Consider a situation where your immigrant parents are spending an extended period in Canada on a super visa, travelling across this country of immense landscapes, experiencing the warmth, and imbued with the welcoming culture. Everything is going well until you realize that your parents’ Super Visa Insurance runs out in the middle of their stay for several more months. Realizing the consequences and what to do next makes you feel scared. This is, unfortunately, a pretty common situation: When a visitor is still in Canada after their Super Visa Insurance ends, here’s what will happen. We are going to delve into practical steps to manage and prevent such a scenario so as to ensure that you will have your loved ones amply covered for the entire stay period. Relating real-life struggles with insurance and providing simple solutions, this piece will help you know how to deal with confidence and efficiency.

What Happens If Super Visa Insurance Expires?

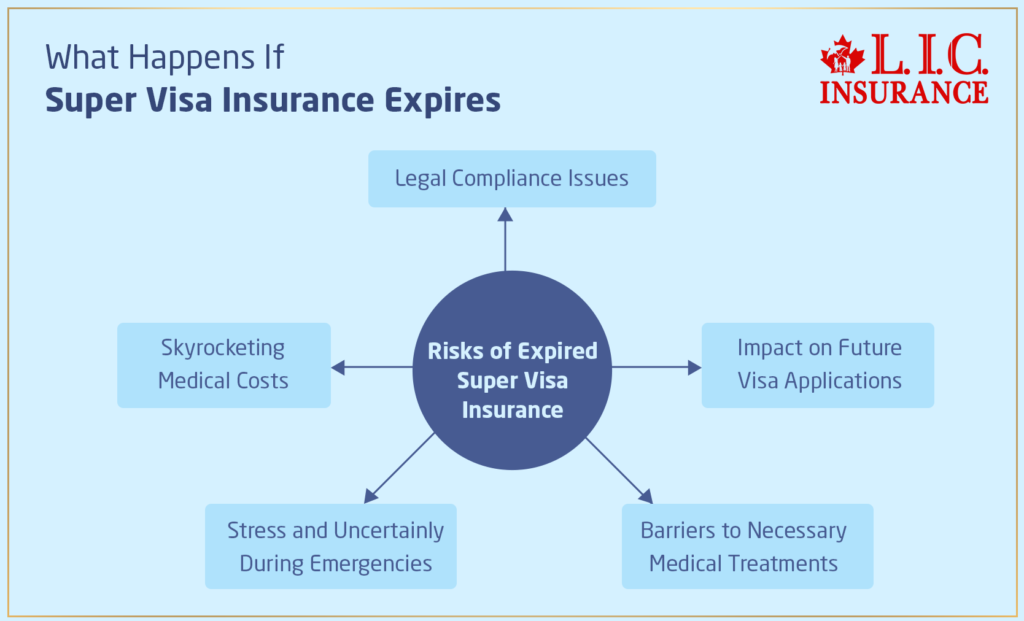

Understanding the Risks

This is Maria and Jose’s story and serves to reemphasize why it is so dangerous and risky when the status of Super Visa Insurance is going to lapse. Overwhelming finances are some of the far-reaching impacts that come with the absence of this coverage. Here, we share various risks related to expired Super Visa Insurance through some relatable situations. We are sure that meeting the Super Visa Insurance requirements is key to ensuring that the inevitable high medical costs are avoided.

Skyrocketing Medical Costs

Lucy and George were a couple from the Philippines who were having a great time with their grandchildren in Toronto. George, on the other hand, slipped on ice and fractured his hip. It so happened that their Super Visa Insurance Coverage had lapsed, without their knowledge, only six days before the accident happened. Their hospital bills are over $50,000, and they have used up not only their entire savings but also had to borrow from family. This situation could have been mitigated if they had maintained their insurance, highlighting the importance of keeping Super Visa Insurance active throughout their stay.

Legal Compliance Issues

Amit and Meena Amit and Meena from India faced a different kind of challenge. After forgetting to renew their Super Visa Insurance, they were questioned by immigration authorities during a routine check. This led to stressful legal scrutiny, as maintaining continuous medical insurance is a key requirement of the Super Visa Program. They had to work quickly to reinstate their insurance to avoid jeopardizing their visa status, proving how crucial it is to understand and comply with Super Visa Insurance Policy stipulations.

Stress and Uncertainty During Emergencies

Emily and Jack, British nationals, decided to stay with their son and his family for two years. When Jack had to be taken for an emergency gallbladder operation, they found, to their horror, that their insurance had failed to be renewed and had lapsed a month before the incident. The uncertainty, the pressure and their deep fear of not knowing how to manage the medical care costs added to their already troubled time. This could have been avoided had they been diligent in checking the status of their insurance.

Impact on Future Visa Applications

After their Super Visa Insurance expired unnoticed, Sofia and Carlos from Mexico had a rough time trying to renew their travel visa. The expired plan indicated failure to follow the conditions of the visa, which made it very hard to go through the process of renewal. The lesson learned from this experience is that a lapse can mean a lot of trouble for upcoming immigration applications. Safeguarding insurance coverage at all times.

Barriers to Necessary Medical Treatments

The Nguyen family from Vietnam hesitated to seek medical help for their daughter’s worsening asthma because their Super Visa Insurance had expired, and they were afraid of the high costs associated with treatment. This delay in seeking necessary medical care could have had dire consequences, illustrating why insurance is not just a legal formality but a crucial element of healthcare access during their stay.

Legal Implications and Compliance

understand that Super Visa Insurance requirements are not just on paper; they are really important in keeping the visa in legal status. Let’s list these requirements and show, using real-life examples, what it really means and why it is important to comply with these requirements.

Maintaining Legal Status in Canada

Key Requirement: Continue Super Visa Insurance Coverage.

Real-Life Example: Thomas and Elaine, from the UK, were enjoying holidaying with their grandchildren in Toronto. However, they missed the Super Visa Insurance expiry date. When the need of the hour arrived, Elaine got sick and had to be hospitalized. All of a sudden, not just a huge medical expense but also the lapse caused them to be in a non-legal position in Canada. All this could have been avoided by simply paying attention to renewal dates.

Avoiding Penalties and Fines

Key Requirement: Keep to your Super Visa Insurance Policies guidelines.

Real-Life Example: Alexei was from Russia and had no idea that allowing his insurance to lapse was inviting him to pay penalties other than the medical ones. When he went for renewal, the process became longer due to non-compliance with requirements. The pressure at that time was such that it could have messed up his chances of getting a visa extension.

Simplifying Future Visa Renewals and Applications

Key Requirement: Ensure you have always fulfilled all Super Visa requirements; insurance forms are part of that.

Real-Life Example: Sarah and Majid, from Iran, have ensured that their Super Visa Insurance and other documents are legal, authentic, and updated. When it came time to renew their super visa, the process was smooth and without complications, demonstrating the benefit of continuous compliance.

Ensuring Eligibility for Health Services

Key Requirement: Immediate coverage in medical emergencies under Super Visa Insurance Policies.

Real-Life Example: Ji-hoon and his wife Hana were in Vancouver from South Korea when they had a minor car accident. With their Super Visa Insurance valid, the critical medical services are available right after the incident, baggage-free from large expenses, emphasizing the importance of the active status of the insurance.

Protecting Against Unexpected Medical Costs

Key Requirement: Adequate coverage as per the Super Visa Insurance requirements.

Real-Life Example: When Lola from the Philippines visited her son in Montreal, she suffered a sudden cardiac arrest. Her Super Visa Insurance covered the intensive care unit costs and necessary medical procedures, highlighting the financial safety net that compliant insurance provides.

Renewing or Extending Super Visa Insurance

Acting fast when your Super Visa Insurance is about to expire is crucial to sustaining continuous coverage. It ensures that you do indeed meet the requirements of Super Visa Insurance. Consider the life example of An and Linh from Vietnam. Their policy was to expire in two weeks, so they managed to call the insurance provider and managed to get an extension of their policy without any break in the coverage.

Contact Your Insurance Provider

Contact your current insurance provider. Understand your existing Super Visa Insurance Policy; what are the existing benefits and limitations? Ask about the possibility of extending your current policy. For instance, consider Raj from India, who realized his parents’ insurance was about to expire; after reaching the insurance company, he learned that they were able to extend their current policy without any difference in terms under which they had the insurance, which took away the pains of going through the entire application process over again. With this, the due date for your Super Visa Policy would have been set for an extension if needed and would get rid of the need and the stress that comes along with looking for another policy. Several insurance providers have a list of questions that you can ask them. Among them are:

What do I need to do to renew my current policy?

Are there changes to the terms and costs if I opt to extend?

Which documents do I need to provide for this process?

Assess New Options

At this time, insurance needs could change, and what was a good deal before might not quite suit you now. This is just the time to shop around and compare what other providers have to offer. Look for a Super Visa Insurance Policy that tops up the minimum of $100,000 for health care, hospitalization, and repatriation with coverage for pre-existing conditions, if required. Take, for example, the case of Hana from South Korea. Her parents had an insurance plan with a rider that excluded some of the pre-existing conditions. As the renewal period was almost there, she was comparing several providers’ plans when she came across one that was comparatively much more comprehensive and competitive in price, thereby ensuring that during that period of stay, better protection was extended to her parents.

Complete Necessary Paperwork

After making up your mind on whether to go with the current provider or change to some new provider, then go on and complete all necessary paperwork as accurately as possible. At this stage, accuracy is important to avoid delays or eventual issues that may arise. All the information you provide should be up to date with information on changes in the health status of the insured or personal details. Take Carlos from Mexico, for instance. He had to renew his Super Visa Insurance. He did this stage with a lot of care, reading and filling in details in the documentation. Since his parents were the ones he was insured, he cross-checked their health and personal information to ensure that every detail was captured in the same way as indicated in the documents. Such attention to detail ensured no delays were encountered in processing, and indeed, the insurance was renewed.

Submit Documentation Early

Do not wait until the last day for the submission. Try getting it done well in advance of the date of expiration of your current policy. This proactive approach does not only give you continued protection but also gives you peace of mind.

Preventive Measures

Regularly Monitor Insurance Validity

Ensuring that your Super Visa Canada Insurance remains valid throughout the visitor’s stay in Canada is paramount. Think of a scenario where David and Emily, a couple from the UK, almost faced deportation because they overlooked the expiration date of their insurance. They were so engrossed in their Canadian explorations that they missed the deadline to renew their policy. Thankfully, a last-minute reminder from a friend sparked them into action, and they managed to renew just in time.

To avoid such close calls:

Set digital reminders: Utilize your smartphone or digital calendar to set multiple reminders about the expiration of your Super Visa Insurance Policy. Start with a reminder three months before, follow up one month before, and a final alert a week before the deadline.

Create a visual reminder: Sometimes, placing a physical calendar on your fridge or a note on your home office desk can serve as a daily prompt to check the validity of your insurance.

These strategies ensure you have ample time to take necessary actions and maintain continuous coverage, aligning with Super Visa Insurance requirements.

Understand the Terms and Conditions

Comprehending the details of your Super Visa Insurance Policy is as crucial as having one. Take the case of Chen, who travelled from China to visit his son in Toronto. He assumed his policy covered emergency dental services, but when he faced a dental emergency, he learned that his assumption was wrong and the policy did not cover it. This misunderstanding led to unexpected expenses and a lesson learned the hard way.

To truly understand your Super Visa Insurance Policy:

Read the fine print: Don’t just skim through your policy documents; read them in detail. If something isn’t clear, make a note of it.

Ask questions: Contact your insurance provider to clarify any doubts about what is covered under your policy and what isn’t. It’s better to ask seemingly trivial questions than face unexpected issues later.

Know your responsibilities: Be clear on what actions might invalidate your coverage, such as engaging in high-risk activities that the policy does not cover.

Consult with Experts

Insurance can be complex, and expert advice can be invaluable, especially when dealing with the nuanced requirements of Super Visa Insurance Policies. When Nadia from Jordan had questions about extending her parents’ stay in Canada, she turned to Canadian LIC for advice. Their expertise helped her understand the complex interplay of policy renewal and visa status, guiding her through the renewal process efficiently and effectively.

Engaging with experts can offer the following:

Personalized advice: Every situation is unique, and expert brokers from Canadian LIC can tailor their advice to fit your specific needs, considering factors like the length of stay, the health conditions of the visitors, and previous insurance claims.

Peace of mind: Knowing that a professional is handling the Super Visa Insurance requirements can reduce stress and boost confidence in your compliance with Canadian visa regulations.

Updated information: Insurance policies and visa regulations can change. Regular consultations with experts ensure you remain informed about the latest requirements and best practices.

By integrating these preventive measures, you can ensure that your experience with Super Visa Insurance is seamless and secure. These strategies not only help in maintaining legal status and avoiding financial burdens but also enrich your or your visitors’ stay in Canada, making it worry-free and enjoyable. Remember, staying informed and prepared is the key to managing Super Visa Insurance effectively.

The Bottom Line

However, the expiration of Super Visa Insurance while the visitors are in Canada says a lot about ensuring safety in both financial and legal terms. From the stories mentioned above, the real struggle can be recognized. And one learns to be more vigilant and proactive in relation to all kinds of insurance issues. Right now, contact Canadian LIC—the number one insurance brokerage in Canada, for purchasing or renewing your Super Visa Insurance. With proper advice and service from them, your family’s stay here in Canada will never be a headache with insurance lapses. Get in touch with Canadian LIC right away and let your loved ones get the worry-free experience they deserve. Do not wait until it is too late; protect their peace of mind now.

Find Out: Is Super Visa Insurance Refundable?

Find Out: How to find the most affordable Super Visa Insurance?

Find Out: Can we cancel Super Visa Insurance?

Find Out: Can you pay monthly for Super Visa Insurance?

Find Out: When should Super Visa Insurance start in Canada?

Find Out: The mistakes to avoid while buying Super Visa Insurance

Find Out: How to apply for Super Visa Insurance?

Find Out: Is there a waiting period for Super Visa Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Super Visa Insurance Requirements and Policies

Super Visa Insurance is medical insurance that the Canadian government needs all Super Visa application recipients to hold. Super Visa Insurance must be $100,000 in coverage for health care, hospitalization and repatriation. It is required to be a policy for a minimum period of one year after entering Canada. For instance, it was necessary for Manushi, from Brazil, who had to learn at the border that her travel insurance did not meet the Super Visa Insurance requirement, so her visit became super stressful from day one.

It would help if you had active Super Visa Insurance throughout the whole visit to be sure you wouldn’t get into a medical emergency without enough coverage, incurring staggering costs. Take the case of John and Linda from Australia, whose insurance lapsed by mistake during their stay. When John needed emergency surgery, they faced immense financial strain due to uncovered medical expenses. Keeping your insurance active safeguards you against such unforeseen medical and financial challenges.

Yes, your Super Visa Insurance Policy can be renewed from within Canada. You must renew some weeks before your current policy expires. This was the case for Alex from the UK, who successfully went this route by buying renewed insurance from Canada two weeks before his insurance was due to ensure that no lapse in coverage occurred.

If your Super Visa Insurance Coverage is expiring and you still need to conclude your stay, you should get in touch with your insurance company immediately to find out more about the renewal process. Take Hye-jin’s example from South Korea, who found out a month before her insurance would expire. Immediately, she contacted her insurer to extend her policy in time, making sure she was covered for the rest of the stay.

To select a good Super Visa Insurance Policy, compare policies from a variety of insurance providers. This may help you find one that offers all the coverage required and at a fair price. Look for policies offering coverage for pre-existing medical conditions, if required, and check out the specifics of coverage, such as hospitalization, repatriation, and emergency medical care. For instance, when Faisal from Jordan shopped around, he found a policy that not only met Super Visa Insurance Requirements but also provided additional coverage for his diabetes, ensuring peace of mind during his stay.

