- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Basics

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

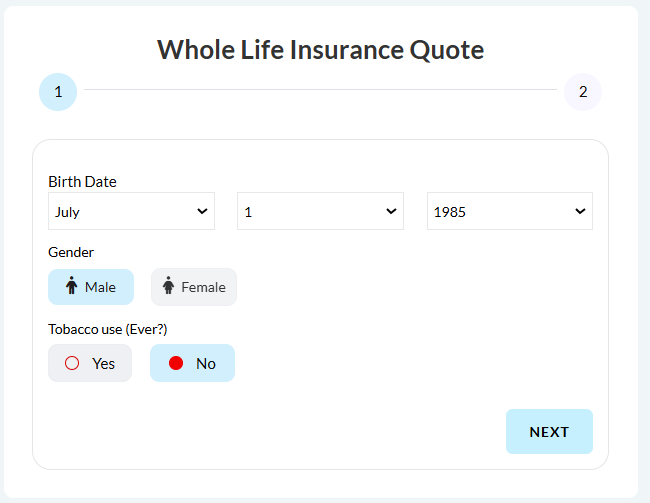

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

The Truth About Participating Life Insurance And Your Financial Future

By Pushpinder Puri

CEO & Founder

- 12 min read

- September 24rd, 2025

SUMMARY

Participating Life Insurance in Canada offers guaranteed coverage and long-term savings through cash value and dividends. Families utilize Participating Whole Life Insurance for protection, retirement income, and estate planning purposes. The participating account builds value in a tax-efficient manner while providing a stable death benefit. Compare a Life Insurance Quote Online to align with your financial goals.

Introduction

We have seen families lose wealth because they thought insurance was only about death. We have also seen others create stability for their kids by using one simple tool the right way. That tool is Participating Life Insurance in Canada.

When people first hear the term, they picture some complicated plan that only rich folks buy. The truth is different. Participating in Whole Life Insurance is a Permanent Life Insurance Plan that mixes protection with long-term savings. It is not for every person, but when it fits, it protects families, creates cash value, and builds wealth in a steady way.

Life Insurance Policy And Why It Matters

Every Life Insurance Policy starts with the same promise. If you die, your family gets a death benefit. That is the basic structure.

But policies are not all built the same. Some are pure protection. Some are protection plus growth.

When we meet new clients, we ask them:

- Do you want coverage for a short term or for life?

- Do you want the lowest cost now, or the value you can access in the future?

- Are you thinking about leaving money behind or also using it while alive?

Answers change everything. A young couple with a mortgage usually picks Term Life Insurance first. A business owner looking at taxes after death often chooses Permanent Life Insurance.

Cash Value That Builds Quietly

People get confused about cash value. Think of it as the part of your policy that slowly grows like savings in the background. It builds because part of your premiums go into the participating account. That account is run by the insurance company.

The total cash value becomes useful in many ways.

- Borrow against it through a policy loan.

- Cash surrender if you want to stop paying.

- Use it as collateral at a bank.

- Keep it growing until retirement income is needed.

We once had a client who thought insurance was only about death. Years later, he used his policy’s total cash value to fund his child’s university. He told us he was shocked that “insurance” helped with education, too.

Universal Life Insurance Compared

Now, we often get this question: Is Universal Life Insurance better? Universal is flexible. You decide where the money is invested. Could be mutual funds, could be fixed interest accounts.

But with flexibility comes responsibility. If you pick poor funds, growth suffers. With Participating Whole Life, the insurer manages the account for you. It is stable, less risky, and easier for people who do not want to play the market.

Both offer a guaranteed death benefit. Both protect families. One requires you to steer. The other is more “set and forget.”

Participating Life Insurance At Work

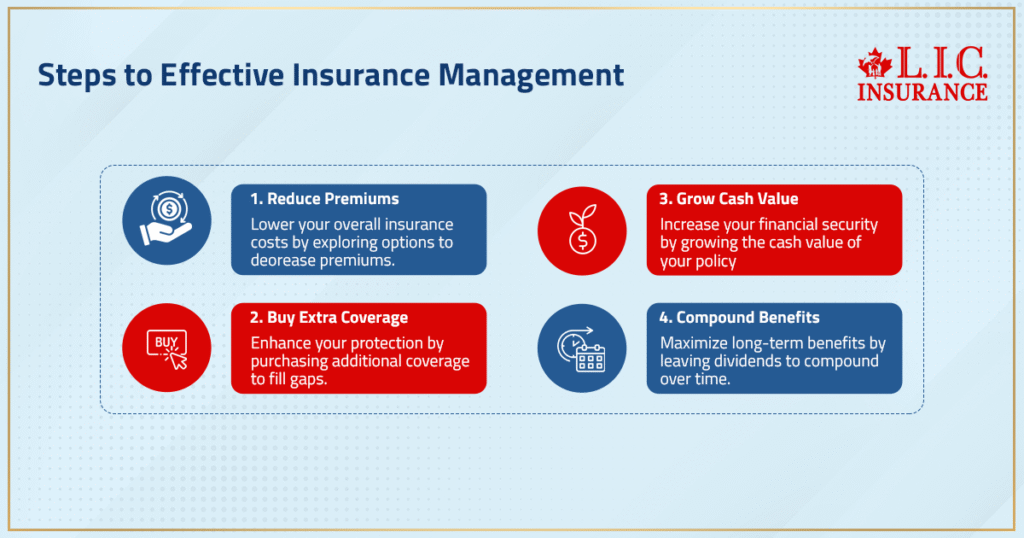

Why “participating”? Because you share in the profits of that participating account. If the insurance company earns more than expected, dividends are paid to policyholders.

What can you do with dividends?

- Reduce premiums.

- Buy extra coverage.

- Grow more cash value.

- Leave them inside to compound.

We have seen older clients light up when they realize their policy is paying for itself after years of dividends. They paid faithfully for years, and now the policy pays them back.

Term Life Insurance Is Straightforward

Term Life Insurance is like renting coverage. You pay, you are covered, you stop, it ends. No cash value. No extras.

It is good for people who want the lowest cost. For example, a 30-year-old with a new mortgage often picks a 20-year term. It protects the family if income stops suddenly.

But the term gets expensive with age. Renewals are a shock. That is when many families think about switching to Participating Whole Life Insurance to lock in guarantees and start building value.

Financial Future And Why Planning Early Matters

Your financial future does not rely only on how much you earn. It depends on what you protect. It depends on whether you let assets grow in a tax-efficient manner.

Participating Whole Life Insurance helps by:

- Protecting your family with a death benefit.

- Building guaranteed value inside.

- Offering access through loans or withdrawals.

- Creating stability when interest rates or mutual funds are shaky.

One retired couple we worked with used policy loans to cover yearly trips. They said it felt better than selling investments in down markets. That is the truth—stability matters.

Insurance Policy Details That Change Outcomes

The way your insurance policy is designed controls everything. Premiums. Growth. Benefit.

- Premiums are fixed.

- Death benefit guaranteed.

- Cash surrender value increases over time.

- Dividends, when paid, raise the total amount.

If you only look at the first year’s cost, you miss the long-term picture. We always show clients how their policy looks at age 40, 60, and 80. That is when the value shows.

Participating Account And Dividends

The participating account is where premiums are invested. Insurance companies put that money into safe, long-term investments. Mortgages. Bonds. Sometimes equities.

Dividends come from the performance of this account. They are not guaranteed, but in Canada, insurers have a long history of paying them.

That is why many families trust Participating Life Insurance. They prefer letting professionals run the account while they focus on life and work.

Whole Life And What It Promises

Whole Life Coverage is Permanent. As long as you pay, it never ends. Term expires. Universal requires choices. Whole Life is steady.

Guarantees matter:

- Premiums never change.

- The death benefit is locked.

- Cash value grows every year.

And dividends can grow the policy beyond guarantees. That is why older Canadians often use it for estate planning and to protect wealth for beneficiaries.

Picking The Right Insurance

The right insurance depends on who you are. A young adult renting an apartment needs simple coverage. A business owner preparing for succession needs more.

We have seen mistakes. People buy the wrong policy and regret it. That is why we spend time asking about age, income, partner needs, children, and financial goals. There is no “one size fits all.”

How It Fits Financial Goals

Policies must match your financial goals. Want to pay off a mortgage? Term is fine. Want to create retirement income or protect assets from taxes? Participating Whole Life Insurance is stronger.

The total cash value inside these policies is not flashy, but it is steady. When markets drop, your insurance value still grows. When you need access, it is there.

That is why many Canadians see it as part of their financial strategy, not only as coverage.

Canadian LIC Perspective

For over 14 years, we have guided families through these decisions. We explain policy loans, total cash value growth, and how to use dividends in a tax-efficient manner.

We worked with a business owner who used his Whole Life Policy to cover estate taxes. Without it, his family would have been forced to sell assets. With it, the company stayed in family hands. That is how Life Insurance protects wealth in practice.

Key Points To Remember

- Every Life Insurance Policy provides a guaranteed benefit.

- Participating Whole Life Insurance in Canada adds cash value and savings.

- The participating account grows value and pays dividends.

- Universal Life Insurance is flexible, but requires investment choices.

- Term Life Insurance is temporary and straightforward.

- The right insurance depends on your age, family situation, and personal goals.

Closing Thought

Life Insurance is not only about death. It is about life, money, and family security. If you want more than coverage, if you want protection plus savings in a stable way, ask us for a Life Insurance Quote Online.

We show you how Participating Whole Life Insurance protects your family today and strengthens your financial future tomorrow.

FAQs

Clients have used that policy to extract more income in later life. Some borrow, some withdraw. It’s successful because the cash value accumulation is very slow and not subject to daily markets. For most of us, it ends up being a reliable plan B when the rest are either shaky or elusive.

Where there is a participating account, the insurance company manages it. It’s not like you choose funds each and every month. Mutual funds are another animal; you take the risk. With the account, the dividends are shared back with the policyholders. And it’s more stable, less noisy, and less daily stress.

Yes, and we have collaborated with numerous. One owner was in line for a massive tax bill upon passing the company on. The policy cleared without having to touch any assets.” It also gave him a cushion while he was alive. It saved the family business.

The term often ends up running out too soon. Premiums jump when you renew. Whole life does not. And that’s not to mention the appreciating cash value. For parents who prefer savings and protection for the child involved, Participating Life Insurance is typically the option.

Cash surrender is when you surrender your policy and take the money inside. “I don’t know if it’s the best option for everyone, but in some cases, families need to be able to get quick access,” he says. The complete cash value is paid by the insurer, minus any loans, if they exist. Coverage ends when you cash it in.

Starting young makes a difference. Premiums remain low, and dividends have decades to compound. We’ve seen young adults take a policy loan down the road for education, or even for a first home. When they first buy Life Insurance, it becomes a foundation that they may never have anticipated.

And interest rates determine how the insurer invests. Bonds, mortgages, long-term assets. When rates change, so do the returns. The point is stability. Even when markets feel rough, your cash value continues to grow year by year. That is what most people would like.

A policy loan is simple. Your own cash value is the collateral, and no bank is involved. There is no lapse in the death benefit. Families frequently turn to this route so they don’t have to sell assets. Repayment is flexible. Instead, it preserves the wealth but gives you money to use.

Whole life ensures that funds are there when death arrives. It is that death benefit that pays estate taxes, protects beneficiaries, and avoids forced sales of assets. We’ve seen it prevent families from losing their desired homes. Guarantees matter.

Permanent Coverage is always there. If you buy a whole life policy that is participatory, you can go even a step beyond that by having a share in the profits that result from the participating account. Dividends are used to purchase paid-up insurance or provide cash value. It’s that extra layer that distinguishes it from Universal Life or simple Permanent Policies.

Key Takeaways

- A Life Insurance policy gives guaranteed protection, but Participating Whole Life Insurance in Canada adds long-term savings and value.

- Cash value builds inside the participating account, and steady growth is managed by the insurance company.

- Dividends can lower premiums, increase coverage, or boost total cash value.

- Universal Life Insurance offers control, whole life offers stability, term Life Insurance offers short coverage.

- Participating Life Insurance supports retirement income, estate planning, and family wealth transfer.

- Picking the right insurance depends on age, family needs, income, and financial goals.

- Policies become powerful when aligned with taxes, retirement income, and wealth protection strategies.

Sources and Further Reading

- Canada Life Dividend Scale History

Shows historical dividend scale, interest rates, and comparisons with other investments like GICs, bonds, and the S&P/TSX, offering context for cash value performance. serenialife.ca+10Canada Life+10Sun Life+10 - Equitable Dividend Scale (2025/2026)

Confirms current dividend scale, interest rates, and policy loan rates—relevant to understanding dividend-based growth and borrowing costs. Canada Life+4equitable.ca+4Sun Life+4 - Top Whole Life Insurance Companies in Canada

Ranks insurers based on dividend history, stability, and long-term value—useful for comparing Participating Life Insurance providers. Canadian LIC+2PolicyAdvisor+2 - Sun Life Dividend Scale Maintenance

Shows how insurers maintain dividend scale interest rates year over year. Highlights commitment to policyholder value and how participating accounts stay stable. equitable.ca+8Sun Life+8Canada Life+8 - How Cash Value Builds in a Life Insurance Policy (Investopedia)

Explains how cash value accumulates over time, the initial allocation of premiums, and the tradeoffs vs. death benefit—excellent for understanding mechanics behind permanent Life Insurance. equitable.ca+15investopedia.com+15Sun Life+15investopedia.com+1 - Life Insurance as Cash Accumulation Tool (Investopedia)

Describes how policyholders access cash value to fund expenses like tuition, emergencies, or supplement retirement—aligns with your examples of using policy value. investopedia.com - Paid‑Up Additional Insurance via Dividends (Investopedia)

Explains how dividends can buy paid‑up additions, compounding policy value without extra premium—a powerful tool for growth within participating whole life policies. RBC Insurance+3investopedia.com+3investopedia.com+3

Feedback Questionnaire:

IN THIS ARTICLE

- The Truth About Participating Life Insurance And Your Financial Future

- Life Insurance Policy And Why It Matters

- Cash Value That Builds Quietly

- Universal Life Insurance Compared

- Participating Life Insurance At Work

- Term Life Insurance Is Straightforward

- Financial Future And Why Planning Early Matters

- Insurance Policy Details That Change Outcomes

- Participating Account And Dividends

- Whole Life And What It Promises

- Picking The Right Insurance

- How It Fits Financial Goals

- Canadian LIC Perspective

- Key Points To Remember

- Closing Thought

Sign-in to CanadianLIC

Verify OTP