- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Cash Value Vs. Cash Surrender Value In Term Life Insurance: What Canadians Should Know In 2025

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 8th 2025

SUMMARY

Learn how Cash Value and Cash Surrender Value work within Canadian Life Insurance, highlighting differences between Term and permanent Life Insurance Policy types. Covers how Cash Value grows, what affects surrender amounts, and the tax implications tied to withdrawals or loans. Provides clarity on Term Life Insurance Coverage, cash out in a Term Life Insurance Policy, and how to buy Term Life Insurance online effectively in 2025.

Introduction

It turns out to be more common than you probably imagine. Could someone have purchased a Term Life Insurance Policy years ago, built up some equity in the contract by paying every premium, and one day started thinking — “I wonder if I could cash out this thing?” What follows is an obstacle course of words like Cash Value, Cash Surrender Value and death benefit.

We’ve sat across from many a Canadian, asking that same question. The confusion isn’t the result of carelessness — it’s how insurance companies bundle information. So, let’s cut the fog and peer into what these numbers really mean for you, in 2025: Plain language (and no sales talk).

Why the Confusion Exists

Here’s the brutal, honest truth: Canadians think that every Life Insurance Policy builds cash. That’s only half true.

A Term Life Insurance Policy provides your family with coverage for a specific time frame – 10, 20, or even 30 years – at considerably lower Term Life Insurance Rates in Canada. You’re paying only for protection, not for a savings plan.

Cash Value, however, is a permanent Life Insurance concept — those lifelong plans that have investment or savings components with tax advantages. The problem comes when you think that a cash-out in Term Life Insurance works the same way. It doesn’t.

A term policy is akin to renting protection. A permanent policy is a bit like owning it, with a small savings account growing within it. Knowing the difference will save you from world pain later on.

What Is Cash Surrender Value?

Each permanent policy (one with a Cash Value, such as whole or universal) accumulates what’s called Cash Value — money you can access while you’re alive.

But the Cash Surrender Value is distinct. That is what you would receive for cancelling your policy. Think of it as the net amount remaining after the insurer deducts surrender fees, policy loans or other factors.

Understand if you want to get your money out down the road, financial institutions such as Manulife and Sun Life said annuity contracts typically have a hit of generally 10 per cent to up to around 35 per cent in the first decade that diminishes over time. So if the Cash Value in your policy has grown to $20,000 after 10 years, you might end up with $17,000 after deducting fees.

It’s your savings less any penalties — the policyholder’s equity.

How Cash Surrender Value Works

This is where most people get tripped up. When you pay premiums on a Whole Life Insurance Policy or a Universal Life Insurance Policy, part of your payment goes toward Life Insurance Coverage; the rest grows as a Cash Value for the policy.

This amount, the Cash Value, starts small but grows increasingly quickly over time through so-called dividends (a provision your policy might pay), interest rates or market returns — depending on what kind of product you have.

If you cancel (surrender) the policy before it matures or before you die, your insurer will send you your Cash Surrender Value — not whatever balance is sitting in your Life Insurance Cash Value account.

It is akin to winding down an account with a long-term investment early. (You’ll still get some money back, but the growth opportunity and future protection disappear.)

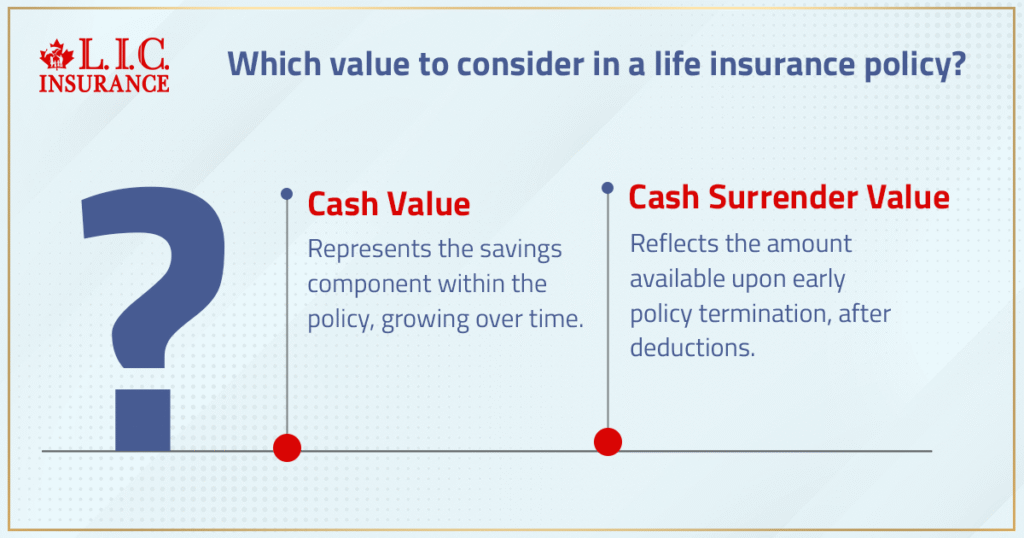

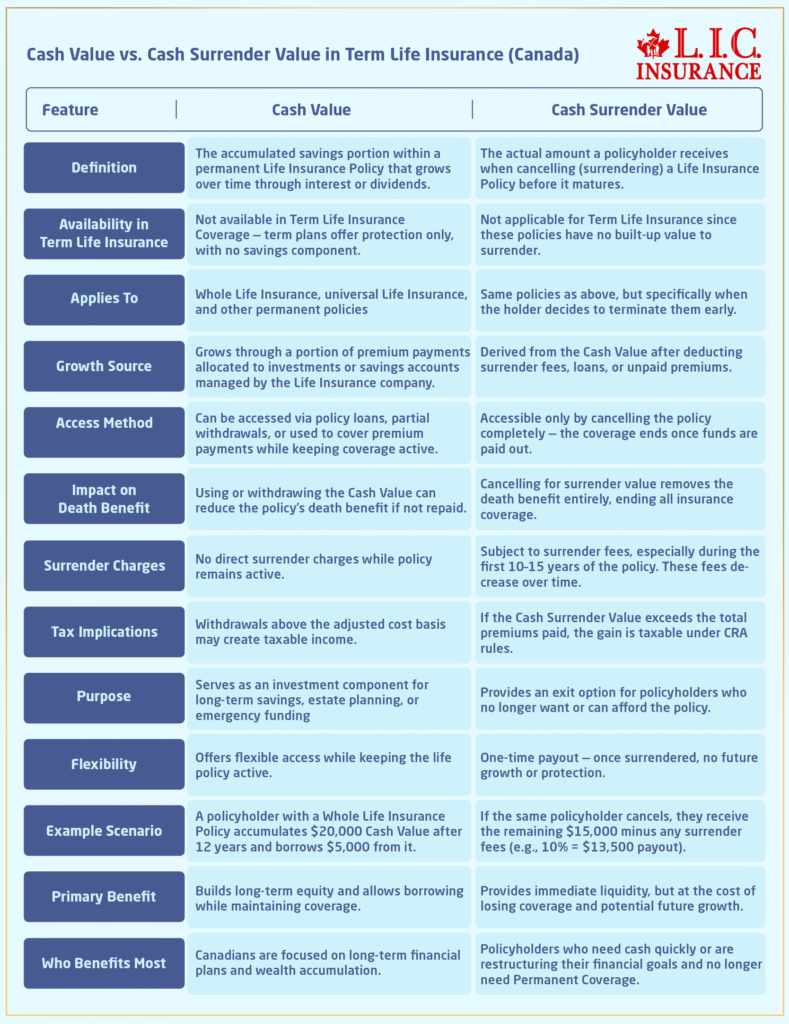

Comparing Cash Surrender Value and Cash Value

Here’s the simplest breakdown we share with our clients:

- Cash Value = Your living savings inside a Permanent Life Insurance Policy.

- Cash Surrender Value = What’s left when you walk away early — minus charges, loans, or partial withdrawals.

And one quick story: A Whole Life Policy holder in Toronto carried a $250,000 policy for 12 years. She has contributed $1,200 a year and has built up $15,000 in Cash Value. And when she needed a little cash flow and requested her Cash Surrender Value, it was $13,600 after fees.

That spread between $15,000 and $13,600 wasn’t a mistake; rather, it was the surrender charge — a price for getting out of the contract early. Those charges would have disappeared completely after 15 years.

It’s easy to forget, but Life Insurance money is not a cash machine; it’s backup capital. The more you hold the policy, the more of that cash is yours.

Calculating Your Cash Surrender Value

There’s no magic formula, but the math is straightforward:

Cash Surrender Value = Cash Value – Surrender Fees – Outstanding Policy Loans

Let’s say you have a universal life policy with $25,000 of Cash Value. Your insurer assesses a 10 percent surrender fee, and you have taken out a $2,000 loan by borrowing against the policy.

You’d receive roughly $20,500.

The Cash Surrender Value is what’s currently available. It is not connected to your death benefit or guaranteed death benefit — those kick in only if the insured person dies when coverage is still in force.

And yes, some of that can potentially trigger tax liabilities. If the total money you’ve received from these payments is greater than the money you’ve paid in premiums, this difference will have to be reported as taxable income according to CRA tax laws (IT Act s. 148).

Cash Surrender Value in Universal and Variable Life Insurance

Not all policies behave alike.

The cash growth is steady and predictable in Whole Life Insurance — the insurer oversees investments, and the death benefit and large Cash Value build are guaranteed.

With Universal Life Insurance Policy, you have flexibility. You have investment options, can control premium payments and could build more Cash Value faster — but at greater risk should markets stumble.

Cancel either policy in the early years, and you lose surrender fees to the insurer. They generally expire over 10 to 15 years. At that point, your Cash Surrender Value and Cash Value are generally synonymous.

That’s why LIC often tells clients in Canada: Don’t judge a policy in those first 10 years. The investment part of it needs time to grow, just as with any long-range financial plan.

Considerations Before Surrendering Your Life Insurance Policy

If you’re considering surrendering, pause before signing. The decision carries more emotional weight than numbers in a statement.

- You lose protection. Cancelling ends the Life Insurance Coverage. Your loved ones no longer receive a death benefit if the insured person dies.

- You might pay tax. Any gain above your adjusted cost basis is taxable income. Always consult a licensed financial advisor before taking action.

- You forfeit future growth. Your policy’s Cash Value and dividend options stop compounding once you surrender.

- You could borrow instead. A policy loan lets you access funds without ending coverage. You’ll pay interest, but keep your policy alive.

- Partial withdrawals exist. You can take money up to the amount you paid in premiums tax-free, keeping the plan intact.

Financial advisors sometimes call this “borrowing against your future self.” It’s a powerful tool if managed carefully. Fail to repay the loan and your policy’s death benefit shrinks — but it’s still there when your family needs it most.

Our Insight

We have been educating Canadians on the real value of their life policies for over 14 years. We believe protection shouldn’t be cancelled out simply for a quick payout. Our experts review all available strategies, including term insurance renewals, policy loans and Cash Value alterations, so you don’t have to sacrifice in your protection of your family or financial objectives.

The Bottom Line

Cash Value vs. Cash Surrender Value Cash Value and Cash Surrender Value may sound similar, but they serve very different roles. The first is the savings engine that resides within your policy; the second is what you get when you walk away from it.

To put it differently, a Term Life Insurance Policy doesn’t accumulate any Cash Value — its role is pure protection. If you want a savings feature, you’ll have to buy a Permanent Policy — Whole Life or Universal Life.

That’s why, before you buy Term Life Insurance online or request a Term Life Insurance quote online, you should consider how long you’ll need coverage and how flexible it will be over time — and whether building equity matters to you.

As we head into 2025, with interest rates continuing to fluctuate, Canadians are thinking more strategically about combining protection with investment potential. Knowing these numbers is more than just financial literacy — it’s financial empowerment.

We are here to help you harness that power —policy by policy, decision by decision and secured future by secured future.

Canadian LIC is here to help you make that power work for you — one policy, one decision, one secure future at a time.

FAQs

Not usually, but a few hybrid products exist that act like mini savings accounts inside Term Coverage.

They’re rare and often pricier than regular Term Life Insurance Rates in Canada.

Most people still prefer standard protection and use other tools for long-term savings.

Your financial advisor can help weigh both options.

When you move or renew, your accumulated value—if any—stays with the old Life Insurance company.

A new plan starts fresh with new premium payments and no transfer of the previous policy’s Cash Value.

That’s why many Canadians review renewal terms carefully before changing providers.

It’s not just about cost; it’s about keeping your long-term financial goals intact.

Yes, when you receive more money than the total premiums you paid.

That extra gain counts as taxable income, and it shows up when you file your income tax return.

Some clients use policy loans instead, which usually delay or reduce tax implications.

It’s always smart to confirm with an accountant before making withdrawals.

Absolutely—you can take a policy loan while your Life Insurance Coverage stays active.

You’ll pay interest, but the loan uses your Cash Value policy as collateral.

If left unpaid, the loan amount reduces the final death benefit your loved ones receive.

Handled wisely, it’s a flexible short-term funding option.

In a Permanent Life Insurance Policy, a portion of your premium payments goes toward a small savings component.

That balance builds over time through interest or dividends from the insurance provider.

It’s slow in the early years but compounds quietly the longer the Life Policy stays active.

That’s what gives these plans their substantial Cash Value over decades.

Not quite. Whole Life Insurance has predictable growth and a guaranteed death benefit, so the Cash Surrender Value is more stable.

With Universal Life Insurance, growth depends on market-linked returns and interest rates.

That means your final surrender amount can move up or down with performance.

Each option suits different financial plans and comfort levels.

It can, depending on how you access your Life Insurance Cash Value.

Withdrawals above your adjusted cost basis may trigger tax consequences under CRA rules.

Some Canadians prefer using policy loans to avoid immediate taxation.

Your financial advisor can help map out what fits your retirement insurance plan best.

If there’s enough policy Cash Value, it can temporarily cover your premium payments automatically.

That keeps your Life Insurance Coverage from lapsing while you get back on track.

But once that balance runs out, the policy lapses, and protection ends.

Many people schedule reviews every few years to avoid surprises.

Yes, because Cash Value Life Insurance builds an investment component that can offset future taxes.

When structured well, it adds a tax-free cushion for heirs beyond the standard death benefit.

Advisors often use it to balance financial goals and legacy planning.

It’s one reason many business owners look at whole life policies for stability.

Surrender fees are small penalties deducted from your Cash Value if you cancel early.

They usually decrease each year and disappear after a decade or so.

That’s why holding your Permanent Policies longer generally returns more money.

It’s not punishment—it’s the insurer recovering initial setup costs.

Key Takeaways

- Cash Value represents the savings portion inside a Permanent Life Insurance Policy, while Cash Surrender Value is what you receive if you cancel the policy early.

- Term Life Insurance Coverage provides pure protection without a savings component, unlike whole or universal Life Insurance that builds equity over time.

- Surrender charges, policy loans, and tax implications can affect how much you receive when accessing your policy’s Cash Value.

- Holding a Permanent Life Insurance Policy long-term allows for higher growth and fewer deductions at surrender.

- Canadians comparing options should review Term Life Insurance Rates in Canada and request a Term Life Insurance quote online before making coverage changes.

- Consulting a licensed financial advisor ensures decisions about policy withdrawals, loans, or cancellations align with long-term financial goals and tax efficiency.

Sources and Further Reading

- Government of Canada – Financial Consumer Agency of Canada (FCAC):

Life Insurance Basics and Consumer Rights

https://www.canada.ca/en/financial-consumer-agency.html - Manulife Canada:

Understanding Term, Whole, and Universal Life Insurance Options

https://www.manulife.ca - Sun Life Financial:

Cash Value and Policy Loan Features in Permanent Life Insurance

https://www.sunlife.ca - Canada Life:

How Life Insurance Cash Value Works

https://www.canadalife.com - Investopedia:

Cash Surrender Value Definition and Examples

https://www.investopedia.com - Canadian Life and Health Insurance Association (CLHIA):

Consumer Information and Industry Guidelines

https://www.clhia.ca - CIRO (Canadian Investment Regulatory Organization):

Investment and Insurance Education Resources

https://www.ciro.ca - Canada Revenue Agency (CRA):

Tax Rules for Life Insurance Policies and Cash Value Withdrawals

https://www.canada.ca/en/revenue-agency.html

Feedback Questionnaire:

Thank you for reading! Your feedback helps improve how we explain complex financial topics. Please take a moment to share your thoughts.

IN THIS ARTICLE

- Cash Value Vs. Cash Surrender Value In Term Life Insurance: What Canadians Should Know In 2025

- Why the Confusion Exists

- What Is Cash Surrender Value?

- How Cash Surrender Value Works

- Comparing Cash Surrender Value and Cash Value

- Calculating Your Cash Surrender Value

- Cash Surrender Value in Universal and Variable Life Insurance

- Considerations Before Surrendering Your Life Insurance Policy

- Our Insight

- The Bottom Line

Sign-in to CanadianLIC

Verify OTP