Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Tax Shelter Or Lifeline? Understanding Permanent Life Insurance For High Earners

By Pushpinder Puri

CEO & Founder

- 11 min read

- August 16th, 2025

SUMMARY

High earners in Canada are increasingly using a Permanent Life Insurance Policy as both protection and a tax-efficient wealth strategy. Learn how Permanent Life Insurance Rates in Canada compare, outlines benefits for professionals, and details the tax advantages of Permanent Life Insurance. It also covers real scenarios where Permanent Life Insurance for professionals supports long-term financial security, legacy planning, and investment growth.

Introduction

Some of the wealthiest people we meet walk into our office with quiet confidence — nice watches, smooth handshakes, firm eye contact. But behind that composure, there’s often a question they haven’t quite admitted to themselves yet: “What happens if my income stops tomorrow?”

It’s strange, isn’t it? You could be earning multiple six figures a year, holding investments across several continents, and still be one health scare, one market crash, or one unexpected tax bill away from scrambling. We’ve seen it enough times to know — financial vulnerability doesn’t disappear just because the numbers in your bank account are larger.

One Tuesday morning, we sat down with a client from the film industry. A producer. Big projects. Big money. But his problem? His cash flow was tied to contracts that could dry up overnight if a studio pulled the plug. He was sitting on assets but didn’t have much in liquid reserves. That’s when our conversation shifted toward the idea of a Permanent Life Insurance Policy — not just as “insurance,” but as an anchor point for his entire financial future.

High Earners Aren’t Immune — They’re Just Playing A Bigger Game

People sometimes imagine that if you’re making a high income, your finances run themselves. But in reality, high earners often face larger financial obligations than average-income households. It’s not just the mortgage on a primary home — it’s vacation properties, private school tuition, investment loans, and sometimes entire business payrolls.

One slip, and the ripple effect is massive. A sudden illness could leave your family’s financial future tangled in debt. Estate costs can eat into even the most carefully built portfolio. And CRA isn’t going to waive estate taxes out of sympathy.

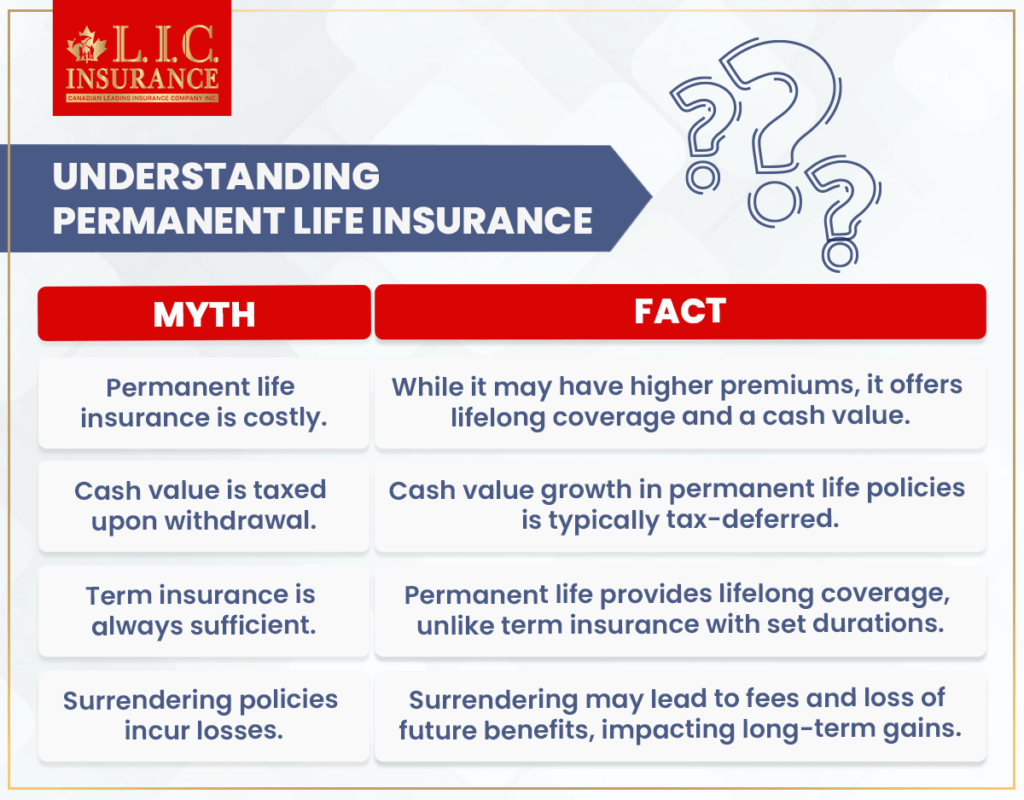

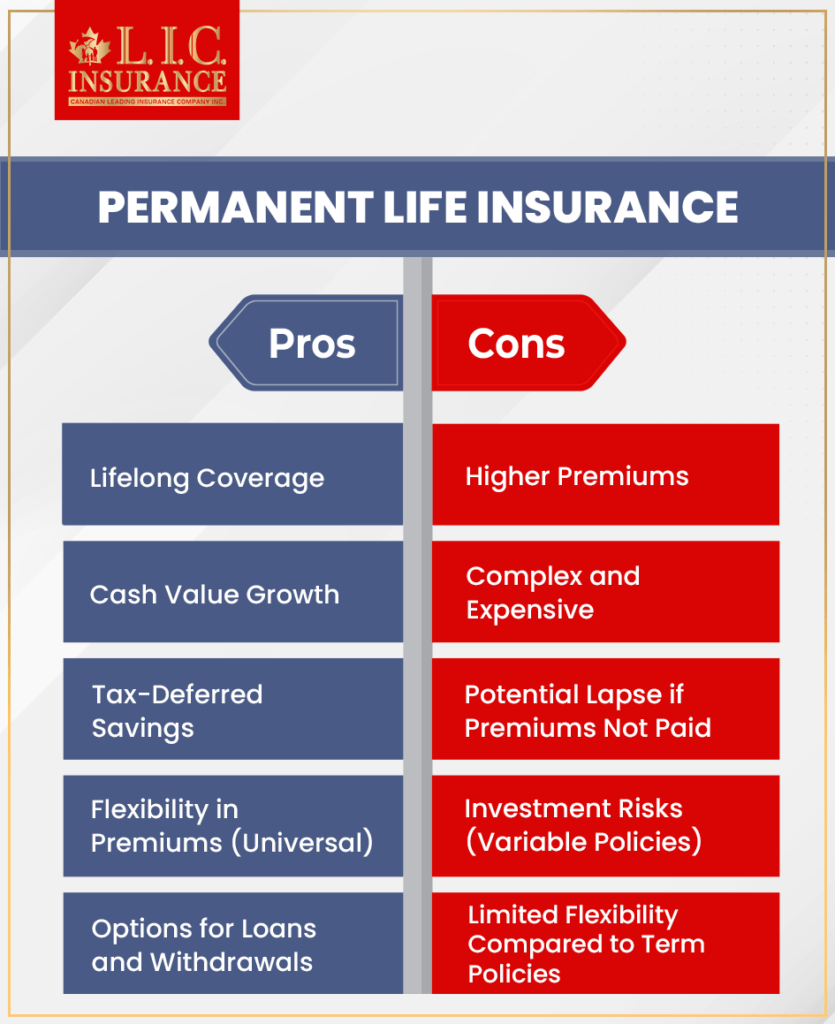

That’s why we find ourselves recommending Permanent Life Insurance coverage so often for this group. It’s not about replacing a modest income — it’s about making sure there’s a tax-free death benefit large enough to handle everything from taxes to business succession. Unlike a Term Life Insurance Policy, which expires, permanent coverage is there for life — and that can mean the difference between your beneficiaries selling assets in a rush or keeping them exactly where they belong.

The Quiet Power Of Cash Value

There’s a part of Whole Life Insurance and Universal Life Policies that people underestimate until they’ve had one for a few years: the cash value.

Think of it less like a savings account and more like a steadily growing reserve, tucked inside your policy, protected from market swings, and building cash value growth over time. That cash value component can be accessed through a policy loan or withdrawal.

We had a client — a boutique hotel owner — who faced an off-season drop in bookings. Instead of taking out a high-interest line of credit, she tapped into her cash value accumulation. It gave her breathing room, avoided taxable events, and kept her doors open until the next tourist rush.

You don’t get that kind of savings component from term life insurance. It’s one of the reasons high earners often gravitate toward permanent insurance when they start thinking about financial stability over decades, not just years.

- Yes, you can give money to your spouse so they can contribute to their own TFSA.

- No, you cannot contribute directly to their TFSA yourself.

The Tax Strategy That Doesn’t Always Get Talked About

Is Permanent Life Insurance a tax shelter? Well, we wouldn’t frame it that way — but the tax advantages of Permanent Life Insurance are undeniable. The growth of your cash value is tax-deferred. The life insurance proceeds are typically tax-free. And for incorporated professionals, corporate-owned life insurance can offer even more efficiency.

Here’s how it played out for one of our clients, a manufacturing CEO. His corporation was the policyholder and beneficiary. When he passed, the tax-free death benefit moved through the company and into the hands of his heirs far more smoothly than if those funds had been drawn from regular corporate assets. That single decision saved his family hundreds of thousands in income taxes.

Flexible Premiums, Flexible Death Benefit — Built For Unpredictable Incomes

We work with a lot of clients whose incomes rise and fall dramatically from year to year — real estate developers, entrepreneurs, even professional athletes. For them, universal life insurance offers with flexible premiums and a flexible death benefit can be the right fit.

One entrepreneur client scaled up quickly, then hit a market dip. He lowered his premium payments during the slow period, then increased them when revenue bounced back. That adaptability kept his insurance coverage intact without creating unnecessary strain on his financial situation.

Scenario One: The Physician Managing Taxes And Legacy

Dr. Malik — we’ve changed his name, but the story is real — was a top surgeon earning a significant income. But high income also meant high income taxes and looming estate taxes on his growing real estate portfolio. He took out a Whole Life Insurance Policy to lock in a guaranteed death benefit and give his family’s financial security and a reliable foundation. Over the years, the cash value growth inside the policy became a secondary savings account he could tap into without triggering taxable events. When he wanted a year off to work abroad, that cash value funded the plan.

Scenario Two: The Executive Protecting A Multi-Generational Plan

Monique, an energy sector VP, thought her existing benefits were enough — until she realized the term life provided by her employer wouldn’t follow her if she changed jobs. She switched to a Permanent Life Insurance Policy with strong cash value accumulation potential. Years later, she used part of that value to help her children with down payments on their homes — without compromising the death benefit her heirs would receive.

Scenario Three: The Business Owner Leveraging Corporate-Owned Life Insurance

James, who ran a growing logistics firm, needed both financial protection for his family and a financial planning tool for his company. By using corporate-owned life insurance, his insurance company structured the policy to allow cash value growth while keeping funds sheltered from market volatility. This not only created a tax-free death benefit but also let him purchase additional coverage as his fleet expanded.

More Than Just A Payout — It’s Stability In Chaos

One of the biggest misunderstandings we encounter is that life insurance is “just about the payout.” In truth, it’s about ensuring financial stability when the unexpected happens. The death benefits from a Permanent Life Insurance Policy can prevent forced property sales, rushed share buyouts, or loss of key business assets.

If you have financial obligations — whether it’s a commercial mortgage, tuition, or business loans — the right insurance policy is the shield that keeps everything from falling apart. And for many high earners, it’s the only thing standing between order and financial chaos.

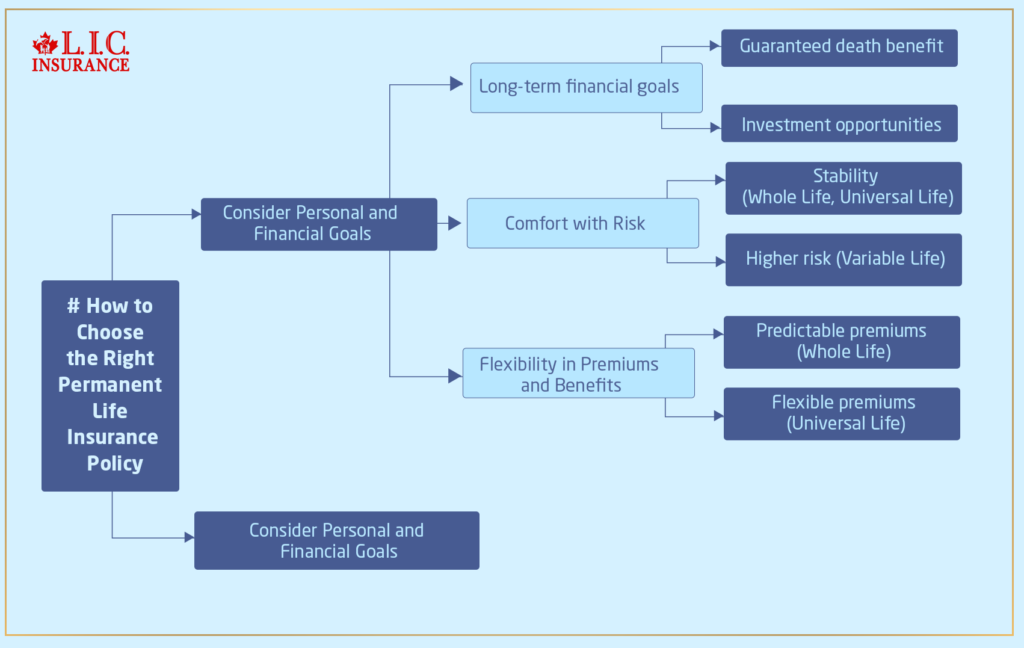

Matching Coverage To Risk Tolerance

Not all high earners are the same. Some want the predictable growth of Whole Life Insurance policies. Others are comfortable with the investment-linked potential of variable life insurance. The decision depends on risk tolerance, long-term goals, and investment options.

The point is: there’s no “one-size-fits-all.” Whether you’re buying life insurance to replace lost income or as part of a more complex financial planning strategy, it has to align with your financial future.

Why We Keep Having This Conversation

We’ve been doing this long enough to know that the people who say, “I don’t need this” are often the ones most relieved when they realize what Permanent Coverage can do.

High earners, especially those with term insurance coverage through work, sometimes forget that those benefits vanish when the job does. And without a plan, the financial burden of taxes and debts can wipe out decades of work.

The right insurance coverage, structured with your life insurance needs in mind, is one of the most effective ways to provide financial security and protect your family’s financial future.

FAQs

Honestly? They rush. But the word “tax advantages” or “guaranteed death benefit” is uttered, and before they even have time to blink, people are signing things they hardly understand. I have mentioned would-be millionaires who work in tech, law and real estate who treat it like any other investment account. But this is not a “buy today, flip tomorrow” type of tool. The key is to understand how it fits into the larger frame of your finances — debts, retirement strategy, and even risk tolerance. If you don’t, then you’re just paying premiums without a strategy.

Not so much—though it’s certainly pitched that way. Of course, if you are a surgeon earning mid-six figures, the tax shelter benefits can be massive. We suspect small business owners can use it to protect their family’s financial future and still have a large part of their wealth growing inside the policy, but I never had any real experience with anyone doing that. That is — now you need a portfolio that can support the premiums without killing your cash every month, right? If it has you skipping mortgage payments to pay for a job, the time is not right just yet.

And, of course, that is where people become shocked. The permanent policy means you likely have some accumulated cash value to tap, so all is not lost like a piece of paper burned off in a puff of smoke. Now, it is also not some miraculous no-consequences button. Your policy might be reduced, your death benefit may fall and if you fail to roll it back when it lapses… well, then you are right in the beginning. It’s like after mile 18 in a marathon — you’ve put in the work, but unless you come out of the race at the end and cross that finish line, where is your medal?

Yes, that is kind of significant. I worked with business owners who tapped into the cash value of their policy to buy out a partner, supplement income during retirement or use in place of their standard salary when they walked away from an operating role within the company. That said, this is not something you can just get up and do — it takes years of strategy, actually, to have someone believe this will work. You should also understand that you cannot simply start your policy today if you are thinking, “I’ll just open a policy now and get my company sold next summer,” it will not work like that.

Yes, there is, but accessible does not mean free money with zero strings attached. You can withdraw from it, you can borrow against your account or in some cases, use your 401 (k) as collateral, each with its own tax implications and interest rate consequences. Equally, we have seen a few people leverage the cash value to snag a business deal or pay for their kids’ college without ever having to tap into their primary investments. But you have to be tactical, as any aggressive lead generation or account expansion strategy can erode the growth you just spent so much time building.

Absolutely. If you have your RRSP, TFSA, and some corporate investments already doing the work they need to, a permanent policy can be that extra layer of insurance and wealth tool and getting a luxury suite in a stadium. The best part is, you don’t even need it actually to watch the game — but it does really complete the experience and give some added bonuses that those without it do not get.

What will you do later on? Right now, all you and your agent may care about is the death benefit, but years from now, maybe you are less concerned with a large lump sum and more interested in building tax-free income in retirement. Alternatively, you may simply want to change the way your cash value is being invested. It can grow with you, but only if you remain clear on what the policy does and pull it out of a drawer again in 20 years.

Key Takeaways

- Permanent Life Insurance isn’t just about coverage — it’s a long-term tool for building cash value and securing your financial future.

- High earners can use it to protect their family’s financial future while also creating tax-efficient wealth through the tax advantages of Permanent Life Insurance.

- The death benefit offers lasting protection, while flexible premiums and a flexible death benefit keep the plan adaptable over time.

- Features like a policy loan can provide liquidity when needed without derailing other investments.

- The real power comes when a Permanent Life Insurance Policy is integrated with your other financial strategies, from retirement planning to estate goals.

Sources and Further Reading

- Government of Canada – Life Insurance Overview

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html - Insurance Bureau of Canada – Understanding Life Insurance

https://www.ibc.ca/on/insurance-101/life-health-disability-insurance/life-insurance - Canadian Life and Health Insurance Association (CLHIA) – Consumer Information

https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/Consumer_Information - Investopedia – Permanent Life Insurance Explained

https://www.investopedia.com/terms/p/permanentlife.asp

- Sun Life Canada – Whole and Universal Life Insurance

https://www.sunlife.ca/en/tools-and-resources/money-and-finances/life-insurance/

Feedback Questionnaire:

IN THIS ARTICLE

- Tax Shelter Or Lifeline? Understanding Permanent Life Insurance For High Earners

- High Earners Aren’t Immune — They’re Just Playing A Bigger Game

- The Quiet Power Of Cash Value

- The Tax Strategy That Doesn’t Always Get Talked About

- Flexible Premiums, Flexible Death Benefit — Built For Unpredictable Incomes

- Scenario One: The Physician Managing Taxes And Legacy

- Scenario Two: The Executive Protecting A Multi-Generational Plan

- Scenario Three: The Business Owner Leveraging Corporate-Owned Life Insurance

- More Than Just A Payout — It’s Stability In Chaos

- Matching Coverage To Risk Tolerance

- Why We Keep Having This Conversation