- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I Extend My Visitor Insurance If I Decide to Stay Longer?

- Can I Use Visitor Insurance for Routine Check-Ups and Preventive Care?

- Can a Visitor Visa Be Converted to a Super Visa?

- Is Visitor Insurance the Same as Travel Insurance?

- Can I Get Visitor Insurance with Pre-Existing Conditions?

- Can I Buy Visitor Insurance After Arrival in Canada?

Can I Add Family Members to My Visitor Insurance Policy?

SUMMARY

Adding family members to your Visitor Insurance Policy saves time, stress, and money. This blog discusses why it really pays off, especially for parents and children, as well as how family Visitor Insurance plans are cost-effective by offering coverage under one single policy. Types of Plans, how to add your family members, considerations when looking for Visitor Insurance, special key considerations for parents needing health care, and finally, comparisons of Visitor Insurance quotes are all included. Practical insights and client stories highlight the importance of preparing for emergencies when travelling with loved ones.

- 11 min read

- September 24th, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- September 24th, 2024

Introduction

You are planning a trip to Canada with your parents, spouse, or your kids. You have arranged travel; however, the one thing that is still at the back of your mind is health insurance. What if someone falls ill during the trip and needs emergency care? Like many others who are in your shoes, you wonder, “Can I add my family members to my Visitor Insurance Policy? “This would most likely be your concern, especially if you have multiple family members staying under one roof and in one plan.

Whether one needs insurance for visitors’ parents or kids, it is always confusing when one does not know where to start. Where Canadian LIC comes in is that we have utilized our experience with clients who are families trying to get everyone in one plan and ensure every person is on board as well. We at Canadian LIC are here to help such families. In this blog, we discuss adding family members to a Visitor Insurance Policy in Canada: what’s offered, what kind of plans are available, and how to compare quotes.

More importantly, we share key insights into how Visitor Insurance for parents, Visitor Insurance for families, and even Visitor Insurance for grandparents can be customized to suit different health needs. If you’re exploring parents Visitor Insurance Canada policies that offer value and flexibility, you’re in the right place. Let us walk you through practical strategies that many families miss when planning their trip. Getting this right could save you from major financial stress during your stay in Canada.

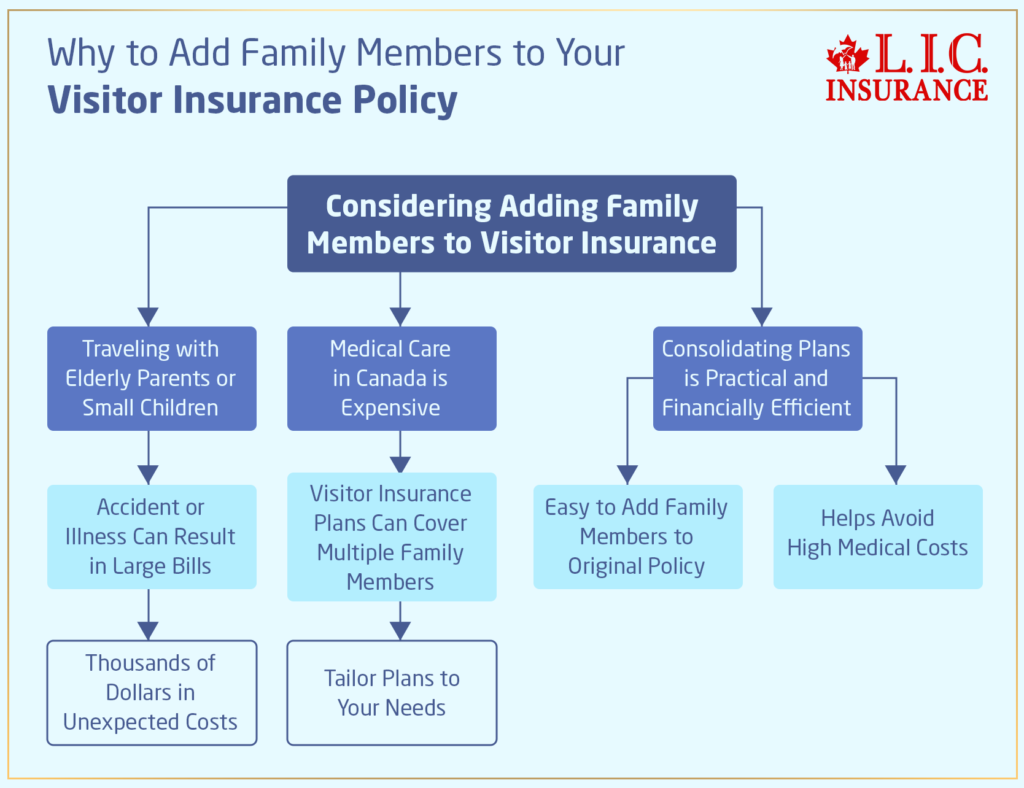

Why You Might Want to Add Family Members to Your Visitor Insurance Policy

Adding family members to your Visitor Insurance Policy can be a game changer, especially if you are travelling with elderly parents or small children. Medical care in Canada is expensive, and a single accident or illness will result in thousands of dollars worth of unexpected bills. For many of our clients at Canadian LIC, insuring multiple family members may be a price they just can’t afford to add to their Visitor Insurance. But the best part is that Visitor Insurance Plans can be tailored according to your requirements, covering more than one person in a single policy. Whichever you look for, Visitor Insurance for Parents or your spouse and kids or consolidation of plans can be financially and practically very efficient.

One of the client stories I recall is that of a family from India. The father had taken Visitor Insurance, but the parents hadn’t. His father fell ill when they were in the country, and without insurance, they got charged very highly for their medical treatment. They returned to Canadian LIC for better options and found it was easy to add the family to the original policy. This is much more common than you think, and that is precisely why we advise adding family members to your coverage whenever possible.

Types of Visitor Insurance Plans You Can Choose

When talking about Visitor Insurance Plans in Canada, there is no one-size-fits-all; you can have a separate plan for every member of the family or combine all your family members into one insurance family plan. Here are the primary types of plans available that you might consider:

- Individual Visitor Insurance Plans: Ideal for those travelling alone or with specific health needs. For example, if you only need Visitor Insurance for Parents who may have pre-existing medical conditions, an individual plan could be the best choice.

- Family Visitor Insurance Plans: These plans allow you to add multiple family members to one policy. They are cost-effective and simpler to manage since you’re only dealing with one policy. This can include your spouse, parents, and children, all under one umbrella of coverage.

One of the major advantages of family Visitor Insurance Plans is that the coverage tends to extend to all insured family members for emergency medical situations, hospitalizations, and often even dental emergencies. However, age and health status may also impact the cost, so be sure to compare quotes for a variety of Visitor Insurance Policies.

How to Add Family Members to Your Visitor Insurance Policy

Actually, the most frequent question we receive from our clients who request coverage through the Canadian LIC is, “How do I add family members to my policy?” It doesn’t matter if you’re looking to add parents on Visitor Insurance, children, or a spouse. The addition is usually straightforward but may slightly vary depending on your provider.

- Identify the Family Members You Want to Add: Start by deciding who you need to cover under the Visitor Insurance Policy. Are you looking to insure just your parents, or do you also want to include your spouse and kids?

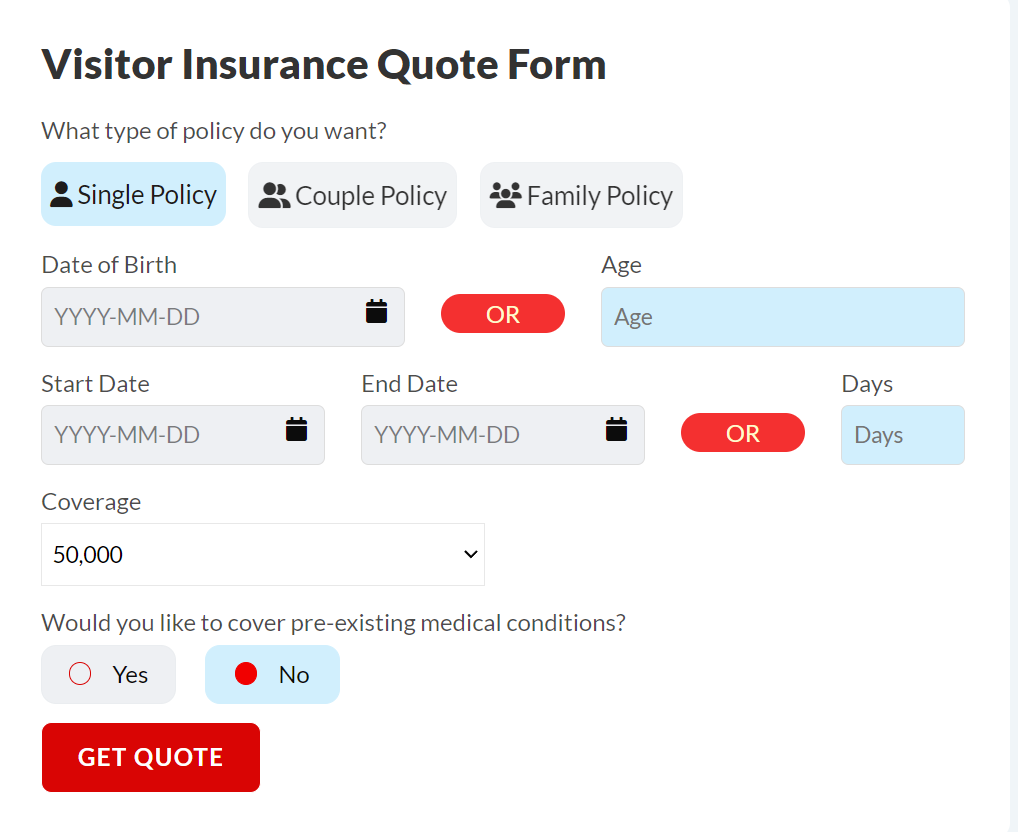

- Get a Visitor Insurance Quote: Once you know who you want to add, request a Visitor Insurance Quote. This is especially important if some family members have pre-existing conditions or fall into different age brackets, as the costs can vary significantly.

- Customizing Your Coverage: Each family member’s needs can differ. For example, your parents may need more extensive medical coverage due to their age, while your spouse and children may only require basic coverage. Many Visitor Insurance Plans offer customizable options, so you can adjust the coverage limits based on each family member’s requirements.

- Reviewing and Finalizing the Plan: After choosing the right Visitor Insurance plan, review all the terms and conditions carefully. Ensure that the policy covers all the necessary medical services, such as doctor consultations, hospital stays, and prescription medications, and confirm there are no exclusions for pre-existing conditions unless clearly stated.

Visitor Insurance for Parents: Key Considerations

Probably the biggest issue we have is parental Visitor Insurance, primarily with parents coming to Canada on a Super Visa. Parents are usually more likely to require higher coverage as they are older and might have age-related health issues. Consequently, a significant number of families take Super Visa Insurance, which has much greater limits on coverage and will usually run for at least a year but at least $100,000.

Our other client was visiting from China with their parents on a Super Visa. It was very tough for him to find a plan that would satisfy the stringent coverage requirements. This was overwhelming, but he finally came to Canadian LIC, and we were able to custom tailor a family Visitor Insurance plan covering his parents so that he could have the fullest coverage available to his parents in order for them to feel at ease during their stay in Canada.

Considerations while taking Visitor Insurance for Parents:

- Pre-Existing Medical Conditions: Many plans have limitations or exclusions for pre-existing conditions. Be honest and clear when providing health information to ensure claims are not denied later.

- Coverage Limits: Always opt for higher coverage limits, especially if your parents are older. The higher premium is often worth it for the extensive coverage.

Comparing Visitor Insurance Quotes for Family Plans

While choosing the Visitor Insurance plan can be really quite daunting, given all the choices out there in the market, comparing Visitor Insurance Quotes from a number of insurance providers is highly recommended to get the best deal for your family.

Here are some tips on how to compare Visitor Insurance Quotes:

- Coverage Amounts: Ensure each quote offers a similar coverage amount so that you’re comparing apples to apples. You don’t want to choose a cheaper plan only to discover it doesn’t cover hospitalization or other necessary services.

- Policy Flexibility: Look for flexibility in terms of adding or removing family members from the policy. Some providers may charge extra for making changes mid-policy, while others offer more lenient terms.

- Exclusions: Carefully review what’s excluded from the policy. Some Visitor Insurance Plans might exclude high-risk activities, certain medications, or treatment related to pre-existing conditions.

- Customer Service: Always consider the customer service experience when comparing providers. At Canadian LIC, we pride ourselves on being there for our clients, guiding them every step of the way, especially when they’re managing policies for multiple family members.

Hidden Costs Most Families Overlook When Buying Visitor Insurance in Canada

One area where many families trip up when buying Visitor Insurance for parents or extended relatives is underestimating the hidden and indirect costs involved in managing multiple individual plans. At Canadian LIC, we’ve worked with hundreds of families who initially opted for individual policies for each visitor, only to return weeks later feeling overwhelmed—financially and logistically.

Let’s break it down: having separate policies for mom, dad, and grandma might seem simple upfront. But when something goes wrong—say, a hospital visit or a change in travel dates—each policy must be handled separately. That means three claim forms, three different customer service queues, and possibly different outcomes for each case. This not only increases the risk of miscommunication but also makes it harder to track deductibles, coverage limits, or renewal timelines.

This is why we recommend Visitor Insurance for families or multi-person policies wherever possible. These plans consolidate administrative overhead and often come at a lower combined premium. More importantly, they ensure cohesive coverage—critical when you’re dealing with aging parents or vulnerable relatives like young children.

We’ve also observed that clients who purchase Visitor Insurance for grandparents under a family plan experience smoother claim settlements because the plan’s structure recognizes the family as a unit—not isolated individuals. For those looking into parents Visitor Insurance in Canada, this distinction can save both time and money while ensuring better care access during medical emergencies.

In short, while most competitors talk about “adding members” or “customizing plans,” very few shed light on the operational and emotional ease that comes with bundling policies. We’ve seen firsthand how families can reduce risk, avoid disputes, and manage care more efficiently when they think beyond just premiums—and that’s the kind of insight we believe every visitor to Canada deserves.

Adding Family Members Mid-Trip: Is It Possible?

We get asked a lot whether you can add family members to your Visitor Insurance Policy when the trip is already underway. The short answer is: it depends. Some providers allow you to add family members mid-trip, while others do not. Add all family members to the policy before you go, but if you join your family mid-trip, you would need to contact your insurer to see if they can add the family member to the policy.

Our client Joe was put in the same shoes as his daughter, who wanted to join him in Canada midway through his visit. He hadn’t included her in the initial plan, thinking she wouldn’t be coming. After contacting Canadian LIC, we were able to include her in his policy mid-trip.

Final Thoughts

It is not a visit that should be taken lightly, especially if the family members have aged parents or children. Adding family members to a Visitor Insurance Policy will not only save time but will ensure that all can get medical attention in case of an emergency. At Canadian LIC, we have seen firsthand the stress that results from falling ill without proper coverage. Planning ahead, including all members of the family in your Visitor Insurance, will spare you from the horrors of unexpected medical expenses while enjoying your trip.

Don’t wait until it’s too late—contact Canadian LIC today to find out about Visitor Insurance Plans for the whole family. No matter if it’s Visitor Insurance for your parents or a full family plan, we are here to find the right coverage at the right price. Obtain a Visitor Insurance Quote and start taking steps to secure the peace of mind you deserve while staying in Canada.

More on Visitor Visa and Visitor Insurance

FAQS

Here are some of the most frequently asked questions about adding family members to a Visitor Insurance Policy in Canada.

Yes, you can add your parents to your Visitor Insurance plan. Many of our clients at Canadian LIC come to us because they are bringing their parents on trips to Canada and want them protected. Adding them to your Visitor Insurance plan is an easy way to ensure everyone is covered. We often see families opt for Visitor Insurance for Parents to save money and keep everything in one policy. Be sure to request a Visitor Insurance Quote that includes family members to compare options.

Adding family members, like parents or children, to your Visitor Insurance plan can increase the cost, but many providers offer family plans that are more affordable than individual policies. One of our clients realized they could save a significant amount by combining their insurance into one plan. We recommend getting a Visitor Insurance Quote to understand how much adding each family member would cost. It’s often cheaper and easier than managing separate plans.

Yes, you can add your children to your Visitor Insurance Policy. Many families travelling together prefer to have everyone under one plan. At Canadian LIC, we’ve helped families travelling to Canada cover their kids under the same Visitor Insurance Plans as the parents. This simplifies the process and ensures everyone is protected, especially if a medical emergency happens during the trip.

If you don’t add your parents to your Visitor Insurance plan, they won’t be covered in case of a medical emergency. We’ve had clients who initially didn’t include their parents and then faced high medical bills when an unexpected illness occurred. Visitor Insurance for Parents is a wise choice to avoid these situations. Always check with us for a Visitor Insurance Quote to see the difference it can make.

In many cases, yes, you can add a family member after the policy is in place, but it depends on the insurance provider. Some of our clients at Canadian LIC have added family members like parents or spouses later during their stay. However, we always recommend adding everyone at the start to avoid complications. It’s best to ask for a Visitor Insurance Quote upfront with all family members included.

Adding family members to your Visitor Insurance plan doesn’t automatically cover pre-existing conditions unless it’s explicitly mentioned in the policy. At Canadian LIC, we often help clients find Visitor Insurance Plans that consider these conditions. If your parents or spouse have pre-existing conditions, make sure to ask about this when requesting a Visitor Insurance Quote.

Yes, some Visitor Insurance Plans allow you to customize coverage for each family member. For example, you may choose higher coverage for your parents due to their age and lower coverage for younger family members. Many of our clients at Canadian LIC appreciate the flexibility of Visitor Insurance Plans, as it helps them manage costs while ensuring the right level of coverage for everyone.

The best way to get a Visitor Insurance Quote is to provide all the necessary information about each family member you want to insure. This includes their age, health status, and length of stay in Canada. At Canadian LIC, we’ve seen clients save time and money by gathering all this information ahead of time. You can then compare different Visitor Insurance Plans to find the best option for your family.

Yes, adding your spouse to your Visitor Insurance Policy will affect your premium, but the increase depends on factors like age and health. One of our clients found that including their spouse in a family plan was much more affordable than purchasing two separate policies. We recommend requesting a Visitor Insurance Quote that includes all family members to see how much your premium will be.

Yes, you can usually cancel the insurance for a family member if they leave Canada before the policy ends. Many of our clients have adjusted their Visitor Insurance Plans when their parents or children returned home earlier than expected. Just keep in mind that some insurance providers may charge a fee, so it’s important to review the cancellation terms when getting a Visitor Insurance Quote.

Here are the FAQs based on real questions our clients at Canadian LIC have asked us, wherein we help secure Visitor Insurance Plans for their loved ones travelling to Canada. Finding the right coverage for your parents, spouse, or children doesn’t have to be rocket science. Let us walk you through it!

Sources and Further Reading

- Government of Canada – Visitors to Canada: Health Coverage

- This official government page provides an overview of health coverage options for visitors to Canada, including information on the importance of Visitor Insurance.

- Government of Canada Website

- Canadian Life and Health Insurance Association (CLHIA)

- CLHIA offers guidelines and best practices on Visitor Insurance and related policies for visitors, families, and those applying for Super Visas.

- CLHIA Website

- Insurance Bureau of Canada – Visitor Insurance

- This resource covers the types of Visitor Insurance available, the coverage they offer, and recommendations on selecting a policy.

- Insurance Bureau of Canada Website

- Super Visa Insurance Requirements

- If you’re adding family members for a Super Visa, this page provides essential details on minimum coverage requirements for parents and grandparents.

- Super Visa Information

These sources provide a well-rounded understanding of Visitor Insurance Policies and can help you further explore adding family members to your insurance plan.

Key Takeaways

- You can add family members: It’s possible to add your parents, spouse, or children to your Visitor Insurance plan, simplifying the process.

- Family plans save money: Combining family members under one Visitor Insurance plan is often more cost-effective than individual policies.

- Customize coverage: Visitor Insurance Plans can be tailored to each family member’s needs, ensuring the right level of protection.

- Request a quote: Always get a Visitor Insurance Quote for your entire family to compare costs and coverage options.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

This questionnaire aims to gather detailed insights into the specific struggles people face, allowing you to address them better.

IN THIS ARTICLE

- Can I Add Family Members to My Visitor Insurance Policy?

- Why You Might Want to Add Family Members to Your Visitor Insurance Policy

- Types of Visitor Insurance Plans You Can Choose

- How to Add Family Members to Your Visitor Insurance Policy

- Visitor Insurance for Parents: Key Considerations

- Comparing Visitor Insurance Quotes for Family Plans

- Hidden Costs Most Families Overlook When Buying Visitor Insurance in Canada

- Adding Family Members Mid-Trip: Is It Possible?

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP