- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

RRSP Loans In Canada 2026: Benefits, Drawbacks, And Smart Strategies To Maximize Returns

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 10th, 2026

SUMMARY

RRSP loans in Canada 2026 help Canadians boost contributions to their Registered Retirement Savings Plan. The blog explains RRSP loan benefits, drawbacks, and requirements, compares RRSP loan rates, and shares investment strategies to balance risk, manage cash flow, and maximize retirement savings while keeping debt under control.

Introduction

More than 6.3 million Canadian tax-filers utilized a Registered Retirement Savings Plan in 2023, as reported by Statistics Canada. The following year, the RRSP contribution limit grew to $32,490 for 2026, up from $31,560 in 2024. According to BMO’s 2026 Retirement Survey, average RRSP contributions were on track to reach about $7,447, roughly 14% higher than 2024’s $6,512 — a projection, not final CRA data. Canadians are suited to long-term wealth-building now more than ever. However, many still have unused room for contributions, mostly because of cash flow limitations. Every day, we meet hardworking professionals who want to accelerate their retirement savings. For them, an RRSP loan in Canada can become a practical bridge between their financial goals and their limited liquidity — but only if used strategically.

“An RRSP loan isn’t just borrowing,” says Harpreet Puri. “It’s a strategy — a way to buy yourself time, discipline, and compounding growth, if you understand how the math works.”

What an RRSP Loan Really Means

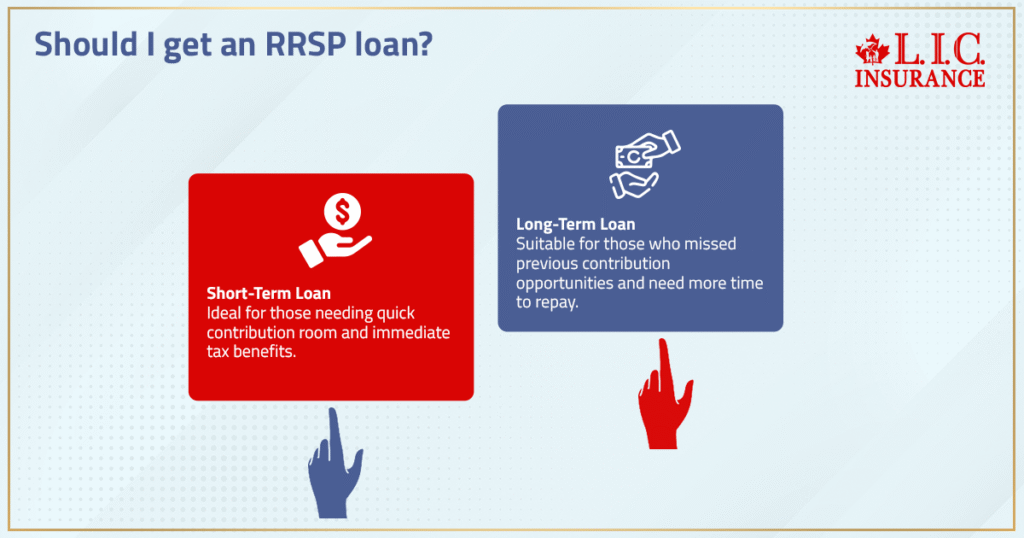

The alternative way to boost your RRSP contribution is to get an RRSP loan. It is possible to borrow money from a bank, credit union, or online lender and then contribute directly to the Registered Retirement Savings Plan. Most people prefer to choose this option in order to assemble extra contribution room quickly, reap the benefits of the tax deduction, and then purchase additional market growth inside their plan. And the RRSP contributions are essentially a tax deduction, with the larger the deposit, generating a more significant immediate refund. Finally, you may use the subsequent income tax refund to reduce the loan once more, allowing you to re-channel funds back into your future. Most banks and financial institutions provide RRSP loans with varying terms – short-term RRSP loans, which are available for a period of around 12 months, and long-term loans, which last up to 10 years. While the short-term option better addresses customers who will be paying their 2026 contribution fees in the nick of time, the long-term option helps those who missed the previous year’s acquisition opportunity.

How RRSP Loans Work in Practice

Imagine a Canadian working average earnings of $90,000 in 2026 who has $1,000 already contributed to his RRSP and still $4,000 of the unused contribution room. After he lends some money for the short term to his RRSP, the total contribution will be $5,000. As this is his excess over the last level of the tax bracket, a 40 percent marginal tax rate generates $2,000 of the refund. Even if he takes all that scraped out of the refund and repays the loan, he is left with a liability of $2,000 plus interest. With RRSP loan rates in early 2026 typically ranging from about 6.25% to 8.5%, depending on the lender, it leaves enough room for growth to exceed the borrowing cost. Inflation was hovering around 2%–2.5% through 2026, making the real return prospect better. Historically, balanced portfolios have returned roughly 5%–8% annually, though future returns are not guaranteed.

“The power is in timing,” Puri often explains. “You’re using next year’s refund to fund this year’s investment — and letting compounding start one year sooner.”

This leveraged strategy can increase investment returns over time, provided the loan fits within your cash flow and your investment portfolio remains diversified enough to absorb market swings.

RRSP Loans in Canada 2026 Benefits

1. Immediate Tax Breaks and Compounding Growth

Each RRSP dollar reduces taxable income. With 2026’s higher limit, high-income earners can enjoy greater deductions while the capital grows tax-deferred. The earlier you contribute, the longer the compounding window — meaning stronger retirement savings in the long run.

2. Catching Up on Missed Contributions

Life happens — mortgage payments, tuition, inflation. A long-term RRSP loan can help fill those gaps. Canadians who haven’t maximized their RRSP contribution room for the past few years can use one loan to invest a larger sum today and let those funds start generating dividends and profits immediately.

3. Flexible Limits and Terms

In 2026, most financial institutions are offering borrowing caps of $50,000 or more with flexible terms spanning 1 to 10 years. Some lenders even tie the rate to your credit score, rewarding responsible savers with lower interest rates.

4. Deferred Repayment Options

The standard deferred repayment grace period remains about 90 days — a window designed to let borrowers receive and apply their tax refund before the first installment. It’s a simple but effective way to pay off the loan faster and save on total interest payments.

5. No Prepayment Penalties

Nearly all RRSP loan contracts now allow early payoff with zero charges. This flexibility enables clients to adjust repayments as bonuses, refunds, or investment gains roll in.

“Flexibility is underrated,” says Puri. “When a loan lets you adapt to life’s rhythm — not the other way around — that’s when financial tools start working for you.”

The Investment Strategies Behind RRSP Loans

A loan without a plan is just debt. A loan backed by a clear investment strategy becomes an asset.

We coach clients through three proven frameworks:

- Refund Repayment Strategy: Contribute, claim the deduction, and apply the refund to lower the principal immediately. It reduces risk and interest exposure.

- Growth Leverage Strategy: Use moderate borrowing during stable interest rate periods to invest in a diversified portfolio — combining equities, bonds, and precious metals. The aim is to capture higher returns than the cost of borrowing.

- Bridging Strategy: Ideal for higher earners. Borrow now while you’re in a top tax bracket, then withdraw in retirement at a lower one. This defers taxes efficiently.

Every decision must match an investor’s risk tolerance, income predictability, and overall life goals.

How 2026 RRSP Loan Interest Rates in Canada Affect Returns

The interest rates on the RRSP loan in Canada will change to a new landscape by 2026. Following numerous hikes by the Bank of Canada in 2024, borrowing costs equalized early this year, with average RRSP loan rates around 6.25%–8.5% depending on lender and credit profile. On the flip side, inflation stabilized around 2%–2.5%, making real-return expectations easier to calculate. The stock market and balanced funds, historically, have gained 5%–8% annually, though this is never guaranteed.

“In 2026, smart leverage isn’t about chasing huge returns,” Puri adds. “It’s about using borrowed money with the same discipline you’d use your own — targeting slow, steady growth.”

RRSP Loan Requirements in 2026

Getting approved for an RRSP loan this year is straightforward but selective. Lenders typically evaluate:

- Credit Score: 660 to 680 minimum for preferred RRSP loan rates.

- Income Verification: T4S or bank statements proving repayment ability.

- Debt-to-Income Ratio: Ideally under 40 percent.

- Employment Stability: Permanent or full-time preferred.

Many banks now allow online approvals within 24 hours. We help clients compare offers and negotiate flexible limits or extended terms aligned with seasonal cash flow.

Managing Cash Flow and Debt Responsibly

The biggest reason RRSP loans backfire isn’t the market — it’s mismanaged cash flow.

A loan should complement your retirement savings, not compete with them. Budgeting for both principal and interest payments is key. We usually recommend maintaining three months of living expenses before taking on new borrowing.

“I tell clients — if you need to borrow, borrow like a professional,” says Puri. “Know your inflows, automate your payments, and treat that loan like an investment partner, not a burden.”

When structured responsibly, RRSP loans create momentum. They transform sporadic contributions into consistent wealth building.

Risks and Drawbacks in 2026

While benefits are real, there are still risks every investor should weigh:

- Debt Pressure: Even at moderate interest rates, carrying debt adds financial tension. If income dips, repayments can strain budgets.

- Market Volatility: With global markets expected to slow in late 2026, short-term losses could offset your gains while the loan remains fixed.

- Low Bracket Limitations: If you’re in a lower tax bracket, your RRSP loan benefits may be minimal after interest.

- Opportunity Cost: Pay off higher-interest credit cards or personal loans before taking on an RRSP loan.

“Leverage is like caffeine,” Puri laughs. “A little can boost performance — too much can keep you up at night.”

Smart 2026 Strategies to Maximize Returns

A few smart steps can make your RRSP loan strategy stronger:

- Diversify Your Investments: Balance across multiple asset classes to spread risk.

- Automate Repayments: Set monthly withdrawals to maintain consistency.

- Apply Refunds Immediately: Every refund dollar paid toward the loan reduces the total cost.

- Align with Flexible Terms: Choose terms that match income cycles — contractors may prefer seasonal structures.

- Review Annually: Market trends, inflation, and interest rates evolve. Adjust your investment strategy each year.

We use customized calculators comparing RRSP loan work scenarios against regular RRSP contributions to find the ideal approach for each client.

When RRSP Loans Make Sense in 2026

In 2026, an RRSP loan Canada plan is best suited for people with consistent income, high marginal tax rates, and a strong payback record. It is particularly effective when contributing up to the new $32,490 RRSP limit for 2026 or when catching up on previous unused contribution room. It is particularly effective when both getting the new $32,490 contribution limit in an RRSP loan scheme or when putting aside earlier times. If the cash flow remains steady and your assets have been structured to perform better in a balanced fashion, it is hard to compete. However, if there is any question regarding frequency or some other financial obligation involving liability, smaller, daily or monthly RRSP contributions remain a more reputable method.

“There’s no one-size-fits-all answer,” Puri emphasizes. “The smartest investors borrow only when the outcome is predictable — not hopeful.”

RRSP Loans and Your Future

The RRSP loans Canada 2026 landscape is both optimistic and cautious. While inflation is easing and the labour market is strong, more Canadians are searching for investment solutions that combine safety with the long-term creation of wealth. We’ve assisted thousands of families in responsibly using RRSP loans to turn borrowed funds into secure retirement accounts that are much more valuable over time. Ultimately, this is defined not by the loan, but by the mindset behind it – consistency, discipline, and rational decision-making, from there.

“I’ve watched clients transform their financial future simply by starting earlier,” says Puri. “Money isn’t the only thing compounding — confidence does too.”

Final Thoughts

An RRSP loan is a friend or a foe, depending on how one handles it. On the one hand, it can significantly add to contributions, save better borrowing through a tax-deductible savings advantage, and boost long-term financial well-being. On the other hand, it can mean just more debt and interest pressure. The RRSP loan can work for Canadians who wish to boost their retirement savings in 2026. One may use it, provided it is combined with good planning, reasonable repayments, and expert advice. Our advisors compare RRSP loan rates, evaluate RRSP loan requirements, and design personalized investment strategies built around your income, goals, and risk tolerance. Because the goal isn’t just to save — it’s to build a future that feels earned, stable, and free.

More on Money Back Life Insurance Policy

FAQs

Yes, in Canada, an RRSP loan can allow you to diversify your investment portfolio by including other asset classes such as bonds, ETFs, or dividend-paying equities. Withdrawal investment is suited to your risk tolerance while enabling you to increase your Registered Retirement Savings Plan balance quickly through tax-deferred investment.

In Canada, the majority of lenders offer fixed RRSP loan interest rates, so your payments remain constant. However, some financial institutions provide variable interest rates based on market variables, such as inflation. Before applying for an RRSP loan, compare several lenders’ RRSP loan rates to ensure a higher return.

If you go into default on a payment, your credit score will suffer, and your credit score may be impacted and you may lose eligibility for preferred RRSP loan rates in future years. Repayments should be coordinated with your cash flow to avoid this issue. We can assist you in selecting flexible terms that work for your financial plan to help you keep making progress towards your retirement savings objective.

Although a deferred repayment period may be helpful, delaying payments increases total interest costs. Applying your tax refund early and minimizing the deferral period helps preserve your overall investment strategy.

They can be, but you must be careful. Conservative investors can use the Canadian RRSP loan strategy to gradually contribute to the plan and invest in low-risk investments like bonds. The most important thing is to align your loan with the investor’s risk preference and avoid borrowing more than your risk tolerance allows, especially during periods of market uncertainty.

Key Takeaways

- RRSP Loans in Canada 2026 allow Canadians to maximize their Registered Retirement Savings Plan contributions, especially when cash flow is tight.

- The RRSP contribution limit has increased to $32,490 for 2026, offering greater tax-deduction potential for consistent savers.

- Borrowing through an RRSP loan Canada can make sense when investment returns are expected to outperform RRSP loan interest rates in Canada, typically ranging from 6.25% to 8.5% this year.

- Using tax refunds to repay the RRSP loan faster minimizes interest and accelerates growth inside your investment portfolio.

- RRSP loan benefits include flexible terms, deferred repayment options, and no prepayment penalties, but they still require strong cash flow discipline.

- The strategy works best for those in higher tax brackets or with unused RRSP contribution room from previous years.

- Managing risk tolerance, keeping a diversified mix of asset classes, and maintaining stable income are critical to success.

- An RRSP loan should be treated as a financial planning tool, not a quick fix — it demands patience, budgeting, and professional advice.

- Canadians with high-interest debts should clear them before borrowing for RRSP investments to avoid financial strain.

- When used responsibly, RRSP loans can turn short-term borrowing into long-term wealth, helping investors grow retirement savings faster and more efficiently.

Sources and Further Reading

- Statistics Canada (2026) – Registered Retirement Savings Plan Contributors and Contribution Trends

https://www150.statcan.gc.ca - BMO Retirement Survey 2026 – Canadians Increasing RRSP Contributions Despite Inflation Pressures

https://newsroom.bmo.com - CRA (Canada Revenue Agency) – Registered Retirement Savings Plan (RRSP) Rules, Contribution Limits, and Tax Deduction Guidelines

https://www.canada.ca/en/revenue-agency.html - RBC Wealth Management 2026 Outlook – Market Insights and Retirement Investment Strategies for Canadians

https://www.rbcwealthmanagement.com - TD Wealth Investment Outlook 2026 – Interest Rate Trends and Portfolio Growth Strategies

https://www.td.com/ca/en/investing - Fonds de Solidarité FTQ – RRSP Contribution Limit and Carry-Forward Rules Explained

https://www.fondsftq.com - National Bank Financial 2026 Insights – How Borrowing to Invest Impacts Long-Term RRSP Growth

https://www.nbc.ca/personal.html - Globe and Mail Personal Finance Section (2026) – Should You Take Out a Loan to Maximize Your RRSP?

https://www.theglobeandmail.com - Mackenzie Investments 2026 RRSP Planning Guide – Strategies to Optimize Registered Retirement Savings Plans

https://www.mackenzieinvestments.com - CPA Canada – Tax Planning and RRSP Loan Considerations for Canadian Investors

https://www.cpacanada.ca

Feedback Questionnaire:

We’d love your thoughts! Please take a minute to share your experience and challenges with RRSP loans so we can create more helpful, personalized content.

Thank you for your feedback!

Our team will use your insights to tailor future content and support to help Canadians make confident RRSP and retirement planning decisions.

IN THIS ARTICLE

- RRSP Loans In Canada 2026: Benefits, Drawbacks, And Smart Strategies To Maximize Returns

- What an RRSP Loan Really Means

- How RRSP Loans Work in Practice

- RRSP Loans in Canada 2026 Benefits

- The Investment Strategies Behind RRSP Loans

- How 2026 RRSP Loan Interest Rates in Canada Affect Returns

- RRSP Loan Requirements in 2026

- Managing Cash Flow and Debt Responsibly

- Risks and Drawbacks in 2026

- Smart 2026 Strategies to Maximize Returns

- When RRSP Loans Make Sense in 2026

- RRSP Loans and Your Future

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP