There is one word that stands out in Canada’s financial planning world, and that word is an RRSP, which stands for “Registered Retirement Savings Plan.” People often praise the Registered Retirement Savings Plan (RRSP) as a financial powerhouse because it gives Canadians a strong way to save for retirement while also getting big tax advantages. Having said that, just like not all the tools in a kit are good for every job, an RRSP is not the best way to save money for everyone. Today, we’re going to answer a big question: Who should not use RRSP?

A Registered Retirement Savings Plan (RRSP) is almost like a special kind of savings account that lets you put money away for retirement. What sets it apart from other options is that it’s really good at saving you money on taxes. Making contributions to an RRSP will get you a special gift on taxes, which would be a reduction based on your top marginal tax rate. You can understand it in a better way with the example of getting a cheap coupon that makes your financial life a little easier.

However, here’s a thing to keep in mind at the same time: This heroic tool may not be the best fit for everyone. An RRSP might not always be the best idea, even when it seems like it would be safe to use one. The main point is not about having a problem with RRSPs but finding the best way to handle your money.

Imagine it like choosing the perfect outfit. Just like you wouldn’t wear a tracksuit to a fancy dinner, not everyone should put on the RRSP outfit. It’s about finding the right match for your unique financial needs.

Just think that if you have a small amount of money coming in every month. What if your income isn’t very high? The RRSP might not be the best choice for you. It’s like having a powerful instrument that isn’t quite right for the job.

We’ll look more closely at a number of situations in which RRSPs might not be the best way to manage your money. Whether you’re thinking about getting an RRSP loan or just want to know the best road for your financial future, buckle up as we go over the many things you need to think about when it comes to RRSPs. Remember that financial planning is a personal journey.

