Health emergencies don’t wait for the right time—and neither should your insurance coverage. With rising medical costs and changing lifestyles, being prepared is no longer optional. We can protect our health and our money with Critical Illness Insurance in case we get sick at an unexpected time. Not having to worry about money keeps us focused on getting better. How? Now, let’s say you get really sick with something like cancer. These plans will step in and offer you a large sum of money straight away.

The question remains, however, when is the best time to purchase this type of insurance in Canada? Well, it depends on a number of factors. That being said, the main idea is easy: start as soon as possible. Why? That’s what this blog is all about: breaking things down so you can understand.

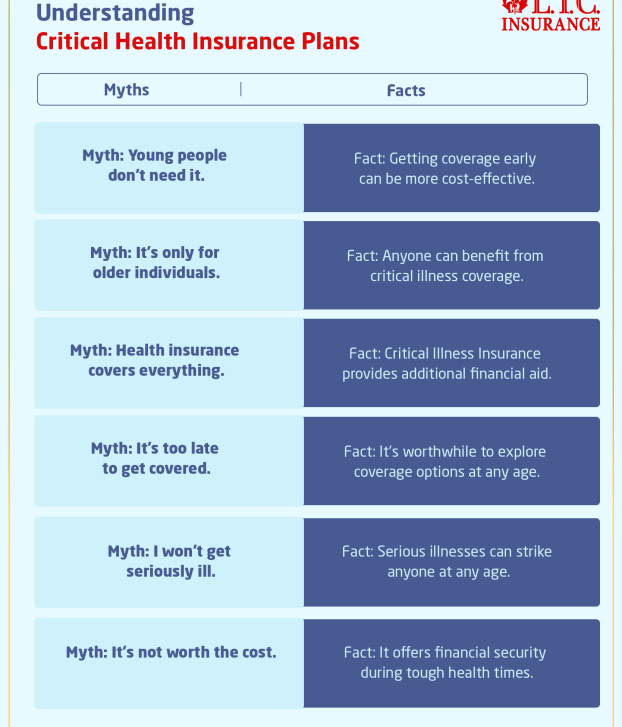

Understanding Critical Health Insurance Plans

Critical Illness Policies provide financial stability, particularly in the event of sudden medical emergencies. These plans provide a layer of financial protection against the financial consequences that come with serious medical illnesses and are specifically designed for Canadians. The primary goal of these Critical illness plans is to give policyholders financial security during difficult times. Critical Illness Insurance pays a lump sum payout after the diagnosis of certain serious illnesses.

The main benefit of Critical Illness Insurance plans is that they cover various life-threatening illnesses that substantially influence an individual’s quality of life. Severe diseases like cancer, heart attacks, strokes, organ transplants, and other specific conditions are usually covered by these plans. Policyholders become entitled to a predefined lump-sum compensation from their insurance provider upon diagnosis of any of these covered critical illnesses.

This lump-sum payment’s flexibility is its greatest feature. It is not limited to medical costs; instead, it offers financial flexibility in a variety of different aspects of life. The reward becomes vital assistance in easing the financial load that comes with severe illnesses, from paying for ongoing treatments and therapies to paying growing medical costs.

Furthermore, the help provided by Critical Illness Insurance coverage goes beyond just covering medical expenses. It steps in as a lifesaver when people struggle to pay their bills or obligations, making sure that these monetary concerns don’t worsen the already difficult circumstances brought on by the sickness. The lump-sum payout provides financial protection for expenses such as mortgage payments and household bills and maintains a level of living, enabling people to concentrate on their recovery rather than financial problems.

These plans are especially beneficial for all those people who do not have full health coverage or whose existing insurance policies don’t sufficiently cover the cost of serious illnesses. Medical treatments are covered by regular health insurance, but Critical Illness Insurance plans offer an additional financial security blanket that comes in very handy in times of serious medical emergencies.

Purchasing essential health insurance is a proactive move toward the preservation of one’s future well-being and financial security, rather than only a financial decision. By acknowledging the importance of this kind of coverage, Canadians may protect themselves from the unpredictability of health-related financial burdens.

Essentially, having Critical Illness Insurance coverage means having some mental peac,e more than just having a policy. It’s about making sure that, during difficult times, the financial parts are handled so that people and their families can concentrate on what really counts—the path to recovery and well-being.

A critical illness plan is an essential addition in Canada, where medical care is excellent but only sometimes fully covered by insurance. In tough times, they’re lifesavers because they help bridge the gap between medical needs and financial realities.

Note that you must understand the complex aspects of these programs. Making educated choices regarding Critical Illness Insurance coverage can be facilitated by consulting with financial advisors or insurance professionals. This will help consumers select a plan that best suits their needs and protects their financial future.

