- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Multi-Trip Emergency Medical Travel Insurance For Canadians In 2026

By Harpreet Puri

CEO & Founder

- 11 min read

- December 12th 2025

SUMMARY

Canadians travelling multiple times a year can simplify protection with Multi-Trip Travel Insurance in Canada. The article explains how a single annual plan provides Emergency Medical Coverage, saves money compared to single-trip options, and covers hospital care, evacuation, and trip delays. It also highlights travel health insurance Canada eligibility, pre-existing condition stability, and how Travel Insurance coverage ensures stress-free journeys in 2026.

Introduction

Canadians are travelling further than ever — quick jaunts for work, family reunions and long weekend getaways among them, but also the occasional “let’s just go” booking that people pull off on a Thursday evening and manage to leave by Saturday morning. Travel is easier, which has not made medical costs abroad any friendlier. The cold, hard truth: Canada’s government health insurance plan does much less to help you once your body leaves your home province or the country than most think. There, in the middle, lies the place of Multi Trip Travel Insurance in your 2026 plan.

This isn’t just another policy. It’s a more intelligent way to protect all those little trips you forget to insure individually. In Canada, from LIC’s perspective, clients have saved money, simplified their year and dodged five-figure medical bills with one step: switching from a panoply of single-trip options to a Multi Trip emergency medical certificate that silently protects every eligible trip for 12 months.

Why Multi-Trip Emergency Medical Coverage Makes Sense

Here’s the pattern we see: a client flies out three or four times a year. Each time, they buy a single-trip plan, fill out forms, and pay a fresh premium. Add it up, and the total cost often exceeds a single Multi-Trip Emergency Medical Insurance Policy that would have covered every departure within the year.

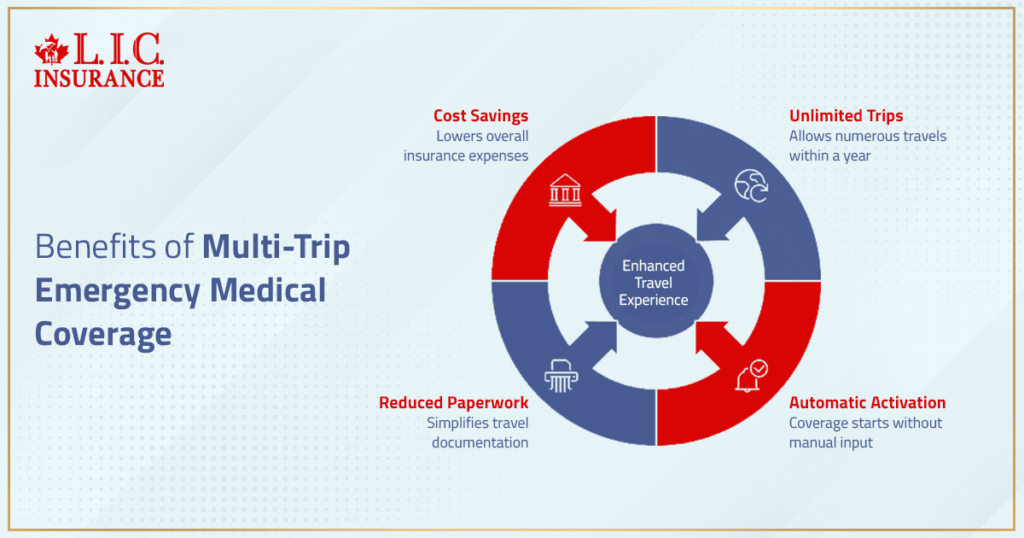

A Multi-Trip plan:

- Covers an unlimited number of trips within twelve months (subject to the per-trip day limit you choose).

- Activates automatically each time you leave home.

- Removes repetitive paperwork and cuts off stress.

- Often lowers total Travel Insurance Policy costs for frequent travellers.

If you travel two or more times a year, it’s usually the more efficient, more affordable choice.

How A Multi-Trip Policy Works

You choose your max per-trip length — typically: 4, 10, 18, 30 or a whopping 60 days. Your policy is then in place for a year. Whenever you leave (out of province or out of country), your emergency medical is triggered up to the limit you chose. When you return, it stops. It begins anew on your next departure. No reapplying. No re-quoting. No calendar math each time you book a flight.

If a specific trip takes you over this time limit, then you can purchase a top-up before your current cover expires. That means you keep that protection for the additional days and sidestep a day without coverage.

What Multi-Trip Emergency Medical Insurance Typically Covers

The right medical insurance plan is built for the medical surprises you can’t predict. Benefits often include:

- Hospital and physician services for emergency care

- Diagnostic tests, X-rays, and urgent care visits

- Paramedical services such as physiotherapy and chiropractic (when medically necessary)

- Ground ambulance and, when required, air ambulance

- Emergency dental for accidental injury to natural teeth

- Medical evacuation and repatriation (returning you home for continued treatment)

- Bringing a family member to your bedside if you’re hospitalized

- Return of dependent children or a travel companion if you cannot travel

- Meals, hotel, and incidental expenses during a covered medical delay

- Return of excess baggage and, in some cases, return of your vehicle

- Childcare or pet return when emergencies interrupt plans

Coverage limits vary by insurer, but Emergency Medical Coverage up to $10 million is common in robust Canadian plans. That ceiling is there because foreign hospital bills can escalate quickly—especially in the United States and certain overseas destinations.

Travellers who want even broader protection can also review Travel Emergency Medical Insurance Plans or get an Emergency Medical Insurance quote online to compare 2026 rates.

Understanding Pre-Existing Medical Conditions And Stability

“Pre-existing medical condition” means a condition that existed before your policy’s effective date. Coverage hinges on stability—a defined period (often three to six months) before your trip, where the condition shows:

- No new symptoms or worsening signs

- No new or changed medications or dosages

- No hospitalizations or ER visits for that condition

- No new tests ordered with pending results

- No recommended but incomplete treatment

- No planned procedures awaiting scheduling

Emergencies under a covered condition are typically included to the extent that the plan requires stable and controlled conditions. If not, then consider a personal medical underwriting plan which can insure pre-existing conditions without the stability clause. Yes, it’s more expensive, but for travellers with chronic conditions — cardiac and respiratory and diabetes-related or otherwise — it can be the difference between full protection and having a major exclusion.

Cost Drivers: What You Actually Pay For

Your premium is influenced by:

- Age and rate category

- The trip duration you select (longer per-trip limits cost more)

- Health history and any pre-existing conditions

- The deductible you choose (higher deductibles lower the premium)

- Total coverage amount and add-ons (e.g., family vs individual)

- Whether you anticipate top-ups for longer journeys

Because you’re insuring a full year’s worth of travel, Multi Trip plans often beat multiple single-trip purchases—especially for professionals, snowbirds doing several shorter visits, and families splitting travel across different months.

If you want to compare, check Emergency Medical Insurance Canada pricing and coverage limits from trusted providers or request an Emergency Medical Insurance quote online through a verified broker.

When Plans Change: Top-Ups, Extensions, And Staying Longer

Life doesn’t always respect itineraries. Planes are delayed, reunions are overdue, and a quick trip turns into 10 days. If a trip becomes longer than expected, you can buy a top-up before the existing coverage expires. Typically, if there’s no open claim and your health hasn’t changed, the extension is relatively straightforward: Pay more for slightly longer coverage and move forward protected.

All small steps that help not to create big problems. The goal is zero gaps — no days unprotected in the middle of a trip.

What To Do During A Medical Emergency Abroad

If you become sick or injured while travelling:

Call the Assistance Centre immediately. The number is on your wallet card or confirmation. Many policies require this call; failing to contact them can reduce benefits.

Follow guidance to approved facilities. The Assistance Centre coordinates with local medical professionals, pre-authorizes treatment, and often arranges direct billing with hospitals to reduce your out-of-pocket stress.

Keep documents. Save receipts, physician notes, and discharge forms. These make claims efficient and verifiable.

Stay in contact. If your condition changes, keep the Assistance Centre and your advisor updated so logistics (including potential medical evacuation) stay aligned with your recovery.

That call is more than a box to tick. It is the gateway to organized care and smooth claims.

Refunds, Effective Dates, Expiry, And Other Fine Print

A few administrative points help avoid surprises:

- Refunds: A full refund is usually available if you cancel before the policy’s effective date. After that, refunds may be prorated or limited based on whether you’ve travelled.

- Effective date vs departure date: Align them. Coverage begins on or after the effective date for each qualifying departure. Misalignment can create an unintended gap.

- When coverage ends: Typically on the earliest of your return home, reaching your per-trip day limit, or hitting your policy expiry date.

- Claims timing: Submit promptly with clear documentation. If the insurer requests more information, responding quickly keeps the claim moving.

Reading the exclusions once—especially around pre-existing conditions—is worth your time. It sets expectations and reduces post-trip confusion.

Multi-Trip Versus Single-Trip Plans: A Practical Comparison

| Feature | Multi-Trip Emergency Medical Plan | Single-Trip Plan |

|---|---|---|

| Coverage For Multiple Trips | Yes (within 12 months) | No |

| Per-Trip Duration Choice | Yes (e.g., 4–60 days) | Applies to that one trip |

| Annual Convenience | One purchase, automatic restarts | New policy for every trip |

| Cost Efficiency For Frequent Travel | Generally better after 2+ trips | Adds up quickly |

| Top-Up Flexibility | Typically available | Often limited |

| Best For | Frequent travellers, short/medium trips | Infrequent long trips |

Many clients keep a Multi-Trip Policy for their routine travel and buy a single-trip policy only for an unusually long journey.

Real-World Scenarios From Canadian LIC’s Desk

The Cross-Border Weekender:

A 45-year-old consultant from Toronto crosses into the U.S. ten times a year for client meetings. He used to buy last-minute single-trip coverage at the airport. He switched to Multi Trip and cut his annual spend while removing the “did I buy it?” anxiety before every border run.

The Grandparent Tour:

A 68-year-old grandparent visits family across provinces three or four times a year. They assumed domestic travel was “fully covered.” After a fall during a visit out west, they learned otherwise. The Multi Trip policy now covers multiple trips across Canada and abroad—no new forms, no confusion.

The Healthy-But-Honest Traveller:

A 61-year-old frequent flyer with a controlled heart condition completed the medical questionnaire in detail. Later, a medical emergency abroad required tests and a short hospital stay. Because the application matched records, the claim proceeded smoothly. Transparency at the start protects outcomes at the end.

The Current Travel Landscape: Why Timing Matters Now

Travel demand is strong, and Canadians are breaking up their travels throughout the year: snappy business runs, provincial family trips and short holidays to refresh. Enter Multi Trip Emergency Medical Insurance, which follows that pattern to a T. Meanwhile, medical prices are still on the rise overseas, and currency fluctuations can make bills grow overnight. That uncertainty is better managed with a well-structured plan from a medical perspective.

You wouldn’t fly without ID, so don’t fly without protection. A single trip to the E.R. or journey by air ambulance can cost more than years of premiums you saved. The question in 2026 is not so much “Should I insure?” as “Which structure best reflects my travel reality?”

Comparing Travel Medical Insurance benefits or exploring International Travel Insurance Plans can also help travellers identify which policy offers the best long-term value for global coverage.

Final Word: The Confident Traveller’s Advantage

Every trip is a story. Some are smooth gate to gate; others feature sudden hospital corridors and anxious calls home. A Multi-Trip Emergency Medical Policy doesn’t alter the surprises, but it does change how those moments feel — organized, supported, financially manageable.

We have a basic aim: to provide travelling Canadians with Emergency Medical Insurance Coverage for travel that reflects real life — it means being flexible for single trips and annual plans, comprehensive in coverage if disaster strikes, but sensible on cost. And when you’re ready to streamline your year and cover every departure with one call, we’ll make it easy: Let us set up the appropriate medical plan, get those dates in alignment and help you travel with peace of mind.

More on Emergency Medical Travel Insurance

FAQs

It simplifies everything. One Emergency Medical Insurance Plan for unlimited business and family trips in a year. You can take multiple trips in any calendar year, and your Emergency Medical coverage automatically resets with each new departure, as long as you stay within your chosen per-trip day limit and maintain eligibility under your provincial health plan.

Yes, most offer travelling Canucks coverage for out-of-province medical emergencies. Even within Canada, if you go to the hospital outside your home province, your government health insurance plan may not cover everything, so take along the same medical insurance protections.

In addition to medical treatment, many all-inclusive or upgraded multi-trip plans can add baggage loss, trip interruption, and meals and hotel costs. These extra safeguards transform a Multi-Trip Travel Insurance Canada policy into total coverage abroad, not just basic health services while travelling.

Absolutely. One family coverage available with one Multi Trip emergency medical policy insures all the members of your household-parents, spouse and children-and there’s no need to complete a separate application for each individual. It’s cheap Travel Insurance for Canadians who do multiple family trips in a year.

You can opt to get a top-up if your trip is longer than the limit you set for yourself before the policy runs out. The insurer merely continues to offer you Emergency Medical Coverage on the extra days. Top-ups are usually quick to arrange, allowing you to extend coverage for additional days without leaving a gap.

If your health status changes prior to departure, inform the adviser right away. A health status update could change your eligibility or rate classification. And, we help travellers to review their current medical plans and stay fully insured before they leave.

Yes, you can. There are providers that allow individual medical underwriting for travellers with pre-existing medical conditions when stability periods are not met. It’s a clever answer for Canadians dealing with ongoing medical treatment, but who still love to travel.

Not always. Even more beneficial coverage can be included in your Travel Insurance plan for trip cancellation and trip interruption. They are combined with the Multi-Trip medical policy of many Canadians for an overall travel coverage and financial protection.

Yes, most seniors are eligible for Emergency Medical Insurance through a medical questionnaire that assesses their eligibility and determines rates. Many insurers offer multi-trip emergency medical coverage to seniors, but eligibility, rates, stability rules, and maximum trip lengths are usually stricter than for younger travellers.

You can apply as early as 180 days out from your effective date. Instead, by ordering them early, you will be protected for all the trips planned this year! We always recommend starting as early as possible, so you never have your policy overlapping or leaving a gap.

Routine check-ups, elective procedures, or claims resulting from a pre-existing medical condition that was not stable are excluded under most plans. Don’t forget to look at your medical plan documents for exclusions before you travel. We can never have too much clarity before we begin our journey.

Definitely, digital nomads, consultants on the go, as well as regular jetsetters save not only time, but a lot of money. They receive full Emergency Medical Coverage for all departures with one Multi-Trip Emergency Medical Insurance Plan, without having to reapply each time.

A collective Multi-Trip Travel Insurance Canada plan is often available to group or corporate travellers. It provides common medical insurance among multiple employees, making management easier and allowing everyone to be covered under one collective policy.

Yes, generally, prescription drugs that need to be replaced or refilled before coverage ends are included if the treatment is related to an emergency. Keep the information on medication material to avoid surprises with your Travel Insurance claim.

Most insurers will also permit renewal at the 11th hour of your Multi-Trip Policy. It guarantees continued medical insurance coverage for any trip next year. Canadian LIC encourages clients to verify their renewal dates in advance so that their next adventure kicks off with protection.

Yes, there are many Travel Insurance plans if one wishes to purchase them that offer such coverage, typically referred to as medical evacuation by air or ground. These benefits will fly you to better facilities or get you home to Canada — crucial coverage most travellers never think they might need someday.

We are dedicated to pairing the right medical plan with your lifestyle—we don’t only sell policies. Our advisors tailor Travel Insurance coverage to your health, trip frequency and family requirements, so you’re guaranteed responsible protection whenever Canadians go away.

Key Takeaways

- Multi-Trip Travel Insurance in Canada offers year-round protection for frequent travellers, covering multiple trips under one annual policy.

- Plans include up to $10 million in Emergency Medical Coverage for hospital stays, ambulance services, evacuation, and medical treatment abroad.

- Eligibility is simple for most Canadian residents with a valid government health insurance plan; travellers over 60 may need a short medical questionnaire.

- Stable pre-existing medical conditions can be covered, and additional top-up coverage is available for longer trips.

- Multi Trip Plans reduce overall Travel Insurance Policy costs and eliminate the need to buy multiple single-trip plans each year.

- Families and professionals who travel frequently benefit from the convenience of automatic coverage and customizable medical plans.

- Immediate contact with the insurer’s Assistance Centre during a medical emergency ensures direct coordination with medical professionals abroad.

- Canadian LIC helps travellers match their health, trip patterns, and budget with the right Travel Insurance coverage to stay protected in 2026.

Sources and Further Reading

- Manulife Travel Insurance Product Summaries & Policy Samples (for various plan features, exclusions, and formal definitions) manulife.ca

- Manulife CoverMe Multi Trip All-Inclusive Plan (shows up to $10 million emergency medical benefits & trip duration options) coverme.com

- Allianz Global Assistance: “Multi Trip Travel Insurance for Canadians” (how Multi Trip vs single-trip plans work) Allianz Global Assistance

- TD Insurance Multi Trip Medical Plan (annual plan for unlimited trips up to per-trip limits) tdinsurance.com

- CAA Multi Trip Travel Insurance (Canadian provider offering 365-day Multi Trip coverage & top-ups) caaneo.ca+1

- Blue Cross Canada’s Travel Coverage (overview of emergency medical protection for Canadians abroad) Blue Cross of Canada

- Manulife “What You Should Know When Travelling Outside Canada” (tips on assistance, calls, international logistics) manulife.ca

Feedback Questionnaire:

IN THIS ARTICLE

- Multi-Trip Emergency Medical Travel Insurance For Canadians In 2026

- Why Multi-Trip Emergency Medical Coverage Makes Sense

- How A Multi-Trip Policy Works

- What Multi-Trip Emergency Medical Insurance Typically Covers

- Understanding Pre-Existing Medical Conditions And Stability

- Cost Drivers: What You Actually Pay For

- When Plans Change: Top-Ups, Extensions, And Staying Longer

- What To Do During A Medical Emergency Abroad

- Refunds, Effective Dates, Expiry, And Other Fine Print

- Multi-Trip Versus Single-Trip Plans: A Practical Comparison

- Real-World Scenarios From Canadian LIC’s Desk

- The Current Travel Landscape: Why Timing Matters Now

- Final Word: The Confident Traveller’s Advantage

Sign-in to CanadianLIC

Verify OTP