- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- What Is Term Life Insurance, and How Does It Work for Seniors?

- What Is the Oldest Age to Qualify for a Term Life Insurance Plan in Canada?

- Why Do Seniors Seek Term Life Insurance?

- Common Challenges Seniors Face When Applying for Term Life Insurance

- How to Choose the Right Term Life Insurance Plan for Seniors

- Seniors Finding the Right Term Life Insurance Plan

- What Happens If You Outlive Your Term Life Insurance Policy?

- Is Term Life Insurance Right for Every Senior?

- How to Apply for Term Life Insurance as a Senior

What Is The Oldest Age At Which You Can Get Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 10th, 2025

SUMMARY

This blog points out options for seniors aged up to 75. It explains the term lengths, costs, and why the right plans will be indispensable when considering debt repayment, provision for loved ones, and death benefits. The blog also discusses challenges such as higher premiums, medical exams, and coverage limitations while highlighting the advantages of comparing term life quotes online and interacting with expert brokers like Canadian LIC.

Introduction:

As seniors are planning for their future, many of them are asking whether or not they are still qualified for Term Life Insurance at their age. This is one of the main concerns since your age plays a huge role in qualifying you for the Term Life Insurance Plan. A lot of Canadians find themselves seeking the right coverage at later ages as their needs change over time. Whether it’s securing the finances of loved ones, paying debts, or even planning for the cost of a will, people realize that they cannot live without life insurance during their golden years.

We at Canadian LIC come across many individuals who feel their age will exclude them from getting Term Life Insurance. From our experience, we have helped many Canadian seniors overcome this fear and guide them to the right options. In this blog, we will explore the oldest age at which you can get Term Life Insurance, as well as some tips on how to find a suitable Term Life Insurance Plan for seniors. Keep reading to know how you may secure coverage and peace of mind for yourself and your family.

What Is Term Life Insurance, and How Does It Work for Seniors?

A term insurance plan can insure a particular life for some definite period- possibly 10, 20, or 30 years – that leaves money to their chosen beneficiaries upon an insured person’s death while covered. The purchase is typically relatively cheap compared to an investment in some kind of Permanent Coverage because no added savings or investment form is involved with term plans.

Term Life Insurance is a realistic plan for elderly persons who would take care of specific financial obligations after they are gone. It is the most commonly used to settle debts, raise money for dependents, or defray funeral costs. Canadian LIC has been able to support senior citizens requiring specific Term Life Insurance packages in order to address their specific financial needs.

What Is the Oldest Age to Qualify for a Term Life Insurance Plan in Canada?

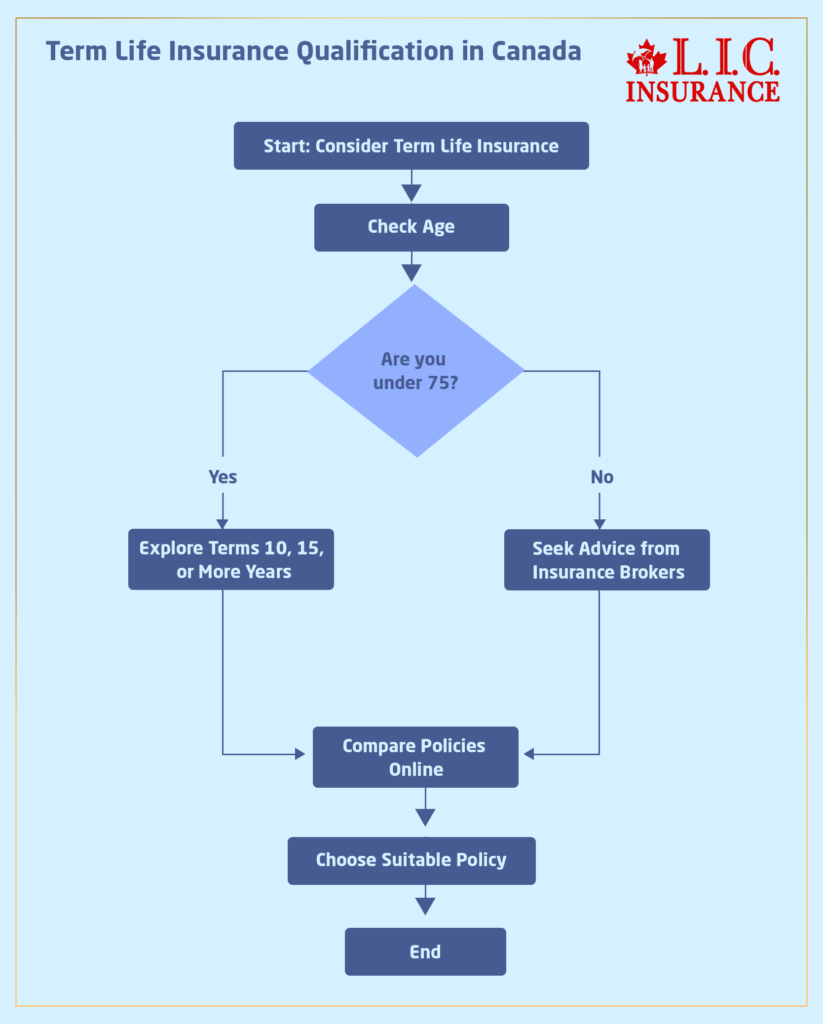

Most insurance providers in Canada grant applicants the chance to qualify for a Term Life Insurance Policy to age 75. However, this is up to the individual insurance provider as well as how long the terms are. There are some who only offer smaller terms, including 10- or 15-year terms, to those in their 60s and 70s.

For the longest time ever, we dealt with clients, even at the tender age of 74, whose requirements we managed to meet. With that said, however, it should be noted that more Term Life Insurance Premiums are tied to age, with increased risks of old age attributed to health hazards. Through Life Insurance Brokers with vast knowledge in the field, seniors find their way; hence, there are more options and side-by-side terms insurance quotes online, and, hopefully, they will arrive at the affordable one that just suits them best.

Why Do Seniors Seek Term Life Insurance?

Seniors usually take Term Life Insurance for several reasons. These include:

- Debt Protection: Many elderly people still carry mortgages, loans, or credit card debt. A Term Life Insurance Policy can ensure these debts do not burden their loved ones.

- Family Support: Some elders want to give financial support to their dependents, like children or grandchildren, in case they die early.

- Funeral Costs: This can be really expensive, so the Term Life Insurance Plan comes in handy to support family members after such a cost.

- Estate Planning: The benefits of life insurance can provide liquidity for estate taxes or other costs associated with estate management.

We have witnessed seniors use Term Life Insurance as a strategic tool to achieve these goals and leave their families with a financial safety net long after they are gone at Canadian LIC.

Common Challenges Seniors Face When Applying for Term Life Insurance

While Term Life Insurance for Seniors has its benefits, there are challenges that come with it. Some of the most common issues include:

Higher Premiums: Age is a critical determinant of insurance costs. The older you are, the more you will pay for your premium. Seniors need to weigh the cost of coverage against their financial goals.

Health Evaluations: Older adults may be asked to have medical check-ups or provide a comprehensive health history. Pre-existing conditions can affect eligibility or drive up premiums.

Limited Term Lengths: Insurers may offer only shorter terms to seniors, which may not coincide with their long-term financial planning.

Through Canadian LIC’s experience as trusted Term Life Insurance Brokers, we’ve guided seniors through these obstacles, helping them secure suitable policies even when they believed their options were limited.

How to Choose the Right Term Life Insurance Plan for Seniors

Choosing the right Term Life Insurance implies you consider your financial needs and aims. Some tips for senior citizens to follow when choosing the right Term Life Insurance are described below.

Determine Your Needs for Coverage

Start by identifying why you need life insurance. Are you paying off a specific debt? Do you want to leave a legacy to your loved ones? Knowing what you are covering will help you determine the right amount of coverage.

Compare Term Life Quotes Online

The easiest option to find coverage at an affordable price is probably by comparing online term life quotes. This lets you review more than one quote and select what best suits you.

Work With Experienced Brokers

Term Life Insurance Brokers know how to be of help because they understand individual situations and all the intricacies of the available insurance policies. At Canadian LIC, we sit down with clients to understand exactly what their particular situation is before we get started.

Consider Your Budget

Term Premiums increase with age, so it’s essential to select a plan that aligns with your budget. Avoid over-insuring yourself, as it may strain your finances unnecessarily.

Understand Policy Limitations

Be aware of all the restrictions and exclusions present in your policy. For example, some may not cover pre-existing conditions.

Seniors Finding the Right Term Life Insurance Plan

We meet many elderly people at Canadian LIC who are frustrated because of the hassle of getting Term Life Insurance. In fact, it happened to a grandmother aged 72. A client came to us with concerns that her children would have to take care of mortgage installments after her demise. We helped her get a 10-year Term Life Insurance cover, which came at a very reasonable cost.

Another client in his late 60s was looking to provide for his wife’s continued lifestyle after he passed away. We assisted him in comparing Term Life Insurance Quotes Online and coordinated with multiple insurers to come up with the best possible policy.

These stories highlight the fact that a Term Life Insurance can always be there, regardless of the age in question.

What Happens If You Outlive Your Term Life Insurance Policy?

A frequent complaint among seniors is outliving their Term Life Insurance Policy. In that scenario, coverage lapses, and nothing is paid if they die afterwards. On some policies, conversion to Permanent Policy or renewal for additional terms can occur, although then at increased cost.

These must be discussed with your insurance broker to prepare for any situation. Canadian LIC provides clients with a better understanding of these details, helping them make the right decisions.

Is Term Life Insurance Right for Every Senior?

Although Term Life Insurance offers many advantages, it might not be appropriate for everyone. For instance, the elderly have long-term goals that they would achieve with Permanent Life Insurance, including estate planning. For those, however, with particular short-term needs, a Term Life Insurance Plan is very practical and economical.

How to Apply for Term Life Insurance as a Senior

Term life application for a senior includes the following:

- Consult a Broker: Contact some experienced Term Life Insurance Brokers and ask them to recommend some personal contacts.

- Collect Required Documents: Provide relevant documents, proof of identity, medical history, and proof of financial soundness.

- Choose the Right Term Length: Choose the correct term length that coincides with your specific financial situation.

- Complete a medical exam: If the policy mandates, you must undergo a medical assessment.

- Compare Quotes: Compare the Term Life Insurance Quotes with other online sources for the most competitive rates.

Act Now: Secure Your Future with Canadian LIC

Never should age be a barrier to securing insurance for your family. If you ask if it’s already too late to apply for Term Life Insurance, the answer is no. With proper guidance, you can find a plan that suits your needs and budget.

Your Trusted Term Life Insurance Brokers: Canadian LIC is here to help. We specialize in helping seniors navigate their options. Do not let it become too late for you; explore Term Life Insurance Quotes Online today and take that first step towards securing your future.

FAQs: What Is the Oldest Age at Which You Can Get Term Life Insurance?

Most companies in Canada take applications for Term Life Insurance until the age of 75; however, most have a lesser limit and coverage for a limited period. The Canadian LIC was able to acquire Term Life Insurance for Seniors well into their 70s; it has cooperated in answering specific requirements.

Yes, there is affordable Term Life Insurance available for seniors; however, their premiums increase as age advances. Quotes for online Term Life Insurance can help estimate competitive rates and coverage needs. Canadian LIC in Canada assists the elderly in reducing premiums by providing coverage tailored according to their individual needs.

The terms of senior life insurance can be between 10 years and 20 years, depending on the insurance company and the age of the applicant. Some seniors in their 70s would qualify to get only a 10-year term. Canadian LIC works with Term Life Insurance Brokers who prefer a shorter-term option for seniors.

Most Term Life Insurance Plans require an older citizen to undergo a medical examination, especially with more coverage. Some insurers will give no-medical-exam policies, although these will normally carry a higher premium and restricted coverage. In our case, at Canadian LIC, we explain all the processes step by step so that the elderly person knows exactly what is out there for him or her.

Seniors need Term Life Insurance to cover outstanding debt, maintenance of dependents, and funeral costs. In many instances, Canadian LIC often seeks to help seniors who might wish to make sure that the debt cannot burden their next of kin after they are gone.

It is possible to find Term Life Insurance coverage in these three ways: getting the amount needed for coverage and comparing online Term Life Insurance Quotes while taking good advantage of seasoned Term Life Insurance Brokers. This is what a Canadian LIC focuses on: giving assistance to elderlies in choosing the right fit that will support their goals according to their budgets.

Most Term Life Insurance Plans offer renewal options. However, the premium becomes very high when renewing. Canadian LIC guides elderly people about renewal options and helps them decide whether to renew or go for other plans.

Yes, it may depend on one’s pre-existing health conditions in that it increases premiums or can make one ineligible. Insurers assess a person’s health history and status to determine how much risk is presented. Canadian LIC has helped countless seniors with existing medical conditions secure Term Life Insurance by seeking flexible insurers.

Yes, Permanent Life Insurance, or no-medical-exam policies, can also be an option for seniors looking at long-term or simplified coverage. Canadian LIC often has these options for clients when Term Life Insurance isn’t the best fit.

To apply, one should contact a reliable Term Life Insurance broker, collect all the required documents, undergo a medical exam if necessary, and obtain Term Life Insurance Quotes Online. Canadian LIC assists the elderly at every stage of the process, so the application process is easy and stress-free.

Indeed, many insurers now provide Term Life Insurance to applicants up to the age of 75. However, there are often fewer options available, and premiums tend to be much higher. Canadian LIC has found Term Life Insurance for Seniors in their 70s.

Some insurance companies offer specific Term Life Insurance coverage plans for seniors. Such plans are typically shorter-term and could even exclude medical exams when the coverage value is relatively low. Canadian LIC assists seniors in exploring these special plans to identify the best option for their situation.

If the premium is no longer affordable, you can reduce your coverage amount, change to a no-medical exam policy, or look into other alternatives. Canadian LIC has helped seniors review their plans and find more affordable alternatives without sacrificing necessary coverage.

Yes, there are no-medical-exam Term Life Insurance Plans offered by some insurers to seniors. The premiums tend to be higher, and the coverage limits lower. We at Canadian LIC guide the senior to the right plan according to his health and financial future goals.

Coverage amounts depend upon the age, health, and needs of the company issuing the coverage. Seniors generally find coverage that ranges between $50,000 and $500,000. Canadian LIC can provide an option to compare online Term Life Insurance Quotes for potential clients and let them choose what they deem to be the right choice.

This would depend on one’s objectives for money. Term Life Insurance is usually good for short-term needs like debt repayment or funeral expenses. Whole Life Insurance offers lifelong coverage and cash value. Canadian LIC has helped numerous seniors make this choice based on their unique circumstances.

Yes, Term Life Insurance covers all immediate expenses incurred on an estate, such as tax and lawyer fees. However, in the event that a long time of coverage for an estate is needed, then it becomes better to have Permanent Life Insurance. Canadian LIC guides the older generations to design their estate in collaboration with life insurance.

Most Term Life Insurance Brokers, such as Canadian LIC, do not charge their clients directly. They get paid through a commission by the insurer. This way, seniors can be advised and assisted by experts without paying extra.

They check age, health, lifestyle, and the amount for which insurance coverage is desired. Smoking habits, chronic ailments, or certain types of hobbies affect their approval decisions. Canadian LIC has helped its senior clients cover several types of health ailments through flexible insurance providers.

If a medical exam is necessary, it might take a few weeks to complete. No-medical-exam policies might get approval in just days. Canadian LIC ensures the efficient completion of the application process by seniors to enable them to obtain coverage at the right time.

Yes, you can cancel your Term Life Insurance at any time, but there will be no refund of the premium paid. Canadian LIC helps elderly people evaluate their needs before cancelling a policy to avoid losing essential coverage.

Some of the insurers cover pre-existing conditions but at a higher premium. Others do not cover some conditions. Canadian LIC has been able to help clients with pre-existing conditions find insurers who will cover them.

These are the questions most frequently asked by clients when searching for Term Life Insurance for Seniors. Whether it’s a new policy or a piece of advice, Canadian LIC is here for you. Contact us at +1 416 543 9000

Sources and Further Reading

Canada Life

Visit Canada Life’s official website to learn Term Life Insurance options and eligibility for seniors.

www.canadalife.com

Manulife Insurance

Learn about Term Life Insurance Plans tailored for older applicants.

www.manulife.ca

Sun Life Financial

Review Sun Life’s Term Life Insurance offerings, including policies for seniors.

www.sunlife.ca

Desjardins Insurance

Explore senior-specific Term Life Insurance Policies from Desjardins.

www.desjardinslifeinsurance.com

Government of Canada – Financial Consumer Agency

Get general advice and tips on purchasing life insurance in Canada.

www.canada.ca

TD Insurance

Check out TD’s Term Life Insurance Plans for seniors and the application process.

www.tdinsurance.com

Key Takeaways

- Eligibility for Seniors: Most insurers in Canada allow Term Life Insurance applications up to age 75, with shorter term lengths for older applicants.

- Importance of Coverage: Seniors use Term Life Insurance to cover debts, support loved ones, and manage end-of-life expenses effectively.

- Affordability Challenges: Premiums increase with age, but comparing Term Life Insurance Quotes Online helps find competitive rates.

- Medical Exam Requirements: Many plans require medical exams, but no-medical-exam options exist for lower coverage amounts.

- Tailored Plans for Seniors: Term Life Insurance Brokers like Canadian LIC help seniors customize policies to meet their specific financial goals.

- Renewal and Conversion: Expired term life policies can often be renewed or converted to permanent plans, but premiums may rise.

- Expert Guidance Matters: Working with experienced brokers ensures seniors get the best coverage options available.

Your Feedback Is Very Important To Us

We value your input in helping us better address concerns about finding the oldest age to qualify for Term Life Insurance. Please take a moment to share your experience by answering the following questions:

Thank you for taking the time to complete this questionnaire. Your feedback will help us improve our services and provide better support to seniors exploring Term Life Insurance options.

IN THIS ARTICLE

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- What Is Term Life Insurance, and How Does It Work for Seniors?

- What Is the Oldest Age to Qualify for a Term Life Insurance Plan in Canada?

- Why Do Seniors Seek Term Life Insurance?

- Common Challenges Seniors Face When Applying for Term Life Insurance

- How to Choose the Right Term Life Insurance Plan for Seniors

- Seniors Finding the Right Term Life Insurance Plan

- What Happens If You Outlive Your Term Life Insurance Policy?

- Is Term Life Insurance Right for Every Senior?

- How to Apply for Term Life Insurance as a Senior

Sign-in to CanadianLIC

Verify OTP