- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Single-Trip Emergency Medical Travel Insurance In Canada 2026: Coverage, Benefits & Cost Guide

By Harpreet Puri

CEO & Founder

- 11 min read

- February 12th, 2026

SUMMARY

Canadian LIC explains everything Canadian travellers need to know about 2026 Emergency Medical Insurance Plans in Canada, including eligibility, coverage, rate categories, pre-existing medical condition rules, trip cancellation, deductible savings, and cost-benefit analysis. Learn how to secure reliable Emergency Medical Insurance Coverage and get the right Emergency Medical Insurance quote online before your next trip.

Introduction

Canadian travellers have never been more eager. But in 2026, the renaissance of international travel is well underway, as the number of trips is projected to match pre-pandemic levels, as per the latest travel report from Statistics Canada. What is usually left until the last minute, however, is emergency medical coverage. Single medical crises abroad can cost between $10,000 and $50,000, depending on the location and treatment. The misunderstanding of limitations within Emergency Medical Insurance Plans in Canada has caused several nightmarish cases, not the plans themselves. What is the smartest approach to protect your health and travel in 2026 within one emergency plan? This guide systematically answers all of your questions.

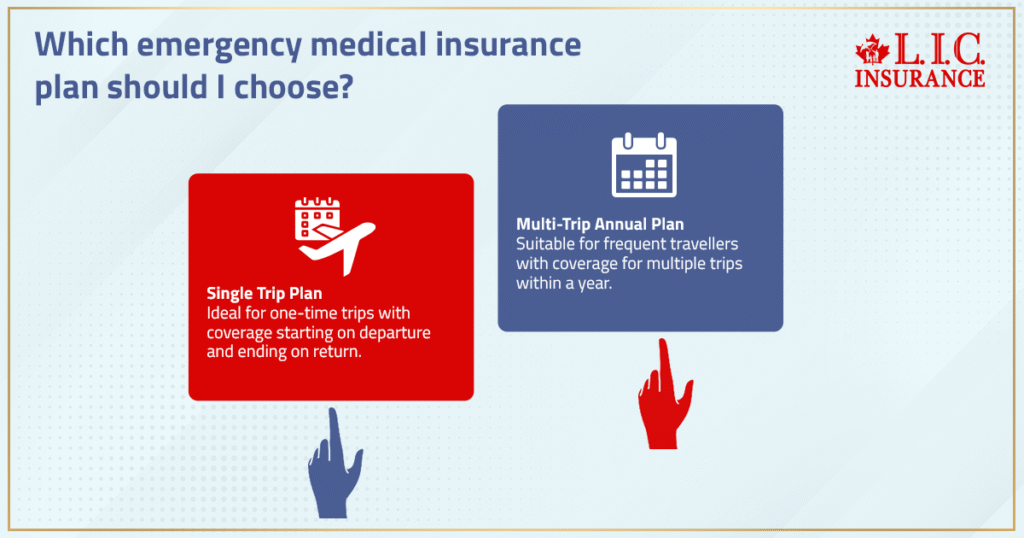

Understanding Single Trip Emergency Medical Insurance Plans in Canada

A Single Trip Emergency Medical Insurance Plan in Canada considers travellers who wish to cross the border once and return to the country after a specified period. Rather than the multi-trip annual plans, this plan covers you during a single journey—be it business, family visit, or a long-overdue vacation. The coverage always starts on your day of departure and terminates on the day you re-enter Canada. Especially for Canadians who appreciate financial security and sensible risk management, it seems wise to get clear on what you’re paying for before leaving the country. We offer responsible consumers the ability to check the effective date, the duration of their stay, and all medical plan requirements.

Eligibility Requirements for Canadian Travellers

To be eligible for most Emergency Medical Insurance Plans in Canada, applicants must be Canadian residents and covered under a provincial or Territorial Health Insurance Plan.

Eligibility Based on Age

- Under Age 60: Travellers under 60 automatically qualify for the base rate category with no medical questions required.

- Age 60 and Over: Travellers over 60 must complete a medical questionnaire before coverage is approved. The responses help determine your rate category, and ultimately, your cost.

Your answers should most accurately reflect your actual or mild medical condition – e.g., newly unstable angina symptoms, worsening lung conditions, or recent medication changes can affect eligibility or rate category, rather than automatically making someone ineligible. Our licensed advisors ask all these questions very carefully to make sure your answers fully describe you at that moment and not to give the insurer an excuse to deny the claim later.

Medical Questions and Rate Category Determination

The rate category plays a critical role in determining the cost-benefit analysis of your Emergency Medical Insurance Coverage.

Rate Categories Explained

There are typically three categories that determine your premium:

- Category A: For those with stable health and no ongoing treatments.

- Category B: For those with minor or well-controlled conditions.

- Category C: For those with certain pre-existing medical conditions that have been stable for a defined period.

Hence, the stability period permitted prior to the effective date should not be under three or six months before the effective date. If the heart condition, lung condition, or any other pre-existing condition was unstable during the period, it may not be covered in your emergency medical coverage. A thorough and brief discussion with our advisor helps give the proper rate category for you, and your pre-existing medical condition can be included from the other end.

Understanding Pre-Existing Medical Condition Rules

A pre-existing medical condition is any health issue you had before your effective date — diagnosed or not. In insurance terms, “stable” means your condition hasn’t changed significantly in the months leading up to your trip.

To be considered stable, the following must all be true:

- No new medication, dosage change, or treatment adjustment

- No new symptoms or hospital visits

- No pending test results or referrals

- No new specialist consultations

- No worsening of your condition

If your pre-existing medical condition meets these requirements, then by the definition in this sense, it is stable and can be covered. We assist our clients in screening their medical histories in light of the insurer’s definition to prevent any discrepancies. Most passengers believe they meet the definition but do not understand the word as precisely as we mentioned above: the difference of even a small change in the prescription may lead to exclusions. With respect, our advisors ensure that before you leave, you get realistic estimates of your coverage.

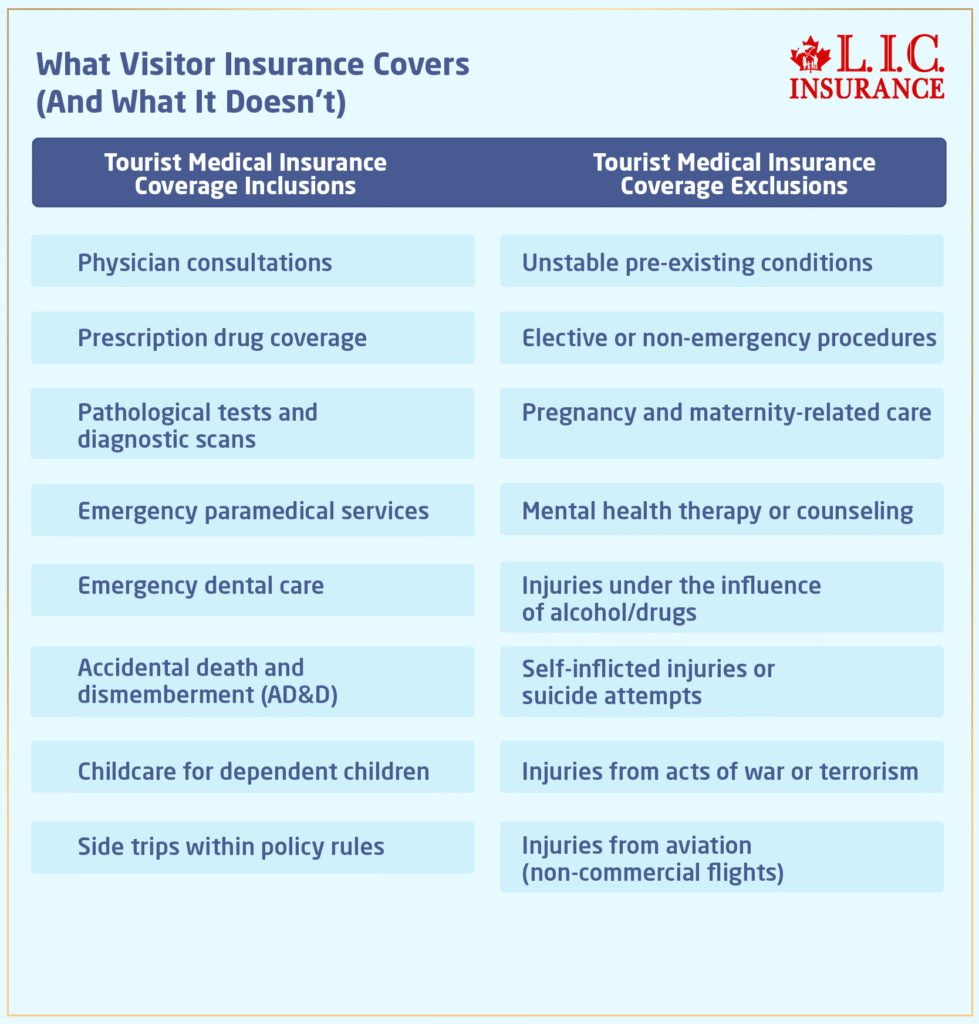

Emergency Medical Coverage Benefits

The benefits of a comprehensive Travel Emergency Medical Insurance are vast. These plans are designed to protect you from both direct costs and indirect costs associated with medical treatment abroad.

Key Coverage Benefits Include:

- Hospitalization and Physician Fees: Covers costs for hospital stays, surgeries, and treatment by licensed medical professionals.

- Paramedical Services: Coverage may include physiotherapy, chiropractic, or massage therapy, depending on your plan.

- Emergency Medical Transportation: Includes air ambulance or ground transport to the nearest appropriate medical facility.

- Prescription Medication: Covers emergency medication required during your trip due to an accident or illness.

- Dental Injury or Emergency Treatment: Protection for accidental injuries affecting natural teeth.

- Return of Deceased: In the unfortunate event of death, it covers the repatriation of remains.

When evaluating Emergency Medical Insurance for international travel, we conduct a detailed cost-benefit analysis for clients to assess coverage depth, potential exclusions, and additional costs that might apply.

Trip Cancellation and Refund Options

This is life – and sometimes, despite being well thought-out, your journey may get cancelled or interrupted. In Single Trip Emergency Medical Insurance cases, these provisions are available as elective options. They reimburse the paid costs of the trip if you are forced to cancel your journey for a valid reason and return you home if you must return home unexpectedly for unforeseeable causes. If you decide to come back earlier, you may receive compensation for the remaining portion of the premium you paid if no claims have been made; however, refund rules vary by insurer and may require written proof of early return, no claims, and insurer approval before processing. Our team checks the refund and ensures the required documents are submitted, so clients don’t have to wait later to be let down.

Extensions and Effective Date Adjustments

Travellers occasionally extend their stay, especially when trips involve family visits or business engagements. You can extend coverage before the expiry date, provided:

- You remain in good health with no new medical issues

- The total trip length remains within your government health plan’s maximum

- You pay any additional costs or premium adjustments

Coverage normally takes effect on the departure date or the effective date indicated, whichever is later, and continues or expires on the first of the return or the expiration date approved on the confirmation, as the case may be. Canadian LIC wishes to advise all clients to confirm the effective date to establish the exact date their Emergency Medical Insurance Coverage will begin the moment they leave Canada.

Deductible Options and Savings

Premium flexibility is a crucial part of smart travel planning. Every medical plan has built-in options to help you save money through deductibles or Group Coverage.

Common Ways to Save Include:

- Deductible Options: Selecting a higher deductible — such as $500, $1,000, or even $5,000 — can reduce your total costs by 10–35%.

- Family Coverage: Families travelling together can save on combined plans, with premiums often calculated based on the eldest traveller under 60.

- Travel Companion Discounts: A 5% reduction may apply when both travellers purchase plans together.

These combinations make sense for Canadian travellers seeking value without sacrificing coverage quality. Our advisors perform a tailored cost-benefit analysis to match deductible levels with each client’s risk comfort and budget.

Understanding the True Costs of Emergency Medical Plans

The total costs of Emergency Medical Insurance Plans in Canada depend on several factors — your age, trip duration, destination, and rate category.

For example:

- A 10-day trip to the U.S. for a 40-year-old might cost around $40–$80 CAD,

- While a 21-day European trip for a senior (age 68) could range between $150–$300 CAD, depending on the medical questionnaire results.

While prices can vary among companies, the value comes from how well the plan aligns with your unique health and travel needs.

We help clients evaluate the coverage and benefits before they pay, ensuring transparency and clarity from quote to claim.

When Pre-Existing Conditions Affect Coverage

Other travellers have long-term or chronic health concerns such as angina pain, a lung condition, or diabetes. In such cases, your rate category and medical plan should take this into account. Most insurers will impose a stability period, which is often three to six months before the effective date, and require that things stay the same during the specified time. If the period is not followed, then the consequence will be exclusions. We doesn’t just process your Emergency Medical Insurance quote online. We will go through every single medical definition, so you know what’s covered in Canada and what isn’t. This eliminates the possibility of claim denials because of a pre-existing condition.

The Role of Medical Professionals During Claims

During a medical emergency abroad, your claim often depends on documentation from medical professionals treating you. Having an accurate record of diagnosis, required treatment, and prescriptions is crucial.

Our advisors educate clients on what to do in these moments:

- Contact the assistance centre before receiving treatment.

- Keep receipts and written confirmation of all services and expenses.

- Verify all details before leaving the facility to prevent limitations during claim processing.

Prompt communication makes sense because failure to contact assistance services may reduce your benefits by up to 20% under some plans.

Common Exclusions and Limitations

Every Emergency Medical Insurance Plan has exclusions — circumstances not covered. The most common include:

- Travel against a physician’s advice

- Ongoing or unstable pre-existing medical conditions

- High-risk activities or sports

- Self-inflicted injuries

- Non-essential treatments or elective surgeries

Understanding these limitations helps travellers determine what coverage is right for them. We go through each exclusion with clients line by line so that there are no surprises in the event of a claim.

Cost-Benefit Analysis: How to Choose the Right Plan

Choosing the right Emergency Medical Insurance for international travel isn’t just about cost — it’s about matching your health profile to your coverage.

Factors to Consider:

- Your age and overall health

- The destination and its healthcare costs

- Presence of a pre-existing medical condition

- Trip length and activities planned

- Comfort with higher deductible levels

A good cost-benefit analysis doesn’t only focus on premium savings — it weighs potential opportunity costs and additional costs if something goes wrong.

Our goal is to ensure every Canadian traveller makes an informed decision that truly protects their finances, their family, and their trip.

Why Working with a Licensed Advisor Makes Sense

Buying Emergency Medical Insurance online may seem simple, but policy language and exclusions can be tricky. Working with a licensed advisor helps you:

- Interpret the fine print

- Verify eligibility and rate category accuracy

- Choose the most suitable deductible and coverage options

- Avoid missed disclosures that can void claims

In 2026, with travel finally back in full force, proper planning just makes more sense than ever. We are the wisest choice for Emergency Medical Insurance Coverage. Our Policy will set your mind at ease — comfortable in the knowledge that you are covered, supported, and protected if an emergency hits. Our experienced team handles every little step, from the very first quote online until a renewal promise, leading you down a transparent, straightforward path from start to finish.

More on Emergency Medical Insurance

FAQs

The name “single-trip” speaks for itself, as the insurance plan views a single trip as one continuous episode. By contrast, multi-trip insurance covers more than one departure from Canada to foreign destinations over a 12-month span. For people who only travel on special occasions, a single-trip provides the most narrowly defined coverage and eliminates additional costs. Its intended use is for vacations, business trips, or family functions that have defined beginning and ending dates.

Many travellers can be eligible due to their health conditions if they remain stable in the time frame required by the insurer. We pay close attention to any and every pre-existing medical situation to ensure proper qualification and rate category. We claim a full disclosure and protection approach without creating gaps during potential emergencies.

Starting early is reasonable since eligibility and pricing are contingent on your age, health status, and date of departure. Generally, a Travel Emergency Medical Insurance Plan can be obtained up to 180 days before the effective date. We suggest that you find coverage as quickly as possible once your travel dates are validated, to potentially save on exclusions at the final minute.

Most insurance companies: – allow you to request an extension before your existing policy ends. If your underwriting factors remain unchanged and you pay the extra premium, your Emergency Medical Insurance for international travel will not lapse. Our advisors make it easier for travellers to complete these items and confirm that their effective date has been updated.

The medical questionnaire accurately judges the rate category and premium pricing for anyone over the age of 60 who is a traveller. Additionally, the medical questionnaire is important for any pre-existing conditions, such as heart or lung conditions, that can help determine the coverage amount for each client. Our licensed advisors go over every question. Thus, a medical questionnaire is a simple way for a potential client to accurately represent their medical profile for immediate determination online when it comes to Emergency Medical Insurance.

Trip cancellation is not so common and is frequently bought as a supplemental service; therefore, it does not automatically come with basic Emergency Medical Insurance. We perform a travel inquiry to check whether it would be advisable and feasible to secure trip cancellation for the insured in case unexpected medical or family-related events take place before travelling.

Lower your total cost and keep the same protection by choosing a higher deductible. A high deductible is a compromise between the immediate savings and unforeseen out-of-pocket expenses at the time of claim. We perform the cost-benefit analysis for every client to calculate a preferred deductible option, considering the individual’s comfort with money and trip frequency.

When an emergency occurs, travellers receive 24/7 assistance from experienced medical professionals who coordinate treatment, hospital transfers, and communication with family. We partner with trusted service networks to ensure swift action and minimal stress. This real-time support ensures proper care and prevents unnecessary delays or indirect costs.

Key Takeaways

- Single Trip Emergency Medical Insurance Plans in Canada protect travellers from costly medical expenses abroad and provide tailored coverage for one continuous trip.

- Eligibility depends on age and health status; those over 60 must complete a medical questionnaire to determine their rate category and coverage eligibility.

- Having a pre-existing medical condition doesn’t automatically disqualify coverage, but stability requirements must be met before the effective date.

- Comprehensive Emergency Medical Insurance Coverage includes hospitalization, physician care, paramedical services, prescription medication, and medical transportation.

- Optional trip cancellation and trip interruption benefits can help recover prepaid expenses when unforeseen events affect travel plans.

- Deductible and family savings options can lower total costs, allowing travellers to balance affordability with adequate protection.

- Conducting a proper cost-benefit analysis ensures travellers get value from their coverage without paying for unnecessary add-ons.

- Working with licensed advisors at Canadian LIC ensures accurate medical disclosures, proper plan selection, and stress-free claim experiences.

Sources and Further Reading

- Government of Canada – Travel and Tourism: Health and Safety

https://travel.gc.ca/travelling/health-safety - Canadian Life and Health Insurance Association (CLHIA) – Travel Insurance Consumer Guide

https://www.clhia.ca - Statistics Canada – Canadian Outbound Travel Data 2026

https://www150.statcan.gc.ca - Financial Consumer Agency of Canada – Understanding Travel Insurance

https://www.canada.ca/en/financial-consumer-agency - Canadian Snowbird Association – Travel Health Insurance Guidelines

https://www.snowbirds.org - International Association for Medical Assistance to Travellers (IAMAT)

https://www.iamat.org - Insurance Bureau of Canada – Health and Travel Coverage Basics

https://www.ibc.ca - Travel Health Insurance Association of Canada (THIA)

https://www.thiaonline.com

Feedback Questionnaire:

We’re committed to making travel insurance simple, transparent, and stress-free. Your feedback helps us understand what travellers need most and how we can serve you better. Please take a moment to share your thoughts below.

IN THIS ARTICLE

- Single-Trip Emergency Medical Travel Insurance In Canada 2026: Coverage, Benefits & Cost Guide

- Understanding Single Trip Emergency Medical Insurance Plans in Canada

- Eligibility Requirements for Canadian Travellers

- Medical Questions and Rate Category Determination

- Understanding Pre-Existing Medical Condition Rules

- Emergency Medical Coverage Benefits

- Trip Cancellation and Refund Options

- Extensions and Effective Date Adjustments

- Deductible Options and Savings

- Understanding the True Costs of Emergency Medical Plans

- When Pre-Existing Conditions Affect Coverage

- The Role of Medical Professionals During Claims

- Common Exclusions and Limitations

- Cost-Benefit Analysis: How to Choose the Right Plan

- Why Working with a Licensed Advisor Makes Sense

Sign-in to CanadianLIC

Verify OTP