- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is The Best Amount For Term Life Insurance Policy?

- Understanding the Importance of the Right Coverage Amount

- Evaluating Your Financial Responsibilities

- The Role of Term Life Insurance Rates in Your Decision Process

- How Term Life Insurance Investments Impact Your Future

- Working with Term Life Insurance Agents for Tailored Advice

- Collecting Term Life Insurance Quotes for the Best Option

- Crafting a Personalized Term Life Insurance Plan

- Practical Guidance on Determining the Best Coverage

- Addressing Common Misconceptions

- Addressing Life Changes and Adjusting Coverage

What Is The Best Amount For Term Life Insurance Policy?

By Harpreet Puri

CEO & Founder

- 11 min read

- February 11th, 2025

SUMMARY

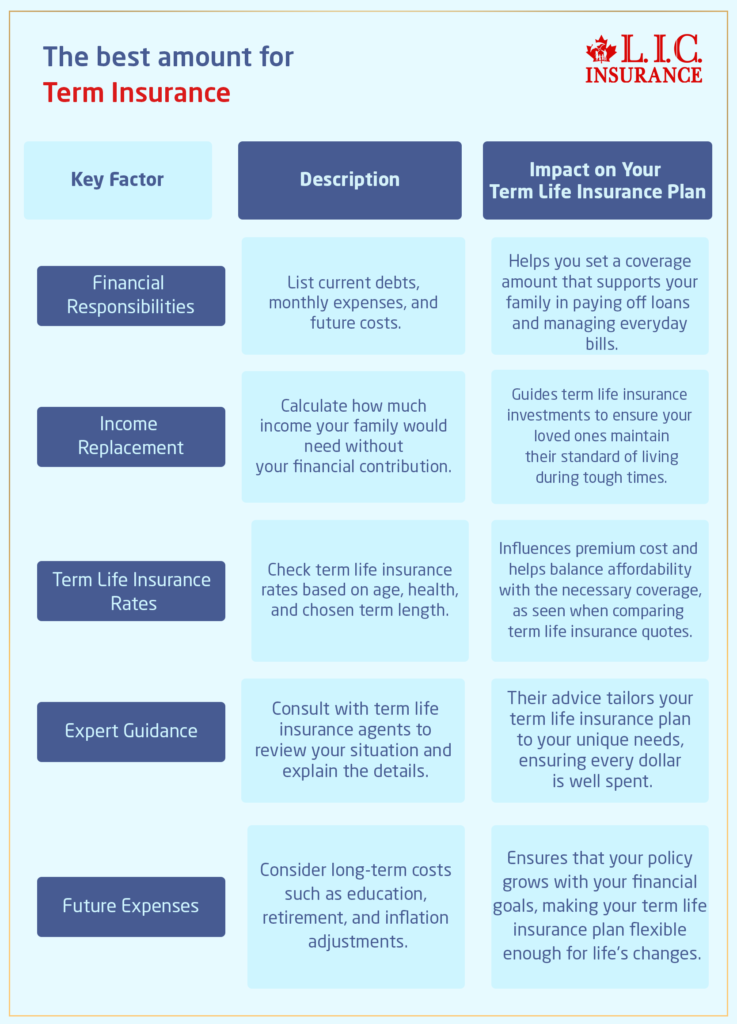

This blog explains how to choose the best Term Insurance amount in Canada. It discusses reviewing financial needs, debts, and income replacement. Readers see how Term Life Insurance Rates, Term Life Insurance Investments, and Term Life Insurance Quotes work with advice from Term Life Insurance Agents to tailor a Term Life Insurance Plan that protects their families and secures their future.

Introduction

Most Canadians face problems when it comes to selecting the right cover amount for a Term Insurance cover. You would probably have analyzed and compared life insurance rates against terms, critically examined Term Insurance investments, and understood the Term Insurance coverage without adequately knowing what amount was best chosen for you. Some of you might have already discussed Term Life Insurance with agents or gathered several quotes for Term Life Insurance and are still wondering if you have the right coverage. Everyday experience with clients at Canadian LIC helps us understand the struggles that you face and offers insight into finding a balance between financial protection and cost.

Have you ever felt overwhelmed by the sheer number of options out there? Are you concerned that you’re not covering enough to protect the people you care about most? We hear these questions constantly from our clients, who want to know whether their current and future needs are covered. We support individuals and families with diverse financial responsibilities and desires for their futures. Their stories remind us that choosing the right level of coverage is not at all about numbers; it is about protecting your family’s future to build more on your hard work in the future.

Understanding the Importance of the Right Coverage Amount

The process of finding the right coverage amount is more than just choosing a number. It requires taking a close look at your financial goals, your debt, and what you would like to protect about your lifestyle. When we’re discussing Term Life Insurance Rates and Term Life Insurance Investments with our clients, we often start off by asking some important questions. What are some of your financial responsibilities? How much income does your family depend on? What are some of your future financial goals?

Many clients tell us they once believed a one-size-fits-all approach would work for Term Life Insurance Plans. One client recalled feeling frustrated after choosing a policy that did not adequately cover his family’s living expenses in the event of his sudden loss. His story highlights that the best amount for Term Insurance must align with your personal situation. At Canadian LIC, we want you to list your current debts, future expenses, and income replacement needs. Thus, this is turned into a foundation of a customized Term Life Insurance Plan truly supporting your family.

Evaluating Your Financial Responsibilities

It is essential to take into account the liabilities one has when one decides how much coverage he or she would need. Begin by checking loans, mortgages, and credit card debts that have not yet been repaid. Then there are the living expenses of dependents, education expenses, and so on. One asks oneself: “What if something unexpected happens?” The amount that one calculates in answering that question can be the sum needed to pay off one’s debts and provide a stable income for one’s family.

For instance, one client was a young professional with an increasing family. She was not sure if the coverage amount was sufficient. She had a mortgage and car loans and was saving for her children’s education. She discussed her situation with one of our Term Life Insurance Agents and soon discovered that her initial quotes did not meet her responsibilities at all. Reassessing her priorities and budgeting for future costs, she came up with a coverage amount that relieved her of stress and ensured the security of her family. This story is a reminder that understanding financial responsibilities is the first step toward choosing the best Term Insurance coverage.

The Role of Term Life Insurance Rates in Your Decision Process

The Term Life Insurance Rates really determine the sum of coverage one can opt for. The insurance rates differ as per the specific requirements, for example, one’s age, health, way of life, and the time period one would choose. It is quite a common thing these days that every Term Life Insurance agent would consider the premium of the insurance pay according to that detail. We have seen clients who thought that the amount covered would be too pricey initially. On doing Term Life Insurance Quotes, however, they would find out that a little more premium offered much better protection. Clients often ask how they can balance costs with the level of coverage they need. Our answer is simple: evaluate your budget next to your goals. We invite you to seek Term Life Insurance Quotes from a few different sources. By doing so, you will become much clearer about what you can comfortably afford without having to compromise the future of your family. The experience of our clients tells us that a thorough review of Term Life Insurance Rates can help you make a well-informed decision.

How Term Life Insurance Investments Impact Your Future

Many people are really interested in investing in Term Life Insurance and seeing how their dollars work to pay for their loved ones. Whereas Term Insurance delivers a death benefit, the product design and premium you pay actually can impact the way you prepare your finances, and we’ve worked with folks who view the Term Life Investment as part of their overall financial strategy.

This kind of Term Life Insurance ensures you provide a known benefit to the family in tough times. Many clients appreciate term policies that pay a level premium for a fixed period of time. While these policies don’t have any cash value that can be applied toward future payments, our Term Life Insurance Agents will tell you that they can provide more cost-effective coverage for you. This would enable you to apply more funds towards other savings or investment options while balancing your financial profile as a whole. The Term Life Insurance Investments would be part of the bigger picture, which would protect your future.

Working with Term Life Insurance Agents for Tailored Advice

One of the frequent observations in our work is that clients appreciate direct contact with Term Life Insurance Agents. A professional agent makes time to understand your concerns as well as get an understanding of your financial circumstances. With such an agent, you are properly guided to select the right sum for Term Insurance Coverage.

One of his clients, after recently getting into a family, had been baffled by the options available online; after a sit-down with one of our expert agents, however, he understood that a critical review of the finances brought him to the right coverage amount in contrast to the amount he originally expected. Indeed, these kinds of experiences within our team of Canadian LIC explain why personal advice is essential. A one-on-one conversation often reveals factors that online calculators may miss, like future plans or unexpected expenses. Be open in your discussions with regard to financial goals and ask questions that clarify every detail so that you may be able to choose the right policy that suits your lifestyle and needs.

Collecting Term Life Insurance Quotes for the Best Option

Gathering multiple term life quotes would be very important for you. Upon comparison, you will learn about different rates of Term Life Insurance available in the market. Each quote may come with its benefits and drawbacks; hence, understanding those is very crucial for making a good decision.

We encourage you to carefully review the details of each quote. Some providers may offer lower rates but have limitations in coverage, while others might offer a comprehensive package at a slightly higher premium. One couple we assisted compared quotes from several companies and eventually discovered that the differences were not solely in price. They found that the quality of service, the process for a claim, and flexibility in the Term Life Insurance Plan contributed to the final decision. Taking the time to analyze Term Life Insurance Quotes will ensure you are getting a policy that meets your Life Insurance needs without breaking the budget.

Crafting a Personalized Term Life Insurance Plan

Each family and person has different needs, and that’s why a customized Term Life Insurance Plan is very important. In making up your plan, take into account the current financial situation as well as your future goals. Have you factored in cost of living adjustments, inflation, or changes in your income? We have seen many clients struggle when they choose a policy that does not adapt to their changing circumstances.

One notable case was a man who initially chose a policy based on the minimum premium presented to him. Sometime later, when he started another job and welcomed a second child, his mortgage payments also expanded. He then realized that this policy was no longer relevant in light of the new circumstances. Again, one of our Term Life Insurance Agents assisted this client in reviewing and upgrading his coverage. His experience underscores the need to revisit your Term Life Insurance Plan so that it can keep pace with your financial commitments. A soundly designed policy will take both the present and the future into account, offering protection for the loved ones that matter regardless of changing circumstances.

Practical Guidance on Determining the Best Coverage

Let’s break this down into a practical approach to determining the amount of Term Insurance that is appropriate for you.

- List Your Financial Responsibilities: Current debts include things like mortgages, loans, and credit cards. Future expenses can include education, healthcare, and living costs.

- Consider Income Replacement: Determine the amount of money your family might need if you were not here to contribute any longer. The number may reflect several years’ worth of income.

- Examine Future Expenses: Determine upcoming costs that will crop up with time. These can include renovating the house, taking trips during special events, or financially supporting older-aged parents.

- Review Your Savings and Investments: Identify what existing assets you have that could come in handy as a cushion during emergencies. Other investments aside from this term, such as life insurance or savings, can contribute to your coverage.

- Request Multiple Quotes: Compare and contrast what different companies offer with the various Term Life Insurance Quotes you gather. Pay attention to rates and coverage details.

- Speak with Experts: Discussions with Term Life Insurance Agents will help eliminate any confusion. They can provide you with detailed insights, keeping in mind current market trends and personal needs.

We encourage you to write down your financial priorities. Use a simple spreadsheet or a notebook to track your obligations and future goals. Many clients appreciate a structured approach, and we have witnessed that this method often leads to more informed decisions.

Addressing Common Misconceptions

Sometimes, wrong information makes it difficult to understand the right amount of coverage. For instance, one may assume that the greater the coverage, the better. However, that is not necessarily true because it all depends on your situation and financial status. Some of our clients have aired their concern about being tied down to a particular policy with large coverage, whereby the premiums are going to be painfully high. Instead, it becomes a more balanced policy due to a rather judicious review of your budget and responsibilities.

Another misconception is that Term Life Insurance is too simplistic to take seriously. The concept may be simple, but the correct amount is far from simple to calculate. Most of our clients have learned this through discussions with Term Life Insurance Agents, as a policy that fits their situation is not only affordable but also necessary to maintain stability in their family.

Addressing Life Changes and Adjusting Coverage

Life changes occur, and the Term Insurance that you have bought should reflect reality. Many of our clients come to us following a significant event, such as the birth of a child, a career change, or some unexpected health development, and then realize that what they had earlier is no longer sufficient. Here at Canadian LIC, we insist on regularly reviewing your policy to ensure it remains aligned with your current situation.

A client once shared how his career was changed overnight, which led to a change in his income stream. He was forced to readjust his coverage amount, sought the help of a Term Life Insurance agent, and asked for new Term Life Insurance Quotes based on his current income and obligations. His proactive approach saved him from financial strain, which could be triggered later on. This experience reminds you to view your policy as a living document—one that evolves as your life does.

