- Can I Purchase Critical Illness Insurance If I Am Already Retired?

- Understanding Critical Illness Insurance for Retirees

- Factors Affecting Eligibility and Cost for Retirees

- Available Critical Health Insurance Plans for Retirees

- The Importance of Comparing Critical Health Insurance Quotes

- How to Apply for Critical Illness Insurance as a Retiree

- The Role of Critical Illness Insurance in Retirement Planning

- Choosing the Right Critical Health Insurance Company

- The Peace of Mind that Comes with Coverage

- Final Thoughts: Taking Action with Canadian LIC

Retirement is often viewed as the time one should take it easy, live life, and indulge in the things that time wouldn’t permit one to do in the high days of work. But with the freedom of retirement comes the responsibility to handle health and finances in a manner that protects your lifestyle and peace of mind. One of the most important facets of preparing for this stage in your life involves taking out appropriate insurance to protect you against the unexpected burden of medical expenses. Critical Illness Insurance is one such coverage that offers protection against severe health conditions. The most common challenge faced by many retirees in Canada is the nagging question, “Will I be able to buy Critical Illness Insurance if I’m already retired?”

At Canadian LIC, we have spoken to retirees who are concerned about their health and the financial implications of life-threatening illnesses. They often share their worries about not having enough coverage or not being eligible for Critical Illness Insurance due to their age. These are real concerns, especially when considering how a sudden illness can drain savings, disrupt retirement plans, and create unexpected financial burdens. Through daily communication with clients, it has come to our attention that retirees would love to seek solutions that offer financial security and peace of mind, but they are totally confused as to where to start or if it is even possible to get Critical Illness Insurance at their age.

Understanding Critical Illness Insurance for Retirees

Critical Illness Insurance pays out a lump sum benefit in the case of having one of the serious medical conditions covered under the policy, such as cancer, heart attack, or stroke. How you choose to use the payment is up to you, whether it’s paying off medical bills and alternate treatments or home modifications because of new needs due to your illness. The primary critical illness benefit is financial flexibility at an unpleasant time.

One of the most frequent questions asked by retirees is, “Can I buy Critical Illness Insurance after retirement?” The answer is simply yes but with some consideration. Most Canadian insurance companies offer Critical Illness Insurance Plans for older adults. Still, availability and cost, as well as available options, depend on several factors, including, but not limited to, age, health status, and the insurer’s underwriting policy.

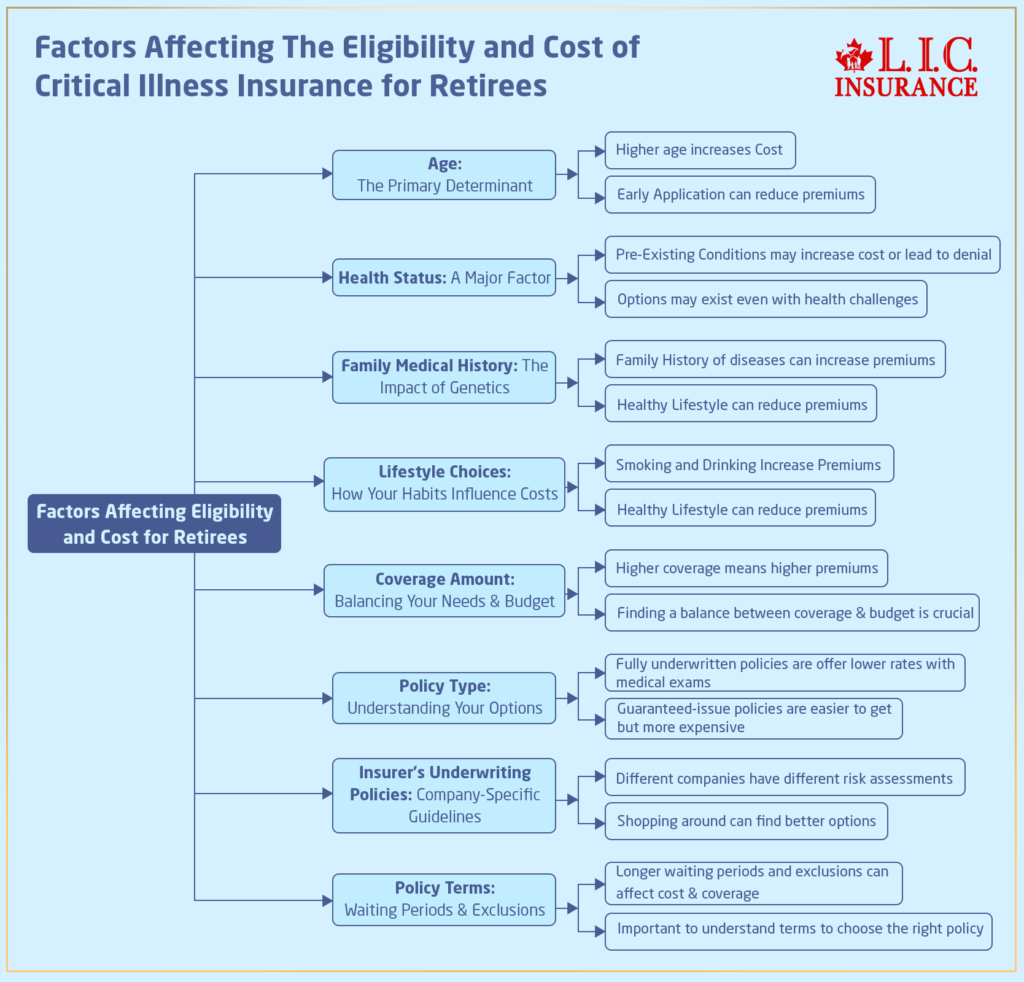

Factors Affecting Eligibility and Cost for Retirees

For a retiree, buying Critical Illness Insurance is based on a number of individual variables that affect your eligibility for the policy and the cost. At Canadian LIC, we often walk our clients through these considerations to select the most appropriate Critical Health Insurance Plans for their needs. Here’s an overview of the important factors that will or may affect your insurance choices:

Age: The Primary Determinant

Age is a very major determinant of the availability of Critical Illness Insurance and certainly the cost. The older you get, the higher your risk of contracting a serious illness, and insurers do take that into consideration when deciding on how to set their premium structures. More often than not, our clients in their 60s or over are quoted higher compared with other younger applicants. For example, one gentleman in his early 60s approached us after one of his close friends was diagnosed with cancer. He was apprehensive about the similar costs he might incur and wanted to be covered. We could manage to obtain Critical Health Insurance Quotes for him but at substantially higher premiums than if he had applied when younger. This experience is common, which is why it’s essential to consider Critical Illness Insurance sooner rather than later.

Health Status: A Major Factor

Another factor assessed by the insurers is your current health status. Those with pre-existing conditions may be highly charged or even declined coverage by some of the Critical Health Insurance firms in Canada. We once dealt with some clients who were afraid of what their health could bring regarding their eligibility for health insurance. For instance, we had a client who had heart disease in the past and was skeptical that no insurance company would ever insure him. However, in working with us, a plan was found that considered his health and yet proved to be the coverage he needed. This shows that even when there is a health challenge, options may exist.

Family Medical History: The Impact of Genetics

Your family’s medical history influences your risk profile that the insurer calculates. Thus, if your immediate family members have a history of life-threatening diseases, it may increase the premiums paid of the policy. We have handled cases where our clients had parents or siblings who suffered from critical illnesses, and it showed up in their insurance quotes. Yes, family history plays a role, but that doesn’t necessarily spell doom for you. With our guidance, you can find Critical Health Insurance Plans that take these disadvantages into consideration but still offer reasonable coverage.

Lifestyle Choices: How Your Habits Influence Costs

Your lifestyle can also greatly influence how much you pay for insurance: smoking, drinking, and exercise come into play in determining the cost of your insurance. Smokers are usually charged higher premiums because they run a greater risk for serious diseases such as lung cancer. One recent client, a retiree who had given up smoking many years earlier, remained apprehensive about how smoking would continue to affect his insurance rates. We worked out a plan that reflected his current healthier lifestyle and thus had lower premiums after some discussion about his options.

Coverage Amount: Balancing Your Needs and Budget

The amount of coverage you choose directly impacts your premium costs. The higher coverage amount, naturally, provides a more expensive premium. Many times, we work with clients to find a balance between the amount of protection they need and what their budget can sustain. Recently, for example, one retired client needed substantial coverage but was sensitive about the cost. By working through several Critical Health Insurance Plans and quotes, we were able to find a middle ground where his coverage was considered adequate without making him unduly bear additional financial stress or strain. It’s all about finding a balance that suits you.

