Universal Life Insurance is helpful as a tool with many benefits if you understand how Canada’s financial system operates. By the time you reach the end of the cover, the policy has built a cash value which can be cashed in should you survive the policy. It’s important to understand why this insurance is becoming so popular and the benefits it provides for Canada.

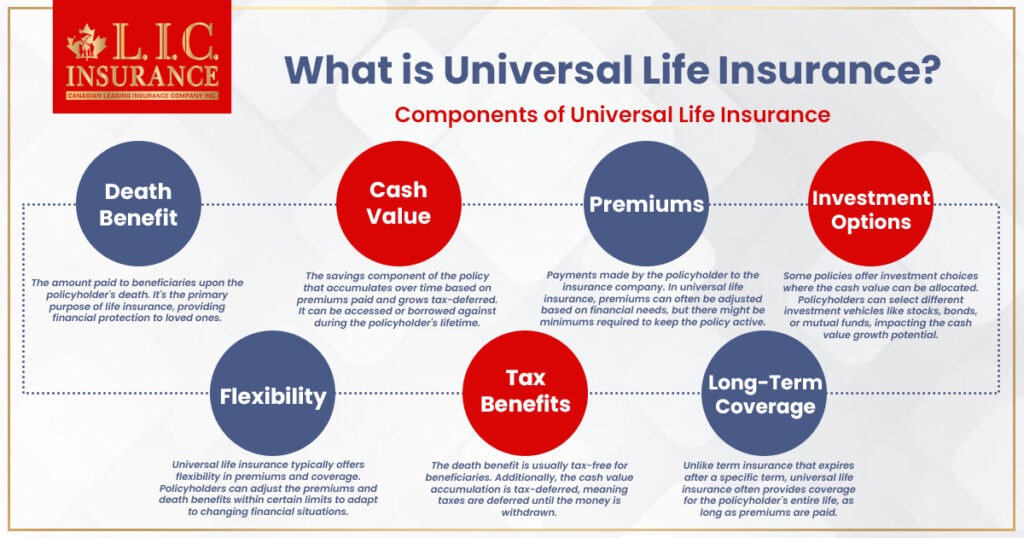

What is Universal Life Insurance?

In Canada, there is a thing called Universal Life Insurance. Insurance of this kind serves two purposes: it ensures your family’s or your dependents’ financial safety net in the event of your death and helps in the accumulation of long-term savings. Or to phrase it differently, it’s as if you have a plan that leaves at least your relatives something, and also builds savings over time.

Understanding Universal Life Insurance in Canada

It is a material that can take many shapes. So you can always tweak things, like how much money you spend, how much service you get, no matter what is happening at any particular time in your life. You may need to take stock and rework your plan if there are changes in your life, perhaps you earn different money or you bring different money to your family. This is usually something you would be able to do with a standard life insurance policy.

This type of insurance protects you, and it can save you money over the long term. A portion of your money will be put into a savings account, to be left to grow over time. This is the good news, right? You are not taxed on this growth until you take it out.

One could find several pros and cons of purchasing such an insurance policy. You can adjust both what you pay and what features are in your plan. Also, save until you use, and save money that receives no tax.

Downside: These plans could be pricier than those other, more stripped-down types of insurance. The way in which they function and how much they charge might be a bit more complicated because they need more work.

Why Universal Life Insurance Might Work for You

It’s nice to know that Universal Life Insurance can cover you for the rest of your life as well. You don’t ever have to be afraid you won’t be protected, as you always will be protected. It can also be especially beneficial if you want to ensure your family receives anything from yo,u or it can then help them with future financial obligations.

Making the Most of Universal Life Insurance

Remember the simple thing - you need to be very familiar with the idea you’re thinking of. Universal Life Insurance policies offer some significant benefits; on the other hand, they are not for everyone. Maybe the cost is way too much as well as the level of intricacy not at all what you are looking for. An insurance expert or advisor can help you decide if Universal Life Insurance policies are the best choice for both your future and the future of your family.

Beyond the Basics: Real-World Strategic Uses of Universal Life Insurance in Canada

For most individuals that are wondering “what is Universal Life Insurance? they’re waiting for tax-free death benefits or long-term savings potential. Although those are foundational functions, the true strategic value of a universal life insurance policy in Canada comes not from what it offers, but from how it can be applied.

And finally, we’ll look at unique situations and advantages of life insurance in Canada not everyone knows about. This is not just a matter of flexibility or deferral of taxes. Get more advice to help your business succeed: “ 12 Steps to Make a Mentorship Work for You: Making Mentorship Work” is the most recent post from Amy Cuddy on Adam Grant’s “Work in Progress” blog — so here’s just one nugget: “Kindergarten teachers never say to their students, ‘You know Timmy, I’m sorry, but you’ll never be a good reader, you’re just not a good reader,’” explains psychologist Ellen Langer: “On the other hand, the only thing holding people back often is believing that they can’t do something.” It’s about how to turn a simple policy into a multi-purpose financial instrument — and why that trait makes it one of the most underused tools in financial planning.

- Business Universal Life Insurance: Protect and Build Value Simultaneously

If you’re a business owner, the benefits of business universal life insurance extend far beyond key-person protection. In Canada, these policies can be used to:

Retain executives with tax-advantaged compensation packages

Fund shareholder buy-sell agreements

Create corporate-owned investment vehicles that grow on a tax-deferred basis

Preserve capital gains exemptions by funding future tax liabilities

Unlike typical insurance, corporate universal life insurance structures allow businesses to pay premiums through the company, accumulate cash value tax-deferred, and use the policy’s death benefit to smooth ownership transitions or finance succession plans. A qualified universal life insurance broker can help tailor solutions that balance coverage, cost, and investment growth.

- Building a Tax-Free Retirement Bridge for Individuals

For those who have maxed out their RRSPS and TFSAS, the best universal life insurance Canada has may be the one which fills the tax-free saving gap.

The cash value of a universal life insurance policy also grows on a tax-deferred basis and can generally be taken out in the form of policy loans or withdrawals without generating immediate taxes. That, in turn, makes universal life insurance a great retirement income cushion, especially for high-income earners or self-employed individuals.

It mostly ends up functioning as a personal pension alternative, though one that can outpace inflation if investment allocations are handled well. The thing is, few Canadians know that it can be used this way, even though it is one of the best universal life insurance tax benefits that are accessible under the current rules set by the CRA.

- Real-Time Adaptability to Life Events

One of the underrated benefits of a universal life insurance policy is its dynamic adjustability. While most people understand it’s flexible, they often don’t realize how flexible:

Experiencing income instability? Shift to minimum premium mode.

Want to leave a larger legacy? Boost premiums during high-earning years.

Need emergency funds? Access the growing universal life insurance investment account or borrow against it, often at favourable rates.

This is where universal life insurance in Canada outpaces whole life and term insurance. With the right guidance, you’re not locked in—you’re equipped to pivot.

- Regional Considerations: Universal Life Insurance in Alberta

Policyholders in Alberta face unique financial planning environments, including inheritance strategies, agricultural business transitions, and corporate taxation structures. The universal life insurance Alberta residents choose can act as a bridge across generations, funding succession in farming families or providing liquidity during probate.

A tailored policy can:

Provide equal inheritance to non-farming heirs

Ensure surviving spouses have income continuation

Minimize estate shrinkage via universal life insurance tax-free payouts

These highly localized benefits rarely appear in generic content, yet are decisive in real-life planning outcomes.

- What Does Universal Life Insurance Cover—and What It Enables

Yes, universal life insurance covers death benefits and a savings component. But it also enables a smarter financial lifestyle.

Ask any seasoned advisor, “How does a universal life insurance policy work?” and they’ll point you to how it empowers people to:

Blend life insurance with long-term investment planning

Take control of tax positioning in later life

Maintain liquidity while accumulating wealth

Reallocate funds based on market opportunities or personal needs

All while keeping the universal life insurance tax-free growth engine running.

- Understanding Cost and Commitment

One of the most searched queries today is “average universal life insurance cost.” The reality? It depends on age, coverage amount, investment performance, and policy structure. But here’s what matters more: cost efficiency over time.

Unlike term policies, which expire, universal life insurance investment builds up—and if used strategically, often ends up paying back more than it ever cost, especially when you count:

Tax-free death benefits

Tax-deferred investment growth

Legacy value

Emergency liquidity

This perspective reframes the common universal life insurance Canada pros and cons comparison and encourages a longer-term outlook.

Designing a Policy for Purpose

The true benefits of universal life insurance emerge when a policy is designed around purpose, not just protection. Whether you’re managing personal wealth, building a family legacy, or navigating corporate financial planning, the right universal life insurance broker can craft a policy that reflects your unique path.

Rather than asking “What is universal life insurance?” a better question might be: “What could it do for me, my business, and my family—10, 20, or 30 years from now?”

The answer might surprise you.

Benefits of Universal Life Insurance in Canada

Customers who are looking for powerful financial security and possibilities to save money can take full advantage of the numerous benefits that are offered by Universal Life Insurance in Canada. These benefits are specifically developed to cater to the needs of insurance policyholders. Let us provide you with a more in-depth look at the benefits that these insurance policies provide:

Benefits of Universal Life Insurance in Canada

1. Flexible Premiums:

If they have Universal Life Insurance plans, policyholders have the ability to adjust their premiums up to a specific point. Because of its versatility, it enables individuals to adjust their coverage whenever it is necessary to take into account changes in their financial circumstances.

2. Cash Value Growth:

The cash value of a universal life policy gradually increases over the course of time. This accumulation is a method for saving money, and it grows tax-deferred, which means that taxes are not required on the growth until the money is withdrawn out of the account.

3. Tax Benefits:

Under most circumstances, the beneficiaries of Universal Life Insurance are not required to pay taxes on the death benefit they receive. There is also the possibility of a tax gain due to the fact that the growth of the cash value is not immediately taxed.

4. Lifetime Coverage:

For as long as the premiums are paid, Universal Life Insurance will continue to provide coverage for the insured throughout their entire life. As a result of this, it can be utilized for estate planning, which offers protection for the financial well-being of loved ones in the future.

5. Investment Options:

When you purchase some Universal Life Insurance plans, you have the freedom to choose how you want to spend the money that you have been given. Policyholders have the choice of investing the cash value in a variety of different forms of investments, every one of which has the potential to encourage growth.

6. Estate Planning Tool:

One of the most practical choices to make when it comes to making preparations for the future is to purchase Universal Life Insurance. You will be able to use the funds that it gives you to pay your estate taxes or to leave an inheritance to your children, both of which contribute to the maintenance of your existing financial security.

7. Loan and Withdrawal Options:

Cash value policies permit policyholders to borrow money on the policy’s cash value or withdraw cash from the cash value. With the utilization of these options, you can possibly save money for the use of meeting an unforeseen need or increase the level of income that you have during your retirement years.

It could be that Universal Life Insurance policies in Canada could be adaptive and beneficial, as can be shown by the benefits offered. Before settling on a purchase of an insurance policy, it is crucial to take these benefits into account based on your own personal taste and objectives for financial issues. Consulting with a financial advisor or an insurance professional can assist you in purchasing Universal Life Insurance that is personalized to your needs and objectives, thus securing your financial status in the long run. This can be achieved through the selection of a policy that is tailored to your protection requirements.

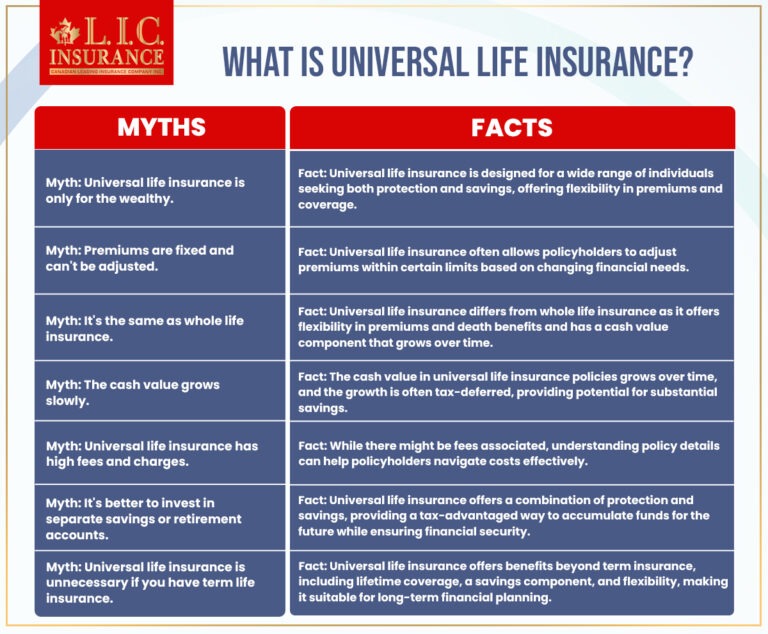

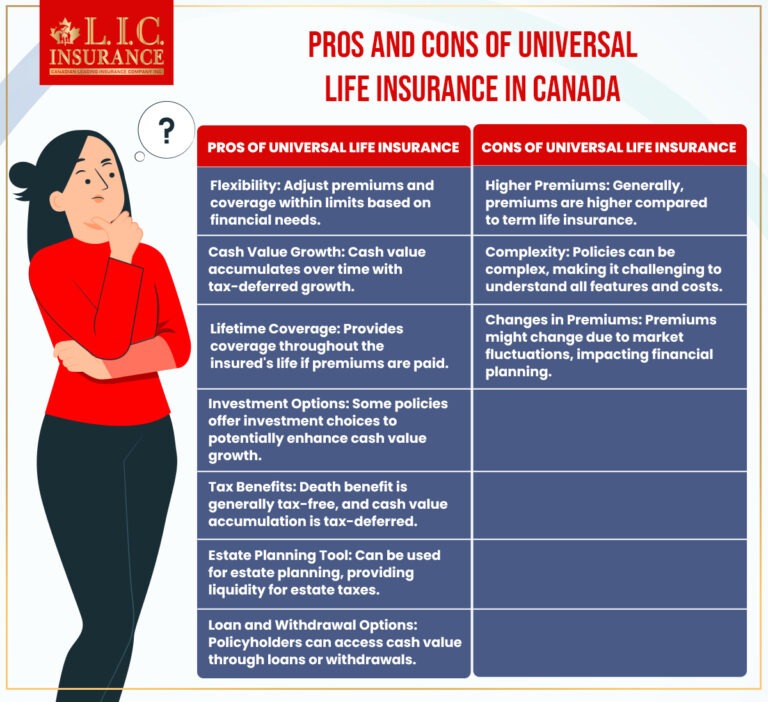

Pros and Cons of Universal Life Insurance in Canada

Universal Life Insurance plans offer unique advantages and considerations for individuals seeking comprehensive coverage in Canada. Understanding the pros and cons can help make a well-informed decision regarding this financial tool.

Pros of Universal Life Insurance:

1. Flexibility in Premiums and Coverage:

Universal Life Insurance provides flexibility to adjust premiums and coverage according to changing financial needs. This adaptability makes it suitable for various life stages, allowing policyholders to increase or decrease coverage based on circumstances.

2. Cash Value Growth with Tax Advantages:

One of the significant benefits is the cash value component that grows over time. This accumulation occurs on a tax-deferred basis, meaning the money invested grows without immediate taxation, offering potential long-term savings benefits.

3. Lifetime Coverage and Investment Options:

Universal Life Insurance provides coverage throughout the policyholder’s life, ensuring financial protection for beneficiaries. Some policies offer investment options, allowing individuals to allocate cash value into various investment vehicles, potentially enhancing growth.

Cons of Universal Life Insurance:

1. Higher Premiums Compared to Term Life Insurance:

Universal Life Insurance typically involves higher premiums compared to term life insurance. The added expense accounts for the cash value accumulation and the flexibility it offers, making it costlier.

2. Complexity in Understanding Policy Features:

Understanding the features and costs of Universal Life Insurance can be complex. Policyholders may need help to grasp the intricacies of the policy, including fees, investment options, and the impact of changes.

3. Changes in Premiums Due to Market Fluctuations:

Premiums in Universal Life Insurance may vary due to market fluctuations, impacting the cash value growth and the cost of maintaining the policy. Economic changes could influence the overall expenses of the policy.

Considering Universal Life Insurance Plans in Canada

Although these points highlight the benefits and drawbacks of Universal Life Insurance, individual situations should be balanced before making any conclusions. Contacting a financial planner or insurance agent can provide worthwhile feedback tailored to your individual financial objectives and requirements.

Before settling on any policy, read the terms and conditions very carefully, analyze the cost and benefits, and weigh long-term financial goals. Such a detailed analysis helps the selected plan be in line with your financial security objectives and provide the desired level of coverage.

Knowing the intricacies of Universal Life Insurance plans and recognizing their possible advantages and disadvantages equips individuals to make informed choices for their financial welfare in Canada.

The End

Universal Life Insurance in Canada provides many benefits, from premium flexibility to growth potential on the cash value. But it’s very important to make careful measurements of your financial requirements and know the policy benefits prior to selecting this kind of insurance.

Talk to a financial planner or insurance agent to discuss whether a Universal Life Insurance policy fits into your long-term financial objectives and requirements.

Remember, insurance needs can vary, so it’s essential to consider your individual circumstances before choosing a policy.

By carefully considering these advantages and disadvantages, you can make a well-informed decision as to whether Universal Life Insurance is suitable for your and your family’s financial well-being in Canada.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's

Universal Life Insurance is a kind of permanent life insurance that brings you coverage throughout the policyholder’s life and has a savings component. It allows flexibility in premiums and offers cash value accumulation.

Cash value accumulates over time as premiums are paid. This component grows on a tax-deferred basis, meaning it’s not taxed until withdrawal.

Yes, the death benefit is typically tax-free for beneficiaries. Moreover, the cash value accumulation portion is tax-deferred.

Yes, within certain limits. Universal life policies offer flexibility, allowing policyholders to adjust premiums to suit changing financial situations.

Some policies offer investment choices where policyholders can allocate the cash value into various investment vehicles, potentially increasing growth.

Universal Life Insurance can serve as an essential tool for estate planning. It provides liquidity to cover estate taxes or leave an inheritance for heirs.

Yes, policyholders can access the cash value through loans or withdrawals. These options offer financial flexibility during emergencies or for supplementing retirement income.

Generally, Universal Life Insurance premiums are higher than term life insurance because of the added cash value and investment components.

Sometimes, yes. The combination of insurance coverage and investment elements can make understanding the policy features and costs complex. Consulting an expert can clarify these aspects.

Assess your long-term financial goals, the need for lifelong coverage, and your willingness to manage investment options within the policy. Consulting with a financial expert can help in making an informed decision.

Yes, some policies allow for changes in the coverage amount, although there might be certain restrictions or conditions associated with such alterations.

If premiums are discontinued, the policy might lose its cash value or terminate based on the ability of the accumulated cash value to cover ongoing charges.

Some insurance providers offer conversion options that allow you to convert term life insurance to a universal life policy. However, this might involve specific terms and limitations.

The guarantees provided by Universal Life Insurance policies might vary. Some elements, like the death benefit, might have guarantees, but other aspects, such as cash value accumulation, might be subject to market conditions.

If you surrender the policy, you may receive the cash value accumulated, subject to surrender charges or fees. However, surrendering the policy might lead to the loss of coverage and potential tax implications.

Yes, riders or additional policy features can often be added to enhance coverage. These riders might include options for accelerated death benefits, accidental death, or waiver of premium, among others.

Generally, loans taken against the cash value of a Universal Life Insurance policy are not taxable, as they’re considered loans and not income.

The ideal coverage amount depends on various factors like your financial obligations, future expenses, and long-term goals. Assessing your financial needs and consulting a financial advisor can help in figuring out the appropriate coverage.

Yes, the premiums in Universal Life Insurance can change, particularly if market conditions or policy features influence the cost structure.

Yes, policyholders have the option to cancel or terminate their Universal Life Insurance policies. However, it’s essential to understand any penalties, fees, or consequences associated with cancellation.

These FAQS aim to provide comprehensive information about Universal Life Insurance policies, but specific terms and conditions might vary between insurance providers. Taking the help of an insurance agent or financial advisor can offer personalized insights based on individual circumstances.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]