- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is the Shortest-Term Life Insurance Policy?

- Why Short Term Life Insurance is Important for Some Canadians

- What is the Shortest Term Life Insurance Policy?

- How Affordable Are Short Term Life Insurance Plans?

- The Pros and Cons of Short Term Life Insurance

- Who Benefits the Most from a Short Term Life Insurance Policy?

- Stories from Canadian LIC: How Short Term Life Insurance Made a Difference

- How to Get the Best Short Term Life Insurance Policy

- Final Thoughts: Choosing the Right Coverage

- More on Term Life Insurance

- FAQs: What is the Shortest Term Life Insurance Policy?

- Sources and Further Reading

- Key Takeaways

- Your Feedback Is Very Important To Us

What Is the Shortest-Term Life Insurance Policy?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 21th, 2024

SUMMARY

Why Short Term Life Insurance is Important for Some Canadians

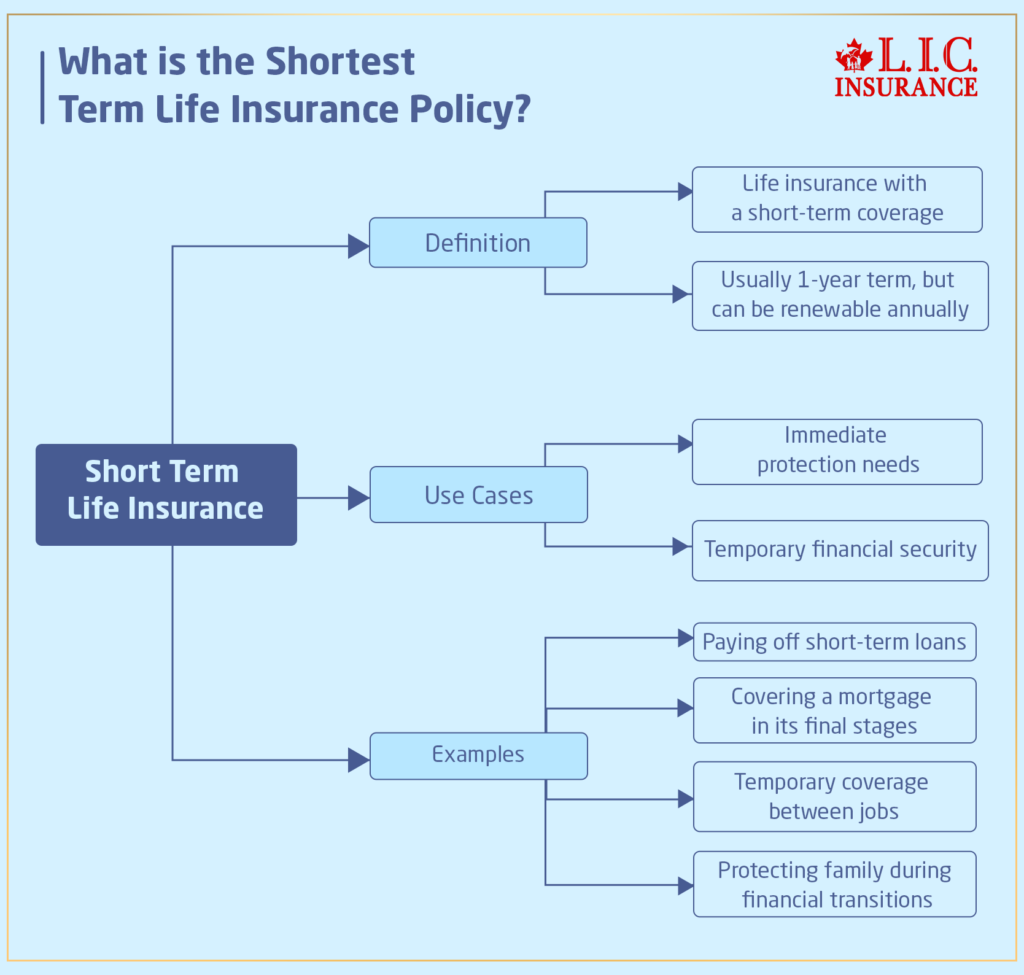

What is the Shortest Term Life Insurance Policy?

Short Term Insurance covers specific needs that range from a short term in time to a one-year term. Examples include:

- Paying off Short Term loans

- Covering a mortgage in its final stages

- Temporary coverage between jobs or while employer-provided life insurance isn’t active

- Protecting a family during a short financial transition period

How Affordable Are Short Term Life Insurance Plans?

The Pros and Cons of Short Term Life Insurance

Like any kind of insurance, Short Term Insurance has its advantages and disadvantages. As a principle, at Canadian LIC, we advise our clients to consider it carefully before making any decision. Here are some key points that are often discussed:

- Affordability: Since the policy lasts for a shorter time, the premiums are typically lower.

- Flexibility: You can choose a term that matches your specific needs, such as one, five, or ten years.

- Renewable Option: Some Short Term policies offer the ability to renew year after year if your situation changes.

- Simple: Short Term policies often come with fewer medical underwriting requirements, making the process faster and easier.

- Limited Coverage: Short Term policies may not offer the same level of coverage that Long Term plans provide.

- Renewal Costs: While the initial premiums may be low, renewable Term Life Insurance premiums can increase significantly with each renewal.

- Lack of Long Term Security: If you are looking for lifelong coverage or to leave a legacy, Short Term Insurance might not be the best fit.

Who Benefits the Most from a Short Term Life Insurance Policy?

As you decide which kind of life insurance might be best for you, remember that financial goals and coverage length are huge factors. Short Term Insurance is a good fit for those who:

- Have a temporary financial obligation, such as a loan or debt

- Need life insurance but plan on retiring soon

- Are you looking for coverage while transitioning between jobs or major life events

- Want affordable, temporary protection for their family

Stories from Canadian LIC: How Short Term Life Insurance Made a Difference

How to Get the Best Short Term Life Insurance Policy

We at Canadian LIC strive to ensure that every client gets the best insurance plan for their money. In light of the fact that life insurance shopping entails a big task and can be very overwhelming, even when you find the best Short Term Insurance, we have made sure that help is ready for all clients who search for such kinds of services.

Final Thoughts: Choosing the Right Coverage

FAQs: What is the Shortest Term Life Insurance Policy?

If you need temporary coverage to protect specific financial obligations, a Short Term Insurance Policy could be the best option. At Canadian LIC, we often see clients who only need coverage for a few years, such as when they’re finishing off a mortgage or loan. Short Term plans provide flexibility without committing to Long Term premiums.

Some Short Term Life Insurance Policies offer a conversion option that allows you to switch to a longer-term plan without having to go through the underwriting process again. We often recommend this to clients at Canadian LIC if they expect their needs to change in the future and want the flexibility to extend their coverage.

Yes, Short Term Life Insurance can be a great choice for young professionals who are starting their careers and only need temporary coverage. For example, we’ve worked with young clients at Canadian LIC who wanted coverage while they paid off student loans or secured their first mortgage. Short Term plans allowed them to get affordable protection without a Long Term commitment.

The longest term life insurance available typically ranges from 30 to 40 years. Some insurers may offer policies up to 50 years, but these are less common. The length of coverage often depends on the insurer’s policy offerings and your age when purchasing the insurance. The longer the term, the higher the premiums may be.

Some of the most frequently asked questions we get from our clients at Canadian LIC as they pursue their Term Life Insurance, most of which are about how long coverage lasts- from one year to another. Let’s understand the benefits of Short Term Life Insurance and how it can give you the right protection for your situation.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – Offers comprehensive information about life insurance products and the industry in Canada. www.clhia.ca

- Financial Consumer Agency of Canada (FCAC) – Provides guidance on choosing the right life insurance policy and understanding Term Life Insurance options. www.canada.ca/fcac

- Insurance Bureau of Canada (IBC) – Explains different types of life insurance, including Short Term and Term Life Insurance Plans. www.ibc.ca

- MoneySense – A trusted source for financial advice, including detailed comparisons of life insurance plans in Canada. www.moneysense.ca

Key Takeaways

- Shortest Term Life Insurance – The Shortest Term Life Insurance Policy is typically one year, offering flexible, renewable coverage for Short Term financial needs.

- Best for Temporary Needs – Short Term Life Insurance is ideal for covering Short Term obligations like a loan, mortgage, or temporary coverage during job transitions.

- Affordable Premiums – Short Term policies often have lower premiums compared to Long Term options, making them a cost-effective solution for many clients.

- Renewable Policies – Many Short Term policies are renewable yearly, but premiums may increase with age, so it’s important to evaluate future needs.

- Personalized Coverage – Short Term Life Insurance Plans can be tailored with riders and coverage amounts, ensuring your specific needs are met without overcommitting to Long Term protection.

- Quick Approval – Short Term Life Insurance Policies often have a faster approval process, making them convenient for those needing immediate coverage.

Your Feedback Is Very Important To Us

IN THIS ARTICLE

- What Is the Shortest-Term Life Insurance Policy?

- Why Short Term Life Insurance is Important for Some Canadians

- What is the Shortest Term Life Insurance Policy?

- How Affordable Are Short Term Life Insurance Plans?

- The Pros and Cons of Short Term Life Insurance

- Who Benefits the Most from a Short Term Life Insurance Policy?

- Stories from Canadian LIC: How Short Term Life Insurance Made a Difference

- How to Get the Best Short Term Life Insurance Policy

- Final Thoughts: Choosing the Right Coverage

- More on Term Life Insurance

- FAQs: What is the Shortest Term Life Insurance Policy?

- Sources and Further Reading

- Key Takeaways

- Your Feedback Is Very Important To Us

Sign-in to CanadianLIC

Verify OTP