Let us imagine a scene together. You are walking along a beautiful mountain trail in Canada. As you take a deep breath of fresh air and enjoy the peaceful, calming feeling that comes over you, you suddenly fall down. Or, let’s say you are a brilliant student walking through the busy streets of Toronto, studying hard in a new country, and all of a sudden, you get really sick. If you are a dedicated professional in Vancouver, balancing tight deadlines and family responsibilities when an unforeseen accident disrupts the delicate equilibrium of your daily life. When things like this happen, the last thing you should be thinking about is how to use your Emergency Health Insurance.

These aren’t just hypothetical situations—they’re the real, lived experiences of countless individuals across Canada. So, you will have to make sure you have support when unexpected things happen in life.

In this blog, we will get to know real stories of real people who faced real sudden health emergencies. Their struggles will make us understand how to take care of our Emergency Health Insurance. This is similar to having a friend who will help you through hard times, like when something unexpected comes up, and your insurance is there to take care of everything.

If this sounded or seemed a little unclear at any point, and you were worried about how Emergency Health Insurance works in Canada, this is where you will get all your answers. Let us help you see things in the right way. We want you to be able to follow this knowledge shared in this blog to seek help anytime you need it, no matter where you are. We’ll go through what to do together to figure out how to make your insurance really work for you.

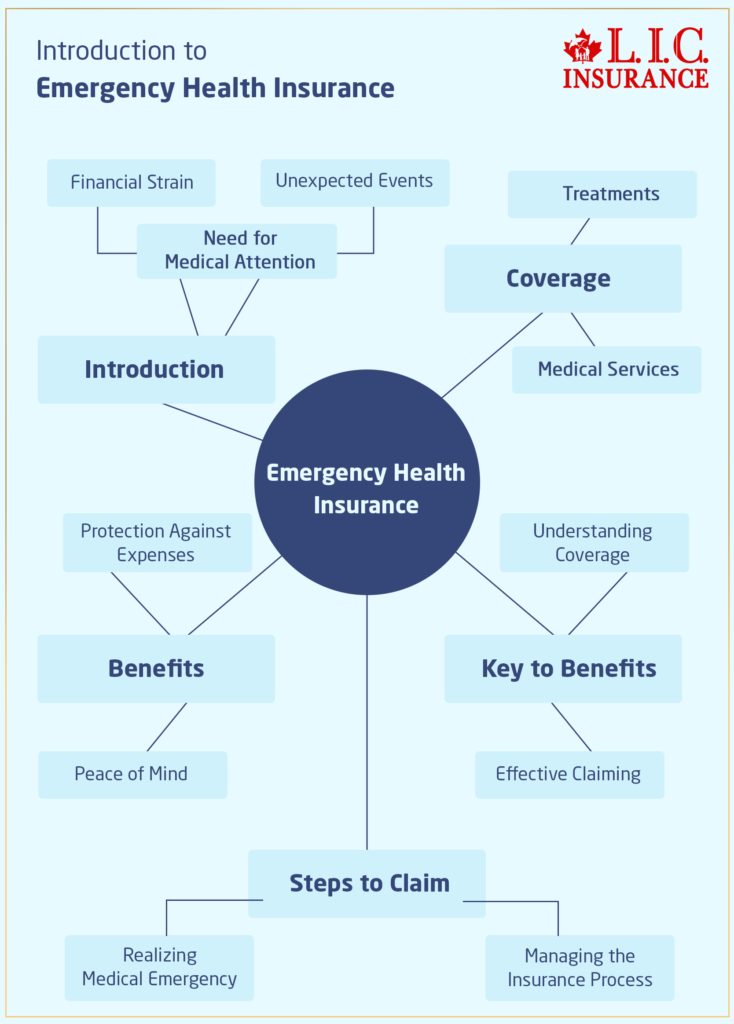

Introduction to Emergency Health Insurance

Imagine for a second that you’re on a serene hike through the Rocky Mountains or a walk along some of the old historic streets in Quebec City, and then all of a sudden, you need medical attention. No one likes to think of it, but this is exactly the time when Emergency Health Insurance is very handy. Next comes the question: What do you do next when realizing you are in a medical emergency, and how can you manage the insurance part of it? Emergency Health Insurance Plans in Canada provide you with the peace of mind that comes from knowing you’re covered for medical services and treatments that come up unexpectedly and can’t wait. The beauty of these plans lies in their ability to protect you from the financial strain of emergency medical expenses, which can be significant. However, the key to unlocking these benefits lies in understanding how to claim your coverage effectively.

Understanding Your Coverage

The first step in claiming your Emergency Health Insurance is thoroughly understanding your plan. The scope for the difference in Emergency Health Insurance is wide. It ranges from basic services that include some ambulance services to types of coverage that offer comprehensive services and even helicopter lifts or medical evacuation. Familiarizing yourself with the specifics of your plan will prepare you for an emergency and ensure you’re fully aware of the benefits that you should get.

The Claim Process: A Step-by-Step Guide

The claims process of an Emergency Health Insurance Plan does not have to be a difficult task. Let’s delve into each process to ensure traveling the path brings both comfort and confidence. Always remember, the whole point is to ensure you will get the Emergency Health Insurance Coverage you need without undue stress or confusion.

Immediate Response: Act Quickly and Wisely

After a medical emergency, there is a need to get medical help immediately. Your health and safety come first. Equally, it is very important to inform your insurance company of the occurrence as soon as possible. But then, you may wonder why that is so. Many Emergency Health Insurance Plans have specific guidelines about timely notifications to ensure your eligibility for coverage. It might seem like a very small thing, but failure in relation to the same could greatly impact the success of your claim’s process. You will understand the importance of it better with the help of Alex’s situation. Alex, a software developer from Vancouver, has recently gone on a business trip to Ottawa. During the trip, he received a light injury. The injury didn’t look that bad, but Alex went to the emergency room. He followed up on what his Emergency Medical Insurance plan had advised him from the hospital’s waiting area. This quick choice to notify his insurer not only streamlined his later claim process but also made sure that all requirements for coverage eligibility were met.”

Documentation Is Key: Your Roadmap to a Successful Claim

As they say, “the devil is in the details,” more so if one is claiming Emergency Health Insurance Coverage. This is one thing that you cannot afford not to do—gathering and organizing all the documentation pertaining to your emergency and treatments. That would be all, from hospital bills to detailed doctor’s notes to any diagnostic reports. A properly documented claim should be like a road map to your insurance provider, showing them your emergency and the treatment rendered. Marias’ story will make things very clear to you. Maria, after a health scare, kept every piece of documentation zealously, even the taxi receipt when she was driving to the hospital. Her thoroughness paid off when her Emergency Health Insurance Plan included not only the coverage of medical expenses but also an allowance for a refund concerning the cost of transportation. The example of Maria’s story shows well how important it is to have clear and full documentation, which is the base for the formation of a successful claim.

Submit Your Claim: Precision and Patience

When all the required documentation is in, filing the claim should be just about routine, correct? Not really, and this is just where precision is key. Canadian Emergency Health Insurance companies usually provide a flexible method to claim submission through their online portals, email, or even mail. In deciding the best way, it’s wise to complete the claim and all the requirements in terms of forms and documents are attached. Missing the required information on the form is one of the most common causes of delays. For example, Jamal made the claim through his insurance company’s online portal following a biking accident. He had carefully reviewed each and every point of the submission checklist and completed the form for the Emergency Health Insurance Plan to ensure that, in reality, each and every document was accounted for before he actually hit ‘submit.’ Attention to detail on his part led to a smooth and fast process of claims. Hence, it is important for you to make sure that the claim you submitted is accurate.

Follow-Up: The Bridge to Your Claim’s Resolution

Submitting your claim isn’t the end, but it’s more to take care of. Staying in touch with your insurance provider and being proactive about any additional information or documentation they may require will be vital to conclude your claim. Regular follow-ups might certainly show commitment to the claim but also fasten the process dramatically. Take the story of Li, who, after submitting her claim, made a point of checking in with her insurance provider weekly. In time, her proactive approach made it possible for her to know of a document missing, and she got that submitted without having to bear an unnecessary delay. Li’s experience brings out a very important practice of follow-up, and if that had not been done, it would have cost her a lot of time, perhaps some interest or penalty or both.

Real-Life Stories

So, now, let’s illustrate this process with the help of a story that might happen to many of you. Meet Sofia, a student from Brazil who studies in Toronto. Once, she had broken her ankle when she slipped on ice one winter. Unfamiliar with the Canadian healthcare system and worried about healthcare costs, she remembered her Emergency Health Insurance. This was, however, an experience from which Sofia said she was really scared at first, even though she managed to call her insurance company from the hospital, take all her medical papers, and file her claim with detailed explanations of the emergency from the hospital itself. All the effort had indeed paid off when, finally, full cover for her medical needs was granted. The story of Sofia should tell you how important it is to be prepared and well-informed. Nonetheless, a strict understanding of your insurance plan and following the claiming process can help eliminate these hurdles successfully.

Find Out: Why Emergency Medical Travel Insurance is important?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Conclusion: Act Today, Not Tomorrow

Emergencies do not wait for anybody; they just come. And when they come, they find one unprepared. That is the reason it is important to know how to make a claim for your Emergency Health Insurance, just in case. It’s more than having coverage; it really is about being ready to have it activated the day it’s needed. Don’t wait for an emergency to come up to understand your insurance plan. So, the time you spend now will get you very well acquainted with your coverage and keep your insurance provider’s contact information handy. Remember, in the world of Emergency Health Insurance, knowledge is not just power—it’s mental peace. By taking action today, you’re not just preparing yourself for potential emergencies; you’re also taking a significant step towards safeguarding your health and financial well-being in Canada. So, contact your insurance providers today for a review of the plan and be ready to know the whole way to claim Emergency Health Insurance. It’s a decision you won’t regret and one that could make all the difference when it matters most.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Claiming Emergency Health Insurance in Canada

Generally, a medical emergency is an unexpected illness or injury that will require instant medical treatment, and the failure to do so at the right time may cause severe injury or damage. Definitions may vary under certain Emergency Health Insurance Plans, so read your policy carefully.

Notice of any loss covered by the policy shall be given to the company immediately after the loss occurs. You will notify your insurer as soon as reasonably possible, but in any case within ideally 24 hours of the happening of the emergency, unless the state of affairs made it impracticable. Failure to give notice may prejudice your claim—please refer to your policy for specific time frames.

In general, detailed medical reports, bills, and receipts of the filled requirements availed with the emergency and treatment have to be submitted. In some instances, you may need to provide a police report, travel documents, and proof of payment. Check with your insurance provider for a complete list.

Preferences are for claims and documentation to be submitted in English or French, which can facilitate the review process. Documents in another language may need to be accompanied by certified translations. Contact your insurer for his specific requirements.

It takes some time to pay you back. As a rule, your claim will be processed a few weeks from the submission date to pay you back, although the complexity of the situation and the necessity to obtain complete documentation may take extra time.

If your claim is denied or you’re unhappy with the decision, you have the right to appeal. First, you are supposed to reconsider the reason for denial with reference to the insurance policy for the process of appealing. Typically, it will be helpful if, during the appeal, you provide additional information or documents in support of your case.

Most Emergency Health Insurance provides international coverage during the period when the traveller is outside the country. Most of them offer worldwide coverage for emergency services, but be sure to contact your insurer to check this or look for any particular difference from domestic claims.

Emergency Health Insurance Coverage is usually reserved for the insured person. Some include travel and accommodation expenses for a person accompanying if the medical condition requires. Please check with your policy for the same.

Be sure to report promptly any incidents to your insurer, maintain full and accurate documentation, and follow up regularly. Proactive management and organization through the claiming process will ensure that it is a smooth experience.

In case you have any questions or need assistance, reach out to the customer service of your insurance company. They will be able to give you the right information as per your policy that will guide you well in the process of succeeding in the claim process.

These FAQs are generally meant to assist in answering basic concerns that could be useful in streamlining your experience claiming Emergency Health Insurance in Canada, leaving you to handle the situation confidently and clearly.

Sources and Further Reading

For readers seeking to delve deeper into the intricacies of Emergency Health Insurance in Canada, understanding your rights, the processes involved, and how to navigate potential challenges is crucial. Here are some resources that can provide valuable information and guidance:

Official Government Resources

Health Canada: Explore the Health Canada website for comprehensive information on health services, including emergency care, across Canada. This site offers insights into the Canadian healthcare system’s functioning, including insurance aspects.

Canadian Life and Health Insurance Association (CLHIA): Visit the CLHIA website for resources on understanding health insurance policies in Canada. It offers guides on choosing the right health insurance plan and navigating insurance claims.

Immigration, Refugees and Citizenship Canada (IRCC): The IRCC website provides specific information for newcomers to Canada, including healthcare rights and insurance coverage options.

Educational Resources

Settlement.Org: Offering articles and guides for newcomers, this website has sections dedicated to explaining the health insurance system in Canada, including emergency medical coverage.

Canadian Healthcare Navigator: This online resource is designed to help immigrants and visitors to Canada understand the healthcare system, including emergency services and insurance coverage.

Health Insurance Providers’ Resources

Insurance Company Guides: Most insurance companies in Canada provide detailed guides and FAQs on their websites about Emergency Health Insurance Coverage. These resources can help understand specific policy details, claims processes, and contact information for emergencies.

Insurance Brokers’ Blogs and Articles: Many insurance brokers and consultants publish articles and blogs offering advice on Emergency Health Insurance in Canada. They often share insights into choosing the right plan and tips for a smooth claim process.

Legal and Consumer Protection Resources

Canadian Consumer Handbook: The Consumer Handbook offers advice on dealing with various consumer issues, including insurance policies and claims.

Provincial Health Ministries: Each Canadian province and territory has its own health ministry website with information on healthcare services, including emergency care and insurance aspects. Accessing your specific province’s health ministry site can provide localized information.

Community Forums and Expatriate Groups

Expat Forums and Social Media Groups: Online communities for expatriates in Canada often share personal experiences and advice on dealing with healthcare emergencies and insurance claims. Websites like Expat.com and various Facebook groups can be valuable resources for firsthand insights.

These sources and further reading options offer a solid foundation for understanding Emergency Health Insurance in Canada, providing both official information and community-based insights. Whether you’re a newcomer, a student, or a resident, being informed is the first step toward navigating the healthcare system confidently.

Key Takeaways

- Know the specifics of your Emergency Health Insurance Plan to use it effectively when needed.

- In a medical emergency, seek care immediately and notify your insurance provider as soon as possible.

- Collect all medical documentation related to your emergency and treatment for a smoother claim process.

- Ensure your claim submission is complete and accurate to avoid delays.

- Regularly follow up with your insurance provider after submitting your claim to expedite the process.

- Use available resources like government websites, insurance guides, and forums for additional support.

- Being prepared and informed about your insurance coverage and claim process is essential for managing emergencies.

Your Feedback Is Very Important To Us

Thank you for reading our blog on navigating Emergency Health Insurance in Canada. Your feedback is essential to help us tailor our content to better meet your needs and address common struggles. Please answer the following questions based on your experiences and how the blog has helped you:

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]