- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Cash Value Life Insurance In Canada: Pros, Cons, And How It Really Works

By Pushpinder Puri

CEO & Founder

- 10 min read

- October 21st, 2025

SUMMARY

Canadian LIC explains how Cash Value Life Insurance in Canada works, comparing Whole Life Insurance Cash Value, Universal Life Insurance, and Term Life Insurance Plans in Canada. The article shows how a Permanent Life Insurance Policy builds a cash value component on a tax-deferred basis, ways to access a policy’s cash value, the difference between cash value and the death benefit, and key pros and cons for Canadians.

Introduction

We have spent more than fourteen years watching Canadians wrestle with one of the most misunderstood tools in personal finance — Cash Value Life Insurance. People hear words like “whole life,” “universal life,” “cash value,” “tax-free growth,” and “guaranteed death benefit,” but rarely see a clear, human explanation. This is our chance to walk you through it the same way we would across the table in Brampton or Calgary, coffee in hand, no jargon shields.

We’ll talk about what Cash Value Life Insurance in Canada really is, how it builds, how you can use it while you’re alive, and where it fits (or doesn’t fit) in a solid plan. We’ll also contrast it with Term Life Insurance Plans in Canada so you can see why one costs more and what you get for the extra premium.

What Is Cash Value Life Insurance?

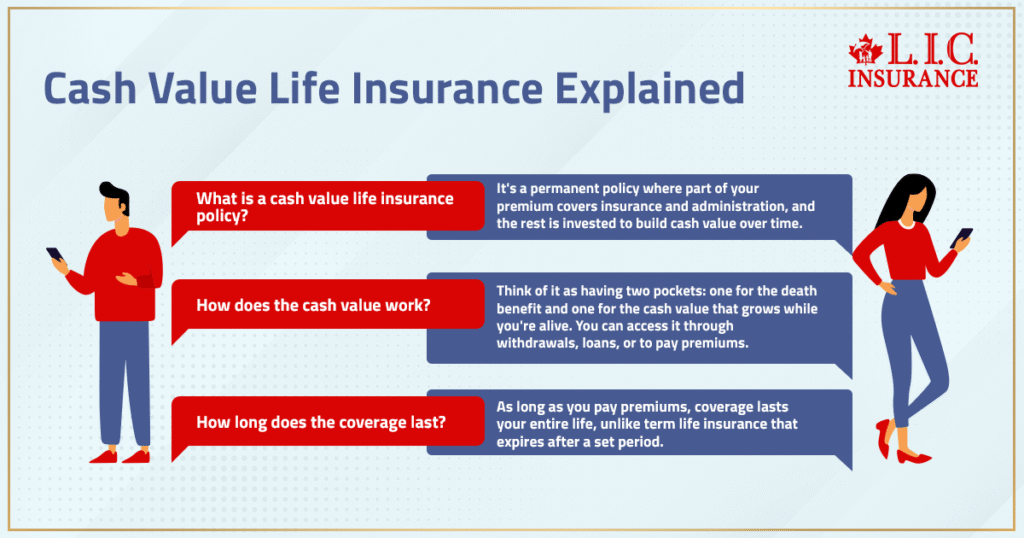

A cash value policy is a type of Permanent Life Insurance Policy — think Whole Life Insurance or Universal Life Insurance — where every premium you pay does more than just keep a death benefit in force. Part of each payment goes to the cost of insurance and administration, and another part is invested by the insurance company in a savings or investment component that builds up over time.

We describe it this way: your Life Insurance Policy has two pockets. One pocket funds the policy’s death benefit — the tax-free lump sum your loved ones get when you pass away. The other pocket, the “cash value,” grows while you’re alive. That cash value is yours to access by withdrawal, policy loan, or to help pay premiums down the road.

Because it’s a Permanent Life Insurance Policy, coverage lasts for your entire life as long as you keep paying premiums. That’s different from Term Life Insurance Policies that expire after 10, 20, or 30 years.

How Cash Value Works In A Whole Life Insurance Policy

Whole Life Insurance is the classic form of Cash Value Life Insurance in Canada. When you make premium payments, a portion funds the guaranteed death benefit, a portion covers expenses, and the rest builds the cash value. This cash value grows on a tax-deferred basis — you don’t pay income tax on the growth until you withdraw it.

