- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Can Tourists Buy Health Insurance In Canada? A Complete Guide To Visitor Medical Coverage

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 04th, 2026

SUMMARY

Tourists visiting Canada are not covered under public healthcare. The article explains how to secure protection through the best Visitor Insurance Plans Canada offers, covering emergency care, hospital stays, and doctor visits. It details Canada Visitor Insurance cost, coverage for pre-existing conditions, and how Visitor Insurance brokers help compare Visitor Insurance quotes online for affordable, reliable coverage.

Introduction

It is a feeling that walking off the plane in Canada captures perfectly — mountains that touch the sky, cities that hum with culture and communities eager to welcome the world. But lurking behind the beauty is a reality many tourists don’t consider until it’s too late: Health care here isn’t free for visitors. It takes one surprise mishap, one bout of fever, or a single fall — and the bills can run from a few hundred dollars to tens of thousands.

We’ve witnessed far too many visitors learn that lesson the hard way. The father of a Toronto home’s one client, who flew in from India that winter, slipped on ice outside the house and ended up in the E.R. The cost? More than $7,000 for one night in the hospital — all out of your pocket. Should you ever need to consult with a medical professional when in the Great White North, that’s why having – and knowing you’re covered by – the right visitors’ medical travel insurance before entering Canada is not just prudent; it’s necessary.

Why Tourists Need Health Insurance In Canada

Canada’s Health Care system is revered around the world, but it’s funded by taxpayers and is administered provincially, with public coverage generally limited to eligible residents who meet specific provincial criteria. Tourists, visitors here on temporary visas, and most newly arrived permanent residents during provincial waiting periods are not eligible.

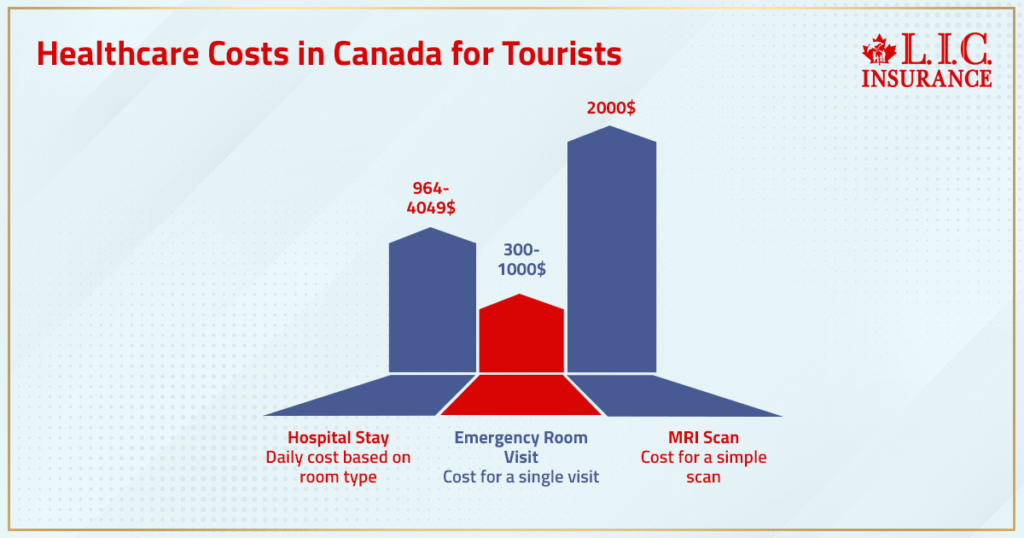

A majority of visitors to Canada purchase emergency medical insurance before arrival, according to industry observations, and that figure continues to grow every year due to greater awareness. The reason is simple:

- A hospital stay can cost from approximately $1,000 to several thousand dollars per day, depending on the room type and level of care.

- Emergency room visits range from $300 to $1,500+, depending on diagnostics required.

- A simple MRI scan can exceed $1,000–$2,500, depending on the facility and urgency.

These numbers aren’t scare tactics; they’re representative cost ranges reported by Canadian hospitals. Without Health Insurance, you’re on your own financially — and that can devastate a travel budget or even a lifetime of savings.

Is Medical Care Free in Canada for Visitors? Real Costs Without Insurance

One of the most common questions travellers ask before travelling to Canada is: is medical care free in Canada?

The honest answer is no — not for visitors or non-residents.

Canada’s publicly funded healthcare system is designed for eligible residents enrolled in provincial health plans. Tourists, visitors on a tourist visa, and other non-residents must pay out of pocket for medical services unless they have Health Insurance for Canadian visitors.

To put this into perspective, here is what travellers commonly face without insurance:

- Doctor visit costs without insurance in Canada typically range from $150 to $600, depending on the clinic and province.

- How much does an emergency room visit cost in Canada?

An ER visit alone often starts at $300–$1,000, and can increase significantly if tests, imaging, or hospital admission are required. - Diagnostic services such as X-rays, CT scans, or blood work are billed separately and can add hundreds or even thousands of dollars to the final bill.

These are not rare cases — they are routine charges issued to visitors who travel to Canada without Health Insurance.

This is why travelling to Canada with Health Insurance is not optional in practice, even if it is not legally mandatory for all visa types. A single doctor visit or emergency room encounter can easily cost more than an entire trip.

For this reason, most travellers now arrange Health Insurance for tourist visas or visitors to Canada travel insurance before arrival, ensuring they can access care without facing unexpected financial strain.

Types Of Visitor Medical Insurance In Canada

When you start looking for the best Visitor Insurance Plans Canada has to offer, you’ll come across two major categories. Both are designed to protect travellers, but each serves a unique purpose.

1. Visitors To Canada Insurance

This policy is for anyone entering Canada temporarily — tourists, certain international students, or even returning Canadians awaiting provincial healthcare reinstatement.

Coverage typically includes:

- Emergency medical and hospital expenses

- Doctor’s visits

- Ambulance transportation

- Prescription drugs

- Diagnostic services

- Emergency dental treatment

We often recommend this to short-term visitors or work-permit holders. It’s flexible, customizable, and available for stays as short as a few weeks or as long as a year.

2. Super Visa Insurance

This is tailor-made for parents and grandparents to visit their Canadian citizens or permanent resident children under the Super Visa program. Those visitors must carry at least $100,000 in emergency medical coverage, valid for a minimum of one year, and issued by a Canadian insurer.

We’re often approached during holidays by families asking us what the best Visitor Insurance for parents is when comparing between providers like Manulife, GMS, or Tugo. We assist them in finding policies that offer a mix of holistic coverage and affordability — particularly when existing conditions are involved.

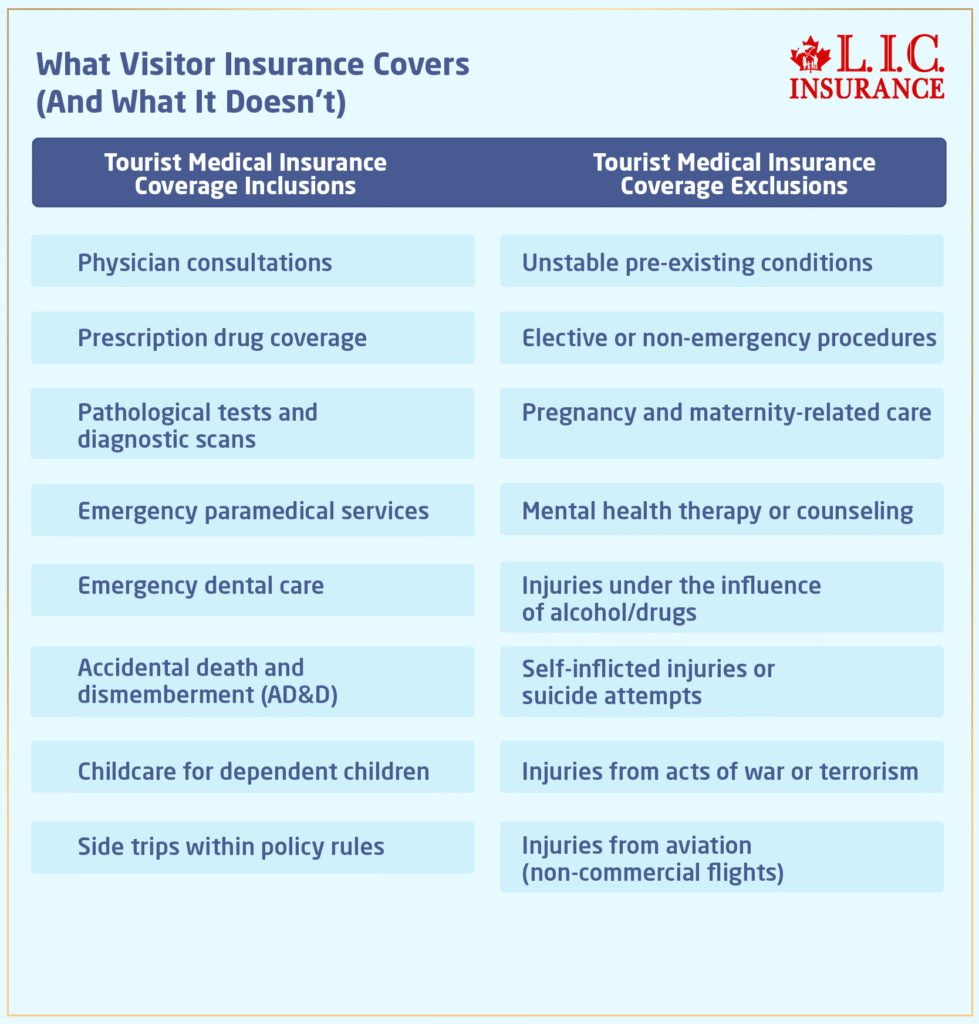

What Visitor Insurance Covers (And What It Doesn’t)

Not all policies are created equal. Knowing what’s included — and what isn’t — can save you stress during a medical emergency.

Our advisors make sure every client understands these details before they buy — because no one likes fine-print surprises when they’re in pain.

Canada Visitor Insurance Cost (2026 Overview)

Estimated monthly premiums for ~$100,000 emergency medical coverage for a 30-day stay.

| Visitor’s Age | Without Pre-Existing Conditions (Approx.) | With Pre-Existing Conditions (Approx.) |

|---|---|---|

| 25 Years | $43–$80 / month | $80–$125 / month |

| 35 Years | $60–$100 / month | $100–$145 / month |

| 45 Years | $80–$125 / month | $125–$185 / month |

| 55 Years | $90–$130 / month | $130–$190 / month |

| 65 Years | $120–$180 / month | $180–$280 / month |

| 75 Years | $200–$300 / month | $280–$480 / month |

| 85+ Years | $300–$450+ / month | $450–$600+ / month |

Notes Based On Current Pricing Patterns:

- Entry-level plans can start lower (as little as ~$43/month for basic coverage) for younger, healthy travellers.

- Older age groups and those needing pre-existing condition coverage see significantly higher prices, often several hundred dollars per month.

- These ranges reflect widely available quote data across common providers and composite rate aggregators; actual rates will depend on plan choices, deductibles, and health underwriting.

Key Pricing Context For 2026

- Age and Health Status Matter Most

Older visitors and travellers with pre-existing conditions consistently pay higher premiums. Plans that cover stable pre-existing conditions and include dental or evacuation benefits cost more than basic emergency plans. - Duration Affects Per-Month Cost

Shorter trips often have higher per-month rates compared with longer stays; some providers price based on total days rather than strict monthly pricing. - $100,000 Is a Common Minimum Requirement

Many visitor and Super Visa insurance policies require at least $100,000 in coverage, but available options range up to $150,000 or more, depending on age and plan choice.

Factors That Affect Visitor Insurance Cost

- Age: Older travellers pay more due to increased risk.

- Length of stay: Longer trips mean higher exposure, hence higher premiums.

- Coverage limit: The higher your medical coverage (e.g., $100K vs $500K), the more you’ll pay.

- Pre-existing conditions: Coverage for stable conditions like controlled diabetes increases cost.

- Destination: Healthcare costs may vary by province, but insurance pricing is generally not province-specific

- Deductible: Higher deductibles lower your premium; lower deductibles mean higher monthly payments.

Our advisors help you adjust these variables smartly — ensuring strong protection without overspending.

Best Visitor Insurance Plans Canada Has To Offer

After 14+ years in the industry, we’ve seen which insurers consistently deliver reliable claims processing and customer support — not just strong marketing.

Here are some of the most trusted names we commonly compare and recommend based on individual needs:

| Insurance Provider | Why It Stands Out |

|---|---|

| Manulife | Comprehensive emergency coverage and global claim network |

| GMS | Excellent pricing with multiple deductible options |

| Tugo | Offers coverage for stable pre-existing conditions |

| 21st Century | Companion discounts for couples and families |

| Secure Travel | Budget-friendly for short-term visitors |

| Travelance | Flexible monthly payment options |

| Blue Cross | Includes “trip break” flexibility to return home temporarily |

Each of these companies offers strong products — but as an independent brokerage, works with all of them, comparing Visitor Insurance quotes online to match every client’s unique situation.

Canadian LIC Vs Direct Insurance Companies

| Feature | Canadian LIC | Manulife / GMS / Tugo / Allianz (Direct) |

|---|---|---|

| Access to Multiple Providers | ✅ Works with 10+ top insurers | ❌ Only their own plans |

| Expert Advisors | ✅ Licensed brokers guiding plan selection | ❌ Self-service or limited support |

| Pre-Existing Condition Review | ✅ Personal assessment for eligibility | ⚠️ Generic forms only |

| Claims Assistance | ✅ Hands-on help during emergencies | ❌ Must contact insurer directly |

| Pricing Advantage | ✅ Compares all available discounts | ❌ Standard retail pricing |

| Custom Coverage Duration | ✅ Flexible start and end dates | ⚠️ Limited flexibility |

| Post-Sale Support | ✅ Available 7 days a week | ⚠️ Customer service hours vary |

| Multi-Language Assistance | ✅ Hindi, Punjabi, English, more | ❌ Mostly English only |

When families buy directly from a single insurer, they often miss better rates or broader coverage that another provider could offer. Through us, you get transparent comparisons — not sales pitches.

Canadian LIC Vs Online Brokers

| Feature | Canadian LIC | PolicyAdvisor / Dundas Life / LifeInsuranceCanada |

|---|---|---|

| Local Presence | ✅ Licensed and operating across provinces | ⚠️ Mostly digital, remote-only |

| Experience | ✅ 14+ years helping visitors & families | ⚠️ Newer online startups |

| Advisor Relationship | ✅ Personalized consultation | ❌ Automated quote system |

| Claim Support | ✅ Dedicated advisor assistance | ❌ Self-managed claim filing |

| Language Support | ✅ Multilingual advisors | ❌ English-only |

| Plan Variety | ✅ Access to 10+ insurers | ⚠️ Limited selection |

| Post-Purchase Service | ✅ Human follow-up & renewals | ❌ Minimal contact post-sale |

| Reputation | ✅ 5-star Google reviews, community trust | ⚠️ Mixed online ratings |

We often get calls from travelers who bought from an online-only broker and then felt lost during claim filing. That’s where we step in — we don’t just sell policies; we stand by you when things go wrong.

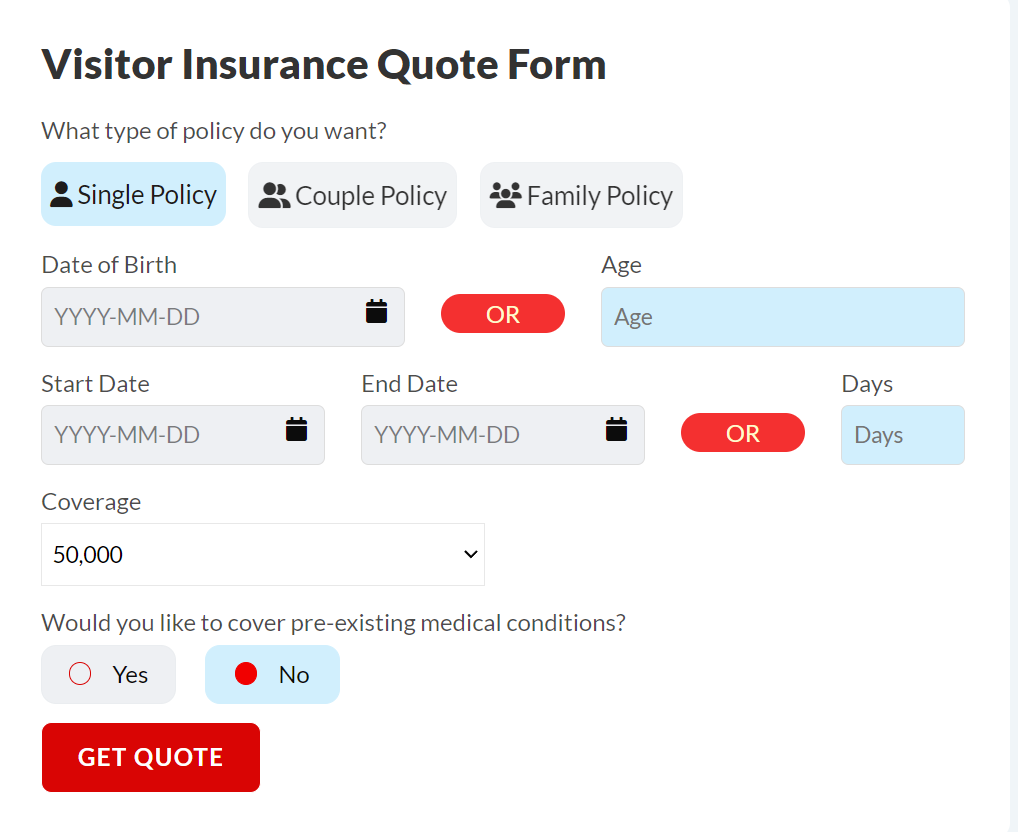

How To Buy Visitor Insurance In Canada

Buying visitor medical insurance is straightforward, but doing it right takes understanding.

- Assess Your Needs:

Decide if you’re coming for tourism, family visits, or a Super Visa stay. - Compare Options:

Use Visitor Insurance brokers to review all available policies side by side. - Review Coverage And Exclusions:

Make sure pre-existing conditions, trip length, and deductible levels fit your needs. - Purchase Online:

Most travelers prefer Visitor Insurance quotes online for quick approvals. Coverage can begin the moment you land. - Keep Documents Handy:

Always carry your policy card or PDF; hospitals often require proof of insurance before treatment.

Clients can compare quotes, apply, and pay online — with advisor support just a call away if they need guidance.

How To File A Claim For Visitor Health Insurance

Filing a claim might seem stressful, especially in a new country, but it’s simple with the right help.

We guide clients through it every step of the way:

- Inform The Insurer Immediately after medical treatment.

- Collect All Documents — original invoices, receipts, and hospital reports.

- Fill Out The Claim Form provided by your insurer.

- Submit Online Or By Email — depending on insurer guidelines.

- Track The Claim — we help you monitor progress and handle any back-and-forth with the insurance company.

One of our client families had a claim worth $12,000 processed in under two weeks — all because they called us first, not the hospital billing department. That’s the difference a broker makes.

Canadian LIC’s Expert Take

Tourists often get a warm welcome in Canada — and they do. But the price for medical care here can be a shock even to a seasoned traveller. For two weeks or two years, health coverage can ensure that travellers find safety instead of uncertainty.

We’re not just selling policies; we’re creating protection plans. That’s why our licensed advisors compare the best Visitor Insurance Policies in Canada, take into account your medical history and get you covered at a low rate – even if you are travelling with pre-existing conditions or parents who visit under the Super Visa program.

With access to leading insurers including Manulife, GMS, Tugo and Travelance, our road is confidential comparisons combined with personal service – all in one place.

Travel is about experiences, not the price tag. Let’s keep it that way.

More on Money Back Life Insurance Policy

FAQs

Medical surprises are never far away, even on a weekend jaunt. Visitor Insurance is the shield against these unpredictable hospital bills, which provides travellers a care-free experience during travel. Here, we’ve assisted many tourists in choosing the standout Visitor Insurance Plans Canada has available for short trips that will keep you safe without breaking your bank.

A broker shops every insurer in one place — rather than locking you to a single company. Our Visitor Insurance brokers provide plain language explanations, highlight hidden exclusions, and customize benefits according to your length of stay and health record — In the process saving time and unnecessary expense.

Yes, but it’s a bit trickier and frequently more expensive. Some insurers have waiting periods or restrict coverage for pre-existing conditions if you purchase after you arrive. To avoid making holes, wireless life insurance Canada always advises applying in advance through online visitor quotes so your protection will start when you arrive by plane.

Family plans usually do not separate adults and children in the policy paperwork; they also lower your overall Canada Visitor Insurance expenses. Our advisers review each member’s medical profile and trip length, then align them with a blend that finds the sweet spot between cost savings and comprehensive medical coverage for the entire family.

However, coverage isn’t a no-go area — it just requires truthful disclosure. Practitioners evaluate stability intervals, typically 90–180 days of being symptom-free. This is why we assist travellers to purchase Visitor Insurance for pre-existing conditions from these companies in Canada, who are more than willing to provide critical emergency insurance coverage, as visitors should not be refused help when they need it the most.

We don’t depend on computer algorithms or blind guesses. Every policy is vetted by licensed professionals who check quotes from several insurers, describe the impact of deductibles and stay involved even after a claim is filed. It’s this personal touch which continues to have us ranked as one of the best Visitor Insurance for parents and newcomers.

Opting for a higher deductible, shorter term or removing optional extras can help cut costs without compromising on safety. Our experts customize every plan to fit travel preferences, age and budget—making a confusing purchase easy, affordable and rapid when you have visiting insurance brokers you can trust.

Most current Visitor Insurance policies treat COVID-19 the same as any other illness, subject to policy terms and exclusions. Pandemic-specific language is no longer standard, but coverage applies as long as the condition was not pre-existing at the time of purchase.

Yes — as long as the policy is still in force and there are no pending claims. Renewal will help long-term visitors stay on continuous coverage, without being subject to new waiting periods. We check expiry dates and alert travellers to renew well in advance so they don’t leave home without Visitor Insurance.

Key Takeaways

- Health Insurance is essential for tourists in Canada, as public healthcare only covers citizens and permanent residents.

- The best Visitor Insurance Plans Canada offers include Visitors to Canada Insurance and Super Visa Insurance, both covering emergency medical care and hospital stays.

- Canada Visitor Insurance cost ranges from $50 to $400 per month, depending on age, trip duration, and coverage limits.

- Travelers with stable conditions can apply for Visitor Insurance with pre-existing conditions, ensuring medical protection without high out-of-pocket expenses.

- Families visiting under the Super Visa program can secure the best Visitor Insurance for parents through licensed advisors for full-year coverage and claim support.

- Working with Visitor Insurance brokers like Canadian LIC ensures unbiased comparisons, personal advice, and easier claim assistance.

- Tourists can compare Visitor Insurance quotes online to find affordable, customizable plans before arriving in Canada.

- Comprehensive coverage guarantees that travelers can focus on their trip — not unexpected hospital bills.

Sources and Further Reading

- Government of Canada – Health Care for Visitors to Canada

https://www.canada.ca/en/immigration-refugees-citizenship/services/visit-canada/health-care.html - Travel Health Insurance Association of Canada (THIA) – Consumer Tips & Statistics

https://www.thiaonline.com - Canadian Life and Health Insurance Association (CLHIA) – Guide to Travel & Health Insurance

https://www.clhia.ca - Ontario Ministry of Health – Non-Resident Health Coverage Information

https://www.health.gov.on.ca/en/public/publications/ohip/travel_coverage.aspx - Alberta Health – Health Coverage for Temporary Visitors and Tourists

https://www.alberta.ca/ahcip-temporary-coverage.aspx - British Columbia Medical Services Plan (MSP) – Coverage for Visitors and Newcomers

https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp/bc-residents/eligibility-and-enrolment/visitors-and-newcomers - Statistics Canada – Tourism and Health Expenditure Data

https://www.statcan.gc.ca - Canadian Institute for Health Information (CIHI) – Hospital Cost Estimates in Canada

https://www.cihi.ca - Global Affairs Canada – Travel and Health Insurance Advisory

https://travel.gc.ca/travelling/health-safety/travel-insurance - Consumer Protection BC – Buying Travel Insurance Safely

https://www.consumerprotectionbc.ca

Feedback Questionnaire:

We’d love to hear from you!

Your experience helps us understand what travelers really face when trying to stay protected in Canada. Please take a minute to share your thoughts below.

Thank you for sharing your thoughts.

A licensed Canadian LIC advisor may reach out if you’ve requested assistance — helping you compare trusted providers, understand fine print, and make your visit worry-free.

IN THIS ARTICLE

- Can Tourists Buy Health Insurance In Canada? A Complete Guide To Visitor Medical Coverage

- Why Tourists Need Health Insurance In Canada

- Is Medical Care Free in Canada for Visitors? Real Costs Without Insurance

- Types Of Visitor Medical Insurance In Canada

- What Visitor Insurance Covers (And What It Doesn’t)

- Canada Visitor Insurance Cost (2025 Overview)

- Factors That Affect Visitor Insurance Cost

- Best Visitor Insurance Plans Canada Has To Offer

- Canadian LIC Vs Direct Insurance Companies

- Canadian LIC Vs Online Brokers

- How To Buy Visitor Insurance In Canada

- How To File A Claim For Visitor Health Insurance

- Canadian LIC’s Expert Take

Sign-in to CanadianLIC

Verify OTP