Securing the financial future of your loved ones is a priority for many Canadians, and one effective way to achieve this is through Universal Life Insurance. This versatile insurance offers both a death benefit and a savings component, making it an attractive option for those seeking long-term financial protection. This blog aims to provide knowledge about the Universal Life Insurance premiums in Canada, shed light on the duration of premium payments, and offer valuable insights to those searching for the best insurance brokerage.

Let’s Understand Universal Life Insurance

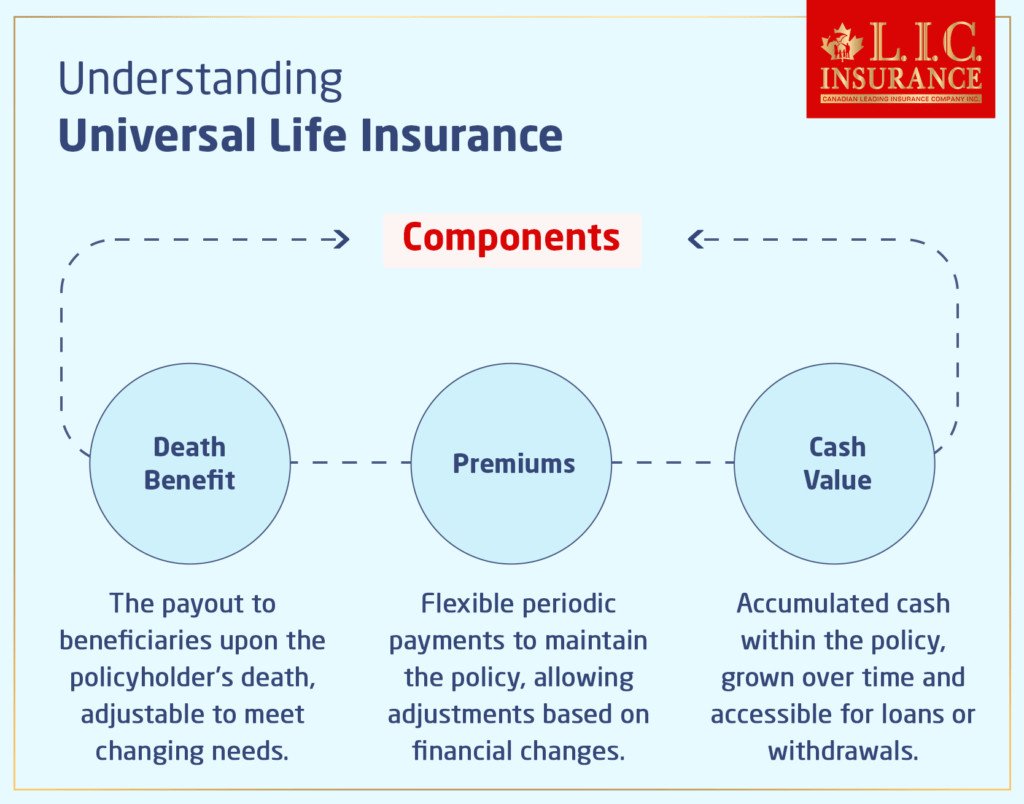

Universal Life Insurance is a special kind of protection that combines death benefits with investments. In this way, people can accumulate cash value over time, which can be used for many things, like adding to their retirement income or paying for unforeseen expenditures. A key feature of Universal Life Insurance is the flexibility it provides, allowing policyholders to adjust both the death benefit and premium payments.

Duration of Premium Payments

Understanding the duration of premium payments is extremely essential when considering Universal Life Insurance in Canada. Unlike Term Life Insurance, where premiums are paid for a specified term, Universal Life Insurance covers the policyholder’s entire lifetime. This unique feature makes it a dynamic and enduring financial tool, allowing individuals to tailor their premium payments to suit their evolving needs and circumstances.

Lifetime Coverage

The fundamental distinction between Universal Life Insurance and its term counterpart lies in the duration of coverage. Term Life Insurance protects you for a particular amount of time, usually between 10 and 30 years. Universal Life Insurance, on the other hand, stays in effect for as long as the user wants it to. This longevity aspect is especially appealing for those seeking a comprehensive and enduring solution to safeguard their loved one’s financial future.

With Universal Life Insurance, you have the mental peace that your policy will continue to provide a death benefit, ensuring your beneficiaries are protected even in your later years. This perpetual coverage aspect makes it a popular choice among individuals who view life insurance as a lifelong commitment rather than a temporary solution.

Flexibility in Premium Payments

A distinctive feature of Universal Life Insurance is the flexibility it affords policyholders in managing premium payments. This adaptability is particularly advantageous as it accommodates the dynamic nature of individuals’ financial situations throughout their lives.

Policyholders have the freedom to vary the amount and frequency of premium payments based on their specific needs and goals. Some may choose to pay premiums consistently over their lifetime, maintaining a stable and predictable financial commitment. This approach provides a sense of continuity and ensures that coverage remains intact without interruption.

On the other hand, individuals with fluctuating income levels or those who anticipate increased financial responsibilities in the future may opt for a more flexible payment structure. They may likely front-load premium payments during their working years when income is typically higher and reduce them during retirement when financial obligations may decrease.

This adaptability extends to the ability to skip premium payments or make additional contributions, depending on individual circumstances. It’s a financial tool that evolves with you, offering a level of control not commonly found in other insurance products.

Exploring Universal Life Insurance Quotes Online

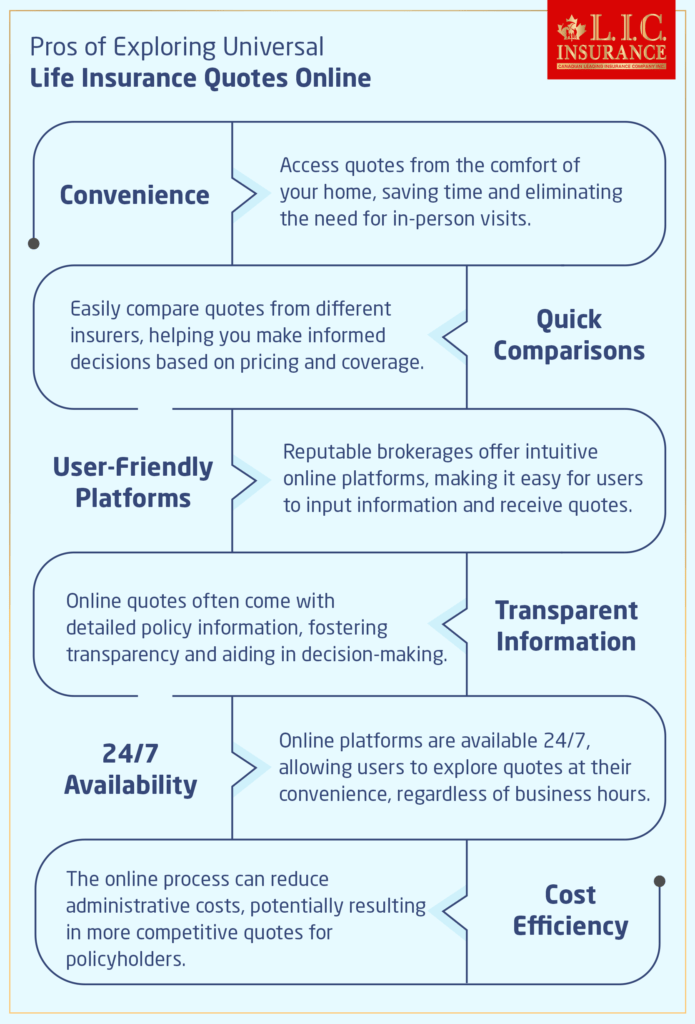

In this modern age, the internet has changed how we get services and information, including insurance. People can now get insurance quotes online with just a few clicks, which makes the process faster and easier than ever. When it comes to securing the best Universal Life Insurance quotes online in Canada, choosing the right insurance brokerage is the most important.

Partnering with a Reputable Insurance Brokerage:

The internet is flooded with insurance options, but not all are created equal. It’s very important to partner with a reputable insurance brokerage that understands the little details of the Canadian market. A reliable brokerage will have a deep understanding of the world of insurance and will be equipped to guide you through the process of obtaining Universal Life Insurance quotes online.

User-Friendly Online Platforms:

A reputable insurance brokerage will offer a user-friendly online platform where potential policyholders can input their information and receive accurate quotes tailored to their unique needs. These platforms are designed to streamline the quoting process, allowing individuals to explore various coverage options from the comfort of their own homes.

When exploring Universal Life Insurance quotes online, look for a brokerage that prioritizes simplicity and transparency. The best online platforms will walk you through each step of the quoting process, ensuring that you understand the information being presented to you.

Competitive Quotes and Informed Decision-Making:

Obtaining Universal Life Insurance quotes online is just the first step in the process. It’s essential to choose a brokerage that provides competitive quotes and takes the time to explain the difficulties in each policy. A trustworthy brokerage will have experienced professionals who can give answers to all your questions and help you decide wisely about your coverage.

As you compare Universal Life Insurance quotes online, consider factors such as coverage limits, premium amounts, and policy features. While price is certainly an important consideration, it’s not the only factor to take into account when selecting a policy. Look for a policy that offers the right balance of coverage and affordability, keeping in mind your long-term financial goals and obligations.

Transparency and Trust:

Transparency is key when exploring Universal Life Insurance quotes online. A reputable insurance brokerage will provide clear and concise information about each policy, including any limitations or exclusions that may apply. They will also be upfront about any fees or charges associated with the policy, ensuring that you understand the terms and conditions before making a decision.

Hence, obtaining Universal Life Insurance quotes online can be a very simple and easy way to explore your coverage options. By partnering with a reputable insurance brokerage that prioritizes transparency and trust, you can confidently secure the best coverage for your unique needs. Remember, your financial security is too important to leave to chance. Take the time to research your options and choose a policy that provides the protection and peace you deserve.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Choosing the Right Insurance Brokerage

Picking up the right insurance brokerage is a very necessary decision to make that can significantly impact your overall financial outcomes. In Canada, the market is filled with numerous options, and careful consideration of certain factors can guide you toward a brokerage that aligns with your needs.

Reputation Matters:

Begin your quest by researching the reputation of potential insurance brokerages. A reputable brokerage often stands out for its consistent delivery of reliable services and customer satisfaction. Some great places to find out about the reputation of different brokerages are online platforms, social media sites, and review websites. Look for indicators of trustworthiness, such as positive client testimonials and a history of providing excellent service.

Customer Reviews:

Going through the customer reviews can offer valuable insights into the experiences of others who have engaged with the brokerage. Pay attention to reviews that specifically mention the handling of Universal Life Insurance policies and the efficiency of the online quoting process. A brokerage with a track record of positive interactions and prompt responses to client inquiries is likely to provide a smoother experience.

Transparent Communication:

A crucial aspect of evaluating potential brokerages is their commitment to transparent communication. A trustworthy brokerage ensures that all communication, whether online or offline, is clear and easily understood. Look for a brokerage that is willing to take the time to explain complex terms and conditions associated with Universal Life Insurance policies. Transparency fosters a sense of confidence, allowing you to make smarter choices about your financial future.

Experienced Professionals:

Understanding the challenges that come with Universal Life Insurance requires guidance from experienced professionals. A credible brokerage will have a team of knowledgeable experts who can assist you throughout the process. Whatever questions you have about coverage options, premium payments, or the online quoting system, having access to professionals with a deep understanding of the insurance world can be invaluable.

To Wrap it All Up

Universal Life Insurance is a powerful insurance choice that offers a combination of life insurance protection and savings opportunities. Understanding the duration of premium payments is the most important factor in maximizing the benefits of this versatile insurance product. When seeking the best Universal Life Insurance quotes online in Canada, choose a reputable insurance brokerage that values transparency and prioritizes your unique needs.

Remember, your financial well-being is a long-term commitment, and with the right Universal Life Insurance policy and a trusted insurance brokerage by your side, you can confidently travel through the path to a secure and protected future.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ’s on Disability Insurance Plans

When you die, Universal Life Insurance pays out a death benefit and lets you save money. There is a difference between Term Life Insurance and Universal Life Insurance. Term Life Insurance only covers you for a certain amount of time, Universal Life Insurance is meant to last forever. The policyholder can change the death payout and the amount of premiums they pay over time.

The suitability of Universal Life Insurance as an investment depends on individual financial goals and risk tolerance. Universal Life Insurance plans have a savings or investment part that lets policyholders build up cash value over time. This cash value can be used for many things, like adding to your retirement income or paying for unexpected costs. It’s essential to carefully assess your financial objectives and consult with a financial advisor to figure out if a Universal Life Insurance policy aligns with your overall investment strategy.

Yes, Universal Life Insurance policies can lapse if the policyholder fails to pay the required premiums. Since Universal Life Insurance is designed to last a lifetime, consistent premium payments are necessary to keep the policy in force. If premium payments are not made, the policy may lapse, which would result in a loss of coverage. Policyholders need to understand the premium payment requirements and ensure timely payments to maintain the integrity of the policy.

In most cases, Universal Life Insurance premiums can increase with age. The cost of insurance is influenced by factors such as age, health status, and coverage amount. As policyholders age, the risk of mortality increases, leading to higher insurance costs. In order to accommodate these increased costs, premiums may be adjusted over time. It’s advisable to review the policy terms and premium structure when considering a Universal Life Insurance policy to understand how premiums may change as you age.

Universal Life Insurance lasts a lifetime, and as long as the policyholder continues to pay the required premiums, the coverage does not expire. Universal Life Insurance covers you forever, while Term Life Insurance only covers you for a certain amount of time. However, if premium payments are not maintained, the policy may lapse, resulting in a loss of coverage. Policyholders should take care in reviewing the terms of their policy and understand the conditions under which the coverage may expire.

Yes, one of the distinguishing features of Universal Life Insurance is the accumulation of cash value.Some of the premium you pay goes into a cash value account. This account grows over time thanks to the investment component of the insurance. This cash value is not the same as the death benefit, and the insured can get to it. The ability to borrow against or withdraw from the cash value provides flexibility and adds an investment element to Universal Life Insurance, making it more than just a protection.

Premium payments for Universal Life Insurance can vary based on individual preferences. Unlike Term Life Insurance Policy, where premiums are paid for a specified term, Universal Life Insurance allows policyholders to pay premiums for as long as they wish to maintain coverage. Some individuals choose to pay premiums consistently throughout their lifetime, while others may opt for a front-loaded approach during their working years.

Yes, many reputable insurance brokerages in Canada provide user-friendly online platforms where you can give your information and receive accurate Universal Life Insurance quotes. It’s essential to choose a brokerage that understands the Canadian market and provides competitive quotes. Look for a platform that not only offers quotes but also explains the details of each policy to help you make a smart decision.

When comparing Universal Life Insurance quotes online, consider factors beyond just the price. Look at coverage limits, premium amounts, and policy features. Consider your long-term financial goals and obligations while choosing a policy that strikes the right balance between coverage and affordability. Additionally, pay attention to the transparency of the brokerage, ensuring they provide clear information about policy terms, limitations, and any associated fees.

Yes, obtaining Universal Life Insurance quotes online can be secure if you choose a reputable and established insurance brokerage. Make sure that the website uses a secure encryption protocol to protect your personal information. Always verify the legitimacy of the brokerage before entering any sensitive details.

Yes, one of the very main features of Universal Life Insurance is flexibility. After obtaining quotes online, you can work with the insurance brokerage to adjust your coverage based on your changing needs. This may include modifying the death benefit or adjusting premium payments to better align with your financial situation.

When obtaining Universal Life Insurance quotes online, you may be required to provide basic personal information such as age, gender, health status, and desired coverage amount. The more accurate and detailed information you provide, the more accurate the quotes will be. Be prepared in advance to answer questions about your lifestyle, work, and any pre-existing health conditions.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com