- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Is there a life insurance policy where you get your money back?

- What is Money Back Life Insurance?

- How Does Money Back Life Insurance Work?

- Who Should Consider Money Back Life Insurance?

- Money Back Life Insurance vs. Traditional Life Insurance Policies

- What to Expect From a Money Back Life Insurance Quote

- Pros and Cons of Money Back Life Insurance

- Should You Buy Money Back Life Insurance?

- Next Steps: How to Get Started

Is There A Life Insurance Policy Where You Get Your Money Back?

Canadian LIC

CEO & Founder

- 11 min read

- March 6th, 2025

SUMMARY

This blog explains Money Back Life Insurance policies in Canada, including how they work, their benefits, and how they differ from other types of life insurance. It covers the process of getting premiums refunded, the advantages of permanent coverage, and who should consider this type of policy. It also compares Money Back Life Insurance with term and Whole Life Insurance. Additionally, it offers tips on how to buy affordable Money Back Life Insurance Plans in Canada and get the best quotes.

Introduction

When most people think of life insurance, they picture paying premiums for years, only to pay no benefit if they survive the policy. This widespread concern leaves many asking the question, “Is there a life insurance policy in which you get your money back?” If you’re one of many who are looking into this question, you’re not the only one. Most Canadians are uncomfortable contributing to a policy that will pay them nothing if they enjoy a long life.

The good news is, there is such a policy — Money Back Life Insurance — which is an appealing option for those who want to have the peace of mind of knowing their premiums will get returned to them if they do not die during the term of the policy. This blog will show you how Money Back Life Insurance works, the types in Canada, and what kind of people can benefit most from it. You’ll also know by the end if this is a good choice for you.

So, if you want to purchase cheaper Money Back Life Insurance policy plans in Canada or want to understand how this life insurance policy works, in this article. We’ll explore the nuances that differentiate money-back policies and make them useful.

What is Money Back Life Insurance?

A Money Back Life Insurance policy is a type of permanent life insurance that promises to pay you back some or all of the premiums you’ve paid if you outlive the policy’s term. Unlike a traditional term life insurance policy, which pays a benefit only after the policyholder passes away, a Money Back Life Insurance policy includes a return of a portion of your paid premiums throughout the duration of the policy.

These are typically laid out in terms of Whole Life (Permanent Coverage with a cash value component) or universal life (permanent coverage with a flexible premium and cash value component). But Money Back Life Insurance is structured so that if you don’t die during the term, you are guaranteed to get a refund on your premiums. The exact mechanics of these refunds differ, but the underlying idea is the same: If, at some point, you don’t need the death benefit, you’ll get some of your money back.

How Does Money Back Life Insurance Work?

The inner workings of a Money Back Life Insurance policy are fairly simple, but there are some important differences between Money Back Life Insurance and regular life insurance:

- Premium Payments: As with any life insurance policy, you pay periodic premiums. These payments build over time and contribute to your death benefit and cash value.

- Coverage: You are accompanied by life insurance, which covers anything that happens to you.

- Return of Premium: If you survive the policy period (usually 20 or 30 years), you can get a portion of the premiums you pay back. The specific amount refunded varies based on the terms of the policy.

- Cash Value Accumulation: Depending on the kind of Money Back Life Insurance you purchase, your premiums may allow your policy to accumulate cash value, which you can access while the policy is still in effect.

Unlike Standard Life Insurance Policies, Money-Back Policies provide a payout of premiums, meaning you’re not just paying for peace of mind — you receive some of your money back if you live a long life.

Who Should Consider Money Back Life Insurance?

It can do the trick for people seeking to hold life insurance: Money Back Life Insurance policies work out best for people who:

- Want Permanent Coverage: These policies offer lifetime coverage. Whereas term insurance ends after a specified number of years, Money Back Life Insurance continues, provided its premiums are paid.

- Are Looking to Get Some Money Back: If you are worried about paying all that money in life insurance premiums and getting nothing in return if you do not die, a money-back policy may be a suitable choice for you.

- Have Higher Premium Affordability: Unlike standard term life insurance, money-back policies are relatively costly. So, you should ensure that the price or costs involved can fit your budget.

- Prefer Long-Term Planning: Money Back Life Insurance is a long-term investment, as policies are often active for 20-30 years. Ideal for individuals seeking long-term protection and wanting to avoid the fear that their premiums end up being “wasted.”

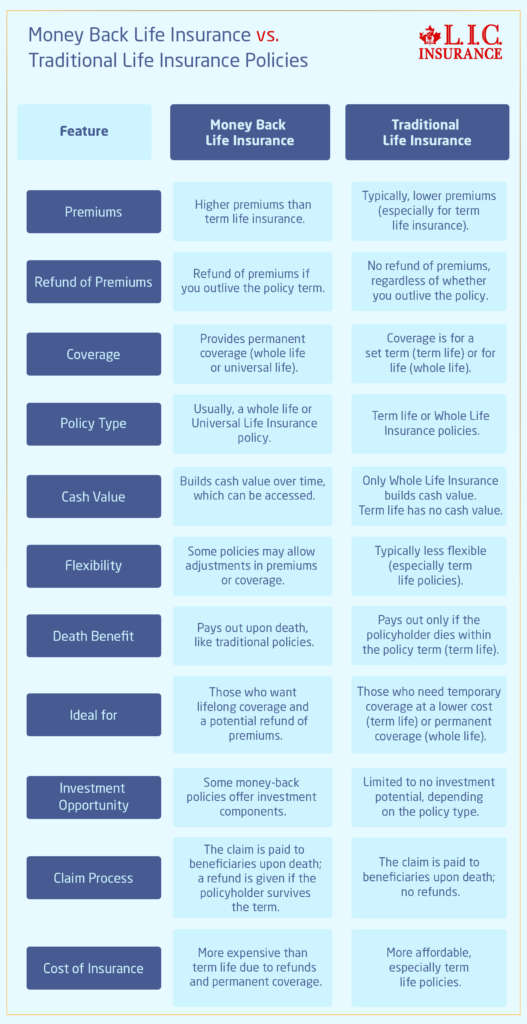

Money Back Life Insurance vs. Traditional Life Insurance Policies

Let’s take a closer look at how Money Back Life Insurance stacks up against other common life insurance policies available in Canada.

Money Back Life Insurance vs. Term Life Insurance

- Term Life Insurance: This type of policy covers you for a specified term (such as 10, 20, or 30 years) and is usually less expensive. But if you outlive the term, you receive nothing in return. You just stop paying premiums, and the coverage ends.

- Money-Back Life Insurance: Money-back plans give you back the premiums paid if you survive until the end of the term. The premium is higher, but you get some of what you paid if you live a long time.

| Feature | Money Back Life Insurance | Term Life Insurance |

|---|---|---|

| Premiums | Higher premiums | Lower premiums |

| Coverage Duration | Permanent (for life) | Temporary (for a set term, e.g., 10–30 years) |

| Refund of Premiums | Refund of premiums if outlived the term | No refund of premiums if outlived the term |

| Death Benefit | Pays out if you pass away during the policy term | Pays out only if you pass away during the policy term |

| Cash Value Accumulation | Yes, accumulates cash value over time | No cash value accumulation |

| Policy Expiry | Does not expire as long as premiums are paid | Expires at the end of the policy term |

| Ideal For | People seeking both life coverage and a premium refund | People who need affordable life insurance for a limited period |

Money Back Life Insurance vs. Whole Life Insurance

- Whole Life Insurance: A Permanent form of insurance that lasts for your entire life and accumulates cash value. However, it tends to cost more than Term Life Insurance.

- Money Back Life Insurance: These policies are usually a type of Whole Life Insurance, and they give you back premiums if you return outliving the policy term. If your main concern is getting something back when the term is up, this may be the better option.

| Feature | Money Back Life Insurance | Whole Life Insurance |

|---|---|---|

| Type of Coverage | Permanent coverage | Permanent coverage |

| Premiums | Higher premiums compared to term life | Higher premiums compared to term life |

| Cash Value | May build cash value over time | Builds cash value over time |

| Refund of Premiums | Refunds premiums if you outlive the policy | No refund of premiums, but cash value accumulates |

| Policy Length | Typically 20–30 years | Lifetime |

| Death Benefit | Paid to beneficiaries upon death | Paid to beneficiaries upon death |

| Flexibility | Less flexible than whole life | More flexible, with options for policy loans or withdrawals |

| Complexity | Easier to understand than the whole life | It can be more complex to understand |

Money Back Life Insurance vs. Universal Life Insurance

- Universal Life Insurance: This policy also provides life coverage as well as an investment component that allows you to adjust premiums and your death benefit. Although it provides flexibility, the returns vary based on the performance of the underlying investments.

- Money Back Life Insurance: Money-Back Policies are generally easier than Universal Life Insurance. Universal policies aim to grow your investment, while money-back policies return premiums if you survive the policy term.

| Feature | Money Back Life Insurance | Universal Life Insurance |

|---|---|---|

| Coverage Type | Permanent life coverage | Permanent life coverage |

| Premiums | Typically higher than term life insurance but fixed | Flexible premiums can adjust over time |

| Refund of Premiums | Refund of premiums if you outlive the policy term | No refund of premiums, but may accumulate cash value |

| Cash Value | Does not typically accumulate significant cash value | Builds cash value over time, based on interest or investments |

| Flexibility | Limited flexibility regarding premiums and coverage | Highly flexible; you can adjust premiums and death benefit |

| Investment Component | No investment component | Includes an investment component that grows based on market performance |

| Policy Term | Fixed term (typically 20–30 years) | Lifelong coverage with flexible term adjustments |

| Return on Investment | Guaranteed refund of premiums if you outlive the policy | No guaranteed return; returns depend on the investment performance |

| Death Benefit | Fixed death benefit | Flexible death benefit: can increase or decrease over time |

| Ideal For | People who want life coverage with the option of a refund | People looking for flexible coverage and potential cash value growth |

What to Expect From a Money Back Life Insurance Quote

When you’re ready to purchase affordable Money Back Life Insurance Plans in Canada, it’s important to know what factors affect the price of a money-back policy:

- Age: The younger you buy the policy, the lower the premiums you’ll pay.

- Health: Frequent medical exams are needed, and your health becomes a direct determinant of your premium rates.

- Coverage Amount: More coverage, more premiums. However, select a coverage amount that meets your needs and financial circumstances.

- Policy Term: Long-term policies (20, 25, 30 years) are subject to a higher yield, but there is a higher possibility of a refund, so it underlines the excitement for long-term insurance.

- Online Quotes: Money Back Life Insurance Policy Quotes Online from different life insurance providers can be compared online in order to find the cheapest. Many insurance brokers provide a simple means of getting personalized quotes tailored to your specific needs.

Pros and Cons of Money Back Life Insurance

Every insurance policy comes with its pros and cons, and Money Back Life Insurance is no exception. Let’s explore both sides.

Pros:

- Refund of Premiums: The most appealing feature of Money Back Life Insurance is the refund part. You will receive some of your premiums if you outlive the policy.

- Lifelong for Life: This type of insurance lasts your whole life, which means your family will receive financial protection at any time you pass away.

- Predictable Returns: Though the returns are generally not as high as an investment vehicle like a mutual fund, the guaranteed return of the premiums makes it a predictable, stable option.

Cons:

- Premiums are Higher: Money-back policies are usually more expensive in comparison to term life insurance policies, so they may be out of individual budgets.

- Low yield or no return: The return you are getting might not be the same as what you could have gotten if you had put your money elsewhere.

- Complex Terms: Understanding the nuances of these policies, including how the refund is calculated and when it is applied, can be complicated.

Should You Buy Money Back Life Insurance?

Whether or not to buy affordable Money Back Life Insurance Plan in Canada is a decision which ultimately comes down to your personal financial goals and situation. If you want permanent coverage with the added bonus of getting some of your money back should you outlive it, a money-back policy may be the guaranteed option for you.

Balancing these policies with traditional ones means that they may be more expensive than traditional life insurance, so it is important to examine whether this option is available for your finances. An insurance professional can determine the nuances of these types of policies and ensure they design a product that meets your financial goals.

Next Steps: How to Get Started

To see your options and purchase inexpensive Money Back Life Insurance Plans in Canada, you can begin with personalized Money Back Life Insurance coverage quotes online. At the same time, compare quotes to find the maximum coverage for the lowest price.

With the help of an expert, you will be able to make an informed decision that best suits your circumstances and will take care of your dependents while providing you with the possibility of getting back your premiums.

FAQs About Money Back Life Insurance

Money Back Life Insurance refers to a policy that returns a portion or your full premiums if you outlive the policy term. It merges life coverage along with getting your premium money back — something many find attractive.

With Money Back Life Insurance, you will pay the premiums periodically, If you outlive the life of the policy, you get some of the premiums back. Such a policy also offers life coverage, so your loved ones are financially secure if you die within the policy term.

The key benefit is that if you outlive the policy, your premiums will be returned to you. Plus, you stay covered for life, so your family views you with assurance. That provides a fair amount of security and potential savings.

Money Back Life Insurance premiums are typically higher than those for term life insurance policies. The price will depend on how old you are, whether or not you are healthy, and how much coverage you want. Because Money Back Life Insurance quotes are available online, it is a good idea to compare prices so you can find the best deal for what you need.

It is designed for people who are looking for coverage over the long term and would like to get their premiums back. This is a good pick if you want a policy that provides life insurance coverage and a way to get some of your money back.

That means you will usually get a refund at the end of the policy term (which is typically 20-30 years). The refund should be made according to the policy tax. Be aware of the particulars while buying a Money Back Life Insurance plan at an affordable cost in Canada.

Yes, you can cancel the policy, but keep in mind that if you cancel before it expires, you may not get a full refund. So always read the fine print before you sign up.

Money-back life insurance, unlike term life insurance, which is coverage for a specified amount of years with no refund of money, gives you back part of your premiums if you live past the term of the policy. Unlike term policies that expire, they provide life coverage.

It does have the advantage of being able to refund the premiums paid, but the trade-off is that premiums are generally higher than with term life insurance. For individuals looking for a lower level of coverage or investors who are comfortable with other markets, it may not be the most cost-effective solution.

To ensure you get the best deal, you need to obtain online quotes of Money Back Life Insurance policies from different service providers. You’re free to compare premiums, coverage amounts, and terms to identify the plan that best suits your budget and needs.

If you want a mix of permanent life insurance and the opportunity to receive back the premiums you pay, Money Back Life Insurance may suit you. It provides peace of mind, as well as potential savings, but it’s crucial to evaluate your financial situation first.

Yes, certain types of Money Back Life Insurance policies accumulate cash value over time. You can usually borrow against this value; [note] however, any unpaid loan will reduce the amount you get back as a refund.

Money Back Life Insurance could be the right choice for you if you desire permanent coverage but worry about the lack of a return on premiums should you outlive your policy. But if affordability is important to you, or you don’t mind rolling the dice, then you may wish to consider other forms of insurance.

Depending on your policy, you may be able to change your coverage amount. Always consult your insurance provider for the specifics before altering your coverage.

We hope to clarify the confusion around Money Back Life Insurance by answering these questions. If you think a Money Back Life Insurance plan is the best option for you, you can get a Money Back Life Insurance quote and talk to an expert who can help you in selecting the most suitable plan.

Sources and Further Reading

- Canada Life – Understanding Life Insurance

A comprehensive guide to the different types of life insurance policies available in Canada, including whole life and Money Back Life Insurance.

Canada Life Website - Manulife – Life Insurance Options

Manulife provides detailed information on various life insurance options, helping you decide between different plans, including money-back policies.

Manulife Website - Sun Life – Understanding Life Insurance

A helpful overview of how life insurance works, including explanations of policy types and how to choose the right one.

Sun Life Website - Insurance Bureau of Canada – Life Insurance

This site offers educational resources about life insurance and tips for choosing the right coverage in Canada.

Insurance Bureau of Canada - Desjardins – Life Insurance Guide

Desjardins provides a guide to understanding life insurance products, including Money Back Life Insurance policies.

Desjardins Website

Key Takeaways

- Money Back Life Insurance Explained: A Money Back Life Insurance policy refunds part of your premiums if you outlive the policy term while still providing lifelong coverage for your loved ones.

- Higher Premiums, But Potential Refund: Money-back policies tend to have higher premiums than term life insurance but offer the benefit of getting some money back if you survive the term.

- Long-Term Coverage and Security: These policies provide permanent coverage, ensuring your family’s financial security no matter when you pass away.

- Who Should Consider It: Money Back Life Insurance is ideal for those who want both life coverage and a potential refund of premiums and who can afford higher premiums.

- Comparisons to Other Life Insurance: Unlike term life insurance (which expires) or Whole Life Insurance (which builds cash value), Money Back Life Insurance offers a guaranteed refund of premiums if you outlive the policy term.

- Get Quotes Online: It’s important to compare Money Back Life Insurance policy quotes online to ensure you’re getting the best coverage at the best price.

- Make Informed Decisions: Before purchasing, evaluate if this type of policy fits your budget and long-term financial goals.

Your Feedback Is Very Important To Us

Thank you for taking the time to complete this brief questionnaire. Your answers will help us understand the challenges people face when looking for life insurance policies with money-back options. Your feedback is valuable in improving our services.

Thank you for your time and feedback! We’ll be in touch soon.

IN THIS ARTICLE

- Is there a life insurance policy where you get your money back?

- What is Money Back Life Insurance?

- How Does Money Back Life Insurance Work?

- Who Should Consider Money Back Life Insurance?

- Money Back Life Insurance vs. Traditional Life Insurance Policies

- What to Expect From a Money Back Life Insurance Quote

- Pros and Cons of Money Back Life Insurance

- Should You Buy Money Back Life Insurance?

- Next Steps: How to Get Started

Sign-in to CanadianLIC

Verify OTP