Canada has become a favourite destination for people to reunite with family or seek out new opportunities in recent years. The Super Visa program is one avenue for families to remain in touch. This is a program which allows Canadian citizens and permanent residents to invite relatives, including parents and grandparents, to come to Canada and visit them for extended periods. But, with the Super Visa also comes the need for Super Visa Insurance. So here we will learn about Super Visa Insurance in Canada and whether it can be cancelled or not.

Many applicants, after purchasing their policy, start to wonder—Can I cancel Super Visa Insurance if my travel plans change or my visa is delayed? Understanding the cancellation terms is just as important as knowing what the policy covers. From flexible refund options to provider-specific terms, there’s more involved than meets the eye. Not all policies offer the same cancellation window or refund structure. That’s why it’s essential to dive deeper into the details before you commit. In this guide, we’ll walk you through not just how the insurance works, but also what you must know about cancelling it under various conditions.

Let’s get to know first- ‘What is Super Visa Insurance?’

Super Visa Insurance is a must for individuals applying for the Super Visa. It provides coverage for emergency medical expenses during the stay in Canada. For a Super Visa, the insurance must cover at least $100,000 and be good for at least one year from the date of entry into Canada.

Super Visa Insurance Quote

You should obtain quotes from multiple insurance providers before purchasing Super Visa Insurance so that you can compare benefits and prices side by side. A Super Visa Insurance quote will usually have information like the sum of coverage, premium price, deductible, and any added benefits the insurer provides. Comparing quotes allows an applicant to choose an insurance plan that makes the most sense for his/her needs and budget.

Usually, the Super Visa Insurance Coverage would involve the cost of emergency medical services such as hospitalization, ambulance service, emergency dental, and repatriation of the body. That said, the words and coverage can vary by Canadian insurance company and by the plan selected. Read the policy details very carefully; this is a very important document which will tell you what is and isn’t covered.

Click here to get to know the right time to start Super Visa Insurance

Can Super Visa Insurance be Cancelled?

One common question among Super Visa applicants is whether the insurance can be cancelled once purchased. Understanding Super Visa Insurance is crucial when planning a trip to Canada under the Super Visa program. One of the most common queries among Super Visa applicants is whether the insurance can be cancelled. So, let’s explore this question in detail, along with the cancellation process, timelines, penalties, and important considerations.

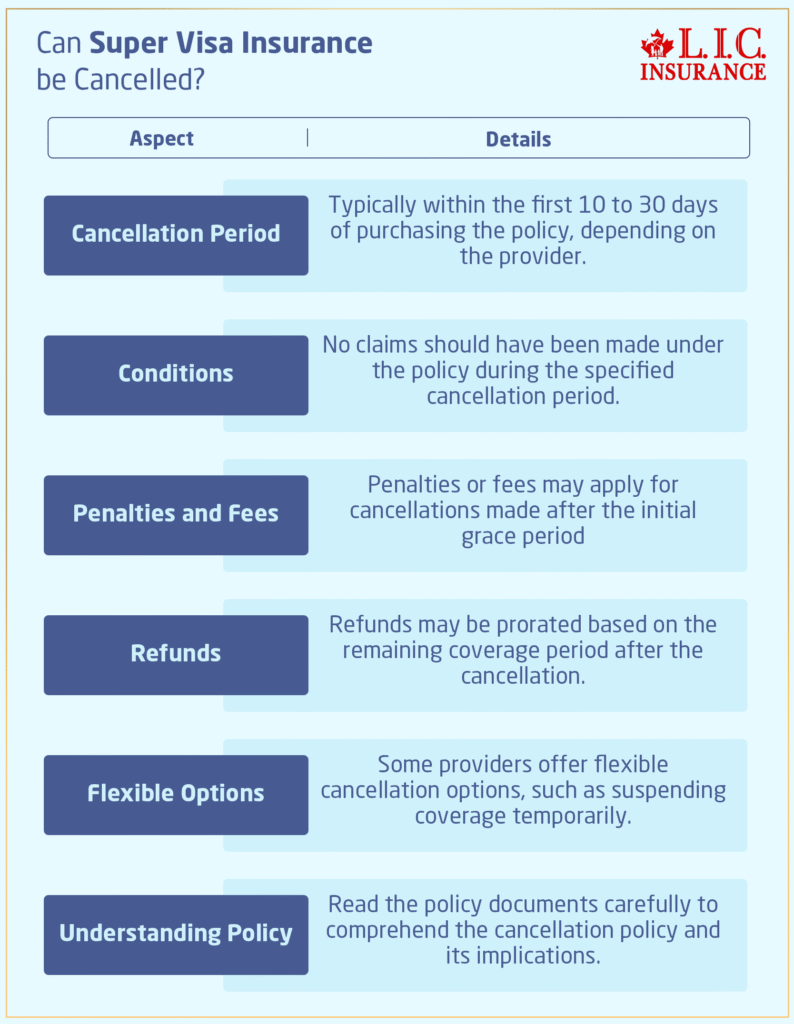

Timeframe for Cancellation:

- Most insurance providers allow for cancellation within a specific timeframe, usually within the first 10 to 30 days of purchasing the policy.

- This timeframe provides applicants with a grace period to review the policy terms, assess their needs, and make any necessary adjustments.

- Cancelling within this period typically incurs no penalties or fees, and applicants may be eligible for a full refund of the premium paid.

Conditions for Cancellation:

- Cancellation conditions vary among insurance providers and may be outlined in the policy documents.

- Generally, cancellation is allowed if no claims have been made under the policy during the specified timeframe.

- It’s important to read the policy terms carefully to find out if there are any conditions or restrictions on cancellation.

Penalties and Fees:

- Cancelling the policy after the initial grace period may result in penalties or fees imposed by the insurance provider.

- These penalties could be in the form of a percentage of the premium paid or a flat fee, depending on the provider’s policies.

- Additionally, refunds for cancellations made after the grace period may be prorated based on the remaining coverage period.

Refund Process:

- Refund processes vary among insurance providers and may be subject to certain conditions.

- Upon cancellation, applicants should contact their insurance provider to initiate the refund process.

- Refunds are usually processed within a certain amount of time, which can be anywhere from a few days to a few weeks, based on how the provider does things.

Flexible Cancellation Options:

- Some insurance providers offer flexible cancellation options to accommodate changing travel plans.

- These options may include the ability to suspend coverage temporarily if the visitor returns to their home country earlier than expected.

- Flexible cancellation options provide added convenience and peace of mind for Super Visa applicants.

A Hidden Factor Most Applicants Overlook Before Asking: “Can I Cancel Super Visa Insurance?”

While many applicants focus on premium costs and coverage details, a lesser-known but critical factor influencing the ability to cancel Super Visa Insurance is policy underwriting and regulatory alignment with IRCC expectations. Each insurance provider in Canada offering Super Visa-compliant plans undergoes regular audits to ensure policies align with changing immigration health standards. What most applicants don’t realize is that if a provider’s underwriting structure changes mid-policy, due to regulatory shifts or mergers, it can affect your cancellation eligibility and refund timeline.

Here’s where firsthand experience matters: we’ve encountered cases where a visitor’s travel plan was postponed due to visa processing delays. They asked, “Can I cancel Super Visa Insurance?”—but weren’t aware that some policies include a non-cancellation clause if your entry date changes, but your visa is approved. That small detail, often buried in fine print, can lead to denied refunds.

For better protection, choose providers offering flexible date-based activation clauses instead of fixed-date ones. This ensures that your insurance activates only upon confirmed travel, giving you stronger grounds for cancellation if your plans change.

This insight isn’t widely discussed on competitor sites, yet it plays a key role in making fully informed decisions. Always review underwriting terms alongside coverage.

Understanding Policy Documents:

- Before purchasing Super Visa Insurance, it’s essential to read and understand the policy documents carefully.

- Pay close attention to the cancellation policy, including any conditions, penalties, and refund processes outlined therein.

- To get more information about any terms or clauses that aren’t clear, don’t be afraid to ask the insurance expert.

Concluding Words

In the end, although Super Visa Insurance is usually refundable within a certain amount of time, one must know about the terms, penalties, and refund procedure with respect to its cancellation. Knowing the policy terms and any flexible cancellation provisions provided by the insurance company could assist in making the right choice and provide the coverage that you require when you travel to Canada. Be sure to compare several Super Visa Insurance quotes for the best rate and coverage.

Find out How to apply for Super Visa Insurance.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

To qualify for medical insurance on Super Visa in Canada, you need to find insurers, ask for quotes, compare coverage and premiums, complete the purchase of the chosen plan, and bring a copy with you at the time of visit. Just be sure to enter the important details of coverage amount, age, duration, and any preexisting conditions needed to get an accurate quote.

Applicants for a Super Visa application visiting Canada are required to have Super Visa Medical Insurance. It covers emergency medical costs while staying in Canada. We must be able to guarantee that any visitor can receive medical care without the burden of insurmountable medical bills in times of unforeseen illness.

To get a Super Visa Insurance quote you can apply to different insurance companies providing Super Visa applicants insurance polices. You can request a quote online through their websites, or you can reach out to them on the phone or via email. Give the information asked – (v) – how long you will be gone, and (2) the amount of coverage you want, so that you receive an accurate quote.

Super Visa Insurance Covers Emergency Medical expenses are hospital room, ambulance service, emergency dental treatment, and repatriation of remains. But coverage can vary depending on the Canadian insurance company and plan selected. This is why you should read the policy details carefully to understand what you’re covered for and what you’re not covered for.

The cost of Super Visa insurance Canada will vary depending on a number of factors such as the applicant age, the amount of coverage required, the number of months of coverage and any pre-existing medical conditions. The average price for a year’s worth of Super Visa Canada Insurance is about $1,000- $3,000 CAD. Comparing premiums and coverage before buying Super Visa Insurance. It is necessary to quote from multiple insurance companies to compare the premiums and other options offered by them before making Super Visa Insurance purchase.

Yes, with most insurance companies, there is provision of cancellation of Super Visa Insurance within a certain period – typically first 10 to 30 days of buying the policy, no claims pending. But canceling your policy after this period could result in penalties or fees, and refunds could be prorated for the time you left coverage unused.

Other Penalties if you Cancel Super Visa Insurance After the First 30 Days. There are penalties if Super Visa Insurance Cancelled after 30 days. These fines may be in the form of a percentage of the premium paid or a fixed amount, at the discretion of the provider. Any refunds on cancellations after the grace period may also be prorated for the portion of coverage not used.

A few insurance companies also include trip cancellation with flex in their packages for travelers who need to book a trip and are unsure of when they’d like to travel. Such options could involve returning to their home country earlier than planned, but then being able to suspend their coverage and transfer it to a new STM policy. When purchasing Super Visa Insurance, it’s great to ask for flexible cancellation options.

In order to know the policy regarding cancellation of your Super Visa Medical Insurance, it is advised that you read the policy pertaining to the insurance coverage in the policy packet supplied by the insurance company you are going to purchase the medical insurance. Note any terms, fines, and reimbursement guidelines as described there. If there are any provisions or qualifiers you are not easily able to understand, you should tell the insurer so that there is no confusion.

Can I Change the Provider of Super Visa Insurance If I am Not Happy with Their Coverage? But it is critical there is no gap in coverage during that transition.” Before signing any new contract, obtain new quotes from your current provider and other insurance companies, and compare your coverage and premium to make sure you have the best option for you.

When you’re picking a provider for Super Visa Insurance, make sure you debrief yourself with how much coverage amount it offers, the cost of premium, the deductible, how reputed the company you’re bracing as your insurer is, are you comfortable with their customer service, and so forth. You may also verify if the insurance company satisfies the Canadian government’s criteria for Super Visa Insurance.

You should buy Super visa Insurance as soon as your travel dates to Canada are confirmed. This will give you enough coverage before you go and help prevent any last minute issues or delays. But you can buy a Super Visa Insurance prior to your date of departure, as long as the policy runs for the entire period of time, while you are staying in Canada.

Whether or not Pre-Existing Medical Conditions are covered in Super Visa Insurance depends on the insurance company and the particular policy. Some Super Visa Insurance plans include a pre-existing condition of the policy, and some may not. Before purchasing a policy, be sure to read the fine print and speak with the insurance company about any health problems you already have.

No, you generally will not need a medical exam to be eligible for Super Visa Insurance. Note: applicants may need to fill out a Health Questionnaire with your applications. The medical questionnaire information submitted by people is used to allow the insurance company to offer and price coverage according to the applicant’s health.

If you end up staying longer in Canada than you anticipated, some companies allow you to extend your Super Visa coverage for added time. But extensions must be accepted by the insurer, and you’d need to provide further documents and pay premiums. If you need to renew your coverage, be sure to contact an insurance professional as soon as possible.

Whenever you make a claim against your Super Visa Insurance, the insurer will review it and make a determination as to whether it meets the criteria for coverage. Once a claim is accepted , insurance companies will reimburse for the eligible costs. Saving medical bills and documentation on the claim is key to making the claims process simpler.

Yes, some insurers offer multi-trip Super Visa Insurance that allows visitors to travel multiple times to Canada in a period of time. These are easy options for those (multiple) times travelers who are coming on Super Visa in Canada. But the fine print matters, so do read up on the terms of the policy, including any limits on the number of trips and length of coverage.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]