Think about how your evening might change if your child suddenly got a high fever that wouldn’t go down. So, you rush to the emergency room with thoughts running through your mind as to what could be wrong until you are hit with a diagnosis that changes everything: a critical illness necessitating ongoing care and perhaps even specialized treatment. This is a scenario no parent wants to envision, yet it is a reality for many Canadian families every year. Critical Illness Insurance for children is protection—a protection against the unknown—to do nothing but recover your child while keeping them free from the looming thought of going broke.

Being worried about your child getting sick is hard enough on its own, but being worried about losing your job can make things even worse. Let’s discuss just how Critical Illness Insurance can provide a safety net by discussing specifics like costs, quotes, and plans. We will share stories from our day-to-day client interactions here at Canadian LIC, which enlighten us on these challenges and solutions to make the whole thing very relatable and understandable.

Understanding Critical Illness Insurance for Children

What is Critical Illness Insurance?

Critical Illness Insurance is meant to assist with financial concerns by giving you a one-time payment if your child gets one covered critical illness by the policy. This money can be used for a variety of things, such as any kind of medical care that isn’t covered by health insurance or changes that need to be made to the child’s home life or way of life.

Why is it Essential for Your Children?

Critical Illness Insurance is not the third thing on your list of things to do. It’s a significant part of a safety net for family members. We outline here some of the main reasons that securing this insurance for critical illness is so imperative for your child’s welfare:

Immediate Financial Support: A diagnosis such as leukemia in a child could immediately increase the financial burden on the family manifold through treatment expenses at special facilities away from home. Critical Illness Insurance will give a lump-sum payout to help compensate for such unexpected expenses right away.

Best Possible Care: This is another area where the money from a Critical Illness Insurance Policy will help pay for treatment by the best expert or facility, even if it means going out of the country if needed. At times, treatments given by the best can make all the difference in terms of quality and effectiveness.

Non-Medical Expenses Coverage: There are so many other such expenditures, besides treatment costs, that arise in the course of a child’s care for a critical illness. Travel, accommodation near specialized hospitals, or even daily expenses if a parent has to stop working can be managed through the insurance payout, hence saving from stress and financial strain.

Preserving Savings: A lot of families use their savings or retirement funds to pay for expensive medical care if they don’t have Critical Illness Insurance. This can put their financial balance and future plans at stake. In such cases, the payout from a critical illness policy protects the savings so they can remain intact for the purpose they were saved for.

Support for the Whole Family: The illness of a child affects more than just the immediate family. More often than not, the extended family glides in to support, probably to the detriment of their pocketbooks. In this situation, Critical Illness Insurance would allow financial independence to the core family unit and reduce the ripple effect on everyone involved.

Emotional and Psychological Relief: Knowing the financial aspects are taken care of allows the parents to concentrate on the much-needed emotional support and care for the sick child and other family members. This may go a long way in mitigating the overall stress brought about by money worries and thus creating a better emotional environment for the recovery of the child.

Flexibility of Fund Use: The lump sum under a Critical Illness Insurance Policy, unlike many insurance types, can be used for anything that the family feels is necessary. It could be to fund experimental treatments not covered by health plans, provide educational tutors if the child falls behind in school, or just have some special family outings to raise everyone’s spirits.

Promotion of early management of health: Critical Illness Insurance may also motivate parents to be more responsible and proactive in managing the health of their children. They will regularly follow up on check-ups and detect diseases at an early stage if they are aware that there is a monetary backup for them.

Lifelong Effect: Some of these critical illnesses have long-term consequences that may haunt the child into adult life. A critical illness policy would provide financial support for continuous medical care, making adjustments to lifestyle changes, and continuous support services.

Peace of Mind: Undoubtedly, peace of mind is the most significant benefit one can have from Critical Illness Insurance. Knowing that there is a potential for some level of safety net in place makes all the difference in how the family navigates that difficult journey with their sick or severely ill child.

The Cost of Critical Illness Insurance

Understanding the ‘Critical Illness Insurance Cost‘ is an important aspect. The cost varies drastically by different factors. The factors may include the age of the child, the sum assured towards the specified illnesses, and the coverage. At Canadian LIC, we have observed that investing in a critical illness plan at a young age is very cost-effective and gives mental peace, knowing that your child is insured.

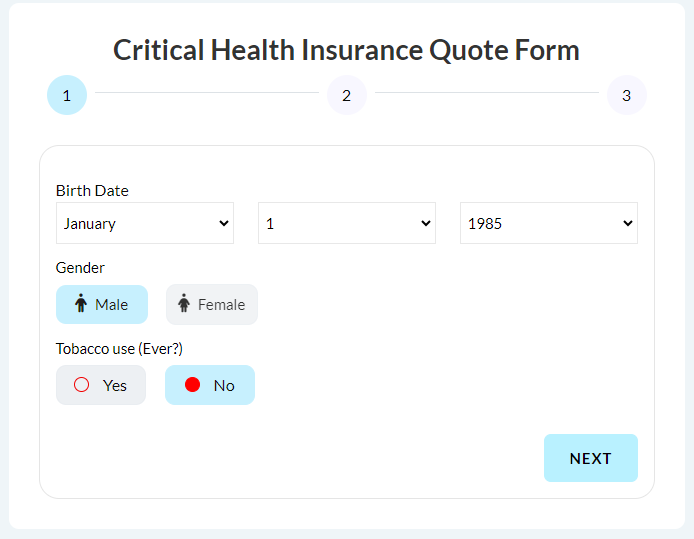

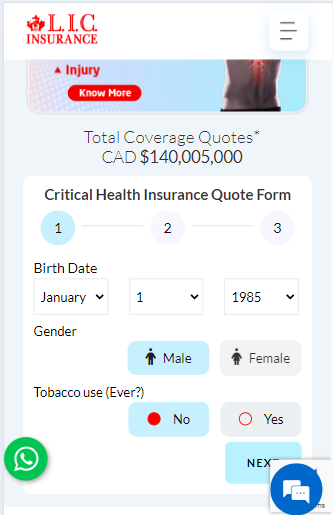

Getting Critical Illness Insurance Quotes

Comparing what is covered under the various contours of plans forms the crux while searching for this ‘Critical Illness Insurance Quote’. Third comes offering various terms and conditions by each insurer, and of course, the premiums—one might differ indeed. At Canadian LIC, our team will help our clients analyze these to get the best quotes that would fit their pocket and requirements. It took the Patel family so many insurance quotes to come up with the perfect one, proof that good research and professional guidance are a necessity in securing the best insurance plans.

Choosing the Right Critical Health Insurance Plans

Choosing between several ‘Critical Health Insurance Plans’ could be a problem. This goes beyond seeking the lowest premium but also working to ensure the coverage includes the most likely illnesses that your child may suffer from. Canadian LIC experience shows that special attention to the unique needs of each family makes for better protection. For instance, a family with a history of diabetes looked specifically for coverage that included this condition and was able to secure a comprehensive plan that provided immense relief when their youngest was unfortunately diagnosed.

Wrapping Everything Up

Knowing that you are able to afford care for your child when they are ill in itself is immeasurable peace of mind. It’s something we at Canadian LIC, the top insurance brokerage firm in Canada, have seen time and again: Critical Illness Insurance making a world of difference at some of the worst times in the lives of families. Don’t wait for a medical emergency to think about your options. Contact our office today to discuss how Canadian LIC can help ensure your child’s future by making sure that, in the event something unthinkable happens, you’re ready for that moment. After all, it’s not simply insurance but assurance that is going to make a world of difference in bringing you peace of mind so that you can actually be there for your child, no matter what.

This will be your first step toward understanding and securing Critical Illness Insurance for your children. If you act now, you are not only planning your finances but also providing for the health of your child and the well-being of your family. Be one of the thousands of parents who found confidence and security through Canadian LIC. Let’s ensure that your family is covered today for a healthier tomorrow.

Find Out: Are broken bones covered by Critical Illness Plan

Find Out: Can Critical Illness Insurance be cancelled?

Find Out: Can you add Critical Illness Cover to an existing policy?

Find Out: Know about a Critical Illness Insurance claim

Find Out:The cancers not covered by Critical Illness Insurance

Find Out: Is heart failure covered by a Critical Illness Policy?

Find Out: Is death covered by Critical Illness Insurance?

Find Out: Is it possible to have two Critical Illness Policies at the same time?

Find Out: Can You Take Out Critical Illness Cover Without Life Insurance?

Find Out: What Age Should You Get Critical Illness Cover?

Find Out: Critical Illness Vs. Disability Insurance In Canada(The Differences)

Find Out: What Is The Difference Between Life Insurance And Critical Illness Insurance?

Find Out: Why Is Critical Illness Insurance Coverage Important? And Do We Need It?

Find Out: How Critical Illness Insurance Can Be Your Lifesaver In Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Critical Illness Insurance for Children

Critical Illness Insurance may vary greatly in cost based upon a number of variables, including age and health status of the child, sum assured, and the number of conditions covered. We at Canadian LIC find that, quite often, families are pleasantly surprised at how affordable premiums can be. For instance, since the birth of their baby boy, the Thompsons have been able to insure him comprehensively at a much lower rate than they had expected, and this now covers him well into adulthood.

You will be able to get Critical Illness Insurance Quotes through brokers such as us at Canadian LIC. We deal with a number of different insurers, all with whom we work to produce a range of quotes to suit different needs and budgets. One of our clients, the Martins, compared a few quotes we provided, which helped them understand better how options could offer the right plan for their daughter, who was diagnosed with a congenital heart condition.

While buying Critical Illness Insurance, pay close attention to the details of the coverage. See which illnesses the plan covers, how much lump sum will be paid, and what supplementary benefits exist for partial payouts and return of premium options. Check how the plan will fit into your financial situation and your child’s health needs. We helped the Nguyen family choose a plan that did not contain only common illnesses but also rare conditions based on the family’s medical history.

Yes, most insurers do allow one to adjust the sum assured. This could prove very important in case your financial situation changes or if your child’s health needs change. Last year, we helped the Kim family increase their coverage after the birth of their second child, who has a very rare genetic disorder so that their insurance plan would meet the new needs.

Typical to most payout processes is some sort of waiting period, often 30 days from diagnosis, to determine that the condition meets the policy’s terms. Once that has been overcome and the claim approved, then normally, the lump sum is paid out, and that is that. In many instances — in as little as weeks — families like the Clarkes, whose boy was diagnosed with leukemia, managed to have a payout that allowed them to take up treatment without further delay.

Generally, a Critical Illness Cover pays off on a tax-free basis in Canada. It means that you can utilize the whole amount toward your child’s needs for support without having to worry about taxes being deducted. This was a significant relief for the Howard family, who used the payout to cover both medical and living expenses during their child’s lengthy treatment.

Although no policy can insure against every known illness, you do have a choice when it comes to picking a plan covering a wide spectrum of diseases. It’s important to review the list of covered conditions carefully and consider any family health history. We, at many times, walk families like the Browns through the fine print to ensure their coverage is the full coverage possible, giving them the peace of mind they need for today and a better tomorrow.

Some critical insurance coverage permits the return of premium options. Either all or part of the premiums paid is refundable if no claim is involved by the end of the policy term. For the Greens, the return-of-premium choice was the deciding factor. They knew they could get their money back if they never needed the insurance.

In general, a Critical Illness Insurance Policy taken for a child is less expensive than an adult because of a lesser risk of being medically diagnosed with any of the illnesses described. However, it is still very important. At Canadian LIC, we often share the story of the Walker family, who were surprised to find that insuring their two children was more affordable than they initially thought, especially when compared to their own adult policies.

To have a good comparison between the Critical Illness Insurance Quotes, a determination shall not be purely on the premium costs but shall further consider the breadth of coverage, the exclusions, and ease of claiming. Here at Canadian LIC, we do a point-by-point comparison side by side for any of our clientele who require it, like in the case of the Lee family, so they comprehend every difference between the plans and get one that can best suit their daughter’s peculiar health needs.

Various types of Critical Health Insurance Plans are available for children, ranging from basic coverage that includes a handful of major illnesses to more comprehensive plans covering dozens of conditions, including rare diseases. For example, the Chen family opted for a comprehensive plan after learning from Canadian LIC about the potential genetic risks associated with their family history.

You can reduce your Critical Illness Insurance premiums further by opting for a policy that has a longer waiting period, specifying just a few illnesses covered, or agreeing to a partial payout for less serious cases of an illness. The Morison family made some adjustments to the variables in the policy with Canadian LIC and reduced the premium burden while buying substantial coverage for their children.

It’s advisable to check your child’s Critical Illness Insurance Policy every few years or after major life changes. These could include, for example, a new diagnosis in the family or just a change in your financial situation. We remind clients like the Thompsons that it is important, from time to time, to review their policies so that their coverage continues to be in line with their current needs and circumstances.

Although Critical Illness Insurance normally provides a lump sum that can be spent at the policyholder’s discretion, some families use it to provide educational support or special schooling if an ongoing illness of a child disrupts their educational life. That was how it was for the Rodriguez family, who used part of the insurance payout to hire a tutor for their son when his illness made him miss several months of school.

If you’re rejected for a Critical Illness Insurance Quote, you want to know why. It may present an issue with the illness itself, or perhaps there may be misinformation regarding your child’s medical history. At Canadian LIC, we work to help our clients, like we did for the Gibsons, who were able to successfully appeal an initial denial by providing additional medical documentation.

By answering these frequently asked questions with real-life scenarios drawn from the daily experiences of Canadian LICs, we would like to help you understand more intrinsically how Critical Illness Insurance can become the saving grace, or that additional layer of protection, for the health and financial well-being of your family.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA) – Offers comprehensive guidelines and definitions related to Critical Illness Insurance in Canada.

Website: CLHIA

Statistics Canada – Provides up-to-date statistical data that can be used to understand the prevalence of critical illnesses among Canadian children.

Website: Statistics Canada

Canadian Cancer Society – A useful resource for information on cancer statistics in Canadian children, which can help in understanding the risks and the need for insurance.

Website: Canadian Cancer Society

Cystic Fibrosis Canada – Offers detailed information on cystic fibrosis, including prevalence rates, which is helpful for parents considering critical illness coverage.

Website: Cystic Fibrosis Canada

CanChild – Provides information on various childhood conditions, including cerebral palsy, which can be covered under Critical Illness Insurance.

Website: CanChild

Canadian Pediatric Society – For insights into various pediatric health conditions and their impact on Canadian families, useful for understanding the scope of Critical Illness Insurance.

Website: Canadian Pediatric Society

These resources provide a solid foundation for understanding Critical Illness Insurance for children in Canada, helping parents make informed decisions based on statistical data, medical information, and financial advice.

Key Takeaways

- The blog clarifies what Critical Illness Insurance is and its importance for financial safety during a child’s severe health diagnosis.

- It highlights the financial relief from insurance, covering costs like medical care and travel, allowing focus on child recovery.

- Insights into determining costs and tips for obtaining and comparing quotes help find suitable and affordable coverage.

- Discussion on the variety of plans available and selecting one that covers a broad spectrum of illnesses relevant to the family.

- Real-life stories from Canadian LIC illustrate how Critical Illness Insurance supports families during critical times.

- Advice on consulting with insurance professionals like Canadian LIC to make informed decisions about tailored coverage.

- Encourages proactive engagement wit

Your Feedback Is Very Important To Us

We are eager to understand your experiences and struggles in purchasing Critical Illness Insurance for your children in Canada. Your feedback is invaluable and will help us improve our services and support. Please take a few moments to answer the following questions:

Thank you for taking the time to provide your feedback. Your responses are crucial in helping us understand and address the needs of parents looking to secure Critical Illness Insurance for their children.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]