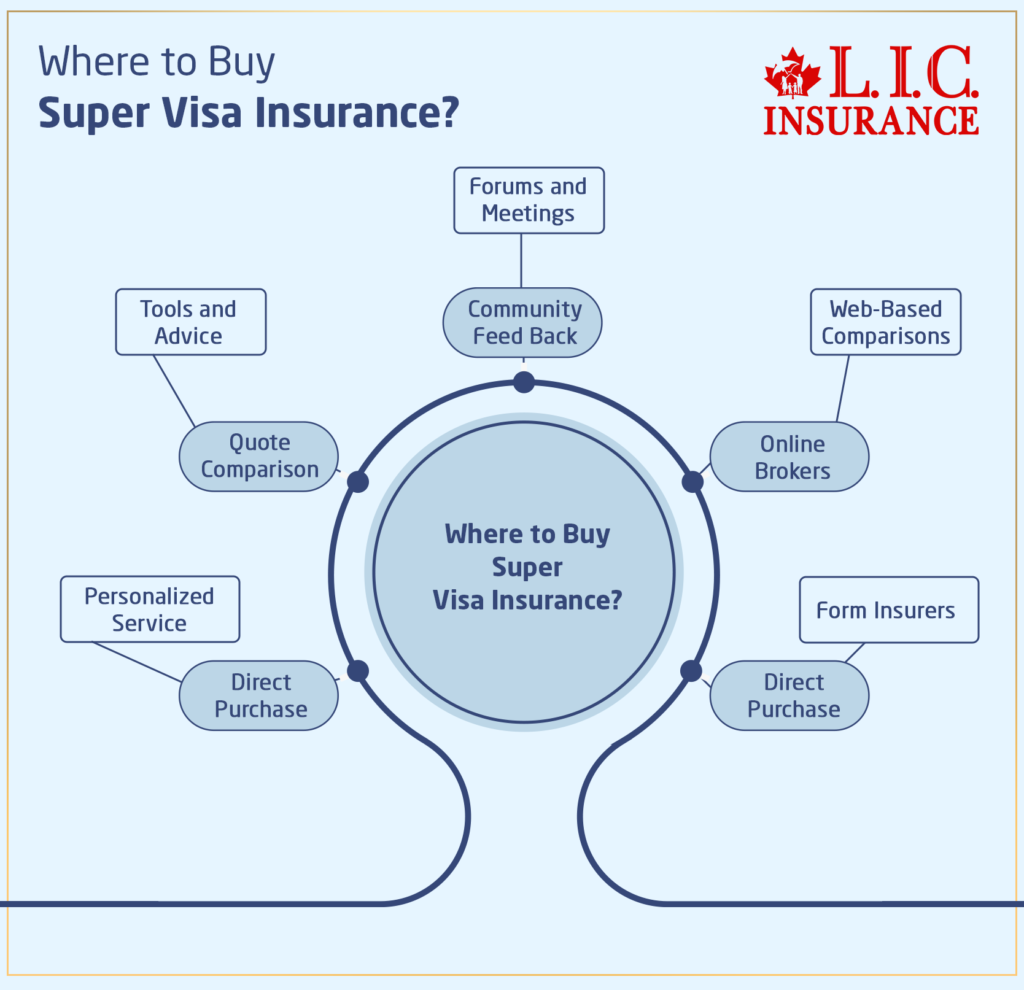

The Super Visa represents an excellent chance for citizens of Canada and the permanent residents to visit their parents and grandparents. But the income is part of the application process. Through understanding the Minimum Necessary Income (MNI), being aware of the LICO statistics and following the advice and the strategies provided above, you can prepare yourself in the best possible way to be able to meet the income requirement and reunite your family in Canada. And keep in mind immigration rules and requirements can change, that’s why you should always check with Immigration, Refugees and Citizenship Canada (IRCC) and ask for legal guidance for the latest information and guidance regarding the Super Visa application process. If you don’t want to buy through a broker, finding an agent to work with. But if you are then, you are going to miss out on the biggest advantage of comparing insurances available in the market. If you choose to go through an agent, do your homework so that you can snag the best deal for your plan.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

A Super Visa permits parents and grandparents to stay in Canada for a longer amount of time without the need for repeated renewals, as opposed to an ordinary visitor visa, which typically allows stays of up to six months.

Parents and grandparents of Canadian citizens or permanent residents can apply for a Super Visa. They must also meet other eligibility requirements, including having a written invitation from their child or grandchild in Canada.

The primary purpose of a Super Visa is family reunification. It allows Canadian citizens and permanent residents to bring their parents and grandparents to Canada for extended visits.

A Super Visa is typically valid for up to ten years, but it does not grant continuous stays for ten years. Each entry allows the parent or grandparent to stay in Canada for up to five years at a time without needing to renew their status.

Super Visa holders are generally not allowed to work or study in Canada. The Super Visa is intended for family reunification and extended visits, not for employment or education purposes.

Super Visa holders are not eligible for publicly funded healthcare in Canada. It’s essential to obtain private health insurance coverage for the duration of their stay to cover medical expenses.

Yes, Super Visa holders can travel in and out of Canada during their visit as long as their visa remains valid. However, they must meet the entry requirements each time they return to Canada.

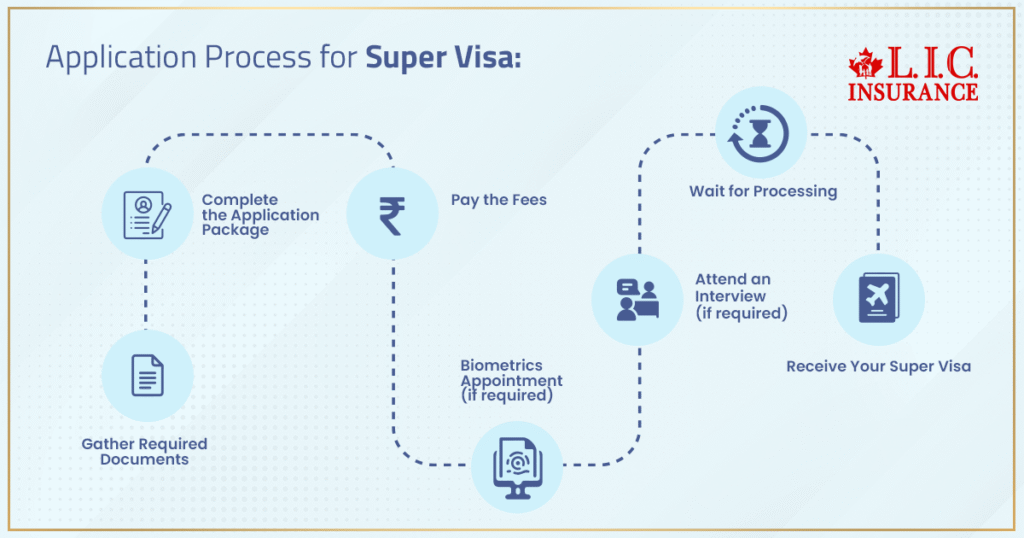

To apply for a Super Visa, you must submit a complete application package to the Canadian visa office responsible for your country of residence, including the required forms, supporting documents, and proof of medical insurance. It’s advisable to consult the official website of Immigration, Refugees, and Citizenship Canada (IRCC) for the most up-to-date application instructions.

No, parents or grandparents cannot apply for a new Super Visa from within Canada if they are already in the country on a visitor status, including a Super Visa. To apply for a new Super Visa, they must do so from outside of Canada, typically from their home country or their country of legal residence.

Yes, grandparents with a Super Visa in Canada can live independently if they choose to do so. They have the flexibility to decide their living arrangements during their extended visit, whether it’s with their sponsoring family or independently while adhering to immigration and insurance requirements.

Yes, you can apply for a Super Visa for your parents in Canada. To do so, you, as the sponsoring child or grandchild, must meet specific eligibility requirements and provide the necessary financial and supporting documentation to demonstrate your ability to support your parents or grandparents during their visit. The necessary forms, papers, and evidence of health insurance must normally be sent to the Canadian visa office in charge of your region as part of the Super Visa application procedure. For thorough and current information on the application process, it is advised to check out Immigration, Refugees and Citizenship Canada’s (IRCC) official website or to see a legal professional.

The Super Visa income requirement is the minimum income that the Canadian sponsor (the child or grandchild inviting their parent or grandparent) must demonstrate to be eligible for the Super Visa. It is calculated based on the Low Income Cut-Off (LICO) figures published annually by Statistics Canada.

No, you need to meet the income requirement at the time of application. Once your parents or grandparents receive the Super Visa, they can stay in Canada for an extended period, usually up to five years, without the need for you to prove your income annually.

Yes, if you have a spouse or common-law partner, you can combine your income to meet the income requirement. Combining incomes can be helpful, especially if one partner has a higher income.

You may need to provide documents such as your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA), employment letters, pay stubs, bank statements, and any other relevant financial documents as proof of your income.

The income requirement is calculated based on the LICO figures and the number of people the sponsor plans to support, including the parents or grandparents they are inviting. Typically, the formula is MNI = LICO for your family size + 30%, where “MNI” stands for Minimum Necessary Income.

There are no specific exceptions to the income requirement for the Super Visa. However, sponsors who cannot meet the income requirement on their own can explore the option of having another family member provide an Affidavit of Support to demonstrate financial support.

If you do not meet the income requirement on your own and cannot provide an Affidavit of Support from another family member, your Super Visa application may be denied. It’s crucial to review the income requirement and plan accordingly carefully.

Yes, you can use valuable assets like property, investments, or savings as part of your application to demonstrate financial stability and help meet the income requirement.

These frequently asked questions (FAQs) include essential details concerning the Super Visa income requirement in Canada. However, for the most up-to-date information and direction on the Super Visa application process, it is best to seek professional advice from one of the expert brokers in Canada like Canadian LIC.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]