- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Why Investors Prefer Tax-Free Savings Accounts To Registered Retirement Savings Plans In Canada

By Pushpinder Puri

CEO & Founder

- 15 min read

- April 23th, 2025

SUMMARY

The blog explains why more Canadians now prefer Tax-Free Savings Accounts (TFSAS) over Registered Retirement Savings Plans (RRSPS). It covers income trends, tax benefits, withdrawal rules, and government benefit impacts. Through client stories and expert guidance, it highlights how TFSAS offer greater flexibility, tax-free growth, and accessibility, making them a better fit for many investors in today’s financial climate.

Introduction

TFSA vs. RRSP—A Decision More Canadians Are Rethinking

Each week, we hear from people who are trying to make the best choices for their future. Most are self-employed, salaried, part-time workers, or just starting to invest. A question that comes up repeatedly is, should I invest in a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP)?

What was once a simple answer is no longer that simple.

The reality is that far more Canadians are now inclined toward Tax-Free Savings Accounts as opposed to Registered Retirement Savings Plans, particularly when reflecting on their income streams in recent years. And this pivot is supported by fresh data from Statistics Canada that indicates evolving wage trends across provinces and age cohorts.

The 2023 national median income stood at $47,650, only a fairly meagre 1.1% higher than the figure for 2022 after inflation. In Newfoundland and Labrador and Nova Scotia, wages increased somewhat better, but Yukon, Alberta, and the Northwest Territories experienced declines. The group that experienced the largest income gain? Seniors aged 65–74, with wages that increased by 12.1%.

So, how is any of this related to TFSAS and RRSPS?

Everything.

At Canadian LIC, we see clients every day who are re-evaluating how they save and invest. How you choose to grow your money — and shield yourself from taxes, if possible — matters whether you make a bit more or less this year. And this is where the transition from RRSPS to TFSAS starts.

TFSAS Are Gaining Ground: The Flexibility Canadians Want

We’ve seen a very sharp shift in the conversations. Clients are now asking about how quickly they can access their savings, what tax implications are associated with withdrawals, and how they can balance short-term and long-term needs.

Here’s the thing: the TFSA answers more of those questions than the RRSP does.

Let’s look at why:

- Withdrawals Are Tax-Free and Re-Contributable

Many of our clients are attracted to the idea that money withdrawn from a TFSA is tax-free. A single mother in Scarborough said, “I had to draw on $6,000 for home repairs. If it were in my RRSP, I’m getting hit hard. “But since it stayed in my TFSA, I didn’t lose anything to tax.”

That ability to withdraw money when you need it — and contribute it back the following year — makes a significant difference, especially for middle-income households.

2. No Impact on Government Benefits

If clients collect Old Age Security (OAS) or Guaranteed Income Supplement (GIS), withdrawals from RRSPS can boost their taxable income and lower benefits. But RRSPS can affect these benefits, whereas TFSAS don’t. That’s great news for older Canadians preparing for retirement.

One retired couple, who did not want to be identified, live in Windsor and told me they moved their emergency fund into a TFSA precisely so it would not affect their GIS eligibility. “It’s just logical,” they were saying.

Why RRSPS Are Losing Appeal Among Some Investors

It’s not that RRSPS are bad. For certain income levels—especially higher ones—they can offer powerful tax advantages. However, when you consider that the median wage in 2023 was $47,650, RRSPS lose some of their edge.

Here’s why:

1. Tax Deferral Doesn’t Always Work in Your Favour

Essentially, RRSPS allow you to take a tax deduction on your contributions. That’s a good thing if you’re in a high tax bracket today and expect to be in a lower one in retirement. But what if your income does not decrease — or even increase?

One teacher we helped out in Saskatoon discovered her pension pushed her into the same tax bracket in retirement. So she pursued a TFSA — a tax-free savings account — so she would not be taxed on withdrawals later.

2. Withdrawals Are Fully Taxable

There are consequences, though: with RRSP withdrawals, unlike TFSAS, the money is treated like income. It is not very convenient if you require immediate cash. One client, a small business owner from Calgary, took $20,000 out of her RRSP during the pandemic and was dismayed to see how much went to tax. “It felt like I was being punished for being able to access my own savings,” she told us.

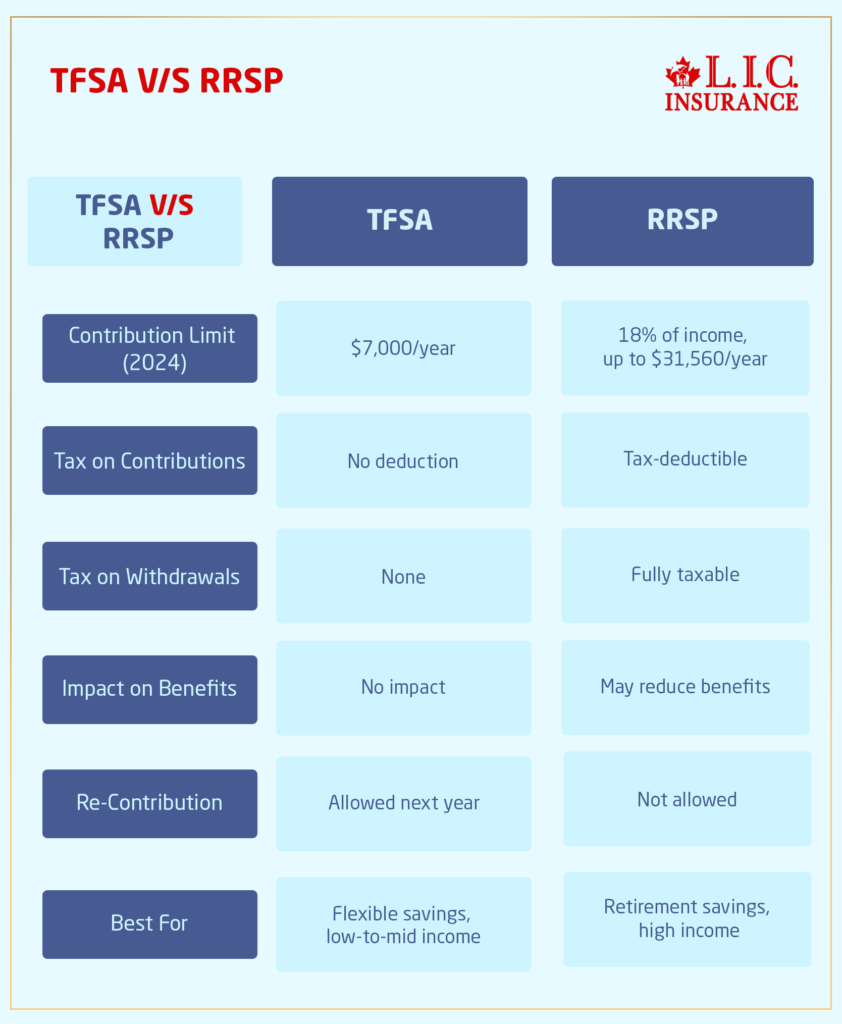

Comparing TFSA and RRSP: What We Explain to Clients

We regularly walk our clients through comparisons based on their income, age, family situation, and future plans. Here’s a simplified breakdown that helps people decide:

TFSA V/S RRSP

Canadians Are Adapting to Changing Wages

The pattern of income across the country is not uniform, as the new Statistics Canada reports confirm:

- In Newfoundland and Labrador, there was a 4% wage growth (as much as $40,000)

- Nova Scotia was next with a 3.9% increase to $42,490

- By contrast, Yukon fell 1.4% to $59,950

- The median income in Alberta dropped to $50,670

And these changes have an impact on saving choices. If an Alberta software engineer suspects their income will fall next year, they might hesitate to lock money away in an RRSP. Likewise, a Canadian in the Maritimes may now have enough growth in income to justify saving more, but they want flexibility, not future tax headaches.

We hear about uncertainty in their industries, from mining to agriculture, from our clients in Saskatchewan and the Territories. That uncertainty is precisely why so many people are opting for the accessibility of TFS.

Planning for the Future: Why Younger Canadians Prefer TFSAS

Younger investors—especially those in their 20s and 30s—are driving much of the shift toward TFSAS. In our daily conversations, we see a few patterns:

- They want flexibility.

- They expect their incomes to grow over time.

- They’re unsure where they’ll be living or working in five years.

The TFSA is, therefore , a safer, more flexible savings vehicle.

One of our clients, a 27-year-old freelance graphic designer living in Toronto, put it nicely: “I don’t want my savings locked up. I might have to relocate, return to school, or assist my parents. A TFSA allows me to do that without being penalized.”

It’s a type of freedom that doesn’t compare well with an RRSP, better geared toward long-term, stable-income savers who are sure they’ll be retiring to a lower tax bracket.

TFSA Contribution Strategies That Actually Work

A lot of our clients ask, “What’s the best way to use my TFSA?” Here’s what we often recommend:

1. Start with Emergency Savings

It’s helpful to create a buffer before investing. Now may be a good time to put 3–6 months of living expenses into your TFSA. That way, you won’t need to borrow or deplete other investments if something happens, such as a job loss, medical bill or a car repair.

One couple we worked alongside in Regina did just that. When they had to replace their furnace halfway through winter, they accessed their TFSA without any tax penalty. They even dubbed it their “financial shock absorber.”

2. Invest the Rest for Growth

Once you’ve got your emergency fund, put the rest of your TFSA to work. You can hold:

- Stocks

- ETFs

- Mutual funds

- Bonds

- GICs

And the best part? All the growth is tax-free. We’ve seen clients turn $20,000 into $30,000 over a few years—all without paying a cent in taxes.

3. Automate Contributions

Whether you earn $2,000 or $10,000 a month, contributing a little regularly adds up. One of our clients in Ottawa set up a $100/month automatic transfer. “It’s like a Netflix subscription,” he joked. “But future me is going to love it.”

So, if you’re earning the average income in Canada of $62,800, you may only have around $13,000–$18,000 left annually after expenses—before taxes and long-term savings.

That’s not much. And for families with children, mortgage payments, or aging parents to care for, the margin shrinks even more.

What About High-Income Earners? When RRSPS Still Win

Insurance isn’t an optional line item—it’s a financial backstop. But we get it. When you’re attempting to spread your income over all of your bills, a few hundred dollars a month for insurance can start to feel like a burden.

As one of our Mississauga clients—a single mom working in healthcare—told us: “I want to cover my son, but I also want to keep the lights on.”

This is the point at which planning becomes really important. Utilising a cheap term life and critical illness plan, we showed that her annual income would be bolstered by insurance. It cost her around $68/month. That’s $816 a year.

Yes, it’s an added cost. But now, she has financial protection that could change her child’s future if something happens to her.

That’s how LIC does business with its clients, linking income with priorities. We explain how to tweak coverage to match what they actually bring home, not just national averages.

Yet, even with the added flexibility of TFSAS, RRSPS can still be the right answer in some situations. We recommend high-income earners—those with incomes over $90,000/year—to employ both tools.

Here’s an ordinary technique in four instances:

- Contribute to the max of your RRSP to limit your taxable income.

- That’s how you can use the tax refund to add cash to your TFSA.

That means you reduce your current tax liability and continue accumulating tax-free wealth for the future. This is the approach one tech executive in Vancouver took, and he told us, “It’s the best of both worlds. “I pay less tax now, and all my TFSA is compound interest, either for retirement or trips.

Debunking Common Myths About TFSAs and RRSPs

Over the years, we’ve heard a lot of confusion. Let’s clear up a few common myths:

❌ TFSAS are only for saving, not investing.”

Wrong. You can hold the same investments in a TFSA as you can in an RRSP. It’s not just a savings account—it’s a powerful investment tool.

❌ “RRSPS are always better for retirement.”

Not always. If your retirement income won’t be much lower than today, RRSPS might not offer the tax benefits you expect. Plus, withdrawals are taxable.

❌ “You lose TFSA contribution room if you take money out.”

Nope. You get that room back the following year. This is one of the main reasons clients love TFSAS for short- and long-term goals.

True Story: From RRSP to TFSA for Peace of Mind

One of our long-time clients, a nurse from Hamilton, used to max out her RRSP every year. But then her husband was laid off, and they needed funds, so she had no option except to withdraw from her RRSP. The taxes were brutal. “We lost over 30 percent of it,” she said.

From there, we worked together on how to rebuild, but with a new approach: a TFSA emergency fund and targeted investments toward her retirement. “Now I feel like I’m in control again,” she told her annual review.

Stories like this one are precisely the reason increasing numbers of investors are moving away from RRSP-only strategies. TFSA flexibility just aligns with more of their day-to-day and future needs.

Seniors and the TFSA Advantage

The report from Statistics Canada, also noted that the 65 to 74 age group for Canadians was the largest wage increase for 2023, up 12.1% to $20,960. Most people don’t realize this group benefits more from TFSAS than any other demographic.

Why? Because:

- RRSPS must be converted to RRIFS by the age of 71, creating taxable income.

- Withdrawals from a TFSA don’t count as taxable income.

TFSA is also safer for income-tested programs, such as GIS and OAS.

We have had retired clients transfer residual RRSP amounts into TFSAS after required withdrawals. One couple in Kelowna told us they sleep better now, knowing that they won’t be penalized for taking out money they’ve already saved and paid taxes on once.

RRSPS Still Have a Place—But They're Not the Only Option

To be clear, we’re not saying RRSPS are obsolete, far from it.

They still work well if:

- You’re in a high tax bracket

- You’re expecting a lower income in retirement

- You want to lower your current tax bill

However, the growing popularity of TFSAS shows that Canadians want more than just tax deferral—they want access, control, and growth potential without future tax penalties.

We see this shift happening across every age group and income level, from new grads to seniors, from gig workers to CEOS.

You Have the Power to Choose What Works for You

Whether you like TFSAS or RRSPS, or a bit of both, your savings strategy must reflect your real-world needs, not what a textbook says.

At Canadian LIC, we have guided thousands of clients through this exact choice. We ask questions. We run numbers. We break it all down in clear, simple English.

Because no two Canadians are alike—and no two investment plans should be, either.

Final Thoughts

Tax-Free Savings Accounts are becoming a more popular choice than Registered Retirement Savings Plans for investors, and the reasons why are simple:

- Easier access to money

- No tax on withdrawals

- Increased agility for short- and long-term requirements

- No impact on benefits

- More Appropriate for Middle-Income Canadians

As wages rise and fall and life’s priorities change, Canadians seek financial tools that are there for them as they grow, not ones that burden them with additional obligations. This is where TFSAS give you some breathing space.

But RRSPS still have their place, and the conversation has evolved. Investors today are asking better questions — and requesting more intelligent solutions.”

So, we’re proud to be a part of that conversation. And we’re always here to help you take the next smart move.

Younger investors—especially those in their 20s and 30s—are driving much of the shift toward TFSAS. In our daily conversations, we see a few patterns:

- They want flexibility.

- They expect their incomes to grow over time.

- They’re unsure where they’ll be living or working in five years.

The TFSA is, therefore , a safer, more flexible savings vehicle.

One of our clients, a 27-year-old freelance graphic designer living in Toronto, put it nicely: “I don’t want my savings locked up. I might have to relocate, return to school, or assist my parents. A TFSA allows me to do that without being penalized.”

It’s a type of freedom that doesn’t compare well with an RRSP, better geared toward long-term, stable-income savers who are sure they’ll be retiring to a lower tax bracket.

FAQs

TFSAS are a more popular choice among Canadians as they provide tax-free withdrawals and flexibility while not reducing government benefits. RRSPS enjoy tax benefits, but they also come with tax problems when you withdraw money.

Yes. You can own stocks, mutual funds, ETFS, bonds and so on inside your TFSA — just like you can inside an RRSP.

No. TFSA withdrawals aren’t included as taxable income and won’t affect income-tested government benefits such as OAS or GIS.

If your current salary is greater than $90,000 a year and you fairly anticipate your income at retirement will be lower, then an RRSP may decrease the amount of taxes you owe right now. Many high earners use both.

Yes. If you have the capacity to contribute to both accounts within the same year, you can do so, allowing you to save money and reap tax advantages.

Key Takeaways

- TFSAs allow tax-free growth and withdrawals, making them ideal for flexibility and short-term goals.

- RRSPs still benefit high-income earners looking for tax deductions but come with taxable withdrawals.

- Median Canadian income changes have made TFSAs more attractive for middle-income households.

- Seniors benefit from TFSAs because they protect eligibility for income-tested benefits like GIS.

- More Canadians are adopting TFSA-first strategies, supported by financial advisors who tailor savings plans to individual needs.

Sources and Further Reading

1.Statistics Canada – Income of Canadians, 2023

Website: https://www150.statcan.gc.ca

2. Government of Canada – TFSA Facts

3. Government of Canada – RRSP Overview

Website: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans.html

4. Financial Consumer Agency of Canada – Savings and pension plan

Website:https://www.canada.ca/en/services/taxes/savings-and-pension-plans/savings-and-pension-plan-administration.html

Feedback Questionnaire: TFSA vs RRSP

We’d love to hear your thoughts. Please take a minute to complete this.

IN THIS ARTICLE

- Why Investors Prefer Tax-Free Savings Accounts To Registered Retirement Savings Plans In Canada

- TFSAS Are Gaining Ground: The Flexibility Canadians Want

- Why RRSPS Are Losing Appeal Among Some Investor

- Comparing TFSA and RRSP: What We Explain to Clients

- Canadians Are Adapting to Changing Wages

- Planning for the Future: Why Younger Canadians Prefer TFSAS

- TFSA Contribution Strategies That Actually Work

- What About High-Income Earners? When RRSPS Still Win

- Debunking Common Myths About TFSAs and RRSPs

- True Story: From RRSP to TFSA for Peace of Mind

- Seniors and the TFSA Advantage

- RRSPS Still Have a Place—But They're Not the Only Option

- You Have the Power to Choose What Works for You

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP