- What Is The Processing Time For A Super Visa In Canada?

- The Super Visa Explained

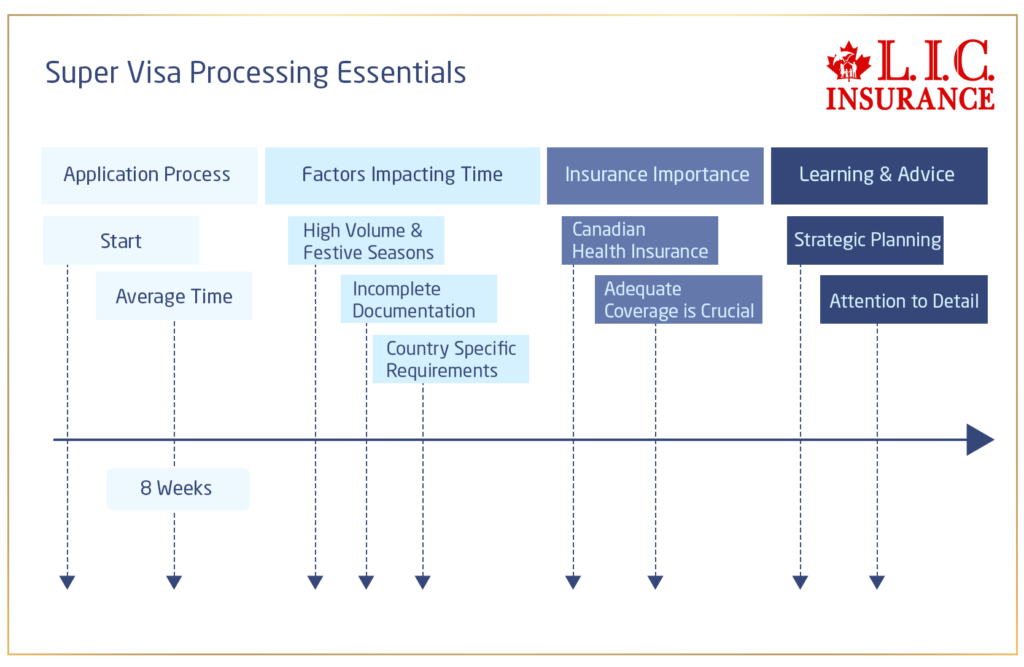

- The Heart Of The Matter: Understanding Super Visa Processing Times

- The Application Volume

- The Role Of Your Country Of Residence

- Understanding Insurance: The Foundation Of Your Application

- Engaging In The Process: Your Path Forward

- Super Visa Insurance In Canada: A Pillar Of The Application

- Choosing The Right Canadian Health Insurance For Super Visa

- Conclusion: Start Your Super Visa Journey With Confidence

What if your parents were here, sitting next to you, chatting over a cup of tea about Canada’s golden autumn leaves and quiet snowy winters? Sounds like a beautiful dream, no? Their eyes glint with interest — they’ve seen these seasons only on screen. You begin to think, “Why not make this dream a reality? That’s where the Super Visa comes in. It allows parents and grandparents to spend an extended period of time with their family in Canada. However, most families have the same issue —so much paperwork and searching for the best Super Visa Insurance in Canada. The process can be disorienting anyway, with questions like how long it takes and what type of insurance is required. So if you want to better comprehend how the Super Visa functions — focusing in particular on the processing time and the reason Canadian health insurance is so integral to it — this blog is for you.

The Super Visa Explained

Let’s be clear about what a parent and grandparent Super Visa comprises before getting into the specifics of insurance and the complexities of processing times. The Super Visa is a ten-year multi-entry visa for visiting parents and grandparents of Canadian citizens and permanent residents, which allows them to enter Canada and remain in Canada for up to five years at a time without having to renew their visa. It’s perfect, isn’t it? However, this is also where many encounter their first obstacle: figuring out and obtaining the appropriate Super Visa Insurance.

This insurance must be from a Canadian provider and include emergency healthcare and hospitalization.

Without valid insurance, even a strong Super Visa application can face rejection or delays.

It’s not just a formality—it’s a key requirement. The insurance must provide a minimum of $100,000 in coverage. It should be valid for at least one year from the date of entry. Only then can your Super Visa application stand a real chance of approval.

The Heart of the Matter: Understanding Super Visa Processing Times

Planning the most awaited reunion with your parents or grandparents in Canada becomes much easier with the parent and grandparent Super Visa. This visa is easy to get, but the process can be hard to understand, especially when it comes to the time it takes to process. It’s estimated to take eight weeks on average, but let’s explore the factors that can extend or reduce this period, highlighting the significance of Canadian Health Insurance or Super Visa Insurance in Canada.

The Application Volume

Think of the Canadian visa office as a busy marketplace where applications are flooding in very quickly. High season means more people, and that, in turn, means longer queues. The truth of the matter is that, especially during peak travel times or festive seasons, this is the reality for Super Visa applications. It really does make a difference: if you apply during off-peak times, you may have much shorter waiting times, though this easy but effective method usually puts you at the back of the line.

Clara and Roberto were an energetic couple from Brazil who had dreamt of seeing the Canadian Rockies with their very own daughter’s eyes, who resided in Alberta. They had decided upon the Super Visa and applied, knowing their plans. However, their journey was delayed because they had incomplete documentation. Of course, this was majorly for their Super Visa Insurance in Canada, which mandates that proof be shown for a valid Canadian Health Insurance policy for the Super Visa and that it is basic for covering the potential medical expenses for the period of said stay.

It is a poignant reminder that the application was not simply a tick-the-box exercise but needed to fill out clear, accurate documentation which met the requirements all along—especially those about Super Visa Insurance. Processing unnecessary time spent away from family can be held up even longer because of these details.

The Role of Your Country of Residence

The place where you apply may also affect the processing time of your Super Visa. Some countries have varying levels of documentation and supplementary requirements, which may ease or complicate the matter. That doesn’t mean that people who live in tougher places feel hopeless about their situation. On the contrary, this emphasizes the necessity of proper preparation and in-depth understanding of all the requirements needed in your country.

Understanding Insurance: The Foundation of Your Application

The focus now will be on the cornerstone of your Super Visa application: getting the correct Canadian Health Insurance for the Super Visa. This is not just one more step; this is your family’s safety and a statement of your readiness.

Excited about their intentions to come to Toronto and be with their son, Mei and Lin did not feel that taking out Super Visa Insurance right in Canada was necessary. They purchased the first policy they saw online, knowing that it was barely passable for the minimums and had limited coverage. When Lin needed sudden medical attention, this led to a huge out-of-pocket cost—a hard lesson about the kind of comprehensive Canadian Health Insurance that should have been purchased for the Super Visa.

Their story will remind every applicant that insurance is not just a requirement but an important part of your family’s health in Canada. It will remind you that it is finding a policy that will meet not only your requirements for the visa but also enough cover to bring peace to your stay.

Engaging in the Process: Your Path Forward

In order to obtain the best insurance, one must be aware of the Super Visa processing time; this is a lengthy procedure that calls for a great deal of patience as well as some strategic planning, which involves research. More than bringing your loved ones to Canada, it ensures their stay is secure, legal, and free from any unexpected medical expenses.

All of them would be quite helpful if one were to apply them and learn from Clara and Roberto’s insured mistake as well as Mei and Lin’s insurance mishap. As you commence on this journey, keep in mind that timing is crucial, ensure that your paperwork is completed accurately, and choose the appropriate Super Visa Insurance in Canada.

Your efforts today pave the way for joyful reunions and new memories in Canada. Proper solid preparation is to include getting strong Canadian Health Insurance for the Super Visa. In fact, you invite them and make it possible for your parents or grandparents to come and visit you, making it a totally worry-free experience within your home away from home. Let this process be a tribute to your love and commitment, ensuring an easy and fun visit for those you love.

Meet Ana and Carlos, who began their Super Visa journey to bring Carlos’s parents to Canada. They would be filled in neatly from top to bottom, every “t” crossed and every “i” dotted with precision. Now, they were at that ever-popular waiting game, growing more excited every week. Was it the error of their ways? Apparently, they did not understand the importance of putting in place a complete application, including a sound Canadian Health Insurance policy for the Super Visa. As a result, their neglect caused unnecessary delays, a problem that many families face. This story highlights the need for attention to detail, especially regarding insurance requirements.

Choosing the Right Canadian Health Insurance for Super Visa

It can feel like a trek through a dark forest to find your way through the world of Super Visa Insurance in Canada. There are many options along the route, all promising to protect your family from medical crises. Together, let’s clear the path by going over every little aspect of Canadian Health Insurance for Super Visa to ensure that your loved ones have a safe and unforgettable visit.

The Coverage Dilemma: Healthcare, Hospitalization, and Repatriation

First, let’s address the core requirements: Any policy you consider must offer comprehensive health care and hospitalization coverage, along with repatriation. These elements guarantee that if a worker becomes ill, or even, unfortunately, in case of death, his respective family members are to be well taken care of and can return to their country without any economic burden if they had to.

Imagine Maya and John securing a policy just two days before John’s parents were supposed to come over. They didn’t look into the repatriation coverage and glanced only at the part related to health care and hospitalization. When an unexpected health issue led to the worst-case scenario, they faced not only emotional turmoil but also the sudden financial strain of repatriation costs. This is an example of the far-reaching importance of comprehensive coverage.

The Reliability Riddle: Choosing a Trustworthy Insurer

As for Super Visa Insurance in Canada, not all insurers are equal. The reliability of the insurer makes a great difference in your experience, most importantly in the events when support is needed the most.

Have you ever considered what happens behind the scenes when you file an insurance claim?

Amina went for her policy on the choice of a friend and paid attention to the reputation of the insurer for reliability. She appreciated the value of this very choice when, on visiting day, it turned out to be of paramount necessity to conduct emergency surgery on her mother. The really prompted and supported claim process by the insurer did come in to ease the stressful experience she was going through. This teaches us the critical lesson of selecting an insurer known not only for its policies but also for its support and service.

The Claims Quest: Understanding the Ease of Claiming

The facility of easily lodging a claim is one of the backbones of good insurance. It’s not just a matter of gathering reimbursement, but it is how the process flows very quickly and smoothly, especially being thousands of miles away.

For this one, if you were from an entirely different point in time and time zone and you had to explain to your parent how the Canadian healthcare system actually works, where would you begin?

Consider Lisa’s story; her father became ill during his visit. The Canadian medical system felt very confusing. But because they had a policy with a very claimable feature, Lisa was able to handle this across the nation and guide her father every step without any hassle. Lisa’s experience proves that a simplified, user-friendly claiming process is paramount: one that ensures distance never gets in the way of quality healthcare.

Pre-existing Conditions: The Unseen Challenges

Pre-existing condition coverage varies widely from one Canadian Super Visa Insurance policy to another. It is an integral part of ensuring that your loved ones will not have to suffer from non-coverage or from large, out-of-pocket expenses.

Imagine your parent has a chronic condition, like diabetes. How would you feel knowing their insurance doesn’t cover the medical attention they might need while visiting you?

The case of Hassan, whose mother came over for such a stressful visit when they found out that her diabetes needs were not catered for by the policy they had taken, was the same. Since then, Hassan has never hesitated to be a firm believer in the precept of reviewing the policy very firmly and with a lot of care, especially on the pre-existing conditions clause. This, if possible, should be done so that others may not suffer as he did.

Find Out: Super Visa Insurance Income Requirement

Find Out: The mistakes to avoid while buying Super Visa Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Conclusion: Start Your Super Visa Journey with Confidence

As our stories show, the way to unite with your family members through the Super Visa is thorny, with special reference to processing times and getting the right Super Visa Insurance in Canada. But armed with the right information and comprehensive insurance cover, this journey should go well.

Many families face delays and confusion when applying for the Super Visa, especially when trying to meet strict insurance requirements and unpredictable processing timelines. It can feel overwhelming, but it doesn’t have to be. When you’re equipped with the correct knowledge, accurate documents, and valid Super Visa Insurance from a Canadian provider, the entire process becomes smoother. The key lies in being prepared and getting expert help early in the process.

We do encourage you not to be discouraged by the long and complex process, but rather consider it a step toward being able to create some of the most lasting and breathtaking memories with your family.

Yes, the Super Visa process takes time and effort—but every form, every waiting period, and every insurance quote is a step toward precious moments with your parents or grandparents. Think of it not as a hurdle, but as an investment in your family’s togetherness. The joy of celebrating festivals together, watching your children bond with their grandparents, or just sharing dinner after years apart is worth every bit of the paperwork.

Don’t let another day pass without making some effort towards reuniting with your loved ones. Find out what you can do with Canadian LIC and take that first step. Your Canadian adventure as a family is still waiting, and preparation will find you meeting in person to share those autumnal scenes and winter wonders.

Time slips away quickly, and the longer you wait, the more memories go unshared. Today is the right time to start working on your Super Visa plan. Whether it’s checking insurance options, gathering documents, or simply speaking with an experienced advisor at Canadian LIC, every action brings you closer to hugging your loved ones again. Those scenic fall colours, the joy of a white Christmas, and the warmth of family dinners in Canada—they’re all just a few steps away.

Faq's

Super Visa Insurance may be understood as health insurance specifically designed for prospective parent and grandparent visitors under the Super Visa program. It includes the repatriation coverage of medical, hospitalization, and reason expenses, which would ensure that visitors could receive medical care in Canada without financial burdens on them or their families.

From Jing’s true story, consider the sense of relief that Jing could have felt when, after her mother arrived from China, she actually needed to get emergency dental surgery—fully covered under her Super Visa Insurance. That’s just a story that highlights what vital insurance protection is against surprise medical bills for visitors.

The Canadian government requires this insurance since a Canadian taxpayer should not be in a position to bear the cost of healthcare for visiting foreigners during their stay. Both are, therefore, comfortable with the fact that the tours and visits will be enjoyable without any worries.

Imagine the experience that Thomas had to go through with his in-law father when he got involved in a small accident while having a tour of the Rockies. Thanks to Canadian Health Insurance for the Super Visa, they could sail through with all expenses well taken care of, pointing to the necessity of this requirement.

You should take coverage for a minimum of 100,000, which would include health, hospitalization, and repatriation. However, since Canada has very high healthcare expenses, it is always wise to go for much more than this.

Lena and her spouse decided to get $150,000 coverage for their parents. After some period of time, they unexpectedly had to cover a certain sum for her father’s operation; they understood that a more substantial sum of coverage would have at least saved them from out-of-pocket expenses.

The Super Visa application process involves completing the online or paper form (IMM 5257), gathering supporting documents like a letter of invitation, proof of financial support, medical insurance, and proof of relationship. Once everything is ready, you submit the application online or at a Visa Application Centre.

The Super Visa processing time can vary depending on the country of application. On average, it may take 8 to 12 weeks, but this can change based on application volume, security checks, and completeness of your documents.

The Super Visa processing time 2025 is expected to remain similar to previous years—generally between 60 to 90 days. However, delays can occur if additional documents or medical exams are required.

While you cannot directly fast-track the Super Visa application process, submitting a complete application with all required documents, upfront medicals, and valid insurance can help reduce delays.

Yes, if a medical exam is required, it becomes part of the Super Visa processing time. Delays in scheduling or completing your medical can slow down your overall application approval.

Some policies do cover pre-existing conditions, but again, read the fine print. Policies do vary; some policies will only guarantee conditions that remain stable or have specific exclusions.

He looked from one policy to another regarding the diabetic condition of his mother. When he finally got a clear term about pre-existing conditions with comprehensive coverage, there was nothing else but a big game-changer for their peace of mind.

Select a policy from any insurer that is said to have a good reputation for customer service and an easy claims process. Read reviews and ask for recommendations to see if other people have had good experiences.

Naomi identified many difficulties with the very complicated process of her parents’ last visit. To this end, she started by identifying an insurer with good reviews on the ease of claiming so that at least that nightmare they went through could be eliminated in their next visit.

