- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Universal Life Insurance In Canada: Benefits, Drawbacks & Costs Explained 2026

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 16th 2025

SUMMARY

The article explains how a Universal Life Insurance Policy that Canadian residents choose combines flexible premiums, lifetime coverage, and growing cash value. It details the benefits, drawbacks, and 2026 costs, outlines how Universal Life Insurance rates by age chart compares with other permanent plans, and shows how to get Universal Life Insurance quotes online for tailored protection and long-term investment options that support lasting financial security.

Introduction

A CPP Universal Life Insurance Policy. If you’re looking into Universal Life Insurance in Canada, you might already be aware that it’s one of the types of permanent life coverage out there. It’s a policy that doesn’t just protect your loved ones — it can also quietly build up your savings.

More than half of Canadian households have some life insurance, according to the Canadian Life & Health Insurance Association, and permanent plans like Universal Life have not grown as quickly since 2024, as Whole Life Insurance has become more popular under post-IFRS-17 pricing changes. The answer is simple: Because Canadians don’t just want coverage, they also want flexibility and control. A Universal Policy allows you to pay your premiums however you choose, let cash value accrue, and use the policy as part of an investment strategy in which you can work to build up wealth over time.

But like all good things in finance, it involves trade-offs. Let’s just be up-front about the benefits, drawbacks and costs of this uniquely Canadian product — and why in 2026 getting Universal Life Insurance quotes online can help to demonstrate how flexibly it can be made to perform.

What Is Universal Life Insurance?

A Universal Life Insurance Policy is a Permanent Life Insurance Policy that provides coverage for the duration of the insured’s lifetime and couples an insurance component with an investment feature. You pay a premium (a payment that includes the cost of your insurance and an amount contributed toward your policy’s cash value).

Unlike Term Insurance, which expires after a predetermined time, Universal Life is good for your whole life — typically until age 95 or 120. It’s meant to provide financial protection for your loved ones with a guaranteed death benefit and give you access to participate in the market by way of investment options that grow the value of your money inside the policy.

That could make a difference for entrepreneurs, freelancers or anyone with a lumpy income. If your business has a slow quarter, you can reduce your premium payments; when cash flow is strong, you can invest more in the investment portion.

How Does a Universal Life Insurance Policy Work?

Here’s the breakdown. When you make your premium payments, the insurance company takes out administrative costs, the cost of insurance and any surrender charges, if they apply. The rest goes into your cash value, which earns interest or returns according to the specific investment direction you’ve selected.

That’s where the flexibility shines. You may pick fixed-interest accounts, equity-linked funds or even market-linked accounts (not U.S.-style Indexed UL, which is not offered in Canada) that follow an index such as the S&P/TSX Composite. It can also grow tax-exempt under CRA’s exempt test rules based on Canada’s tax treatment of life insurance restrictions.

The policy offers:

- Lifelong protection through a guaranteed death benefit.

- Flexible premium payment options that can increase or decrease over time.

- Cash value growth that you can borrow against, withdraw, or use to cover future premiums.

But this also means you must be involved—Universal Life Insurance work requires a hands-on approach. If you stop monitoring your account, poor investment performance or rising administrative fees could erode your cash value.

Types of Universal Life Policies in Canada

Canadian insurers like Canada Life, Sun Life, and Manulife offer several variations, each tailored to a specific financial personality:

1. Standard Universal Life

The traditional plan. You control your premium payments, choose how your investment components are allocated, and watch your cash value grow at rates set by the insurer.

2. Indexed Universal Life Insurance

Canadian insurers do not offer true U.S.-style Indexed UL (IUL). Instead, they offer market-linked or equity-indexed accounts without the capped-and-floored return structure used in the United States.

3. Variable Universal Life Insurance

This product type is no longer available in Canada. No Canadian insurer offers Variable UL (VUL) in 2026, as the category was discontinued years ago.

