- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Temporary Health Insurance Plans In Canada 2026: Essential Coverage Guide For International Students

By Harpreet Puri

CEO & Founder

- 11 min read

- December 09th 2025

SUMMARY

Temporary Health Insurance Plans in Canada 2026 explains how international students can stay protected during MSP waiting periods with Private Health Insurance. It covers iMED details, cost of Health Insurance for international students, eligibility, provincial coverage rules, and how to compare International Student Insurance Quotes online for the right Health Insurance plan and comprehensive coverage across provinces.

Introduction

You’re flying to Canada with a study permit, a suitcase full of clothes and exactly zero tolerance for unexpected medical bills. Smart. There is no “free health care” here for newcomers, and you can’t assume provincial coverage starts on day one. In provinces like B.C., international students face a waiting period before public coverage begins. In contrast, in others (such as Ontario) many students are never eligible for the provincial plan and must rely on school or private coverage instead. BC’s MSP wait, for instance, is the remainder of the month you arrive plus two months — it can mean up to 90 days, where a broken wrist might bust your budget if you don’t have something temporary in place.

We’ll guide you through Private Health Insurance, how the Medical Services Plan (MSP) and other provincial coverage operate, and what to do during waiting periods. There’s also UBC’s iMED for a ‘clean’ example of how temporary coverage works (provider: David Cummings Insurance Services; claims through MSH).

Private Health Insurance: Why You Need It Before Provincial Coverage Starts

Regardless of which province you live in — and whether it has a waiting period (B.C. is the classic example) or not — Private Insurance provides that coverage for doctor visits, ER trips, and eligible hospital care while you wait out your penalty period. UBC’s iMED does it right: This insurance covers emergency hospitalization and medical services for unforeseen sickness or injury during those first three months, and it is even set up for direct billing at certain clinics/hospitals, so you’re not shelling out big bills upfront.

Real talk: ER isn’t cheap. CIHI data show that a typical emergency-department visit already runs into the hundreds of dollars in direct hospital costs alone, and that still doesn’t include physician fees or prescription drugs. Costs keep trending up. Private Short Term Insurance is tuition for not going broke.

Medical Services Plan (MSP): How The Medical Services Plan MSP Works In B.C.

MSP is B.C.’s Public Health Insurance for eligible residents (international students included once you meet residency rules and apply). The waiting period is the remainder of the arrival month plus two months; you should carry Private Coverage until coverage begins. Apply as soon as you arrive—don’t coast.

Provincial Coverage: The Big Idea (It’s Not One-Size-Fits-All)

Provincial Health Coverage varies. B.C. has MSP (with a waiting period). Most international students in Ontario are not eligible for OHIP; instead, universities and colleges typically enroll them in private plans such as UHIP or other school-arranged health insurance that mimics provincial coverage. If you can provide proof of 12 months’ intent, Alberta may issue an AHCIP in some short-permit scenarios. Translation: you can’t copy what your friend did in another province.

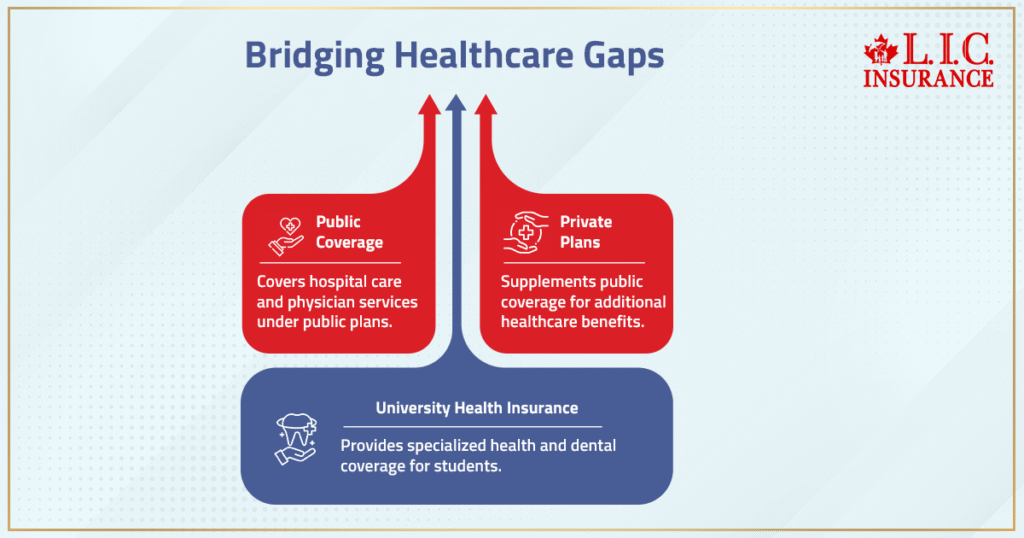

Public Health Insurance: What It Covers (And What It Doesn’t)

Public Coverage (MSP/OHIP/AHCIP, etc.) pays for hospital care and physician services. It doesn’t mean all the benefits you have under traditional plans will be free — often, prescription drugs, dental care, vision care, and paramedical services such as massage therapy are outside core benefits if they aren’t already covered by a supplemental Private Plan. That’s when Private Plans or your university Health Insurance Plan takes over the burden. ( UBC example: the gap there is iMED, and they must have a separate student health/dental plan for add-ons).

Temporary Residents: Your Step-By-Step Guide To Not Getting Caught Uninsured

- Confirm your province’s rules (waiting periods, eligibility, timelines). For B.C., apply for MSP online and set a reminder for the start date.

- Buy Health Insurance for the gap. If your school auto-enrolls (like iMED at UBC), check your student account for the fee so you don’t accidentally opt out of your own safety net.

- Save your policy card (digital + printed). Keep passport, study permit, and policy number ready for clinics/hospitals; some facilities bill directly to the insurer (iMED/MSH list exists for Vancouver/Okanagan).

- Know the claims flow: routine clinics often ask you to pay upfront; hospitals sometimes bill the insurer; you/they submit claims with receipts.

International Student Reality Check: Volume Is High, Policy Is Shifting

Canada’s student landscape is moving. Since 2024, IRCC has introduced national caps on study permits and required most applicants to obtain a provincial attestation letter; for 2026, overall study-permit targets are being trimmed again, while master’s and doctoral students at public institutions are now exempt from both the cap and the attestation requirement. You just need to plan coverage, not panic. (Check current IRCC and provincial updates for the latest study-permit rules in effect when you apply.)

International Student: What Counts As “Comprehensive Coverage” For The First 90 Days?

Look for International Student Insurance Coverage that clearly lists:

- Emergency hospital care, doctor visits, and diagnostics (MRI/CT often need pre-authorization).

- Prescription drugs in emergencies.

- Direct-billing networks near campus (cuts out-of-pocket shock).

- Clear exclusions, waiting periods for pre-existing conditions, and claim submission steps. (UBC iMED uses MSH Assistance and publishes a direct-billing map.)

Health Insurance Plans: Picking The Right Health Insurance For Your Program Length

- Programs 6+ months (B.C.): Expect iMED for the first 3 months, then MSP.

- Programs <6 months: iMED (or an equivalent Private Plan) may cover your full stay.

- Arriving early/late: adjust dates or buy advance coverage so your coverage begins the day you actually touch down. (Yes, you can shift iMED in specific cases; rules apply.)

Public Health Coverage: Where Students Trip Up

- Assuming “free healthcare” applies on day one. It doesn’t. Waiting periods are real in several provinces.

- Forgetting to apply to the Provincial Plan once eligible. No application = no provincial coverage.

- Ignoring exclusions in Private Plans (pre-existing, ongoing care, electives).

- Not keeping receipts for medical expenses. No proof, no reimbursement.

Hospital Care: How To Handle A Sudden Emergency

It’s that serious; the advice goes to the rowing community. Present your Private Insurance card, your passport and your study permit. Ask upfront if the insurer can be billed directly. If surgery/specialist care is a possibility, you (or perhaps a friend) will need to call the service provider right away for pre-authorization. (That’s how iMED/MSH expects it.)

Heads-up on price transparency context: Our hospital costs are captured by CIHI’s Patient Cost Estimator; actual amounts differ per province/hospital and do not include physician billing. Do not DIY this — use the hotline provided by your insurer.

Waiting Periods: If You Arrive Too Early (Or Too Late) For Your Default Dates

- Early arrival: Buy Advance Coverage so you’re protected from the minute you land.

- Late arrival: request a date change (when allowed) so you’re not paying for months you weren’t in-province.

- Arrive in another province first: you may need an extension to cover you until you physically enter B.C. (specific to iMED rules).

Private Coverage: What About Dental Care, Vision Care, And Paramedical Services?

These are typically outside the public plan. Many campuses bundle a Student Health and Dental Plan for dental care, glasses/contacts (vision care), and paramedical services (physio, chiro, etc.). Check your school’s plan and top up if needed. (UBC points students to compare iMED vs MSP vs AMS/GSS Health & Dental.)

Public Health Insurance: Ontario And Alberta Examples (So You Don’t Get Caught)

- Ontario (OHIP): Apply as a visitor; many international students are ineligible; schools arrange private or Group Coverage. Don’t take it for granted that your cousin in Mississauga has a health card, so OHIP will cover you.

- Alberta (AHCIP): Some study-permit holders under 12 months may be eligible with a school letter stating an intention to live for at least 12 months. If not, you will need Private Insurance (UAHIP or equivalent) to pay for medical costs.

International Health Insurance: Quotes, Costs, And What We Tell Students

Out-of-pocket expenses for Health Insurance in Canada. Are you wondering how much Health Insurance costs in Canada for international students? UBC publishes iMED’s current three-month premium and any direct-billing fees on its website; use that as a public price marker, then compare it against your own school’s plan or a private policy if you’re not auto-enrolled.

Provincial Health Coverage: Keep Your Paper Trail Tight

When you apply for Provincial Health Insurance, keep:

- Study permit + passport

- School acceptance/enrolment proof

- Canadian address and arrival date

- B.C. explicitly publishes MSP eligibility criteria and the application process—other provinces do too. Don’t overthink it. Do it.

For International Students: Our No-Drama Checklist

- Before you fly: Line up Private Coverage (or confirm your University Health Insurance Plan auto-enrolment).

- Week 1 in Canada: Apply for Provincial Coverage (MSP/AHCIP/etc).

- Carry your card: Physical + digital; keep receipts for cover services claims.

- Know the hotline: Insurer assistance for pre-authorization (MRIs, specialist care, surgery).

- Gap solved: When Public Coverage kicks in, decide if you need supplemental coverage for prescription drugs, dental, vision, and paramedical.

Why This Matters Right Now

Canada’s policy environment for students is shifting (permit caps, attestation letters, approvals). That’s macro noise. Your move is simple: don’t let a waiting period turn into a financial L. Get appropriate coverage, read your policy, and keep your documents tight.

Bottom Line

We help international students choose a Health Insurance recipe that’s just right: Private Coverage for waiting periods, provincial coverage once you’re eligible and supplementary plans for the stuff public plans don’t cover. When you’re ready to have us sanity check your dates (arrival vs. policy start), compare Private Plans or map your campus direct-billing options, just send over your program length, province and arrival date. We will keep travel crisp, compliant and cost-sane.

(P.S. Yes, we maintained natural-looking keywords throughout headings and body. No keyword-stuffing circus. If you would like a counts-by-term version of an extreme LSI frequency pass, please let us know, and we will track it.

FAQs

Shortlist three Private Health Insurance options, then scan exclusions first (sports, pregnancy, pre-existing).

Check prescription drugs, physio/paramedical services, trip limits, and hospital care caps.

Now get an International Student Insurance Quote Online and map benefits to your real risks (labs, mental health, meds).

Yes—read the “out-of-province” rules. Some Health Insurance Plans cover hospital visits nationwide, some don’t.

If your Provincial Health Coverage is limited, add a top-up for emergency medical expenses.

Last line: Tell your insurer before you move for co-op or fieldwork.

Depends. “Recreational” is often fine; “organized/competitive” can be excluded.

If you ski, board, or play varsity, get specialized International Student Insurance Coverage.

Confirm ambulance, imaging, and post-injury doctor visits are included.

Many plans treat pregnancy as pre-existing unless you bought Private Coverage early.

Ask specifically about ultrasounds, delivery, and newborn hospital care.

If excluded, budget separately or add a maternity rider in your Health Insurance Plan.

Usually yes, but it’s a separate application and price.

Compare Canadian Health Insurance options for dependents (benefits and Health Insurance cost vary).

Make sure vaccinations, urgent care, and basic medical services are clear in writing.

Coverage doesn’t teleport with you.

Get interim Private Plans while your new Provincial Coverage (e.g., B.C.’s system) activates.

Ask both insurers about continuity so there’s zero gap during waiting periods.

Some include short-term counselling; many cap sessions or exclude psychiatrists.

If it matters to you (it should), buy supplemental coverage or a richer health plan.

Confirm referral rules and tele-health availability before you book.

Ask if your policy covers prescription drugs outside of inpatient care.

Use direct-billing pharmacies when possible; they lower out-of-pocket medical expenses.

If no drug coverage, compare discount programs and school plans for more comprehensive coverage.

Yes, sometimes—but many need pre-authorization.

Get the assistance phone number saved; no pre-auth can mean no payout.

For fast referrals, confirm if Public Health Insurance pathways are required first.

Often yes, and they’re clutch for quick doctor visits and renewals.

Check your International Health Insurance for tele-health limits and eligible platforms.

Screenshots of consult notes + e-receipts = smoother reimbursement.

Most insurers allow it with proof, and before claims—timing is everything.

Keep acceptance letters, denial letters, and payment receipts together.

Ask about admin fees and deadlines when you request changes.

Start with essentials: ER, inpatient hospital care, imaging, and reasonable drug caps.

Increase the deductible a bit to trim the cost of Health Insurance for international students.

Grab an International Student Insurance Quote Online from two providers to keep them honest.

Rarely under basic “emergency-only” temporary residents plans.

Add school dental care and vision care packages if you need them.

If you want checkups, pick a plan that covers basic medical services, not just emergencies.

Some policies end with enrollment; others let you extend.

If there’s a gap, buy short-term Private Plan days until classes restart.

Keep proof of continuous Health Coverage to avoid messy claims.

If you’re in B.C., align policies so your gap ends when provincial plans start.

Ask about direct-billing clinics near campus to avoid big swipe charges.

Save every document; it speeds up claims under any medical services plan, MSP crossover, or private policy.

Key Takeaways

- Temporary Health Insurance protects international students during MSP or other provincial coverage waiting periods across Canada.

- The iMED program by David Cummings Insurance Services offers basic medical coverage for new UBC students until the Public Health Insurance Plans begin.

- Each province sets its own eligibility criteria and timelines, so always verify when coverage begins under your local medical services plan MSP.

- Private Health Insurance helps cover medical expenses, hospital care, and doctor visits before Public Coverage takes effect.

- Compare International Student Insurance Quotes Online to find comprehensive coverage that includes prescription drugs, dental care, and vision care.

- Always apply for Provincial Health Coverage promptly upon arrival and keep all policy cards, receipts, and documents for claims.

- Reviewing both Public Health Insurance and Private Coverage ensures full protection against high Health Insurance costs in Canada.

Sources and Further Reading

- iMED: Temporary Health Insurance For International Students — UBC / David Cummings Insurance Services david-cummings.com+3students.ok.ubc.ca+3iMED+3

- Health Fee & MSP rules for BC international students (health fee, waiting period) Government of British Columbia

- MSP eligibility criteria & enrollment in B.C. Government of British Columbia+1

- Alberta AHCIP eligibility & application rules Alberta.ca+2Alberta.ca+2

- University of Alberta’s Health Insurance info for international students University of Alberta

- International student Health Insurance options across Canada (coverage, provincial eligibility) Edvoy+1

- Medical benefits outside BC under MSP (reimbursement rules) Government of British Columbia

- UBC Student Health & Dental (supplemental coverage) context UBC Students+2UBC Students+2

Feedback Questionnaire:

We’d love to hear from you!

Your experience helps us improve how we explain health coverage for international students in Canada. Please take 2 minutes to share your thoughts below.

Thank you for sharing your thoughts!

Your feedback helps improve support for international students navigating health coverage in Canada.

IN THIS ARTICLE

- Temporary Health Insurance Plans In Canada 2026: Essential Coverage Guide For International Students

- Private Health Insurance: Why You Need It Before Provincial Coverage Starts

- Medical Services Plan (MSP): How The Medical Services Plan MSP Works In B.C.

- Provincial Coverage: The Big Idea (It’s Not One-Size-Fits-All)

- Public Health Insurance: What It Covers (And What It Doesn’t)

- Temporary Residents: Your Step-By-Step Guide To Not Getting Caught Uninsured

- International Student Reality Check: Volume Is High, Policy Is Shifting

- International Student: What Counts As “Comprehensive Coverage” For The First 90 Days?

- Health Insurance Plans: Picking The Right Health Insurance For Your Program Length

- Public Health Coverage: Where Students Trip Up

- Hospital Care: How To Handle A Sudden Emergency

- Waiting Periods: If You Arrive Too Early (Or Too Late) For Your Default Dates

- Private Coverage: What About Dental Care, Vision Care, And Paramedical Services?

- Public Health Insurance: Ontario And Alberta Examples (So You Don’t Get Caught)

- International Health Insurance: Quotes, Costs, And What We Tell Students

- Provincial Health Coverage: Keep Your Paper Trail Tight

- Why This Matters Right Now

- Bottom Line

Sign-in to CanadianLIC

Verify OTP