- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

RESP Subscriber vs. Promoter: Understanding the Key Differences (2026 Guide)

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 13th, 2026

SUMMARY

A comprehensive 2026 overview of the Registered Education Savings Plan in Canada, explaining the difference between a subscriber and promoter, RESP contribution limit, RESP withdrawal rules, and how to transfer an RESP to an RRSP. It also covers using RESP funds for apprenticeship programs, maximizing government grants like the Canada Education Savings Grant, and getting an accurate RESP quote online.

Introduction

Why Clarity On Roles Matters In A Registered Education Savings Plan In Canada

Parents need clear answers: who is the plan opened by, who handles grants and who pays out when school begins? In a Registered Education Savings Plan for Canada, you have two sides of the house — subscriber and promoter — as getting them mixed up can lose money. As a team of advisers, we’ve seen how confusion around these roles causes preventable financial mistakes.” We’ve seen families overcontribute, lose out on grants or put off payments for education assistance because responsibilities weren’t agreed upon. That’s avoidable.

A Registered Education Savings Plan is meant to make education savings grow tax-efficiently, as the investment growth compounds without any taxes due while it’s in the account. There’s no annual limit, but the RESP contribution limits are a per-child lifetime limit — one part of a framework of lifetime contribution limits that marry up with government incentives, including the Canada Education Savings Grant and the Canada Learning Bond. When families understand how the subscriber and promoter work together, they make sharper choices during sign-up, trim friction at payout time and keep momentum going toward their child’s future education.

The Subscriber: Decision-Maker, Funder, And Rule-Keeper

Think of the subscriber as the architect of a plan. The subscriber to the RESP opens the account, selects the beneficiary and investments, decides how much to invest regularly in a RESP and makes contributions over time. In the end, the subscriber chooses to open an RESP either as an individual RESP, a family plan or a group plan. The subscriber will also keep the plan within a lifetime limit, coordinate with grandparents or other helpers so as not to trigger an excess contribution penalty and ensure beneficiary information remains up-to-date to avoid grant delays. If the beneficiary chooses to switch schools, go on a gap term or change programs, then it’s up to the subscriber how RESP money and educational assistance payment streams are diverted.

Because the contributions are after tax and not deductible for federal tax, discipline is even more important. We aid subscribers to schedule deposits that catch the full education savings grant match without overshooting limits. Where families fall behind, we add in catch-up strategies that consider the RESP contribution rules, monitor remaining contribution room and increasingly target maximum Canada Education Savings grants.

The Promoter: Administrator, Grant Pipeline, And Payout Gatekeeper

The promoter is the bank or plan dealer that provides the education savings plan and maintains it in good standing. The promoter reports information about the Canada Education Savings Program. You apply for the Canada Education Savings Grant, and the promoter applies for your Canada Learning Bond (CLB) if your household is eligible. The promoter verifies the beneficiary is who they said they were, records each eligible child’s date of birth and monitors your savings to make sure they get only invested in GICs, ETFs or mutual funds, for instance, so the plan never once stumbles over the Income Tax Act. Once schooling starts, the promoter confirms enrolment at a qualifying post-secondary educational institution or other eligible educational institution and distributes educational assistance payments and withdrawal of contributions according to RESP withdrawal rules.

The guardrails are also administered by promoters: they verify that a program is qualified, ensure caps on upfront payouts at the very start of an education and make sure bills are “reasonable” for core educational costs. They are the operational backbone of paperwork moving smoothly, and grants getting out, and post-secondary ed payments happening on time.

Education Savings Grant: Getting The Numbers Right, Every Year

Think of the education savings grant as the catalyst that transforms consistent contributions into meaningful education savings. The basic grant is 20% of the first $2,500 you deposit each year — equal to $500 per year (replacing incorrect “CAGR of $500”) — and up to a lifetime limit of $7,200. Additional CESG is 10–20% on the first $500, depending on family income. That’s free government support on top of your contribution and investment earnings – and the promoter is the one who applies for it after your money is in the RESP account.

We construct contribution calendars that are suitable for Canada Education Savings optimization. Suppose you took a break from contributions in previous years. In that case, we map your catch-up room, confirm the maximum lifetime contribution limit, and pace deposits so you collect the full Canada Education Savings Grant without incurring an excess-contribution circumstance.

Canada Learning Bond: Extra Support For Eligible Families

Some families are also eligible for the Canada Learning Bond, which can contribute up to $2,000 to the plan even if you’re not able to put in money right away. The promoter makes the request, and upon approval, the subscriber provides the required authorization and identification documents, and the CLB is deposited directly into the RESP. We ensure clients know about the Canada Learning Bond and the CLB acronym, as you’ll see both on the paperwork.

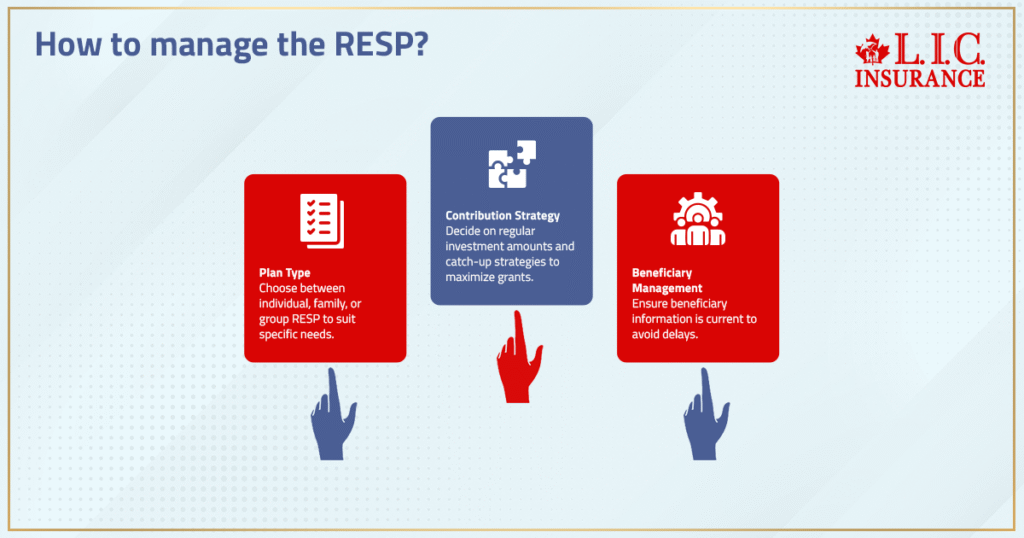

Choosing The Right Structure: Individual RESP, Family Plan, Or Group Plan

Individual RESP: It’s best if there’s only one beneficiary. Beneficiary — The beneficiary does not have to be related to the subscriber. Deposits may be lumpy, and disbursements are clean when it is time to bring the education assistant’s payment income home to the student. If you prefer to have full control and a less restricted definition of relatedness, the individual RESP is usually the simplest option. For some families, it’s best to keep the plan narrow and simple, invest in broad mutual funds and let compounding do most of the heavy lifting.

Family Plan / Family RESP: A family plan or a family RESP can be efficient if the subscriber has more than one beneficiary who is related to him or her by blood or adoption. Contributions need to be tracked for each child, but the assets can later be divided up according to the rules. The family plan is a winner for parents with two or three kids who may be starting in different years. You can also tweak how allocations work in certain scenarios: one child’s pursuit of post-secondary education comes earlier than a sibling pursuing it, for example, and remains within the lifetime contribution limit per child. We usually suggest the family plan when the children are near each other in age, and parents desire one investment lineup, one governance, and predictable education savings flows.

Group Plan / Group RESP: Group Plans operate on a collectivist, scheduled contribution system. Payments are locked into a schedule, and there are additional restrictions and higher fees. When it’s time to access RESP funds, for some families, the structure is appreciated; for others, it’s stifling. If you take this route, review fee schedules closely and learn how group plan dealers extract their payouts. A group plan can be workable for a rule-bound client who loves fixed milestones, but we always compare the cost and flexibility to a family plan or individual or family RESP before you sign.

What Counts As A Qualified Investment (And Why It Matters)

Within a Registered Education Savings Plan, the promoter has to keep the assets in the “qualified” range. Cash, GICs, government bonds and most listed securities, mutual funds and ETFs may be eligible too. The answer is: It depends on the time horizon and risk tolerance. If your child is a decade away, funds tilted toward growth can be in order; if school looms two years down the line, we tame volatility and defend the money you’ll need for tuition, books and housing. Qualification helps ensure the plan stays in sync with the Income Tax Act, and will contain provisions that say the financial institution will contact you if a move appears offside.

Withdrawal Mechanics: Educational Assistance Payments And Refunds Of Contributions

When you start payout, you can request EAPs and take some of the contributions back to the subscriber tax-free. EAPs are not required to be refunded; contributions are refunded to the subscriber tax-free, and otherwise are required to refund contributions back to you, tax-free. In the first half of the first year of post-secondary education, there is a cap on EAP amounts, and then the promoter decides what makes sense for ongoing support of payments in post-secondary education.” The secret is clean paperwork: evidence of enrollment and program specifics that confirm a qualifying educational program.

Of course, we also anticipate part-time, co-op and gap-term realities. Some EAPs may still be available if the student takes an educational break from regular post-secondary education, provided that certain conditions are satisfied and contributions were not made within the 6-month period prior to issuance. This is where promoter expectation and subscriber wish intersect, but our job is to get the facts right so that the financial institution can pay quickly and accurately.

If Plans Change: Transfer RESP To RRSP, AIPs, And Edge Cases

Not every path is linear. If a child doesn’t attend a post-secondary school or delays post-secondary education, there are safety valves:

- Transfers Between Plans: You can move assets to another Registered Education Savings Plan (new provider, new structure, or different subscribers) as long as the rules are followed and the receiving plan is properly registered. This preserves the education savings runway without jeopardizing grants, provided conditions are met.

- Accumulated Income Payment (AIP): If no eligible student remains and timelines are up, earnings may be paid to the subscriber as an accumulated income payment. You’ll pay tax at regular rates on that amount and an additional tax, so we treat AIPs as a last resort.

- Transfer RESP To RRSP: A smart alternative for many subscribers—shift up to $50,000 of accumulated income payment into a Registered Retirement Savings Plan, if you have room. This can dramatically cut the taxes at exit. We do the math before anything moves, especially for households using spousal RRSP strategies under the same umbrella.

Registered Disability Savings Plan Considerations: If a child has a severe and prolonged mental impairment and can’t attend, rules around the Registered Disability Savings Plan and RESP timelines can come into play. This is a niche area where coordination with the promoter and the Canada Revenue Agency guidance is essential, and we’ll handle the analysis and documentation.

Promoter Duties You Want To See In Writing

A strong promoter relationship reduces friction. Expect the financial institution to:

- Confirm the beneficiary’s SIN, maintain accurate records, and monitor age-related rules.

- File clean data for the Canada Education Savings Program so government grants don’t bounce.

- Verify that the school is an eligible educational institution or post-secondary educational institution.

- Keep investments qualified and flag exceptions fast.

- Apply RESP withdrawal rules consistently and help document education savings usage for tuition, books, housing, and other allowable costs.

- Guide transitions between Individual RESP, Family Plan, and Group RESP where permitted.

- Verify age-related rules, including CESG eligibility periods and AIP timing windows

Family Plan Mechanics: Tracking More Than One Beneficiary The Right Way

For family plans, each contribution has to be tagged for specific children to prevent any one child from exceeding the lifetime maximum. If children are close in age, a family plan can help do the heavy lifting rather than requiring individual amounts to stay on track. Should one child complete post-secondary education and the other is still attending, then any remaining funds can be transferred as appropriate. The recipient dictates the program, though the subscriber remains responsible for limits and timing. When families engage us, we create an annual one-page “traffic light” report detailing their remaining room for resp monies, grant eligibility and how EAPs could map out — using the projected date of attending post-secondary education.

Grants Beyond CESG: Provincial Add-Ons And Tax Credits

In some provinces, you could see additional incentives — such as the Quebec Education Savings Incentive — in addition to federal government grants. We similarly map child-benefit flows, such as the Canada Child Benefit, since savings nudges are also coordinated by some provinces throughout the year. Where applicable, we point out any refundable tax credit interactions that indirectly provide cash to increase education savings. Alberta and B.C. provincial education savings grants remain discontinued.

Investment Lineups: Simple, Diversified, And Aligned With The School Date

Within the Registered Education Savings Plan in Canada, we maintain clean lineups — broad mutual funds or ETFs for growth years and then de-risked mixes in advance of school. The aim is that parents won’t be forced sellers when it comes time to pay tuition. If the credit union or bank platform establishes minimums, then we structure a model that’s convenient for them, and the promoter still keeps everything eligible under ITA. Quarterly check-ins help you stay focused on the calendar that matters: deposit windows for the education savings grant, enrollment confirmations for educational assistance payments, and the glidepath to first-year post-secondary. Some promoters now offer auto-glidepath portfolios, which automatically reduce investment risk as the beneficiary ages.

Apprenticeship Programs And Trade Schools: The Non-Traditional Track

Many families continue to believe RESPs are only for university. Not true. Under the EAP, funds are used to pay for tuition, tools and other related costs when an eligible child is registered for a recognized apprenticeship program or trade school that qualifies under the plan. The promoter will request some evidence that you’re eligible; we help get as low a package to introduce it and let the educational assistance money start flowing immediately. If the student goes in a different direction, or decides to do a co-op term, we’ll recalculate the EAP side of things so income taxes are kept low for the student and your RESP is still working efficiently.” CRA updates its list of designated apprenticeship and foreign institutions annually, which promoters reference when approving EAPs.

Compliance Windows You Can’t Miss

- Contribution window: up to the 31st year after the plan opens.

- Termination window: by the end of the 35th year.

- Special rules exist for disability cases.

- Transfers keep the original effective date logic intact, which matters for when accumulated income payment options start.

- The only beneficiary rule applies to individual RESPs; family plans and family RESP formats allow one or more beneficiaries, as long as the relationship conditions are met. The 35-year termination rule remains unchanged through 2026.

We monitor these timelines for clients so no one loses free money or incurs avoidable tax consequences.

How Canadian LIC Sets You Up For Smooth Payouts

- Plan Choice: We compare Individual or Family RESP formats against Group RESP schedules and fees.

- Grant Maximization: We lock in Education Savings Grant CESG and, where applicable, Canada Learning Bond eligibility.

- Deposit Discipline: Auto-contributions sized to the RESP contribution limit, tuned to your family income, and coordinated with grandparents to avoid excess contribution issues.

- Investment Mix: Qualified assets aligned with the start date for post-secondary education.

- Payout Design: We map initial EAP caps, ongoing “reasonable” educational assistance payments, and parent contribution refunds to balance the tax exposure.

- Exit Strategy: If school isn’t on the table, we evaluate transfer RESP to RRSP options before any AIP; we also consider edge cases tied to prolonged mental impairment and the Registered Disability Savings Plan.

- Provider Fit: Bank, credit union, or investment dealer—we ensure the financial institution acting as promoter can meet your service expectations and timeline. Grant filings follow updated CESP electronic submission standards for 2026.

Headline Numbers You Should Memorize

- RESP contribution limit is enforced by a lifetime contribution limit per child across all Registered Education Savings Plans.

- Education savings compounding is tax-free inside the plan; refunds of contributions are tax-free to you; EAPs are taxable to the student, typically minimizing income taxes.

- The Canada Education Savings match is designed to reward early, steady savings.

- If no student attends, accumulated income payment rules apply—plan before you move, because the tax impact can be material without the RRSP transfer option.

When To Call Us (And What We’ll Bring To The Table)

Whether you are ready to open an RESP, need to transfer money from a group plan to a family plan or simply want to know how you can make withdrawals for EAPs, we’re here. If you’ve maxed out the lifetime contribution and need to verify the grant status, we’ll audit. If grandparents are kicking in, we’ll coordinate so that everyone is within the lifetime limit and to avoid triggering an excess contribution penalty for anyone. And if their plans change after high school, there are a couple of guaranteed options we’ll have in place that may ensure that your education savings continue for your student’s post-secondary education or beyond.

Get An Accurate, No-Pressure Comparison And RESP Quote Online

We show you a straightforward apples-to-apples comparison of an individual RESP, a family RESP and a Group RESP with the same deposit amounts, the same start date and the same target age for college — plus we factor in when we expect to take any EAPs. If you ask for an RESP quote online, we’ll code it with the exact forms from their promoter, so there’s no retyping, only signing. Our advisers oversee the flow of information from subscriber to promoter, double-check grant filings and ensure that the education savings are there, ready whenever acceptance letters start arriving.

Final Word From Canadian LIC

You establish a goal; your financial advisor team and the promoter follow the rules. Firstly, keep it simple: a little for savings in a Registered Education Savings Plan, regular pieces to put into that account and keep your eye on the post-secondary education starting line. With the lines neatly divided — subscriber decisions here, promoter management over there — you stave off hostilities, capture every available dollar and launch your student forward with a plan that honours both the spirit and letter of Canada’s system.

More on Emergency Medical Insurance

FAQs

Yes. Grandparents can subscribe to an RESP in Canada if the child has a SIN. Any contributions they make go toward the same lifetime contribution limit as their parents. Our advisors work to coordinate the two plans so that family gifts can compound tax-free and without triggering an excess contribution penalty.

The promoter can still release educational assistance payments if the student attends a recognized post-secondary educational institution outside Canada. The subscriber simply provides enrollment proof, and the funds continue to earn tax-free growth until withdrawal. We ensure cross-border documentation meets Canada Revenue Agency standards.

Not at all. Eligible apprenticeship programs and trade schools qualify under the same education savings plan rules. The promoter verifies the institution’s designation before releasing the educational assistance payment. We guide families so that every certified training path accesses full CESG education savings grant benefits.

Yes, within a family plan or when siblings are related by blood or adoption. The transfer keeps the original investment earnings and Canada Education Savings Grant eligibility intact. We coordinate with your financial institution to protect your education savings and prevent over-contribution across Registered Education Savings Plans.

Grant eligibility adjusts each year automatically based on CRA-verified family income. The promoter recalculates any extra education savings grant or canada learning bond entitlement. Our review ensures no missed credits and optimizes ongoing education savings toward your child’s post-secondary education goals.

Grant eligibility adjusts each year automatically based on CRA-verified family income. The promoter recalculates any extra education savings grant or canada learning bond entitlement. Our review ensures no missed credits and optimizes ongoing education savings toward your child’s post-secondary education goals.

The promoter can hold the funds for years as long as the plan stays within its 35-year lifespan. RESP withdrawal rules allow flexibility so you can wait until the beneficiary decides on a program. Meanwhile, investment earnings continue growing tax-free to support future post-secondary education payments.

Your financial advisor and the promoter share that role. The promoter files CESP data; the advisor tracks contribution limits, grant eligibility and EAP timing to ensure smooth compliance. Together, we make sure your Registered Education Savings Plan runs smoothly under the Income Tax Act.

Key Takeaways

- The subscriber opens and funds the Registered Education Savings Plan in Canada, while the promoter—the bank, credit union, or investment dealer—administers contributions, files for grants, and releases payments.

- The RESP contribution limit is $50,000 per beneficiary, with earnings growing tax-free until withdrawal. Overcontributions are penalized at 1% per month.

- The Canada Education Savings Grant (CESG) adds 20% on the first $2,500 contributed each year, and low-income families can qualify for the Canada Learning Bond (CLB) up to $2,000.

- Funds can support university, college, apprenticeship, and other post-secondary educational institutions, as long as eligibility requirements are met.

- RESP withdrawal rules allow students to receive educational assistance payments (EAPs) once enrolled, with EAPs taxed in the student’s hands and subscriber contributions refunded tax-free.

- If no beneficiary pursues post-secondary education, subscribers may transfer the RESP to the RRSP (up to $50,000) to avoid paying additional tax on accumulated income payments.

- Choosing the right structure—individual RESP, family RESP, or group RESP—depends on the number of beneficiaries and the flexibility desired.

- The promoter must ensure compliance with the Income Tax Act, maintain accurate records, and manage grant applications under the Canada Education Savings Program.

- Working with a knowledgeable financial advisor ensures smooth communication between subscriber and promoter, accurate grant filings, and full use of all government education savings incentives.

- Regular reviews help keep your plan on track, maximize education savings, and secure future funding for your child’s post-secondary education.

Sources and Further Reading

- Government of Canada – Canada Education Savings Program (CESP)

Details on Canada Education Savings Grant and Canada Learning Bond eligibility.

🔗 https://www.canada.ca/en/employment-social-development/services/student-financial-aid/education-savings.html - Canada Revenue Agency (CRA) – Registered Education Savings Plans (RESPs)

Rules for RESP contribution limit, RESP withdrawal rules, and taxation.

🔗 https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-education-savings-plans-resps.html - Employment and Social Development Canada (ESDC) – RESP Promoter Resources

Technical documentation for promoters on registration and reporting standards.

🔗 https://www.canada.ca/en/employment-social-development/programs/education/education-savings/resp-promoters.html - Financial Consumer Agency of Canada (FCAC) – Education Savings

Overview of education savings plan RESP types, grants, and consumer tips.

🔗 https://www.canada.ca/en/financial-consumer-agency/services/savings-investments/resp.html - Government of Quebec – Quebec Education Savings Incentive (QESI)

Information on provincial top-up programs for education savings.

🔗 https://www.revenuquebec.ca/en/citizens/tax-credits/quebec-education-savings-incentive/ - Canada.ca – Registered Plans Directorate Publications (RC4092 and IC93-3R)

Technical CRA publications on accumulated income payment and transfer RESP to RRSP rules.

🔗 https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4092.html - Statistics Canada – Postsecondary Education and Family Savings Reports

Data on Canadian household education savings participation and trends.

🔗 https://www150.statcan.gc.ca/n1/en/subjects/education_training_and_learning/postsecondary_education

Feedback Questionnaire:

Thank you for reading our detailed 2026 guide on RESP Subscriber vs. Promoter: Understanding the Key Differences.

Your feedback helps us understand what Canadians truly need when planning their child’s education savings and managing a Registered Education Savings Plan in Canada.

Please take a minute to share your thoughts below 👇

Thank you for your feedback!

Our team will review your responses and reach out if you requested personalized help with your Education Savings Plan RESP) or grant eligibility review.

IN THIS ARTICLE

- RESP Subscriber vs. Promoter: Understanding the Key Differences (2026 Guide)

- The Subscriber: Decision-Maker, Funder, And Rule-Keeper

- The Promoter: Administrator, Grant Pipeline, And Payout Gatekeeper

- Education Savings Grant: Getting The Numbers Right, Every Year

- Canada Learning Bond: Extra Support For Eligible Families

- Choosing The Right Structure: Individual RESP, Family Plan, Or Group Plan

- What Counts As A Qualified Investment (And Why It Matters)

- Withdrawal Mechanics: Educational Assistance Payments And Refunds Of Contributions

- If Plans Change: Transfer RESP To RRSP, AIPs, And Edge Cases

- Promoter Duties You Want To See In Writing

- Family Plan Mechanics: Tracking More Than One Beneficiary The Right Way

- Grants Beyond CESG: Provincial Add-Ons And Tax Credits

- Investment Lineups: Simple, Diversified, And Aligned With The School Date

- Apprenticeship Programs And Trade Schools: The Non-Traditional Track

- Compliance Windows You Can’t Miss

- How Canadian LIC Sets You Up For Smooth Payouts

- Headline Numbers You Should Memorize

- When To Call Us (And What We’ll Bring To The Table)

- Get An Accurate, No-Pressure Comparison And RESP Quote Online

- Final Word From Canadian LIC

Sign-in to CanadianLIC

Verify OTP