While a majority of the insurers will have a clause for a cancellation and refund for the unused policy, the terms of each individual policy do vary, so do check the cancellation terms before purchasing.

Alex had to postpone his parents’ visit at the very last moment, and he was very happy that he could avail himself of a full refund for the Super Visa Insurance since the policy had not commenced. This is a good reminder to know what your policy offers beforehand.

It’s wise to purchase insurance as soon as you have your travel dates. Some insurers allow you to specify a start date that aligns with your arrival in Canada, ensuring you’re only paying for coverage when you need it.

When Mei purchased insurance three months in advance for her grandmother, setting the start date to coincide with her arrival, she found peace in knowing everything was arranged well ahead of time, highlighting the benefit of early preparation.

Yes, Super Visa Insurance can often be extended, provided you request the extension before the current policy expires. However, ensure this is planned in advance to avoid any gaps in coverage.

When Maria’s parents decided to extend their stay to experience a Canadian winter, Maria was initially worried. However, she quickly learned that their policy allowed for an easy extension, ensuring her parents remained covered throughout their adventurous stay. This experience teaches the importance of understanding the flexibility of your insurance policy.

The most basic one, and which Super Visa Insurance would cover, pertains to hospitalization; it will take care of expenses that concern hospital stays, surgery, and other medical emergencies. The policies then go further to articulate details like the types of rooms eligible for, types of room rentals or included surgical fees.

Ali’s grandmother went through an emergency appendectomy; though it was a time of stress, this was a relief in itself. The fact that the hospitalization covered every detail of the procedure, literally from scalpel to scalpel, and included the hospital stay epitomizes how comprehensive such insurance really is.

The Super Visa Insurance policies do not bind one to certain hospitals or doctors. However, it contains some preferred networks that could limit the out-of-pocket costs. Be sure to check your policy’s details.

Suppose there was a scenario which you needed to find a doctor to consult over your mother’s chronic condition on a non-emergency level of exigency. With Zoe’s Super Visa Insurance, she would be free to visit any doctor of her choice in order to consult about her visiting mother’s chronic condition.

Where claim denial occurs, the insurer’s reason for such denial is, in fact, first reviewed. Most policies do provide for an appeals process. Knowing the policy terms prevents surprising responses to claims that are negative.

Jay had a denial due to a misunderstanding over his father’s pre-existing condition. He was able to reverse the denial by the process of appeal and explaining the stability of the condition. One clearly sees where the importance of proper communication and understanding of policy terms was essential.

Knowing the exclusions, one should compare coverage, consider the reputation of an insurer, and look at experiences with customer service. Prioritize—those points most important for your family’s needs.

Priya sifted through weeks of going over policies and focused on the ones with the best coverage of pre-existing conditions and an easy way of making claims. When it came to the use of insurance, everything was covered, from the ambulance to the plane ride, without trouble because of doing prior research.

Super Visa requirements definitely stipulate that the insurance coverage should be for the entire period of stay in Canada to meet the visa conditions.

This Kevin learned the hard way when he allowed his parents’ insurance to expire, assuming that with just one month left in Canada, they would not have anything to cover. A minor accident that got them worried at the last moment to renew their coverage. Only then did they realize how important it is to have continuous insurance coverage.

However, it is recommended that the Super Visa Insurance be paid for by family members in Canada or the visitor. Most importantly, it must be paid for, the policy must meet the requirements, and it must be active for the period one will stay.

Linda, living in Canada, started to prepare all the required documents and sponsor the Super Visa Insurance for her parents as a gift from her, making sure they do not have to worry about one thing more. This gesture not only complied with visa requirements but also brought peace of mind to her family.

The aim of these FAQS and stories is to make your journey with Super Visa Insurance in Canada clearer and more relatable. We do understand that every family has unique experiences, but learning from others can always help us. For further questions or individual advice, the contact should be an insurance advisor of good repute, with the possibility to offer tailor-made solutions to meet effectively all your family needs. Let’s ensure your loved one’s visit to Canada is protected and memorable.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]