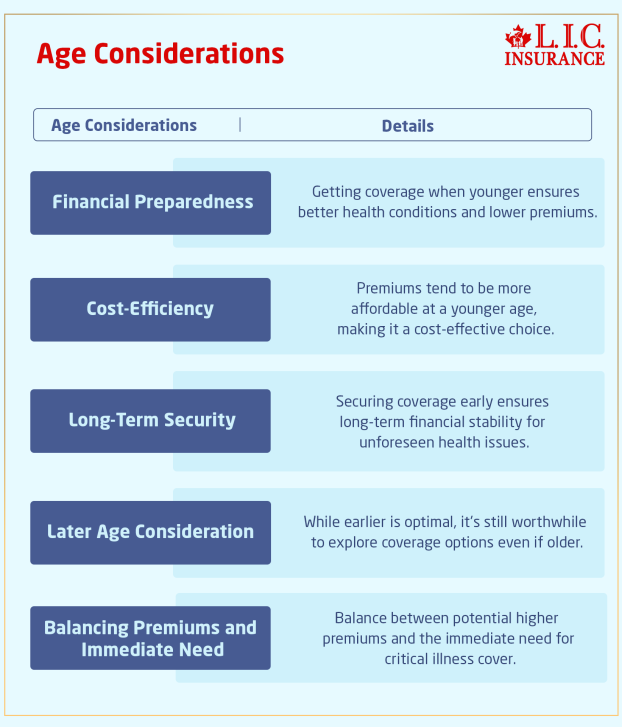

Age Considerations

Age is very important in finding the right time when one can start thinking about Critical Illness Insurance coverage in Canada even though we cannot say that there is a fixed age that can be suitable for each and everyone, there are good, compelling reasons why it can be highly beneficial if one decides to get this coverage at a younger age.

Financial Preparedness

Younger people, usually in their twenties or thirties, have a higher chance of obtaining Critical Illness Insurance plans without having any pre-existing medical conditions. This means that coverage will be easier to obtain and more seamless, free from restrictions or higher premiums because of pre-existing medical conditions.

Early participation in Critical Illness Insurance coverage is a smart step toward financial preparation. It acts as a measure of protection against unanticipated future changes in health. If you were to receive an unexpected diagnosis of a serious illness, having this coverage in place would be helpful in preventing you from having to pay excessive medical bills.

Cost-Efficiency

One of the significant advantages of choosing to go for critical illness coverage at a younger age is the cost factor. Premiums for these insurance plans are often more affordable when you’re young and healthy. This is possible because the younger you are, the fewer chances you have of health problems.

As time passes and age increases, health risks tend to start increasing, making the Critical Illness Insurance premiums also increase. The best part about securing coverage at a young age is that individuals can have lower premiums, which helps them save reasonable amounts over the long term compared to those who choose to get the coverage at an older age.

Long-Term Security

Critical Illness Insurance coverage isn’t all about having protection at the current moment; it’s mainly about securing long-term financial security for yourself. If one gets this coverage early, then he/she not only get shielded from unexpected health crises but also ensure financial stability for their family.

Imagine if you get diagnosed with a critical illness and have the financial means to cover medical expenses, mortgage payments, or daily living costs without depleting savings or relying on loans. Being well aware that unforeseen health challenges don’t compromise your family’s financial future gives you a profound sense of security and mental satisfaction.

The Strategic Move

Getting Critical Illness Insurance coverage when you are younger can be a great way to protect your financial future. It’s about being cautious, planning for possible health uncertainties, and lowering the cost of dealing with them.

While most people think that the best age to get Critical Illness Insurance coverage is between the late 20s and mid-40s, the choice is ultimately up to the person and their needs. The general idea is still the same, though: the benefits in terms of accessibility, affordability, and long-term security increase with the earlier you obtain this coverage.

In Canada, getting Critical Illness Insurance coverage is a must if you want to protect your health and your finances. People can improve their long-term security, financial readiness, and cost-effectiveness by thinking about it earlier in life. This way, they will have a backup plan to fall back on if they get a life-changing illness.

The Optimal Age Range

People are most likely to think about Critical Illness Insurance between the ages of twenty-five and forty. You might ask, “Why this age range?” Well, this time in life is usually when health is better, and there are fewer health problems to begin with. Because of this, people in this age group usually have an easier time getting critical health insurance plans with lower rates.

Health Considerations

We are likely to have fewer health problems when we are in our twenties and thirties. Being healthier makes us more appealing to insurers, which lowers the risk of getting serious illnesses. Since insurers are now offering more reasonable rates, now is a good time to get Critical Illness Insurance coverage from a financial point of view.

Financial Viability

Also, from the late 20s to the mid-40s, a lot of us start families, start building our jobs, or make big financial commitments like mortgages or student loans. As we go through these important times in our lives, Critical Illness Insurance gives us assurance that a sudden health problem won’t put our finances at risk.

Why Older Individuals Shouldn’t Overlook Coverage

While this age range is no longer valid, it doesn’t mean that you can’t get Critical Illness Insurance. You should still look at your choices because it’s smart to do so. Even though premiums may be a little higher as you get older because of higher health risks, the benefit of coverage stays the same.

Why Understanding Critical Illness Insurance Age Limit Matters More Than You Think

When considering Critical Illness Insurance in Canada, most people focus on the cost of premiums or which illnesses are covered. However, a crucial but often overlooked factor is the Critical Illness Insurance age limit imposed by insurers. While many providers allow new applicants up to age 65 or 70, fewer people explore what happens after that point, and how it may impact eligibility and cost structure long-term.

One key insight: many insurers not only stop accepting new applicants past a certain age, but they may also significantly reduce the payout options or increase exclusions for applicants nearing that age ceiling. Moreover, some plans that offer lifelong coverage only do so if purchased before hitting a specified age bracket, often 60 or 65. Missing that window can mean limited plan availability or the need to combine coverage with other products like long-term care or disability insurance.

For Canadians planning their financial future, understanding Critical Illness Insurance age limits isn’t just about getting in early—it’s about knowing how age impacts accessibility and the value of the coverage offered. Taking action before reaching these upper thresholds ensures more options, better pricing, and fuller coverage—something that becomes invaluable when health risks increase with age.

Balancing Premiums and Immediate Need

For older people, the key is to find a balance between the need for coverage right away and the possibility that premiums will go up. Even though the rates may be higher, Critical Illness Insurance coverage is worth the extra money for the mental peace and financial security it provides.

Considerations for Late Applicants

It’s important to carefully consider your health and finances if you’re thinking about getting Critical Illness Insurance coverage after the prime age range. Some policies may not cover people with certain pre-existing illnesses or may have age limits. Still, you can still find good options that meet your needs if you do a lot of study and get advice from professionals.

It’s best to think about Critical Illness Insurance when you’re between the ages of twenty-five and forty, when you’re healthier, and the rates are lower, but it’s essential that you think about Critical Illness Insurance at any age.

While you’re still in your prime years or older, Critical Illness Insurance is still a great way to protect your finances in case of an unexpected health emergency. The important thing is to look at your situation, talk to experts, and make a choice that fits your health and financial goals.

It’s important to get Critical Illness Insurance coverage at the right time, but it’s also important to get it at any age because it protects you and your family when you need it most.

Conclusion

Critical health insurance plans are a very important way to protect your finances during hard times. Most of the time, getting insurance earlier in life is best, but the choice depends on the person’s health, finances, and personal circumstances.

By knowing how important critical health insurance plans are and starting to look into them at the right age, Canadians can protect their finances and peace, making sure they have the help they need if they get a serious illness that changes their life.

Additionally, it is always advisable to talk to insurance or financial experts in order to figure out your exact requirements and the best time for you to purchase Critical Illness Insurance coverage.

In the end, Critical Illness Insurance in Canada is a smart way to protect your future health and finances, and thinking about it when you’re younger can help you feel safe in the long run.

Planning ahead is very important, but remember that you can always put your health and finances first.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Critical Illness Insurance FAQs

Critical Illness Insurance is a type of coverage designed to provide financial assistance when an individual is diagnosed with specific severe health conditions such as cancer, heart attack, stroke, and more. A critical illness policy offers a lump-sum payment upon diagnosis, providing policyholders with financial support to navigate medical expenses and other associated costs.

Critical health insurance plans work by offering policyholders a predetermined lump-sum payout when they are diagnosed with a covered illness. This payout can be used at their discretion, covering medical treatments, debts, daily living expenses, or any other financial obligations that arise due to the critical illness.

Commonly, illnesses like cancer, heart attack, stroke, organ transplants, and other specified serious conditions are all included under the Critical Illness Insurance cover. The exact list of covered critical illnesses can vary among insurance providers, so it’s essential to review the policy terms and conditions to know well about each covered critical illness.

While the ideal age to consider critical illness policy is typically between the late twenties and mid-forties, the decision depends on individual circumstances. Locking in coverage at a younger age can be cost-effective, but it’s never too late to explore options, even if you’re older.

While health insurance covers medical treatments, Critical Illness Insurance covers additional financial support. It offers a lump-sum payout that can be used for various purposes, including non-medical expenses like mortgage payments, debts, and maintaining your standard of living during recovery.

The eligibility for critical illness coverage may vary among insurance providers. While some pre-existing conditions may affect coverage or premiums, to buy Critical Illness Insurance, it’s advisable to consult with insurance professionals who can guide you based on your specific health history.

Premiums for Critical Illness Insurance are typically based on factors such as age, health status, coverage amount, and the length of the policy. Generally, obtaining coverage at a younger age can result in more affordable premiums, providing long-term cost efficiency.

Critical Illness Insurance and disability insurance serve different purposes. While disability insurance replaces lost income if you are unable to work due to illness or injury, Critical Illness Insurance provides a lump-sum payout upon diagnosis of a covered illness, irrespective of your ability to work.

Many insurance providers offer flexibility in coverage options. You may have the opportunity to customize your Critical Illness Insurance plan based on your specific needs and budget. It’s recommended to explore these options and tailor your coverage accordingly.

The right amount of coverage depends on your individual financial situation, including existing insurance coverage, debts, and anticipated expenses. Consulting with financial advisors or insurance professionals can help you assess your needs and determine an appropriate coverage amount for your Critical Illness Insurance plan.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]