Policy Type: Understanding Your Options

The type of Critical Illness Insurance Policy that is chosen also can impact both eligibility and cost. In this regard, there typically are two key categories of retiree policies: those that are fully underwritten and those that come with a guaranteed issue. Fully underwritten Critical Illness Policies require a medical exam, as well as a comprehensive health questionnaire, but generally provide more complete coverage at lower rates. While guaranteed-issue policies require no medical examination, one can easily qualify for them. However, they may be more costly and limit coverage. A retired gentleman did not want to take a medical exam, so we could place him with a guaranteed issue policy that provided the amount of coverage he was comfortable with, although at a slightly higher cost. It is a matter of what each policy type can offer and then choosing what suits you best.

Insurer’s Underwriting Policies: Company-Specific Guidelines

Understandably, various insurance companies subscribe to various underwriting policies, and hence, their acceptability of your case and premiums can vary based on the different insurance firms. We have seen many clients declined by one company but approved by another with a slightly varied risk assessment. It is for this reason that we compare Critical Health Insurance Quotes from different firms here in Canada to make certain our clients receive the best option available. One client had a minor health issue pop up, so he’d been declined by multiple providers. He filled out an application with a company that specialized in retirees with that specific condition. He was approved. Again, this shows the need to pursue all avenues and not let one negative decision from an insurance company be the final word.

Policy Terms: Waiting Periods and Exclusions

Other conditions of your Critical Illness Insurance Coverage, such as waiting periods and exclusions, may also affect the scope of your coverage and the cost of the policy. Other policies have longer waiting periods before you can claim under the policy, while others may exclude certain conditions due to your medical history. We have assisted a client who was concerned about the waiting period for her policy. We could then compare a number of other Critical Health Insurance schemes and find one with a lesser waiting period for our client. Understanding these terms is crucial to the choice of the right policy, especially when health concerns are in the prime of consideration at retirement.

Available Critical Health Insurance Plans for Retirees

The different products of Critical Health Insurance in Canada can be quite varied to suit the needs of different age groups and health profiles. A number of insurance companies have developed specific plans for seniors, recognizing that their needs differ from those of younger adults. These plans may come with certain limitations, such as reduced coverage amounts or fewer covered conditions, but they still provide valuable protection.

For instance, we have recently taken a retired couple in their late 60s who needed coverage primarily for heart-related illnesses due to a family history of such diseases. After some research, we found one such plan offered by one of the reputable Critical Health Insurance Companies here in Canada that provided specific coverage pertaining to cardiovascular conditions. They were also grateful that this was designed for seniors, affording them security in retirement.

For this reason, the details of each policy need to be carefully gone through with a view to the exclusions applied, the coverage area, and the waiting period before the coverage kicks in. Other insurers have guaranteed issue policies, which don’t need to check on health conditions but have limits to the cover amount or are more costly. These plans may be a good option for retirees with possible pre-existing conditions or who are concerned about being declined due to health history.

The Importance of Comparing Critical Health Insurance Quotes

The comparison of Critical Illness Insurance quotations from many service providers is a necessary step for the retiree. Very often, we at Canadian LIC extend help to our clients as we endeavour to collect quotes for Critical Health Insurance of various companies from Canada, comparing their values. This process allows retirees to see a range of options and make an informed decision based on their needs and budget.

We worked with a retired teacher who right away saw the problem with too many choices. She was afraid that maybe she would make an inappropriate selection of a plan while overpaying for coverage that she could live her whole life without ever needing. We took her through the various quotes and let her know the pros and cons of each so she was able to choose the plan that would give her the best balance of coverage versus affordability. This way, she is not only saving money but also gaining trust that she is making a wise financial decision.

Quote comparison is thus a critical step as it illustrates how divergent the premiums and coverage can be with the multiple insurers. Some companies can have a lower premium but with more limitations in coverage, while some may accord broadly at higher costs. In understanding these differences, the retiree can choose a plan that best fits his or her health priorities and financial capability.

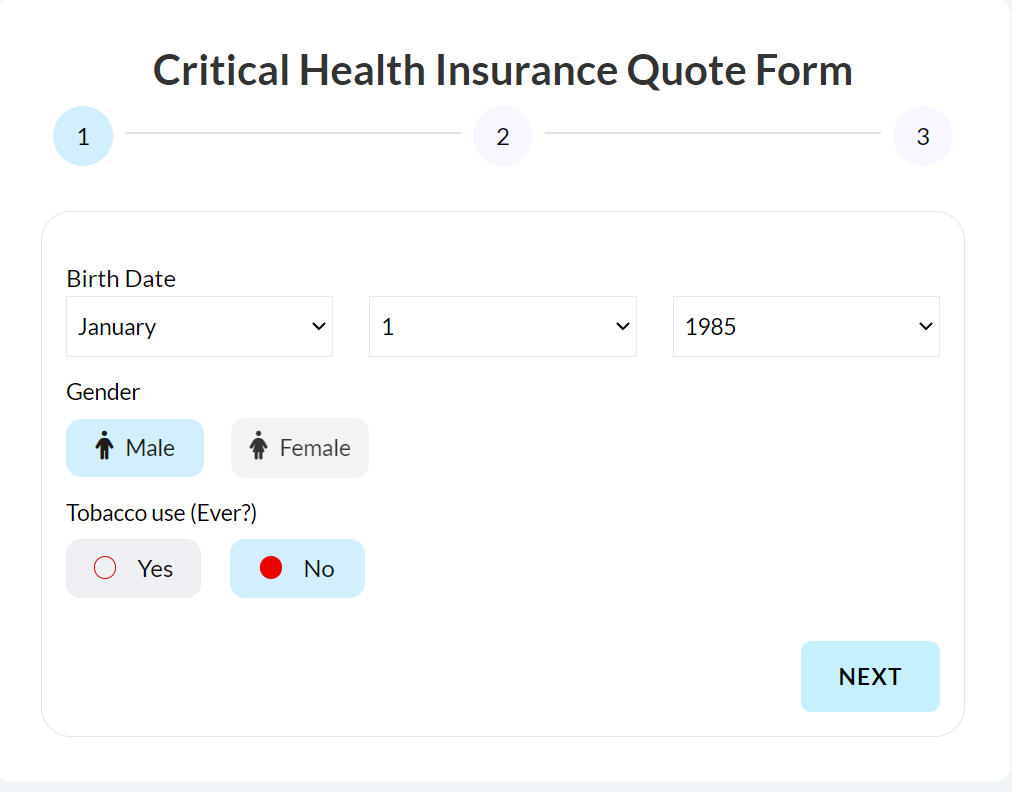

How to Apply for Critical Illness Insurance as a Retiree

As a retiree, you can apply for the Critical Illness Policy and consider the following steps: First, evaluate your present health status and any pre-existing conditions. Some providers tend to have “guaranteed issue” policies, which imply that they automatically issue a policy irrespective of a medical examination or a lengthy health-related questionnaire that may inquire into your current or previous health history. You must be honest about your health history since it may be that your claim could be invalidated later because the information you provided was not right.

We at Canadian LIC guide clients through the application process and advise them on what is required and how to gather any necessary documentation. There have also been instances when some clients did not apply due to a perceived threat to their health; however, with the right support and information, they were able to get coverage.

After the submission of an application, the insurance company will check the details and find out if you qualify for the respective policies. This might, according to the working organization and to the health situation of respective individuals, take some of the weeks. This process can take a few weeks, depending on the insurer and the complexity of your health situation. If approved, you will receive a policy outlining the terms of your coverage, including the covered illnesses, waiting period, and premium amount.

The Role of Critical Illness Insurance in Retirement Planning

Critical Illness Insurance plays a vital role in retirement planning through the building of financial security against high medical costs due to serious health conditions. One of the major concerns of retirees is the protection of their savings to ensure that they have enough to maintain their lifestyles when unexpected medical expenses arise.

We once had a client who had retired early but was concerned about the long-term financial impact of a potential illness. He finally, after a lot of discussion, opted for Critical Illness Insurance that would supplement his health coverage. This gave him the assurance that he would not have to take down his retirement portfolio in case he was confronted with a serious health situation. It also allowed him to focus on enjoying his retirement without the constant worry of what might happen if he fell ill.

Critical Illness Insurance helps retirees protect a lifetime of hard-won assets, not just health care costs, so they can focus on recovery. The cash benefit from a Critical Illness Policy could pay the debt, living expenses, or alternative treatments that are not covered by traditional Health Plans.

Choosing the Right Critical Health Insurance Company

However, the insurance company is equally as important as the type of policy one selects. Different companies boast different strengths, and it is very important to work with a provider that understands the unique needs of retirees. Some insurers have specialized in offering coverage to older adults, having oriented their products and services to meet such needs.

At Canadian LIC, we work directly with some of the leading Critical Health Insurance Companies in Canada, knowing that we’re offering our clients the best options out there. Through the years, we have developed good relations with the insurers, which have enabled us to fight and support our clients in finding the best cover for them.

We have assisted one retiree who was declined coverage by one insurer due to a pre-existing condition. By using our relationships with other insurance companies, we were able to locate another provider willing to offer reasonable premium coverage. This experience highlights the importance of working with a knowledgeable licensed insurance advisor who can navigate the complexities of the insurance market and find solutions that might take time to arrive.

The Peace of Mind that Comes with Coverage

The ultimate reason to buy Critical Illness Insurance as a retiree is peace of mind. In a case where one has covered a safety net, they would never have to dwell on thoughts of what could happen in case a serious illness strikes, but rather enjoy their retirement, spend time with their loved ones, and do exactly what they feel is best.

We have witnessed firsthand the difference this cover makes to our clients’ lives. One retiree related feelings of relief from knowing that, with Critical Illness Insurance, she was finally able to travel and enjoy her hobbies without the constant fear of financial ruin due to a health crisis. Her story is just one of many that mirrors how such insurance can affect the golden years.

Final Thoughts: Taking Action with Canadian LIC

In Canada, if you are a retiree looking into Critical Illness Insurance, now’s the time to start exploring your options. Whether it is paying for medical expenses, protecting your savings, or ensuring you maintain your lifestyle regardless of anything, Critical Illness Insurance offers some valuable protection that may help achieve those goals.

At Canadian LIC, we will be able to guide you through the process of comparing quotes and finding the perfect plan that suits your needs. Our experience in dealing with retirees throughout Canada has given us a real understanding of the challenges faced and the solutions that work best. We encourage you to take this first step in securing the coverage you deserve to enjoy your retirement with no concerns.

Buying Critical Illness Insurance is one of the most important decisions you’ll ever make in safeguarding your financial future. Canadian LIC, supported by a team of seasoned professionals, can help you confidently make that decision.

More on Critical Illness Insurance

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- How Does Inflation Affect My Critical Illness Insurance Coverage?

- Can You Claim Twice for Critical Illness Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Can I Purchase Critical Illness Insurance for My Children?

- Does Critical Illness Insurance Cover Broken Bones?

- Can I Cancel My Critical Illness Insurance?

- Can You Add Critical Illness Cover to an Existing Policy?

- What is a Critical Illness Insurance Claim?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- Can I Have Two Critical Illness Policies?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- What Age Should You Get Critical Illness Cover?

- Critical Illness vs. Disability Insurance in Canada: Understanding the Differences and Making Informed Choices

- What is the Difference between Life Insurance and Critical Illness Insurance?

- All About The Critical Illness Insurance Policy & The Benefits of Critical Illness Insurance

- Why is Critical Illness Insurance Coverage Important? And Do We Need It?

- How Critical Illness Insurance Can Be Your Lifesaver in Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Purchasing Critical Illness Insurance After Retirement

Here are some commonly asked questions around purchasing Critical Illness Insurance after retirement, along with simple answers to help you understand your options better.

Yes, you can still buy Critical Health Insurance even if you are already retired. Most Critical Health Insurance firms in Canada have plans for older adults. Their availability and cost would be different based on age and health status, but there is hope. We have been able to place quite a number of retirees with appropriate Critical Health Insurance Plans that were suitable for their needs, even when the people thought it might be too late.

Your age is one of the major determining factors in the cost of Critical Illness Insurance. The older you become, the more susceptible you are to contracting a critical sickness; thus, this is where insurance companies base their charges. Many of our clients find that in their 60s and going into their elderly years, they seek higher premiums. With different companies and comparing their Critical Health Insurance Quotes, we can usually find one within your budget.

Yes, it can. Some insurers might offer higher premiums or exclude certain conditions based on your health history. Yes, we do have clients who were worried about their health status affecting their coverage. By exploring different options in a Critical Health Insurance plan, we have been able to find options for them to give them the protection they need despite pre-existing conditions.

Of course, there are Critical Health Insurance Plans that exist for retirees. Such plans factor in the peculiar needs of elderly people, sometimes covering diseases that occur with the advancement of age. It was just the other day that we helped a retired couple find a plan focused on cardiovascular conditions, which is mainly what bothered them. Of course, you also have to be working with a knowledgeable broker to help you identify such specialized plans.

Comparison of Critical Health Insurance Quotes is definitely the best way to find the right plan. You will know what all the coverage is, how much premium is required, and if there are any exclusions or waiting periods. Canadian LIC compares quotes from several Critical Health Insurance Companies across Canada to ensure the best deal for our clients. We have seen how this process saves money and aids our clients in making better decisions.

In the selection of a Critical Illness Insurance Plan, a retiree should consider his or her health status, family medical history, and lifestyle, in addition to budget. Of course, one also needs to focus on specific illnesses for which he or she needs insurance protection. We have been able to help many retirees balance these so that they can get the right protection without breaking their budget. Given there are several options out there, choosing the right plan calls for a considered approach, and we will be happy to guide you on how to go about it.

Yes, you are still covered if you have a family history of critical illnesses, but this can impact your premium. Often, your family’s medical history comes into play when an insurance company evaluates how much risk you will be to them. We have helped many clients with a family medical history of illnesses find Critical Health Insurance Plans that will cover their needs. It is very important to make sure accurate information is provided so you can handle the future.

It depends on the policy, of course. With some Critical Health Insurance policies, there is medical underwriting required, while others are not. We have had clients who were nervous about taking a medical exam and were able to place them with guaranteed issue policies that could still offer them the coverage they needed. The key is to understand your options, and we can help you decide the best path forward.

The amount of coverage you choose directly affects how much your premiums will be. The more coverage there is, the higher the premium. Many times, we help retirees calculate how much coverage they will require based on their financial situation and health concerns. We have found that by comparing Critical Health Insurance Quotes, there can be a balance between getting enough coverage and getting premiums that are affordable.

In that regard, if one insurance company rejects your application, it doesn’t mean you are out of options. Different companies have different underwriting rules. We have seen many clients who have gotten a decline from one insurer and later received approval from another. That is why it is very important to work with a broker who can explore multiple Critical Health Insurance Companies in Canada on your behalf. And we’re here to help you find that solution, even if it means your first application wasn’t successful.

These frequently asked questions should help give you a better idea of what to expect when thinking about Critical Illness Insurance for your retirement future. For more information or to speak with a broker who can help place you into the right plan, contact knowledgeable brokers at Canadian LIC. We’re here to walk you through it and help you attain the protection you’ll need.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

- Overview of Critical Illness Insurance in Canada and its benefits.

- Link to CLHIA

- Government of Canada – Insurance and Financial Services

- Information on various insurance products available in Canada, including Critical Illness Insurance.

- Link to Government of Canada

- Sun Life Canada

- Detailed guides on Critical Illness Insurance, including options for retirees.

- Link to Sun Life

- Manulife Canada

- Insight into Critical Health Insurance Plans for seniors, including plan comparisons.

- Link to Manulife

- Canadian Cancer Society

- Resource on the importance of financial planning for serious illnesses.

- Link to Canadian Cancer Society

These sources provide valuable insights and additional information on Critical Illness Insurance, helping you make informed decisions about your coverage options as a retiree in Canada.

Key Takeaways

- Retirees Can Still Get Coverage Even if you’re already retired, you can still purchase Critical Illness Insurance in Canada.

- Age and Health Matter: Your age and health significantly impact eligibility and premium costs, but options are available with the right guidance.

- Compare Quotes: It’s essential to compare Critical Health Insurance Quotes from multiple companies to find the best plan for your needs.

- Specialized Plans for Retirees: Some Critical Health Insurance Companies in Canada offer plans specifically tailored for retirees, focusing on common age-related illnesses.

- Work with a Broker: A knowledgeable broker can help you navigate the process, explore options, and secure coverage that suits your health and financial situation.

Your Feedback Is Very Important To Us

We appreciate your feedback. Your responses will help us understand the challenges Canadians face when purchasing Critical Illness Insurance after retirement.

Thank you for your feedback! Your insights will help us improve our services and better support retirees in Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]