Whole Life Policies often have a guaranteed minimum interest rate on the cash value. That gives predictable, steady growth regardless of market conditions. Over time, participating Whole Life Policies may also pay dividends. Those dividends can be used to buy paid-up additions (increasing your policy’s death benefit), reduce premium payments, or just accumulate as additional cash value.

Because we work with more than 30 Life Insurance companies, we see a wide range of dividend scales and interest crediting rates. But the underlying principle is the same: the earlier you start and the longer you hold, the more significant cash value you build.

Universal Life Insurance And Flexible Cash Value

Universal Life Insurance adds flexibility to the cash value component. You can choose how much premium above the minimum to contribute and how to allocate it among investment options inside the policy. You also have more freedom to adjust your death benefit and premium payments over time.

This flexibility appeals to Canadians who want both Permanent Coverage and the ability to invest within their policy on a tax-deferred basis. But it also requires more engagement — the investment choices inside a universal life policy carry market risk. We often see people pick Universal Life Insurance because they’re high earners looking for another tax-sheltered savings vehicle after maxing out RRSPs and TFSAs.

Difference Between A Policy’s Cash Value And Death Benefit

This is one of the biggest misconceptions. The death benefit is the amount paid to your beneficiaries when you die. The cash value is the living benefit you can use while you’re alive. In most policies, your beneficiaries do not get both. They get the policy’s death benefit only; whatever cash value remains at death reverts to the insurance company.

Some insurers offer riders that let you add the cash value to the death benefit for an extra cost. That’s something we explore with clients when legacy size is critical.

Another key difference is taxation: death benefits are generally paid out tax-free to your beneficiaries, but withdrawals of cash value above what you’ve contributed (your adjusted cost basis) are taxable as income.

How Long Does It Take to Build Cash Value

Patience is required. In the early years of a Permanent Life Insurance Policy, most of your premium goes to administrative costs and the pure cost of insurance. That’s why the cash value builds slowly at first. After about 10–15 years, growth accelerates because more of your premium is working inside the investment component and compounding.

If accelerating growth is important, sometimes recommends limited pay Whole Life Insurance — 8-, 10-, 15- or 20-pay structures. Because you finish paying premiums earlier, the policy has more time to grow before retirement.

Ways To Access Your Policy’s Cash Value

One of the most attractive features of Cash Value Life Insurance in Canada is the ability to use the money while you’re alive. Here’s how our clients typically do it:

Withdrawals

You can withdraw part of the cash value directly. This may trigger income tax on any gains withdrawn and will permanently reduce the death benefit.

Policy Loans

You can borrow against your policy’s cash value from the insurer at competitive interest rates. These loans are often tax-free as long as the policy stays in force. If you die with a loan outstanding, the insurer deducts the balance and interest from the death benefit.

Collateral Assignment To A Bank

Many Canadian banks will accept the cash value of a Life Insurance Policy as collateral for a loan. This lets you access funds without disturbing the policy. The bank typically allows 50–90% of the cash value as collateral.

Surrendering The Policy

If you no longer need coverage, you can surrender your policy and receive its cash surrender value (cash value minus any fees or outstanding loans). But surrendering ends your coverage and can trigger tax on gains.

Tax Treatment Of Cash Value Life Insurance In Canada

The cash value inside a Life Insurance Policy grows on a tax-deferred basis. You don’t pay income tax on interest or investment gains as long as they remain in the policy. When you withdraw funds or surrender the policy, any amount above your adjusted cost basis is taxable as income.

Policy loans are generally not taxable when the policy stays in force. But if the policy lapses with a loan outstanding, the loan amount may be deemed a withdrawal and taxed. This is why we spend time on ongoing policy management with our clients — to preserve the tax advantages.

Benefits Of Cash Value Life Insurance For Canadians

From our front-line experience, here’s what makes Cash Value Life Insurance Canada attractive:

- Lifelong Coverage – Unlike Term Life Insurance Plans in Canada, a Permanent Life Insurance Policy stays in force for your entire life as long as premiums are paid, ensuring your loved ones receive a guaranteed death benefit.

- Tax Deferred Growth – The cash value component accumulates on a tax-deferred basis, letting your savings grow faster than in a taxable account.

- Access to Funds – You can borrow or withdraw from your cash value for emergencies, education funding, or to supplement retirement income.

- Guaranteed Growth – Whole Life Insurance Cash Value offers a guaranteed minimum rate of return, adding stability to your long-term plan.

- Financial Flexibility – You can use dividends or cash value to pay premiums or adjust coverage.

- Estate Planning Advantages – The death benefit is generally paid tax-free to beneficiaries, making it an effective tool for estate planning.

Drawbacks And Limitations

It’s not all upside down. Cash value policies have real costs and complexities:

- High Premiums – Permanent Life Insurance Policies cost far more than Term Life Insurance Policies with the same death benefit.

- Slow Early Growth – Cash value builds slowly in the first years.

- Complexity – Combining Life Insurance and an investment component requires more understanding and ongoing management.

- Opportunity Cost – Premium dollars locked into a policy may yield lower returns than outside investments like stocks or mutual funds.

- Surrender Charges – Cancelling a policy early can reduce the cash value you receive.

We always show clients side-by-side illustrations of Term versus Permanent Coverage so they can see exactly how much Life Insurance they’re getting for each premium dollar.

When It Makes Sense To Purchase A Cash Value Policy

Cash Value Life Insurance shines for Canadians who:

- Have long-term or lifelong insurance needs.

- Have maxed out other tax-advantaged accounts like RRSPs and TFSAs, and want another place for tax-deferred savings.

- Want predictable growth and a guaranteed death benefit.

- Plan to use policy loans in retirement for tax-efficient income.

If your main goal is inexpensive protection for a limited period, Term Life Insurance Plans in Canada are usually more suitable. If you’re a high earner or business owner looking for both protection and an investment component, a Permanent Life Insurance Policy may be ideal.

How We Help Clients Use Cash Value Strategically

Because we work with many top insurance providers, we’re able to compare Whole Life Insurance Cash Value projections, Universal Life options, and Term Life Insurance Policies side by side. We show exactly how much premium you’d pay, how much Life Insurance you’d get, and how the cash value might accumulate over time under different scenarios.

We also help clients plan withdrawals or policy loans so they don’t accidentally turn tax-deferred growth into taxable income. That might include using the cash value as collateral for bank financing rather than taking a direct withdrawal, or choosing dividend options that enhance the policy’s death benefit instead of reducing premiums.

In short, we treat the policy as part of your overall wealth plan — not just an insurance contract. That’s where Cash Value Life Insurance in Canada stops being an abstract concept and starts being a real tool for financial flexibility.

Key Points To Remember About Cash Value Life Insurance In Canada

- It’s a form of Permanent Life Insurance — you’re buying lifelong coverage, not a short-term Term Life Insurance Policy.

- Each premium funds both the death benefit and a cash value component that grows on a tax-deferred basis.

- You can access the policy’s cash value through withdrawals, policy loans, or as collateral, but doing so may reduce the policy’s death benefit or trigger income tax.

- Beneficiaries generally receive the death benefit only — not the accumulated cash value — unless special provisions are added.

- Premiums are higher than for term coverage, but you’re also building a savings component inside your Life Insurance Policy.

Our Perspective After Fourteen Years

We’ve watched Canadians of all ages use Cash Value Life Insurance as a tool to build financial flexibility, cover estate taxes, or create retirement income. We’ve also seen others buy it for the wrong reasons — dazzled by the idea of “free insurance” or “investment you can’t lose” — and end up disappointed.

That’s why our job is to show the real numbers, the real timelines, and the real pros and cons so you can decide with eyes wide open. Cash Value Life Insurance is neither a scam nor a magic bullet. It’s a powerful but expensive tool. Used wisely, it can give your family protection and give you living benefits while you’re here.

Bottom Line

Permanent Life Insurance Policies, such as Whole Life and Universal Life, accumulate a cash value because the insurer invests part of your premiums. That cash value isn’t free money — it’s a living benefit you can use strategically for loans, withdrawals, or premium payments. Term Life Insurance Policies cost far less but don’t build savings.

If your goals include lifelong coverage, a guaranteed death benefit, and a tax-deferred savings component, Cash Value Life Insurance in Canada can be a cornerstone of your plan. If your goals are purely short-term protection at the lowest cost, Term Life Insurance Plans in Canada remain the simplest solution.

Either way, the key is getting advice that’s transparent and personalized. That’s our approach.

FAQs

It accumulates tax-deferred within the policy. Withdrawals or surrender values in excess of your adjusted cost basis are considered income. Policy loans (up to the amount of premiums paid) are generally tax-free as long as the policy is continued.

Yes. Some lenders will agree to a collateral assignment of the cash value of your policy that allows you to borrow without surrendering it. The loan is based on the available cash value.

It remains in the policy, where it continues to grow tax-deferred. Upon death, you receive only the death benefit — unless you made other arrangements.

Typically, at least 10 years. Early premiums largely go toward costs and the guaranteed death benefit. At later ages, growth speeds up as additional funds compound inside the policy.

Yes. For many of the clients, their policy’s cash value is used as a tax-efficient source of retirement income. Sometimes the money can be accessed without generating immediate income tax, as long as the policy remains in force, usually by taking what are known as policy loans instead of withdrawals.

No. The growth within your policy is tax-deferred and doesn’t affect your RRSP limit. But if you make large withdrawals and they turn into taxable income, that money could factor into the means-tested government benefits in the year it is received.

Almost all Term Life Insurance in Canada will be convertible. That means you’re able to make the conversion to a Permanent Life Insurance Policy — Whole or Universal — without new medical underwriting up to a certain age. We frequently assist clients in making such a transition when their income rises or their needs evolve.

If your policy has enough cash value accumulated, the insurer will simply dip into that sum to cover a stream of premium payments for a period. Finally, if premiums are not paid and the value is depleted, a policy will lapse. That’s why we track policies for our clients and discuss strategies like reduced-paid-up coverage.

Yes. Key Person Coverage, funding buy-sell agreements, and creating a tax-advantaged asset inside the corporation are among the many reasons many business owners use Permanent Life Insurance to provide for those vehicles with cash value on their own behalf. The death benefit of the corporate-owned life policy may then be applied to flow tax-free through the Capital Dividend Account to pay out to shareholders.

Key Takeaways

- Permanent Life Insurance Policies Build Cash Value – Whole life and Universal Life Insurance in Canada grow a cash value component alongside the guaranteed death benefit.

- Cash Value Is A Living Benefit – Unlike the death benefit, the policy’s cash value can be accessed while alive for loans, withdrawals, premium payments, or as collateral.

- Growth On A Tax-Deferred Basis – Interest and investment earnings inside a Life Insurance Policy accumulate without immediate income tax; tax applies only on gains withdrawn.

- Beneficiaries Usually Receive The Death Benefit Only – Unless a special rider is added, any remaining cash value stays with the insurance company when the insured dies.

- Premiums Are Higher Than Term Life Insurance Plans In Canada – You’re paying for lifelong protection plus a savings component, not just temporary coverage.

- Strategic Use Creates Financial Flexibility – Properly managed, Cash Value Life Insurance can supplement retirement income, cover emergencies, or enhance estate planning.

Sources and Further Reading

- Government of Canada – Life Insurance Basics

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html

Explains types of Life Insurance sold in Canada, how premiums work, and what to ask before buying. - Financial Consumer Agency of Canada – Insurance Guides

https://www.canada.ca/en/financial-consumer-agency/services/insurance.html

A library of plain-language resources on Permanent Life Insurance, cash value features, and tax rules. - Insurance Bureau of Canada – Understanding Life Insurance

https://www.ibc.ca/on/home-insurance/understanding-insurance/understanding-life-insurance

An industry-wide overview of Whole Life Insurance Cash Value, Universal Life Insurance, and death benefits. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca/

Offers publications and fact sheets on Permanent Life Insurance Policy structures, cash value components, and taxation. - Investopedia – Cash Value Life Insurance

https://www.investopedia.com/terms/c/cash-value-life-insurance.asp

A detailed explainer (U.S.-centric but applicable to Canadian policies) covering how the cash value grows and can be accessed.

Feedback Questionnaire:

IN THIS ARTICLE

- Cash Value Life Insurance In Canada: Pros, Cons, And How It Really Works

- What Is Cash Value Life Insurance?

- How Cash Value Works In A Whole Life Insurance Policy

- Universal Life Insurance And Flexible Cash Value

- Difference Between A Policy’s Cash Value And Death Benefit

- How Long Does It Take to Build Cash Value

- Ways To Access Your Policy’s Cash Value

- Tax Treatment Of Cash Value Life Insurance In Canada

- Benefits Of Cash Value Life Insurance For Canadians

- Drawbacks And Limitations

- When It Makes Sense To Purchase A Cash Value Policy

- How We Help Clients Use Cash Value Strategically

- Key Points To Remember About Cash Value Life Insurance In Canada

- Our Perspective After Fourteen Years

- Bottom Line

Sign-in to CanadianLIC

Verify OTP