- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- Understanding Group Term Life Insurance

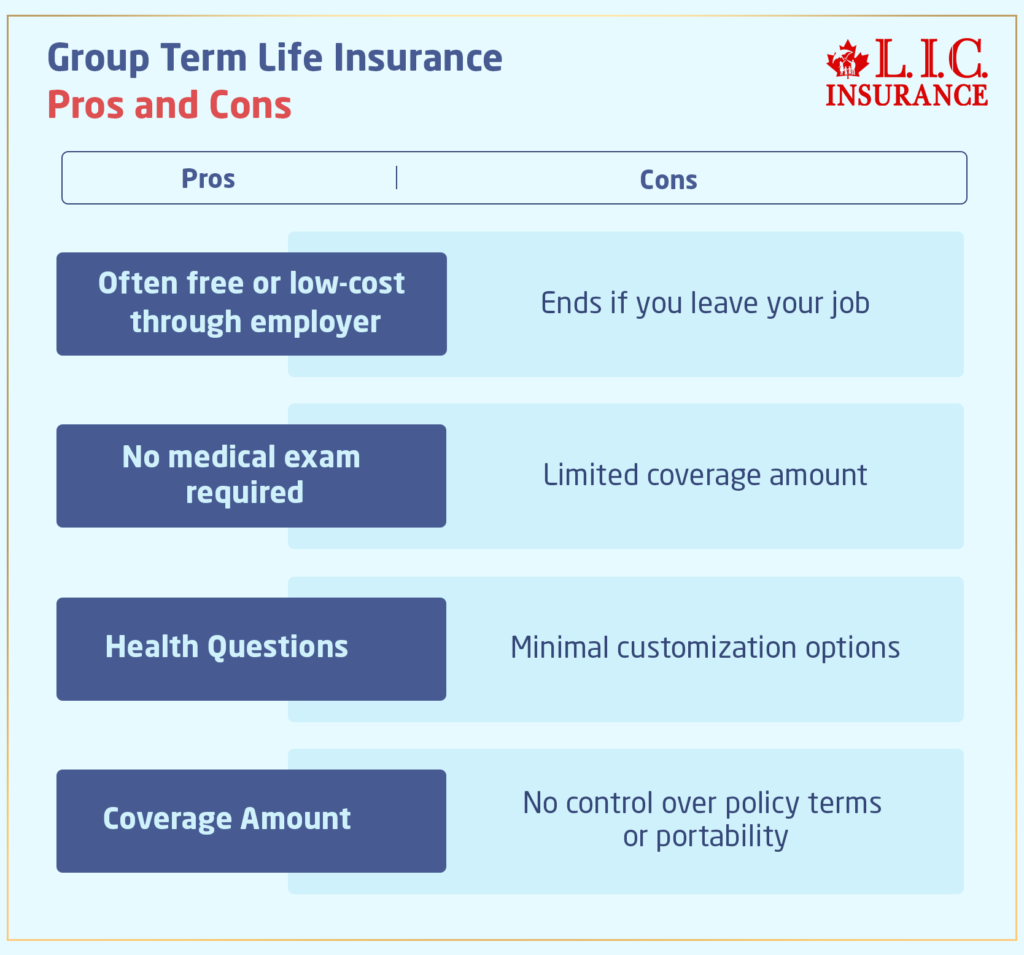

- Pros and Cons of Group Term Life Insurance

- Group Term Life Insurance Pros and Cons

- Understanding Individual Term Life Insurance

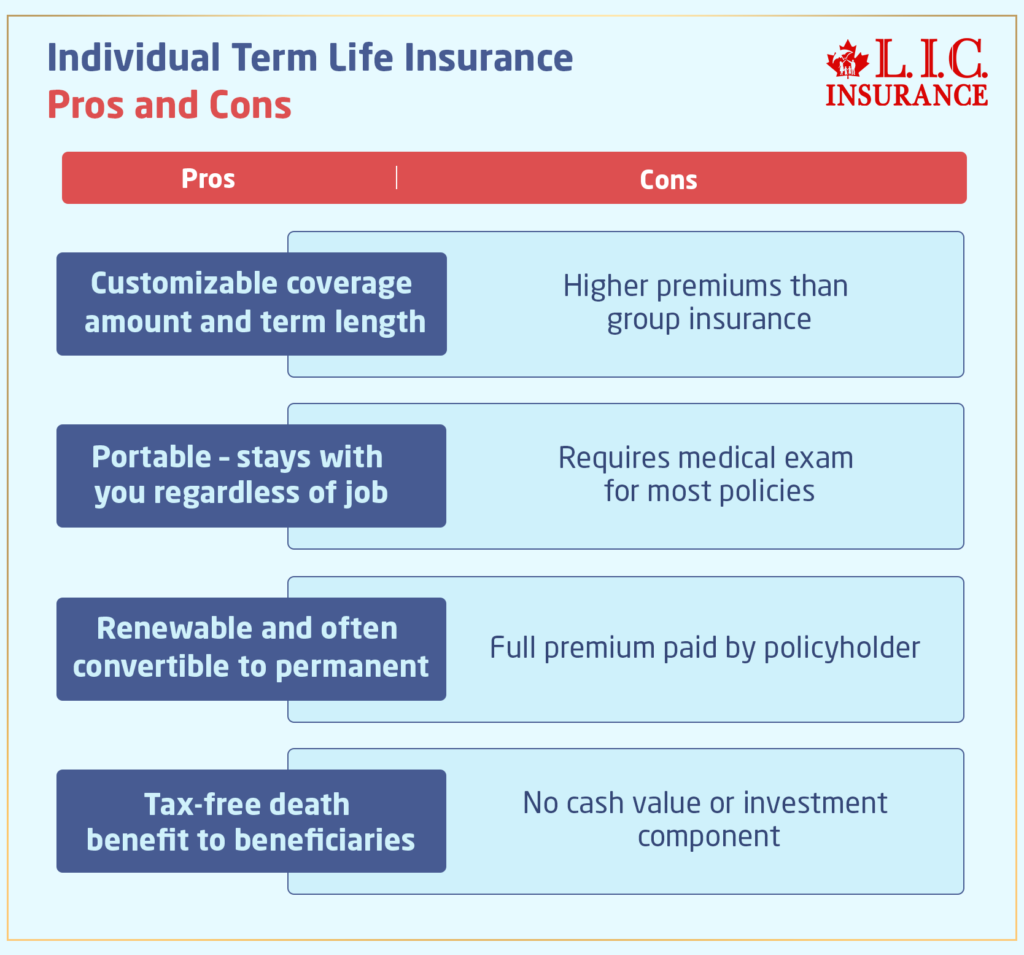

- Pros and Cons of Individual Term Life Insurance

- Individual Term Life Insurance Pros and Cons

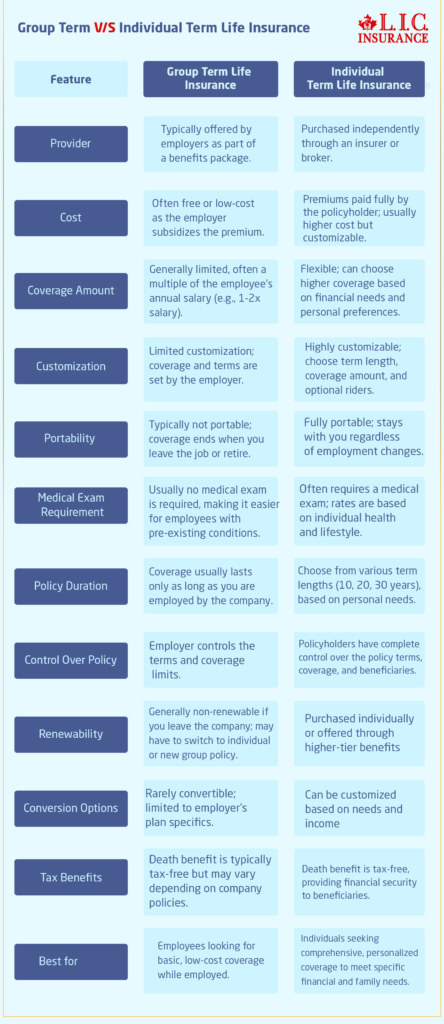

- Comparing Group Term and Individual Term Life Insurance

- Group Term V/S Individual Term Life Insurance

Group Term Life Insurance & Individual Term Insurance: Know The Details

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 7th, 2024

SUMMARY

Planning for future life insurance is a fundamental building block in any solid financial strategy. Many of the clients at Canadian LIC, the best insurance brokerage, are now asking whether they should rely on Group Term Life Insurance provided by their employer or seek an individual term insurance plan. This may make it difficult to differentiate between the two alternatives, as no one will know which better secures the future of their family. This is entirely understandable, especially considering one has to weigh the various financial goals against the requirements of the moment.

In Canada, there are two types of Term Life Insurance: Group Term Life Insurance, provided by an employer, and Individual Life Insurance Plans, bought directly. While both provide essential coverage, they each come with unique advantages, potential downsides, and varying degrees of control. Canadian LIC has helped countless clients determine which of these Term Life Insurance Plans is the right fit, offering tailored advice to align with their life stages, financial objectives, and family responsibilities.

Let’s dive in and explore how these two different types of Term Life Insurance vary, why some people prefer one over another, and how each serves as a meaningful step in your Term Life Insurance Investments.

Understanding Group Term Life Insurance

What is Group Term Life Insurance?

Group Term Life Insurance is a type of Group Coverage. One policy covers a group of people under one contract. This benefit is usually offered by a company to its employees in a package deal. An advantage of Group Term Life Insurance is that it often comes at no cost to employees, so many Canadians buy it, who may not otherwise buy Life Insurance for themselves.

Many of our clients at Canadian LIC feel relief knowing they have this coverage through their employer. But it’s when they begin wondering if it is actually enough that the main problem starts. Group Term Life Insurance typically provides a simple amount of coverage, perhaps one to two times an employee’s annual salary. Although this seems like a great deal of money, it will still be insufficient to meet all the needs that may arise in a family at the time of a sudden loss.

Pros and Cons of Group Term Life Insurance

Here’s a breakdown of some key advantages and disadvantages of Group Term Life Insurance based on what we often discuss with clients:

Pros:

- Affordable or Free: Most employers cover the cost entirely or offer the plan at a minimal rate, making it highly accessible.

- No Medical Exam: This type of insurance typically doesn’t require a medical exam, making it easier for individuals with pre-existing conditions to get coverage.

- Convenience: Group Term Life Insurance is convenient, as it’s automatically set up by the employer, with no effort required on the employee’s part.

Cons:

- Limited Coverage: One of the most significant limitations is that the coverage amount may not be sufficient to meet all financial obligations.

- Lack of Portability: Group Term Life Insurance is generally only valid while you’re employed with that specific employer. If you change jobs, you may lose your coverage or have to buy a new policy, often at a higher rate.

- No Personalization: Group policies don’t allow customization based on individual family needs or goals.

Group Term Life Insurance Pros and Cons

For example, one of our clients, Mr. Smith, realized that his Group Term Life Insurance was only covering a portion of his financial needs. Although he appreciated the cost-free coverage from his job, he began looking into Individual Term Life Insurance Plans to fill the gaps, ensuring his family wouldn’t face financial hardship.

Understanding Individual Term Life Insurance

What is Individual Term Life Insurance?

It provides coverage that you will acquire, and you have total authority to determine how much money you want the benefit amount to be. What this means is you do get more flexibility as far as personalization than you could with Group Term Life Insurance. Suppose serious money-making commitments are desired by investing in term life. In that case, personal choices can be set and fit individual financial responsibilities that an investment must meet, for instance, for mortgages, children’s educational years, or perhaps that comfort cushion for the future care of your spouse while alive or after death.

We have helped hundreds of customers at Canadian LIC to make their choices from all the options that exist under Individual Term Life Insurance Canada offers. They often find that having the freedom to choose their coverage amount and duration—typically ranging from 10 to 30 years—brings them peace of mind. This ensures they’re not only meeting their current needs but also preparing for future possibilities.

Pros and Cons of Individual Term Life Insurance

Here’s a closer look at the benefits and drawbacks of Individual Term Life Insurance, highlighting what we discuss with clients:

Pros:

- Customizable Coverage: You have control over the coverage amount and term length, which can be tailored to suit your specific needs and financial goals.

- Portability: This policy stays with you even if you change jobs or retire, giving you uninterrupted coverage.

- Opportunity for Term Life Insurance Investments: Unlike group policies, individual term policies can be an investment toward long-term financial stability, as they are designed to protect your personal obligations and assets.

Cons:

- Cost: Individual policies are generally more expensive than group term insurance. However, the cost is often justified by the higher coverage and flexibility.

- Medical Underwriting: Individual term insurance usually requires a medical exam, which can be a barrier for some. However, Canadian LIC can help clients navigate this, offering options for coverage based on their health situation.

Individual Term Life Insurance Pros and Cons

Our client, Ms. Lee chose an Individual Term Life Insurance policy because she had the requirement of having a big sum to pay off the mortgage and leave some amount for the children. For the choice of the 20-year term, she could lock into a rate suited to her budget and ensure her family will be protected long after she is no longer around.

Comparing Group Term and Individual Term Life Insurance

Consider the life goals you have for making an informed decision between Group Term and Individual Term Life Insurance Plans. The following are some common factors that clients weigh at Canadian LIC:

- Affordability vs. Coverage Needs: Group policies are often cheaper, but individual plans provide the option to cover larger needs.

- Control and Personalization: Individual policies allow you to choose the term length and coverage amount, while group policies have predetermined limits.

- Longevity of Coverage: Group insurance is tied to your employment, meaning it may end when your job does. Individual policies stay with you as long as you pay the premiums, regardless of job changes.

Group Term V/S Individual Term Life Insurance

Why Individual Term Insurance Might Be Worth the Investment

Group Term Life Insurance certainly is a convenient option, but the benefits of Individual Term Life Insurance often make it the better choice for clients looking for total protection. You may well want to plan for sizable financial commitments, for instance, with dependents, outstanding debts, or long-term goals.

The Canadian LIC often makes the clients realize how a reliable Term Life Insurance plan invested in now provides them with lots of financial security later. Many realize that Individual Term Life Insurance isn’t an expense but an investment in the future stability and comfort of their family.

Why Both Types of Insurance Could Complement Each Other

One common question that arises is whether it’s necessary to choose between group and Individual Term Life Insurance Plans. In many cases, a combination of both may be beneficial. Group Term Life Insurance serves as a foundation, offering basic coverage that doesn’t require out-of-pocket expenses. Meanwhile, an individual-term policy can supplement this by providing additional protection tailored to personal needs.

Take the case of Mr. Thompson, who preferred to hold on to the group insurance offered by his employer while supplementing it with a personal term policy for extra security. That way, he would make sure the financial protection for his family would be more than the one that his group insurance could provide. This method is how one can use Term Life Insurance Canada and have coverage for all scenarios in life without overstraining the budget.

Key Takeaways for Choosing the Right Term Life Insurance Plan

When deciding on group versus Individual Term Life Insurance, Canadian LIC encourages clients to think beyond just immediate costs. By considering long-term needs, potential changes in employment, and personal financial obligations, you can make a choice that truly aligns with your goals.

- Assess Your Coverage Needs: Estimate your family’s financial requirements in the event of an unexpected loss.

- Consider Your Employment Situation: If you’re likely to change jobs, an individual policy offers more stability.

- Look at Term Life Insurance Quotes Online: Get a range of Term Life Insurance Quotes Online to compare options and understand the market rate for the coverage you’re seeking.

The journey toward choosing the right life insurance isn’t just about finding affordable rates; it’s about finding a plan that serves your family’s unique needs.

Why Canadian LIC is Your Partner in Life Insurance

Life insurance decision-making is a pretty daunting task, but with Canadian LIC’s years of experience, our team guides the client through the entire process. We do not merely sell policies; we know what real-life situations make life insurance crucial. Our informed agents offer insights from first-hand interaction with families across Canada who trust us to protect their futures.

If you’re willing to find Term Life Insurance Plans that fit your lifestyle, Canadian LIC can certainly help. Our team will be happy to guide and answer your questions regarding determining the coverage you’ll require and to provide Term Life Insurance Quotes Online for which you can budget with proper goals. Contact us on +1 416 543 9000. With Canadian LIC, you are choosing a trusted partner dedicated to securing what matters most.

Term Life Insurance from Canadian LIC is not just an investment in a policy; it’s a promise to your family toward financial security. So, let us begin securing our future today.

More on Term Life Insurance

FAQs: Understanding Group Term Life Insurance & Individual Term Insurance in Canada

Group Term Life Insurance can be an excellent option for those who are seeking affordable coverage without the need for a medical exam. However, it often comes with limited benefits and may not be available once employment ends. Individual life insurance provides greater flexibility, long-term coverage, and the ability to adjust the policy as life circumstances change, though it can be more expensive. The best option depends on personal needs, financial goals, and whether you’re looking for temporary or permanent coverage.

Yes, you can have both. Most of our clients find it useful to have both as, for example, the Group Term Life Insurance provided by your employer is often the minimum, and an individual term policy is found to complement this better for your family’s financial needs. It is a common practice that many use to guarantee themselves protection in all walks of life.

Group Term Life Insurance may be adequate here if the need is not heavy and your present employer has a good reason to be stable for at least a long period of time. However, if the financial burdens are increasing, for example, to finance a mortgage or pay for education if you have children, keeping all other debt in check, an individual term insurance may be able to cover that extra demand. When clients come to Canadian LIC with this question, we assess their overall financial picture to help them decide if additional coverage through Individual Term Life Insurance is wise.

Individual Term Life Insurance is actually an investment. You could have a policy term of ten to fifty years, which depends on what you require. You also get to decide how much coverage you will need to ensure that your family will be provided for. In this sense, you are not confined to the limitations of a group plan. For many clients, buying an individual plan is more of taking control over one’s financial future and having peace of mind in knowing there is always something for security. Canadian LIC generally interacts with clients who crave comfort and security that something has been placed there, particularly for them.

No, Group Term Life Insurance is typically associated with your employment. When you leave that job, coverage typically ends or is very costly to continue individually. This is a serious issue for many Canadian LIC customers; it’s also a common situation for clients who have recently changed careers or are about to retire. For this reason, most people obtain an individual term life policy for continuity of coverage; the coverage ends when your employment does.

Some employers allow you to increase your coverage under their group plan, but it’s often limited. The increase may also come at a higher cost to you. If you need substantial coverage beyond what your employer provides, an Individual Term Life Insurance plan may be a better solution. Clients who need larger policies often consider individual plans that offer customizable coverage without the restrictions of group policies.

Yes, you may still be eligible for a Term Life Insurance policy despite health problems, but premiums will likely be higher. In fact, in some cases, group-Term Life Insurance policies do not require a medical exam. This is often a very good option for people who have health problems. However, individual policies do include health assessments. Canadian LIC works on the client’s behalf, identifying the best options available based on their health status while searching for group or individual plans that could possibly be suitable for them.

Age significantly impacts the cost of Term Life Insurance Quotes Online. Younger applicants generally pay lower premiums, as they pose a lower risk to insurers. The premium increases with age, and therefore, the earlier one obtains the plan, the more affordable it will be in the long run. At Canadian LIC, we advise our clients to obtain Term Life Insurance early enough to secure lower rates.

Yes, most Term Life Insurance policies have specific exclusions, such as suicide within the first two years of the policy or death resulting from criminal activities. These exclusions can vary, so it’s important to read your policy carefully. At Canadian LIC, we review these details with our clients so they fully understand what their Term Life Insurance plan covers and what it doesn’t.

Yes, most Term Life Insurance Canada providers allow both monthly and annual payment options. Many people find that paying annually can even save money on premiums. At Canadian LIC, we help clients compare payment options and find the one that best fits their budget so they feel confident in managing their policy costs.

If you miss a payment, most insurers offer a grace period (typically 30 days) to catch up before coverage lapses. If payments remain unpaid after this period, the policy may be cancelled. We always advise clients to stay on top of payments to avoid losing their coverage. Canadian LIC also assists clients in setting up automatic payments to make premium management easier.

If you die within the term, Term Life Insurance Plans will pay your beneficiaries tax-free. This benefit can help keep up with the ongoing family expenses, including paying off your home, everyday lifestyle, education fees, and many other things. Often, it’s a big consolation for the client when they know that Term Life Insurance can be used as a good safety net, securing daily life without much worry over financial burdens.

The above FAQs represent some of the common questions people often raise when thinking about Group and Individual Term Life Insurance. Whether you are thinking about investing in term life or just want some peace of mind, Canadian LIC will help you make an informed decision that will suit your family’s needs.

Sources and Further Reading

For a deeper understanding of Group Term Life Insurance and Individual Term Life Insurance in Canada, consider exploring the following resources:

- TD Insurance: Offers insights into the differences between employer’s Group Term Life Insurance and Individual Term Life Insurance, helping you make informed decisions.

TD Insurancel - Savvy New Canadians: Explains how group life insurance works in Canada, its benefits, and how it compares to personal life insurance.

Savvy New Canadians - Manulife & CAA: Discusses the differences between group and individual life insurance, offering perspectives to help you choose the right coverage.

Manulife Insurance - Canada Revenue Agency: Provides information on Group Term Life Insurance policies and employer-paid premiums, including tax implications.

Canada.ca

These resources offer valuable information to help you understand the nuances of life insurance options in Canada.

Key Takeaways

- Coverage and Cost: Group Term Life Insurance is often affordable or free through employers, providing basic coverage. Individual Term Life Insurance, although typically more expensive, offers flexibility and allows for higher coverage amounts tailored to your needs.

- Portability: Group Term Life Insurance is tied to your employment, meaning it usually ends if you leave the job. Individual Term Life Insurance, on the other hand, is fully portable, ensuring you stay covered regardless of employment changes.

- Customization and Control: Individual Term Life Insurance provides full control over policy details, such as term length, coverage amount, and additional riders. Group policies are limited in customization and are controlled by the employer’s terms.

- Medical Exam Requirements: Group term insurance generally does not require a medical exam, making it accessible to those with health concerns. Individual policies typically involve medical underwriting, impacting rates based on health and lifestyle.

- Renewability and Conversion: Individual Term Life Insurance policies often offer renewability and can be converted to Permanent Coverage options, giving you long-term security. Group Term Life Insurance usually lacks these options, limiting flexibility in the future.

- Complementary Approach: For comprehensive protection, combining group and Individual Term Life Insurance can be beneficial. Group insurance offers foundational coverage, while individual insurance provides additional, customizable security.

- Financial Security for Loved Ones: Both types of insurance can play an essential role in securing your family’s financial future, but Individual Term Life Insurance Investments provide a more personalized and lasting safety net.

Your Feedback Is Very Important To Us

Thank you for sharing your experience with Group Term Life Insurance and individual term insurance. Your insights will help us understand the challenges you face and how we can provide better guidance. Please take a few moments to answer the questions below.

Thank you for your feedback! Your responses will help us tailor our services and offer guidance that aligns with your needs.

IN THIS ARTICLE

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- Understanding Group Term Life Insurance

- Pros and Cons of Group Term Life Insurance

- Group Term Life Insurance Pros and Cons

- Understanding Individual Term Life Insurance

- Pros and Cons of Individual Term Life Insurance

- Individual Term Life Insurance Pros and Cons

- Comparing Group Term and Individual Term Life Insurance

- Group Term V/S Individual Term Life Insurance

Sign-in to CanadianLIC

Verify OTP