- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- A Guide to the Rules of Trading Stocks within Your TFSA: Avoiding Pitfalls and Maximizing Your Benefits

- The Basics of Trading Stocks in a TFSA

- When Does TFSA Stock Trading Become Taxable?

- What Are Qualified Investments in a TFSA?

- How to Avoid Tax Issues When Trading Stocks in a TFSA

- How TFSA Stock Trading Differs from Other Accounts

- Explaining how TFSA stock trading differs from other accounts like RRSP and RESP

- Avoiding Day Trading Pitfalls in Your TFSA

- Final Thoughts

A Guide to the Rules of Trading Stocks within Your TFSA: Avoiding Pitfalls and Maximizing Your Benefits

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 4th, 2026

SUMMARY

This blog explains the rules of trading stocks within a TFSA, including when stock trading income becomes taxable. It covers the concept of business income, non-qualified investments, and the CRA’s criteria for determining business activity. The blog also discusses qualified investments, such as stocks, bonds, and ETFs, and offers tips on avoiding tax penalties while trading. Additionally, it compares TFSA trading with other registered accounts like RRSPs and highlights best practices for stock trading within a TFSA.

Introduction

Do you plan to use your TFSA (Tax-Free Savings Account) to buy and sell stocks? Do you have some questions regarding the rules surrounding it? TFSAs have incredible benefits, like tax-free growth on your investments, so many Canadians are enrolling. However, there are some rules governing stock trading inside these accounts that could trip up even seasoned investors. It may seem easy to say trading within your TFSA is no different from any other investment, but this is an attempted use of your TFSA against the spirit of its creation, and therefore, there are rules in place to ensure it is used as intended.

For example, you may be an investor who has built a successful portfolio of stocks. You’ve been buying and selling in your TFSA, cashing in on some gains, and everything seems great. Except it turns out that one of your trades has resulted in a tax because you’ve broken some rules. That may sound frustrating, but it’s a situation some investors get themselves into if they don’t know exactly how their TFSA can be used.

In this guide, we’re going to explore TFSA stock trading rules and what you can and cannot do within the account while also explaining how to avoid tax penalties that might come with stock trading in your TFSA.

The Basics of Trading Stocks in a TFSA

Let’s start with the good news: capital gains you realize when trading stocks inside a TFSA are tax-free. The reasoning behind this is that TFSAs are designed to encourage long-term saving and investing. A TFSA can be great for anyone, whether you invest infrequently or want to build wealth. You won’t pay taxes on the gains you make from stocks, dividends and interest, and you won’t pay taxes when you take out your money.

However, this “tax-free” label applies only if you follow the rules set down by the Canada Revenue Agency (CRA). It’s common for people to get confused when their gains on stock trades inside a TFSA become taxable, and it’s often for one of a couple of reasons. So, let’s go over those now.

When Does TFSA Stock Trading Become Taxable?

Most TFSA investors will never have to worry about paying taxes on their stock trading profits. But there are some exceptions. Understanding these will help you avoid the trap of accidentally triggering a tax penalty:

1. Business Income

The first scenario in which your TFSA stock trading could become taxable is where your activity is determined to be carrying on a business. The CRA considers several factors that determine if your stock trading counts as business income. Several of the reasons are:

- Transaction Frequency: If you are trading stocks regularly, such as day trading or flipping stocks constantly, the CRA may treat this as business activity rather than investment.

- Duration of Ownership: The longer you own a stock, the more likely you are to consider it an investment. If you plan to hold onto a stock for a brief period of time before you sell it, the CRA may deem this speculative trading.

- Time Devoted to Trading: When you spend a lot of time on trading, it could be a sign you treat it as a business.

- The Type of Stocks You Trade: If you’re putting your money into high-risk stocks and then flipping them quickly for a profit, that could also be an indication that you’re doing business.

For example, consider someone who trades stocks daily, capitalizes on market movements by buying and selling stocks in quick succession and spends considerable time analyzing market trends. The CRA may deem this a “business” activity, and your profits may be taxable.

So it went in the case of Vancouver-based investment adviser Fareed Ahamed, who ended up with a massive tax bill when his day trading — done often enough to be classified by the Tax Court of Canada as a business – hit his TFSA. Ahamed was a frequent trader of penny stocks on the TSX Venture Exchange, which prompted the CRA to determine that his income was taxable, as it fulfilled several points out of the business activity checklist.

When CRA taxes TFSA trading activity, it may be taxed as business income, not as a capital gain, which can increase the tax impact.

2. Non-Qualified Investments

A TFSA can hold non-qualified investments or assets that are not allowed to be held within a TFSA. For instance, investments such as stocks listed on major stock exchanges and government bonds are allowed, but some investments are not. Examples of non-qualified investments may include:

- They are not listed on any particular stock exchange.

- Certain foreign mutual funds.

- Personal stakes or investments, like shares in a business you own or manage.

- If you have non-qualified investments in your TFSA, you might incur a big penalty. If you have non-qualified investments in your TFSA, the CRA will assess the value of those investments at the time of withdrawal and will charge a 50% tax on that amount, as well as any capital gains tax you owe on the investment.

What Are Qualified Investments in a TFSA?

Qualified investments are assets that CRA generally allows inside a TFSA. These often include publicly traded stocks on designated stock exchanges, ETFs, mutual funds, GICs, and many bonds.

Most Canadians only hold qualified investments without even realizing it, because major broker platforms usually offer TFSA-eligible products by default.

Still, it is smart to confirm TFSA eligibility before buying unfamiliar assets, private shares, or certain foreign investments.

How to Avoid Tax Issues When Trading Stocks in a TFSA

While many Canadians use their TFSAs to hold for long-term investments like stocks, bonds and ETFs, there are steps you can take to ensure you’re not inadvertently crossing into business territory.

Trade Less Frequently

Maintaining a low volume of stock trades is one of the simplest ways to ensure that your stock trading activity is not treated as a trade or business. Instead, avoid any type of day trading or selling stocks after short amounts of time. Instead, invest in stocks that you plan to hold for more extended periods. This will also help keep your activities squarely in the business of investing, not running a business.

Diversify Your Portfolio

A further good practice is that you are avoiding speculative stocks. If you trade speculative, high-volatility stocks on a regular basis, you may be considered to be doing business, particularly when your trades are short-term. Rather, retreat to a balanced portfolio of long-term stocks, including established companies and ETFs.

Talk to a Tax Professional

If you’re not sure if your trading practices could cause tax penalties or if you are concerned, it’s always wise to speak to a tax professional. An expert can explain the rules in more detail and advise you on how to avoid potentially expensive mistakes.

TFSA Rules Canada: How Many Trades Are Allowed, Requirements, And Smart Strategy

Many Canadians follow TFSA trading rules for buying and selling stocks, but they still ask the same thing: TFSA how many trades allowed before CRA starts paying attention? The honest answer is that the CRA does not publish a fixed number. There is no official “10 trades per month” or “50 trades per year” limit written in law. Instead, CRA looks at your pattern, frequency, and intent to decide whether your TFSA activity looks like investing or business-level trading.

If you are serious about avoiding trouble, treat your TFSA as an investing account first. When you trade too frequently, rotate in and out of positions quickly, and chase short-term gains, CRA may question whether that activity is really investing. That is why people also search for day trading rules Canada, because what matters most is whether CRA believes it looks like day trading.

To make it clear, here is what many investors want to know:

TFSA Rules: Can You Buy And Sell Stocks In TFSA?

Yes, you can buy and sell stocks inside a TFSA, and TFSA stocks can grow tax-free through capital gains and dividends. This is why trading in a TFSA is so popular among Canadians. As long as your activity stays within CRA expectations, your gains and TFSA dividends taxable concerns do not apply because the investment income is normally tax-free.

TFSA Short Term Trading: What Does CRA Consider Day Trading TFSA?

People ask, what does CRA consider day trading TFSA, because the risk is real. CRA may view it as business activity if your trades look like you are flipping stocks for profit, not building long-term wealth. TFSA short-term trading becomes risky when you are constantly buying and selling the same holdings, holding for very short periods, and putting a lot of time into it like a job.

TFSA Requirements: What Investments Are Not Allowed In TFSA?

A big part of TFSA requirements is holding the right type of assets. So the question, what investments are not allowed in TFSA, matters a lot. In general, most investors stay safe by sticking to TFSA-eligible investments like publicly traded stocks, ETFs, mutual funds, GICs, and bonds. Risk starts when investors buy investments that are non-qualified, prohibited, or not eligible under CRA rules.

Can You Trade Options In A TFSA? Can You Buy Options In TFSA?

Yes, many Canadians ask, can you trade options in a TFSA or can you buy options in TFSA, and the answer is: it depends on the brokerage rules and what kind of options you use. Some platforms allow certain option strategies in a TFSA, but not all strategies qualify. Options trading can also look more speculative, so if you are using options with frequent short-term trading behaviour, it may raise CRA concerns faster than long-term stock investing.

How To Invest TFSA In Stocks: A Safer TFSA Investing Strategy

If your goal is long-term growth, the simplest approach is to focus on strong companies and diversified funds. Many investors searching for how to invest TFSA in stocks do better with a slow and steady plan rather than chasing quick wins.

A smarter TFSA investing strategy usually includes:

- Picking stable sectors or diversified ETFs

- Avoiding constant buy/sell flipping

- Holding for longer periods instead of short bursts

- Building a portfolio of Canadian stocks for TFSA if you want to stay closer to home-market familiarity

The goal is simple: grow the account with consistency, not chaos.

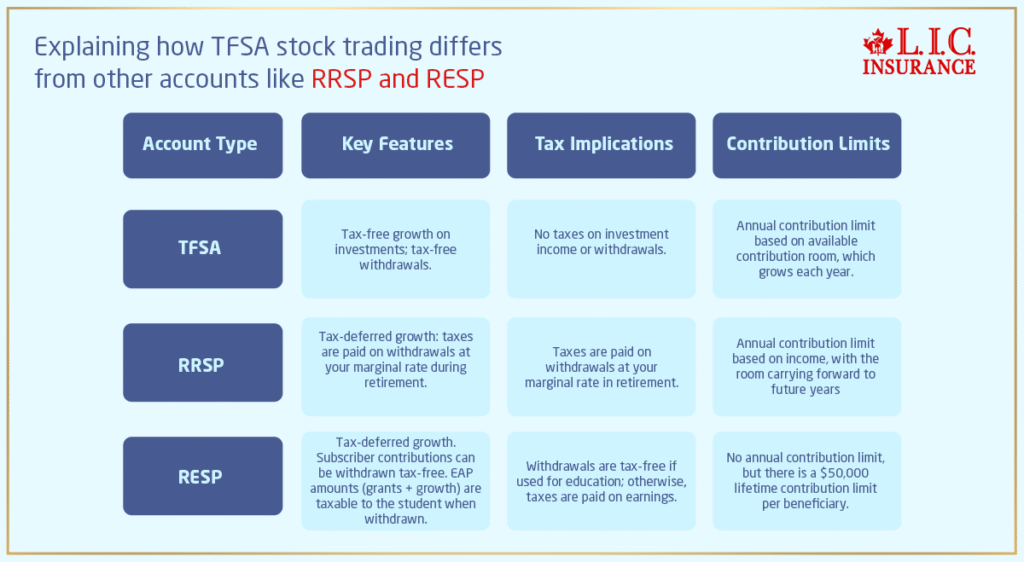

How TFSA Stock Trading Differs from Other Accounts

If you trade stocks in other kinds of registered accounts — like a Registered Retirement Savings Plan (RRSP) or Registered Education Savings Plan (RESP) — you may be asking yourself how TFSA stock trading stacks up. The rules for stock trading in an RRSP or RESP differ from those of a TFSA.

In an RRSP or RESP, you earn income on your profits from trading stocks. It is not taxed when earned, but when you take money from those accounts, you will pay tax on that income. With TFSAs, on the other hand, all investment income is tax-free as long as you stick by the rules.

Explaining how TFSA stock trading differs from other accounts like RRSP and RESP

Avoiding Day Trading Pitfalls in Your TFSA

Unless you’re a professional trader or qualified in investment advice, day trading and swapping stocks constantly are probably going to be a headache. You don’t have to tiptoe around this, but it sure helps to know how the CRA is likely to interpret your trading activities.

If you’re buying and selling stocks within a TFSA, keep in mind that this is supposed to be a long-term investment tool and not something you’re trading stocks every day. The longer you hold an asset in your TFSA, the higher the chance your trading will be viewed as an investment activity rather than a business activity. So, for those of you who want to trade stocks in your TFSA and reap short-gain profits, it is important to respect the limits imposed by CRA.

Final Thoughts

Investing in stocks through a TFSA can be an excellent way to build wealth while benefiting from tax-free growth. However, there are rules governing how TFSAs are used and who can use them. With qualified investments, avoiding excessive trading, and holding on to stocks for the long term, you will not be worried about enjoying the tax benefits of your TFSA without any troubles with the CRA. When in doubt, an expert can help ensure that your trading practices remain above board.

Ultimately, knowing the rules and leveraging your TFSA to grow wealth for the future—while making sure your trades comply with the CRA—is the path to success with TFSA stock trading.

Frequently Asked Questions (FAQs) on TFSA Stock Trading

Yes, generally, income earned from buying and selling (trading) stocks in a TFSA is tax-free. This means that you do not pay taxes on capital gains, dividends, or interest you earn from your TFSA investments. On the other hand, if the CRA views your trading endeavours as business endeavours, then those profits may be taxable.

If you trade stocks in a way that the Canada Revenue Agency (CRA) considers “business activity,” the income you realize from those trades will be taxable. The CRA may consider your trading to be a business, not an investment, if you conduct a high number of trades, hold your securities for short periods of time, or spend a lot of time researching companies.

Non-qualified investments are investments that may not be properly held inside a TFSA. This includes securities that are not on a designated stock exchange, certain foreign mutual funds, or investments that you have a personal connection to (like owning shares in a company you own). Non-qualified investments can trigger a tax equal to 50% of the fair market value at the time the investment was acquired or became non-qualified.

Yes, you can trade penny stocks in your TFSA if they’re traded on a recognized stock exchange, such as the TSX or TSX Venture Exchange. The problem is that frequent trading of speculative penny stocks could be treated as business activity by the CRA, which can result in tax penalties.

These include stocks listed on designated stock exchanges, bonds, mutual funds, ETFs, government bonds and GICs. The investments can grow tax-free in your TFSA.

Factors such as the volume of transactions, the time devoted to trading, and the nature of the stocks being traded are considered by the CRA. The CRA may view your activities as being business-related if you’re day trading, only holding stocks for short periods of time, and spending a considerable amount of time observing and analyzing the markets — this may create a taxable earning.

Day trading is permitted in a TFSA, but caution should be exercised. On the flip side, buying and selling shares with frequency over the course of a few days or weeks may lead the CRA to designate that you are doing business trading vs investing for the long haul. That could have tax consequences. Just make sure you keep yourselves on the right side of CRA regulations when you mix up short-term trades along with long-term-oriented investments.

Yes, if you are holding non-qualified investments in your TFSA, the CRA may apply a 50% tax based on the fair market value when the investment was acquired or became non-qualified/prohibited, and additional taxes may apply depending on the situation. Moreover, the income earned on these non-qualified assets will be subject to standard capital gains taxation.

Well, you can take out everything you make (capital gains, dividends, and interest) tax-free, any time you want — which is a big advantage of a TFSA. There are no taxes or penalties on withdrawals, and the amount you take out is added back to your contribution room in future years.

Be sure that you never cross the line from investing in the business, or you risk tax penalties. Your trades should only be occasional — investing and changing your portfolio to suit long-term objectives, but don’t go short-term too crazily in buying and selling. If you’re not sure, it’s always best to check with a tax pro.

In other registered accounts like a Registered Retirement Savings Plan (RRSP), the rules are different. Income generated through stock trading within an RRSP has not been taxed when earned but will be taxed at the time of withdrawal in retirement. Withdrawing money from a TFSA is completely tax-free.

So, if you are new to investing, you can start trading stocks in your TFSA. Still, on the other hand, it’s important to understand the rules, and you may want to slow down a little and learn about the risks and the regulations before you get into frequent trading. Sticking to long-term investments like ETFs or blue-chip stocks can help you comply with CRA rules.

Well, this FAQ is here to help you understand how you can use TFSA to its maximum potential to trade stocks without falling into common debate traps. If you have further doubts, consult with a tax professional or financial advisor to make sure your trading strategy is compliant with the respective regulations.

Sources and Further Reading

- Canada Revenue Agency (CRA) – Tax-Free Savings Account (TFSA) Guide

This official guide provides detailed information on the rules surrounding TFSAs, including eligible investments, contribution limits, and tax considerations.

Visit CRA’s TFSA Guide - Investopedia – TFSA: What It Is and How It Works

Investopedia offers a comprehensive breakdown of TFSA rules and how Canadians can maximize their tax-free savings.

Read more on Investopedia - Financial Consumer Agency of Canada – TFSA Overview

A useful resource for understanding the ins and outs of TFSA accounts, including who can contribute and what types of investments are allowed.

Learn more on the Financial Consumer Agency of Canada - Canadian Securities Administrators – Investment Rules for TFSAs

The Canadian Securities Administrators provide guidelines on what constitutes a qualified investment in a TFSA.

Visit Canadian Securities Administrators - The Globe and Mail – Understanding the TFSA Day Trading Rules

This article offers insights into the CRA’s stance on day trading within TFSAs and how frequent trading can be considered a business activity.

Read more on The Globe and Mail - TaxTips.ca – TFSA Investment Rules

This site offers a thorough breakdown of the rules governing investments in TFSAs, with additional tips on managing contributions and understanding tax implications.

Check out TaxTips.ca

These resources provide a broader understanding of how TFSAs work, how to avoid tax penalties, and how to maximize the benefits of your TFSA.

Key Takeaways

- Tax-Free Earnings with Conditions: Trading stocks within a TFSA is typically tax-free, but if your activity is deemed “business” by the CRA, your earnings could become taxable.

- Qualified Investments: Only certain investments, such as stocks listed on designated exchanges, bonds, ETFs, and mutual funds, are allowed within a TFSA.

- Avoid Frequent Trading: Excessive buying and selling, especially with short holding periods, may lead to the CRA viewing your trading as a business, triggering tax penalties.

- Non-Qualified Investments: Holding non-qualified investments, like certain foreign assets or personal company shares, can result in a 50% tax on their value.

- Compare with Other Accounts: Unlike RRSPs, which tax withdrawals, TFSA earnings remain tax-free even when you withdraw them, as long as you follow the rules.

- Consult a Tax Professional: If you’re unsure whether your trading activities could be considered a business, it’s wise to consult with a tax professional to avoid penalties.

- Long-Term Focus: TFSAs are designed for long-term investing. Keeping stocks for extended periods helps you avoid triggering tax implications tied to business-like trading.

Your Feedback Is Very Important To Us

We appreciate your feedback! This questionnaire aims to help us understand your struggles and challenges in navigating the rules of trading stocks within your TFSA, as discussed in the blog “A Guide to the Rules of Trading Stocks within Your TFSA: Avoiding Pitfalls and Maximizing Your Benefits.” Your responses will assist us in providing better guidance and resources.

Thank you for taking the time to complete this feedback questionnaire. Your insights are invaluable to us!

IN THIS ARTICLE

- A Guide to the Rules of Trading Stocks within Your TFSA: Avoiding Pitfalls and Maximizing Your Benefits

- The Basics of Trading Stocks in a TFSA

- When Does TFSA Stock Trading Become Taxable?

- What Are Qualified Investments in a TFSA?

- How to Avoid Tax Issues When Trading Stocks in a TFSA

- TFSA Rules Canada: How Many Trades Are Allowed, Requirements, And Smart Strategy

- How TFSA Stock Trading Differs from Other Accounts

- Explaining how TFSA stock trading differs from other accounts like RRSP and RESP

- Avoiding Day Trading Pitfalls in Your TFSA

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP