- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Personal Vs. Business-Owned Critical Illness Insurance: Which Option Is Right For You In 2026?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 17th 2025

SUMMARY

The blog explains how personal and Business Owned Critical Illness Insurance works in Canada, comparing coverage, tax implications, and financial protection benefits. It highlights how Critical Illness Insurance costs, premiums, and payout options differ for individuals and corporations. Readers gain clarity on choosing between personal and business-owned illness insurance for stronger financial security and long-term business continuity.

Introduction

Each year, a growing number of Canadians understand at a gut level that one health diagnosis can rock personal finances and destabilize business. Nearly 2 in 5 Canadians are expected to develop cancer during their lifetimes, according to the Canadian Cancer Society, and the Heart and Stroke Foundation has reported that someone in Canada suffers a stroke every five minutes. But the majority of families and small business owners have inadequate savings to provide a financial cushion for an extended period of illness.

That’s why there is Critical Illness Insurance — a policy that promises to deliver payment as a tax-free lump sum when the worst of covered diagnoses lands on you. We’ve seen when this coverage becomes a lifeline — be it a business owner maintaining steady payroll or a parent tending to private medical bills in order to give recovery the time and money it needs.

But there’s one key decision that often gets little attention: whether your Life Insurance Policy should be owned by you personally or by the business. Both can provide financial security, but which one is the best for you depends on your goals, structure and lifestyle.

Understanding How Critical Illness Insurance Works

Consider Critical Illness Insurance a bridge between the diagnosis of a serious health condition and financial recovery. If a covered critical illness, such as cancer, heart attack, or multiple sclerosis, hits, the insurer makes a tax-free payout to help pay for things that Regular Health Insurance does not.

Disability Insurance replaces income monthly, but Critical Illness Insurance Coverage provides a lump sum all at once for you to use in the way you see fit — whether that means covering medical bills, your mortgage, or hiring temporary help to continue operating your business.

We have been able to assist both employees and business owners in customizing Critical Illness Insurance Policies according to their specific needs. And in each and every conversation, the same question always arises:

“Should the policy be under my name, or my company’s?”

Let’s break that down clearly.

Personally Owned Critical Illness Insurance: Protecting Your Life and Family

When you buy a personally owned Critical Illness Insurance Policy, you (not your business) are the policyowner. You pay the premiums, and if you make a claim, the lump sum payout is paid directly to you — typically tax-free.

How It Works in Real Life

Last year, one of our clients, a self-employed graphic designer in British Columbia, had a heart attack out of the blue. His Critical Illness Insurance kicked out a lump sum payment within weeks. That money sustained his family — paying the bills, paying for private rehab, and even personal expenses such as groceries and utilities, while he recovered.

Not having to explain such major outgoings to anyone or be concerned about business expenses was one of the perks of having personally owned his policy. He was spending the money to keep afloat during the months of downtime.

Why It Matters

Personally owned illness insurance offers:

- Freedom: You decide where the money goes.

- Flexibility: Use it for out-of-pocket expenses, home care, or even to top up savings.

- Protection: Keep your financial security intact without touching investments or your retirement portfolio.

For many Canadians, especially sole proprietors and gig workers, this is the most straightforward way to safeguard income and independence.

Business Owned Critical Illness Insurance: Protecting Your Company’s Future

Now, picture a different situation. You are the owner of a small construction company. You’re the decision-maker, you’re the estimator, and you’re the relationship-builder. If you become sidelined by a major illness, operations could shut down overnight.

An employer-owned Critical Illness Insurance Policy can help stop that financial spiral. The corporation holds the coverage, the business is paying the premiums, and if there is a covered illness, a tax-free lump sum comes back to the company.

That payout could be applied to business debts, used to hire key workers, or pay rent and utilities — guaranteeing the survival of operations and securing owners’ assets.

A Real Example from Our Desk

Recently, we worked with three partners in a mid-sized accounting firm based in Toronto. Both parties were covered by Critical Illness Insurance owned by the business. When one of the partners was found to have cancer, the payout paid for a new accountant and, in effect, ensured that nothing changed for clients.

This was a kind of protection against financial disaster and business expansion. The others could concentrate on operations, not sweat the expenses.

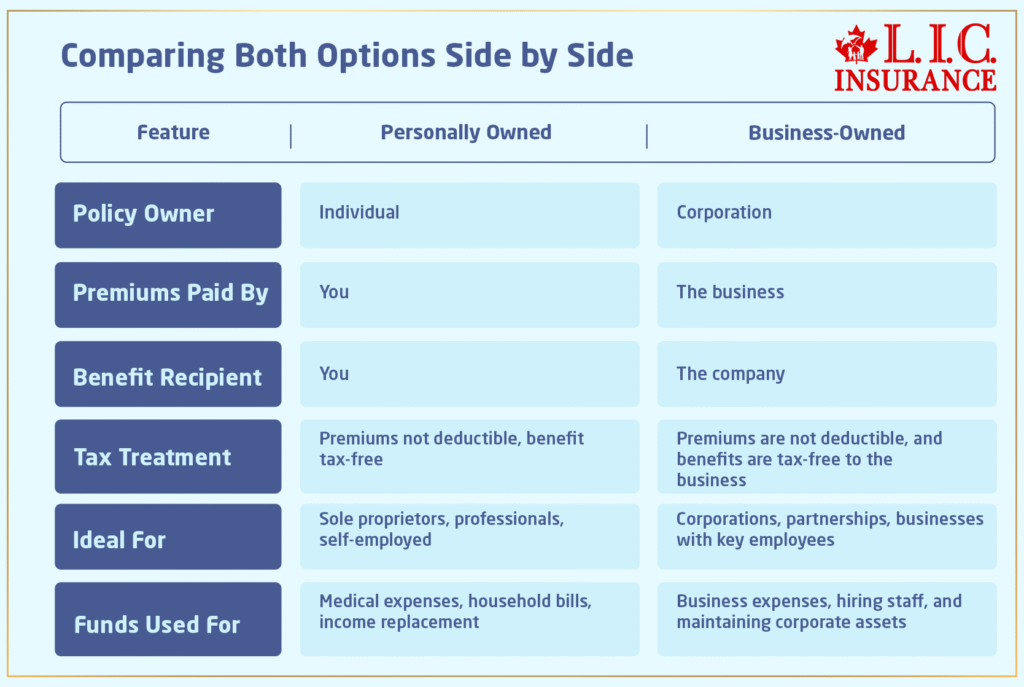

Comparing Both Options Side by Side

This table looks simple — but each side carries long-term implications for taxes, ownership, and financial flexibility.

Tax Implications You Should Understand

For Critical Illness Insurance — it’s not deductible, in standard structures, whether owned personally or corporately by Canada Revenue Agency (CRA rules. However, in the event of a life-threatening condition, personal and commercial payouts are typically tax-free separately.

But there are nuances — Critical Illness Insurance does not generate a Capital Dividend Account (CDA) credit because it is not life insurance, which means corporate payouts remain inside the company unless paid out as a taxable dividend.

But there are nuances — and importantly, CRA has begun actively warning (2025–2026) against aggressive CI-based tax schemes involving loans or offshore insurers. Regular CI policies are still treated normally, but anything marketed as a “tax-free extraction strategy” is now being challenged.

But there are nuances — your original line saying “racking up that death benefit” is incorrect, because Critical Illness policies do not have a death benefit. Replace with: “if a corporation uses CI payouts for the personal benefit of shareholders or mixes personal/corporate benefit improperly, it may create taxable shareholder benefit issues.

When Personally Owned Coverage Makes More Sense

We often recommend Personally Owned Critical Illness Insurance when clients need flexibility and direct access to cash. It’s particularly effective for:

1. Covering Personal Medical Expenses

Private treatments, experimental drugs, or specialized therapy sessions often fall outside public healthcare coverage in Canada. A tax-free payment from your policy can fund these medical expenses, helping you access better care faster.

2. Maintaining Household Stability

If a critical illness forces time off work, income drops, but bills don’t. A lump sum can keep mortgage payments and monthly expenses on track. That financial breathing room reduces financial stress and prevents long-term debt.

3. Protecting Investments and Retirement Plans

Without insurance, many people dip into RRSPs or TFSAs during a serious illness, derailing years of saving. A Critical Illness Insurance payout keeps those funds untouched, preserving future financial security.

4. Covering Other Insurance Premiums

We’ve seen cases where clients used their Critical Illness Coverage payout to keep Life or Disability Insurance active during recovery. That’s smart planning — ensuring your entire protection portfolio remains intact when it matters most.

When Business-Owned Coverage Is the Smarter Strategy

For incorporated professionals or entrepreneurs with staff, Business-Owned Critical Illness Insurance can play a major role in continuity and reputation management.

1. Replacing a Key Person

Losing a key employee or key person — even temporarily — can stall growth. The lump-sum payment from Critical Illness Insurance can fund training or hiring, keeping your business continuity intact.

2. Covering Business Loans and Overheads

Many small firms carry lines of credit, equipment leases, or expansion loans. The insurance policy payout can cover those business debts or pay business expenses like rent, utilities, or salaries.

It’s the difference between shutting down and staying afloat.

3. Supporting a Buy-Sell Agreement

If one partner suffers a critical illness, a Business Owned Critical Illness Insurance Policy can fund a buy-sell agreement, allowing the remaining partners or family to buy out the affected person’s shares. This structure protects both ownership and succession plans.

4. Protecting Corporate Assets

Without proper coverage, businesses might have to liquidate corporate assets or tap into business savings to handle a crisis. Insurance ensures that doesn’t happen — preserving your company’s balance sheet and financial protection.

The Financial Impact of Choosing Wrong

Here’s something that most people do not consider: The wrong ownership setup can actually thwart your entire plan.

If you depend entirely on coverage owned by your business, and eventually leave the company, or it dissolves, that protection may not travel with you. By the same token, if you purchase only Personal Coverage and your business has multiple partners or key employees, your company is susceptible.

We have worked with numerous business owners to help them restructure their Critical Illness Insurance in a way that allows them to maintain both for peace of mind — Personal Coverage for family security and business-owned coverage for operational resilience.

That two-pronged tactic can shore up both sides of your financial life.

Critical Illness Insurance Premiums: What Affects the Cost

Whether Personal or Business-Owned, the cost of Critical Illness Insurance depends on several factors:

- Age and health: Younger applicants in good health pay less.

- Smoking status: Smokers face higher premiums paid.

- Coverage amount: Higher coverage equals higher cost, but better protection.

- Waiting period: Shorter waiting periods increase cost but reduce payout delay.

- Return of premium benefit: Some plans refund part of your premiums paid if you never claim — these options add flexibility.

According to Sun Life and Canada Life, average monthly premiums for the best Critical Illness Insurance in Canada range from $30 to $100 for modest coverage, depending on age and condition history. These estimates apply primarily to younger, healthy, non-smoking applicants with basic benefit amounts.

Balancing Business and Personal Needs

We often tell clients:

“Your health coverage should move with your life — not trap you in your business.”

That means evaluating both personal and corporate needs annually. If you recently incorporated, expanded your team, or took on business debts, it’s worth reviewing your protection plan. The goal isn’t just having insurance; it’s having the right ownership structure to support your future.

How Critical Illness Insurance Supports Broader Financial Goals

Retirement Planning

If you’re self-employed, a Critical Illness Insurance Policy helps preserve your retirement funds by covering living expenses during illness, instead of dipping into RRSPs or TFSAs.

Estate Planning

Business owners aiming to pass on their company to family or partners can use Business Owned Critical Illness Coverage to handle buyouts and tax obligations — ensuring a smoother transition.

Wealth Preservation

For high-net-worth clients, both personal and business-owned insurance play a role in maintaining financial stability during a major illness. It keeps both portfolios — personal and corporate — intact when life throws a curveball.

Making the Decision: Key Considerations

When clients ask which option is “better,” our honest answer is: it depends. But here’s how to frame the decision:

- Who depends on your income? If your household relies on you, Personal Coverage is essential.

- Who depends on your leadership? If your team or partners depend on your presence, business coverage is vital.

- Do you want tax simplicity or operational leverage? Personally owned coverage simplifies taxes. Business-owned coverage builds resilience.

- Do you need both? Many business owners combine the two — a Personal Policy for their family and a business one for continuity.

This layered structure offers the strongest safety net and is common among incorporated professionals, contractors, and entrepreneurs across Canada.

Final Thoughts: Protecting Both Sides of Your Life

We’ve witnessed the difference that the perfect strategy for Critical Illness Insurance can provide. Whether it’s ensuring the financial protection of a family while undergoing treatment or keeping corporate assets protected for a business owner whose star employee is on the road to recovery, our goals are unchanged: stability during instability.

The choice between Personal vs. Business Owned Critical Illness Insurance is not an either–or decision. It’s coverage that aligns with your life. That’s why, in 2026, when Personal Health Insurance is becoming more expensive by the day in Canada, and as CRA is on high alert for tax implications, being proactive isn’t a choice; it’s an imperative.

Your health may be unpredictable. But it doesn’t have to be your financial future.

And when you are prepared to discuss your Critical Illness Insurance Policy or looking for the best Critical Illness Insurance in Canada, it is here with you — helping Canadians secure what counts: family, business, and financial peace of mind.

More on Critical Illness Insurance

FAQs

Disability Insurance pays a monthly percentage of your income, while Critical Illness Insurance provides a tax-free lump sum following diagnosis. You also get to choose how to use the money — personal bills, travel for medical care, or business expenses. Both serve to safeguard your financial security, but in vastly different ways.

No, Critical Illness Insurance Premiums aren’t generally tax-deductible according to the Canada Revenue Agency. However, when a critical illness strikes, the payout is generally tax-free, and your company is provided with funds to fall back on without incurring additional tax consequences. Corporate CI payouts do not create CDA room, so payouts withdrawn by shareholders may still be taxable as dividends.

How much is your Critical Illness Insurance cost? Your costs will vary depending on your age, health, the coverage amount you select, and whether or not you smoke. Several are offering add-ons like a return of premium benefit for flexibility. You can easily compare policy rates provided by various insurance companies across Canada online when you request a Critical Illness Insurance quote online.

Yes — a Business Owned Critical Illness Insurance Policy can provide financial help if a key employee or key person becomes ill. The lump-sum payment can be used to help pay for expenses related to the business, bringing in temporary staff, as well as helping with continuity as the organization recovers.

Key Takeaways

- Critical Illness Insurance provides a tax-free lump-sum payment that supports recovery and prevents financial strain during a serious illness.

- A personally owned Critical Illness Insurance Policy protects individuals and families by covering personal expenses, medical costs, and lost income.

- A Business Owned Critical Illness Insurance Policy helps companies maintain business continuity, protect corporate assets, and support key employees.

- Critical Illness Insurance cost varies by age, health, and coverage type, while payouts are typically tax-free under Canada Revenue Agency guidelines.

- Balancing both personal and business-owned illness insurance can provide stronger financial protection and long-term financial stability in 2026.

Sources and Further Reading

- Sun Life Financial — Critical Illness Insurance (overview of how coverage works in Canada, including tax-free lump sum)

Sun Life - Canada Life — Critical Illness Insurance (clear explanation of policy specifics and payout structure)

Canada Life - Manulife — Taxation of Critical Illness and Disability Insurance Living Benefits Products (deep dive into premium-deductibility and tax implications)

EN - Empire Life — Corporately Funded Critical Illness Coverage for Employees (business-owned policy ownership and corporate tax issues)

empire.ca - The Co-operators — Critical Illness Insurance (covers family-friendly benefit features and coverage depth)

cooperators.ca - Canada Revenue Agency (CRA) — Eligible Medical Expenses You Can Claim On Your Tax Return (details on medical expense tax credits and how they interact with Critical Illness Insurance receipts)

canada.ca

Feedback Questionnaire:

We’d love to hear your thoughts!

Please take a minute to share your struggles and experiences so we can guide you better.

IN THIS ARTICLE

- Personal Vs. Business-Owned Critical Illness Insurance: Which Option Is Right For You In 2026?

- Understanding How Critical Illness Insurance Works

- Personally Owned Critical Illness Insurance: Protecting Your Life and Family

- Business Owned Critical Illness Insurance: Protecting Your Company’s Future

- Comparing Both Options Side by Side

- Tax Implications You Should Understand

- When Personally Owned Coverage Makes More Sense

- When Business-Owned Coverage Is the Smarter Strategy

- The Financial Impact of Choosing Wrong

- Critical Illness Insurance Premiums: What Affects the Cost

- Balancing Business and Personal Needs

- How Critical Illness Insurance Supports Broader Financial Goals

- Making the Decision: Key Considerations

- Final Thoughts: Protecting Both Sides of Your Life

Sign-in to CanadianLIC

Verify OTP