4. Guaranteed Universal Life

A “set-and-forget” version. The cash value growth is minimal, but you get predictable premium payments and a guaranteed death benefit—ideal for those who want lifelong protection without market risk.

Note: Several Canadian insurers streamlined their UL product lines between 2024 and 2026. Some investment options and policy variations available before 2024 may no longer be offered in 2026.

Universal Life Insurance Cash Value

The living, breathing part of your policy is the cash value. Consider it an internal savings account that accrues within your coverage. This balance increases with each payment you make, net of any deductions. The policy’s cash balance can then grow over time, as interest compounds in the perspective of a death benefit, leaving a powerful financial cushion.

You can then access the money in several ways — by making a partial withdrawal, taking out policy loans, or even paying premiums with it if other months are tight. The value of a cash surrender — that is, the amount you’d get paid if you cancel it — will vary depending on how long you’ve owned the policy and how much growth has accumulated.

Some Canadians access the cash value when needed, although using UL as an emergency fund is not recommended under the 2026 tax-exempt guidelines. Others see it simply as a supplement to their retirement income or even as collateral for a small business loan.

Universal Life Insurance Premiums and Costs

Flexibility is one of the major benefits of a Universal Life Plan. You can choose how much to pay beyond your minimum premium. Paying more increases your cash value, while paying less may still keep coverage in place if there is enough money in the account to cover the monthly cost of insurance.

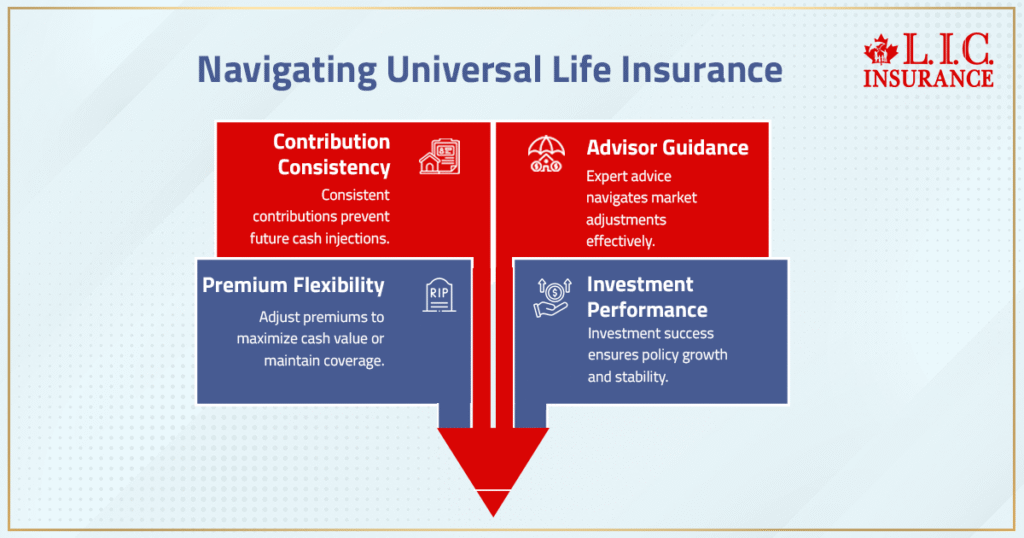

But flexibility had its downside, too. If your investments don’t perform well, or if you skip contributions, the amount of money you owe could grow and ultimately require you to inject more cash later. That is, if you have a licensed insurance advisor in your corner who can support and guide you on managing market value adjustments to get the most from your investment strategy.

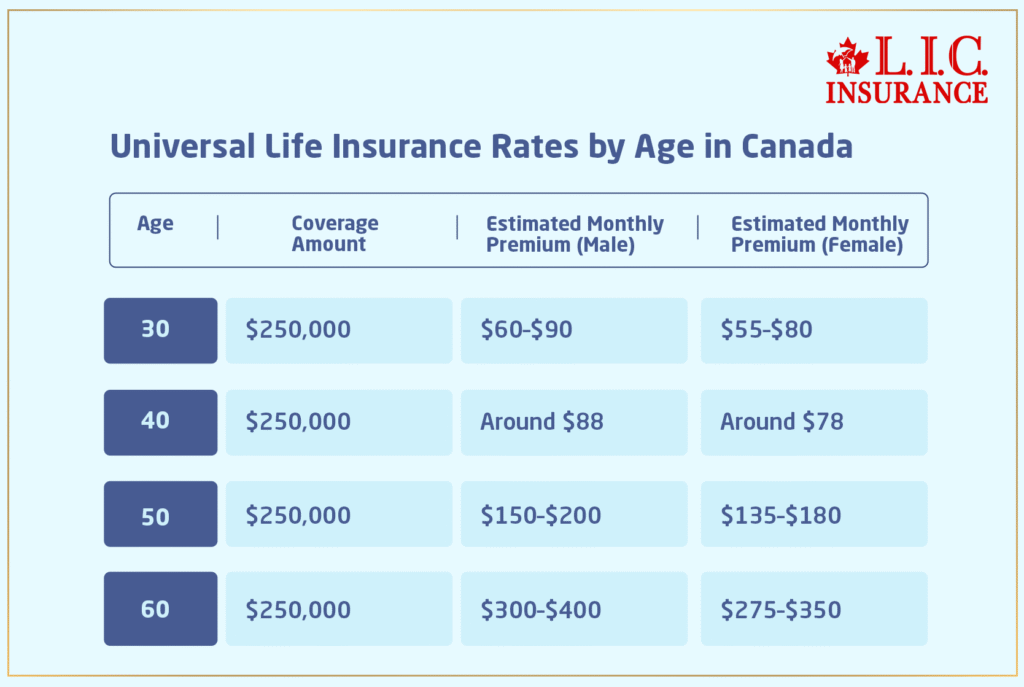

Universal Life Insurance Rates by Age in Canada (2026 Estimates)

Here’s a general look at the Universal Life Insurance rates by age chart based on 2026 market data from major Canadian insurers:

While Universal Life Insurance premiums are higher than term policies, they often cost less than Whole Life Insurance. And unlike term plans, they build cash value that can enhance your financial future.

Benefits of Universal Life Insurance in Canada

- Flexible Protection and Premiums

You control the premium payments and frequency. This flexibility is unmatched in other forms of life insurance. - Tax-Free Growth

Your cash value grows tax-exempt under CRA’s exempt test, meaning the returns compound without immediate income tax. - Build Wealth While Protected

Because of the investment portion, you can build wealth while keeping your family protected. For many, it’s a way to diversify beyond traditional savings accounts. - Lifelong Protection

Unlike term insurance, which expires, Universal Life offers lifetime coverage—ideal for estate planning or leaving a tax-free legacy. - Adjustable Death Benefit

You can modify your coverage amount to match your changing needs. Some even use their policies to fund buy-sell agreements or cover business debt.

Drawbacks and Risk Factors

- Higher Costs

Compared to term insurance, the cost of Universal Life is higher due to its investment features and lifelong nature. - Complexity

It’s not a “set it and forget it” product. You need to monitor performance, premium payment levels, and potential market value adjustments. - Exposure to Market Fluctuations

When markets fall, so can your cash value — although Variable UL is not offered in Canada in 2026. - Possible Lapse

If you don’t have enough cash value to cover the cost of insurance, your policy could lapse unless additional funds are paid. - Administrative Fees

Insurers charge ongoing administrative fees for managing the investment portion, which can slightly increase costs over time. Since 2026, many insurers have reduced their UL fund shelf options and increased administrative and management fees as part of IFRS-17 adjustments.

Universal Life Insurance vs Whole Life Insurance

Both are Permanent Life Insurance products offering cash value, but they differ in structure and management.

