Hey there! Ready to secure your financial future? Don’t forget to check out the RRSP (Registered Retirement Savings Plan) contribution limits for 2024. Understanding these limits is a vital piece of the puzzle in planning a successful retirement. With the new year around the corner, understanding these changes can help you plan better and maximize your savings. This guide is here to walk you through the 2024 RRSP contribution limits, offering insights and strategies to make the most of your retirement savings. Whether you’re a seasoned saver or just starting, this information is pivotal in shaping your financial future. So, let’s get started on understanding these updates and how they can benefit you!

What is the Maximum RRSP Contribution for 2026?

By Canadian LIC, January 22, 2026, 8 Minutes

- What Is The Maximum RRSP Contribution For 2026?

- Why the RRSP Contribution Limit Is More Than Just a Number

- What Is the Maximum RRSP Contribution for 2026?

- What Counts as Earned Income for RRSP Purposes?

- What Happens If You Over-Contribute to Your RRSP?

- What If You Don’t Use All Your RRSP Room?

- RRSP Interest Rate 2026: What You Should Expect

- Real Client Story: Retirement Confidence From a Strategic RRSP Plan

- The RRSP vs TFSA Question in 2026

- How to Maximize RRSP Contributions Strategically

- The Real Power of RRSPs in 2026: More Than Just Tax Savings

- Final Word

SUMMARY

Canadian LIC breaks down the 2026 registered retirement savings plan contribution limit of $33,810, who qualifies for it, and how to use it strategically. The content also explains RRSP interest rate 2025 trends, penalties for over-contribution, and how to coordinate RRSPs with TFSAs, spousal plans, or employer contributions to maximize tax savings and long-term retirement growth.

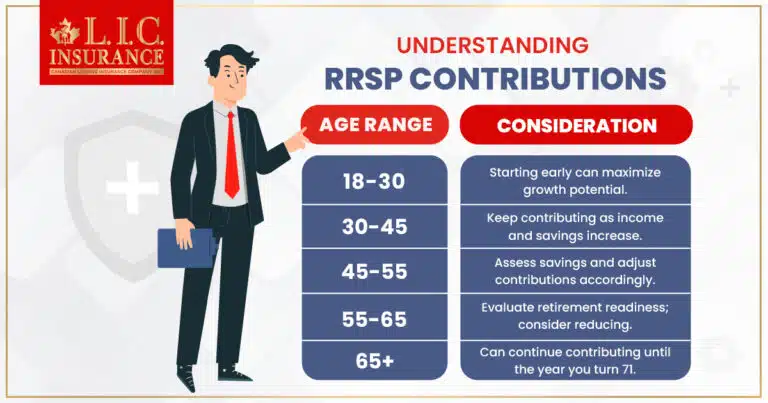

Introduction

Every year, we see Canadians miss out on thousands in tax savings and compound growth simply because they didn’t fully understand how much they could contribute to their Registered Retirement Savings Plan (RRSP). Some over-contribute and face penalties. Others under-contribute and miss the chance to reduce taxable income or grow their retirement savings effectively. At Canadian LIC, we’ve helped clients recover from both scenarios — and plan smarter with clear, personalized strategies built over 14+ years of working directly with Canadian families.

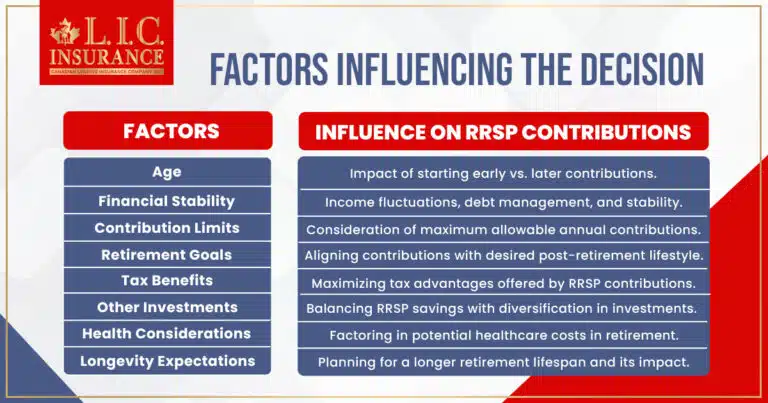

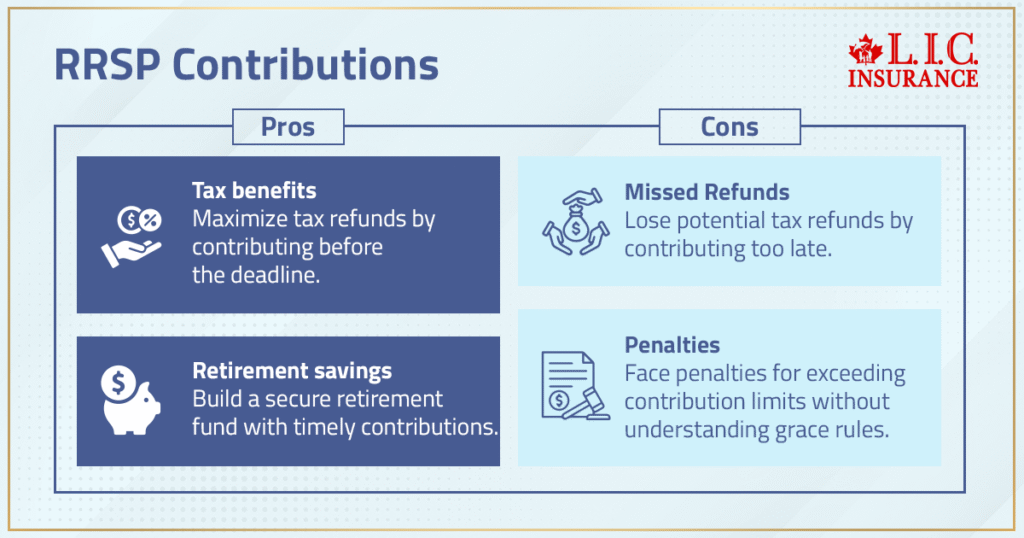

Why the RRSP Contribution Limit Is More Than Just a Number

At Canadian LIC, we often meet clients who assume the RRSP contribution limit is a number they can look up once and forget. But in our work, that number represents much more. It reflects how prepared you are to reduce taxes, how flexible you can be with your savings plan, and how successfully you can take control of your retirement.

We’ve met families who left thousands in tax refunds on the table simply by contributing too late. We’ve also seen individuals pay painful CRA penalties for accidentally going over the limit because no one explained the $2,000 grace rule.

Understanding the maximum RRSP contribution for 2026 isn’t just about knowing the ceiling. It’s about using the number the right way, at the right time, for the right result.

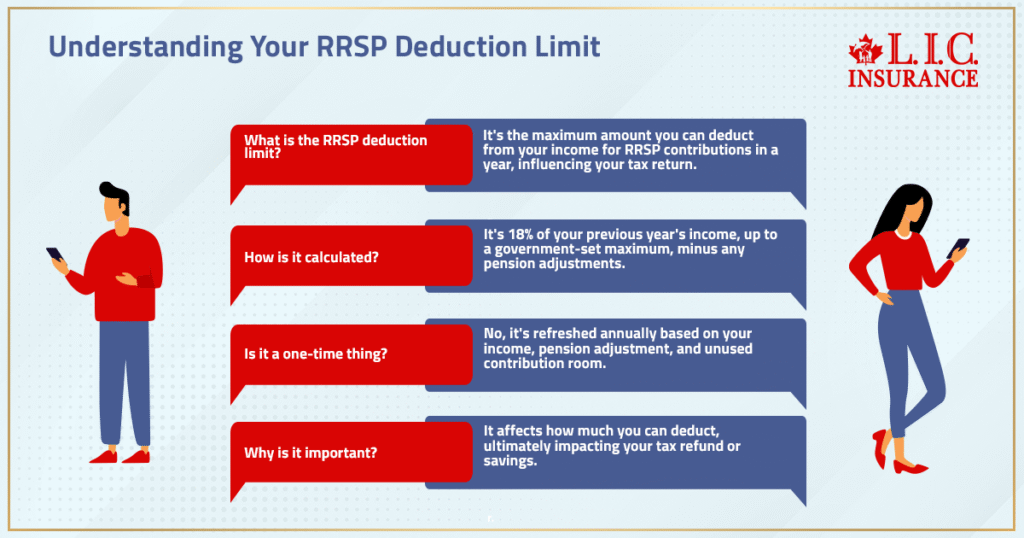

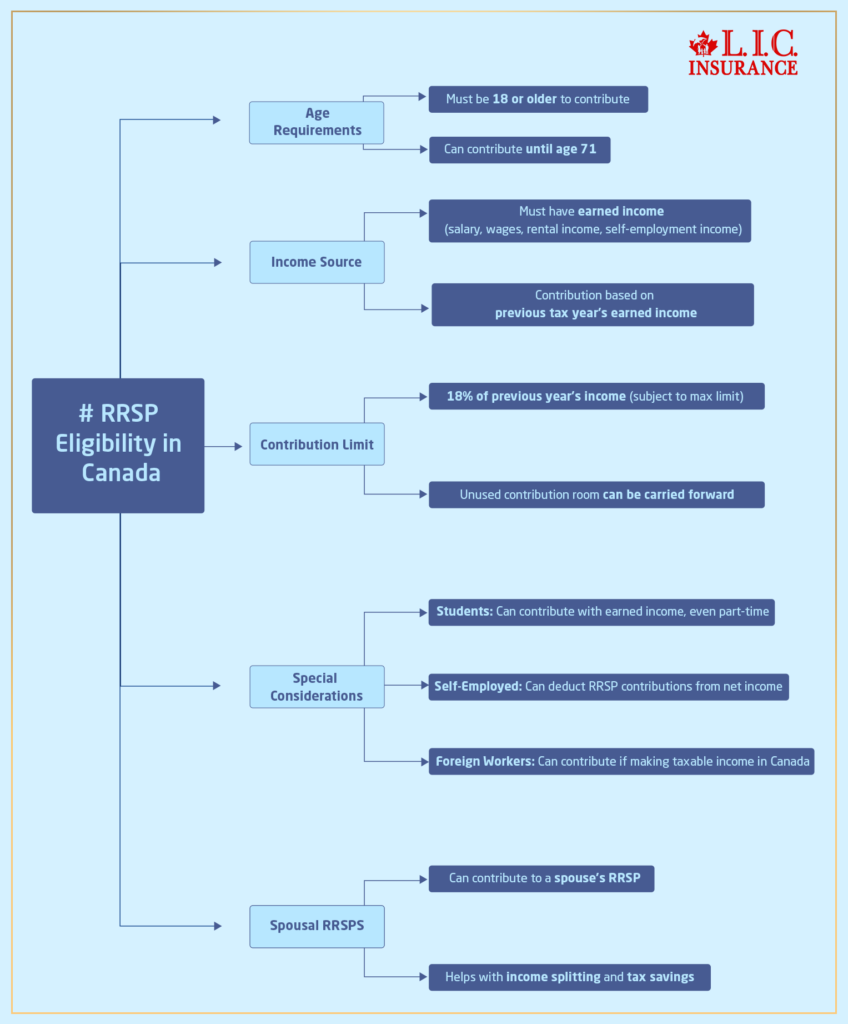

What Is the Maximum RRSP Contribution for 2026?

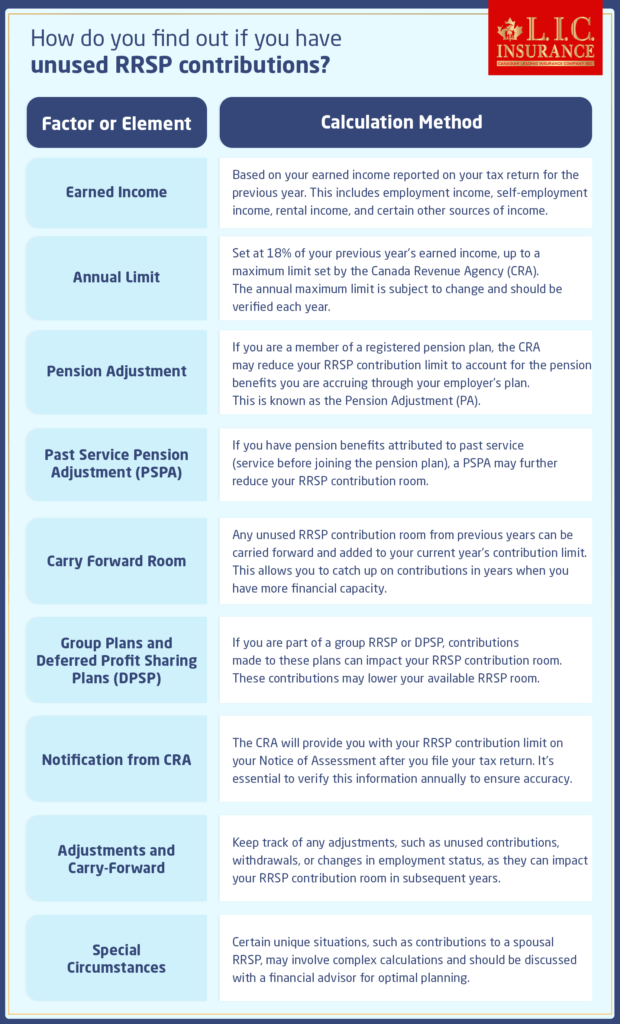

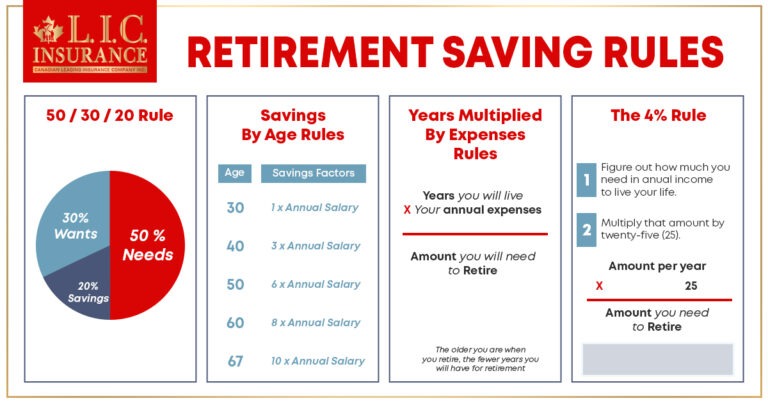

For the 2026 tax year, the maximum RRSP contribution limit is $33,810, which increased from the 2024 limit of $31,560. But don’t stop reading there — because most Canadians aren’t RRSP eligible to contribute the full amount unless they have earned income of approximately $180,500 or more in 2024, and their pension adjustment does not reduce their available contribution room.

The actual calculation is 18% of your earned income from the previous year (2024) up to the annual maximum.

Example:

If you earned $75,000 in 2025, your RRSP contribution room for 2026 would be $13,500.

Key facts:

- Max contribution: $33,810

- Based on 18% of earned income in 2024

- Deadline to contribute for 2026 tax return: March 2, 2026

We always remind clients: even if you can’t contribute the full amount now, any unused room carries forward indefinitely. That unused room is your future opportunity.

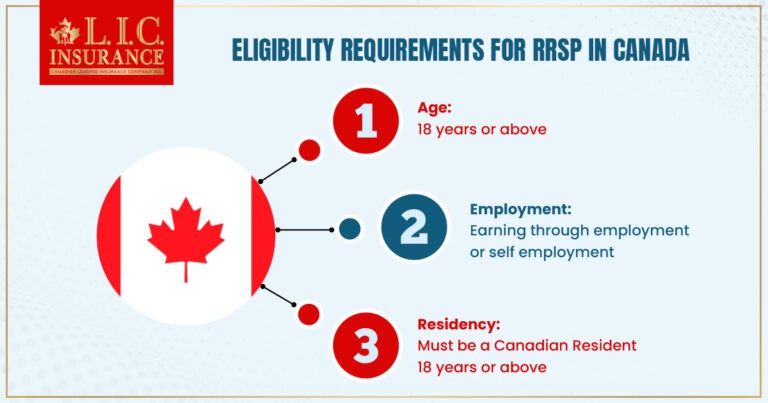

What Counts as Earned Income for RRSP Purposes?

CRA calculates RRSP contribution room based on “earned income,” which includes specific employment and business income items and is adjusted for pension participation and other deductions.

This is where many people go wrong. RRSP room is based on earned income — not all income.

At Canadian LIC, we take the time to explain this clearly to every client. We often see people assume their investment gains or pension payouts will boost their RRSP limits. They don’t

What counts:

- Salaries and wages

- Self-employment or business income

- Net rental income

- Alimony received (if taxable)

What doesn’t count:

- Investment income (dividends, capital gains)

- CPP, OAS, EI, and pension income

- Lottery winnings or inheritance

Knowing what counts means you can plan contributions properly — especially if your income mix includes freelance or rental earnings.

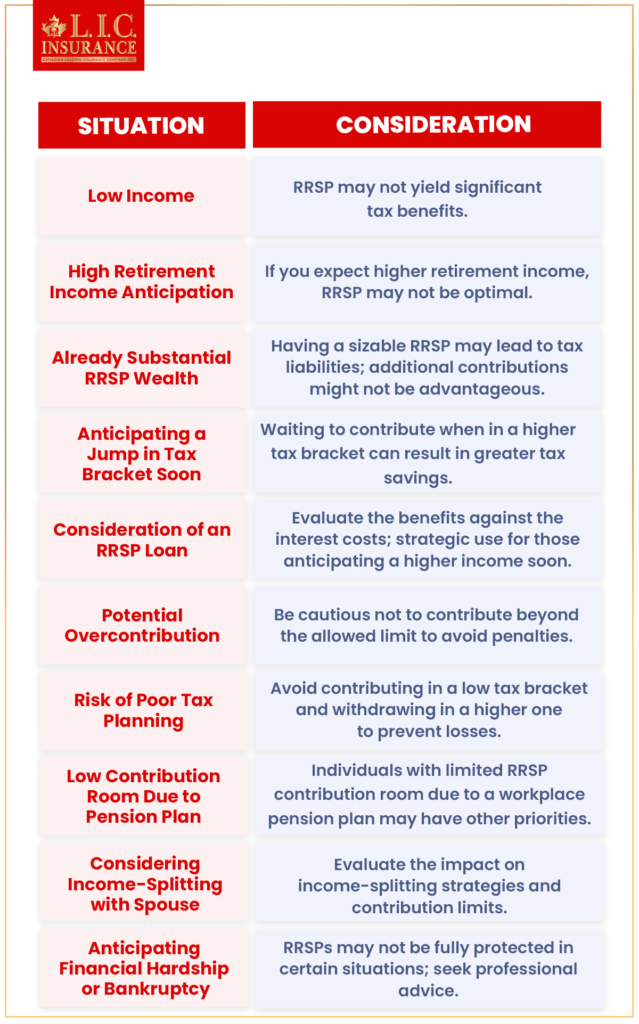

What Happens If You Over-Contribute to Your RRSP?

One of the biggest mistakes we help people fix at Canadian LIC is over-contributing to their RRSP without realizing it.

There’s a $2,000 lifetime overcontribution buffer allowed without penalty. But anything beyond that? You’re looking at a 1% penalty per month — that’s $10 for every $1,000, every single month until it’s fixed.

Real case:

A client contributed through work and personal channels. No one told him his group RRSP was being deducted automatically. By year’s end, he was $5,200 over. We helped him file a T3012A and withdraw the excess using CRA Form T746.

The solution is available — but the stress is avoidable with the right guidance.

