- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

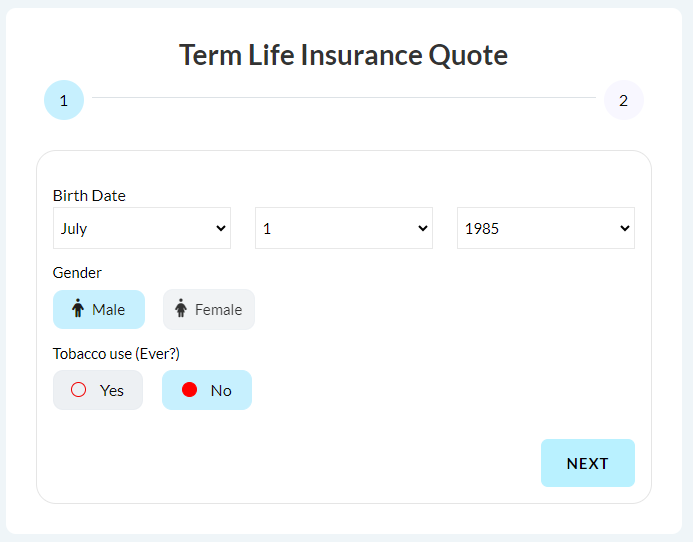

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Do You Get Money Back When You Cancel Life Insurance In Canada?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 23rd, 2026

SUMMARY

The article explains whether you get money back when you cancel Life Insurance in Canada, detailing how term and Permanent Life Insurance Policies differ, how cash value and cash surrender value work, and what surrender charges and tax implications to expect. It also highlights how Permanent Life Insurance for high earners complements RRSPs, TFSAs, and other tax-saving strategies in Canada while maintaining long-term financial protection.

Introduction

Life changes — your insurance should evolve with it.

But for many of us Canadians, it comes as an eye-opener when you learn that when you cancel your Life Insurance Policy, this doesn’t necessarily mean getting your cash back.

The Canadian Life and Health Insurance Association (CLHIA) says that there are more than 22 million Canadians who have some kind of insurance protection for death or illness. Three out of four households, to be precise. But as inflation increases and budgets grow tighter, thousands of policyholders ask the same question each year: “If I cancel my Life Insurance, do I get my money back?”

So let’s put that confusion to bed here and now — not with vague answers, but through actual insights, a multi-insurer broker in Canada celebrating over 10 years helping families take confident decisions toward their own financial health.

Understanding Your Life Insurance Policy

Every Life Insurance Policy has a form, function and financial moving part of its own. A few will give you insurance for life and a way to build savings. Others simply offer plain protection for a certain length of time.

When you buy Life Insurance, you are effectively purchasing a financial safety net — an agreement between you and the insurance company. The gist of the promise is straightforward: You pay premiums and get a death benefit if you die while the policy is in effect, with a level premium to be paid for life.

But there’s just one catch: you get your money back or a portion of it, in any case, it depends solely on the type of coverage you have — Term Life Insurance and permanent Life Insurance.

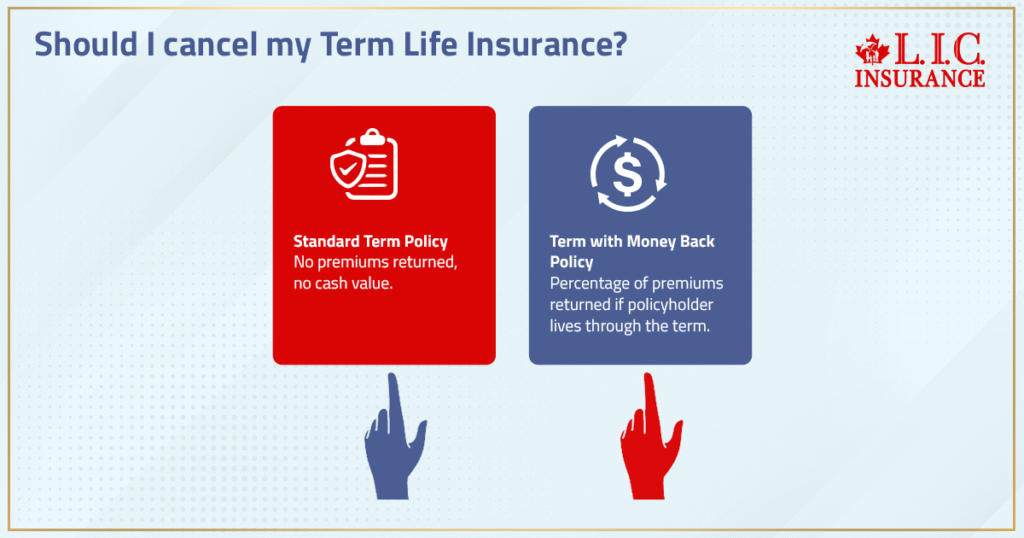

Term Life Insurance Policies: Simple, But No Refund

A Term Life Insurance Policy covers you for a set period of time, typically 10, 20 or 30 years. It’s meant to fill in a need that’s temporary, such as a mortgage, business loan or education for children.

Here’s the straight truth:

If you cancel Term Life Insurance, generally, you don’t get your premiums back. These plans are all protection and no savings.

Simple as that.” Picture car insurance. You pay monthly premiums to stay covered, and if you don’t file a claim, you don’t get refunded at the end of the year.

But a few newer offerings — such as Term Insurance with Money Back Policy — are overturning that assumption. These hybridized plans factor in regular Term Coverage and Money Back Life Insurance features, with the return of a portion of your premiums if you outlive the policy.

We can assist in comparing these options by providing real-time Money Back Life Insurance quotes online, so you actually see for yourself exactly how much cash value is potentially available if anything at all could potentially be withdrawn in the future.

Permanent Life Insurance: Where Cash Value Comes In

If you have a Permanent Life Insurance Policy, it’s a whole other ballgame.

Permanent Life Insurance, whether Whole or Universal Life, has an investing component, which is funded by monthly premiums and builds cash value over time. Part of the money you pay in premiums goes into that savings account within the policy.

Here’s what makes it powerful:

That collected cash value grows on a tax-deferred basis, which is to say that you don’t pay income tax on the growth as long as it stays in the policy.

Suppose you do decide to cancel Life Insurance. In that case, your insurer will calculate a cash surrender value (which is the amount of money you would receive back after subtracting any applicable surrender charges or administrative fees).

So yes, you can get a refund in this case. But the amount varies depending on how long you’ve had the policy and how much cash value has grown.

Whole Life: The Classic Form Of Permanent Protection

Whole Life ensures coverage for your entire lifetime, provided you keep up with the premiums. And it ensures that your cash value will increase at a specified rate, set by the insurance company.

A lot of Canadians view it as a way to mix life coverage with long-term wealth accumulation. But — and here’s the catch — if you stop premiums too soon, or cancel the policy before large cash value accumulates, you might walk away with little or nothing.

We’ve encountered cases where clients had purchased Life Insurance many years previously — in some instances, dating back to the 1980s or 1990s — and only after the passage of years discovered that they had tens of thousands in accumulated cash value with which they were completely unfamiliar.

Free Look Period: Your Short-Term Safety Window

A free look period (10 to 14 days); Every new Life Insurance Policy in Canada includes a free-look period.

This gives you an opportunity to look at your policy and determine whether it is a fit for your current financial standing. If you cancel during that period, we’ll give you a full refund of your premium payments — no questions asked.

Then, once that window has closed, any cancellation could also set off cancellation fees or deductions related to the cash surrender value — if there is one.

It is also advisable to read the policy carefully and verify if there is an opportunity for a refund before signing or cancelling.

Cancelling Term Life Insurance: What Happens To Your Money

When you want to cancel Term Life Insurance, here’s the easy answer:

You won’t get your premiums back if you’re outside your free look period. Standard Term Policies have no cash value, no policy loan and no investment features.

But if you have bought a Term with Money Back Policy (TMB), the structure is different. Some products combine a degree of insurance with savings, to return a percentage (often 75%–100%) of the total premiums paid if you live through the policy.

You’re basically pre-paying for the opportunity to receive something in return later — sort of like forced savings with a safety net attached.

Life Insurance Providers And Policy Loans

Leading Life Insurance companies, such as Sun Life, Manulife and Canada Life, provide policy loans to their clients with permanent policies.

These policy loans permit you to borrow against your growing cash value without any credit check. The insurance company puts your policy’s cash surrender value down as security.

This feature can be a lifesaver during a financial downturn by letting you get at your money without tapping into investments or retirement accounts.

But unpaid policy loans decrease your death benefit if you don’t repay them, and interest still accrues. That’s why we always suggest consulting with a licensed financial advisor or insurance planner before taking such an action.

The Role Of Your Insurance Provider In Refunds

How much you will get back through a return of premium policy is decided by your Life Insurance company and depends on the type of policy, payment history and how long you’ve held it.

If you cancel in the beginning, some insurance companies may have administrative fees or surrender charges that will reduce what you get. Others might give you the chance to convert your Term Policy into Permanent Life Insurance, thus keeping in place lifetime coverage — just not from scratch.

We carefully review your Life Insurance Policy before advising cancellation — in some cases, converting or reducing the coverage can be a better option than cancelling altogether!

Tax Implications Of Cancelling Your Insurance Policy

Upon withdrawal or surrender of Permanent Life Insurance Policies, the cash surrender value in excess of adjusted cost basis (ACB) is included as taxable income.

The excess is treated by the Canada Revenue Agency (CRA) as investment income, so accuracy in reporting is critical. That’s another reason why collaborating with an insurance specialist or financial advisor can be a good way to help ensure that you stay compliant, but also optimize your refund.

The Reality Of Surrender Charges And Fees

If your policy has sufficient cash value accumulated in it, there could be surrender charges if you cancel before a predetermined period of time has passed.

These fees tend to get lower as time passes. For instance, if you cancel it within the first five years, it may have significant deductions, but there might be none or lower ones after ten years.

That is why many policyholders opt for a partial surrender instead, in which they take some or all of the cash value while leaving the life coverage in place.

When Cancelling Might Be A Smart Move

There are legitimate situations where cancelling could make sense:

- You’ve found more affordable coverage with another insurance provider.

- Your debts or dependents’ needs have changed.

- Your policy has become too expensive due to rising monthly premiums.

But before making any decision, evaluate whether you’re forfeiting Money Back Life Insurance benefits or valuable investment components. Sometimes, keeping a smaller permanent policy or using policy loans for liquidity is a better route than walking away from your Life Insurance Coverage entirely.

How Life Insurance Works As A Long-Term Asset

A good Life Insurance Policy is not only protection — it’s a financial asset.

Your premiums don’t just evaporate into the ether. In permanent policies, they build up cash value that can be borrowed against, surrendered or allowed to grow tax-deferred.

Term Life Insurance Policies can even be layered with Money Back Life Insurance benefits, so that you don’t end up with nothing at renewal.

This is how Life Insurance works for families who prepare: blending protection with growth, flexibility and tax advantage.

Canadian LIC’s Take: Why You Should Review Before You Cancel

Over the decades, we examined thousands of cases where customers sought to cancel policies — typically in anger, not strategy. In many others, they were sitting on thousands in cash surrender value or had the option of money back, which was under their nose but unknown to them.

As an insurance broker, we work for you. While single-insurer Life Insurance providers can only shop policies from one provider, we compare across dozens – Manulife, Canada Life, Allianz, Sun Life and many others– in order to help our clients understand each refund, charge, or benefit connected with their insurance policy.

We guide clients through a careful review of their Life Insurance Policy in Canada, running cash value, policy loans and tax implications before they do anything irrevocable.

Final Thoughts — Make Every Dollar Count

It is never prudent to cancel a policy on a whim. It’s not just a question of getting money back, but whether that choice makes sense for your financial picture and your long-term goals.

If you’re uncertain whether your policy has cash back Life Insurance benefits, a surrender value, or permits taking loans from it, contact a licensed advisor.

Because in insurance — as with much else in life — the best decisions arise from having a full picture of options available before you act.

FAQs

Yes, many insurers allow you to convert your Term Life Insurance Policy into a Money Back Life Insurance Policy in Canada before the term ends. This lets your future premium payments start building cash value without new medical exams or credit checks.

If a policy loan exists, the insurance provider subtracts the owed amount plus interest from your cash surrender value. It’s wise to talk with a financial advisor first to avoid shrinking your death benefit or facing unexpected tax implications.

Not at all. Surrender charges differ based on how each Life Insurance provider structures its permanent Life Insurance Policies. We review several Life Insurance providers side-by-side so you know exactly what you’d lose—or keep—before cancelling.

Getting a fresh Money Back Life Insurance quote online helps compare Life Insurance Coverage options that fit your new financial situation. It shows whether switching to a Term Insurance with Money Back Policy could recover part of your premiums and keep you financially secure.

No, cancelling Term Life Insurance doesn’t impact your credit score directly. However, if you took automatic payments or linked policy loans to a credit line, missing those could show up later. Always confirm with your insurance provider before ending the plan.

When you surrender a Permanent Life Insurance Policy, you receive its cash surrender value. Cancelling usually ends the Life Insurance Coverage with no refund. Understanding both options helps you decide whether to keep your cash value component or exit the policy altogether.

Yes, some Permanent Life Insurance Policies let you do a partial surrender, withdrawing only part of your accumulated cash. It’s a smart way to access funds while keeping your lifetime coverage active and avoiding full surrender charges.

No, not every Money Back Life Insurance Policy in Canada guarantees returns. The refund rate depends on your insurance company, policy type, and the fixed period of coverage. Always check how the money-back benefits are calculated before signing.

Stopping premium payments can cause a policy lapse, which means you lose Life Coverage and possibly any cash value. Officially cancelling through your insurance provider ensures proper calculation of refunds, cancellation fees, or remaining cash surrender value.

Once you cancel, the investment component inside your Permanent Life Insurance stops growing. The insurance company liquidates it and pays you any eligible cash surrender amount after deducting administrative fees and surrender charges.

Absolutely. You can always purchase Life Insurance again, but the new Life Insurance Policy will use your current age and health to set premiums. That’s why advisors often compare Life Insurance quotes online before you make any changes.

The best time is during major life circumstances—marriage, retirement, or paying off debt. Reviewing your insurance policy with a licensed insurance specialist ensures you don’t lose valuable Money Back Life Insurance benefits or tax-free cash value potential.

Key Takeaways

- Cancelling a Life Insurance Policy can result in money back only if it’s a Permanent Life Insurance Policy with accumulated cash value; Term Life Insurance typically offers no refund.

- The cash surrender value is the amount you receive after the insurance provider deducts surrender charges, policy loans, and administrative fees.

- Whole Life Insurance and universal Life Insurance Policies can provide money back through partial surrenders or policy loans while keeping lifelong coverage active.

- Cancelling too early can trigger surrender charges and tax implications, especially when the payout exceeds your adjusted cost basis.

- Using a policy loan can be a smarter way to access funds from your Life Insurance Policy without losing coverage or disrupting your financial plan.

- The free look period—usually 10 to 30 days—offers a risk-free way to cancel and receive a full refund of premiums paid.

- A financial advisor or insurance specialist can help evaluate if cancellation aligns with your tax-saving strategies in Canada, especially when balancing RRSPs, TFSAs, and other investment components.

- Before deciding to cancel Life Insurance, always compare long-term benefits, cash value growth, and tax advantages with the immediate need for liquidity.

- Keeping your Life Insurance Coverage active often offers greater value than early cancellation, especially for high earners seeking tax-efficient wealth strategies.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA). Canadian Life & Health Insurance Facts, 2024 Edition. Provides industry-wide data on coverage levels, product types and cash-value trends in Canadian Life Insurance. clhia.ca+2clhia.uberflip.com+2

- Financial Consumer Agency of Canada (FCAC). “Life Insurance” consumer-information page. Explains how term and Permanent Life Insurance Policies work, including cash value and surrender issues. Canada.ca

- Assuris. Consumer-protection organization for Canadian Life Insurance Policyholders. Important for understanding what happens if a Life Insurance provider becomes insolvent, an aspect often overlooked. CDIC+1

- OmbudService for Life & Health Insurance (OLHI). Independent dispute-resolution service for life and health insurance in Canada. Useful for policy-holders reviewing cancellation rights and complaints. olhi.ca

Feedback Questionnaire:

IN THIS ARTICLE

- Do You Get Money Back When You Cancel Life Insurance In Canada?

- Understanding Your Life Insurance Policy

- Term Life Insurance Policies: Simple, But No Refund

- Permanent Life Insurance: Where Cash Value Comes In

- Whole Life: The Classic Form Of Permanent Protection

- Free Look Period: Your Short-Term Safety Window

- Cancelling Term Life Insurance: What Happens To Your Money

- Life Insurance Providers And Policy Loans

- The Role Of Your Insurance Provider In Refunds

- Tax Implications Of Cancelling Your Insurance Policy

- The Reality Of Surrender Charges And Fees

- When Cancelling Might Be A Smart Move

- How Life Insurance Works As A Long-Term Asset

- Canadian LIC’s Take: Why You Should Review Before You Cancel

- Final Thoughts — Make Every Dollar Count

Sign-in to CanadianLIC

Verify OTP