The implications of this might be denied entry into your prospective host country, Canada, with legal status complicating things further if it were to be found throughout your stay. This was the unfortunate case for Ekaterina from Russia, who was not allowed to enter Canada when her insurance was found to be insufficient at the border, highlighting the importance of ensuring your policy complies with all requirements.

You will have to have a letter of confirmation or certificate from the insurance company stating that your Super Visa Insurance meets the required conditions. The letter should have your name, clearly stating the dates the policy is effective, the amount of coverage, and that it covers health care, hospitalization, and repatriation. For example, when Soo-Min from South Korea sent in documents relating to her super visa, she correctly stated the information in her insurance certificate, which benefited her by allowing the entry process to go quickly and smoothly.

In case your insurance provider winds up while you are still in Canada, you will be required to replace the Super Visa Insurance Policy as quickly as possible to maintain your current status under the Super Visa requirement. As an example, let’s take a look at what happened to Roberto from Italy, whose insurer, facing financial difficulties, went out of business. He was quick to take action to secure a new Super Visa Insurance Policy from a different provider, thus making sure he remained compliant with Canadian regulations.

Yes, Super Visa Insurance Coverage needs to be purchased through a government-approved company. You may wish to buy from a well-regarded insurer with a good track record of issuing Super Visa Insurance, as Leah from the Philippines found to her cost when she bought from a firm unknown to anyone else, and her insurance was not accepted, thus delaying the issuance of her visa.

You can always do that, keeping in mind that there should not be a single day without insurance coverage while switching. Make sure you get the new policy before the old one expires. Ahmad from Jordan changed his provider after discovering a better deal that offered more for less. He purchased his new policy on the very next day after his previous policy expired to make sure he was fully insured and thus complied with Super Visa Insurance requirements.

In case you need to extend your Super VisaMedical Coverage, you would have to contact your insurance provider before your current policy expires and request an extension of the policy. Most insurance companies would be flexible with policy extensions. Natasha from Ukraine decided to spend more time with her grandchildren, and since she had to extend her stay, she contacted her insurer a month before the expiration of the policy. She successfully extended her coverage without any problems.

It can produce severe consequences, like being financially responsible for all the medical expenses claimed against you, possible legal action, or deportation. Also, it can affect your future visa applications to Canada. The other good example is Carlos from Mexico, who had failed to renew his policy on time and was left with a huge medical bill when he needed emergency services, besides having complications in renewing his super visa.

These FAQs will help you to get out of confusion about the Super Visa Insurance requirements and policies, using current examples that are very relatable to show the need for compliance and proactive handling of your insurance needs. Make sure you understand your obligations and stay covered to enjoy a worry-free stay in Canada.

Sources and Further Reading

Here are some sources and suggestions for further reading to deepen your understanding of Super Visa Insurance requirements and what to do if your insurance expires while you’re still in Canada:

Government of Canada – Immigration and Citizenship

Official page for Super Visa applications and requirements.

Canadian Life and Health Insurance Association (CLHIA)

A guide to understanding health insurance in Canada, including details relevant to Super Visa Insurance.

Insurance Brokers Association of Canada (IBAC)

Provides information on choosing the right insurance provider and policy for super visas.

URL: https://www.ibac.ca/

Settlement.Org

Discusses insurance requirements and legal aspects for visitors to Canada, including Super Visaholders.

These resources offer comprehensive information that can help ensure you meet all requirements and understand the implications of your Super Visa Insurance Policy in Canada.

Key Takeaways

- Maintain uninterrupted Super Visa Insurance Coverage to avoid legal and financial issues.

- Lapses in insurance can complicate future visa renewals and applications.

- Monitor the insurance expiration date and renew well in advance to prevent lapses.

- Ensure your policy meets the $100,000 minimum coverage requirement for healthcare and repatriation.

- Contact your insurance provider for an extension or switch providers if necessary before expiration.

- Consult insurance experts or brokers for tailored advice and the best insurance solutions.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]