Many Canadians only learn about the fine print of their insurance policies when it’s too late, often when a Critical Illness Insurance claim is denied unexpectedly. The emotional toll of a diagnosis is hard enough without the added confusion of a rejected claim. In those moments, what matters most is clarity, support, and knowing your rights. Understanding the full picture of how claims work can make all the difference.

Let us assume the following scenario: a person was waiting in the doctor’s waiting room for what seemed like hours, even though it was just a few minutes that had passed. When you think about it, one of the first things that comes to mind is the financial consequences: how are you going to handle the coming storm that will affect your investments and savings? And this is where insurance claims for critical Illnesses turn into a ray of hope.

Sadly, the condition and the complicated process of making a Critical Illness Insurance claim cause a lot of stress to most Canadians. This makes dealing with a critical Illness even more stressful. Even the information that is clear and easy to understand is not easily available. That is why today, we are going to take the mystery out of the what, why, and how of Canadian critical Illness claims and Critical Health Insurance Coverage importance by using real-life examples to give it more meaning. So let’s begin.

What is a Critical Illness Insurance Claim?

A Critical Illness Insurance claim is a request for payment that you make to your insurance company when diagnosed with a certain, listed, specific disease in your policy, such as cancer, stroke, or heart attack. The main difference between regular health insurance and Critical Illness Insurance comes at the point of payment: Whereas the former will take care of different costs linked to the medical state, the latter is paid as a sum that one can use for various reasons—perhaps to adjust to losing income or meet the cost of private nursing or adapt your home to new health needs.

Understanding the Importance of Critical Health Insurance Coverage

John, a father of two from Toronto, faced a tough battle with leukemia. He discovered the true value of his Critical Illness Insurance plan when he could no longer maintain his job at a construction site. His lump-sum payout helped his family remain afloat during his treatment and shows the importance of Critical Health Insurance Coverage. John’s is just among those many stories that portray how much insurance served as a financial cushion, allowing patients to concentrate on recovery alone, with no burden of financial stress on them.

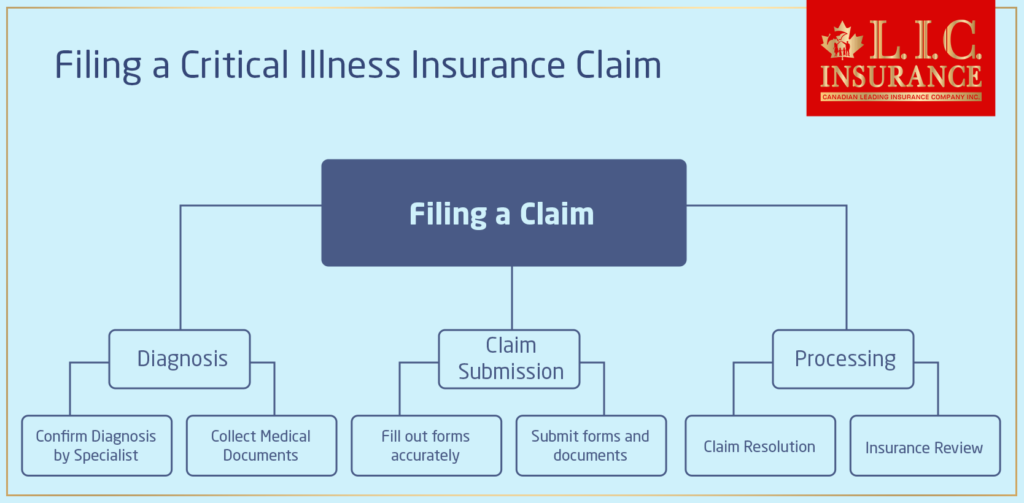

Filing a Claim: A Step-by-Step Guide

It can be difficult to file a claim for Critical Illness Insurance when you are under a lot of stress. Let’s go over each one of the ways with real-life examples so that you not only understand why Critical Health Insurance is important but also learn how to manage your plans.

Confirmation of the Diagnosis: The diagnosis must be confirmed by an appropriately qualified medical professional who is listed on your policy. This may be a specialist in your exact Illness, for example, an oncologist for cancer, or a cardiologist for heart disease. This is the solid backbone of your claim; devoid of this diagnosis, your journey can never take flight.

