- Are There Any Tax Benefits for Life Insurance?

- The Basics of Life Insurance

- Tax-Free Death Benefit

- Tax-Deferred Growth in Permanent Life Insurance

- Tax Advantages of Policy Loans

- Estate Planning and Life Insurance

- Considerations for Business Owners

- Is Life Insurance Right for You?

- Bottom line: Life Insurance payouts are usually tax-free in Canada

- Contact us now to learn more about Life Insurance and your taxes

When it comes to financial planning, Life Insurance is usually seen as a protective measure that will help your family if you die too soon. In Canada, though, Life Insurance is useful for more than just safety, especially when it comes to taxes. Understanding how Life Insurance can help you save on taxes can be a big part of your financial plan. This blog’s goal is to look into these benefits. So keep reading to learn more about the subject.

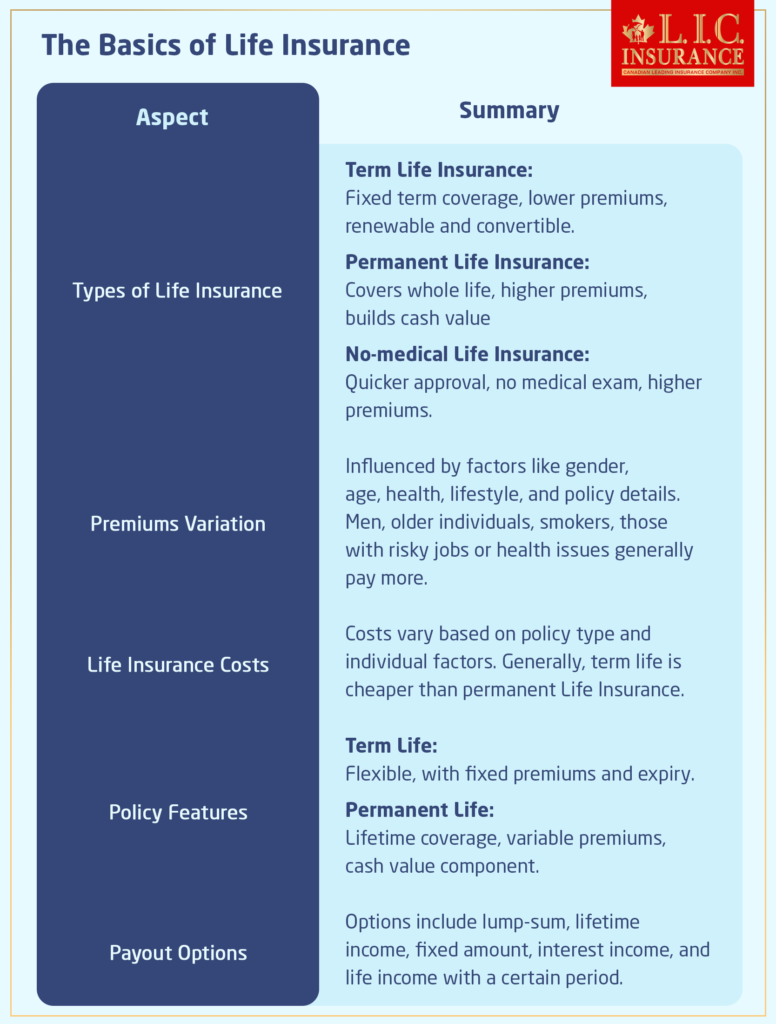

The Basics of Life Insurance

Tax-Free Death Benefit

One of the primary tax benefits from Life Insurance is the tax-free death benefit. Regardless of whether you choose a term or a permanent policy, the death benefit paid to your beneficiaries is generally free from federal and provincial income tax. This aspect is very important as it ensures that your beneficiaries receive the full amount of the policy without any deductions, providing them with financial security and the ability to:

- Maintain their standard of living

- Pay off debts and mortgages

- Fund education for children or dependents

Tax-Deferred Growth in Permanent Life Insurance

Permanent Life Insurance policies offer a unique feature – a cash value component that grows over time. This cash value accumulation is tax-deferred, meaning you don’t pay taxes on the growth as long as the policy is in force. This allows your investment to grow more efficiently over time. However, it’s important to note that tax may be applicable if you decide to withdraw funds from the cash value.

Tax Advantages of Policy Loans

Another significant aspect of Permanent Life Insurance is the ability to take out loans against the policy’s cash value. These loans can be a tax-advantaged way to access funds. You’re essentially borrowing from yourself, and the loan amount is not subject to tax. However, it’s vital to understand that the loan amount, along with interest, may reduce the death benefit and cash value if not repaid.

Estate Planning and Life Insurance

Life Insurance can play an essential role in estate planning. The death benefit from a Life Insurance policy can provide the funds to pay any estate taxes due upon your death, ensuring that your heirs are not burdened with significant tax liabilities. This can be particularly important in preserving the value of an estate for your beneficiaries.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Considerations for Business Owners

For business owners, Life Insurance can provide unique tax benefits. It can be used to fund buy-sell agreements or provide key person insurance, both of which can offer tax-efficient solutions for business continuity and succession planning.

Is Life Insurance Right for You?

Each person has different needs when deciding if Life Insurance is a good addition to their financial plan. A lot of personal factors need to be carefully thought through. In this evaluation, it’s not enough to just know that Life Insurance exists; you also need to know how it fits into your particular situation. Let us talk more about what you should think about.

Understanding Your Financial Goals

Your financial aspirations should be considered when deciding whether to incorporate a Life Insurance policy into your plan. Are you looking to provide security for your family after you’re gone, or are you more focused on aspects like saving for retirement or planning for your children’s education? A Life Insurance policy can serve multiple purposes. Besides offering peace of mind about your family’s financial security, certain types of Life Insurance come with cash value components that grow over time, which can be an asset for long-term financial goals.

Analyzing Family Needs

Your family’s needs are a topmost priority when considering Life Insurance. If you are a primary breadwinner, how will your family manage financially in your absence? A Life Insurance policy ensures that your family’s standard of living can be maintained in the event of your untimely demise. It can provide for essentials like daily living expenses, mortgage payments, and educational costs for your children. This protective shield is one of the most profound expressions of care and responsibility towards your family.

Evaluating Tax Situation

Understanding the tax benefits of Life Insurance is vital. In Canada, for instance, the death benefit from a Life Insurance policy is generally tax-free, which means your beneficiaries receive the full amount. Additionally, permanent Life Insurance policies offer a tax-deferred growth opportunity on the cash value. This means you won’t pay taxes on the policy’s growth until you withdraw the money, potentially allowing for more significant growth over time. These tax advantages can substantially benefit your overall financial strategy, especially if you’re in a higher tax bracket.

Considering Your Current Age and Health

Age and health are significant factors in determining the cost and type of Life Insurance. Generally, the younger and healthier you are, the lower the premiums. It’s advisable to consider Life Insurance at an early stage to lock in lower rates and better terms. However, even if you’re older or have health issues, Life Insurance options are still available, though they might come at a higher cost.

Consulting a Financial Advisor

Given the complexities surrounding a Life Insurance policy and the tax benefits from Life Insurance, consulting with a financial advisor is invaluable. An advisor can provide personalized advice based on your unique financial situation, goals, and family needs. They can help you learn the various types of Life Insurance policies, explain their benefits and limitations, and how they fit into your overall financial plan.

Bottom line: Life Insurance payouts are usually tax-free in Canada

If you want to make the best decisions about your financial future, you need to know about the tax benefits of Life Insurance in Canada. Life Insurance isn’t just a form of protection; it can also be a helpful instrument for planning your finances, with tax benefits that can help you and the ones who will benefit from you.

If you’re considering integrating Life Insurance into your financial plan, it’s time to take action. Reach out to a financial advisor to discuss your options and how a Life Insurance policy can enhance your financial well-being. Remember, the right policy can provide not only mental peace but also significant tax advantages that can positively impact your financial journey.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Contact us now to learn more about Life Insurance and your taxes

Uncover the full potential of Life Insurance in your financial strategy with Canadian LIC, a leading insurance brokerage in Canada. Our expert team specializes in simplifying the complexities of Life Insurance and its tax benefits, ensuring you make the best decisions. Whether securing your family’s future, planning for retirement, or protecting business interests, Canadian LIC tailors solutions to your unique needs. Contact us now to explore how Life Insurance can enhance your financial planning. Trust Canadian LIC to guide you toward the most beneficial Life Insurance policy for your specific situation.

Find Out: Is it worth having Life Insurance after the age of 70?

Faq's

In Canada, a Life Insurance policy’s most significant tax benefit is that the death benefit paid to beneficiaries is generally tax-free. Additionally, with Permanent Life Insurance policies, the cash value grows tax-deferred. This means you won’t owe taxes on any growth within the policy unless you make a withdrawal.

Absolutely. Life Insurance can be a strategic component of estate planning. The tax-free death benefit can provide the funds necessary to cover any estate taxes, ensuring that your heirs are not burdened with significant tax liabilities and preserving the value of your estate.

Age and health are essential factors in determining the cost and availability of Life Insurance. Typically, younger and healthier individuals receive lower premiums. However, there are policies available for older individuals or those with health issues, though they may come at a higher cost.

Yes, policyholders can access the cash value of their permanent Life Insurance through loans or withdrawals. However, it’s important to note that this can reduce the death benefit and may have tax implications.

Term Life Insurance provides coverage for a specified period and pays out only if the policyholder dies during that term. Permanent Life Insurance, on the other hand, provides coverage for the policyholder’s entire life and includes a cash value component that grows over time.

Yes, consulting with a financial advisor is highly recommended. They can help you understand how a Life Insurance policy fits your overall financial goals and advise on the best type of policy for your needs.

Choosing the right policy involves assessing your financial goals, family needs, health status, and budget. It’s advisable to compare different policies and consult with a financial advisor to find a policy that best suits your individual circumstances.

Yes, the death benefit from a Life Insurance policy can be used by beneficiaries to pay off debts, including mortgages, personal loans, or credit card debts, thereby relieving financial stress during difficult times.

In Canada, beneficiaries generally do not have to pay taxes on the death benefit received from a Life Insurance policy. The amount is typically paid out tax-free, making it a financially efficient way to transfer wealth or provide for your loved ones after your passing.

For individuals, Life Insurance premiums are not typically tax-deductible in Canada. However, there are certain situations, especially in the context of business-related Life Insurance, where premiums may be deductible. It’s always best to consult with a tax professional for specific advice in these cases.

Life Insurance is taxable in Canada under certain circumstances. For instance, if the policyholder surrenders a permanent Life Insurance policy, the cash value received over and above the premiums paid can be subject to taxation. Additionally, if a corporation is the beneficiary of a policy, there may be tax implications.

The deductibility of Life Insurance premiums for business owners in Canada depends on the purpose and structure of the policy. If the policy is used as collateral for a business loan, a portion of the premiums may be deductible. The specific amount and eligibility should be discussed with a tax professional.

A cost that can be taken out of your gross income to lower your taxable income is called an income tax deduction. When you take deductions, the amount of income that is taxed goes down. This could mean that you owe less in taxes generally.

Yes, Life Insurance can be an effective tax planning tool in Canada. Its tax-free death benefit, potential for tax-deferred growth in permanent Life Insurance policies, and the possibility of using insurance for business-related tax strategies make it a versatile tool in financial and tax planning.

While Life Insurance proceeds are generally not taxable, they cannot directly reduce the tax on your final tax return. However, the tax-free nature of the death benefit can provide significant financial relief to beneficiaries, which can indirectly impact the overall tax situation of an estate.

In most cases, you do not need to report Life Insurance payouts on your tax return in Canada, as the death benefit is typically tax-free. However, if there are any taxable elements (like interest earned on the payout), you should report those. Always consult with a tax professional for accurate reporting.

Using your Life Insurance policy as collateral for a loan does not in itself trigger a tax. However, if you surrender the policy or it lapses with an outstanding loan, the policy proceeds used to pay off the loan may be considered taxable income to the extent they exceed the policy’s adjusted cost basis.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]