Imagine landing in a new country, excited to see and take in everything there is. All of a sudden, unfortunately, you need medical attention. Stress starts to increase since you have to deal with the process of making an insurance claim, which is totally different from the process you’d be familiar with back at home. Many travellers tell stories of complicated forms and feel uncertain about what steps to take. This blog is out to change that all around. Whether dealing with a minor injury from a slip at Niagara Falls or something more severe, knowledge of how to file a claim on your Visitor Health Insurance Plans can make all the difference. Let’s get started with a detailed guide that will not only teach you but also involve you with real-life events to make the process as simple as possible.

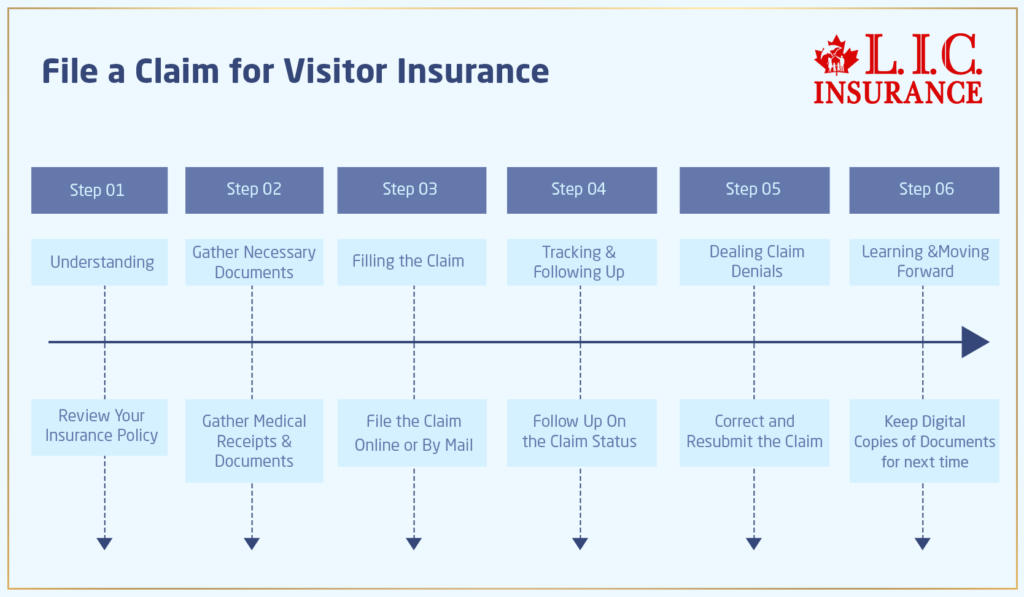

How to File a Claim for Visitor Insurance

It doesn’t have to be hard to file a claim. We’ll get through this journey together by breaking it down into easy steps and adding some first-person stories. Remember that knowing the right things can make something difficult to handle very simple.

Step 1: Understanding Your Coverage

Before you ever need to file a claim, you need to know what your Visitor Insurance covers. Let’s look at Ana, a student from Brazil skiing the beautiful Rocky Mountains. When a particularly unlucky spill on the slopes lands her in the hospital, she is all prepared. Earlier, Ana had read her Visitor Health Insurance policy in full and knew exactly what it covered.

Key Takeaway: You should always review your Visitor Insurance Quote and policy details once you receive them. Knowing what is covered and what is not will help you avoid a lot of surprises.

Step 2: Gather Necessary Documents

Once you know you need to file a claim, gathering the right supporting documents is your next step. Meet Raj. He loved visiting his cousin in Toronto. When he went to hang out with his cousin, they played a friendly game of cricket. Unfortunately, Raj twisted his ankle. Because Raj had saved all his medical receipts and had copies of his passport and visa ready, his claim was smoother and faster.

Key Takeaway: Keep a folder with essential documents like your passport, visa, medical bills, and receipts. Being organized is key to a hassle-free claims process.

Step 3: Filing the Claim

Most Visitor Health Insurance Plans let you submit claims online, by mail, or even by fax. Maria, a student from Italy, experienced minor food poisoning. She found it very convenient to file her claim online while lying down in bed. She had access to her insurance provider’s website, where she could easily upload documentation and fill out the required fields without leaving her bed.

Key Takeaway: Choose whichever method to file a claim is more suitable to you. Find out if your insurance provider has an online portal since it can be the quickest and easiest way to file a claim.

Step 4: Tracking and Following Up

After you submit your claim, it is important that you track what is going on with it. Think about Tom, who had to follow up with his insurance provider on several occasions after he had submitted his claim because it seemed like it was taking a long time to process. Yet, checking the status online and calling customer service ensured that his claim wasn’t lost in the shuffle.

Key Takeaway: Take charge. Check on your claim’s progress on a regular basis, and don’t be afraid to follow up if things seem to be stuck.

Step 5: Dealing with Claim Denials

If your claim is denied, there is no need to panic. Just do what Amina did. When her claim was initially denied for missing information, she reviewed the Explanation of Benefits, corrected the mistake, and submitted it again, with success.

Key Takeaway: Know the error on the claim and make sure to correct it. Sometimes, a simple correction can pave the way for a successful claim.

Step 6: Learning and Moving Forward

Every claim is a chance to learn something. Take a moment to think about what you could do differently next time, whether your experience was easy or you had to stay up all night to help customers. Just like Keiko, who decided to keep a digital copy of all her documents after her first complicated claim, her next claim process was significantly easier.

Key Takeaway: Learn from each claim. For the next one, prepare better. It can save you time and stress by allowing you to prepare better.

With this list of all the steps and experiences, you can ease and reduce the headaches with your Visitor Insurance claims process. Now, each step, from learning what your plan covers to preparing for medical needs, is structured to increase your confidence and help you feel prepared if you get sick or hurt in Canada.

Coming to the end

Getting your Visitor Insurance claim processed may seem difficult at first, but if you plan ahead and know what you’re doing, it will be an easily achievable part of your trip. Let the paperwork not scare you from the experience that Canada has to offer. Canadian LIC, the best insurance brokerage, is here to support you every step of the way. Act now to secure your visitor visa insurance and travel with peace of mind, knowing you’re covered. Remember, the best time to prepare is before you even step on the plane. Have safe travels and smooth claims!

Find Out: Can I extend my visitor insurance if I decide to stay longer?

Find Out: Which Visitor Insurance is best?

Find Out: Is Visitor Insurance mandatory?

Find Out: Is Visitor Insurance the same as Travel Insurance?

Find Out: Can you buy Visitor Insurance after arrival in Canada?

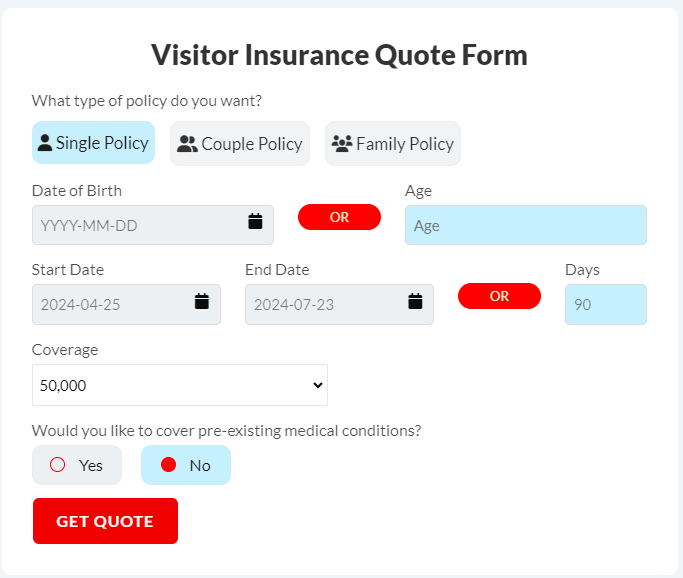

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) About Filing a Claim for Visitor Health Insurance Plans

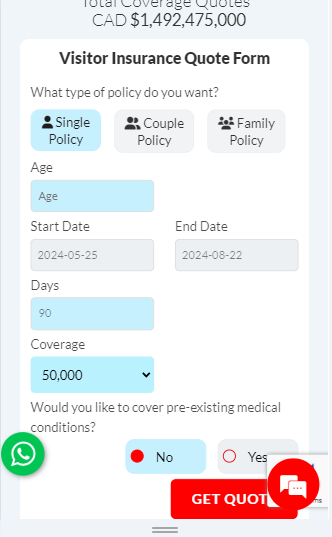

Getting a Visitor Insurance Quote is easy. You can go to the website of any insurance provider that you have selected. There, you will be guided to fill in information regarding your travel and health. For example, Emily from France used this process to get several quotes before her trip to Canada for hiking. This allowed her to gain insight into the best plan for her needs without any confusion.

Share your experiences or questions regarding how to get insurance quotes. We are here to help you find that plan!

While submitting a claim, you need to provide some documents to process the claim. This usually includes medical bills, a copy of your ID (passport or visa), and any relevant receipts. You may also remember Raj, one who was always very well-organized with his documents. He was able to submit the claim without any time lapse for his cricket mishap. Start organizing your documents right from the time you step foot into the facility for medical care. Keeping everything organized can drastically speed up the claims process.

This could vary, but in general, the processing takes a few weeks to a few months. Tom’s story is a good reminder to follow up if the process takes longer than expected. Regular contact with your insurance provider can ensure that your claim is not overlooked.

Have you ever experienced delays in your claim processing? Share your story, and let’s explore how to avoid such issues in the future.

If denied, the first step is to check the Explanation of Benefits that reflects the denial of your claim. Amina had that happen and was able to correct the mistake; with the documents that had been missing, her claim was paid on the second submission.

Always ask for clarification on the denial and double-check if you’ve missed submitting any necessary documents. Correcting these can often reverse the denial.

Yes, many insurance companies have online claim submission; it’s user-friendly, fast, and, for the most part, the easiest way to submit a claim. Maria found this method particularly helpful when she needed to file a claim for food poisoning without leaving her accommodation.

Have you ever filed a claim online? How was your experience? We’re curious to hear how it went for you!

Prepare all needed documents, have all the relevant details on your Visitor Health Insurance beforehand, and file your claim according to the terms and conditions. Keep digital copies of your papers, as Keiko did. This is a great tip for people who want to make their future claims easier. Keeping a checklist of required documents and steps can be a lifesaver.

Choosing the right Visitor Health Insurance Plan involves comparing different Visitor Insurance Quotes to find one that best meets your needs. Take into account Laura’s experience: she had to have a plan that covered adventure sports, as she was planning to go skiing and hiking in Canada. She compared several quotes and found a plan that specifically covered these activities but was also within her budget.

Did you find it hard to pick a plan? Explain your experiences or ask for help here!

Health insurance plans for visitors have different modules within them for coverage of pre-existing conditions. Basic plans do not include the benefit of coverage for pre-existing conditions, while the comprehensively designed plan might give you limited coverage. This was a big deal for Alex from Germany: he needed a plan that would cover his medical needs now and look out for anything that might be a pre-existing condition in the future. He specifically looked for a plan that offered some coverage for pre-existing conditions and read the policy details carefully to ensure it matched his requirements.

Read the fine print about pre-existing conditions in your Visitor Insurance Quote all the time. It’s better to know ahead of time what’s covered and what isn’t.

The best time to buy Visitor Health Insurance is before you start travelling. Sarah learned the hard way by delaying the visit to Canada and putting off buying insurance until she arrived. She ended up paying more for the cost and getting less coverage. Purchasing insurance before the trip can often guarantee better coverage and more peace of mind.

Have you ever delayed buying a Travel Insurance Policy? How was your experience buying late?

Yes, many Visitor Health Insurance Plans give you the flexibility to extend your coverage if, during your travel plans, you decide to stay longer. Just make sure to request the extension before your current plan expires. This is exactly the same thing that John did when he decided to extend his trip to explore more of Canada. One week before the expiry of the plan, he was on the phone with his insurance provider and was successfully able to extend his coverage.

Do not wait until the last minute to extend your plan. Early requests can ensure continuous coverage is provided.

If you lose your policy documents on the trip, notify your insurance company immediately to have replacements sent to you. A replacement will be sent as soon as possible. This is what happened to Emily when she was in Montreal. She actually received digital versions of her documents via email, which she was then able to use for a minor medical claim.

Have you ever lost very vital travel documents? How did you deal with the situation?

You should always carry your Visitor Health Insurance proof with you and understand what can possibly be covered in your plan. Therefore, when Mark fell ill during his trip to Vancouver, the possession of his insurance card and the knowledge of hospitals covered in his plan enabled him to acquire treatment with no financial stress.

Do you have any concerns about medical coverage while traveling? Ask here, and let’s clarify them together.

These FAQs are meant to provide you with insight and clarify, step by step, the process of filing a claim under your Visitor Health Insurance Plan. We hope that by telling you first-person stories based on real events and answering your concerns directly, we can give you the information you need to be better prepared for anything that might happen while you are travelling.

Sources and Further Reading

To support the content of the blog “How to File a Claim for Visitor Insurance” and provide additional resources for readers who want to delve deeper into the topics of Visitor Health Insurance Plans and filing claims, here are suggested sources and further reading materials:

Insurance Information Institute (III)

Website: iii.org

Description: Offers a broad range of information on various types of insurance, including travel and health insurance. It’s a reliable resource for understanding insurance basics and detailed guidance on managing claims.

Canadian Life and Health Insurance Association (CLHIA)

Website: clhia.ca

Description: Provides comprehensive details about health insurance coverage in Canada, including guidelines for visitors. This site is particularly useful for understanding the regulatory framework and protections available under Canadian Visitor Health Insurance Plans.

Consumer Reports

Website: consumerreports.org

Description: Known for unbiased reviews and consumer advice, this resource offers insights into choosing the right insurance plan, understanding policy terms, and tips on filing insurance claims.

Travel Insurance Review

Website: travelinsurancereview.net

Description: This website provides reviews of various travel insurance plans and companies, advice on what to look for in a good travel insurance plan, and how to deal with claims. It’s especially useful for comparing different Visitor Health Insurance Plans.

Canadian Immigration Blog

Website: canadianimmigrant.ca

Description: While primarily focused on immigration topics, this blog often features articles on health insurance for newcomers and visitors to Canada, offering practical tips and personal stories.

World Health Organization (WHO) – Travel Health Advice

Website: who.int

Description: Provides health advice for travelers, including the importance of insurance. It’s a good starting point for understanding global health risks and the need for comprehensive insurance coverage.

By exploring these resources, readers can gain a deeper understanding of Visitor Health Insurance Plans, enhance their ability to choose the right coverage, and handle claims more effectively. These sources are intended to empower travelers with knowledge, making their travels safer and more enjoyable.

Key Takeaways

- Check your Visitor Insurance Quote and plan details to avoid unexpected costs.

- Keep necessary documents like passports and medical bills organized.

- Choose the best filing method for your claim—online, mail, or fax.

- Regularly follow up on your claim's status to ensure timely processing.

- Review and address any reasons for claim denials promptly.

- Reflect on each claim experience to improve future claims handling.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]