Lisa from Ottawa faced, once again, some odd symptoms and went to her family doctor. She was thinking of her most likely diagnosis: multiple sclerosis. Knowing how critical confirmation of the diagnosis was in this case, Lisa quickly made a reference to her Critical Illness Policy so as to look for an approved neurologist under her insurance. She made efforts proactively towards getting her diagnosis confirmed quickly so that she could proceed with filing her claim, free from undue delays.

Collection of Documents: Once the diagnosis is confirmed, a very important part from your side is collecting all the relevant medical documents. It includes the results of the diagnostic tests, doctor’s reports, and every other kind of medical record that justifies your state. By keeping a record of all such documents in a detailed and organized manner, you can save yourself the trouble of the claim process.

For example, when Sarah from Edmonton was found to be suffering from a critical Illness, she collected every piece of paper related to her Illness. She had arranged them chronologically in a folder so that processing with the insurance company could become easier in her case. This thorough preparation underscored the importance of Critical Health Insurance Coverage, as it prevented any potential delays that could arise from missing or incomplete documentation.

Claim Submission: Armed with the confirmation of the diagnosis and all the documents, you are now set to make your claim. Fill out all the necessary forms from your insurance company. Kindly ensure that the forms are filled out duly and entirely. A delay in processing your claim may occur if the form is incomplete or partially filled, or if there are any errors.

Take, for example, the case of Michael from Toronto. He made mistakes in a rush to fill out his claim forms, which came immediately after receiving the diagnosis. Obviously, the mistake delayed the entire claim process. This is a pretty common story, and it just illustrates why one needs to take quite a lot of time to fill in all those forms and then double-check them.

Real-Life Struggles with Claims

Of course, despite best intentions, there can still be hiccups. What really opens one’s eyes is the experience of a man from Calgary, Ahmed, who went through a late diagnosis that traumatized him emotionally. That messy insurance claim got into a complicated mess. The confirmation was the fact that he had already missed some key deadlines to submit his documents.

Ahmed’s ordeal shows just how big a job it is to get timely medical advice and necessities. This is a vivid lesson in exactly why starting the critical Illness claims process early is critical, and following up with your healthcare providers and your insurance company frequently is very important.

It is not just about bureaucracy, but engaging in the process of filing a critical Illness claim is a very important step. As you can see from Lisa’s, Sarah’s, and Michael’s stories, getting informed and prepared can make a world of difference in the outcome of your claim. Remember, understanding your Critical Health Insurance Plans and the importance of the coverage will help guide you effectively. If ever in doubt, then don’t shy away from asking for help from insurance professionals who will take you through the process. Remember, this is not just a claim form to be filled in. This is your solace at times when it is most needed.

What to Do If Your Claim Is Denied

Receiving a claim denial can really bring you down. Take the case of Sophie from Montreal. Her claim under the Critical Illness Policy was declined in the first instance itself, as there was a misunderstanding regarding whether the medical condition fit the policy’s criteria for entitlement. People like Sophie can find themselves in this position all the time. Now, what should be your actions in case you find yourself in this predicament?

Step 1: Get to Know the Denial. First, take a breath and read through the denial letter sent by your insurance company. It is important that you understand why your claim was denied—maybe for the lack of complete documentation, perhaps miscommunication of your medical condition, or whatever other reason. Knowing the reason will guide your next steps.

Step 2: Collect Detailed Medical Evidence: Sophie’s success in appealing a claim denial came when she collected more detailed medical evidence. She made a visit to the doctor again, and with much review and medical detail, she was evidently pointing out that the claim was supportable. This might involve collecting diagnostic reports, detailed notes from your treating physicians, or even a second opinion to bolster your case.

Step 3: Submit an Appeal: Once you have all the paperwork ready, you must appeal to your insurance company. Write a letter of appeal in a clear, concise, and convincing manner. Detail the reasons and evidence attached to the claim that you think should be considered again. Attach all the required medical evidence. Clarity in making the appeal can make a big difference in the outcome.

Step 4: Follow up with the insurance company: After you submit an appeal, keep following up with the insurance company. Regular follow-ups will ensure that your appeal doesn’t get lost in the bureaucracy. Set reminders to check in with them periodically.

Why Some Critical Illness Insurance Claims Are Denied—and What You Can Do About It

One lesser-known, yet crucial, aspect of critical illness coverage in Canada is understanding why some claims are denied, even when all paperwork seems complete. While claim denials are frustrating, they are not always final, and understanding the reasons behind them can help policyholders respond effectively.

A Critical Illness Insurance claim denied may often stem from medical definitions not aligning with those stated in your policy contract. For instance, certain types of early-stage cancer or minor strokes may not meet the severity threshold required for payout. Additionally, many denials occur due to incomplete documentation, such as missing diagnostic reports or forms not signed by a qualified specialist.

Another common reason? Policyholders unknowingly fail to meet the “survival period” clause, which usually requires them to live a set number of days post-diagnosis before the benefit becomes payable.

The takeaway here is not just to read your policy, but to revisit it annually. If you ever experience a denial, don’t assume it’s the end of the road. Many Canadians successfully appeal by providing clearer medical records, securing second opinions, or working with a licensed insurance advisor.

By knowing these lesser-discussed aspects, policyholders can better prepare, minimize claim delays, and improve the likelihood of approval when it matters most.

Professional Help

If the process becomes overwhelming, consider seeking help from a professional. Insurance advisors or patient advocates can offer invaluable assistance in dealing with the complexities of insurance claims.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Maintaining Your Policy: The Essential Checklist

Ensuring that your Critical Illness Insurance policy is active and effective requires more than just initial sign up. It’s about consistent management and understanding the importance of Critical Health Insurance Coverage. Below, we’ll explore a practical checklist to maintain your policy.

Stay Current on Premium Payments

But what if you missed any of those payments? Well, that would not be possible. Your coverage would lapse, and you would be left unprotected from a situation.

Take the story of Lisa from Edmonton. After her husband unexpectedly fell ill, they were shocked to find out their policy had lapsed due to missed payments during a particularly chaotic time. This added immense financial strain to their situation. To prevent this, setting up automatic payments through your bank ensures that premiums are never overlooked, no matter what life throws your way.

Understand Your Policy Terms in Depth

Understanding the inclusions and what is not covered in your insurance, as well as knowing every limit it has, will prevent you from being surprised while you handle a claim.

Raj from Mississauga learned this the hard way when he assumed his policy covered all types of cancers. However, his specific type, a rare form not listed in his policy, was not covered. This misunderstanding could have been avoided if Raj had reviewed his policy terms carefully upon receipt and periodically thereafter. Make it a habit to review your policy annually or after any major life change.

Keep Your Contact Information Updated

This ensures that your insurer will always have your up-to-date contact information and that you will receive important policy notifications.

Amina from Halifax hadn’t updated her address with the insurance company since she moved. Many important notifications were missed, and among them was the one from a policy change affecting her coverage. A simple call to the insurer could have saved her confusion and stress.

Regularly Assess Your Coverage Needs

As life changes—marriage, children, a new house—financial obligations increase, protection needs increase.

When Theo and Marie moved to Vancouver, and the first baby was born, they recognized the need for revisions in the Critical Illness Policy. They observed that the sum assured at the commencement of the policy would not be adequate to provide for the growing family. They have wisely topped up the coverage in order to duly secure the family’s future.

Set Reminders for Policy Renewals and Reviews

Life gets busy, and it’s easy to forget when it’s time to renew or review your policy.

Simran in Quebec would set a phone reminder to look over her policy every year, so at any point, if she had a job change or got a promotion, she could make the respective alterations to coverage in terms of income and responsibility increase.

Consider the Benefits of Automatic Renewal

Automatic renewal could save them from an unwitting coverage lapse and be constantly protected.

Harish in Toronto opted into automatic renewal for his Critical Illness Insurance. This decision paid off when he was diagnosed with a covered condition shortly after his policy would have expired under manual renewal terms. Because of his foresight, his claim was processed without any hitches, providing essential financial support during a difficult time.

Conclusion: Taking Action with Canadian LIC

We incorporated some insights and real-life stories across this blog, all emphasizing Critical Health Insurance Coverage to your financial health in the context of your life going through a medical crisis. Understanding your policy and knowing how to file a claim is much more than just administrative tasks. They are important steps to ensure security for you and your family.

“Protect your loved ones. Reach out to Canadian LIC, the trusted insurance brokerage in Canada at +1 416 543 9000, for Critical Illness Insurance that gives them peace of mind.” Remember, in health, preparedness is not an option but a prerequisite. Act now and ensure you are covered before life throws an unexpected challenge. Start today to protect your tomorrow with Canadian LIC.

Find Out: Does Critical Illness Insurance cover heart failure?

FAQs on Critical Illness Insurance

Having this insurance is very important, in the sense that one may face a critical health condition and thus will need financial security; one can, therefore, concentrate on recovery without the tension of suffering from financial ruin. Samy, in Winnipeg, with her Critical Illness pay, was able to cover her living expenses and medical treatments at a time when she would not be able to work. This more clearly demonstrated the importance of critical coverage of health insurance.

In seeking the right plan for you, ensure that you look into the covered Illnesses, the lump sum payment required, and terms and conditions of the policy. You may also visit an insurance broker who will help you in making a choice. Mark from Toronto compared some of the top Critical Health Insurance Plans before settling on a comprehensive one that would basically cover every disease that ran in his family. This way, he was ready for any health problems that might arise.

Yes, you can hold different policies with other providers. This will then raise your level of cover and possible Critical Illness Insurance payout. Linda in Montreal benefited from this strategy upon diagnosis of a critical Illness as two of her policies paid out, and she was able to use the extra money to pay for the extensive rehabilitation expenses.

The survival period means the span for which the life assured has to survive following the diagnosis of a critical Illness before an insurance claim is made. Usually, this period is about 30 days. For example, Anita of Saskatoon had just been diagnosed with a critical Illness but had still managed to claim her benefit after surviving the required period. This was the point that had helped her claim and would now help her while she recovers—this time, financially.

Yes, most have an age cap; some at 60 and others at 65. You need to buy the most Critical Illness Policies before you reach that age. Take, for instance, Roberto, who lives in Montreal. At the age of 58, he purchased a Critical Illness Plan when most insurers would not provide him one based on age alone. It emphasizes the importance of timely decision-making when it comes to Critical Health Insurance Coverage.

Absolutely! You can often extend your Critical Illness Insurance to include coverage for your spouse and dependent children. This was a relief for Jenna in Brampton, who added her spouse to her plan, and when he was diagnosed with a serious Illness, the policy’s benefits helped sustain their family through tough financial times.

To make a claim, simply provide a completed claim form together with medical evidence from a health professional appropriately qualified to make the relevant diagnosis. That’s just what Samir in Vancouver did when he was diagnosed with an eligible Illnesses. He ensured the claim processes were smooth and successful, with careful documentation and sustained follow-up.

Moving abroad could affect your Critical Illness Insurance. Most policies have geographical limits. Toronto—This was something that became evident to Fatima, who resides in Toronto when she prepared to move to Europe. All the while, she contacted her insurer to adjust her critical coverage as she emphasized the importance of ensuring that all of those critical details related to the plan are understood.

Critical Illness Insurance generally doesn’t pay for issues related to mental health, like depression or anxiety; it usually focuses on crises of physical health that meet certain criteria. However, awareness and policies are evolving. When Tim in Halifax inquired about coverage for mental health, he learned it was not included, which led him to seek additional insurance options to cover all bases of his health needs.

Critical Illness Insurance pays a lump sum if you are diagnosed with one of the specific major Illnesses listed in the policy, which can be used for various expenses. Health insurance, on the other hand, covers a broader spectrum of health care expenses on a pay-as-you-go basis. For example, Carlos in Edmonton used his critical Illness payout to cover his mortgage while he was home recuperating, while his health insurance directly handled his medical bills.

Not exactly. Most plans only cover serious forms of cancer and exclude less aggressive forms, such as some types of skin cancer. Julia in Ottawa learned this the hard way when her early-stage skin cancer diagnosis did not trigger a payout, highlighting the importance of thoroughly reviewing the specific conditions covered by your Critical Health Insurance Plans.Find out more on this here

The amount of coverage should ideally match your estimated financial needs in the event of a critical Illness, taking into account your income, debts, and other financial obligations. Neil from Calgary calculated his coverage based on potential medical expenses and living costs during treatment and recovery periods, ensuring his family’s financial stability for a full year.

Yes, many insurers offer the option to increase coverage amounts, often requiring further medical underwriting. For instance, Priya from Vancouver took the opportunity to increase her coverage after getting married and having a child, to better secure her growing family’s future, reflecting proactive financial planning.

The best age is when you are young and healthy; this is when premiums are lower and obtaining coverage is easier. For example, consider Derek from Montreal who secured a low-rate policy at 30 years old. This decision proved beneficial when he was diagnosed with a critical condition ten years later, allowing him to financially benefit significantly from the policy.

In Canada, premiums for personal Critical Illness Insurance are generally not tax-deductible. However, the payouts received are tax-free. This was a significant relief for Anna in Toronto, who was able to use her entire tax-free payout to cover unexpected recovery costs without worrying about additional tax burdens.

Always scrutinize the fine print for exclusion clauses, coverage limitations, and the definitions of covered conditions. Alex in Halifax overlooked this aspect and was surprised when his claim for a borderline condition was denied. His experience points out the importance of understanding every detail of your Critical Health Insurance Plans.

Through these questions and stories, we aim to deepen your understanding of Critical Illness Insurance and its crucial role in securing financial stability during health emergencies. These real-life examples highlight the tangible benefits and essential features of Critical Health Insurance Plans. If you have further queries or need personalized advice, don’t hesitate to reach out. Let’s ensure you and your loved ones are well-protected with the right insurance strategy tailored to your unique needs.

Sources and Further Reading

To deepen your understanding of Critical Illness Insurance and ensure you are fully informed on how to navigate your policy options and claims, the following sources and further reading recommendations provide comprehensive and reliable information. These resources can help you explore the critical health insurance coverage importance and guide you in selecting the best critical health insurance plans to meet your needs.

Canadian Life and Health Insurance Association (CLHIA):

Website: CLHIA Homepage

Resource: Guides on life and health insurance products, including Critical Illness Insurance specifics, policy management, and claims processes in Canada.

Insurance Bureau of Canada (IBC):

Website: IBC Homepage

Resource: Provides detailed brochures and articles on various types of insurance, including critical illness, and advice on managing insurance policies and handling claims.

Government of Canada – Financial Consumer Agency:

Website: Financial Consumer Agency of Canada

Resource: Offers resources on insurance choices and consumer rights in Canada, including tips on choosing insurance plans and understanding insurance contracts.

Canadian Cancer Society:

Website: Canadian Cancer Society

Resource: Information on how Critical Illness Insurance can support families dealing with cancer, including financial advice and insurance buying tips.

Heart and Stroke Foundation of Canada:

Website: Heart and Stroke Foundation

Resource: Insights into how Critical Illness Insurance can aid with financial burdens in the event of severe heart conditions or strokes.

By engaging with these resources, you can gain a more thorough understanding of Critical Illness Insurance, enhancing your ability to make educated decisions about your and your family’s insurance needs. These sources will arm you with the knowledge necessary to navigate the often complex landscape of insurance policies, ensuring you are well-prepared for any health uncertainties that may arise.

Key Takeaways

- Critical Illness Insurance provides a lump sum payment for specified conditions, helping manage financial burdens during health crises.

- This coverage is a financial safety net that supports beyond medical expenses, covering income loss and other financial needs.

- Choosing the right plan involves understanding covered illnesses, payout terms, and exclusions to avoid surprises during claims.

- Keeping up with premium payments and policy terms through automatic payments and regular reviews prevents coverage lapses.

- If a claim is denied, review the denial reasons, gather more documentation, and consider an appeal to potentially overturn the decision.

- Proactive policy management includes updating contact information and reassessing coverage needs to ensure policy effectiveness.

- Real-life stories throughout the blog illustrate the challenges and complexities individuals face with their insurance policies.

- Consulting legal experts or insurance brokers is advised for clarity and to ensure policy benefits when filing claims or choosing plans.

Your Feedback Is Very Important To Us

This questionnaire is now enhanced to capture not only demographic and basic insurance details but also the source of information that influenced the choice of insurance, providing deeper insights into decision-making processes related to Critical Illness Insurance.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]