- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I Extend My Visitor Insurance If I Decide to Stay Longer?

- Can I Use Visitor Insurance for Routine Check-Ups and Preventive Care?

- Can a Visitor Visa Be Converted to a Super Visa?

- Is Visitor Insurance the Same as Travel Insurance?

- Can I Get Visitor Insurance with Pre-Existing Conditions?

- Can I Buy Visitor Insurance After Arrival in Canada?

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

How To Choose The Best Visitor Insurance For Your Trip To Canada?

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 24th, 2025

SUMMARY

This blog provides a comprehensive guide to choosing the best Visitor Insurance for your trip to Canada. It covers essential factors like coverage limits, pre-existing conditions, and the difference between comprehensive and limited plans. It also discusses how to compare Visitor Insurance Rates in Brampton and find affordable Visitor Insurance Policies in Ontario, Canada. The blog helps you navigate the process of selecting a reliable Visitor Insurance provider and ensures you’re well-informed.

Introduction

If you are visiting Canada for tourism, business, or to visit family, finding the right Visitor Insurance is one of the first things on your to-do list. However, there are so many options available. How do you know which one is the best for you? What if you are able to find Visitor Insurance Policies in Ontario, Canada, with great coverage at an affordable price? How to Compare Visitor Insurance Rates in Brampton or Elsewhere in Ontario?

These are generic questions that most people encounter as they sift through the mind-boggling array of Visitor Insurance Policies and options. And here is where the troubles often begin. Maybe you’ve identified a plan that looks great on paper, only to discover the coverage doesn’t really reflect your needs. Or maybe the premium’s way higher than what you thought. These are all frustrations that visitors to Canada face daily. You want coverage that’s reliable, affordable and comprehensive, but it can be hard to know where to begin.

That’s where we come in! This blog explains everything you need to know in order to select the best Visitor Insurance Plan for your travel to Canada. From differentiating the various types of plans to learning how to compare Visitor Insurance Quotes Online, you’ll find all the information you need to make an informed decision while also getting the best deal for the most reliable coverage.

What is Visitor Insurance, and Why Is It Important?

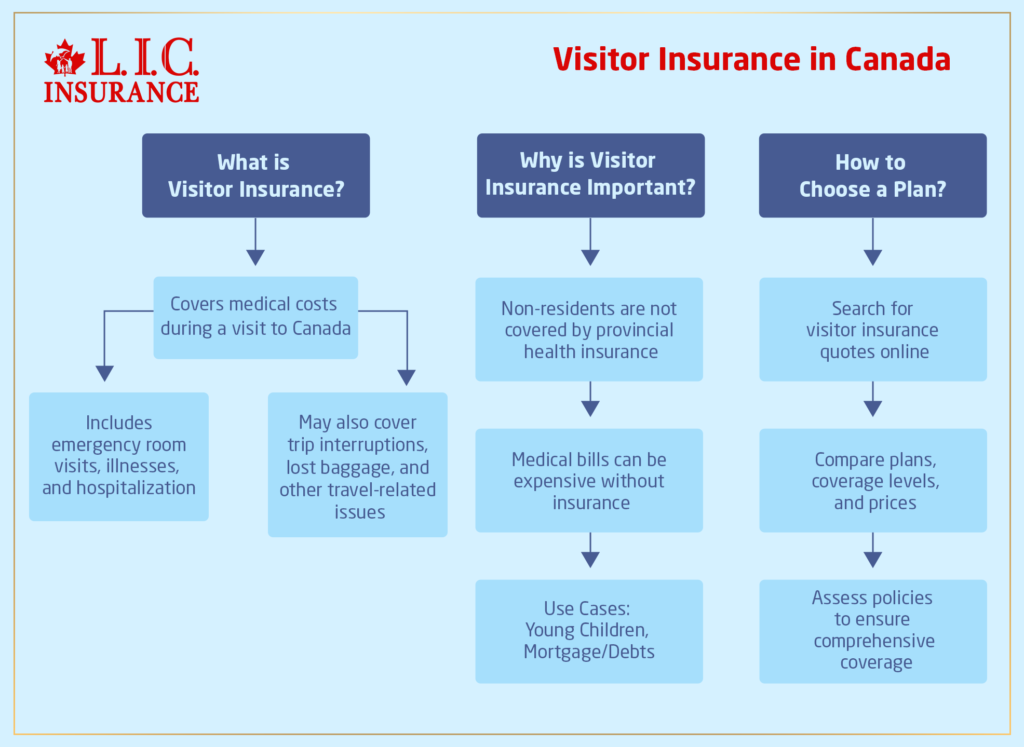

In Canada, Visitor Insurance covers the unknown medical costs that you will likely encounter while visiting this country. So whether you need to go to the emergency room after an accident, come down with a sudden illness, or require hospitalization, this insurance ensures you don’t have to dig into your own pocket for medical care. Additionally, Visitor Insurance may cover trip interruptions, lost baggage, and other travel-related issues.

Visitors to Canada who are not covered by the country’s provincial health insurance find that without Visitor Insurance, medical bills can quickly add up. For this reason, it’s important to pick a plan that protects against all medical costs you could run into while on your trip.”

If you are wondering where to begin, the best way to start is to search for Visitor Insurance Quotes Online. This lets you see different plans all at once, allowing you to compare options, coverage levels and prices when deciding. But when you have so many options, what do you look for when you assess different policies?

Key Factors to Consider When Choosing Visitor Insurance

Finding the best Visitor Insurance Plan for your needs can be confusing. But there are a few important factors that will help you to narrow down your choices:

- Coverage Limits: A policy with a greater coverage limit can give you peace of mind as long as you know that if something happens, you won’t be stuck with big medical bills. Check the upper limits on coverage for medical emergencies, hospitalization, and ambulance services.

- Pre-existing Conditions: It is best to check with your Visitor Insurance provider’s coverage on Pre-existing conditions. If you or someone travelling with you has a pre-existing medical condition, it’s crucial to find a policy that will cover related health issues while you are there.

- Emergency Medical Coverage: Perhaps the single most important benefit of Visitor Insurance. It means that you’re covered for the unexpected — a medical emergency, which could be anything from an accident to the flu. Read the details closely to make sure the plan covers all types of emergencies that could occur.

- Trip Cancellation and Interruption Coverage: If an emergency requires you to cancel or interrupt your trip, trip cancellation insurance can reimburse you for nonrefundable expenses, including flights and hotel reservations. Some policies even provide coverage if reasons like natural disasters or strikes delay your trip.

- Insurance Prices: Prices can vary depending on your type of coverage and personal circumstances. The insurance provider that offers the lowest rates may not arrest your move, but the insurance plan you have in your hand could well be.

How to Compare Visitor Insurance Quotes Online

Comparing quotes for Visitor Insurance online will give you a better idea of what is contained in each plan. Use websites that enable side-by-side comparison of policies to make this process much easier. Here’s one way to think about the comparison:

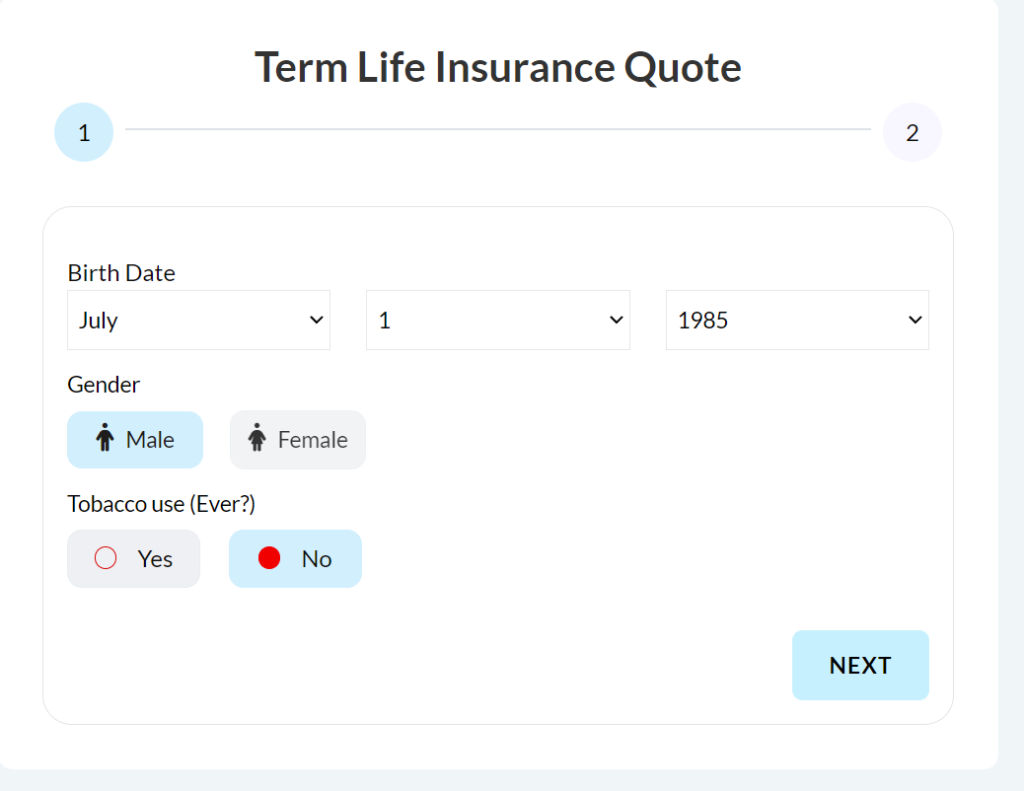

- Add Basic Information: First, input information such as your age, travel dates, and pre-existing conditions. That will help weed out those that don’t fit your needs.

- Review Key Benefits: Examine the coverage provided by each plan. Does it include emergency medical services? What are the limits for hospital stays or ambulance services?

- Examine the Deductible: The deductible is the amount you pay out of pocket before the insurance coverage starts; plans with lower deductibles may charge higher premiums but could save you money if you file a claim.

- Check for Extra Benefits: Some Visitor Insurance Plans may cover lost luggage, trip delays, and travel-related emergencies.

Affordable Visitor Insurance Policies in Ontario, Canada

A highly sought-after touring location in Canada, Ontario is another province that tourists love to visit, which creates a demand for cheap Visitor Insurance Policies in Canada. Visitor Insurance costs will be variable based on a few different factors, including how old you are, how long your trip is, and whether or not you have health conditions. But you can find cheap insurance without compromising coverage.

- Opt for a High Deductible Plan: It is the best option for people who want to keep their medical insurance premium rates low. This means that you’ll pay more out-of-pocket if you file a claim, of course, but that can be a great option if you want to save money on your premium when you first sign up.

- Bundled Coverage: Certain insurance providers have bundled policies for medical coverage, trip cancellation and others for travel-related coverage at little or no additional cost if purchased separately.

- Find Seasonal Discounts: Ontario Canada Visitor Insurance Policy Providers offer seasonal discounts at certain times of the year, especially in the off-season. The right timing could save you on premiums.

Top Visitor Insurance Providers in Ontario, Canada

Though there are many insurance providers to choose from, it is important to choose one with competitive rates, solid customer service, and comprehensive coverage. Some leading visitor insurance suppliers in Ontario, Canada, are written below:

- Manulife: One of the top insurance providers in Canada, Manulife provides a diverse selection of Visitor Insurance Policies with options for pre-existing conditions, medical emergencies, and trip interruption coverage.

- Blue Cross: Another leading insurance provider that offers flexible Visitor Insurance Plans with varied coverage options for different needs. Their plans typically include emergency medical services, trip cancellation and more.

- Allianz Global Assistance: A trusted name in medical Travel Insurance Coverage, Allianz offers the best Visitor Insurance coverage with affordable premiums. Their policies cover emergency medical services, hospitalization, and even evacuation and repatriation if necessary.

- Travel Guard: Travel Guard offers a range of Visitor Insurance options with high coverage limits for emergency medical services and trip cancellations. They also offer assistance services, including 24/7 support during emergencies.

A simple comparison of Visitor Insurance Quotes Online lets you compare the coverage, premium, and benefits offered by various providers. This will assist you in making an informed decision.

Why Choosing the Right Visitor Insurance is Crucial

All Visitor Insurance plans are the same, which seems to be an easy assumption to make. But that could not be further from the truth. With different benefits, coverage limits and exclusions, each policy will have something different to offer, so it’s important to select one that matches your specific needs. When you dedicate some time to finding the right policy, you make sure that you are protected against unexpected events that might occur on your trip to Canada.

The last thing you want is to wind up in a medical crisis with inadequate insurance coverage. Comprehensive Travel Health Insurance will not only provide you with peace of mind regarding your coverage for medical emergencies, but you’ll also be able to enjoy your stay in Canada without worrying about the risks.

Common Mistakes to Avoid When Buying Visitor Insurance

Here are the common errors that one makes when choosing the best Visitor Insurance policy for you. Here are some common ones and how you can avoid them:

- Not Reading the Fine Print: Reading the policy details carefully is one of the biggest mistakes people make when buying insurance. It’s important to know what is covered by your coverage and what is not covered by your coverage. Some policies, for instance, may not cover injuries suffered while participating in extreme sports like skiing, while others may have limitations on coverage for pre-existing conditions. Read every insurance policy all the way through before you buy.

- Just Choose the Cheapest Plan: While saving money is always on everyone’s mind when it comes to Visitor Insurance, picking the cheapest plan is not always the best plan. Some budget plans may have lower coverage limits, which means if you experience an emergency, your out-of-pocket costs could be high. If you do, make sure you compare rates for Visitor Insurance in Brampton and across Ontario and that the level of coverage you’re getting makes the premium you’re paying worth it.

- Neglecting to include Emergency Evacuation Coverage: Emergency evacuation can add up to a lot, particularly if an airlift to a local hospital is required. Visitor Insurance is not mandatory with such coverage and may have to be added specifically to some plans. Be sure to take a policy that covers emergency evacuation in the event of a medical emergency or illness.

- Inadequate Consideration of Duration of Stay: If you are planning to stay in Canada for a longer duration, your insurance needs may differ compared to someone visiting for a brief period. Ensure that your policy is appropriate to the duration of your stay. Some policies limit coverage if you remain for some time after a certain point, so pick a plan that covers your entire length of stay.

Customer Story: A Real-Life Struggle with Visitor Insurance

Allow us to share a brief anecdote about our experience here at Canadian LIC. Last winter, a client named Adam, who was travelling from the United States, contacted us. He had bought a basic Visitor Insurance policy before his trip in the hope that it would cover any emergency medical expenses. However, when Adam sustained minor injuries on a skiing trip, he learned that his policy didn’t cover high-risk activities like skiing, even though the insurance had been sold to him as “comprehensive.”

Adam’s experience is not uncommon. Most tourists tend to believe that the basic temp Visitor Insurance will cover all events so they can be safe when they are on out, only to find themselves in situations not covered by this insurance. If he had researched and compared plans closely and checked the exclusion and coverage limits, then this scenario could have been avoided.

This is a reminder to always check what is covered and what is not covered under your Visitor Insurance policy before buying it.

Final Thoughts

Choosing the best visitor insurance for Canada: A guide. By comparing policies, noting the coverage limits and setting clear expectations with a provider, you can ensure that you are protected against unexpected costs and trip disruptions.

While it might be tempting to go for the cheapest option, remind yourself that the policy you tailor to your specific needs will give you peace of mind throughout your trip. Regardless if you want to compare Visitor Insurance Rates in Brampton, find cheap Visitor to Canada Insurance Plans in Ontario, Canada or get Visitor Insurance Quotes Online, spending some time to search for a suitable plan will help you save big down the road.

Remember, if you are not sure which plan is best for you and need help searching for the best Visitor Insurance provider, do not hesitate to contact our insurance broker today! We’ll help you navigate the process for a smooth, stress-free visit to Canada.

Cover your travel plan before you go. With this mindset, you will be able to enjoy your stay in Canada with confidence, knowing you have the coverage needed.

More on Term Life Insurance

- What Pre-Existing Conditions Are Not Covered in Visitor Insurance?

- Can I Use Visitor Insurance for Routine Check-Ups and Preventive Care?

- Can Visitor Insurance Cover Emergency Dental Care During My Stay in Canada?

- What Is the Difference Between Visitor Insurance and Regular Health Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- How Can I Verify If a Hospital or Clinic Accepts My Visitor Visa Insurance?

- Does Visitor Insurance Cover Mental Health Services?

- Can Family Members Visiting Together Get a Group Discount on Visitor Insurance?

- Are There Any Age Restrictions for Purchasing Visitor Insurance?

- What Documents Do I Need to Buy Visitor Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- How Do You File a Claim for Visitor Insurance?

- Can I Extend My Visitor Insurance If I Decide to Stay Longer?

- Which Visitor Insurance is Best?

- Is Visitor Insurance Mandatory?

- Is Visitor Insurance the Same as Travel Insurance?

- Can I Get Visitor Insurance with Pre-Existing Conditions?

- What Can You Not Do with a Visitor Visa?

- Can I Buy Visitor Insurance After Arrival in Canada?

- Can I Get Insurance as a Visitor in Canada?

- Visitor Visa vs. Super Visa: Understanding the Differences

FAQs on Visitor Insurance in Canada

These types of Visitor Insurance quotes can be obtained online. Consider sites where you can compare several to get started. You’ll have to provide some basic information, such as your age, travel dates, and medical history. That helps the system create tailored quotes according to your specific needs. Comparing these quotes will provide a solid outline of the top policies in the market.

In Ontario, Canada, there is a wide range of affordable Visitor Insurance Policies in Ontario Canada. The cost of insurance will depend on factors such as your age, length of your stay and your health. It’s essential to compare the policies closely to get the best value for your dollar. In some cases, a high deductible can help reduce your premium while still providing excellent coverage.

Comparison tools are available online that let you compare the rates and policies of various Visitor Insurance plans in Brampton within seconds. These services allow you to compare coverage options, rates, and policy benefits. Just enter details, such as your age and travel dates, and you’ll be able to compare which policies offer the best value for your money in Brampton.

The cheapest policy might not be the best option. In some cases, the cheapest option provides minimal coverage that leaves you with a significant out-of-pocket liability in the event of something going wrong. It’s preferable to shop around for different policies and make sure that the one you select has the coverage you need, even if it comes at a slightly higher premium. You can always look for some budget-friendly Visitor Insurance Plans in Ontario, Canada, that suit your price v/s coverage criteria.

When you seek a Visitor Insurance policy, you should be concerned about coverage limits for medical emergencies, hospitalization, and trip cancellations. If you are travelling to remote areas, you should also consider whether the policy covers emergency evacuation. You can also find information on the average Brampton Visitor Insurance Rates or others to check that you’re receiving the best overall occupancy for the provider you want.

A few Visitor Insurance Plans offer coverage for pre-existing conditions, but all do not. It is critical to identify a policy that actually covers pre-existing conditions if you have one. Always review the policy terms or inquire with Visitor Insurance policy sellers in Ontario, Canada, about whether they offer this protection before purchasing.

In order to get the best Visitor Insurance Policy Providers in Ontario, Canada, you can also request referrals from friends or relatives who have previously used insurance services in Canada. You can also look for online reviews and ratings of various providers. Ensure you review the conditions of each policy to get one that meets your travel requirements.

Comprehensive Visitor Insurance protects you for almost every situation, such as medical emergencies, trip cancellations, and lost luggage. Limited insurance, however, protects you against only certain risks. If you need more coverage, choose comprehensive coverage. Compare Visitor Insurance quotes in Brampton to determine which plan is best for you according to your requirements.

Comprehensive Visitor Insurance covers you for nearly all circumstances, including medical issues, trip cancellations, and lost baggage. Limited insurance, on the other hand, covers you against specific risks. If you require additional coverage, opt for comprehensive coverage. Compare Visitor Insurance quotes in Brampton to see which plan suits you based on your needs.

To ensure you’re getting the best price, compare a few Visitor Insurance Quotes Online. Find policies that provide good coverage at affordable rates. Reviewing the policy terms and comparing a few options will assist you in finding the best combination of cost and coverage. If you’re in Ontario, you can compare cheap Visitor Insurance Policies in Ontario, Canada and review the coverage limits to determine if the policy is right for you.

These FAQs are intended to cover some of the most frequently asked questions that visitors to Canada might have when buying insurance. Always take the time to thoroughly consider your choices and ask questions so that you receive the best coverage for your requirements.

Sources and Further Reading

- Government of Canada – Health and Medical Insurance for Visitors

Website: https://www.canada.ca/en/services/immigration-citizenship.html

This official page provides information about health insurance requirements for visitors to Canada. - Insurance Bureau of Canada (IBC)

Website: https://www.ibc.ca/on

A great resource for understanding the basics of various insurance policies in Canada. - Canada Travel Insurance – Trusted Brokers

Website: https://www.canadatravelinsurance.com

A dedicated platform offering in-depth information and options for travel and Visitor Insurance. - Travel Insurance Association of Canada (TIAC)

Website: https://www.travelinsurance.ca

TIAC provides valuable insights into the travel insurance industry in Canada, including what to look for in a Visitor Insurance policy. - World Nomads – Travel Insurance

Website: https://www.worldnomads.com

It offers a range of resources about travel insurance, including details on medical coverage and advice for international travellers.

Key Takeaways

- Visitor Insurance is Essential: Ensure you have adequate coverage for medical emergencies, trip cancellations, and unexpected situations during your visit to Canada.

- Compare Insurance Options: Use tools to compare Visitor Insurance Rates in Brampton and other Ontario areas to find the best value for your needs.

- Understand Coverage Limits: Pay attention to coverage limits, especially for medical expenses, emergency evacuations, and pre-existing conditions.

- Affordable Options Exist: Affordable Visitor Insurance Policies in Ontario, Canada, are available, but ensure that the coverage meets your requirements before purchasing.

- Choose a Reliable Provider: Research and choose trusted Visitor Insurance Policy Providers in Ontario, Canada, that offer comprehensive coverage and good customer service.

- Be Aware of Exclusions: Some policies don’t cover high-risk activities like skiing or hiking. Always check if these activities are included if you’re planning such activities.

- Don’t Just Choose the Cheapest Plan: Opt for a plan that balances both cost and coverage. The cheapest plan may not always offer sufficient protection for medical emergencies.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your valuable feedback! We want to understand your struggles and help you make the best choice when selecting Visitor Insurance for your trip to Canada.

Please answer the following questions to help us understand your needs:

Thank you for sharing your feedback with us! If you have any additional comments or questions, please feel free to share them below:

This questionnaire will help us understand the specific struggles visitors face when selecting insurance and enable us to offer better assistance. Your input is greatly appreciated!

IN THIS ARTICLE

- How To Choose The Best Visitor Insurance For Your Trip To Canada?

- What is Visitor Insurance, and Why Is It Important?

- Key Factors to Consider When Choosing Visitor Insurance

- How to Compare Visitor Insurance Quotes Online

- Affordable Visitor Insurance Policies in Ontario, Canada

- Top Visitor Insurance Providers in Ontario, Canada

- Why Choosing the Right Visitor Insurance is Crucial

- Common Mistakes to Avoid When Buying Visitor Insurance

- Customer Story: A Real-Life Struggle with Visitor Insurance

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP