- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Universal Life Insurance Cash Value In Canada: How It Grows & Why It Matters

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 30th 2025

SUMMARY

A detailed look at Universal Life Insurance cash value in Canada, showing how a Universal Life Insurance Policy supports long-term growth, flexible insurance coverage, and tax-advantaged options. The content compares Universal Life Insurance vs Term Life Insurance, explains Universal Life Insurance cost, highlights access to cash value, and shows why many Canadians request Universal Life Insurance quotes online.

Introduction

Something is quietly changing across Canada, and if you’ve been advising families here with Canadian LIC as long as we have, you can sense it. The statistics show that more Canadians are getting over the thrill of a short-term fix and are shifting their focus towards Universal Life Insurance cash value, not because it sounds cute, but because the financial picture is ugly compared to what it has been.

As a group, Canadians have more than $4.7 trillion of Life Insurance and annuities in place through the CLHIA’s 71-member companies. Add to that additional data published by the National Association of Insurance Commissioners, which says 92% of Life Insurance Policies end up lapsing or being surrendered with no death benefit ever paid, and it becomes even clearer. Canadians are not marked to lose value because policies don’t work — they’re marked to lose value because they’re headed in the wrong direction too late.

Where we sit with families daily, try to make sense of complicated rules in simple terms and guide seniors through decisions no one ever prepared them to even have to consider, accessing Universal Life Insurance cash value is one of the financial instruments Canadians wish they had known about long before now.

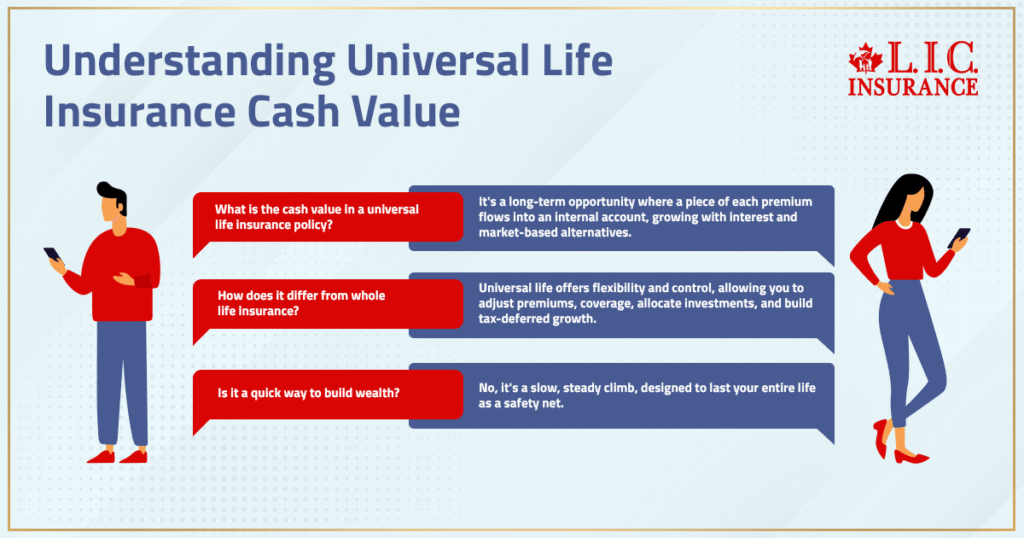

Understanding The Cash Value Inside A Universal Life Insurance Policy

If you’ve never looked under the hood of a Universal Life Insurance Policy in Canada, here’s the engine block: every dollar you pay into it divides like cells into two engines —the death benefit and cash value.

And that second engine, the cash,” he said, “It’s a long-term opportunity.” A piece of each premium quietly flows into an internal account. The insurance company adds it with interest, sometimes with market-based alternatives and in some cases via a guaranteed minimum interest rate. This eventually turns into a large sum of money.

This is often mistaken for whole life, but the differences in structure are significant. Whole life provides the growth pattern; universal life provides flexibility and control. Both are types of permanent Life Insurance, but universal life offers the ability for:

- Adjust premium payments

- Increase or decrease Life Insurance Coverage

- Allocate deposits into different investment accounts

- Build long-term tax-deferred growth

It’s a slow, steady climb. But that’s exactly the point. A safety net shouldn’t sprint; it should last — ideally for your entire life.

Why Universal Life Insurance Matters More In This Economic Era

Let’s be real. Costs are up. Taxes feel heavier. Retirements last longer. Families aren’t just looking at protection anymore — they’re looking for flexibility, lifelong coverage, and the ability to access cash without collapsing their financial plans.

And that’s where the benefits of Universal Life Insurance show up.

A well-funded Universal Life Plan can:

- Build long-term assets quietly in the background

- Cover you for a lifetime

- Provide a tax-free death benefit

- Cushion your savings

- Replace lost wealth in retirement

- Offer a more flexible structure than other Permanent Life Insurance Policies

Clients tell us they appreciate that their money isn’t locked away forever. If you need funds — whether for health, debt, or a family emergency — you’ve built your own reservoir.

And unlike Term Life Insurance, universal life isn’t designed to “expire on you.” It evolves.

Life Insurance, Cash Value, And Canada’s Tax Advantage

Here is where Canadians pay attention during our water cooler meetings: taxes.

The tax-free policy and cash value status of universal life enable the growth schedule (for the cash-value component to be graded) without taxation each year. That’s the big win. You are subject to tax only on any amounts withdrawn in excess of the adjusted cost basis.

We have clients call us every single day, asking if they’ll need to pay income tax when accessing their policies. The honest answer?

Not so often — and sometimes not at all.

Here’s how:

- Policy loans are typically tax-free

- Withdrawals up to the adjusted cost basis are tax-free

- A well-managed plan can deliver tax-free retirement income

This is why many high-income Canadians prefer using Cash Value Life Insurance as part of their long-term savings structure. They want growth without the annual tax drag — something traditional investment accounts can’t promise.

How Universal Life Insurance Cash Value Actually Grows

Growth inside a universal life policy is driven by:

- Premiums paid

- The insurer’s credited rate

- Chosen investment component options

- Market-linked accounts

- The internal cost of insurance

- The policy’s age

As the years pass and you build deposits, the policy’s cash value grows more secure and solid. It’s not unusual for policies that have been held a long time to have several hundred thousand dollars, especially if they’ve been structured more aggressively early on.

And the magic here is that you decide how much to pay over and above the minimum premium. A lot of our clients prefer to “overfund” themselves early so they can maximize cash surrender value later.

Universal Life Insurance vs Term Life Insurance – Choosing The Right Path

Let’s dissect a comparison that Canadians tend to get wrong.

Term Life Insurance offers a high death benefit for an affordable premium. But the policy doesn’t have a savings component, no cash value, and it eventually lapses. Most families will outlive their term, and that’s why term is appropriate for mortgages, kids’ college years and income replacement — but not long-term wealth.

Universal Life, on the other hand:

- Builds the policy’s cash value

- Creates equity

- Lasts for life

- Offers an adjustable death benefit

- Provides the option to withdraw or borrow

- Creates a transferable asset for your family

As we always tell clients:

Term is temporary. Universal Life is strategic.

What Happens To Your Cash Value When You Pass Away

This is where many Canadians get surprised.

Depending on the structure, your policy may:

- Pay only the death benefit, or

- Pay death benefit + cash value

Option 2 is more expensive, but families who want to maximize legacy often choose it. The key is understanding how much of your policy’s cash value you want to leave behind.

And yes — the tax-free death benefit passes directly to your beneficiaries, bypassing probate in most situations.

How Canadians Access Cash From Their Universal Life Policy

There are three main ways to extract money:

1. Policy Loans

The favourite choice of retirees.

Your policy acts like a personal bank — you take a loan secured against your life policy, often at competitive rates. And it remains tax-free in most cases.

2. Withdrawals

This reduces the remaining cash value, and if withdrawals exceed the adjusted cost basis, you may pay tax. But for disciplined planners, it works beautifully.

3. Cash Surrender Value

If you fully surrender, you receive the accumulated cash surrender value. Not ideal, but better than walking away with nothing.

Life Settlements: A New Opportunity For Seniors Holding Universal Life Policies

This is where the conversation gets interesting — especially because Canadians rarely hear about this option.

Based on NAIC findings and independent research:

- Seniors historically got nothing when they surrendered their policies.

- Healthy seniors were once excluded from life settlements.

- Now, many can qualify — even those with stable health.

A typical healthy senior settlement requires:

- Age 75 or older

- A Universal Life or Guaranteed Universal Life Policy

- A death benefit of $250,000 or more

Let’s revisit the case study you provided:

Case Study: Robert, Age 75

He held a $1 million GUL policy.

No cash value.

No longer needed the coverage.

He received $150,000 from a life settlement — money he would have completely lost if he surrendered the policy.

Not enough Canadians know this. Not enough advisers address it. And too few families know that millions of dollars end up being thrown away each year when policyowners sit back and allow their policies to lapse because they’re convinced they have no other practical value.

We believe awareness is everything. When a policy can turn into retirement income, a lump sum or a bridge over tough years, families should know.

How Much Insurance Coverage Should Canadians Choose?

This depends on:

- Income replacement needs

- Debt

- Family responsibilities

- Business ownership

- Legacy or charitable intentions

A universal life policy can be structured around exact needs — and changed as those needs evolve.

Investment Accounts Inside Universal Life Insurance Plans

Canadians enjoy a range of flexible choices:

- Conservative interest accounts

- Index-linked strategies

- Market-linked exposure

- Equity-based or fixed-income-style options

Unlike standalone mutual funds, the growth inside a Universal Life Plan occurs under a tax-deferred umbrella, as long as the policy remains within CRA guidelines.

This is why high-net-worth families and business owners frequently combine Universal Life with tax planning strategies.

Understanding The Cost Of Universal Life Insurance In Canada

No surprises here — cost varies because the product is customizable.

Factors include:

- Age

- Health

- Deposit strategy

- Chosen coverage

- Policy structure

- Desired cash value performance

- Internal insurance company charges

We constantly hear the question: “How much premium do I need to put in?”

The truth is, you can deposit minimally… or treat it like a long-term asset and fund it aggressively.

There’s no one path — only the path that matches your goals.

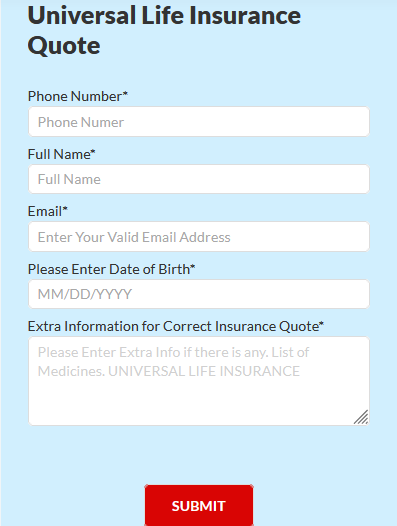

Universal Life Insurance Quotes Online — What Canadians Should Look For

Online quote tools are helpful, but they rarely tell the full story.

Before selecting a policy, Canadians must:

- Understand whether a medical exam is required

- Know how the policy will grow

- Evaluate which Life Insurance companies are most competitive

- Check how flexible the funding limits are

- Review how the death benefit paid changes over time

Our advisors walk clients through these variables so they’re choosing strategically — not guessing through online calculators.

Cash Value Policy Strategies For Retirement Income

Some of the strongest retirements we’ve seen were built, not by chasing risky investments, but by layering in Cash Value Life Insurance earlier in life.

Here’s how retirees commonly use their universal life policies:

- Tax-free policy loans for a steady retirement income

- Increasing the lifetime coverage

- Using policy loans instead of taxable withdrawals from RRSPs

- Keeping overall taxable income low

This provides flexibility and peace in the years where predictability becomes priceless.

Why Canadians Should Take Universal Life Insurance Seriously

Universal life isn’t just another Life Insurance Policy.

It’s a long-term financial system wrapped in protection.

When structured properly, it offers:

- Lifelong security

- Tax-advantaged growth

- A cash value reserve you can lean on

- A tax-free death benefit

- Liquidity when you need it most

- A way to protect, grow, and transfer wealth efficiently

From our desk, after years of walking families through life’s hardest decisions, we can confidently say this:

Universal Life Insurance isn’t about buying coverage. It’s about building options — and Canadians deserve options.

More on Universal Life Insurance

FAQs

The cash value of Universal Life Insurance provides you with room to create your financial road, instead of being confined by the framework. It adjusts when your income changes, your goals expand, or life nudges you in a different direction. You call the shots in terms of how the deposits flow and how you want your growth to correspond with your financial objective. It’s a flexible add-on to your Life Insurance in Canada, not a fixed contract.

Canadians also use Universal Life for a smoother retirement, with predictable and structured withdrawals. When used properly, the policy can lessen the need for fully taxable accounts. It mixes protection with strategy and makes it easier to balance your retirement income. Here is where Cash Value Life Insurance provides a quiet stabilizer.

Business owners like coverage that expands with them, not against them. Universal life morphs as their insurance needs change from personal to corporate and back again. It also provides the long-term room for an extra reservoir of value that they can unlock during periods of key business phases. It is protection that follows the realities of building wealth.

Vision is what calls to people who imagine on a decadal horizon — not the year-to-year fix but policies that come of age with them. The price is the ability for you to tweak the funding, change strategies, and create a cash value policy that will last an entire life. Instead, it is integrated into an overall wealth plan, not just a bill that you pay. That’s the long horizon at which universal life justifies itself.

Each insurer has its own pace when it comes to crediting interest, dealing with internal costs and supporting the policy’s long-term health. Strong companies provide clear options for investment accounts and a path to growth. The insurance company’s reliability determines how safely its policyholders can plan for the future. Stability rolls into the real advantage over time.

It all comes down to measured pacing and the right time to take a light touch and when to lay off. With proper design, having a loan doesn’t put pressure on the policy. The point is to watch how the loan meets with this continuing growth. This way, the policy’s cash value is able to work the way it was intended.

Universal Life allows you to steer the growth, whereas whole life sets and keeps the course straight. Some Canadians are looking for the frame of Whole Life; others, the steering wheel that universal life provides. Both are types of Permanent Life Insurance, but the journey is not the same. It’s a matter of whether you opt for the version that aligns with your own pace and priorities.

Online resources should be a starting place, not the whole picture. The real numbers shift depending on age, health, goals for coverage and how aggressively you want the cash value to grow. A good quote will need to factor in more than just monthly premium amounts. That’s why professional advice can still mould the long-term outcome more than a snap estimate.

How much is enough? That’s up to your shoulders — the weight of responsibilities, like income needs, long-term plans and the legacy you intend to leave. Other families use Universal Life to achieve a mix of protection and equity-building. Others zero in on the maximum death benefit. Every path is personal, and the numbers represent building your life.

Seniors appreciate how Universal Life continues working quietly even when traditional investments slow down. The cash value portion can support lifestyle shifts, health needs, or estate goals without forcing drastic moves. It becomes a familiar anchor in unpredictable years. Flexibility is the real benefit here — not just the coverage.

Key Takeaways

- Universal Life Insurance cash value is becoming a core financial tool in Canada

Families are leaning toward long-term protection that also builds internal value, giving them more choice when planning around shifting responsibilities or future goals. - A Universal Life Insurance Policy in Canada offers flexibility that traditional options can’t match

Policyholders can adjust premium levels, shape their insurance coverage over time, and use different investment accounts to support personal strategies and changing priorities. - The benefits of Universal Life Insurance extend beyond protection

Canadians value the ability to grow funds quietly, keep savings tax deferred, and use the policy as a financial backup that can support retirement income or long-term plans. - Universal Life Insurance vs Term Life Insurance isn’t just a cost comparison

Term Life Insurance delivers straightforward coverage, while universal life builds equity and remains in force for an entire life, making it better suited for wealth planning. - Access to cash value adds real financial stability

Canadians appreciate having the option to borrow through policy loans, draw from the cash value policy when needed, or reposition funds without disrupting their long-term protection. - Universal Life Insurance cost reflects lifetime value, not short-term expense

When structured properly, deposits strengthen the policy’s cash value, increase future options, and help Canadians maintain a stronger long-term financial position. - Life settlements create new opportunities for seniors with universal life policies

Older Canadians who no longer need their coverage can convert their policies into meaningful payouts instead of lapsing or surrendering them for little or nothing. - Universal Life Insurance quotes online are only a starting point

Real planning requires understanding how much insurance coverage is needed, how the cash value portion fits into long-term goals, and how different Life Insurance companies structure growth. - The policy’s cash value can complement retirement income strategies

Tax-efficient access, thoughtful timing, and long-term planning help Canadians reduce dependence on taxable sources and create a steadier income during retirement. - Universal Life Insurance remains one of the most adaptable permanent Life Insurance tools in Canada

It supports lifelong coverage, tax advantages, evolving financial needs, and multigenerational planning — giving Canadians a foundation that grows with their lives.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

Industry reports, Canadian Life Insurance data, and policy trends.

clhia.ca - Office of the Superintendent of Financial Institutions (OSFI)

Regulatory guidelines for Life Insurance companies and policy structures.

osfi-bsif.gc.ca - Canada Revenue Agency (CRA) – Life Insurance Tax Rules

Official details on policy taxation, adjusted cost basis, and tax-exempt rules.

canada.ca – CRA Income Tax Folio S3-F9-C1 - National Association of Insurance Commissioners (NAIC)

Research on policy lapse statistics, life settlements, and industry findings.

naic.org - Conning Research & Consulting

Independent reports on life settlements, senior markets, and UL policy trends.

conning.com - Fidelity Investments – Retirement Health Care Cost Estimates

Annual research on projected medical expenses for retirees.

fidelity.com – Health Care Cost Estimate Reports - Munich Re / Swiss Re (Global Reinsurance Reports)

Global insights on Life Insurance growth, mortality trends, and product performance.

munichre.com

swissre.com - Canadian Institute of Actuaries (CIA)

Technical papers on policy design, mortality assumptions, and universal life mechanics.

cia-ica.ca - Investment Industry Regulatory Organization of Canada (IIROC)

Guidance on investment components and market-linked accounts.

iiroc.ca - Insurance Bureau of Canada (IBC)

Industry overviews and consumer-friendly insurance explanations.

ibc.ca

Feedback Questionnaire:

IN THIS ARTICLE

- Universal Life Insurance Cash Value In Canada: How It Grows & Why It Matters

- Understanding The Cash Value Inside A Universal Life Insurance Policy

- Why Universal Life Insurance Matters More In This Economic Era

- Life Insurance, Cash Value, And Canada’s Tax Advantage

- How Universal Life Insurance Cash Value Actually Grows

- Universal Life Insurance vs Term Life Insurance – Choosing The Right Path

- What Happens To Your Cash Value When You Pass Away

- How Canadians Access Cash From Their Universal Life Policy

- Life Settlements: A New Opportunity For Seniors Holding Universal Life Policies

- Case Study: Robert, Age 75

- How Much Insurance Coverage Should Canadians Choose?

- Investment Accounts Inside Universal Life Insurance Plans

- Understanding The Cost Of Universal Life Insurance In Canada

- Universal Life Insurance Quotes Online — What Canadians Should Look For

- Cash Value Policy Strategies For Retirement Income

- Why Canadians Should Take Universal Life Insurance Seriously

Sign-in to CanadianLIC

Verify OTP