- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Canada Protection Plan Life Insurance Review 2025 Honest Insights For Canadians

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 16th, 2025

SUMMARY

Canada Protection Plan Life Insurance Review 2025 offers honest insights on simplified and guaranteed issue Life Insurance, highlighting key Life Insurance Policy benefits, Term Life Insurance Policy choices, permanent Life Insurance options, and how Canadian LIC helps compare Life Insurance quotes online with leading Canadian Life Insurance companies to secure coverage tailored to individual needs.

Introduction

The Life Insurance market in Canada has never been more crowded or confusing. As licensed advisors, we spend every day comparing Life Insurance products from Canadian Life Insurance companies. We see the marketing promises, the fine print, and the reality of claims and service. That’s why this review of Canada Protection Plan Life Insurance is different. It’s not a sales pitch. It’s an honest look at what this insurer does well, where it falls short, and who it’s truly best for in 2025.

We’ve written this so that you, a Canadian consumer, can read it and know exactly what you’re getting into before you buy Life Insurance or request a Life Insurance Quote Online.

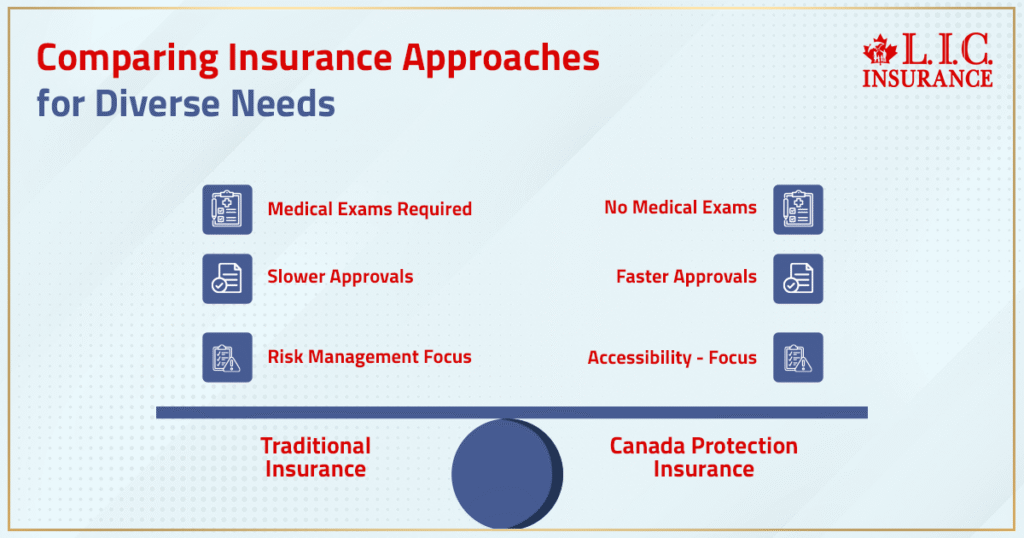

Why Canada Protection Plan Exists In The First Place

Most Canadians still think of Life Insurance as a process that involves a medical exam, blood work, and endless forms. Traditional Term Life Insurance Policies from the big brands like Sun Life or RBC Insurance work that way because underwriting is how insurers manage risk. But there’s a large group of people who don’t fit the standard model. They’ve had health issues. They dislike medical tests. They need coverage fast because of a mortgage closing or a business loan.

That’s the niche where Canada Protection Plan built its name. It offers Simplified Issue and Guaranteed Issue Life Insurance products that skip the medical tests and offer faster approvals. In other words, it’s one of the rare Canadian Life Insurance companies where your medical history and smoking status don’t automatically disqualify you or skyrocket your premiums.

What Makes Canada Protection Plan Life Insurance Different

We regularly compare Life Insurance Policy benefits across the market. Here’s what stands out about Canada Protection Plan:

- No Medical Exam Required: For most of its simplified and guaranteed plans, you answer a short health questionnaire, and you’re done.

- Fast Decisions: Approval in days instead of weeks.

- Coverage Even With Health Issues: Applicants who have been declined elsewhere often get approved here.

- Convertible Options: Term Plans can be converted to Permanent Life Insurance until age 70, which is a lifeline for clients whose health may worsen over time.

- Foresters Financial Backing: Policies are underwritten by Foresters Life Insurance Company, giving policyholders access to member benefits like scholarships, grants, and emergency assistance.

This blend of speed, access, and Life Insurance Protection makes Canada Protection Plan appealing to a lot of people who otherwise wouldn’t be able to get coverage.

The Products: Term, Whole Life, And More

Term Life Insurance Policy Options

Canada Protection Plan isn’t a single product; it’s a suite. On the Term Life Insurance side, you’ll see names like Deferred Elite Term, Simplified Elite Term, Preferred Term, Express Elite Term, and Preferred Elite Term. Each one is built for a different health profile and coverage need.

- Deferred Elite Term: For hard-to-insure applicants. Coverage up to $350,000 with a two-year limitation on the death benefit for non-accidental death.

- Simplified Elite Term: For relatively healthy applicants who don’t want a medical exam. Coverage up to $500,000, no waiting period.

- Preferred Term: For good-health applicants who want faster approval than traditional underwriting. Coverage up to $1,000,000.

- Express Elite Term: For excellent health, with up to $750,000 coverage for ages 18–50.

- Preferred Elite Term: Fully underwritten with medical exam; up to $1,000,000 coverage for those willing to go through traditional underwriting.

All these term plans are renewable to age 80 and convertible to Permanent Insurance until age 70. Terms of 10, 20, 25, and 30 years are available, plus a 25-year decreasing option ideal for mortgage protection.

Whole Life And Permanent Insurance

Beyond Term, Canada Protection Plan offers small-face-amount Whole Life Insurance and Permanent Life Products aimed at final expenses and estate planning. Coverage starts as low as $10,000, a common amount for funeral expenses, and policies are Guaranteed Issue for those with significant health challenges. These can provide a modest cash value component, and because they’re underwritten by Foresters, they carry the same member benefits.

Critical Illness And Other Products

In addition to Life Coverage, Canada Protection Plan sells four different Critical Illness Insurance Policies: Cardiac Protect CI, Cancer Protect CI, Cardiac & Cancer Protect CI, and Cardiac OR Cancer Protect CI. These provide lump-sum benefits for serious health events and can be paired with Life Insurance to round out a protection plan.

They also offer Travel Insurance and Health & Dental Coverage through partnerships (like Manulife) and even a hospital cash benefit. This makes them more than a single insurance company; they’re positioning themselves as a flexible insurance provider for Canadians with different needs.

Pros And Cons Of Canada Protection Plan Life Insurance

Pros

- Multiple products offering simplified, no-medical coverage for applicants across all health categories.

- Quick online application with digital e-policy.

- Convertible to Permanent Coverage until age 70.

- Accepts temporary residents, such as students and workers, not just citizens.

- Annual premiums payable by credit card.

- Decreasing Term option for Mortgage Debt Coverage.

Cons

- Premiums can be higher than traditional underwriting if you’re in excellent health. You’re paying for convenience.

- Coverage tops out at $1 million, which may be low for high-income families or business owners.

- Coverage ends at age 80 instead of 85 like some competitors.

We’re upfront about these trade-offs. For clients who value speed and simplicity over rock-bottom premiums, Canada Protection Plan is often worth it. For those in perfect health looking for the lowest Life Insurance Rates, we often quote other carriers alongside Canada Protection Plan to show the difference.

Who Should Consider Canada Protection Plan Life Insurance

From our experience as an insurance broker handling hundreds of applications, Canada Protection Plan is best suited for:

- People with pre-existing health issues or lifestyle risks who’ve been declined elsewhere.

- Applicants who need coverage fast and don’t want a medical exam.

- Families planning for final expenses who want small-face-amount Whole Life Plans without underwriting hassle.

- Canadians who like the idea of converting to Permanent Life Insurance later but can’t qualify for it now.

It’s less ideal for:

- Young, healthy applicants can qualify for a fully underwritten term at much lower premiums.

- High-net-worth families needing more than $1 million in coverage or advanced Life Insurance Products like corporate-owned policies with large cash value growth.

How Much Does Canada Protection Plan Life Insurance Cost In 2025?

Premiums vary by age, gender, product, and smoking status. As a reference point, non-smoker rates for $500,000 coverage under the Simplified Elite Term plan range from about $77/month for a 25-year-old male to over $600/month for a 60-year-old male. Female rates are lower.

Because the Life Insurance Premiums are higher than fully underwritten products, we always run multiple quotes across different Canadian Life Insurance Companies to show our clients the real spread. You can request a Life Insurance Quote Online and see Canada Protection Plan alongside Sun Life, Empire Life, Equitable Life, BMO Insurance, and others in seconds.

Comparing Canada Protection Plan With Other Canadian Insurers

When clients ask us about the best Life Insurance companies, we don’t give a one-size-fits-all answer. We evaluate financial strength, claims history, underwriting philosophy, and member benefits.

- Foresters/Canada Protection Plan: Great for simplified and guaranteed issue Life Insurance.

- Sun Life, Canada Life, Empire Life, RBC Insurance: Great for traditional fully underwritten term and Universal Life Insurance with larger death benefits and cash value accumulation.

- Equitable Life, IA Financial Group, BMO Insurance: Niche players with competitive rates for specific demographics.

Each insurance company has its place. Our job is to match you with the right insurance company for your needs, whether that’s Canada Protection Plan, Canada Life Assurance Company, or another provider entirely.

What We Like Most: Member Benefits And Flexibility

One underrated feature of Canada Protection Plan Policies is the connection to Foresters Financial. Policyholders gain access to scholarships, grants, community volunteering programs, and emergency assistance. These are real benefits that add value beyond the basic death benefit.

Flexibility is another plus. Being able to convert Term to Permanent Coverage later without a medical exam is a huge advantage for clients whose health may change. It’s an example of how Simplified Issue Policies can still offer long-term planning options.

Our Verdict On Canada Protection Plan Life Insurance For 2025

We rate Canada Protection Plan as one of the top choices in the Life Insurance space for hard-to-insure applicants and anyone who wants quick, convenient coverage. It’s not the cheapest option if you’re in perfect health, but it’s often the only option for those with pre-existing conditions, and it delivers on its promise of accessibility.

We’ll continue to monitor financial stability and product updates, but as of 2025, Canada Protection Plan remains a reliable insurance provider with a strong niche in the Canadian market.

How Canadian LIC Helps You Choose

Choosing a Life Insurance Plan isn’t just about premiums. It’s about fit, flexibility, and future planning. We:

- Compare Life Insurance Quotes from dozens of carriers in real time.

- Evaluate your medical history and lifestyle to match you with the right underwriting category.

- Explain the pros and cons of Term, Whole Life, and Universal Life in plain language.

- Show you how to blend term and Permanent Life for cost-effective long-term coverage.

- Provide ongoing service for policy changes, Life Insurance Claims, and Disability Insurance needs.

When you book a call with our licensed advisors, you’ll get unbiased advice from professionals who have placed thousands of policies across different insurance companies.

Ready To See Your Options?

If you’re considering Canada Protection Plan Life Insurance or any other Life Insurance Products in 2025, we invite you to compare quotes with us. Our team understands the nuances of Term Life Insurance Coverage, Permanent Life Insurance, and Guaranteed Issue Life Insurance, and we’ll help you make a choice that protects your family without overpaying.

Call us at 1-416-543-9000 or Schedule a Consultation Online.

Final Words On Canada Protection Plan Life Insurance

- Canada Protection Plan specializes in No-Medical and Simplified Issue Life Insurance — perfect for people with health challenges or who want fast coverage.

- Term Products go up to $1 million and are renewable to age 80 and convertible to Permanent Insurance until age 70.

- Premiums are higher than fully underwritten policies from other Canadian Life Insurance Companies, but you’re paying for speed and access.

- Underwritten by Foresters Financial, giving policyholders unique member benefits.

- We can help you compare Life Insurance Quotes Online across all major carriers, including Canada Protection Plan, so you can pick the plan that truly fits your needs.

More on Life Insurance

- Simplified Vs. Guaranteed Issue Life Insurance: Choosing What Truly Fits You

- Tax Shelter Or Lifeline? Understanding Permanent Life Insurance For High Earners

- 7 Common Life Insurance Mistakes To Avoid

- Universal Life Insurance Plan Vs Term Life Insurance Plan

- Is There A Limit To a Whole Life Insurance Policy?

FAQs

Canada Protection Plan processes Life Insurance claims through Foresters Life Insurance Company, which gives access to specialized support teams.We guide policyholders during complex claims so that benefits like the death benefit or critical illness riders are paid promptly.

Yes. Even though coverage amounts are smaller, a Permanent Life Insurance Policy from Canada Protection Plan can be structured to cover funeral expenses or leave a modest estate gift. Our advisors show how to combine this with other Canadian Life Insurance Companies for a larger legacy plan.

Guaranteed Issue Life Insurance has no health questions at all, which can be vital for clients with severe health issues or pre-existing conditions. It costs more than a simplified issue, but for some families, it’s the only way to secure Life Insurance protection quickly.

We run side-by-side Life Insurance Quotes Online from Canada Protection Plan, Sun Life, Empire Life, RBC Insurance, and more. This lets you see how much Life Insurance each provider offers, which policy benefits fit your goals, and which Life Insurance Policy truly meets your budget.

Key Takeaways

- Canada Protection Plan Life Insurance remains the strongest option in 2025 for Canadians who want simplified or guaranteed issue Life Insurance without a medical exam.

- The company’s mix of Term Life Insurance Policy choices and small-face-amount permanent Life Insurance plans fills a unique gap that many other Canadian Life Insurance companies don’t address.

- While premiums can be higher than fully underwritten products, the speed, flexibility, and Foresters’ member benefits often outweigh the extra cost for clients with health issues or urgent coverage needs.

- Our advisors help you compare Life Insurance quotes online across Canada Protection Plan, Sun Life, Empire Life, RBC Insurance, and Canada Life Assurance Company so you can secure the right Life Insurance Policy benefits for your family.

Sources and Further Reading

- Foresters Financial – Underwriter for Canada Protection Plan

https://www.foresters.com/en-ca

(Provides corporate background, member benefits, and financial strength details.) - Canada Protection Plan – Official Site

https://www.cpp.ca/

(Shows product brochures, term and whole life coverage details, and application processes.) - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca/

(Offers general information on Canadian Life Insurance companies, consumer guides, and market trends.) - Financial Consumer Agency of Canada – Life Insurance Guide

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html

(Government consumer resource on understanding Life Insurance Policies, term vs permanent, and choosing providers.) - Insurance Bureau of Canada – Life & Health Section

https://www.ibc.ca/on/insurance/life-health

(Explains types of Life Insurance products and tips for evaluating financial stability.) - Canadian Life Insurance Reviews (Independent)

https://insurancemarket.ca/life-insurance/

(Independent reviews and comparisons of Canadian Life Insurance companies.)

Feedback Questionnaire:

We value your input. Please share your experience and challenges so we can improve our guidance.

IN THIS ARTICLE

- Canada Protection Plan Life Insurance Review 2025: Honest Insights For Canadians

- Why Canada Protection Plan Exists In The First Place

- What Makes Canada Protection Plan Life Insurance Different

- The Products: Term, Whole Life, And More

- Pros And Cons Of Canada Protection Plan Life Insurance

- Who Should Consider Canada Protection Plan Life Insurance

- How Much Does Canada Protection Plan Life Insurance Cost In 2025?

- Comparing Canada Protection Plan With Other Canadian Insurers

- What We Like Most: Member Benefits And Flexibility

- Our Verdict On Canada Protection Plan Life Insurance For 2025

- How Canadian LIC Helps You Choose

- Ready To See Your Options?

- Final Words On Canada Protection Plan Life Insurance

Sign-in to CanadianLIC

Verify OTP