- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

What Is An RRSP Deduction Limit And How Do Contributions Affect It?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 05th 2026

SUMMARY

The content explains how the RRSP deduction limit and RRSP contribution limit determine tax savings and retirement growth within a Registered Retirement Savings Plan in Canada. It covers unused RRSP contributions, RRSP loans in Canada, and RRSP benefits such as tax advantages, financial protection, and long-term RRSP coverage strategies for individuals and business owners seeking stronger financial security and informed investment decisions.

Introduction

It’s on your tax slip, the spreadsheet from your accountant and even the Canada Revenue Agency letter in your mailbox — the RRSP deduction limit. Those might sound like technical words, but they are the key to one of the most powerful wealth-building tools available to Canadians.

We witness this every single tax season – people are leaving tens of thousands on the table as potential tax savings, simply because they don’t understand how RRSP contribution limits and deduction limits were designed to complement each other. So let’s dissect it as we do with our clients: in plain language, real strategy behind every number.

The Registered Retirement Savings Plan

A Canadian Registered Retirement Savings Plan is more than just an account. It’s a government-registered investment plan that encourages you to save for retirement early. What’s so great about it is the tax benefits — you contribute pre-tax dollars, lower your taxable income for the year, and your money grows tax-deferred until withdrawal.

Think of this as a bargain between you and the government — you promise to save responsibly for retirement, and they reward you by permitting your contributions to shrink your tax bill now. When you add up the impact of consistent savings, tax reductions and compound growth over time, it really becomes some retirement power.

But to get the best result, you need to understand your RRSP contribution limit and your RRSP deduction limit — two numbers that may sound alike but are not.

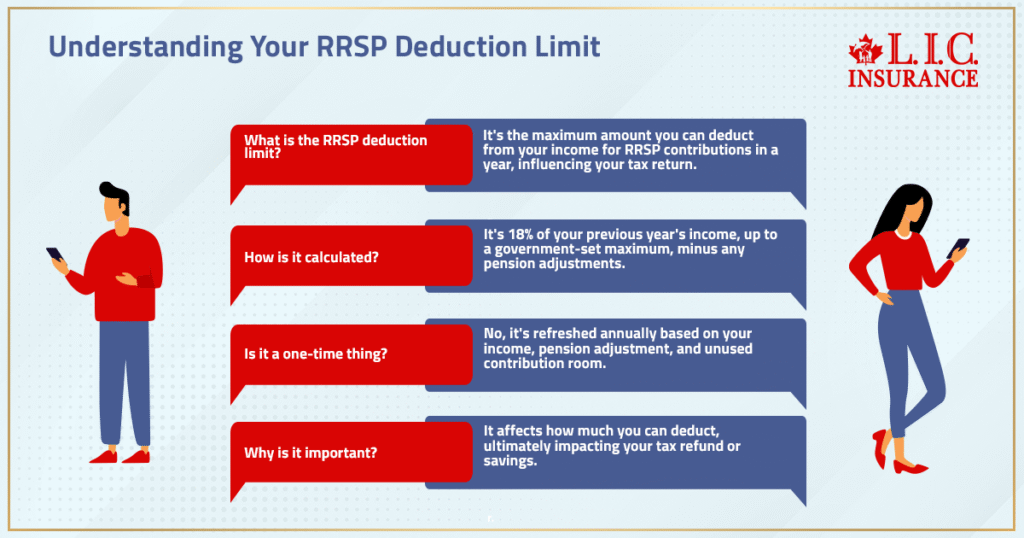

What Is the RRSP Deduction Limit?

Your RRSP deduction limit is the most you are able to deduct from your income for RRSP contributions in a year. It directly influences the amount you can claim on your tax return to decrease your income tax payable.

For the majority of Canadians, this is 18% of their income earned in the previous year, up to a maximum annual amount set by the government. If you earned $80,000 last year, you could claim a deduction of $14,400 — that’s if you don’t already have another pension plan, which reduces your available contribution room.

This limit is refreshed every year and is based on your income in the prior year, pension adjustment (if you have a company or group pension plan), and RRSP contribution room left over from previous years.

It’s important to note that this limit doesn’t just restrict how much you can contribute. It has an impact on how much you can deduct — and that’s ultimately what affects your tax refund or tax savings.

How the RRSP Deduction Limit Is Calculated

Let’s break it down in simple steps, because this is where many Canadians get lost.

- Start with your unused contribution room from the previous year.

- Add the lesser of 18% of your earned income or the annual limit set for the tax year.

- Subtract any pension adjustments (if you’re part of a registered pension plan through your employer).

- Add any reversals if you left a pension plan (pension adjustment reversal).

The math is that if you’re married, and filing your taxes jointly as a couple, you should take the absolute value of half of whatever number popped out when all those would-be deductions were added up, then subtract $313,8000 (or $622,050 in New York state), then multiply by.05(either 5 cents on every dollar over that original basis amount) for a final “limitation amount’’ once doing that arithmetic it turns out to be less than nothing. If not (because arithmetic insists), your limit is zero. That’s the maximum you can use as an RRSP deduction on your tax return for that year.

You will find that figure on your most recent Notice of Assessment from the Canada Revenue Agency. It is the official acknowledgement of what your contribution room actually is.

Why the RRSP Deduction Limit Matters

Your deduction cap is your ticket to immediate tax savings. Every dollar you put in up to that limit decreases your taxable income, so the less you owe this year.

Here’s the truth we explain to clients every day: your marginal tax rate determines how potent that deduction is. If you’re in a higher income bracket, every RRSP contribution saves you more on tax. For example, if he or she is in a marginal tax bracket of 40%, such an RRSP contribution would save the taxpayer about $4,000 in income tax.

It’s not black magic — it’s math plus government policy. The objective is simple: To reward savers, both the consistent and future retirees who plan ahead.

RRSP Contributions and How They Affect the Deduction Limit

Whenever you contribute to your RRSP, you’re using up part of your available contribution room. Your RRSP contribution limit and your deduction limit work together — contribute too little and you’ll carry forward room; contribute too much and you risk penalties.

Let’s look at the three possible outcomes:

- You contribute up to your limit. Perfect — you’ll get the full deduction, and your money starts growing tax-deferred.

- You contribute less than your limit. No problem — your unused RRSP contribution room carries forward indefinitely, giving you flexibility for future years.

- You contribute more than your limit. That’s a red flag. If you go beyond your allowed contribution room by more than $2,000, you’ll owe a 1% per month tax penalty on the excess amount until it’s withdrawn or the limit catches up.

We always advise clients to track their RRSP contribution room carefully. Over-contributing is one of the easiest ways to waste money unnecessarily.

The Relationship Between Contribution Limit and Deduction Limit

Many people use the terms interchangeably, but they’re not the same.

- The contribution limit is how much you’re allowed to deposit into your RRSP during the year.

- The deduction limit is how much you can deduct from your taxable income on your tax return.

You can contribute more than you deduct in a given year — and choose to carry forward part of the deduction to a future year when your income (and tax rate) might be higher. This gives you tax flexibility, especially if you’re self-employed, a business owner, or expect fluctuating income.

Understanding Unused Contribution Room

Not everyone can afford to max out the RRSP every year — and that’s fine. The RRSP scheme is a forgiving structure.

Let’s start by acknowledging that your contribution room doesn’t vanish at year-end if you haven’t used it. Instead, it carries forward indefinitely. So, if you didn’t save much in your 20s or 30s, you have the opportunity to contribute more later when you are earning more money and your financial situation has improved.

For instance, if you worked for $60,000 a year over five years and failed to contribute a year either of those years, your RRSP deduction limit potentially could have become upwards of $50,000 in just a few short years. That’s a huge opening that could be put to strategic use.

The Power of Carry-Forward Contributions

Upon speaking with one of our clients, we learned that a lot of them do plan ahead and strategically carry forward their unused RRSP deductions to subsequent years. Why? That is because waiting until your marginal tax rate is higher can make more sense.

For example, if you find yourself in a lower tax bracket today but anticipate getting a promotion, growing your business or receiving an influx of money next year that will lead to higher income levels, contributing now and taking the deduction in 2019 could potentially result in greater savings.

This type of planning distinguishes reactive savers from strategic investors. That’s the difference between simply having an RRSP and being in control of where and how it fits into your long-term plan.

RRSP Deadlines, Withdrawals, and Retirement Conversion

Every RRSP has a contribution deadline — typically 60 days after the close of the calendar year. The tax is based on contributions up to that date for the purpose of deductibility in the prior tax year.

Withdrawals, however, have tax implications. When you make a withdrawal from an RRSP, the money is taxed as income in that year. The idea is to contribute when you’re in a higher tax bracket, and then withdraw later, when your income is lower — saving on taxes both coming and going.

At age 71, you can no longer contribute to your RRSP. Your RRSP must be converted to a Registered Retirement Income Fund (RRIF) or an annuity by the end of that year. “So then the goal becomes preserving capital to drawing income tactically.

Avoiding Over-Contribution and Tax Penalties

Canada Revenue Agency offers a little wriggle room — $2,000 worth of escape hatch — on RRSP over contributions. That excess amount results in a 1% charge per month until it is reduced to the tolerable levels.

But many over-contributions are inadvertent, occurring when people forget about payroll-deducted RRSPs or automatic investment plans. Always compare your most recent Notice of Assessment with your current contributions to ensure accuracy.

If you do accidentally over-contribute, don’t freak out. You can adjust with CRA or withdraw the overcontribution. But it is easier to prevent than to file paperwork.

RRSP Loans: Boosting Your Contribution Power

One common question we hear: “What if I don’t have enough cash to maximize my RRSP this year?” That’s where an RRSP loan in Canada can make sense.

There are short-term RRSP loans available from banks and other financial institutions aimed at helping you make last-minute contributions. The appeal is straightforward: you receive the tax deduction in full today, and often enough, it results in a big refund that can cover the loan.

It’s not for everyone — you need to be disciplined and confident about repayment — but for many Canadians, it is a powerful method of maximizing tax-deferred growth without losing any year contribution room.

RRSP and Taxable Income: The Bigger Picture

The point of the RRSP deduction limit is all about shrinking your taxable income while growing your personal wealth. The higher your income, the more potent your deduction will be.

For example, if you make $120,000 and contribute $20,000 to your RRSP, your taxable income goes down to $100,000. And depending on your province, that can save you between $6,000 and $9,000 in income tax right away.

Those savings aren’t merely numbers on a tax form — they’re cash flow available for reinvestment, insurance or debt paydown. Sure enough, that’s the main reason why RRSPs are one of the coolest vehicles we have to balance financial growth and tax.

Integrating RRSPs with Insurance and Long-Term Financial Security

Here’s where most advisors get it wrong — your RRSP doesn’t function in isolation. For our part, we often bundle RRSP planning with CI or Critical Illness Insurance Coverage, parallel to disability insurance and some other protective policies.

Why? Because life has curveballs. Should a major illness or disability prevent you from earning, your RRSP contributions could halt — or, even worse, necessitate premature withdrawals that result in taxes and less retirement money.

Critical Illness Insurance Policies have the advantage of allowing you to withdraw from your retirement account if you experience one of the covered illnesses. The same can hold true for disability insurance — it keeps your income protected, so your long-term financial goals remain on track in times of hardship.

A combination of financial protection and tax-efficient investment planning is the essence of real financial security.

Business Owners and the RRSP Deduction Advantage

For entrepreneurs and incorporated professionals, RRSPs are one of the most basic strategies to lower taxable income earned from salary or dividends. Together with tactics such as corporate-owned life insurance or tax-deferred investment accounts, they form a stacked framework for a company’s financial security and business continuity.

For instance, a business owner can take a salary from the corporation and make an RRSP contribution with that earned income and continue to have the corporate investment options. And it’s that combination of personal and business growth that makes RRSPs so valuable in tax planning.

Strategic Takeaways for Smart Contributors

- Know your numbers. Always check your deduction limit on your Notice of Assessment before contributing.

- Use carry-forward wisely. Plan deductions for high-income years to maximize savings.

- Avoid penalties. Track all contributions — especially from automatic transfers or employer programs.

- Consider spousal RRSPs. They balance income between partners, creating smoother tax brackets at retirement.

- Pair RRSPs with insurance coverage. Protect contribution consistency through Critical Illness Insurance and Disability Insurance to avoid derailing your long-term plan.

- Think long game. RRSPs are not a quick win. Their real value appears when you combine consistent investing, tax savings, and compounding growth over decades.

The Emotional Side of Saving

Let’s face it: Saving for retirement is not always the sexiest pastime. The majority of Canadians have mortgages, childcare and soaring costs of living to worry about before considering their 70-year-old selves.

But here we sit every year, meeting with people who tell us the same thing — “I wish I started earlier.” The RRSP deduction limit is more than a tax math problem; it’s a friendly push from the system reminding you that your future merits today’s consideration.

Your RRSP isn’t some clever way to try to beat the taxman, in other words: It’s an investment in your future freedom — the right to decide when you stop working, where you live and how comfortably you spend your later years.

Final Thoughts

How the RRSP deduction limit, contribution limit and unused RRSP contributions all inter-relate is not only important to know, but it’s essential for any Canadian who wants to retire with dignity. Every contribution lowers your taxable income more, makes your investment grow faster and establishes a safety net for the rest of your life.

We’ve had the privilege to help thousands of Canadians – be it young professionals or established business owners, including doctors — plan their path with RRSPs. We believe that wealth isn’t created by accident; it’s built through structure, discipline and educated action.

So as you consider your next RRSP contribution, remember: the more time your investments have to grow for you, the better. The cleverer you are about the amount of your deduction, the more money you can keep in your pocket instead of padding Uncle Sam’s chequebook.

Let’s sit down, take a look at your existing Registered Retirement Savings Plan (RRSP), evaluate the levels of RRSP coverage you have in place, and help make sure you’re getting as much benefit from both your tax advantages and long-term financial protection. Because your retirement deserves more than hope — it deserves a plan.

More on International Student Insurance

FAQs

Use the Registered Retirement Savings Plan in Canada for immediate tax savings and the TFSA for flexible withdrawals.

Direct bonuses or windfalls to the TFSA; funnel career-year income to RRSP contributions for stronger tax advantages.

In volatile markets, keep emergency cash in a TFSA so RRSP benefits compound uninterrupted.

This balance reduces pressure to withdraw money early from your RRSP coverage.

Consider an RRSP loan in Canada when your refund can quickly retire the loan, keeping interest costs contained.

It helps front-load investing so growth starts sooner while preserving cash flow for personal expenses.

Best used by disciplined savers aiming to hit the RRSP contribution limit before the contribution deadline.

Pair the strategy with a payoff plan so debt doesn’t crowd future contributions.

A spousal approach smooths retirement income and can lower future income tax on withdrawals.

Contribute to your partner’s plan when they’ll be in a lower future bracket, and you need additional tax deduction room.

It complements unused RRSP contributions by shifting future taxable income across the household.

Keep records clean if both partners also use a Group RRSP or a Registered Pension Plan.

Short answer: consistency wins. Keep RRSP contributions steady while adjusting the mix, not the habit.

Use cash buffers or the TFSA for shocks so the retirement savings plan, RRSP, keeps compounding.

Rebalance instead of timing; let the carry-forward room work if cash is tight for a quarter.

Staying invested typically beats reactive, stop-start contributions.

Critical Illness Insurance Coverage provides a lump sum payout so you don’t raid your RRSP during recovery.

Disability Insurance replaces income, so contributions continue through a waiting period.

That guardrail preserves investment income momentum and long-term financial security.

It’s practical synergy: protect cash flow first, then maximize RRSP benefits.

Yes—draw salary to create earned income and build contribution room while keeping corporate flexibility.

Layer in key person protection (life or critical illness insurance) to defend operations and business continuity.

Use unused contribution room to time larger RRSP moves in high-profit years.

Document pension adjustment details if you also sponsor a company pension plan.

They’re tools, not shortcuts—treat withdrawals as temporary bridges with a defined repayment cadence.

Keep unused RRSP contributions available so regular saving doesn’t stall during payback years.

If life throws a curveball, insurance can help cover expenses so repayments stay on track.

Use HBP/LLP sparingly to avoid shrinking future tax savings.

Use a top-up, a short RRSP loan in Canada, or split contributions between now and early next year.

Claim part now and carry forward a portion of the deduction for a higher marginal tax rate year.

Automate monthly deposits so the next tax year isn’t a scramble.

Ask for an RRSP quote online to map cash flow and the maximum amount you can sustain.

Stack them during strong income years, but avoid excess contributions above the small buffer.

Coordinate with group RRSP payroll deductions so totals match your RRSP contribution limit.

Defer a slice of the deduction if you expect a bigger raise next calendar year.

Monitor your Notice of Assessment—your contribution limits change with each previous year update.

RRSPs target retirement income; permanent insurance can add a typically tax-free death benefit.

For complex estates or business partners, insurance can fund buy-sell needs while RRSPs handle retirement cash flow.

Some plans offer return of premium benefit options on specific riders; different purpose, different math.

Blend tools thoughtfully—Registered Retirement Savings Plan tax benefits Canada plus strategic insurance equals resilience.

Yes—pair contributions with critical illness insurance policies and disability insurance.

A lump sum payment after a covered illness stabilizes monthly expenses and avoids RRSP withdrawals.

That cushion limits financial stress and keeps the plan compounding during recovery.

Think of it as durable scaffolding around your retirement savings.

Start small to open a contribution room, then scale as income stabilizes.

Use diversified, low-cost options via reputable financial institutions to grow tax-deferred.

Balance TFSA liquidity with RRSP tax advantages for the long run.

When ready, request an RRSP quote online to formalize targets and automate momentum.

Totally—contribute now and claim the offsetting deduction later if next year’s bracket will be higher.

This lets carry forward mechanics do their quiet magic on your tax bill.

It’s a clean way to turn unused contributions into bigger future tax savings.

Just track timing and keep receipts tidy for your tax return.

Tie deposits to real milestones: child care costs easing, a mortgage renewal, or career jumps.

Use small auto-contributions plus a bigger lump sum when bonuses hit.

Review RRSP benefits annually like a health check—then upgrade coverage options where needed.

Stay consistent; let your future self send the thank-you note.

Key Takeaways

- The RRSP deduction limit determines how much you can deduct from your taxable income each year, directly affecting your annual tax savings.

- Your RRSP contribution limit equals 18% of your previous year’s earned income, up to the government’s annual maximum, minus any pension adjustments.

- Unused RRSP contributions carry forward indefinitely, allowing flexibility to claim larger deductions in high-income years.

- Exceeding your deduction limit by more than $2,000 triggers a 1% monthly tax penalty on excess contributions.

- Using an RRSP loan in Canada can help maximize contributions and boost tax-deferred investment growth when planned strategically.

- Combining RRSP planning with critical illness insurance and disability insurance safeguards your contributions during health or income disruptions.

- The Registered Retirement Savings Plan in Canada remains one of the most effective tax-advantaged tools for building long-term financial stability and RRSP coverage for retirement.

- Strategic use of spousal RRSPs, carry-forward deductions, and consistent contributions can optimize RRSP benefits and reduce lifetime income tax burdens.

Sources and Further Reading

- Government of Canada – Canada Revenue Agency (CRA)

Registered Retirement Savings Plan (RRSP) Contribution and Deduction Limits

www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans.html - Financial Consumer Agency of Canada (FCAC)

Understanding Registered Retirement Savings Plans (RRSPs)

www.canada.ca/en/financial-consumer-agency/services/savings-investments/rrsp.html - Statistics Canada (StatCan)

Canadians’ Contributions to RRSPs and TFSAs: Annual Trends

www150.statcan.gc.ca - Sun Life Canada

RRSP Contribution Limits and Tax Benefits Explained

www.sunlife.ca - Wealthsimple Canada

RRSP Contribution Limit and Carry Forward Rules

www.wealthsimple.com/en-ca - BMO Financial Group

RRSP Strategies to Maximize Tax Savings and Retirement Income

www.bmo.com - RBC Royal Bank

RRSP Contribution Deadlines and Deduction Limits in Canada

www.rbcroyalbank.com - TD Canada Trust

Understanding RRSP Deduction Limits and Contribution Room

www.td.com - National Bank of Canada

RRSP: Know Your Contribution and Deduction Limits

www.nbc.ca - Manulife Canada

Planning for Retirement: How RRSP Contributions Affect Your Taxes

www.manulife.ca

Feedback Questionnaire:

We’d love your feedback!

Your responses help us understand what Canadians find most confusing about RRSP deduction limits, contributions, and tax savings — so we can create more content that truly helps.

Thank you for sharing your thoughts!

Our team will review your responses and, if you requested it, reach out with a personalized breakdown of your Registered Retirement Savings Plan in Canada, including your RRSP contribution limit, RRSP coverage, and RRSP benefits tailored to your income and goals.

IN THIS ARTICLE

- What Is An RRSP Deduction Limit And How Do Contributions Affect It?

- The Registered Retirement Savings Plan

- What Is the RRSP Deduction Limit?

- How the RRSP Deduction Limit Is Calculated

- Why the RRSP Deduction Limit Matters

- RRSP Contributions and How They Affect the Deduction Limit

- The Relationship Between Contribution Limit and Deduction Limit

- Understanding Unused Contribution Room

- The Power of Carry-Forward Contributions

- RRSP Deadlines, Withdrawals, and Retirement Conversion

- Avoiding Over-Contribution and Tax Penalties

- RRSP Loans: Boosting Your Contribution Power

- RRSP and Taxable Income: The Bigger Picture

- Integrating RRSPs with Insurance and Long-Term Financial Security

- Business Owners and the RRSP Deduction Advantage

- Strategic Takeaways for Smart Contributors

- The Emotional Side of Saving

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP