- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

RESP Vs RRSP In Canada 2025: Key Features, Pros, And Who Benefits Most?

By Harpreet Puri

CEO & Founder

- 10 min read

- November 21st, 2025

SUMMARY

RESP vs RRSP Canada 2025 is explained with a focus on key features, contribution limits, and who benefits most. The comparison highlights how a Registered Education Savings Plan supports a child’s education through grants and tax advantages, while a Registered Retirement Savings Plan reduces income tax and builds retirement wealth. Families gain clarity on savings plans, government programs, and strategies to balance education and retirement goals.

Introduction

Money decisions are never clean. People think it’s math, but it isn’t only math. It’s math plus feelings, plus timing or whatever life throws at you. And nowhere is this more evident than the penny-pinching question of whether or not to put money in an RESP for our kids, or continue to top up our RRSP.

What do you want to do with this? Same question, though every family has its own story. Income levels, debts, priorities, how in your gut do mom and dad personally feel about student loans versus their own retirement — it all changes the answer. Let’s talk it out. The business landscape is changing rapidly in Canada. But with costs rising, demand unclear, and the competitive landscape uncertain, resilience is a priority. Debt is a feature of growth, but it doesn’t have to be a liability.

How risk protection is created with loan protection insurance for business owners. They provide continuity, protect their families and ensure the security of the company’s foundation for years into the future.

We’re on a mission to help entrepreneurs protect what they’ve built. In 2025, that involves making intelligent choices choices that capture the economic benefits of business ownership without incurring the risks of a loan.

Registered Education Savings Plan (RESP) Explained

The Registered Education Savings Plan (RESP) is not a difficult animal to understand. It’s just a smidgen for a child’s education. You contribute money, and the government contributes more. Put in $2,500 a year, and the government kicks in $500. That’s the Canada Education Savings Grant (CESG). The lifetime limit is $7,200 of free government money if you can stay the course.

That $500 for the year is free money that you don’t get if you don’t contribute, period. Yes, you can catch up on some past years, but you can’t double for eternity. That’s why we tell families that if they do nothing else, aim for the $2,500 each year.

RESPs aren’t all about cash in an account. You put it to work — mutual funds, ETFs, stocks, and bonds. It compounds without being eaten into by taxes every year. If your child pulls money from an RESP for post-secondary education, the portion you contributed comes out tax-free. The growth and the grants are taxable in the child’s hands. And students typically have very little income, so almost no tax.

But what if the child does not attend school? Money isn’t wasted. Some of them can also transfer into your Registered Retirement Savings Plan (RRSP) if you have room. You are limited in the amount you can contribute, but at least the money isn’t gone.

Registered Retirement Savings Plan (RRSP) Explained

For retirement planning in Canada, the classic tool is the Registered Retirement Savings Plan (RRSP). Here’s the big hook: tax deduction.

Contribute $5,000. If your top tax rate is 30%, you receive $1,500 back after tax time. Families love that refund. But the error comes in spending it. The smart move? Rechannel to RESP or more RRSP. That’s how you multiply your impact.

Once inside the RRSP, money grows on a tax-deferred basis. Interest, dividends, and capital gains are allowed to grow tax-free until you take them out. The scheme is basic: high tax rate now, lower tax rate when you retire. Pay less overall.

The Canada Revenue Agency (CRA) dictates the limit for each year, which is 18 per cent of earned income, subject to an upper cutoff as defined by CRA. Unused contribution room is carried forward indefinitely.

RRSPs are actually way more flexible than most people think. Home Buyers’ Plan allows you to withdraw as much as $35,000 for a home. A Lifelong Learning Plan is a way to finance your own training. Both must be repaid, but they have choices.

RESP Vs RRSP – The Common Dilemma

Parents say: “Our child can get student loans, but we can’t get retirement loans.” Correct. Retirement loans don’t exist.

But here’s the other side: if your child graduates debt-free, they start life ahead. They can save, invest, and buy a home earlier. That ripple effect is powerful.

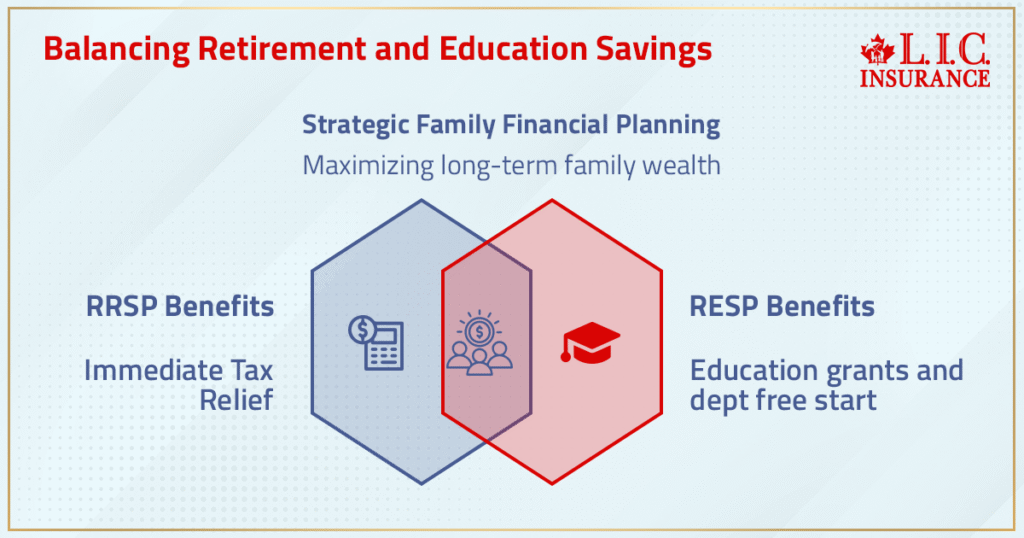

So the real answer isn’t either-or. It’s a balance. It’s timing. Do you want to shrink your income tax bill today? That’s RRSP. Do you want government grants for education? That’s RESP.

A Real Family Example

We worked with a couple—let’s call them Mike and Mindy. Both 40. Household income $150,000. One child, age five. They asked: “We’ve got $2,500. Should it go to RESP or RRSP?”

Here’s the breakdown:

- Scenario 1: RRSP – $2,500 contributed. Refund at 31.48% marginal tax rate = $787. So effectively $3,287 invested. After 15 years at 7%, around $9,048. Withdraw at retirement, after tax, about $6,200.

- Scenario 2: RESP – $2,500 contributed. CESG $500 added. $3,000 invested. After 15 years at 7%, about $8,276. Withdrawals taxed in the child’s name usually result in nothing.

RESP won. Not by miles, but enough. So what did they do? Both. They contributed to RRSP, got the refund, and dropped that refund into RESP. That’s layering. That’s optimization.

Non-Registered Accounts Vs Registered Plans

Some families ask: “Why not just invest in a regular account?”

Sure, you can. But every year, interest, dividends, and investment earnings are taxed. No shelter. No grants. That’s a big leak over decades.

Non-registered accounts only make sense after you’ve maxed out RESP, RRSP, and TFSA.

Other Programs To Keep In Mind

- Tax Free Savings Account (TFSA): Flexible. Growth and withdrawals are tax-free. Use alongside RESP and RRSP.

- Registered Disability Savings Plan (RDSP): If a child qualifies for the Disability Tax Credit, the RDSP comes with massive government grants and bonds. A game-changer for those families.

Withdrawal Rules – Don’t Forget The Fine Print

- RRSP: You can withdraw anytime. Taxes apply unless it’s through the Home Buyers’ Plan or Lifelong Learning Plan.

- RESP: Contributions can come out tax-free. Grants and growth tied to education use. If a child doesn’t pursue school, funds can shift into an RRSP up to certain contribution limits.

Who Should Prioritize What?

- RESP Benefits: Parents who want to fund their child’s education, avoid student loans, and grab government grants.

- RRSP Benefits: Higher-income families who want an immediate tax refund and to build retirement wealth.

- Both Together: The smartest path. Use RRSP contributions to reduce tax, then use that refund to contribute to RESP. Capture grants. Grow retirement. Fund education.

RESP vs RRSP Comparison Table (Canada 2025)

| Feature / Factor | RESP (Registered Education Savings Plan) | RRSP (Registered Retirement Savings Plan) |

|---|---|---|

| Primary Purpose | Save for a child’s education | Save for retirement |

| Tax Treatment on Contributions | Not tax-deductible | Tax-deductible, lowers income tax today |

| Government Support | CESG: 20% match up to $500 per year; lifetime maximum amount $7,200 | No direct grant, but contributions create tax refunds |

| Contribution Limits | Lifetime contribution limits of $50,000 per child | 18% of earned income, up to CRA annual limit; unused contribution room carries forward |

| Growth of Funds | Investment earnings grow tax-sheltered until withdrawal | Growth (interest, dividends, capital gains) grows tax-deferred |

| Withdrawals | Contributions: tax-free; grants & growth taxed in child’s income (usually very low) | Withdrawals are fully taxable as income in retirement |

| Flexibility | Funds tied to post-secondary education; some unused funds can roll into RRSP | Withdraw anytime; penalties apply unless using HBP or LLP |

| Best For | Families wanting to maximize education savings with government grants | Individuals in higher marginal tax rate brackets seeking immediate tax relief and long-term retirement planning |

| Key Risk / Limitation | The child may not pursue higher education; grants must be returned if not used | Withdrawals in retirement may affect government benefits and taxation |

| Ideal Strategy | Contribute at least $2,500 annually to grab CESG, then invest for growth | Use RRSP for tax refund, and funnel refund into RESP to capture grants (layered approach) |

Our Honest Closing Thoughts

We have said this before: RESP vs RRSP is not a battle. They are two complementary savings plans. The government already takes plenty, so when they actually give some tax advantages and free grants, why not take them up on it?

Some years you’ll contribute to RRSP, other years to RESP and some to both. Occasionally, nothing because life — car breaking down, loss of paycheck, expenses. That’s normal. The point is to stay in the game.

Families that have used these tools year after year, decade after decade — and built wealth, sent kids to school debt-free, for example, and retired with dignity. RESP and RRSP are not just accounts. They’re levers. And if you’re not drawing on them, you’re simply leaving money on the table for CRA.

FAQs

Yes, if your child wins big scholarships, you don’t lose the RESP benefits. Families can often move unused contributions into an RRSP within their contribution limits. It’s a way to keep the growth sheltered and still make the most of the RESP vs RRSP Canada advantage.

Every financial institution has its own fee structure. Some charge for account administration while others waive annual costs. Choosing the right platform can mean keeping more of your investment earnings working for your family instead of being eaten by fees.

The Canada Learning Bond is a separate government program, but it works inside the Registered Education Savings Plan. Families with lower adjusted family net income can qualify for extra grants, making RESP an even stronger part of their long-term savings strategy.

When you contribute to an RRSP and receive a tax refund, it doesn’t clash with a tax-free savings account. Many Canadians actually use that refund to top up TFSA room, building flexibility alongside retirement planning and RESP contributions for a child’s future.

Yes, unused contribution room doesn’t vanish. Parents can catch up in later years, though the CESG match is capped annually. Planning across previous years ensures no grant money is wasted and keeps your child’s education savings on track.

Withdrawals from a Registered Education Savings Plan may be considered when schools look at student aid, but it depends on the program. Grants and bursaries often take household income into account more than RESP balances. Still, families should weigh both the RESP vs RRSP Canada choices when planning.

Yes, some parents like to mix RESP with non-registered accounts for extra flexibility. The RESP handles education goals with grants, while the open account covers any costs without rules. Balancing both can reduce pressure if expenses change.

RRSP withdrawals count as income later, which may reduce certain government benefits like OAS. That’s where pairing RESP vs RRSP Canada with a tax-free savings account can help smooth retirement income tax impacts. Families benefit from using different savings tools together.

Yes, the CESG tops out once the maximum amount of $7,200 in grants is reached. Even if families contribute more to the RESP, no additional government grant is added. Understanding these details avoids surprises down the road.

The Canada Revenue Agency enforces the rules for both RRSP and Registered Education Savings Plan accounts. They track contribution limits, unused room, and ensure tax rules are applied. Families should confirm information directly with CRA before making big moves.

Yes, grandparents and even family friends can contribute to an RESP. It’s a flexible savings strategy that allows more than just parents to support a child’s education. Just be careful that total RESP contributions don’t pass the $50,000 maximum amount.

Inflation reduces purchasing power over time, which makes investing in an RESP or RRSP more important than leaving cash idle. Both savings plans give a framework to fight rising costs, though investment choices determine how well families keep pace.

Key Takeaways

- RESP vs RRSP Canada 2025 is not about choosing one over the other but about balancing both to match family goals and income levels.

- A Registered Education Savings Plan builds education funding with government grants and tax advantages for a child’s future.

- A Registered Retirement Savings Plan reduces income tax today and secures wealth for retirement through tax-sheltered growth.

- Using both savings plans together can maximize contributions, capture grants, and create stronger financial security for education and retirement.

Sources and Further Reading

- Government of Canada – Canada Education Savings Grant (CESG): Official details on eligibility, contribution rules, and lifetime maximum amounts.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-education-savings-plans-resps/canada-education-savings-programs-cesp/canada-education-savings-grant-cesg.html - Canada Revenue Agency – Registered Retirement Savings Plan (RRSP): Contribution limits, unused room rules, and withdrawal information.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans.html - Government of Canada – Registered Education Savings Plans (RESP): Comprehensive information on RESP benefits, grants, and tax treatment.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-education-savings-plans-resps.html - Statistics Canada – Tuition Fees Data: Current average tuition costs across Canada to understand rising education expenses.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3710001801 - Financial Consumer Agency of Canada – Saving for Education: Guidance on RESP, CESG, and other savings plans for families.

https://www.canada.ca/en/financial-consumer-agency/services/savings-investments/resp.html

Feedback Questionnaire:

We’d love your feedback! Please share your thoughts below so we can better understand your needs and provide resources that truly help.

IN THIS ARTICLE

- RESP Vs RRSP In Canada 2025: Key Features, Pros, And Who Benefits Most?

- Registered Education Savings Plan (RESP) Explained

- Registered Retirement Savings Plan (RRSP) Explained

- RESP Vs RRSP – The Common Dilemma

- A Real Family Example

- Non-Registered Accounts Vs Registered Plans

- Other Programs To Keep In Mind

- Withdrawal Rules – Don’t Forget The Fine Print

- Who Should Prioritize What?

- RESP vs RRSP Comparison Table (Canada 2025)

- Our Honest Closing Thoughts

Sign-in to CanadianLIC

Verify OTP