Travelling is an exciting trip that promises new experiences and memories that you will never forget. But in the excitement of travelling, it’s important not to forget about an important part of getting ready for a trip: getting Travel Insurance. Today, we’ll talk about a question that many people who are excited to travel often have, which is how long you should wait to get Travel Insurance in Canada.

Understanding the Importance of Travel Insurance

Before we talk about when to buy Travel Insurance, let’s quickly go over why it’s so important. In the event of unanticipated circumstances such as trip cancellations, medical problems, or misplaced luggage, Travel Insurance serves as a form of security, providing financial safety. If you want to travel through Canada without stress, you must make sure you have the right coverage.

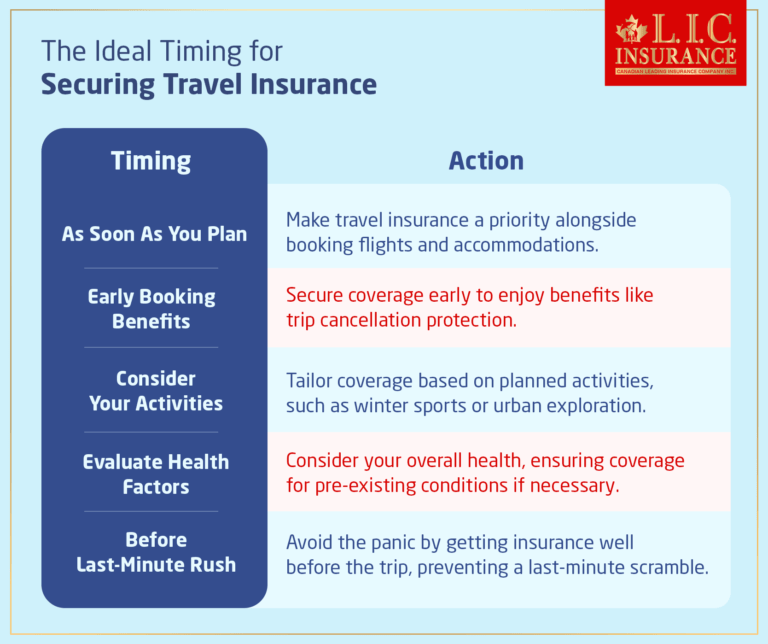

The Ideal Timing for Securing Travel Insurance

Going on a trip is exciting because it means new experiences and seeing things you never thought possible. But when you’re busy planning your trip, getting Travel Insurance doesn’t always get the attention it deserves. The following steps will help you figure out when to get your Travel Insurance put in place for a worry-free trip!

1. As soon as the need to travel comes to mind:

The moment you feel the itch to explore, that’s the perfect time to think about Travel Insurance. As a golden rule, make it a part of your initial trip planning checklist. Don’t let it linger on your to-do list; instead, consider it as important as booking your flights and accommodations. This proactive approach guarantees that you’re taken care of from the start, protecting against any unexpected challenges on the road.

2. People who get there first get the best coverage:

Early birds often get the best deals, like getting the cheapest flights and hotel rooms. For Travel Insurance, it’s the same thing. A multitude of advantages become available when you secure coverage as soon as possible. Some policies come with extra benefits, like protection against trip cancellation that starts a long time before your travel date. Planning ahead of time will make sure you have full coverage and could save you trouble in the future.

3. The Unpredictability Factor:

Life is unpredictable, and so is travel. The journey is full of uncertainties, from sudden flight cancellations to unexpected health issues. By getting your Travel Insurance early, you’re protecting yourself against these unpredictabilities. Whether it’s a family emergency or a sudden change in plans, having coverage in place ensures that you don’t bear the financial pressure of unforeseen circumstances.

4. Beat the Last-Minute Rush:

Imagine that you realize you forgot to get Travel Insurance just days before your much-anticipated trip. As the time runs out, fear sets in, and you’re left rushing to find coverage. This won’t happen if you make getting Travel Insurance a goal early on in the planning process. Avoiding the last-minute rush not only makes for a stress-free experience but also gives you more policies or insurance companies to choose from.

5. The Mental Peace Factor:

Perhaps the most significant advantage of securing Travel Insurance early is the mental peace you get. Knowing that you’re covered in case of unforeseen events allows you to focus on the excitement of your upcoming adventure. It’s like having a travel companion that has your back, ensuring you can embrace your journey confidently and enthusiastically.

6. Where to Begin:

Now that you understand the importance of early planning, kickstart your journey toward securing the best Travel Insurance coverage by obtaining quotes. Explore reputable Travel Insurance providers in Canada that are known for their reliability and comprehensive offerings. A quick online search for “Travel Insurance Providers in Canada” can lead you to trustworthy options. Remember, a reliable provider offers competitive rates and ensures prompt and hassle-free claim settlements.

Factors Influencing Your Decision

Travelling is an exciting experience that offers limitless opportunities, but having the right kind of Travel Insurance is also essential. As you get ready to buy your coverage, let’s go over the things that should help you make your choice. Keep your seat belt on for a simple explanation of how to make your Travel Insurance fit your needs.

1. The Coverage Start Date Dilemma:

Imagine that you are very excited and have your bags packed and tickets in hand. All of a sudden, something unexpected happens that makes you cancel your trip. That’s when the service start date really matters. A lot of policies offer benefits like protection against trip cancellation well before your real departure date. Pay attention to this when you’re looking for Travel Insurance quotes. You’ll be protected even before you go on your adventure if you choose insurance with early coverage initiation.

2. Tailoring Coverage to Your Destination:

Canada is a big country with a lot of different climates and surroundings. If you’re heading to the snowy mountains or the bustling cities, your Travel Insurance needs may vary. Consider your travel destination carefully and tailor your coverage accordingly. For instance, if you’re planning a winter sports extravaganza in the Rockies, ensure your policy includes coverage for skiing or snowboarding mishaps. Similarly, urban explorers might want coverage for theft or lost belongings in crowded areas. So, wisely choose a policy that aligns with the specific risks associated with your destination.

3. Activities Matter – Choose Wisely:

Would you rather take a leisurely stroll through historical places, or are you someone who is constantly looking for thrills in the great outdoors? Your chosen activities significantly impact the type of coverage you need. If you’re planning on scuba diving in the crystal-clear waters of Vancouver Island or hiking the rugged trails of Banff National Park, ensure your policy covers potential risks related to these activities. However, if your plans include more low-key activities, you can change your coverage to fit those needs. Remember to include the things you’ll be doing when you get a quote for Travel Insurance to make sure you get full coverage.

4. Health Comes First:

Your overall health is the most important factor when selecting Travel Insurance. Take a moment to evaluate your medical needs and potential health risks. If you have pre-existing conditions, ensure that your policy covers them adequately. Consider the level of medical coverage provided, especially if you’re travelling to remote areas where access to medical facilities may be limited. Having complete protection guarantees that you won’t be unprepared for unforeseen medical problems.

5. The Budget Balancing Act:

It’s important to have full coverage, but it’s also important to stick to your budget. There are different types of Travel Insurance policies in Canada, each with different levels of coverage and different premiums. Take the time to obtain quotes from reputable providers to compare costs and benefits. This allows you to make a well-aware choice that is per your financial comfort and the coverage you need. Remember, finding the right balance ensures that you’re not overpaying for unnecessary coverage or compromising on protection.

Where to Get Your Travel Insurance Quote

| Source | Characteristics |

|---|---|

| Online Search | A quick Google search for “travel insurance providers in Canada” can lead you to a variety of options. |

| Local Providers | Consider homegrown heroes – local providers who understand the unique needs of Canadian travellers. |

| Recommendations | Seek advice from friends, family, or online communities for trusted recommendations based on personal experiences. |

| Reviews | Dive into online reviews to gain insights into the experiences of fellow travellers with different insurance providers. |

| Established Providers | Explore well-established providers with a history of serving travellers, often indicating reliability and comprehensive offerings. |

| User-Friendly Websites | Navigate through the websites of potential providers, looking for a user-friendly interface that simplifies the quoting process. |

| Competitive Rates | Compare quotes from different providers to find the best value for your money, considering both affordability and coverage. |

Deciding to get Travel Insurance is like walking onto a road that will bring your mind to ease. What is the first important step? Getting a Travel Insurance quote. Let’s simplify this important process with simple points that will make it easy for you to choose a provider.

1. Google is Your Ally:

In today’s digital world, Google has become your trustworthy companion. A simple online search for the best Travel Insurance companies in Canada can open the door to many options. Take a moment to scroll through the search results and explore providers that catch your eye. Google is like your virtual map, guiding you to reputable destinations.

2. Homegrown Heroes – Local Providers Matter:

While the internet is vast, there’s something comforting about choosing a homegrown hero. Local Travel Insurance providers in Canada often understand travellers’ unique needs. Look for names that resonate within the Canadian surroundings and have a reputation for reliability. After all, who knows better than a Canadian provider the challenges of exploring the Rockies or the charm of Quebec?

3. Trusted Tales – Seek Recommendations:

Just as fellow travellers share tales of their adventures, seek recommendations from friends, family, or fellow explorers. Their experiences with Travel Insurance providers can provide valuable insights. Were they impressed by seamless claim settlements or the efficiency of customer service? Trusted tales can guide you toward providers who have proved themselves in the world of Travel Insurance.

4. The Power of Reviews:

In the digital age, reviews are your treasure of authentic information. Carefully read the online reviews for different Travel Insurance providers. What are the fellow travellers saying about their experiences? Pay attention to patterns – consistent positive reviews are like the guiding light, taking you toward providers with a track record of reliability and customer satisfaction.

5. The Classics – Established Providers Shine:

In the realm of Travel Insurance, the classics often shine. Look for well-established providers with a good history of serving travellers. These companies have been in the business for a long time and have learned how to make their products better to meet the needs of all kinds of explorers. The classics are classics for a reason – they stand the test of time.

6. User-Friendly Websites – Go through with Ease:

Once you’ve identified potential providers, walk through their websites once as well. A website that is easy to use is like a well-marked pathway; it makes it easy to find what you’re looking for, understand the rules, and get a Travel Insurance quote. Providers that prioritize a seamless online experience often reflect the same commitment to their services.

7. Competitive Rates – Where Value Meets Affordability:

While securing reliable coverage is important, the affordability factor is equally important. Seek providers offering competitive rates that meet your budget requirements. Remember, it’s not just about the lowest price but the best value for your specific travel needs. Finding that sweet spot where value meets affordability ensures you start on your adventure without burning a hole in your pocket.

The End

Overall, getting Travel Insurance is an important step that should be taken as soon as possible when planning a trip. By making this important part of planning a trip a top priority, you not only protect your trip against the unexpected but also set the stage for a stress-free adventure. Remember that a good policy from a reputable Canadian Travel Insurance company can make all the difference in making sure your trip is both fun and safe at the same time. Have a safe journey!

Go here for Tips on buying Travel Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) about Travel Insurance in Canada

It’s advisable to start thinking about Travel Insurance as soon as you begin planning your trip. Ideally, make it a priority alongside booking your flights and accommodations to ensure comprehensive coverage from the start.

Absolutely! In fact, it’s a smart move. You can request Travel Insurance quotes from multiple providers early in your planning process to compare coverage, deductibles, and premiums. This allows you to make an informed decision that is similar to your budget and travel needs.

Yes, many Travel Insurance policies offer coverage for cancelled flights due to unforeseen circumstances like illness, severe weather, or airline strikes. Check the policy details for the specific covered reasons.

No, Travel Insurance must be purchased before your departure. Once your journey has commenced, it’s usually not possible to buy or extend coverage.

In some cases, Travel Insurance providers may request access to your medical records to assess pre-existing conditions or verify the necessity of a claim. It’s crucial to be transparent about your health history during the application process.

Many Travel Insurance policies have a cooling-off period, typically within 10 to 15 days of purchase, during which you can cancel the policy and receive a refund. After this period, cancellations and refunds may be subject to specific terms outlined in the policy.

Yes, some Travel Insurance policies allow for extensions. It’s important to contact an insurance expert well before the policy expiration date to inquire about extension options and associated costs.

The type of Travel Insurance you need depends on various factors, including your destination, planned activities, and personal health. Consider options such as trip cancellation, emergency medical coverage, and coverage for lost or stolen belongings. Choosing a policy that is suitable for your specific travel needs and also provides adequate coverage is advisable.

A quick online search for “Travel Insurance Providers in Canada” can lead you to trustworthy options. Additionally, consider recommendations from friends, family, or online communities, and explore reviews to determine the experiences of fellow travellers.

Tailor your coverage based on factors such as your travel destination, planned activities, health considerations, and the coverage start date. Assess the risks associated with your specific trip to ensure your policy meets your unique needs.

Comparing quotes allows you to assess coverage, deductibles, and premiums offered by different providers. This step ensures you find the best value for your money and select a policy that comes in line with your budget and travel requirements.

Local providers often have a better understanding of the unique needs of Canadian travellers. However, the key is to choose a provider with a strong reputation for reliability and comprehensive offerings, whether they are local or international.

The coverage start date is crucial, as some policies offer benefits like trip cancellation protection well before your departure date. Pay attention to this detail to ensure you’re protected from the early stages of your journey.

Opt for a reliable provider with a history of prompt and hassle-free claim settlements. Reading reviews and seeking recommendations can provide insights into the efficiency of a provider’s claims process.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]