What should you do if your parents are not in Canada and are invited to come here under the Super Visa program? As they begin getting ready for their long stays with their grandchildren and the beautiful landscapes and towns of Canada, they are excited. But the joy quickly turns to confusion, as the requirement for Canadian Super Visa Health Insurance seems like a major challenge. How should they start? What kind of coverage is enough? And how can they find a company they can trust so their trip is stress-free?

We bet a similar one could be heard from your neighbourhood: friends or relatives, for that matter, who have to struggle through so many insurance offerings, each one full of jargon and small print. Many will relate to their stories. It does point out a common challenge, that is working through the world of Super Visa Insurance in Canada.

In this blog, we take you step by step into the purchase process of the right Super Visa Insurance, from understanding the basics to competitive Super Visa Insurance Quotes. We guide you through everything that is necessary to make the right choice for you and your loved ones. So, come on, join us, and let’s turn this potential roadblock into an opportunity for your loved ones to have the trip of a lifetime.

Understanding Super Visa Insurance Requirements

The Super Visa is an opportunity for parents and grandparents of Canadian citizens and Canadian permanent residents to visit their family in Canada for up to five years at a time without having to renew their status. One of the mandatory needs, however, will be for the students to purchase health insurance from a Canadian insurance provider before coming, which shall insure them for at least one year.

What if your grandma, who always wanted to visit Niagara Falls for years, becomes confused in all the different insurance, terms, and policies? This is where you come in. Your grandmother will not have to worry about her health while she was travelling if she had the basic Super Visa Insurance in place. This included minimum coverage of $100,000 for medical care, hospitalization, and repartition.

Find Out: More on Super Visa Insurance

Find Out: Super Visa Insurance Benefits

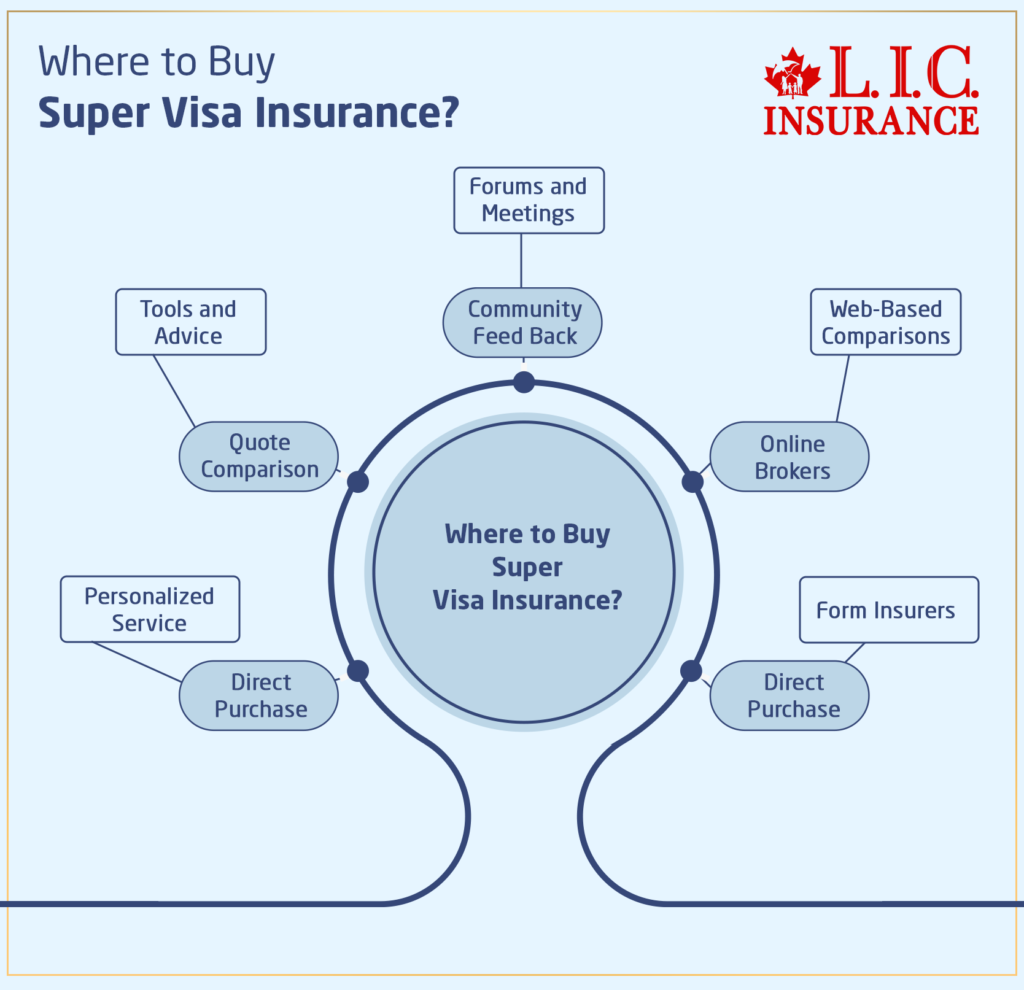

Where to Buy Canadian Super Visa Health Insurance

Online Insurance Brokers

Suppose those who wish to purchase Super Visa Insurance indeed want the best way. In that case, online insurance brokers offer various plans from different insurance providers to enable a person to shop features, premiums, and coverages under one roof. It’s just like having a single shopping mall where you can shop at various stores at once.

For example, look at Raj: he used a web broker to scout for the best deal for his parents, who were visiting from India. All he did was enter simple details with regard to their health and age, and he got several Super Visa Insurance Quotes in the next few minutes. This way, he saves time and can compare what is available to ensure he gets comprehensive plans that suit the budget and the needs of his parents.

Direct from Insurance Companies

If you’d rather go the more direct route, you can buy a policy straight from a Canadian insurance company. Most of the providers have an option for online application, meaning that you can be in a position to do so right from your home.

Take the case of Maria, who decided to buy Super Visa Insurance directly from a well-known Canadian insurance company. She was now directly dealing with the insurer and felt that the decisions were in her hands; she asked detailed questions regarding the policy to ensure everything was being met for her mother’s Super Visa.

Local Insurance Brokers

A good source is also a local insurance broker. Those are service providers who offer personalized service and more knowledge in detail. The broker may help find a way through mostly complicated terms and conditions and find the policy fitting the history of an applicant and his needs.

For example, John came for the help of his old father in obtaining a super visa and went to a broker in Toronto. The experience and knowledge the broker had in Canadian Super Visa Health Insurance enabled John to get a plan that would cover pre-existing conditions, and for that, his father had been having difficulty securing the perfect plan through online platforms.

Comparing Super Visa Insurance Quotes

Therefore, the comparison will be the best way to point at the right Super Visa Insurance cover; it will comprise the amount in deductibles, limits of the cover, the kind of pre-existing conditions that are included, and the credibility of the insurance provider.

Saumya’s story tells us never to underestimate the power of comparison. The diligent comparison of quotes she was able to do was all from tools she got online, with advice coming from a local broker when their parents were coming from the UK to visit them. So, she used a dual approach to assist in looking at the subtle differences that each of these plans would have made and buying value for money that would offer her peace of mind.

Engaging with Community and Online Forums

Another very valuable but often neglected resource is community feedback and online forums. Hearing from others who have gone through the process can provide insights that are not readily available through official channels. These real-life experiences can help steer you from regular pitfalls and lead you to select the most suitable insurance providers from the market.

Let’s know what Alex did. He read through many forums and even visited community meetings to pick up firsthand accounts of some of these people’s experiences with various insurance companies. This community intelligence was invaluable to his final decision and gave him assurance that the insurance company he was looking at was well-ranked in the eyes of fellow Canadians.

The Final Thoughts

It shouldn’t be hard to find your way around Super Visa Insurance on your own. With the right kind of information and resources, it can be an easy, confident decision to get the coverage your loved ones need to enjoy their stay in Canada. Remember that getting the right insurance isn’t just fulfilling the law; it’s also about making sure that your family can enjoy the beauty of Canada without having to worry about how they’ll pay for medical bills.

This is the time. Do not let complexities in insurance stop you. This is your chance for your parents or grandparents to come here and be able to explore Canada with the full safety net of excellent health coverage. If you are looking forward to discovering how affordable and easy it could be to get Super Visa Insurance, then come to Canadian LIC—the number one brokerage for all insurance needs. Your Canadian adventure with the family is just looming in the future, and if the right preparations are made, then certainly it will be as rosy and hassle-free as you would dream it to be. Now, go ahead and apply for your Super Visas, along with Super Visa Medical Insurance, as it is going to ensure a lot of cherished memories with your loved ones. Have a happy and safe journey ahead!

Find Out: Can you pay monthly for Super Visa Insurance?

Find Out: Super Visa Insurance Buying Mistakes

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Canadian Super Visa Health Insurance

Canadian Super Visa Health Insurance is something that falls under the category of the type of coverage required to visit one’s parents or grandparents, who are permanent resident or Canadian citizen, under the Super Visa program. This is actually a health insurance policy for which a minimum of $100,000 covering is required to take care of hospitalization and repatriation for one year. We take the story of Amina, her parents from Morocco, who were excited to visit her in Canada, but they were initially confused about the insurance requirements. With Canadian Super Visa Health Insurance, they found peace of mind knowing that all major medical expenses would be covered during their stay.

Getting a Super Visa Medical Insurance quote is actually quite easy. One may get it via an intermediary or directly from an insurance company. Think of Carlos, who compared online offers for his visiting parents. This time around, he just needed to input their ages and dates of travel into an online form, and in no time, he had very many options. After comparing them, Carlos could decide on an insurance plan that, apart from having the best price, also contained comprehensive coverage.

Yes, there is Super Visa Medical Insurance for parents with pre-existing medical conditions. However, an individual has to bear in mind that he or she is going for a policy covering the same. For example, Julia helped his father in taking the right policy for him with the pre-existing condition of diabetes. She made sure that, in the course of their discussion with the insurance brokers and having read the fine print and details of the policies very well, his condition was surely covered.

If one shops around for a Canadian Super Visa Medical Coverage, check the amount of coverage (at least $100,000), coverage for pre-existing conditions, deductibles, and terms of the policy regarding hospitalization and repatriation. Think of the case of Rajesh, in which he took a low-deductible plan only because he had a very old mother, and she was scared of out-of-pocket expenses if she had to take medical care in Canada while staying with them.

The processing of Super Visa Medical Insurance may vary, but in most likely cases, the time span from the start of discussing insurance with a company to actually being insured can be a minimum of a few hours to a maximum of a few days. This process involves comparing quotes, selecting a policy, and completing an application. For example, Shreya was able to get cover for her in-laws within a day from an effective online broker, which made it easy to show how simple and fast it can be to get coverage.

Yes, Super Visa Medical Insurance can be renewed. Most of the insurers do have the provision of renewing the policy period if your loved ones stay more than the planned number of days in Canada. Take the case of Ming: if his parents decide to stay longer, Look at Ming’s experience—when his parents extended their stay, he was able to renew their policy online, ensuring continuous coverage throughout their visit.

Cancelling coverage for a Super Visa Medical Insurance policy can give you a full refund, provided there have been no claims and the policy has not been brought into effect. The visa for her mother was delayed, and therefore, Chloe had to cancel the policy. She contacted the insurer, and upon explanation, a full refund was issued without delay, hence easing her financial concerns in such an uncertain time.

When inquiring about Canadian Super Visa Health Insurance, do read reviews and compare quotes of the best insurers, or perhaps most importantly, talk directly with these experienced brokers who can guide you as per your specific needs. Consider how Tom utilized online reviews and customer testimonials to select a provider known for their reliable customer service and comprehensive coverage, making an informed choice that suited his family’s unique circumstances.

The minimum coverage required for Canadian Super Visa Health Insurance is $100,000.. The Super Visa Health Insurance covers health hospitalization and repatriation care for a period of one year from the day of entering Canada. Consider the story of Hina and her mother, who happened to have first purchased a policy with only $50,000 coverage and later were pushed to buy additional insurance upon visa requirements. This very case highlights the importance of the policy meeting all Canadian government guidelines from its inception so that there is no problem upon arrival.

You should always, at a minimum, revise your Super Visa Insurance Quote yearly or when an important change in your circumstances or in the details of the policy takes place. For example, there was a time when Mark’s parents decided to change the travel plans from a short visit to a whole two-year stay with a super visa. He reviewed and adjusted their insurance to make sure their needs could be well attended to throughout the stated period.

Yes, in many instances, Canadian Super Visa Insurance can often be more ideally tailored to the insured. This might include changes to the deductible, pre-existing conditions coverage, or even the amount of coverage offered in total. Take the case of Lisa, for example. She customized her policy to cover her father’s heart condition so that the needed care would be given without much financial burden on his stay in Canada.

One is required to compare quotes from different providers in order to get the best and lowest Super Visa Insurance Quote; one may also consider going with a higher deductible to lower premiums or check if any discounts are available, including those offered for purchasing policies for multiple years. By comparing offers online and engaging in side-by-side comparisons, Ahmad was able to get the cheapest policy for his parents at a more affordable cost but with the best coverage.

Suppose a person does not have enough insurance for a super visa. In that case, it can expose the person to very high financial risks if the person is not able to afford treatment in Canada, which could otherwise be very costly without insurance. Another consequence of such a failure is that future visa applications may be delayed. Yuri learned this the hard way, with his mother-in-law getting a heavy bill for the minor surgery she was subjected to during her visit. This, again, highlights the importance of having good insurance.

When you claim to be using the Super Visa Insurance, you are supposed to report the incident to the insurance provider immediately. You should provide them with all the necessary documentation required, such as medical reports and bills, then follow the instructions given to you by the provider. Simran’s experience was smoother, as she had all her documents ready, so the claim was made faster, hence making it possible for her father to focus on recovery rather than running around for paperwork.

In case your Super Visa Medical Coverage claim has been denied, first look into why it happened. Ensure that you have filed the claim and that all the requested information is included in it. You can appeal the decision by producing additional documents or clarification if demanded by the insurer. David had to appeal once, as his first claim was rejected due to mistakes in filing the paperwork. He then filed the claim again, accordingly.

Most companies will require full names, date of birth, and the dates when they plan to travel to Canada on Super Visa Medical Insurance Coverage. For example, when helping her parents apply for Super Visa Insurance, Sunita had all this information at hand; therefore, it was possible to fill out the forms online quite fast without any problems retrieving the quote.

You can usually cancel your super visa health insurance in Canada in case of visa application refusal, and you will be refunded the full sum if no claims take place. Kevin’s aunt’s visa application was suddenly refused. He was able to cancel the insurance policy she had purchased and received a full refund, thus eliminating at least some of the disappointment felt at losing money because of the visa denial.

The “deductible” is the amount that one has to put out of his pocket before the insurance takes effect. Having a higher deductible can lower your premium, yet, in simple translation, it literally means you put up more money upfront just in case there is a medical issue. For example, Layla chose a higher deductible to reduce the monthly costs of her grandparents’ insurance. This decision was budget-frie

Some general exclusions included in Canadian Super Visa Health Insurance are coverage for pre-existing medical conditions if they have not been stable for a certain period before the coverage starts, injuries from participation in hazardous activities, and intoxication. Juan got to know about the exclusions when his father had to go through emergency surgery for a pre-existing heart condition, and he wasn’t fully covered under the base policy, leaving big out-of-pocket expenses.

The Super Visa Medical Coverage must be filed as soon as possible after the finalized travel dates. This ensures that the visa application process has documentation with proof of insurance dates and that insurance coverage can be shown as part of the process. This proactive approach helped Mei’s parents avoid delays, as they included proof of insurance with their initial visa application, which streamlined their approval process.

Most will cover travellers of any age, but premiums and coverage options can differ drastically for older applicants. Monica learned this firsthand in September when she had to shop around to get an affordable policy for her 78-year-old grandmother. She said it showed her that while coverage is available, it can sometimes be pricey for older travellers.

Yes, it can mostly be renewed from outside Canada, but the initiation to extend the policy should be before the expiry date of the current policy. Akash had arranged this for his parents, and the time of the stay, when it was to be extended, he had made a call to the insurance company a fortnight before the expiry of the policy so that it may not keep any chance of gap during the extension of the stay.

Sources and Further Reading

Immigration, Refugees and Citizenship Canada (IRCC)

Website: Canada.ca

Details: The official website provides the most authoritative and up-to-date information on the requirements for the Super Visa, including insurance needs and application procedures.

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA.ca

Details: The CLHIA offers comprehensive guides on various types of insurance available in Canada, including visitor insurance, which covers the Super Visa requirements.

Financial Consumer Agency of Canada (FCAC)

Website: Canada.ca/en/financial-consumer-agency

Details: The FCAC provides information on consumer rights and responsibilities when purchasing insurance in Canada, helping you make informed decisions about Super Visa Insurance.

Books and Publications:

Title: The Canadian Guide to Protecting Yourself from Identity Theft and Other Fraud” by Doug Shadel

Details: While primarily focused on fraud protection, this guide offers insights into managing your financial products in Canada, including insurance purchases.

Blogs and Community Forums:

Examples: Expat Forum, TripAdvisor’s Canada Travel Forum

Details: These platforms allow you to read about personal experiences with Super Visa Insurance from other users, ask questions, and get advice from people who have been through the process.

Legal Advice Resources

Examples: FindLaw Canada

Details: For legal concerns related to insurance policies or claims, these resources can provide guidance and help you understand your legal rights when dealing with insurance companies in Canada.

By exploring these resources, you will be able to gather a wealth of information that can guide your decision-making process, ensure compliance with Canadian regulations, and provide peace of mind for you and your loved ones visiting Canada. Whether you are gathering initial information or looking to deepen your knowledge on specific issues related to Super Visa Insurance, these sources offer valuable insights and practical advice.

Key Takeaways

- Canadian Super Visa Health Insurance must cover at least $100,000 for health care and be valid for one year.

- Super Visa Insurance can be bought online, from direct insurance companies, or through local brokers.

- Comparing Super Visa Insurance Quotes from multiple providers helps find the best coverage and rates.

- Ensure any pre-existing medical conditions are covered by the insurance policy.

- Apply for insurance as soon as travel dates are confirmed to simplify the visa application process.

- Understand your policy’s terms on renewals, cancellations, and claims to manage changes smoothly.

- Use resources like government sites, comparison tools, and forums for additional information and assistance.

- Be aware of your insurance policy's legal and financial aspects, including deductibles and coverage limits.

- Read community feedback and reviews to choose a reliable insurance provider.

- Act promptly to secure Super Visa Insurance to ensure compliance and peace of mind during the visit.

Your Feedback Is Very Important To Us

To better understand the challenges Canadians face when securing Super Visa Insurance for their family members, we’ve created this questionnaire. Your feedback is invaluable and will help us improve the information and support we provide to make this process as smooth as possible.

Your feedback is crucial for us to better understand and address the needs of Canadians applying for Super Visa Insurance. Thank you for taking the time to help us improve this essential service.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]