Getting an opportunity to explore Canada as a visitor can be an exciting adventure. As a visitor to Canada, you can discover so much, from exploring the stunning landscapes to immersing yourself in diverse cultures. However, one crucial aspect often not taken too seriously by any visitor to Canada is purchasing travel insurance coverage. A question that might be arising in a lot of people’s minds would be: ‘Can I get insurance while visiting Canada?’ The answer to it is a very big yes! Visitor Insurance, which is designed specifically for travellers, provides mental peace to visitors to Canada along with financial protection during the entire time they plan to stay in Canada.

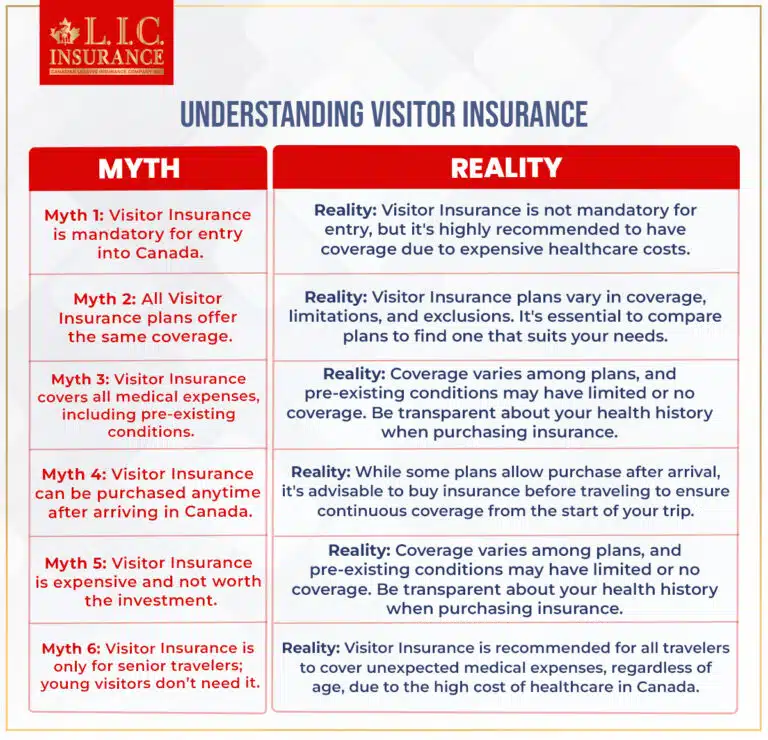

Understanding Visitor Insurance

Visitor Insurance, sometimes also referred to as travel insurance for visitors or insurance for Canadian visitors, serves as a protective and preventive tool specifically designed for individuals travelling to Canada. This type of specialized insurance coverage is an imperative part of planning your trip, as it provides peace and financial security during your entire stay within the country.

The essence of Visitor Insurance lies in its comprehensive coverage. It’s made suitable mainly for addressing unforeseen emergencies and expenses that were not planned, and that can arise during your trip to Canada. The best thing is it mainly focuses on providing essential protection for various situations that travellers or visitors to Canada may encounter at any time during the trip.

Medical emergencies stand as one of the key aspects that are taken care of under Visitor Insurance. It encompasses coverage for any type of sudden illness or accident, making sure visitors to Canada have access to medical care and attention all the time without worrying about such hefty bills, starting from doctor visits to hospitalization and prescription medications. This insurance offers financial assistance for all of these necessary medical treatments.

Additionally, Visitor Insurance also accounts for potential trip interruptions that might even occur unexpectedly. Whether it’s a delayed flight, trip cancellation, or other unforeseen circumstances disrupting your travel plans, this insurance can provide coverage for incurred expenses or losses.

If we move even further, baggage loss or unexpected mishaps related to personal belongings are also part of the coverage scope. This is another great thing as it ensures that in the event of lost luggage or other baggage-related issues, you are financially protected and safe against all these losses.

So, we can say that Visitor Insurance is an adaptable net of safety that protects travellers against a spectrum of unexpected events. This makes it possible for all visitors to Canada to explore Canada with confidence, as you are well aware of the fact that you have coverage for various potential situations that may arise during your visit.

Coverage for Canadian Visitors

Visitor Insurance, for those exploring Canada, encompasses a good range of essential protections. Primarily, it covers medical emergencies. This makes sure that if any unexpected health issues arise during your visit, you have financial support for necessary medical care. Let’s know what is included in it. It includes hospitalization, doctor visits, and prescription medications.

An amazing part about it is, that some of the plans extend their coverage beyond medical needs. They might include provisions for emergency medical transportation, an essential aspect during unforeseen health crises as it requires immediate transfer to specialized healthcare facilities.

Additionally, Visitor Insurance often accounts for more than just medical contingencies. It may include coverage for trip cancellations and offering financial reimbursement in situations where your planned itinerary faces unexpected alterations. This could be due to flight cancellations or other unforeseen circumstances.

Baggage loss, another concern for travellers, is often covered under these plans. In the unfortunate event of lost luggage or other baggage-related issues, Visitor Insurance offers financial protection against these unexpected losses for visitors to Canada.

So, insurance for Canadian visitors serves as a safety guard, providing coverage beyond medical emergencies, protecting you against potential trip interruptions, and offering support in the face of baggage-related mishaps. In the end, it’s about ensuring a worry-free exploration of Canada, knowing you’re protected against unforeseen situations that might occur during your visit.

Why Visitor Insurance Matters:

Let’s find out:

Financial Protection: Canada boasts a reputable healthcare system known for its quality. However, medical expenses for visitors Canada travel insurance can be overwhelming. Even minor injuries or illnesses could result in significant medical bills. Visitor Insurance stands as a strong shield against these unexpected costs, ensuring you’re financially safe during your whole stay.

Cost of Medical Care: In Canada, medical costs for visitors can be surprisingly high. Simple consultations or emergency treatments might lead to substantial expenses. Visitor Insurance serves as a financial support, covering various medical services, hospitalization, and prescription medications, alleviating the financial burden of unexpected healthcare expenses.

Mental Satisfaction: Traveling to Canada should be about exploration and enjoyment, not worrying about potential medical costs. Visitor Insurance provides peace, allowing you to focus on experiencing the beauty of the country without fretting about unforeseen health-related financial strains.

Unforeseen Emergencies: Accidents and health issues can occur unexpectedly, even during a short visit. Visitor Insurance ensures that you’re prepared for these unforeseen circumstances, offering coverage for sudden injuries, illnesses, or medical emergencies that might happen while you are staying in the country.

Comprehensive Coverage: The comprehensive coverage of Visitor Insurance extends beyond medical emergencies. It also includes provisions for trip interruptions, baggage-related issues, and more, ensuring you’re protected against a wide variety of unforeseen events that could disrupt your visit.

Smart Investment: Consider Visitor Insurance as a smart investment rather than an unnecessary expense. It’s a strategic financial move, protecting you against potentially exorbitant medical costs and making your travel experience worry-free and enjoyable.

Healthcare Accessibility: Having Visitor Insurance facilitates easier access to healthcare services. In emergencies, it ensures prompt medical attention without concerns about the financial aspects, allowing you to focus solely on getting the necessary care.

Avoiding Financial Strain: With Visitor Insurance, you can altogether eliminate the stress and financial strain of unexpected medical bills. It allows you to manage your budget and enjoy your time in Canada without worrying about potential healthcare costs.

Hence, Visitor Insurance for Canadian visitors stands as a crucial investment, offering financial security and peace during your visit to this beautiful country.

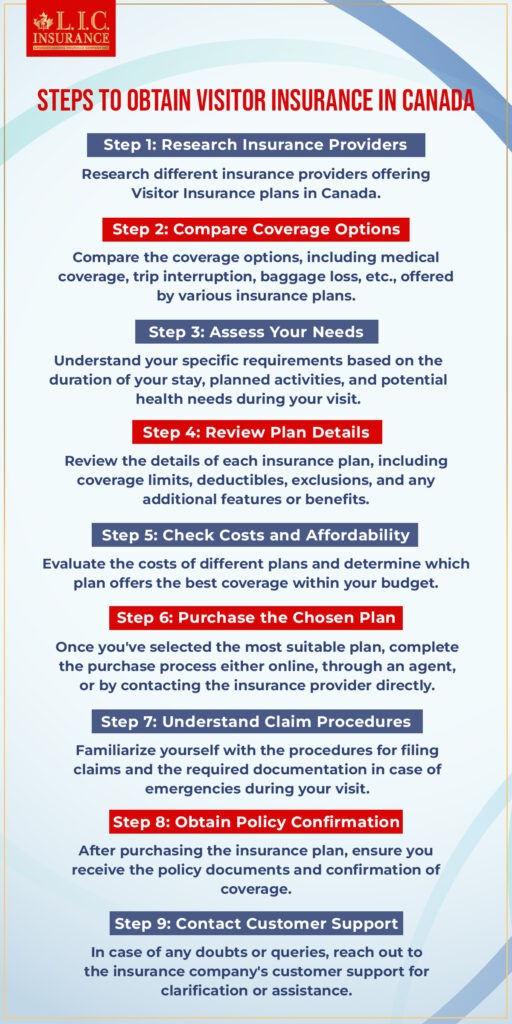

How to Obtain Visitor Insurance

Follow the below-mentioned steps to obtain Visitor Insurance:

Research Insurance Providers: Numerous insurance companies offer specialized Visitor Insurance plans tailored for those travelling to Canada. Research and gather information about different providers, their reputations, and the plans they offer. Look for insurance providers with good track records and positive customer reviews.

Plan Variations: Visitor Insurance plans come in various forms, differing in coverage, duration, and cost. Some plans might focus primarily on medical coverage, while others offer comprehensive protection, including trip interruptions and baggage-related issues. Understanding the variations helps in choosing a plan that aligns with your needs.

Identify Your Needs: Before purchasing Visitor Insurance, carefully assess your requirements. You need to consider factors like the time duration of your stay, planned activities, and any pre-existing medical condition. This evaluation enables you to determine the level of coverage required for your specific situation.

Compare Plans: Once you’ve identified your needs, compare different insurance plans. Pay attention to coverage limits, deductibles, exclusions, and any additional benefits offered by each plan. Comparing multiple options allows you to find the most suitable coverage that matches your requirements and fits within your budget.

Consult Insurance Experts: Seeking advice from insurance experts or brokers can streamline the process as they possess in-depth knowledge of various insurance plans and can help you out to choose the most appropriate one. Insurance experts can analyze your needs and recommend plans that offer the best coverage for your circumstances.

Understand Policy Details: Before finalizing your choice, carefully review the policy details and documentation provided by the insurance provider. Ensure you understand the coverage, limitations, exclusions, and procedures for making claims. This understanding is necessary to avoid surprises or misunderstandings coming up in the future.

Purchase Wisely: After thorough research and consideration, make an informed decision when purchasing Visitor Insurance. Choose a plan that offers comprehensive coverage, suits your needs, and provides peace during your visit to Canada.

Factors to Consider for Visitor Canada Travel Insurance

Now, let’s come to the factors to keep in mind:

Coverage Limits: Understand the maximum coverage amount provided by the insurance plan. Ensure it aligns with your anticipated expenses in case of emergencies, especially considering the cost of healthcare services in Canada.

Deductibles: Deductibles are the amount you pay before the insurance coverage kicks in. Assess the deductible amount and choose a plan that has a deductible you can comfortably afford in case of an incident.

Exclusions: Every insurance plan has exclusions—specific situations or conditions not covered by the policy. Carefully review these exclusions to know precisely what the insurance won’t cover. Pay attention to any limitations or restrictions that might impact your coverage.

Pre-existing Conditions: Some insurance plans might not cover pre-existing medical conditions or may have limited coverage for them. Disclose your health history honestly and accurately when purchasing insurance to ensure you receive appropriate coverage.

Comprehensive vs. Basic Coverage: Determine if you need comprehensive coverage that includes various contingencies like trip interruptions, and baggage loss, or if basic medical coverage suffices for your visit.

Duration of Coverage: Consider the length of your stay in Canada. Choose a plan that aligns with the duration of your visit, ensuring you’re covered for the entire period.

Activities Planned: If you’re engaging in specific activities like extreme sports or high-risk adventures during your visit, verify if these activities are covered under the plan or if you need additional coverage for them.

Claim Procedures: Understand the procedures for filing claims and the documentation required in case of an emergency. Familiarize yourself with the claim process to ensure a hassle-free experience during sudden, unexpected situations.

Customer Support and Services: Assess the quality of customer support and services offered by the insurance provider. Reliable customer service is crucial, especially during emergencies when you need immediate assistance.

Cost and Affordability: While evaluating various factors, consider the cost of the insurance plan. Choose a plan that offers the best coverage within your budget, ensuring a balance between affordability and comprehensive protection.

So, carefully considering these factors when selecting Visitor Insurance ensures that you choose a plan that fits your specific needs, provides adequate coverage, and avoids any potential claim issues during your stay in Canada. Transparency about your health history is key to receiving the right coverage in order to avoid facing any complications in the future.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Final Words

Visitor Insurance offers invaluable protection and mental peace during your stay in Canada. Whether you’re here for a short visit or an extended stay, having insurance for Canadian visitors ensures that you can explore this beautiful country without any worries, as you remain covered in case of any unexpected events.

Remember, it’s always better to be prepared when visiting Canada! Invest in visitor Canada insurance to make the most of your time in Canada without stressing about the unexpected. Get in touch with an expert today for the best suggestions on Visitor Insurance.

Faq's

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com