- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

High-Value Life Insurance In Canada: Why Coverage Over $1 Million Matters

By Harpreet Puri

CEO & Founder

- 11 min read

- January 06th, 2026

SUMMARY

A Million Dollar Life Insurance Policy isn’t a luxury—it’s smart protection. With rising living costs, debts, and family responsibilities, Canadians need higher coverage for true financial security. This guide from Canadian LIC explains why coverage over $1 million matters, how cash value and Permanent Life Insurance Policies build long-term wealth, and how to choose the best Life Insurance Plans in Canada for your family’s future.

Introduction

A Million Dollar Life Insurance Policy isn’t about luxury or showing off. It’s not about flaunting wealth — it’s about showing up for the people who count on you. Many Canadians believe a smaller policy will suffice, but when they add up mortgage loans, tuition fees, caregiving for families or business debts, the harsh truth hits: half a million doesn’t go as far as it once did. Increasing living costs, longer lifespans, and the financial responsibilities families have today have upended what is truly enough protection.

We witness this reality daily. Families come to us believing they have “enough coverage,” only to learn that after taxes, debts and inflation, their survivors would be hard pressed to make ends meet. That’s why we’re not talking about Million Dollar Life Insurance Policies as some sort of luxury; it’s because they are an affordable form of financial protection specifically tailored for today’s Canadian families.

How Much Life Insurance Is Truly Enough?

A lot of people don’t even stop to figure out how much Life Insurance they need in the first place. They choose a number that sounds all right — $250,000 or $500,000 — and move on. But when we do the math together, that comfort zone disappears real quick.

Think about it. If you make $100,000 a year and your family depends on that income for ten years, then, already, your replacement need alone creeps up to the million-dollar mark. And that’s not even counting mortgages, education expenses or debts carried from the past. That’s why a $1 million Life Insurance Policy is actually reasonably sized coverage, not excessive.

Such coverage offers families more than money; it gives them continuity. It guarantees mortgage payments continue, children’s education is not derailed, and surviving spouses remain on a path toward long-term financial security. That’s what Life Insurance Coverage is designed to do — maintain stability when life itself gets dicey.

Why Canadians Are Re-Evaluating Their Insurance Coverage

For the past few years, the conversation around money has changed. The cost of living has skyrocketed — housing prices, the price of education, groceries, and health care — all rising more rapidly than incomes. A tiny policy that might have looked “safe” now covers a few years of expenses at best.

We want to remind clients that Life Insurance Coverage should change as their financial situation changes. If your mortgage balance, the value of your business, or the size of your family has increased, so should your insurance. When you’re replacing decades of earned income and trying to keep an accumulation of assets that you spent your life building, a million dollar policy in coverage sounds a lot less big.

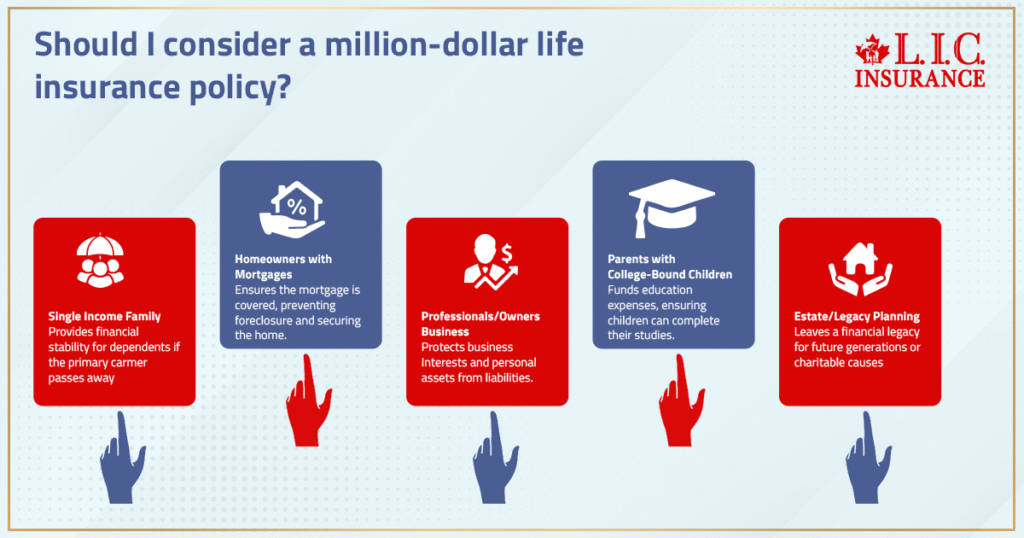

Why A Million Dollar Policy Is About Financial Security, Not Vanity

Let’s clear one thing up. The money in a Million Dollar Life Insurance Policy isn’t all about you—instead, it’s money to take care of your loved ones when you’re gone. It’s making sure the roof stays over their heads, that they can pay the bills and find a way to make those someday dreams happen.

Financial security isn’t about how much we make; it’s about how well off our family would be if we disappeared tomorrow. It’s why we typically suggest higher coverage levels, especially if you have:

- Families relying on a single income

- Homeowners with long-term mortgages

- Professionals and business owners with significant responsibilities

- Parents supporting children through post-secondary education

- Individuals planning to leave behind an estate or charitable legacy

When life happens unexpectedly, your death benefit becomes the lifeline that keeps everything together. And when that benefit is properly structured—like a Million Dollar Life Insurance Policy—it replaces not just income but the sense of financial independence your loved ones deserve.

Understanding The Real Cost Of A Million Dollar Life Insurance Policy

One of the biggest misconceptions we hear is, “A million-dollar policy must be expensive.” The truth is, it depends on what kind of policy you choose.

For example:

- A Term Life Insurance Policy offers temporary coverage—typically 10, 20, or 30 years—at lower premiums.

- A Whole Life Insurance Policy provides lifetime coverage and builds cash value over time.

- A Permanent Life Insurance Policy (which includes Universal Life or Whole Life) combines lifelong protection with a growing investment component.

Younger, healthy applicants can often secure a Million Dollar Life Insurance Policy at a surprisingly affordable cost, sometimes less than a daily coffee. As brokers, we help our clients compare these structures side by side to ensure they balance cost, coverage, and long-term benefits.

How Cash Value Works In High-Value Life Insurance

When we discuss cash value Life Insurance, people don’t often seem to understand that it’s not simply insurance, but an asset. With every premium payment, you build equity inside the policy, growing tax-deferred over time. That also means that you can have access to this cash value during your life — through policy loans, withdrawals or even as collateral for investing in a business!

For Canadians who are looking to grow and diversify wealth or plan for retirement income, the cash surrender value can serve as a strong safety net. It’s part of why so many professionals choose Whole Life Insurance—because it provides both protection and flexibility, bundled into a single financial plan.

Cash Value Life Insurance is often used as part of larger strategies we help clients with: tax-free income in retirement, funding future opportunities while maintaining a guaranteed death benefit for your heirs. It’s intelligent, stable and structured for the long haul.

Balancing Term And Permanent Coverage For Optimal Protection

You don’t necessarily need the same amount of insurance for all time. It’s often best to take a middle path.

Often, we construct hybrid strategies — a layer of term Life Insurance for shorter-term needs (say, around your mortgage or dependent years) on top of a base of whole life or universal life to provide lifelong protection. This combination keeps the premiums affordable, while your family is still fully covered in the event of an unforeseen death.

This method also allows for potential financial planning in the future. As your income expands or loans get paid down, you can convert term coverage to permanent while using the time to build up the cash value aspect. It’s about creating a plan that fits in with your life, rather than against it.

A Million Dollars: Putting The Number In Perspective

Let’s talk plain: a million dollars sounds enormous until you get into the weeds.

If your family spends $80,000 per year, a million-dollar death benefit can replace approximately 12 years of income — and that’s before taking inflation into account. Throw in mortgage payments, taxes, education, and health care, and you begin to understand why it isn’t over the top. It’s essential.

Most Canadians are unaware that running a household is more expensive than they think. That’s a big reason why I often come back with numbers beyond a million dollars when we figure out how much Life Insurance a family really does need.

We’re not dream merchants. We protect reality. And that reality costs money. Sufficient Life Insurance means your family won’t have to make impossible decisions in the worst possible circumstances.

Life Insurance And Business Owners: Beyond Personal Coverage

For business owners and incorporated professionals, High Value Life Insurance Policies are more than personal protection—they’re a strategic financial tool.

A Million Dollar Life Insurance Policy can:

- Secure funds to buy out partners through shareholder agreements

- Cover corporate loans or key-person risks

- Provide liquidity for estate or tax obligations

- Support business continuity for employees and clients

Incorporated professionals also benefit from cash value accumulation inside corporate-owned whole life policies, which can later support retirement income, succession planning, or even collateralized lending. It’s one of the smartest ways to ensure both your business and your family remain financially stable.

Financial Planning That Includes Life Insurance

True financial planning isn’t just about saving or investing—it’s about protecting what you already have. A Life Insurance Policy worth over $1 million integrates seamlessly with your broader wealth strategy.

Here’s how we often position it for our clients:

- Estate Planning: A tax-free death benefit ensures assets transfer smoothly without eroding value.

- Debt Protection: Coverage large enough to settle all liabilities, from mortgages to business loans.

- Legacy Goals: Funding charitable donations or trusts for future generations.

- Retirement Supplement: Leveraging cash value for extra cash or tax-advantaged withdrawals.

Every one of these objectives supports long-term financial protection and financial independence—the pillars of true wealth stability.

Choosing The Best Life Insurance Plan In Canada

When it comes to finding the best Life Insurance Plans in Canada, there is no “one-size-fits-all”. It all depends on your goals, your age and your tolerance for risk.

We begin with a comprehensive needs analysis– examining your financial responsibilities, income, assets, dependents and future goals. Next, we review Life Insurance providers in the industry and find contracts that offer strong insurance protection, consistent cash value growth, and flexible terms.

We are independent brokers, so we work for you — not for the insurance companies. Whether you’re thinking about whole life, term life or universal life, we ensure your coverage will meet your real-world needs, not some sales quota.

The Real Question: What Is Your Life Insurance Worth?

Life Insurance is like that rarefied dusty old Rolling Stones album — something that only gains in value after it’s too late to purchase anymore. Today, the cost of Life Insurance is always cheaper than tomorrow, the regret. So when you want to know “How much Life Insurance should I buy?” —the response should always be commensurate with your income, lifestyle and the dreams you wish to have guarded.

If you’ve managed to put down roots, create a home and raise your baby — that is life worth something, right? — Then your coverage should reflect that value. And in most Canadian homes, that means a million dollars or more. Because safeguarding your family’s future isn’t simply something you can do—it’s your legacy in action.

Final Thoughts: Why It’s Time To Think Bigger

A Million Dollar Life Insurance Policy is not extravagant – It’s just enough coverage. It’s about vision and discipline, and love in the form of money. It’s a whole life policy that offers long-term growth, or a term life layer to cover short-term debts – the Commute in this portfolio is already preparing you for your departure time.” “A permanent policy designed for legacy transfer is no different.

We understand that with the right plan, everything is possible. Families grieve—but they don’t collapse. The founder is lost to the company, but on their feet. Futures continue, uninterrupted.

That is the essence of Real Life Insurance Coverage. It preserves your story long after you’ve read the final page.

FAQs

Professionals frequently have various financial obligations — business loans, family commitments, you name it — that smaller plans simply can’t accommodate. With a $1 million Life Insurance Policy, your earning potential, debts and legacy wishes are 100% secure under the shadow of that one financial rainy day fund.

Returns on the cash value Life Insurance portion are typically built up over time with some guaranteed interest rates and dividends. It’s also a built-in savings account, and you can access your funds without impacting the death benefit (which is guaranteed), so it becomes an integral part of your long-term financial plan.

Once the cash surrender value of your Life Insurance Policy is strong, the whole life policy could be a supplement to retirement through tax-efficient access to dollars you’ve saved. This option adds more flexibility: you can use part of your investment while you are alive and simultaneously retain lifetime coverage.

A good plan centers on purchasing lifetime insurance that can grow and change with your financial situation. It’s intended for Canadians who see Life Insurance as one piece of a larger financial plan that mixes protection, potential cash flow and long-term wealth preservation.