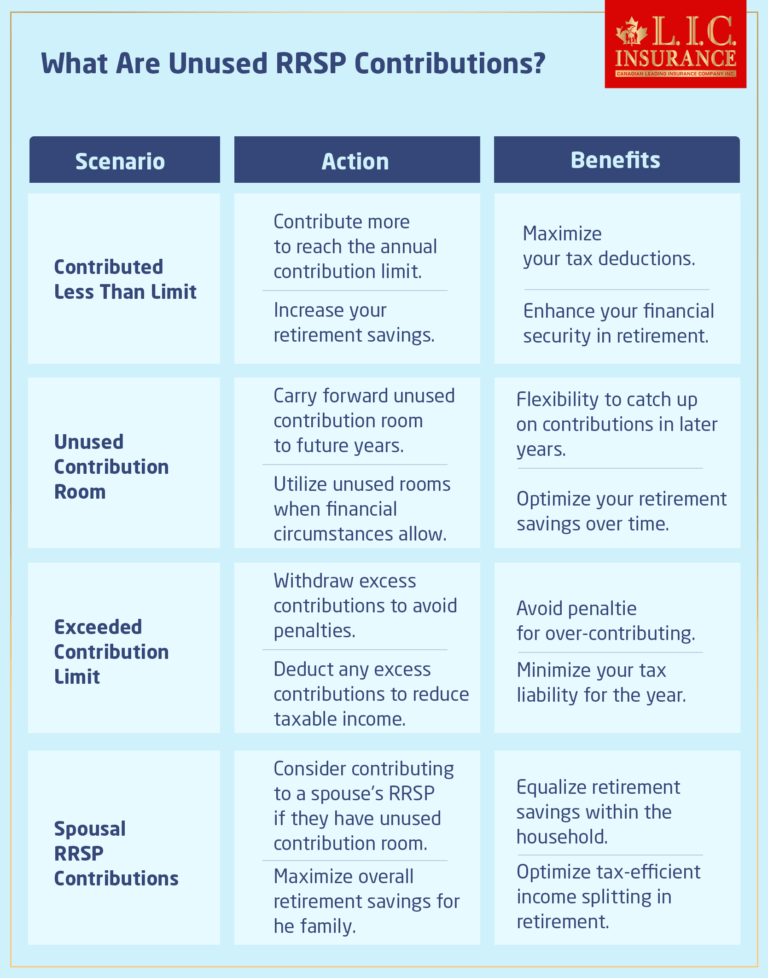

What If You Don't Use All Your RRSP Room?

Contrary to what many people think, unused RRSP room never expires. We’ve had clients in their 50s with $100,000+ in unused space.

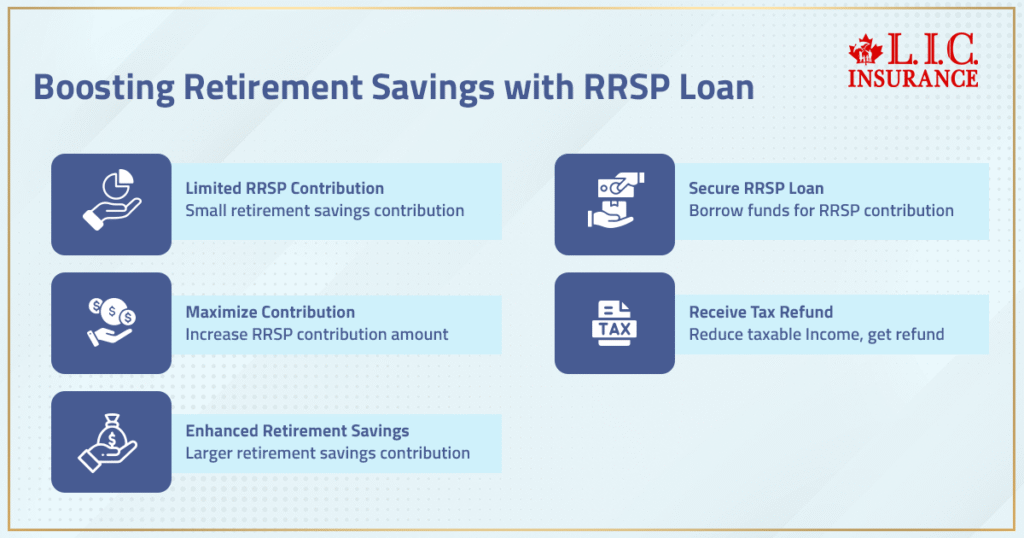

Rather than panic, we build a long-term contribution strategy. Sometimes, that means using RRSP loans strategically to catch up. Other times, we create monthly deposit plans aligned with bonuses, tax refunds, or seasonal income.

An unused room isn’t a problem — as long as it’s part of the plan.

RRSP Interest Rate 2026: What You Should Expect

RRSPs themselves don’t have a “rate” — they’re accounts. The growth depends on what you invest in inside the RRSP.

However, many clients choose RRSP GICs, especially during periods of market uncertainty.

RRSP GIC rates vary by term and financial institution and can change frequently throughout the year. Investors should review current posted rates and may consider strategies such as GIC laddering to balance return and liquidity.

Real Client Story: Retirement Confidence From a Strategic RRSP Plan

A couple in their mid-40s came to us thinking they were behind on their retirement savings. Their combined income was strong, but they were unsure about their unused RRSP room. We pulled CRA data, found over $45,000 in available space, and structured the following:

- $10,000 lump sum RRSP deposit before the deadline for instant tax relief

- Monthly contributions of $1,000 aligned with their pay schedule

- GICs and ETFs are selected based on risk level

Within a year, their tax return included over $5,000 in refunds, which we reinvested. Now, they’re on track to retire comfortably — not because they saved more, but because they saved smarter.

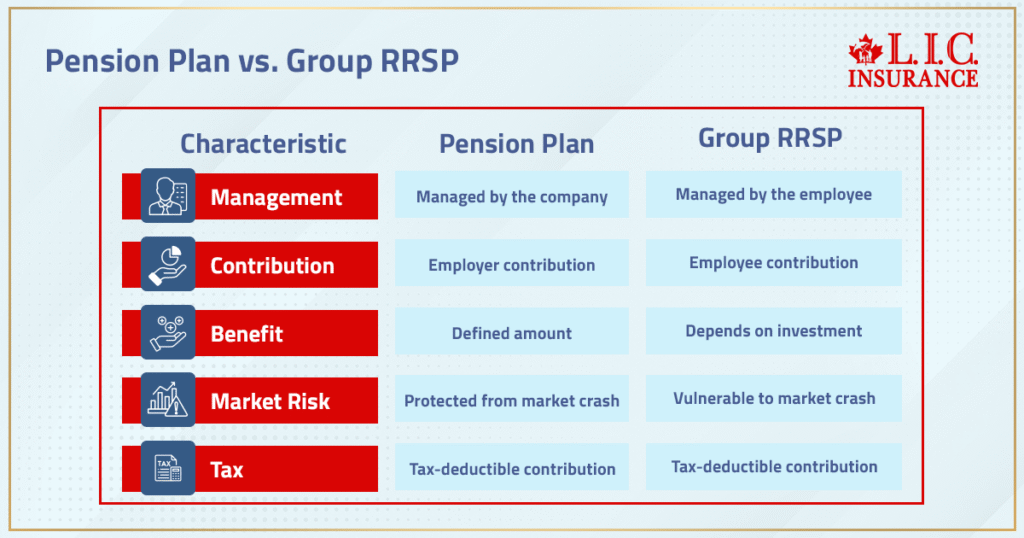

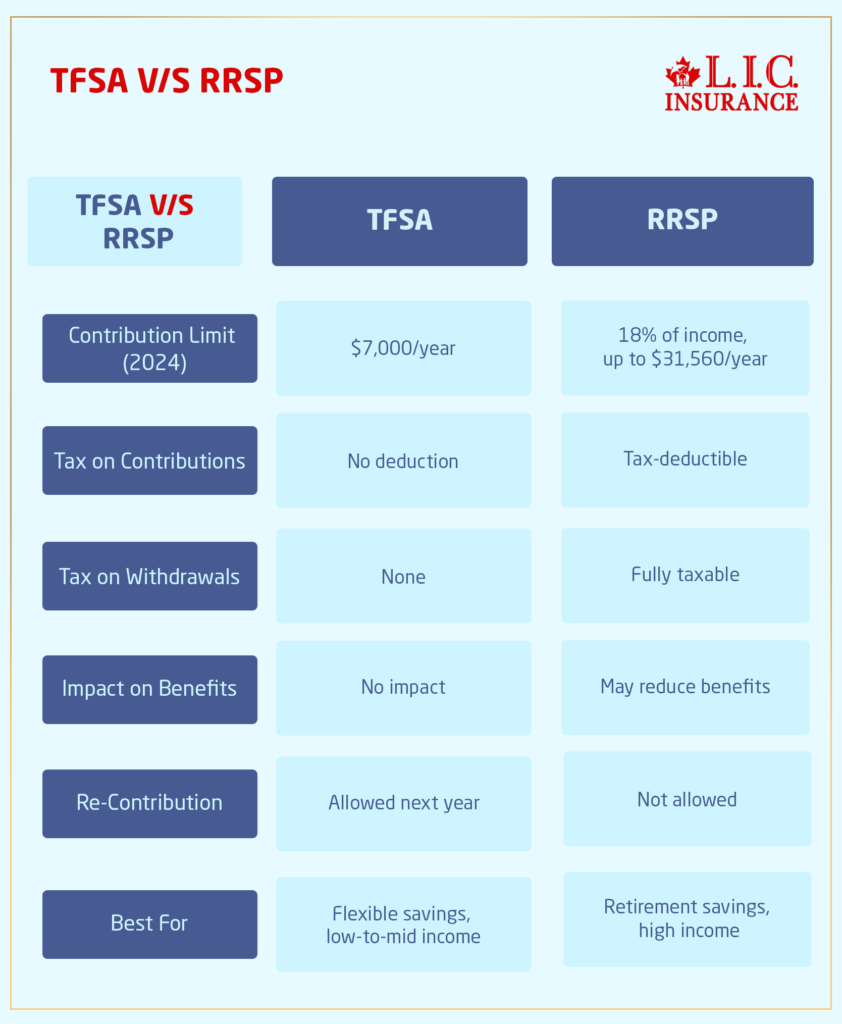

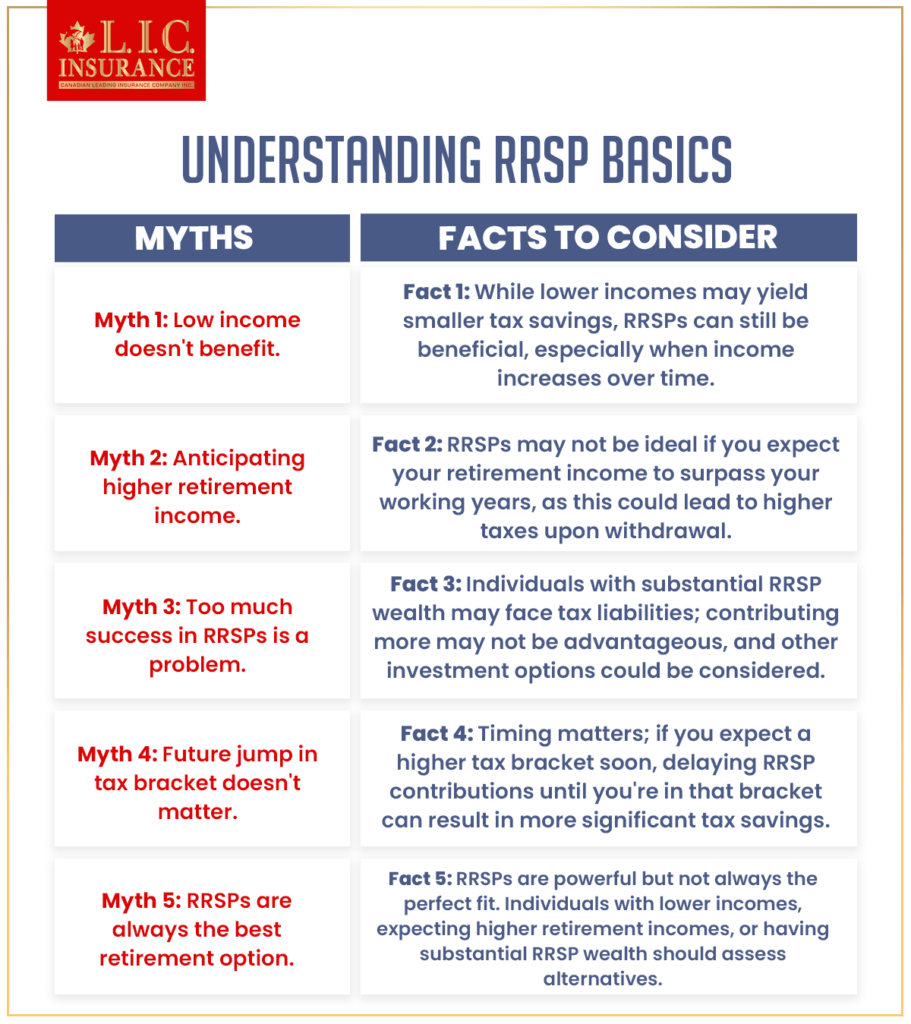

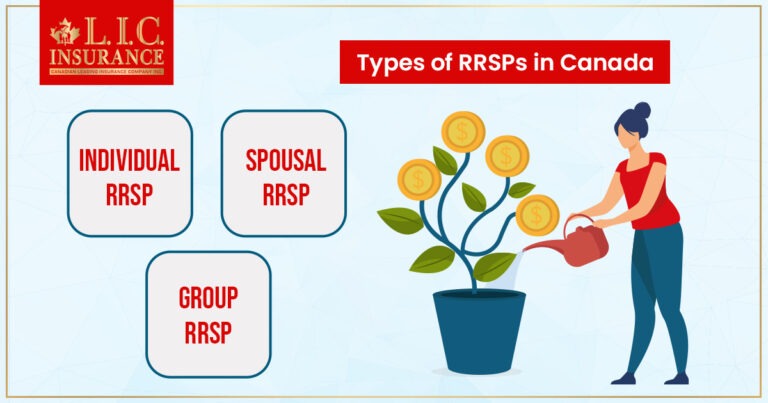

The RRSP vs TFSA Question in 2026

This question comes up in nearly every client meeting we have: “Should I contribute to my RRSP or my TFSA first?”

The answer depends entirely on your current tax bracket and your expected retirement income.

We recommend RRSPs when:

- You’re in a high-income bracket now

- You want to reduce your taxable income immediately

- You expect lower income in retirement

We recommend TFSAs when:

- You’re in a lower income bracket today

- You want flexible withdrawals with no tax impact

- Have you already maxed out RRSPs or expect a higher retirement tax rate

At Canadian LIC, we often recommend using both accounts. We build dual strategies that combine tax-deferral today and tax-free growth for tomorrow.

How to Maximize RRSP Contributions Strategically

Here’s what we guide our clients to do in 2026:

- Automate deposits: Set monthly contributions to avoid end-of-year scrambling.

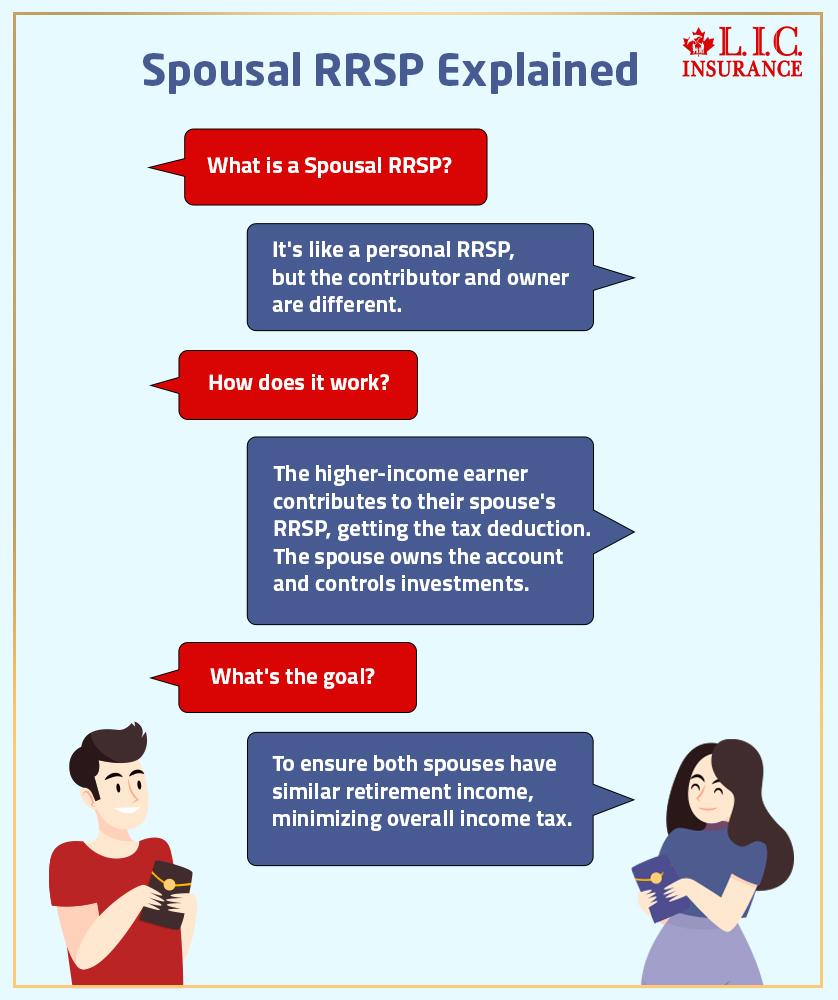

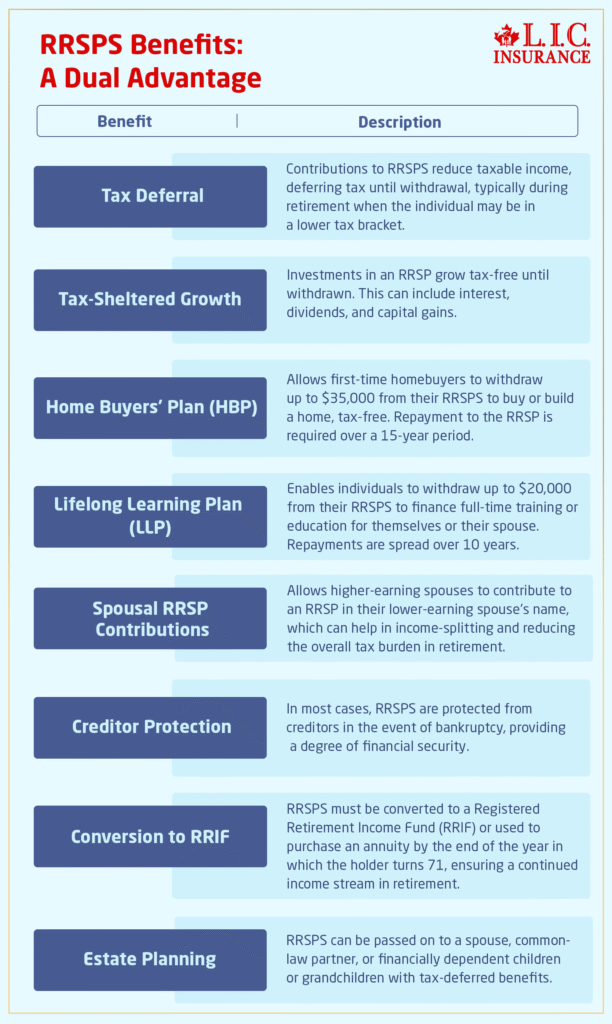

- Use spousal RRSPs: Perfect for couples with unequal incomes. It allows future income-splitting.

- Track your contribution room: Use CRA My Account or let us help monitor it for you.

- Time contributions smartly: Some clients benefit from lump sums just before filing taxes.

- Invest wisely inside your RRSP: Not all investments grow the same — we help tailor yours.

- Check eligibility for RRSP loans: Sometimes, a small loan now creates a much bigger refund later.

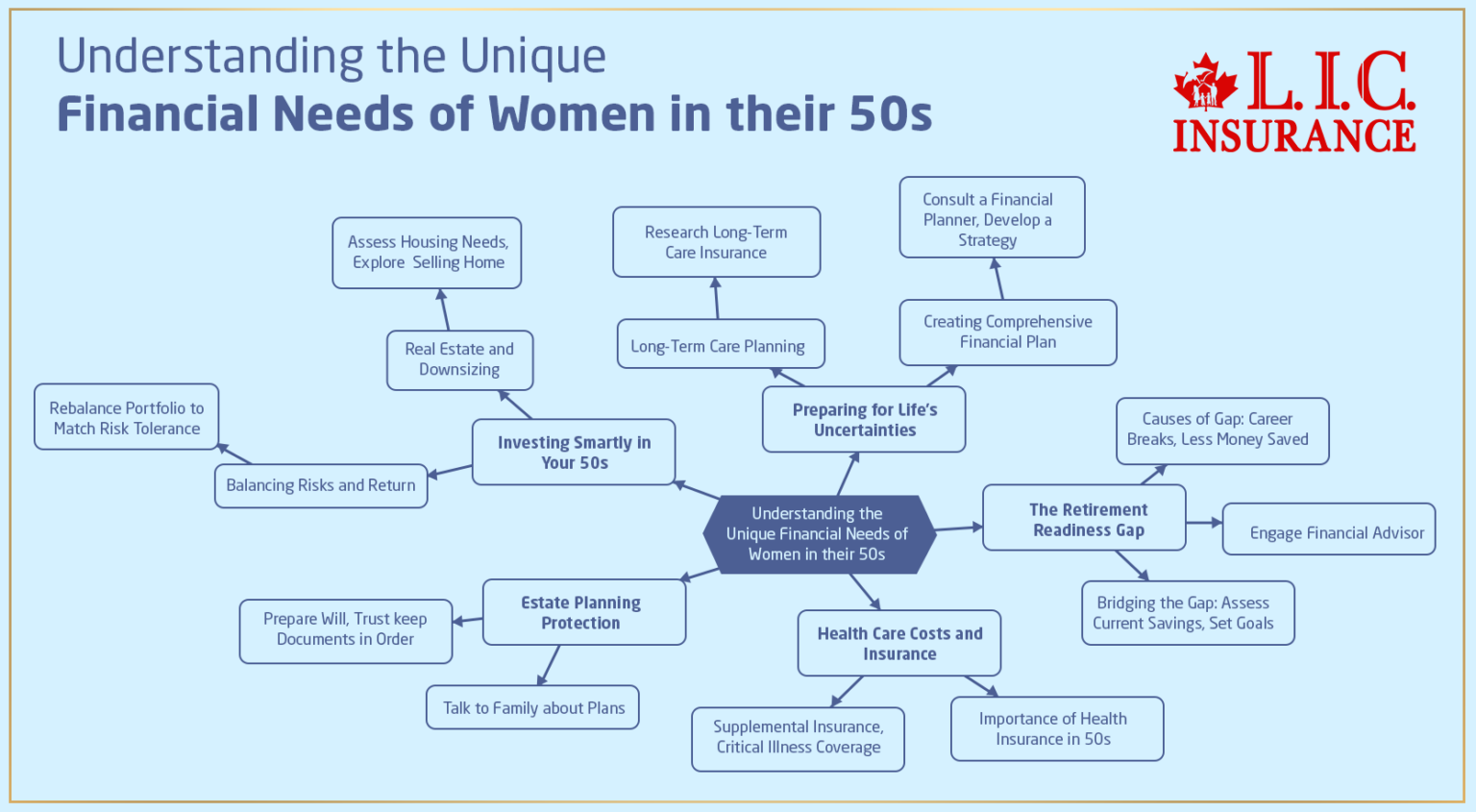

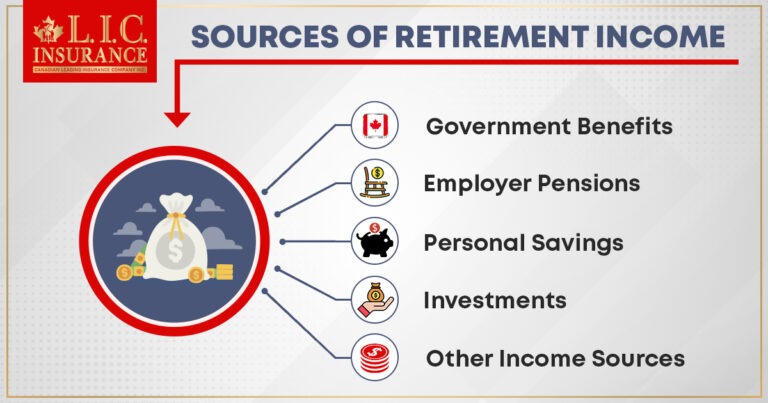

The Real Power of RRSPs in 2026: More Than Just Tax Savings

We remind every client that an RRSP isn’t just a tax tool. It’s a retirement accelerator.

When used properly, your RRSP:

- Reduces taxable income now

- Compounds investment returns tax-deferred

- Supports retirement income later

- Gives you options for spousal or annuity income splitting

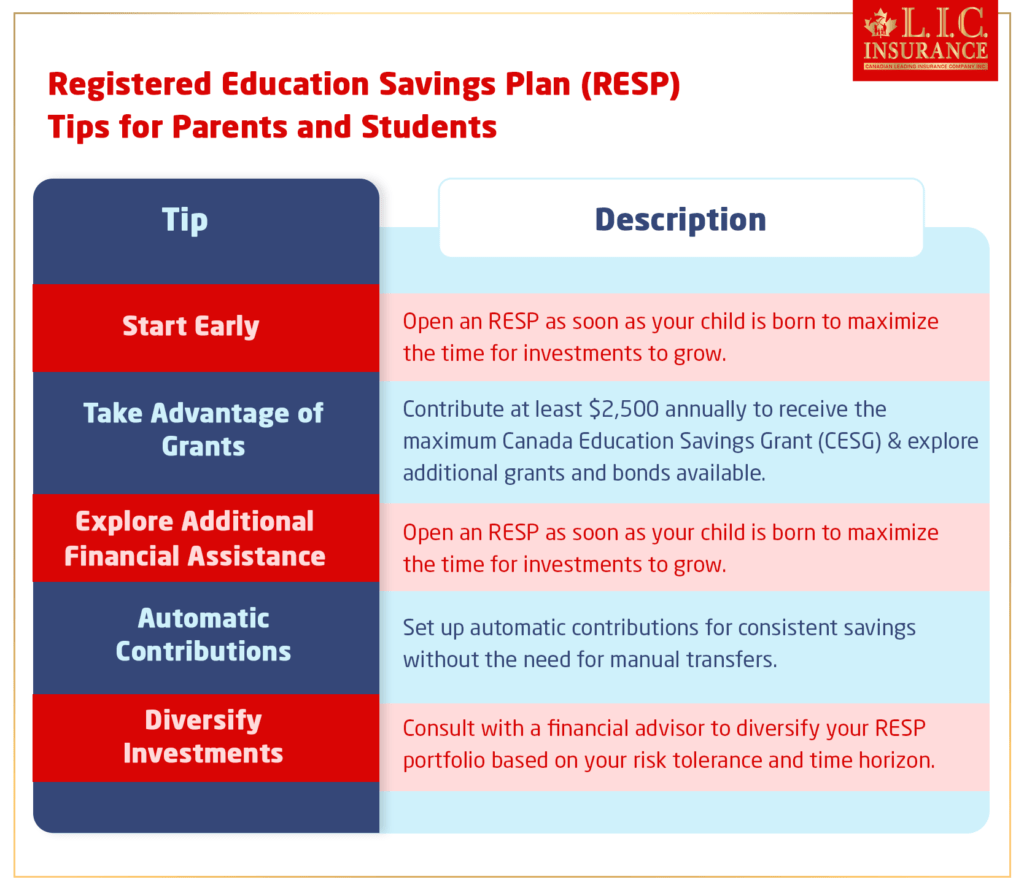

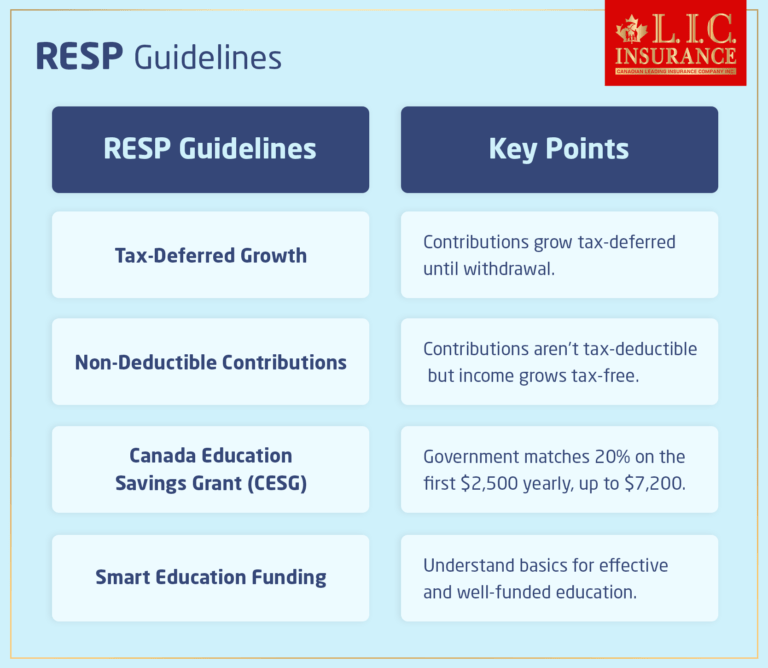

It can also open the door to other financial strategies — like the Home Buyers’ Plan or the Lifelong Learning Plan. At Canadian LIC, we integrate RRSPs into the broader financial landscape — mortgages, kids’ education, estate planning, and more.

Final Word

The maximum RRSP contribution for 2026 is $33,810 — but that number only matters if you use it well.

At Canadian LIC, we go beyond reminders and numbers. We build tax-efficient RRSP strategies that are customized to your income, family needs, and future goals.

RRSP success isn’t about guessing. It’s about guided planning backed by real expertise.

If you’re wondering whether you’ve contributed enough, contributed too much, or contributed at the wrong time, we’re here to help.

Let’s get your RRSP working as hard for your future as you do today.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

Yes, you can still make your RRSP contributions before the March 2, 2026, deadline, even if you haven’t filed your 2025 tax return yet.

You can contribute to a spousal RRSP even if your partner files a separate return. We often help couples structure this smartly — where one spouse contributes and gets the tax break while the other builds their retirement cushion. It’s not about filing together — it’s about planning together. And our advisors walk you through every line to ensure both benefits are maximized.

Many clients with employer RRSP matching programs don’t realize those contributions count toward their personal limit. This is one of the top sources of over-contribution errors we see. At Canadian LIC, we help you account for both your payroll deductions and your direct contributions to make sure you don’t exceed your limit unknowingly.

Yes — but only under specific programs like the Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP). We’ve helped first-time buyers and adult students use these options to their advantage. But we always explain the repayment terms clearly — because if you don’t repay on time, the withdrawal is added to your income and taxed. Our role is to help clients use RRSPs without triggering surprise tax bills.

This is one of the more overlooked questions. RRSP withdrawals in retirement can increase your taxable income — and that may reduce eligibility for benefits like GIS or age credits. That’s why we model long-term income scenarios for our clients. With the right planning, we balance RRSP usage with TFSAs and other assets to protect future benefit entitlements.

Only if you still have an RRSP room from when you were a resident and earned qualifying income. We’ve worked with Canadians living abroad who kept contributing — and faced unexpected CRA letters. Our team walks you through residency status, contribution eligibility, and tax treaty considerations to keep everything legal and penalty-free.

Waiting for a windfall often means never starting at all. Many of our most successful clients began with monthly automated contributions of $100 or $200. It’s the habit — not the amount — that compounds. And we often show clients how small monthly amounts lead to larger refunds than they expect by tax time.

We always point our clients to CRA’s “My Account” portal — but we don’t stop there. We walk them through reading their Notice of Assessment, explain what pension adjustments mean, and even verify group plan deductions. You don’t need to guess your room. With the right help, you can see it, use it, and plan around it confidently.

You must convert your RRSP to a RRIF (Registered Retirement Income Fund) or an annuity by December 31 of the year you turn 71. We prepare our clients for this year in advance — showing them how to reduce taxes with early withdrawals, income splitting, and TFSA re-contributions. It’s not the end of tax deferral — it’s the start of income strategy.

Our work doesn’t end at contribution season. We offer quarterly check-ins, annual reviews, and real-time investment insights so your RRSP evolves with your goals. Whether it’s reallocating funds during market changes or rebalancing to protect gains, we ensure your RRSP continues to grow efficiently — without losing sight of your long-term retirement vision.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com