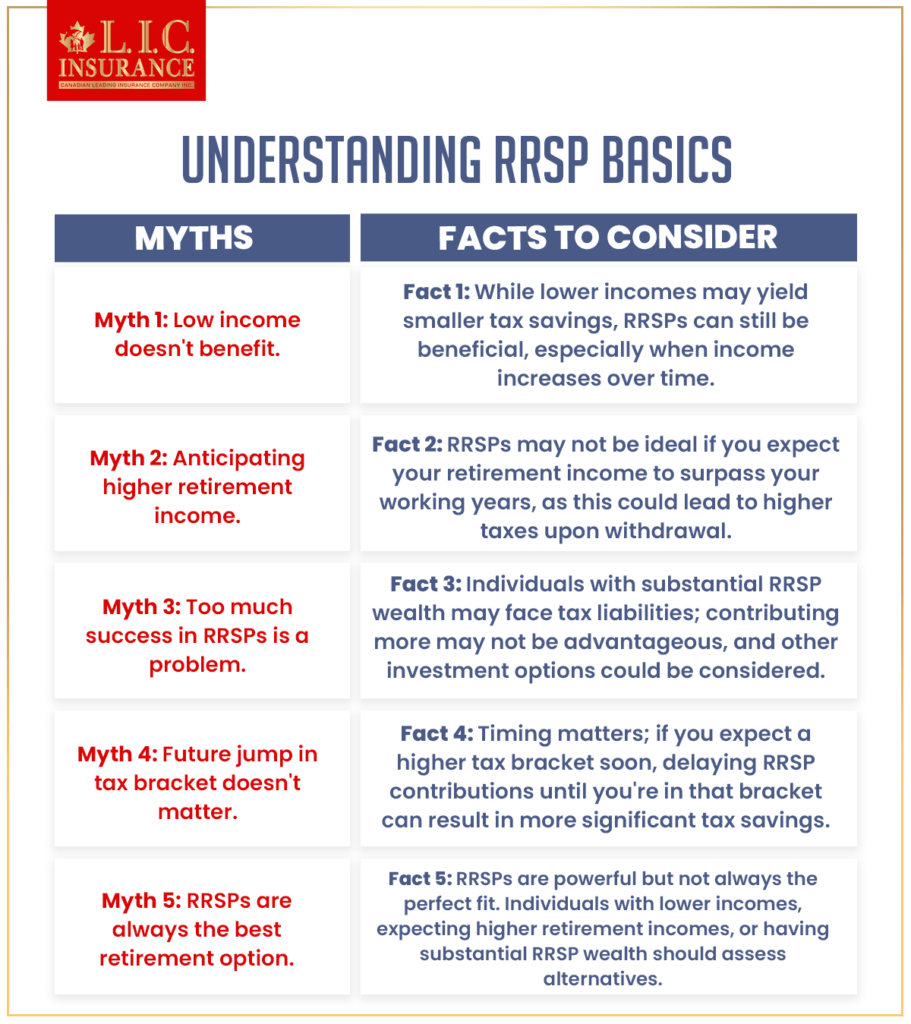

Understanding RRSP Basics

The Registered Retirement Savings Plan (RRSP) offers financial superpowers, offering a dynamic blend of retirement savings and tax benefits in Canadian finance. It operates as a strategic tool to secure a comfortable future while providing a deduction based on your marginal tax rate. Let’s go deep to understand the little details of RRSPs, exploring scenarios where they may not be the perfect solution for everyone.

Tax Benefits:

When you put money into an RRSP, it’s like boosting your financial future. Here’s how it works: you get a discount on your income taxes, thanks to something called a deduction based on your tax rate. So, it’s a totally advantageous situation – you save for the future and get a tax break right now.

Low-Income Earners:

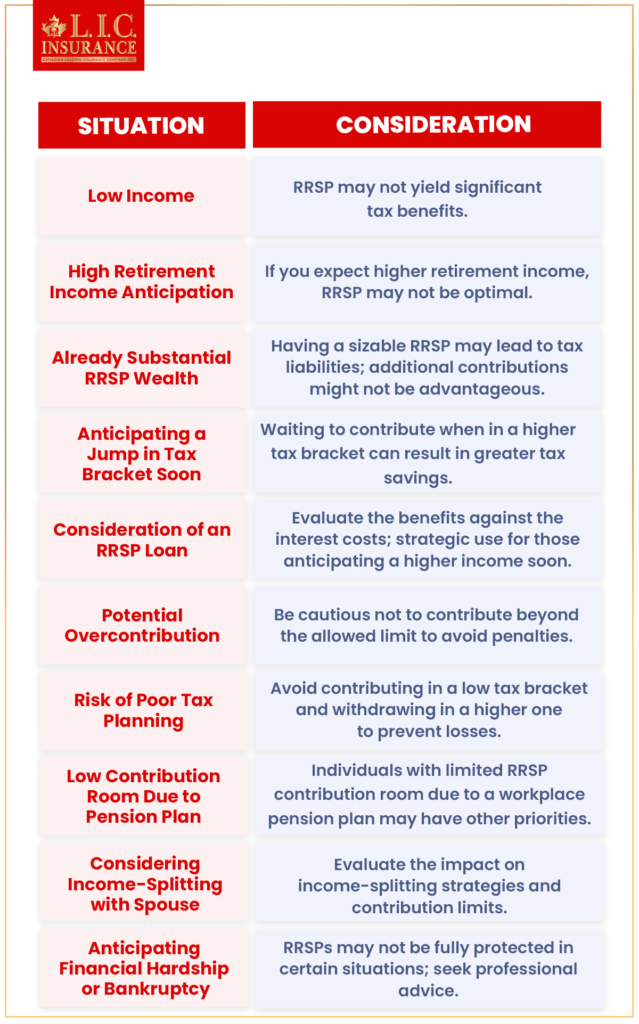

Assume your income is on the lower side, close to the entry-level limit. In this case, RRSPs might not be the best way to save money. The reason is simple: the tax reduction you get is based on how much money you make. If you have a small tax bill, the Registered Retirement Savings Plan (RRSP) gain is not as big. You can think of it like having a ticket for a product you don’t really need. You’ll save money, but it might not be worth it in the long run.

High Retirement Income Anticipation:

Now, let’s imagine that you are a financial genius working hard to make the best retirement plan ever. If you think that your retirement income will be higher than what you make now, RRSPs might not be the best thing for you. It doesn’t happen often, but if you leave and find yourself in a higher tax bracket, the tax advantages you used to enjoy might go away. It’s like planting seeds today and then realizing that the crop might not be as big as you thought it would be.

Already RRSP Wealthy:

Some people are very lucky and get great returns on their Registered Retirement Savings Plan (RRSP) investments. Take George as an example. He was very good at dealing with the tech stock world. His RRSP fund has grown beyond his wildest dreams, showing how successful he really is. Putting more money into an RRSP that is already doing well might not be the best idea, especially since increased wealth comes with higher taxes. When a garden is already in full bloom, adding more seeds might not make a big difference in the growth.

Anticipating a Jump in Tax Bracket Soon:

When it comes to money, timing is very important. If you’re about to move up on the salary ladder, it might be smart to put off making RRSP contributions for a while. Take Betty, who is looking forward to getting a raise next year. She could save more on taxes if she waits until her income goes up. This would make the most of her RRSP contributions.

The Bottom Line

There is no specific advice that works for everyone when it comes to personal finances. An RRSP may not be the best option for everyone despite being an effective means in the Canadian financial world. If you find yourself in any of the above situations, you might want to rethink your RRSP plan.

Keep in mind that financial planning should fit you perfectly, much like a custom outfit. Understand your situation and your objectives, and make choices that will help you reach your specific financial goals.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

A Registered Retirement Savings Plan (RRSP) is a special savings account for Canadians to help them save for retirement. It offers tax benefits, allowing individuals to deduct contributions from their taxable income.

When you contribute to an RRSP, you receive a tax deduction based on your marginal tax rate. This reduces your taxable income for the year, providing immediate tax savings.

RRSPs are beneficial for individuals who want to save for retirement while enjoying tax advantages. Those in higher tax brackets can particularly benefit from the significant tax savings on contributions.

No, RRSPs are not a one-size-fits-all solution. Individuals with low incomes, those expecting higher retirement incomes, those already with substantial RRSP wealth, and those anticipating a jump in tax brackets soon may find RRSPs less suitable.

Yes, RRSPs can be worth it for many Canadians. They offer a tax-advantaged way to save for retirement, providing immediate tax deductions on contributions. The potential for tax-deferred growth can result in a more financially safe retirement.

An RRSP works by allowing Canadians to contribute a portion of their income to a registered account. Contributions are tax-deductible, reducing taxable income. The investments within the RRSP grow tax-free until withdrawal during retirement when they are taxed as income.

Upon death, the value of your RRSP is included in your income for the year of death, potentially leading to taxes. However, if you name a beneficiary, the RRSP can transfer directly to them without going through probate, minimizing taxes.

The RRSP deduction limit is the maximum amount you can contribute to your RRSP and deduct from your income for tax purposes. It is calculated based on your earned income and any carried-forward contribution room from previous years.

The specific RRSP investments depend on your risk tolerance, financial goals, and time horizon. Common options include mutual funds, stocks, bonds, and GICs. Consulting with a financial advisor can help tailor your investment strategy.

RRSPs are generally protected from creditors in the event of bankruptcy or financial difficulties, with some exceptions. However, contributions made within a certain time frame before declaring bankruptcy may be subject to seizure.

Yes, RRSPs can include liquid assets, such as cash, stocks, or mutual funds, that can be easily converted into cash. This liquidity allows flexibility in managing your investments.

The RRSP limit is calculated based on 18% of your earned income up to a specified annual maximum. Unused contribution rooms are carried forward, and additional rooms are added each year.

RRSP deductions work by reducing your taxable income for the year in which you make contributions. The deducted amount is based on your marginal tax rate, providing immediate tax savings.

RRSP withdrawals are taxed as income in the year they are withdrawn. The tax rate depends on your total income for that year, potentially resulting in lower taxes if you withdraw in a lower tax bracket during retirement.

After retirement, you can start withdrawing from your RRSP. The withdrawals are taxed as income, but the tax rate may be lower if your overall income is reduced during retirement.

RRSP contributions reduce your taxable income for the year in which they are made. This can result in immediate tax savings, and the contributions grow tax-free until withdrawal during retirement.

RRSPs may not be the best fit for low-income earners, as the tax benefits are directly linked to the individual’s income. In some cases, it might not result in significant tax savings.

Yes, contributing to RRSPs when in a low tax bracket and withdrawing in a higher tax bracket can lead to a loss due to poor tax planning. It’s crucial to consider the timing of contributions and withdrawals.

Ideally, contribute to an RRSP when in a high marginal tax rate and withdraw when in a lower tax bracket. This strategic approach can maximize tax savings.

An RRSP loan is an option to boost contributions, especially if you’re anticipating a higher income in the near future. However, it’s essential to weigh the benefits against the interest costs of the loan.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com