- Travel Medical Insurance Plans: Choose the Perfect One for Your Trip

- Understanding the Need for Travel Medical Insurance

- The Complexity of Travel Medical Insurance Plans

- Canadian LIC’s Comparative Approach

- Personalized Recommendations

- The Convenience of Online Access

- Real-Life Testimonials

- Making Your Travel Worry-Free

- Customization for Your Unique Needs

- The Freedom of Choice: Multiple Insurance Providers

- Conclusion: Empowering Your Travel Experience

Planning a trip can be an exciting yet overwhelming experience, and one crucial aspect often overlooked is Travel Medical Insurance. Canadian LIC, a leading insurance brokerage in Canada, understands the importance of ensuring your health and financial well-being while abroad. This blog explains how Canadian LIC compares Travel Medical Insurance plans, empowering you to make an informed choice and enjoy your journey with a relaxed mind.

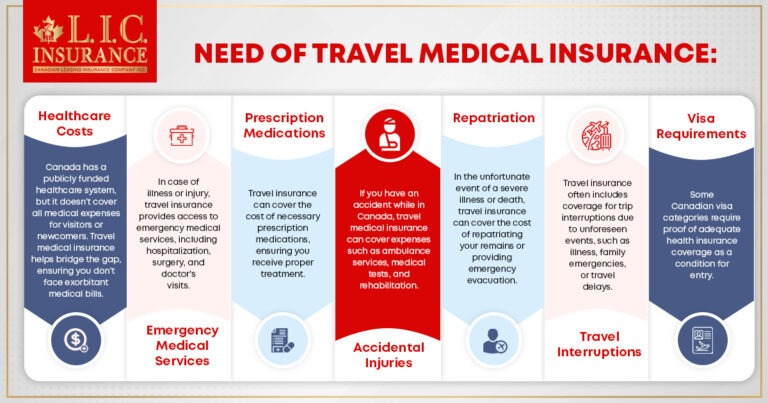

Understanding the Need for Travel Medical Insurance

Before delving into the process of securing Travel Medical Insurance with Canadian LIC, it’s essential to understand why such coverage is critical. For Canadian travelers, having provincial healthcare coverage can be a reassuring protection. However, it comes with limitations when you venture beyond the country’s borders.

When travelling abroad, your provincial healthcare plan may offer limited coverage, leaving you vulnerable to high medical costs in case of illness or injury. Additionally, expenses related to emergency medical evacuation, repatriation, or unexpected trip interruptions are typically not covered by provincial healthcare.

Travel Medical Insurance steps in to fill these gaps. It provides coverage for medical emergencies, hospitalization, medical transportation, and other unexpected incidents that can occur while you’re away from home. By securing Travel Medical Insurance, you ensure that you and your loved ones have access to quality healthcare and financial protection during your travels.

The Complexity of Travel Medical Insurance Plans

Choosing a suitable Travel Medical Insurance plan can be challenging due to the multitude of options available. Policies vary in terms of coverage, limits, exclusions, and premiums. Understanding the fine print is crucial to ensure you receive adequate protection during your travels.

Canadian LIC’s Comparative Approach

Canadian LIC simplifies the process of selecting the right Travel Medical Insurance plan by offering a comparative approach. Their experts thoroughly review multiple insurance plans from reputable providers, considering factors such as:

- Coverage Limits: Canadian LIC evaluates the maximum coverage offered by different plans, ensuring it meets your needs.

- Premiums: They analyze premium costs to find an option that fits your budget.

- Coverage Details: Canadian LIC examines the specifics of coverage, including emergency medical treatment, hospitalization, prescription drugs, and more.

- Exclusions: They highlight policy exclusions and limitations to prevent unexpected surprises during your trip.

- Additional Benefits: Canadian LIC identifies plans with additional benefits, such as coverage for trip cancellations, delays, or lost baggage.

Personalized Recommendations

Canadian LIC goes the extra mile by providing personalized recommendations. They consider your travel destination, duration, activities, and any pre-existing medical conditions to tailor their suggestions to your unique requirements. Whether you’re embarking on a relaxing beach vacation, a daring adventure, or visiting family abroad, Canadian LIC ensures you have the right level of coverage.

The Convenience of Online Access

Canadian LIC’s user-friendly online platform allows you to compare Travel Medical Insurance plans at your convenience. You can access quotes, policy details, and expert recommendations from the comfort of your home, saving you time and effort.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Real-Life Testimonials

Real-life testimonials from satisfied travellers highlight Canadian LIC’s commitment to excellence. These stories demonstrate how Canadian LIC helped travellers during challenging situations abroad, showcasing their dedication to providing reliable insurance solutions.

Making Your Travel Worry-Free

Canadian LIC’s thorough comparative approach ensures you choose the most suitable Travel Medical Insurance plan for your trip. By addressing potential concerns and risks in advance, you can embark on your journey with peace of mind, knowing that you are adequately protected.

Customization for Your Unique Needs

Every traveller is unique, with specific needs, preferences, and circumstances. Canadian LIC recognizes this individuality and ensures that the insurance plans they recommend can be customized to align with your unique requirements.

Here’s how Canadian LIC facilitates customization:

- Personalized Coverage: Canadian LIC works with you to understand your specific travel needs. This includes factors such as destination, trip duration, activities, age, and any pre-existing medical conditions. They use this information to recommend plans that can be tailored to your unique circumstances.

- Coverage Adjustments: Depending on your requirements, Canadian LIC can help you adjust coverage limits for various aspects, such as medical expenses, emergency evacuations, and trip interruptions. This ensures that your plan matches your expectations.

- Optional Benefits: Some insurance plans offer optional benefits or riders that you can add to enhance your coverage. Canadian LIC helps you explore these options and select the ones that align with your travel plans.

- Deductibles and Co-Pays: Canadian LIC provides information about any deductibles or co-pays associated with a plan. These may affect the overall cost of the plan, and they can be customized based on your preferences.

- Budget-Friendly Options: If budget is a primary concern, Canadian LIC can recommend cost-effective solutions that meet your essential coverage needs without overstretching your finances.

- Pre-Existing Conditions: If you have pre-existing medical conditions, Canadian LIC can help you find plans that offer coverage for these conditions, provided certain conditions are met.

- Family or Group Coverage: Canadian LIC takes into account the unique needs of families or groups travelling together, recommending plans that provide comprehensive coverage for all members.

Customization ensures that your Travel Medical Insurance plan is tailored to your specific needs and preferences. This level of personalization allows you to travel with confidence, knowing that your coverage aligns perfectly with your unique circumstances.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

The Freedom of Choice: Multiple Insurance Providers

One of the significant advantages of working with Canadian LIC is the freedom of choice when it comes to insurance providers. Canadian LIC maintains an extensive network of insurance providers, allowing you to access a diverse range of plans from various companies.

Here’s why having multiple insurance providers at your disposal is advantageous:

- Diverse Options: Different insurance providers offer a variety of plans with varying features and benefits. Having access to multiple providers ensures that you can explore a wide array of options.

- Competition: Competition among insurance providers can lead to more competitive pricing and better value for travellers. Canadian LIC can leverage this competition to recommend plans that offer favourable terms.

- Provider Reputation: The reputation and reliability of insurance providers can vary. Canadian LIC can recommend plans from trusted sources with a track record of quality service.

- Specialized Coverage: Some insurance providers specialize in certain types of coverage or cater to specific niches. Canadian LIC can help you find providers that offer specialized coverage that aligns with your travel plans.

- Coverage Availability: The availability of coverage can differ between providers. Canadian LIC ensures that you have access to plans that provide coverage where you need it, especially if you’re travelling to remote or less-visited destinations.

Having the freedom to choose from multiple insurance providers means that you are not limited to a single provider’s offerings. This flexibility ensures that you have access to a comprehensive selection of plans, increasing the likelihood of finding one that perfectly suits your travel needs.

The Benefits of Choosing Canadian LIC Put Together

Securing Travel Medical Insurance through Canadian LIC offers several key benefits that make the process straightforward and advantageous:

- Expertise: Canadian LIC’s team comprises experienced insurance professionals who are well-versed in the intricacies of Travel Medical Insurance. They understand the complexities of insurance plans and can provide valuable guidance.

- Access to Multiple Providers: Canadian LIC has access to an extensive network of insurance providers. This means that they can offer you a wide array of insurance plans to choose from, ensuring that you find one that suits your specific needs.

- Customer-Centric Approach: Canadian LIC places the customer at the center of its operations. They take the time to understand your travel plans, concerns, and requirements, allowing them to offer personalized insurance solutions.

- Simplified Process: Navigating the world of insurance can be daunting. Canadian LIC simplifies the process for you, providing clear explanations, assisting with paperwork, and ensuring that you have a hassle-free experience.

- Financial Security: Travel Medical Insurance from Canadian LIC provides financial security during your journey. It covers medical expenses, emergency evacuations, trip interruptions, and more, preventing unexpected costs from derailing your travel plans.

- Peace: Perhaps the most significant benefit is the peace of mind that comes with knowing you are well-protected. With Canadian LIC as your insurance partner, you can travel with confidence, knowing that you have a safety net in case of unexpected events.

Conclusion: Empowering Your Travel Experience

Choosing the right Travel Medical Insurance plan is a critical step in ensuring a worry-free and enjoyable journey. Canadian LIC, with its commitment to customer satisfaction and expertise in the insurance industry, stands as a reliable partner for Canadian travellers. Their approach to comparing Travel Medical Insurance plans simplifies the decision-making process, allowing you to make informed choices that cater to your unique needs, preferences, and budget.

With Canadian LIC by your side, you can embark on your travels with the confidence that you are well-protected. The freedom to choose from multiple insurance providers, the transparency in pricing, and the focus on customization ensure that your Travel Medical Insurance plan is as unique as your travel experiences. So, before you embark on your next adventure, remember the importance of Travel Medical Insurance, and consider contacting Canadian LIC as your trusted partner in securing the right coverage for your journey.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]