Insurance is a vital consideration when it comes to protecting your financial future and your loved ones. In Canada, one common question that often arises is whether you can obtain Critical Illness Insurance without bundling it with a Life Insurance policy.

Here, we will explore the possibilities, options, and factors to consider when it comes to Critical Illness Insurance in Canada. We’ll also go into the benefits of having a Life Insurance policy with Critical Illness Coverage.

Let’s Get to Know Critical Illness Insurance Coverage

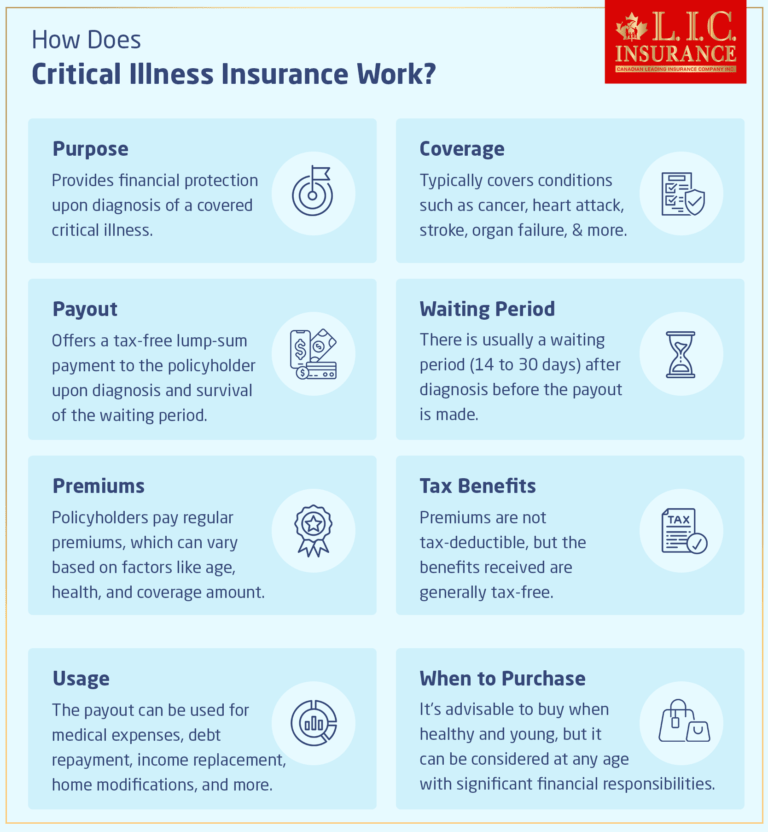

Critical Illness Insurance, often referred to as critical illness cover, is a type of policy that provides a lump-sum payment in the event you are diagnosed with a serious illness covered by your policy. These illnesses typically include conditions such as cancer, heart attack, stroke, and organ failure, among others. The payout from Critical Illness Insurance can be used to cover medical expenses, debt repayment, or any other financial needs that may arise during your illness.

Can You Get Critical Illness Insurance Without Life Insurance?

Yes, you can obtain Critical Illness Insurance without having to purchase a Life Insurance policy alongside it. In Canada, Critical Illness Insurance is available as a standalone product. This means you can choose to buy a critical illness policy independently to protect yourself and your family from the financial burden of a serious illness.

Standalone vs. Combined Cover

While it is possible to opt for a standalone Critical Illness Insurance plan, it’s essential to consider the pros and cons of this approach. One advantage is that you get dedicated coverage for critical illnesses, and the payout is not dependent on your passing away. However, it’s worth noting that standalone critical illness policies may be more expensive compared to combining them with a Life Insurance policy.

Tax Benefits of Combined Coverage

In Canada, insurers often receive tax benefits on Life Insurance policies. This can make it more cost-effective to bundle Life Insurance with Critical Illness Coverage. By doing so, you can potentially save money on premiums, making it a more attractive option for many individuals and families.

Comparing Quotes

In order to make an informed decision about whether to opt for standalone Critical Illness Insurance or combined life and Critical Illness Insurance, it’s crucial to compare quotes from different insurance providers. By doing this, you can assess the premium differences and determine which option best suits your budget and needs.

Existing Life Insurance Policies

If you already have a Life Insurance policy in Canada, you might wonder if you need additional Critical Illness Coverage. The answer to this question largely depends on your individual circumstances. It’s advisable to consult with a financial adviser who can assess your current Life Insurance policy, your medical history, and any changes in your lifestyle and budget.

A financial adviser can provide personalized recommendations based on your specific needs. They can help you determine if your existing Life Insurance policy offers sufficient protection in the event of a critical illness or if it’s worthwhile to add a standalone critical illness policy.

Why Seek Expert Advice?

Choosing the right insurance coverage is a significant decision, and making the best choices that suit your financial goals and your family’s well-being is essential. Here are a few reasons why seeking expert advice is crucial:

Tailored Recommendations: An experienced financial adviser can assess your unique circumstances, including your current insurance coverage, financial goals, and risk tolerance. They can tailor recommendations to ensure you have the right level of protection.

Cost-Efficiency: Advisers can help you identify cost-effective options by considering bundled policies, available discounts, and potential tax benefits.

Peace of Mind: Knowing that you have the right insurance coverage in place can provide peace of mind. It ensures that you and your loved ones are protected financially, no matter what life throws at you.

To Wrap Up

In Canada, you can indeed obtain Critical Illness Insurance without bundling it with a Life Insurance policy. However, the decision to go standalone or opt for combined coverage depends on various factors, including your budget, financial goals, and existing insurance policies.

If you’re unsure about the best approach for your specific situation, seeking advice from a qualified financial adviser is highly recommended. They can help you deal with the complexities of insurance options and ensure that you make the right choices to safeguard your financial future.

Whether you choose standalone Critical Illness Insurance or decide to combine it with Life Insurance, taking proactive steps to protect yourself and your family is a wise decision. Life Insurance with Critical Illness Coverage can provide you with financial security and mental peace, knowing that you’re prepared for any unexpected health challenges that may arise.

Don’t hesitate to reach out to our friendly and expert team for personalized assistance in selecting the right insurance coverage for your needs.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

Yes, Critical Illness Insurance is important because it provides financial protection in the event you are diagnosed with a covered critical illness. It offers a lump-sum payout that can help you cover medical expenses, debt, and other financial needs while you focus on your recovery.

The cost of Critical Illness Insurance varies depending on several factors, including your age, health, coverage amount, and the insurance provider you choose. Premiums can range from a few hundred to several thousand dollars annually. It’s advisable to obtain quotes from multiple insurers to find a policy that fits your budget.

Critical Illness Insurance typically covers a range of serious medical conditions, including but not limited to cancer, heart attack, stroke, organ failure, major organ transplant, and paralysis. The specific covered illness may vary between insurance policies and providers, so reviewing your policy documents is essential.

Critical Illness Insurance works by providing a tax-free lump-sum payment upon the diagnosis of a covered illness. You select a coverage amount when purchasing the policy. Suppose you are diagnosed with a qualifying condition and survive the waiting period (usually 14 to 30 days). In that case, you receive the payout, which can be used for medical expenses or any other financial needs.

In Canada, Critical Illness Insurance premiums are typically not tax-deductible for individuals. However, the benefits received from a Critical Illness Insurance policy are generally tax-free.

The ideal time to get Critical Illness Insurance is when you are healthy and in good medical condition. Purchasing a policy when you are younger can result in lower premiums. It’s also advisable to consider Critical Illness Insurance if you have dependents or significant financial responsibilities.

Critical Illness Insurance pays out when you are diagnosed with a covered critical illness and survive the waiting period specified in your policy. The payout is made after you provide your insurance provider with the necessary medical documentation and proof of diagnosis.

You can use Critical Illness Insurance payout for various purposes, including:

Covering medical expenses not covered by provincial health plans.

Replacing lost income if you cannot work during your illness.

Paying off debts, such as a mortgage or loans.

Funding necessary home modifications or caregiving expenses.

Providing financial security for your family during your recovery.

Yes, you can purchase Critical Illness Insurance as a standalone policy in Canada. It is not mandatory to bundle it with a Life Insurance policy.

Standalone Critical Illness Insurance policies may be more expensive compared to combined life and Critical Illness Insurance because of the tax benefits associated with Life Insurance. It’s essential to compare quotes to determine the cost difference.

Cancer, heart disease, stroke, organ failure, and other serious diseases are often covered by Critical Illness Insurance. The specific covered conditions may vary between insurance providers, so reviewing the policy details is essential.

Combining Life Insurance with Critical Illness Insurance can often result in cost savings due to tax benefits associated with Life Insurance policies. It’s recommended to compare quotes and consult with a financial adviser to determine the most cost-effective option for your needs.

Depending on your insurance provider and policy terms, you may have the option to add Critical Illness Coverage as a rider or endorsement to your existing Life Insurance policy. It’s advisable to contact your insurance company to inquire about this possibility.

If you want to find out whether your current Life Insurance policy offers sufficient protection in the event of a critical illness, it’s best to consult with a financial adviser. They can evaluate your policy, medical history, and individual circumstances to provide personalized recommendations.

Financial advisers have expertise in assessing your unique financial situation and insurance needs. They can help you make smarter decisions, identify cost-effective options, and ensure that you have the right level of protection in place.

Critical Illness Insurance provides a lump-sum payment upon diagnosis of a covered condition, helping you cover medical expenses, debt repayment, and other financial needs during your illness. It offers financial security during a critical health crisis, whereas Life Insurance primarily provides a payout upon your passing.

To receive personalized assistance and expert guidance on selecting the right insurance coverage for your needs, you can contact our friendly team at Contact@canadianlic.com or Info@canadianlic.com Phone: 1 844-542-4678 or 416 543 9000. We are here to help you secure your financial future.

Critical Illness Insurance can be suitable for individuals of various ages, but the suitability may depend on your specific circumstances and financial goals. Consult with a financial adviser to determine if it suits your needs or not.

Your ability to obtain Critical Illness Insurance with a pre-existing medical condition may vary between insurance providers. Some insurers may offer coverage with certain restrictions or exclusions, while others may decline coverage. It’s advisable to shop around and discuss your options with an insurance advisor.

The waiting period, also known as the “survival period,” varies between insurance providers and policies. Typically, it ranges from 14 to 30 days after the diagnosis of a covered critical illness. Review your policy documents for specific details on the waiting period.

Most insurance policies allow for cancellation, but it’s essential to understand the terms and conditions. Some policies may offer a grace period during which you can cancel for a full refund. Others may have cancellation fees or partial refunds. Contact your insurance provider for details.

If you outlive the term of your Critical Illness Insurance policy and do not make a claim during that period, you typically do not receive any benefits. The policy coverage ends, and you may need to explore other insurance options if necessary.

Some insurance policies may allow you to adjust the coverage amount, but it often depends on the terms and conditions set by the insurance provider. Review your policy documents and contact your insurer for information on making changes to your coverage.

Critical Illness Insurance can be particularly valuable for self-employed individuals and business owners who may not have employee benefits to rely on. It provides financial protection in case of a critical illness, ensuring business continuity and financial security.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com