- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Using Life Insurance As Loan Collateral In Canada 2025: What You Should Know

By Harpreet Puri

CEO & Founder

- 11 min read

- November 26th 2025

SUMMARY

The blog explains how using Life Insurance as loan collateral in Canada allows policyholders to access funds from the cash value of a Life Insurance Policy. It details how whole life and Universal Life Insurance work as secure financing tools, outlines the benefits, risks, and tax-free aspects of a Life Insurance loan, and highlights how financial planning using Life Insurance supports both liquidity and long-term wealth stability.

Introduction

There’s a quiet confidence that you get when your money works for you instead of against you. We’ve witnessed families, business-owners, and retirees realize that their Life Insurance isn’t just something to fall back on – it’s actually one of the most dynamic financial tools available. And one of the savviest ways people throughout Canada are releasing capital these days is by tapping into their Life Insurance Policy as loan collateral.

It may seem radical — until you consider a fact: that a Life Insurance Policy in Canada you’ve been putting money into for decades might already offer the solution to accessing funds and making do without going after savings or selling investments. RESPs remain a powerful tool. But they’re not automatic. The earnings they derive from not using it, for other purposes or other people (calls to parents on the weekend, unlimited), are above the line.

We believe that your RESP should grow with you. If your child changes his or her goals, you have to change along with him or her.

Don’t simply open a plan — make it your own.

The Growing Trend: Why Canadians Are Leveraging Life Insurance

The number of Canadians with a Permanent Life Insurance Policy containing a cash value component has grown over the last ten years, according to Statistics Canada. Now, many policyholders are finding out that this built-in value can be used to fund real-world goals — from growing a business to paying for schooling.

Wouldn’t it be dramatic to build a bridge and sacrifice the cash value of the policy on an epic funeral pyre? We’ve been retained to wade through these kinds of situations – owning policies that contain sufficient cancellation values for downpayment money, or financing access to equity in a piece of property purchased with debt. They did not think that the value of their Life Insurance Policy in Canada could serve as collateral for a bank loan, one with lower interest and faster approval than unsecured credit.

We’re already there: In 2025, with borrowing costs licked and credit still tight for small business concerns, financial planning via Life Insurance has become one of the savviest games in town.

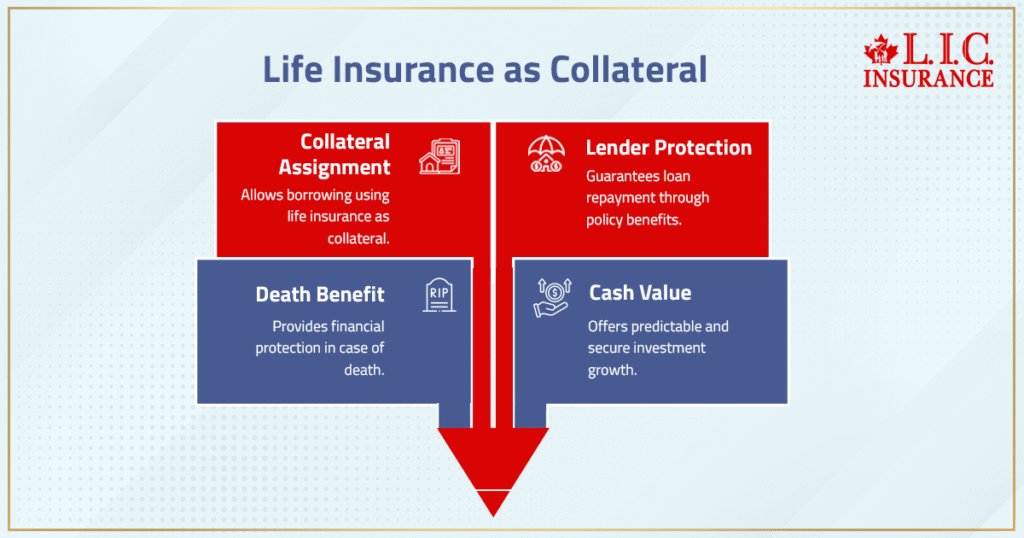

How Life Insurance Works As Collateral

Consider your Life Insurance Policy in terms of two halves. There aren’t many people like you or me, Williams explains: “The death benefit is your protection, and it’s the one thing that if something happens to Robyn, you get paid.” The other half, if you have a whole or Universal Life Insurance Policy, is the investment component that grows over time — your cash value.

This is the part banks and lenders like. It’s predictable, secure and guaranteed by the insurance company. That’s why it’s possible, when you approach a lender, for you to borrow money using the accumulated cash value as collateral — something we call Life Insurance collateral assignment.

By this agreement, the bank is an alternative beneficiary. If something does happen to you before you repay, the lender gets what’s owed from the policy’s death benefit, and your family takes care of the rest.

It’s a win-win: You get some money without having to sell something, and the bank knows its loan is protected by an asset value that can be depended on.

What Types Of Life Insurance Qualify

Here is where people typically get into trouble. Not all insurance is eligible to be used as collateral.

Built-in: Only Permanent Life Insurance plans — such as Whole Life and Universal Life Insurance Policies — include a cash value component. This is the pool from which you can borrow.

By contrast, Term Life Insurance Policies are temporary and will not grow cash value as they age. They’re pure security — cheap, straightforward and not designed for borrowing.

So if you have a Whole Life Insurance Policy, you have in hand a financial asset that grows tax-deferred from year to year. That appreciation is available when you transfer the policy as collateral to a third-party lender.

The Step-By-Step Reality Of Using Life Insurance As Loan Collateral

Let’s make this practical. Over the years, we’ve walked countless clients through this exact process. It looks something like this:

- Set Up The Right Policy

You start with a Permanent Life Insurance Policy — either whole life or universal life. These policies accumulate cash value every time you make Life Insurance premium payments. The longer you hold it, the more cash value growth you see.

- Build Enough Cash Value

You’ll need a few years of contributions before your policy’s cash value is significant enough to use. Some insurance companies allow borrowing after as little as three years, but most prefer at least five to ensure there’s enough cash value to back a loan amount.

- Approach A Lender

When you’re ready, you meet with your bank or a financial advisor to discuss a collateral loan. Major Canadian banks, including RBC, TD, and Scotiabank, regularly offer loans backed by Life Insurance collateral assignment.

The lender will evaluate your policy’s cash surrender value, typically offering 50 % to 90 % of that amount as a secured loan.

- Assign The Policy

You’ll complete a collateral assignment form through your insurance company. This officially names the lender as the primary payee up to the outstanding balance of the loan. Once the paperwork is done, the loan is processed.

- Repay (Or Not Right Away)

You’ll pay interest on the borrowed funds. The rates are often lower than those of a personal loan or credit card because the loan is fully secured. Some clients even structure interest-only payments to keep cash flow flexible.

The Benefits That Make It Worth Considering

Let’s be real — banks don’t give out favours. But when you back a loan with Life Insurance, you’re leveraging an asset that’s both stable and tax-efficient.

Tax-Free Access To Funds: The money you receive from a Life Insurance loan or collateral loan isn’t considered taxable income, as long as the policy remains in force.

Low Interest Rates: Because the loan is secured, your interest rate is typically lower than that of unsecured credit.

No Credit Check Hassle: Your credit score might not even come into play, making it ideal for those with a low credit score or inconsistent income.

Keep Other Assets Safe: Your home, car, or other personal property stays untouched.

Maintain Growth: Your policy’s cash value continues to grow, and your death benefit remains intact — as long as the loan is managed properly.

This is why so many Canadian business owners and professionals are quietly using Life Insurance as a strategic financing tool.

The Risks You Should Be Aware Of

It’s easy to take off in your mind with the perks, but let’s call a spade a spade on this one — borrowing from Life Insurance also comes with obligations.

If the interest on your loan compounds quickly than your cash value’s growth, you run the risk of having a loan balance that surpasses what’s in your policy. Lenders may also ask for additional collateral or early repayment in certain cases.

And if you don’t pay it back, the amount may be deducted from your insurance policy’s death benefit — or your policy could lapse. If that happens while you’re still alive, your heirs lose the insurance coverage, and any unpaid loan becomes taxable.

And though loan proceeds are received tax-free, partial withdrawals in excess of your policy’s adjusted cost basis could result in tax consequences.

That’s why we always say — if you’re thinking of using your policy’s cash value, work with a licensed insurance advisor to run the numbers. We help ensure your plan continues to work long after its documents are signed.

Life Insurance Policy Loans Vs. Collateral Loans

It’s a point of confusion for many people, so let’s sort this out.

The money for a Life Insurance Policy loan comes directly from your insurance company. It depends on your policy’s cash value amount, and you’ll generally be able to borrow 90 % or 95 %.

If you are using Life Insurance as loan collateral, the proceeds are typically derived from a bank loan or similar financial institution. You are not borrowing from your insurer; you’re using your Life Insurance Policy as collateral to take out a loan elsewhere.

Both are legitimate — the right one for you depends on your credit score, how much you need to borrow and how quickly you can repay.

We’ve seen policy loans work great for clients who required flexibility and immediate access, while collateral (i.e. true loan against policy) made more sense for larger business or investment opportunities.”

Real-World Example From Our Desk

One of our clients – a small-business owner from Mississauga – required a lump sum for the purpose of re-designing his storefront and to replenish the inventory he needed before the New Year. However, traditional banks could only offer credit upon substantial collateral. His Whole Life Insurance Policy accumulated more than $150,000 in the cash surrender value. Within several days, the client arranged a collateral loan at a favourable interest rate and retained his previous investments. He already repaid it, and the cash value only kept growing with accruals. This is how financial planning with Life Insurance works out.

Paying Back The Loan — And Why It Matters

A Life Insurance loan is not free. Although the loan amount is not taxed, it grows with interest. If you allow that interest to compound or default and do not make payments, you could risk diminution of your cash value or death benefit. Moreover, the policy loan or the collateral loan exceeds your cash surrender value, and the policy can be closed by the insurer. At the same time, it is important to know that, if you die with an unpaid loan, the insurance will pay off to the lender first, and only the rest, if any, will be left to your relatives. Therefore, it is important to get expert advice. The qualified agent can set up repayment compliance or policy loan caps to ensure that your coverage is maintained but remains available when you need liquidity.

How Life Insurance Fits Into Broader Financial Planning

Using Life Insurance as loan collateral is not just about short-term cash flow for many Canadians. It’s just one piece of a larger wealth-building plan.

Entrepreneurs tap the cash value to help finance business expansions. Many retirees employ tax-free policy loans as a means to supplement retirement income without increasing taxable wages. Parents rely on it to help pay tuition, without realizing capital gains from selling investments.

High-net-worth individuals use IFA policies, too; they take loans out against the policy’s cash value and reinvest it, taking interest deductions to shield more income from taxation.

Each requires precision — and that’s where professional advisers come in.

Using Cash Value To Pay Off Debt

We’ve seen many clients use Life Insurance loans to consolidate high-interest debt. Here’s how it typically works:

- They access loans from their policy’s cash value component.

- The loan terms are simpler than those of traditional secured loans.

- Repayments are flexible, with no credit check required.

In some cases, clients choose to withdraw funds — taking a portion of the cash value as a lump sum. That’s a final withdrawal, reducing the death benefit but freeing up immediate cash for emergencies.

Each route has pros and cons; we help families compare every angle before deciding.

Why This Matters In 2025

With interest rates starting to cool off after years of turbulence, and household indebtedness at record highs, Canadians are asking themselves what “financial flexibility” truly entails.

A Life Insurance Policy that silently compiles equity via growth of cash value can not just be a safety net but a strategic financial lever.

The trick is to understand how your insurance policy works, how to structure a Life Insurance collateral assignment and how to balance borrowing with long-term protection.

It’s not merely the liquidity, it’s the freedom — the right to deploy for life when you most need it.

The Canadian LIC Perspective

Each year, we come across hundreds of Canadians who have no idea their Life Insurance Policies could finance their next objective. Whether people want to pay off debt, grow a business or simply have some breathing room during difficult times, leveraging Life Insurance as loan collateral allows them to unlock certain doors without compromising safety.

Our advisors have helped customers throughout Ontario – and beyond – learn how to create and preserve cash value, and most importantly, when and how to use it, all while keeping your family safe.

When constructed the right way, your permanent Life Insurance becomes not just a policy but an integral part of your financial strategy.

So, instead of applying for a bank loan or selling that investment you’ve grown over the years, take a harder look at your whole life or Universal Life Insurance Policy. The answer may already be in your hands.

More on Emergency Medical Insurance

FAQs

Yes, if managed well, a Life Insurance loan can actually improve credibility with lenders. It shows you’ve built assets that hold cash value and can back a secured loan responsibly. But stacking multiple policy loans without repayment could limit how much banks trust your future Life Insurance collateral assignment.

A Universal Life Insurance Policy gives you more control over investment options and premium schedules. Some Canadians prefer it for managing cash value growth around changing income. Whole Life Insurance, on the other hand, trades flexibility for long-term stability and guaranteed accumulation — both can work if the goal is to borrow money safely.

Absolutely — many Canadian business owners use their Permanent Life Insurance Policy to fund growth or smooth out cash-flow cycles. The policy’s cash value often covers what a traditional bank loan wouldn’t. It’s a quiet way to keep ownership intact while tapping into the tax-free advantages that corporate Life Insurance loans can offer.

If you cancel or surrender your insurance policy while money is still owed, the insurance company will deduct the outstanding balance and interest first. Any remaining cash surrender value comes back to you, though parts may count as taxable income. That’s why surrendering a Life Insurance plan too early can undo years of value building.

A Life Insurance Policy loan can reshape how assets pass to your heirs. It can reduce the final death benefit, but also prevent you from selling other holdings or triggering capital gains. For estate planners, using Life Insurance as loan collateral is a way to access liquidity while keeping wealth structured for smooth succession.

Key Takeaways

- Life Insurance as loan collateral allows Canadians to access liquidity using the cash value built within their Life Insurance Policy in Canada without selling investments.

- Only whole life and Universal Life Insurance Policies qualify, as they accumulate cash surrender value that lenders recognize as secure collateral.

- Borrowing against a permanent Life Insurance Policy provides tax-free loan proceeds and lower interest rates compared to traditional loans.

- Using Life Insurance loans strategically can protect personal property while keeping your Life Insurance coverage and death benefit intact.

- Mismanaging loan interest or leaving an outstanding balance unpaid can reduce or cancel the policy’s death benefit, affecting beneficiaries.

- Partnering with a licensed insurance advisor ensures proper structure for a Life Insurance collateral assignment, keeping both coverage and growth secure.

- Integrating financial planning using Life Insurance can support business expansion, debt consolidation, and long-term wealth creation across economic cycles.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – Life Insurance Facts & Industry Data 2024

https://www.clhia.ca - Government of Canada – Financial Consumer Agency of Canada (FCAC) – Understanding Life Insurance and Policy Loans

https://www.canada.ca/en/financial-consumer-agency.html - Office of the Superintendent of Financial Institutions (OSFI) – Guidelines for Life Insurance Companies in Canada

https://www.osfi-bsif.gc.ca - Canada Revenue Agency (CRA) – Tax Treatment of Life Insurance, Policy Loans, and Adjusted Cost Basis

https://www.canada.ca/en/revenue-agency.html - Bank of Canada – Household Credit, Interest Rates, and Collateral Trends 2025 Review

https://www.bankofcanada.ca - Financial Services Regulatory Authority of Ontario (FSRA) – Life Insurance Licensing, Compliance, and Consumer Guidance

https://www.fsrao.ca - Insurance Bureau of Canada (IBC) – Understanding Life and Health Insurance in Canada

https://www.ibc.ca - Statistics Canada – Household Wealth and Financial Asset Composition 2024 Update

https://www.statcan.gc.ca - CIRO (Canadian Investment Regulatory Organization) – Insurance-Linked Investment and Loan Strategies 2024 Report

https://www.ciro.ca - Manulife Financial Learning Centre – Understanding Cash Value and Life Insurance Loans

https://www.manulife.ca

Feedback Questionnaire:

We’d love to understand your experience and challenges better. Please share your thoughts below — it only takes a minute.

Your information stays private with Canadian LIC Inc. and is used only to provide personalized advice or updates on Life Insurance and financial planning strategies in Canada.

IN THIS ARTICLE

- Using Life Insurance As Loan Collateral In Canada 2025: What You Should Know

- The Growing Trend: Why Canadians Are Leveraging Life Insurance

- How Life Insurance Works As Collateral

- What Types Of Life Insurance Qualify

- The Step-By-Step Reality Of Using Life Insurance As Loan Collateral

- The Benefits That Make It Worth Considering

- The Risks You Should Be Aware Of

- Life Insurance Policy Loans Vs. Collateral Loans

- Real-World Example From Our Desk

- Paying Back The Loan — And Why It Matters

- How Life Insurance Fits Into Broader Financial Planning

- Using Cash Value To Pay Off Debt

- Why This Matters In 2025

- The Canadian LIC Perspective

Sign-in to CanadianLIC

Verify OTP