Utilizing Tools and Calculators Effectively

Many online resources provide calculators and tools to help estimate how much coverage you need. While these tools are a good beginning point, they don’t reflect many aspects of your financial life. We would caution you that their use should be part of a more comprehensive plan supported by professional consultation.

One client went to an online calculator first to get a rough estimate, then sat down with one of our Term Life Insurance Agents to discuss the outcome. The agent responded by pointing out that the calculator didn’t include future medical costs or even future long-term care needs. After speaking with the agent, the client revised his figures and made a selection that offered greater security. This example illustrates the possibility of acquiring a more appropriate and individualized Term Life Insurance Plan through the integration of technology along with expert consultation.

Comparing Different Providers and Their Offerings

Compare Term Life Insurance Quotes. Avoid being a price shopper because there are often nuances between policies, including the terms of the renewal options and riders that improve your coverage. For example, one may have more flexibility to adjust the amount of coverage at certain times in the future, and another might have conversion options that allow you to change a term policy to a Permanent Life Insurance one.

We have observed clients benefitting from comparing the details carefully. One couple looked at several Term Life Insurance Quotes and found a provider with higher rates that offered more riders that covered critical illnesses. Their decision to choose a policy with a wider scope gave them greater confidence in their financial security. As you look at your options, keep in mind how each policy will fit your long-term goals instead of focusing only on the upfront cost.

Evaluating the Long-Term Value of Your Policy

It is important to assess the long-term value of your Term Life Insurance Plan. The premium you pay today locks in a benefit that may extend over decades. This aspect of your coverage requires careful thought. Many clients have expressed that the idea of a policy lasting for a long period gives them assurance that their family will remain protected no matter what changes occur.

In discussions with Term Life Insurance Agents, you find out that the value of the policy extends far beyond just paying for current expenses. It serves as a source of security for your family and becomes increasingly more important with increasing responsibilities. With long-term value, you know that your coverage will support your family throughout every stage of their lives.

Everyday Experiences and Shared Lessons from Canadian LIC

At Canadian LIC, we learn a lot through daily interactions with clients. We have heard hundreds of stories of how a Term Life Insurance Plan has helped families tide over trying times. It makes us remember that though numbers and rates are crucial, the human element is no less important.

Such as the case in which a customer was unsure about taking a greater coverage amount for a slightly higher premium. The reason was he feared that the added cost might tighten his monthly wallet. With some discussion with Term Life Insurance Agents, he achieved a balance to meet his requirements with his means. The advice changed his perception regarding Term Life Insurance Investments, and he finally chose a policy with adequate protection but a manageable premium. This story, among others, shows how careful planning with expert advice is the difference maker.

Yet another family did not know why various Term Life Insurance Quotes were so drastically different. They compared rates for several providers and discovered the benefits and flexibility make all the difference. This family was happy that the conversation was made crystal clear when discussing all the details with an agent. These kinds of experiences are exactly what drive you to ask questions, compare, and not settle on the first policy that you encounter.

Practical Tips for a Customized Approach

When you are choosing the right Term Insurance amount for yourself, apply these practical points:

- Review frequently: Review policy details at milestone points in life. A new financial situation, health change, or a sudden increase in your family size will call for raising your coverage sum.

- Write It Down: Just make a note of all those financial obligations now and in future. Writing makes the amount seem more real to you.

- Ask Questions: Whether you are talking to Term Life Insurance Agents or comparing Term Life Insurance Quotes online, don’t hesitate to ask questions.

- Balance Cost and Coverage: The lower the premium, the more attractive the deal may seem. However, make sure the policy covers all your essential needs. Review the details of Term Life Insurance Investments and other benefits that may add value.

- Consider Future Goals: Consider where you’d like your family to be five, ten, or twenty years from now. Your Term Life Insurance Policy should help you realize those dreams regardless of the direction life takes.

With these considerations in mind, you can construct a customized approach that reflects your needs. Many clients have told us that having their goals and responsibilities written down helps turn a vague decision into a concrete plan.

Crafting a Term Life Insurance Plan That Adapts With You

The ideal policy adapts to changes in your life. Many clients begin with a coverage amount that suits their needs at the time but later require adjustments as their responsibilities shift. Whether you are increasing your coverage due to a growing family or scaling back because you have paid off major debts, your Term Life Insurance Plan should be flexible.

One client once increased his policy when his children attained the college-going age. According to him, he had invested in enough Term Life Insurance at the initial stages of his career for his family’s protection, but a review revealed that the long-term goals required the increase so as to better take care of the children’s education and his wife’s financial plan. This experience underlines the fact that buying a Life Insurance Policy is not a one-time decision. Regular discussions with Term Life Insurance Agents can help you update your coverage to match your current situation.

The policy evolves with the progression of your different stages of life, and, as such, it reflects those new challenges and opportunities whether you are just starting out in life or making plans for your retirement, Term Life Insurance would be an indispensable part of an overall financial planning strategy.

Listening to Your Instincts and Relying on Expertise

In cases where there are so many options, trust your instincts and seek the advice of an expert. Our team at Canadian LIC hears you out on your concerns and utilizes our daily interactions to help you find a policy that will suit your budget as well as your aspirations. Each discussion cements the fact that a tailored approach, with in-depth research and clear Term Life Insurance quote comparisons, is the only way you can be confident about the decision you are making.

Think about the sense of security a family will experience if it finds out that should the unexpected befall, such a family is covered in sufficient funds to finance their daily cost of living expenses, debt-paying capacity, or further future endeavours. According to clients, the correct amount of insurance will not only satisfy current claims but also provide flexibility as individual circumstances change in life. Discuss your choices with Term Life Insurance Agents for a plan built to really last you a long time.

Embracing a Forward-Thinking Strategy

A forward-looking strategy means planning for the present and also for the problems of tomorrow. Many Canadians are overwhelmed with balancing a budget, saving for retirement, and other long-term goals. However, setting the right amount for Term Insurance is important in your overall financial plan. It safeguards the future of your family while giving you time to focus on wealth-building through other means.

Consider the merits of aligning your Term Life Insurance Investments with your overall financial plan. Upon comparing Term Life Insurance Rates and gathering quotes, you see a well-chosen policy frees up resources for other savings or investment opportunities. The integrated approach helps many of our clients feel much more secure and better prepared for the future.

The best amount for Term Insurance

Final Thoughts and an Invitation to Act

After considering all of these aspects: financial liabilities, Term Life Insurance Quotes, investments in Term Life Insurance, and advice from Term Life Insurance Brokers, you’ll realize that figuring out the appropriate amount of Term Insurance requires serious consideration and ongoing effort. You have control over crafting a plan suitable to your requirements by listing

your liabilities, Term Life Insurance quote comparison, and expert guidance.

We encourage you to take ownership of your future and your wallet by reviewing what is going on and planning for the unexpected. Each conversation builds on your base of knowledge, brings you one step closer to a customized Term Life Insurance program that will remain timeless, and puts trust into the process: learn from their mistakes and find people who work in the same details. Your efforts today will pave the way for a secure tomorrow.

Your journey toward the right coverage amount is one of empowerment and responsibility. With the right tools and advice, you can confidently protect the financial future of your loved ones. The experiences we share at Canadian LIC highlight that thoughtful planning and proactive adjustments ensure that your policy continues to serve you well, even as life brings new challenges.

If you are prepared to review coverage or have questions on the amount you need, speak with a knowledgeable agent who will take you through it step by step. Spend time comparing the available Term Life Insurance Quotes, discuss them widely, and settle for a plan that’s within your budget now but will be a step toward safety in the future. Your commitment today builds a legacy of financial strength and security for those you care about most.

It has been our great pleasure to spend time exploring such an important topic. The very first step in securing a bright future is dedicated to doing the right thing by having your facts in order. We greatly appreciate the chance to help you get started with setting up a Term Life Insurance product that will, for decades into the future, be specifically tailored to meet the needs of your family.

Secure your policy in harmony with your dreams and obligations by actively reviewing your financial responsibilities, comparing Term Life Insurance Rates and quotes, and engaging with dedicated Term Life Insurance Agents. You know what you have to do: assess your needs, gather the information needed, and take action to set up coverage that ensures financial stability for your family. Step forth with confidence toward your financial future, embracing an opportunity to construct a plan that will meet your needs today and fuel your aspirations for tomorrow.

More on Term Life Insurance

- What Is The Waiting Period For Term Insurance?

- Is Natural Death Covered In Term Insurance?

- Should I get a 20 or 30-year Term?

- How Do I Claim Term Insurance?

- Can I Use My Term Life Insurance To Pay Off Debt?

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs on Determining the Best Amount for Term Insurance

Begin by compiling a list of your financial needs and responsibilities. Put down the debts, monthly bills, and future costs. Most clients make a decision by having too little or too much coverage. Clients often compare Term Life Insurance Quotes to determine which best fits them. Our Term Life Insurance Agents do the trick for you as they listen to your story and then recommend a Term Life Insurance Plan according to your needs. So, have you jotted down your expenses?

Term Life Insurance Quotes depend on various factors, like your age and health, as well as the term. Clients often wonder how these quotes change their premium cost. The lower rates can let you buy a higher coverage amount. Reviewing Term Life Insurance Quotes may give you an idea of different prices. For many people, speaking with Term Life Insurance Agents helps them clear up the numbers. Do you feel confident about the rate you see?

Term Life Insurance Investments give a fixed benefit for your loved ones. This helps in covering day-to-day and future expenses. Many clients shared that this kind of support really helped them forget their worries in hard times. A good Term Life Insurance Plan is a good collaboration with other savings and investments you have. It becomes a core part of your overall financial plan. Have you seen how these investments protect you when needed?

A good Term Life Insurance protects your debts and bills as well as future needs. The clients collaborate with term life agents to discuss these options. Term life quotes are checked, and the benefits are compared. Term length and premium cost are considered. Select a term that addresses both your budget and your future needs. Is it clear which features you need?

Term Life Insurance Agents spare time to understand your situation. They explain various Term Life Insurance Rates and quote details. Many clients, therefore, feel relieved after talking to an agent who listens and advises carefully. They help you compare quotes for Term Life Insurance and suggest a plan made especially for you. This one-on-one guidance makes quite a difference. Do you have someone to discuss your needs with?

Collect quotes from different providers for a comparative overview of options available. Check very carefully the rates quoted in Term Life Insurance and what coverage each one offers. Most clients start by putting their requirements on the side of the paper and comparing all Term Life Insurance Quotes thereafter. Asking Term Life Insurance Agents for a clear explanation helps you understand the differences. This process lets you choose the best plan for your budget and goals. Have you started making comparisons to the quotes provided?

Each answer is rooted in the experience we witness each day at Canadian LIC. These stories reflect your common struggles and questions. We do hope these answers will give you more confidence as you make those Term Insurance decisions.

Sources and Further Reading

- Insurance Bureau of Canada – Offers extensive information on insurance products and consumer rights.

www.ibc.ca - Financial Consumer Agency of Canada – Provides guides on personal finance and insurance choices.

www.canada.ca/en/financial-consumer-agency.html - Canadian Life and Health Insurance Association – Features research and insights into life and health insurance in Canada.

www.clhia.ca - RBC Insurance – Delivers useful insights on various Term Insurance plans and financial planning tools.

www.rbcinsurance.com - Manulife – Provides detailed information on Term Insurance options and planning resources.

www.manulife.ca - Sun Life Financial – Offers educational resources and planning tips for choosing Term Insurance.

www.sunlife.ca

Key Takeaways

- List your financial responsibilities, debts, and future expenses to set a clear coverage target.

- Check Term Life Insurance Rates to see how age, health, and term length affect your premium.

- Use Term Life Insurance Quotes from several providers to compare policy benefits and costs.

- View Term Life Insurance Investments as a key part of your overall financial strategy.

- Work with Term Life Insurance Agents who offer personalized advice tailored to your needs.

- Update your Term Life Insurance Plan as your financial situation and family responsibilities evolve.

Your Feedback Is Very Important To Us

Thank you for taking a moment to share your thoughts. We value your input and want to learn about your challenges in choosing the best Term Insurance amount. Your feedback helps us serve you better.

Thank you for sharing your experience. Your input helps us understand the common struggles and improve our support for families like yours.

IN THIS ARTICLE

- What Is The Best Amount For Term Life Insurance Policy?

- Understanding the Importance of the Right Coverage Amount

- Evaluating Your Financial Responsibilities

- The Role of Term Life Insurance Rates in Your Decision Process

- How Term Life Insurance Investments Impact Your Future

- Working with Term Life Insurance Agents for Tailored Advice

- Collecting Term Life Insurance Quotes for the Best Option

- Crafting a Personalized Term Life Insurance Plan

- Practical Guidance on Determining the Best Coverage

- Addressing Common Misconceptions

- Addressing Life Changes and Adjusting Coverage

Sign-in to CanadianLIC

Verify OTP