Yes. Insurance plans are usually flexible to increase your coverage or make changes based on changes in financial responsibilities. Whether you buy more term coverage or beef up your permanent policy, a good insurance company should be able to customize choices that will keep pace with changes in your life and earnings.

Most of the time, when a Life Insurance claim is filed, the payout will be tax-free for families, allowing them to have access to the lump sum when they need it most. As a result, Million Dollar Life Insurance is one of the most effective tools available for wealth transfer and long-term financial independence.

Canadians who want comprehensive coverage — for short-term debts and lifelong commitments — are best served. Combining term Life Insurance and whole Life Insurance provides you with low-cost coverage today, with permanently protected financial security for your family’s future.

Your Life Insurance rate will depend on health, age, policy type and coverage amount. The cost of a Million Dollar Life Insurance Policy can vary a lot, but choosing the right coverage from top Life Insurance companies will guarantee value, security and enough protection for your family’s future.

Key Takeaways

- A Million Dollar Life Insurance Policy is not about wealth—it’s about providing real financial security for your family’s future.

- Rising living costs, education expenses, and long-term debts make higher Life Insurance coverage more necessary than ever for Canadians.

- Combining term Life Insurance and whole Life Insurance helps balance affordability with lifetime protection and cash value growth.

- A well-structured Life Insurance Policy can also support financial planning, business continuity, and estate goals.

- The cash surrender value of permanent Life Insurance creates flexibility, offering access to funds during your lifetime if needed.

- High-value coverage ensures your death benefit truly replaces income, protects your home, and maintains your family’s financial independence.

- Working with experienced advisors like Canadian LIC helps you compare Life Insurance companies and choose the best Life Insurance Plans in Canada for your unique situation.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – Life Insurance in Canada Fact Book 2024

Provides national data on coverage amounts, claims paid, and Life Insurance ownership trends among Canadians.

https://www.clhia.ca - Statistics Canada – Household Debt and Financial Security Reports

Offers insights on average Canadian debt levels, mortgages, and the financial obligations that drive insurance needs.

https://www.statcan.gc.ca - Financial Consumer Agency of Canada (FCAC) – Understanding Life Insurance

A government-backed overview of Life Insurance Policy types, coverage limits, and choosing the right plan for your family.

https://www.canada.ca/en/financial-consumer-agency.html - Insurance Bureau of Canada (IBC) – Consumer Guide to Life and Health Insurance

Details how Life Insurance works, policy structures, and claim processes within Canadian regulatory frameworks.

https://www.ibc.ca - Canadian Institute of Actuaries (CIA) – Research on Longevity and Financial Planning

Offers data-backed insight on lifespan trends, long-term coverage needs, and mortality risk management.

https://www.cia-ica.ca - Bank of Canada – Household Finances and Economic Well-being Reports

Analyzes inflation, debt-to-income ratios, and cost-of-living data relevant to determining adequate Life Insurance coverage.

https://www.bankofcanada.ca - Canada Life Assurance Company – Understanding Whole Life and Permanent Insurance

Explains the structure and benefits of permanent Life Insurance and its role in long-term financial planning.

https://www.canadalife.com

Feedback Questionnaire:

Your thoughts help us serve families and professionals across Canada better. Please take a minute to share your experience and challenges below — it only takes a moment but means a lot to us.

IN THIS ARTICLE

- High-Value Life Insurance In Canada: Why Coverage Over $1 Million Matters

- How Much Life Insurance Is Truly Enough?

- Why Canadians Are Re-Evaluating Their Insurance Coverage

- Why A Million Dollar Policy Is About Financial Security, Not Vanity

- Understanding The Real Cost Of A Million Dollar Life Insurance Policy

- How Cash Value Works In High-Value Life Insurance

- Balancing Term And Permanent Coverage For Optimal Protection

- A Million Dollars: Putting The Number In Perspective

- Life Insurance And Business Owners: Beyond Personal Coverage

- Financial Planning That Includes Life Insurance

- Choosing The Best Life Insurance Plan In Canada

- The Real Question: What Is Your Life Insurance Worth?

- Final Thoughts: Why It’s Time To Think Bigger

Sign-in to CanadianLIC

Verify OTP