- Whole Life Insurance provides guaranteed growth, fixed monthly premiums, and a steady death benefit—ideal for those who prefer predictability.

- Universal Life, by contrast, provides flexibility, optional investment components, and variable returns—best for those comfortable managing their policy.

- Since 2024, Whole Life Insurance has become more stable and more competitively priced than Universal Life due to IFRS-17 reserve requirements, which increased the long-term cost structure of UL policies.

- For Canadians who value lifelong protection and adaptability, Universal Life strikes a balance between investment opportunity and insurance protection.

Using Universal Life Insurance as an Investment Strategy

Universal Life can be more than protection — it is a quiet investment strategy that complements long-term financial planning. The cash value can be used to augment retirement income, as tax-exempt growth, or supplement—not replace—a Registered Retirement Savings Plan (RRSP).

The investment funds within your policy may or may not outperform traditional savings depending on market conditions, fees, and risk exposure, when handled with care. That’s why insurers suggest you review the investment options — and discuss them with an adviser — annually.

There are even Canadians to whom Universal Life makes sense in combination with small businesses — they secure key-person coverage and also build funds for future succession planning.

However, rising COI charges after 2024 mean policies must be monitored more actively to protect long-term value.

Is Universal Life Insurance Right for You?

Ask yourself:

- Do I want lifelong protection with flexible protection options?

- Am I comfortable adjusting premium payments as my income changes?

- Would I like to grow cash value that can help with financial obligations later?

If your answers lean yes, a Universal Life Insurance Policy Canada could fit your financial goals. However, if you prefer stability and predictable returns, a Whole Life Plan might be more your style.

How to Find the Best Universal Life Policy

- Compare Multiple Companies — Get Universal Life Insurance quotes online from major insurers.

- Review Investment Options — Make sure the available investment options match your investment strategy.

Consult a Licensed Insurance Advisor — A qualified expert can tailor coverage and guide you through premium payment strategies that maximize growth while maintaining the policy’s tax-exempt status.

Final Thoughts

Universal Life Insurance in Canada is proving to be an increasingly versatile financial product. It takes care of your family, helps you accumulate wealth and gives you options no other plan offers.

It’s not for everyone — you need comprehension, patience and a dash of fiscal discipline. But for those who crave lifetime coverage, tax-free growth and the freedom to create a policy around their life, Universal Life is a formidable option.

We have had clients use this plan to pay off a mortgage, finance their retirement and leave legacies for generations. The best Universal Life Insurance quote Canada can provide is tailored to you: one that evolves as you do—safeguarding more than just your here and now but also the trajectory of your financial outlook.

More on Universal Life Insurance

FAQs

Hundreds of thousands of Canadians — not millions — use Universal Life Insurance as part of their long-term planning. The value of that policy’s cash portion can increase with your market-based investment options, so you can adjust your coverage based on upcoming financial responsibilities, such as retirement or estate planning.

The cash value performance inside a Universal Life Plan is affected by interest rates. When interest rates rise, insurer crediting rates may increase; when rates fall, the long-term cost of insurance tends to rise, which can reduce projected cash value growth.

If you take out a withdrawal or loan from the cash value of your policy that is beyond your adjusted cost basis, it could result in income tax consequences. With the policy maintaining its tax-exempt status under CRA rules, your investment fund grows tax-exempt within the plan.

Absolutely. In Canada, for a majority of small businesses with Universal Life Insurance, it would serve as lifelong protection for key people and as a financial asset that builds up cash value. The accumulated funds, in turn, may contribute to business growth, succession plans or collateral for a loan from the bank. Rising COI and fee structures after 2024 mean owners should monitor performance annually.

Compared to other Permanent Life Insurance Policies, Universal Life also allows the flexibility of premium payments and investment options that can be adjusted. You can mould cash value growth to suit evolving objectives, which you can’t do with a traditional whole life policy.

It can happen if the portion of the investment that you’ve put to work underperforms, or if certain market risks go rogue. The cash value in the policy is based on returns from interest and the market. Nonetheless, most plans guarantee a minimum interest rate, preventing you from losing it all.

Not always. Certain providers offer simplified or express approval for limited levels of coverage. But for more coverage or investment options, a complete medical exam is generally required to obtain cheaper Universal Life Insurance rates.

A lot of Canadians use Universal Life Insurance to transfer wealth in a tax-efficient way. Its income-tax-free death benefit can be used to pay any income tax liabilities or made available as liquidity to heirs. The cash value has other financial advantages to it as well, such as the ability to make strategic withdrawals and keep your estate whole.

If your cash value is strong, it can float to pay the premiums for a period of time. But if it falls too low, your coverage may lapse. As long as you consult with a licensed insurance advisor to understand your account policy’s cash balance, it can be easy simply by not paying.

Yes, many entrepreneurs do use it to protect key people or partners. The policy’s investment fund can grow tax-deferred, while the death benefit provides continuity in the event a business owner dies, so Universal Life is an intelligent long-term asset for small businesses.

Key Takeaways

- Universal Life Insurance in Canada provides both lifetime coverage and the ability to build cash value, offering a flexible alternative to traditional plans.

- A Universal Life Insurance Policy Canada residents to adjust premium payments, manage investment options, and grow funds that can be used for future financial obligations or retirement goals.

- The 2026 Universal Life Insurance rates by age chart shows premiums rise with age, but the plan’s tax-free growth and death benefit make it a powerful long-term asset.

- Indexed and variable Universal Life Insurance options offer greater investment components and growth potential, though they carry higher risk factors and require active monitoring.

- A well-structured Universal Life Plan supports small businesses, estate planning, and legacy goals by combining insurance protection with investment strategy and tax-advantaged growth.

- Before buying, always compare Universal Life Insurance quotes online and work with a licensed insurance advisor to design coverage that fits your income, goals, and tolerance for market risk.

Sources and Further Reading

- Canada Life — “Universal Life Insurance” overview and features (insurance + investment component) Canada Life

- Canada Life — Universal Life advisor guide/product features (Stable Growth Account, AI 100 COI, etc.) acp.canadalife.com+1

- Manulife UL product page — flexibility, customization, how their Universal Life product is marketed in Canada manulife.ca

- Sun Life Canada — Universal Life Insurance (death benefit, premium flexibility, investment savings elements) Sun Life

- Canada.ca (Government of Canada) — life insurance basics, how Universal Life works in a Canadian regulatory context Canada.ca

- Lifebuzz Canada — detailed explanation of Universal Life mechanics, indexed and variable forms in Canada lifebuzz.ca

- PolicyMe — pros, cons, and practical commentary about Universal Life as an “investment strategy” for Canadians policyme.com

- Assuris — protecting policyholders in case an insurer becomes insolvent in Canada (important for life insurance risk) Wikipedia

- Insurance-Portal / article on Manulife reinsurance of Universal Life block in Canada (industry risk/capital moves) insurance-portal.ca

Feedback Questionnaire:

Your experience and opinions help us guide Canadians toward smarter insurance and investment decisions.

Please take a minute to share your thoughts below.

IN THIS ARTICLE

- Universal Life Insurance In Canada: Benefits, Drawbacks & Costs Explained 2026

- What Is Universal Life Insurance?

- How Does a Universal Life Insurance Policy Work?

- Types of Universal Life Policies in Canada

- Universal Life Insurance Cash Value

- Universal Life Insurance Premiums and Costs

- Universal Life Insurance Rates by Age in Canada (2026 Estimates)

- Benefits of Universal Life Insurance in Canada

- Drawbacks and Risk Factors

- Universal Life Insurance vs Whole Life Insurance

- Using Universal Life Insurance as an Investment Strategy

- Is Universal Life Insurance Right for You?

- How to Find the Best Universal Life Policy

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP